- Media & Industry

- Meetings & Events

- Select Language 简体中文 繁體中文(香港) 繁體中文(臺灣) India (English) Bahasa Indonesia 한국어 ภาษาไทย Tiếng Việt Singapore (English) Philippines (English) Malaysia (English) Australia/New Zealand (English) Français Deutsch Italiano Español United Kingdom (English) Nordic countries(English) Canada (English) Canada (Français) United States (English) Mexico (español) Português العربية Japan(日本語) Global (English)

- India (English)

- Bahasa Indonesia

- Singapore (English)

- Philippines (English)

- Malaysia (English)

- Australia/New Zealand (English)

- United Kingdom (English)

- Nordic countries(English)

- Canada (English)

- Canada (Français)

- United States (English)

- Mexico (español)

- Global (English)

- Fujiyoshida

- Shimonoseki

- Ishigaki Island

- Miyako Island

- Kerama Island

- Tokyo Island

- Koka & Shigaraki

- Hida Takayama

- Ginza, Nihonbashi

- Beppu & Yufuin (Onsen)

- Ginzan Onsen

- Nagasaki Islands

- Kumano Kodo

- Shikoku Karst

- Amami Oshima

- Hachimantai

- Omihachiman

- Aizuwakamatsu

- Diving in Japan

- Skiing in Japan

- Seasonal Flowers in Japan

- Sustainable Outdoors

- Off the Beaten Track in Japan

- Scenic Spots

- World Heritage

- Home Stays & Farm Stays

- Japanese Gardens

- Japanese Crafts

- Temple Stays

- Heritage Stays

- Festivals and Events

- Theater in Japan

- Japanese Tea Ceremony

- Cultural Experiences in Japan

- Culture in Japan

- Local Cuisine Eastern Japan

- Local Cuisine Western Japan

- Local Street Food

- Japan's Local Ekiben

- Japanese Whisky

- Vegetarian and Vegan Guide

- Sushi in Japan Guide

- Japanese Sake Breweries

- Art Museums

- Architecture

- Performing Arts

- Art Festivals

- Japanese Anime and Comics

- Japanese Ceramics

- Local Crafts

- Scenic Night Views

- Natural Wonders

- Theme Parks

- Samurai & Ninja

- Iconic Architecture

- Wellness Travel in Japan

- Japanese Ryokan Guide

- A Guide to Stargazing in Japan

- Relaxation in Japan

- Forest Bathing (Shinrin-yoku)

- Experiences in Japan

- Enjoy my Japan

- National Parks

- Japan's Local Treasures

- Japan Heritage

- Snow Like No Other

- Wonder Around Japan

- Visa Information

- Getting to Japan

- Airport Access

- COVID-19: Practical Information for Traveling to Japan

- Anime Tourism

- Countryside Stays

- Accessible Tourism

- Hokkaido Great Outdoors

- Scenic World Heritage in Tohoku

- Shikoku’s Nature and Traditions

- Southern Kyushu by Rail

- Traveling by Rail

- How to Travel by Train and Bus

- JR Rail Passes

- Scenic Railways

- Renting a Car

- Sustainable Travel in Japan

- Travel Brochures

- Useful Apps

- Online Reservation Sites

- Eco-friendly Accommodation

- Luxury Accommodations

- Traveling With a Disability

- Hands-free Travel

- How to Book a Certified Tour Guide

- Volunteer Guides

- Tourist Information Center

- Japanese Manners

- Spring in Japan

- Summer in Japan

- Autumn in Japan

- Winter in Japan

- Cherry Blossom Forecast

- Autumn Leaves Forecast

- Japan Visitor Hotline

- Travel Insurance in Japan

- Japan Safe Travel Information

- Accessibility in Japan

- Vegetarian Guide

- Muslim Travelers

- Safety Tips

- JAPAN Monthly Web Magazine

- Arts & Cultures

- Nature & Outdoor

- Festivals & Events

- Insider Blog

- Things to do

- Local Guides

- Food & drink

- Traditional

- Hokuriku Shinetsu

My Favorites

${v.desc | trunc(25)}

Planning a Trip to Japan?

Share your travel photos with us by hashtagging your images with #visitjapanjp

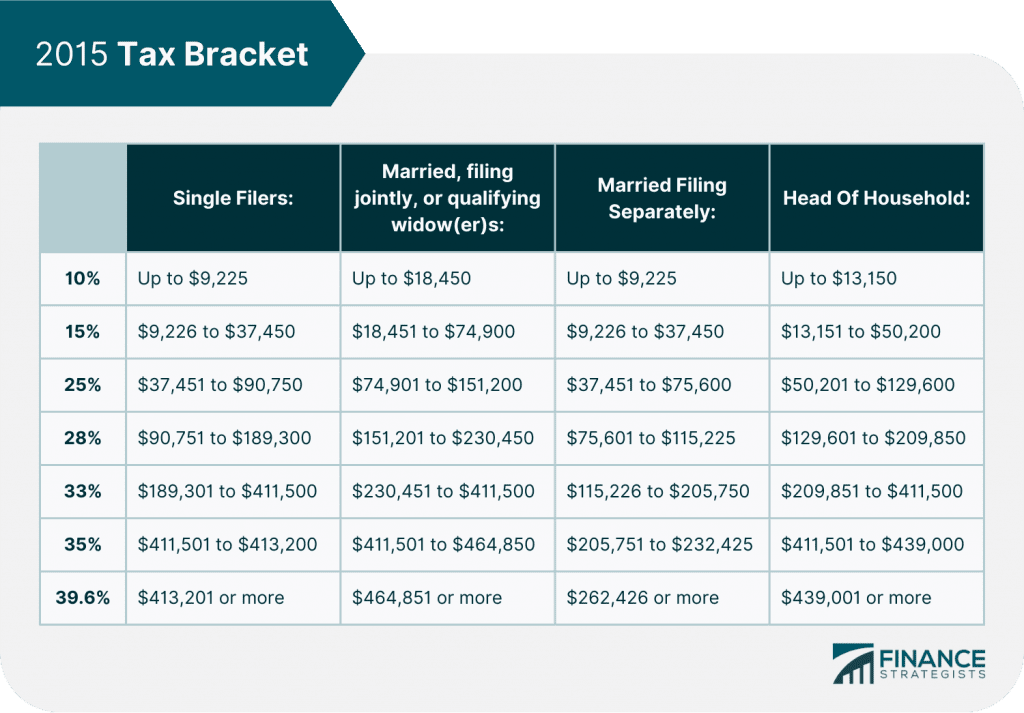

Japan's Tax Exemption

- Helping You Plan

- Japan's Tax Exemption

To fully enjoy shopping in Japan, you need to know about Japan's tax exemption program.

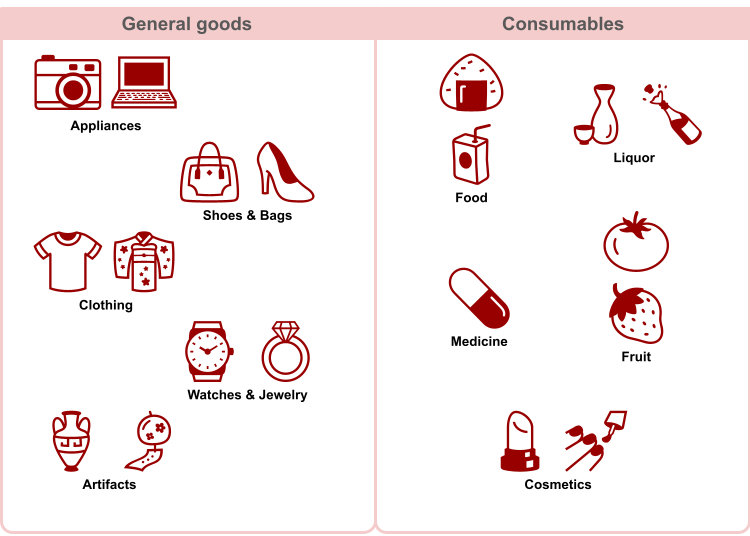

Tax exemption in Japan basically applies to all items, from general items such as home appliances, accessories, and shoes, to consumable items such as alcohol, food, cosmetics, cigarettes, and medicines. Tax is exempt only under certain conditions.See below for information about the current tax exemption in Japan.

Certain items are subject to a reduced tax rate.Visit the following website for more information about tax rate.

When you purchase merchandise, you can pay the tax-exempt price.

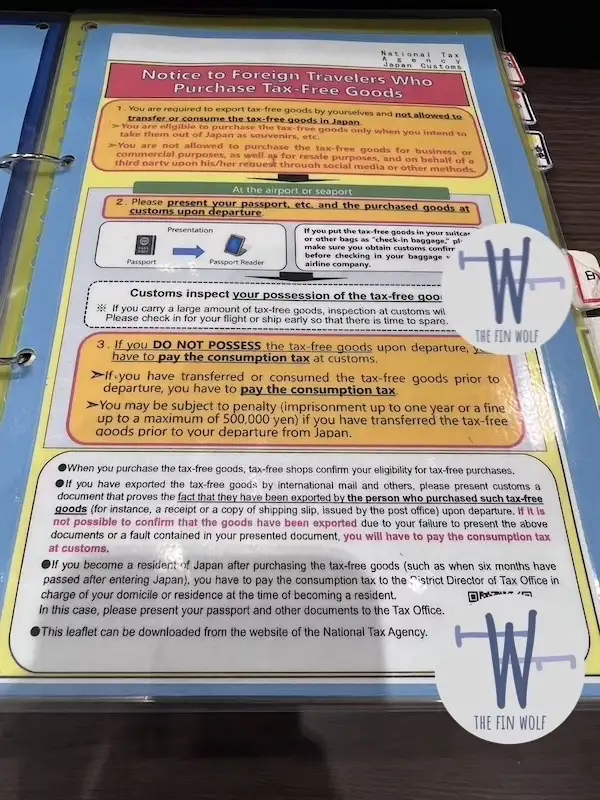

The tax refund procedure must be carried out while at an airport or similar location. To carry out the procedure, you must show your actual passport, not a copy of the visa page. Tourists traveling by cruise ship need to show their cruise ship tourist permit.

*For those on the Trusted Traveler Program (TTP), be sure to bring your passport along with your Registered User Card.

Purchases that total 5,000 yen or more qualify for a tax refund.

The terms and conditions of tax refunds depend on the type of product.

The program only applies to foreign visitors in Japan temporarily.

This program is applicable to foreign visitors staying in Japan for less than six months only.

*Non-residing Japanese nationals may be eligible to apply for tax exemption.

In addition, purchased tax-exempt items in Japan can be shipped to overseas homes, etc. For more information, please refer to the following.

Did this information help you?

out of found this information helpful.

Thank you for your feedback.

Recommended for you.

Please Choose Your Language

Browse the JNTO site in one of multiple languages

Tax Refund in Japan

Tax Refund and Exemption

Duty-Free Shops in Japan

Most frequently asked questions.

- What is the difference between tax-free and tax refund? Tax free product has a net price after deducting tax. Product with tax refund, on the other hand, allows customers to re-claim tax after paying the total. For a tax refund, you will be refunded on value-added tax and consumption tax. When you purchase a tax free product, you get exempted from import tax. Many products in Japan have very little import tax if any, so tax exempt or tax refund usually refers to consumption tax.

- What type of tax is waivered by tax free shops? The tax waivered is usually the consumption tax. In Japan, tax and price are listed separated. Products in Japan usually show two prices: the original price and the price including tax. Starting October 2019, the tax on some certain products increases from 8% to 10%.

- How much do I need to spend to qualify for tax free? Since the implementation of the new tax policy in 1 July 2018, any purchase, on common goods or consumables, over 5000 yen qualifies for tax free. Consumables include food, beverages, alcohol, pharmaceuticals, cosmetics, etc.

- What is the tax refund requirement? For foreign visitors with a less than 90 days visa, they can get tax refund for any purchase over 5000 yen. Unopened products carrying out of the country qualify for tax refund, but products for commercial purpose do not qualify for tax refund.

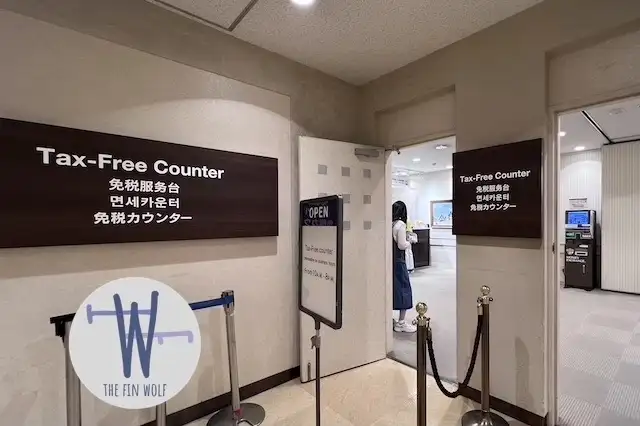

- What is the process on getting a tax refund? In Japan, there are two ways to get a tax refund. One method is to get tax deduction at checkout counter by showing your passport. Another method is to first pay with tax, and then get a tax refund at a designate counter within the same day of purchase by showing your purchase, receipt, and passport.

- How do I get a tax refund after paying with tax? You can claim a tax refund at designate counter or service center. You will have to show your purchase, receipt, and passport. After signing any required document, the tax will be returned to you in cash. If you pay by credit card, the tax can also be refunded to the credit card.

- What are the tax free shops in Japan? There are approximately 50198 tax free shops in Japan, where you can buy almost anything you want. The tax free shops are located not only in airports, but also large department stores such as Daimaru, Seibu, Tobu, Matsuya, and Keio, Big Camera, Donki, and Don Quixote.

- Are prices shown in shops including or excluding consumption tax? Whether the price is shown with or without consumption tax depends on the type of shops, so it is important to make sure whether the price tag shows the full price or not.

- Tel: +81 50-3701-6391

- Email: [email protected]

- Working Hours: 8am-7pm, (Japan)

- Tel: +1-6265617117

- Working Hours: 8am-7pm, Pacific Time

- Bahasa Melayu

- Bahasa Indonesia

All You Need to Know About Tax-Free Shopping in Japan

Planning a trip to Japan and looking forward to some retail therapy? Get ready to shop till you drop without breaking the bank! This comprehensive guide will walk you through the ins and outs of tax-free shopping in Japan. From understanding what 'tax-free' really means to navigating the process, we've got you covered. Whether you're a seasoned globetrotter or a first-time visitor, this guide will help you make the most of your shopping spree in Japan. Main image: Tupungato / Shutterstock.com

How much is consumption tax in Japan?

What stores offer tax-free shopping in japan what about duty-free shopping, who can not shop tax-free in japan, how does tax-free shopping work is there a minimum purchase amount to shop tax-free, precautions when buying consumables tax-free, tax-free shopping process, tax-free coupons, major stores offering tax-free services, duty-free shopping is not available at these shops, japan tax-free shopping online.

The consumption tax in Japan has been 10% since October 1, 2019. Certain products are taxed at a reduced rate of 8%, including takeout meals and drinks, drinks from a hotel refrigerator/minibar, and fruit picked and taken home. Generally, drinks and meals consumed at a restaurant or food court, as well as hotel room service, are subject to the 10% consumption tax.

'Tax-free' refers to a system in which the purchaser is exempt from consumption tax when shopping. Note that consumption tax exemption only applies in specific places and situations, such as at duty-free shops in airports, certain electronics shops and department stores , and a handful of other stores ( duty-free shops ) that have been authorized by the tax office to sell goods for export. Recently, however, the number of department stores , shopping malls , outlets, and other shopping centers that offer tax exemption counters has been increasing, even expanding to include certain small businesses. For tax-free shopping, look for the duty-free shop symbol (below) posted on the storefront.

・Those who used an automatic gate at the airport and do not have an entry stamp on their passport. ・Those who have been in Japan for more than six months. ・Those currently working in Japan. ・Those who do not meet the required purchase amount for exemption. Tax-free shopping is only available to non-residents, such as tourists from abroad. 'Non-resident' refers to foreigners who have been in Japan for less than six months, and Japanese nationals who left the country to live abroad for two years or more and have only returned to Japan temporarily for less than six months.

Products eligible for tax exemption are those for personal use and consumption by non-residents, not for business or resale. It is also a requirement to bring items out of the country before use. In the case of general goods , such as home appliances, clothes, bags, and watches, the sum total of goods purchased at one store on the same day must be at least 5,000 yen (tax excluded; hereinafter all prices are tax excluded). For consumables , such as food, cosmetics, and pharmaceuticals, total purchase amount must fall within the range of 5,000-500,000 yen in one day at a single store, and must be packaged in a specific way as to not be consumed in Japan. Additionally, in the case of department stores and shopping malls with a tax-free counter, you may qualify for tax exemption if the combined purchase total from multiple stores equals 5,000 yen or more. However, note that depending on product category, some items may not be eligible for tax exemption, even if they meet the minimum purchase amount.

Consumables are packed in a consumables bag (sealed with a sticker to show if it has been opened) or in a cardboard box. These packages must not be opened before leaving the country. Also, as a general rule, the total purchase price of consumables and general goods cannot be combined for tax exemption. To qualify, the sum of each category (consumables only or general goods only) must total a minimum of 5,000 yen or more. However, note that if items are packaged like consumable goods in a way in which they will not be consumed in Japan, they may be combined with consumables under the same requirements.

Depending on the store, there are two ways to apply for tax exemption. (A) Present your passport at the time of purchase and pay the total with consumption tax already deducted. (B) Get a refund by visiting the designated tax exemption bulk deduction counter, and presenting your purchases, purchase receipt, and passport. Please note that this process must be completed on the same day as your purchase and that, in some cases, extra fees may apply. Also, try stopping by the counter before shopping. You may be able to get discount coupons! At the store: 1. Present your passport Present the passport of the purchaser. (Copies not accepted). You will be asked to confirm your photo, name, nationality, date of birth, the status of residence, date of entry into Japan, and passport number. 2. Explanation of necessary items from the store of purchase With the digitization of duty-free sales procedures since October 2021, the 'Duty-Free Record of Purchase' procedures describing purchased item information have been completely abolished. The store of purchase creates the purchase record information data and sends it to the National Tax Agency. It is also no longer necessary to sign a 'Purchaser Pledge.' Instead, ask the store of purchase to explain the necessary information. 3. Payment and Product Delivery ・Case (A): Pay sales amount with tax excluded and receive your product. ・Case (B): After shopping at each store, visit the tax-free bulk counter and receive a refund in the amount of the consumption tax. If the purchase total is less than the minimum required amount for tax exemption due to returns or exchanges, the tax exemption will be canceled for all products, and you will have to pay the full amount, including consumption tax. At the airport : 4. Present Your Passport Present your passport to the customs officer, as the purchase record information will be sent electronically. Generally, the purchaser of the tax-free items must carry them when leaving Japan. If you plan to put your duty-free items in your checked baggage, please inform the airline staff at the check-in counter before checking in your luggage. A customs officer will come to the check-in counter to check your duty-free items. 5. Departure After passing through customs, the tax exemption process is complete.

Register with Visit Japan Web for greater convenience

Imagine strolling through the airport , getting through quarantine, immigration checks, and customs declarations all in one swift process. Visit Japan Web makes that possible! For travelers entering Japan (including returning Japanese nationals), this web-based service combines all these crucial steps into one seamless experience. And on April 1, 2023, Visit Japan Web introduced an exciting new feature: "Tax-Free Purchasing." No more showing your passport at every duty-free counter! With the "Tax-Free Purchasing" feature, your shopping experience will be smoother and faster. So how exactly does it work? Prepare Ahead: Input your travel information (name, nationality, date of birth, residence status, arrival date, passport type, and number). Scan the QR Code: A QR code button will be added under the "Preparation for Tax-Free Procedures" section. Just present this code at a participating Japanese duty-free store, and they'll scan it. Easy as that! Note: This method is only applicable at stores compatible with QR code scanning, so it's not available at every tax-free shop. Please check with the store first. If they don't support the feature, you can still proceed with tax-free procedures by presenting your passport and providing the necessary information. Want to know more about operating the "Duty-Free Shopping" feature on Visit Japan Web? Check the link here and get ready to make your Japanese journey more comfortable and enjoyable!

Enjoy tax-free shopping in Japan with special coupons at top retail destinations. Save up to 15% at Don Quijote, a favorite discount store , and discover a wide array of electronics at BicCamera. Additionally, take advantage of exclusive discounts at all MITSUI OUTLET PARK locations, perfect for fashion lovers and bargain seekers.

1. Discount coupon combined with tax exemption (BicCamera)

BicCamera is a renowned electronics chain in Japan, known for its vast selection of gadgets, appliances, and tech accessories. With its user-friendly layout and competitive pricing, it's a go-to destination for both locals and tourists looking for the latest electronic products.

2. Discount coupon (up to 10% off) combined with tax exemption (All MITSUI OUTLET PARK locations)

Mitsui Outlet Park is a popular chain of outlet malls spread across Japan. It offers a diverse range of international and domestic brands, providing shoppers with discounted prices on clothing, accessories, and lifestyle products in a pleasant, open-air mall setting. ・Present this screen at an eligible facility's General Information counter to receive a coupon book offering up to 10% off and a novelty gift. ・Eligible facilities include: All MITSUI OUTLET PARK locations, Mitsui Shopping Park LaLaport TOKYO-BAY, Urban Dock LaLaport TOYOSU, LAZONA Kawasaki Plaza, LaLaport KADOMA, LaLaport EXPOCITY, LaLaport FUKUOKA , DiverCity Tokyo Plaza, COREDO Muromachi. ・For MITSUI OUTLET PARK SAPPORO KITAHIROSHIMA, KISARAZU, JAZZ DREAM NAGASHIMA, and DiverCity Tokyo Plaza, please visit the Tourist Information Center .

3. Discount coupon combined with tax exemption (Don Quijote)

Don Quijote, often referred to as "Donki," is a famous discount chain store known for its eclectic and extensive product range. From electronics and cosmetics to snacks and novelty items, its bustling aisles and late closing hours make it a unique shopping experience. Now when shopping at Don Quijote, you can get up to 15% off your purchase! Just tap the coupon above and show it to the cashier when checking out. (Conditions apply. See coupon page for details.)

4. Discount coupon combined with tax exemption (AEON MALL)

Aeon Mall is a major shopping mall chain in Japan, offering a comprehensive shopping experience with a mix of retail stores, entertainment options, and dining establishments. It's a family-friendly destination, catering to a wide range of needs and preferences. DISCOUNT COUPON: 500 yen OR Novelty Gift. Redeem your 500 yen coupon by presenting the QR code at the Service Counter.

5. Discount coupon combined with tax exemption (Tsuruha Drug Store)

Tsuruha Drugstore is a widespread pharmacy chain in Japan, recognized for its extensive selection of health and beauty products. It's a favored spot for both medicinal needs and cosmetic finds, including popular Japanese skincare and makeup products.

6. Discount coupon combined with tax exemption (Lotte Duty Free Ginza)

Lotte Duty Free Ginza , located in Tokyo's upscale Ginza district, is a premium duty-free shop offering a variety of luxury brands and products. From high-end cosmetics and fragrances to designer accessories, it's a prime spot for tax-free shopping in a sophisticated environment.

In Japan, not only airports and department stores , but shopping malls , discount stores , drug stores, and a wide range of other shops offer duty-free shopping, as well. Here, we introduce some major stores that offer duty-free shopping, listed by category. Please note that not all shops in department stores and shopping malls offer tax exemptions. Also, some nationwide chain stores may not offer duty-free shopping. Please check in advance before visiting.

- Address Tokyu plaza 8, Ginza, the ninth floor, 5-2-1, Ginza, Chuo-ku, Tokyo, 104-0061 View Map

- Nearest Station Ginza Station (Tokyo Metro Ginza Line / Tokyo Metro Marunouchi Line / Tokyo Metro Hibiya Line) 1 minute on foot

- Phone Number 03-6264-6200

*Note: Some stores in department stores and shopping malls may not be eligible for tax exemption. Also, not all discount stores and drugstores in Japan are tax exempt.

Online tax-free shopping is a convenient option for travelers in Japan. You can order items online before or during your trip and choose to collect your purchases at your accommodation, the airport , or a duty-free shop . This service saves you time, allowing you to enjoy sightseeing without the hassle of carrying bulky purchases. This service spans various products, including home appliances, cosmetics, snacks, stationery, and Japanese specialties. When collecting your items, ensure you have a device with internet access, your credit card or e-money, and your passport stamped with your entry date into Japan. Remember, cash payments are not accepted, and only the person who made the purchase can claim the goods. Some airport duty-free stores also offer a pre-order service. You can order items online and pick them up at the airport 's duty-free counter. For more convenience, use TaxFreeOnline.jp to order tax-free products before your Japan trip and have them delivered to your hotel or collected at an airport . Visit their website below for more details.

*Information in article as of August 2023. English translation by Krys Suzuki

- Category Department Stores Pharmacies Duty Free Shops

- How To: Shopping

Share this article.

Limited time offer: 10% discount coupons available now!

Recommended places for you.

Kamesushi Sohonten

Umeda, Osaka Station, Kitashinchi

seibu shibuya

Department Stores

Daimaru Tokyo

Tokyo Station

Yoshida Gennojo-Roho Kyoto Buddhist Altars

Nijo Castle, Kyoto Imperial Palace

SEIBU IKEBUKURO

ISHIDAYA Hanare

Kobe, Sannomiya, Kitano

Step Into the Story: Inside Immersive Fort Tokyo

Best Things to Do in Tokyo in April 2024: Events, Festivals & More

A Complete Guide to the JR West Kansai Area Pass

12 Unique & Fun Tokyo Food Tours to Enjoy in 2024

The Complete Guide to the Kintetsu Rail Pass

Opened in Spring 2024! What to do at Tokyu Plaza Harajuku Harakado

(Japanese Brands: ATSURO TAYAMA) Here's the "Healthy Back Bag" fashion fanatics are clamoring for!

Aizu-Wakamatsu Sake Crawl: Enjoy the Heart of Fukushima's Sake Culture

5 Must-Visit Nara Temples and Shrines: Discover the Timeless Beauty of Japan's Ancient Capital

Plan Your Perfect Hanami to Remember With Ecute Ueno - Obento Lunchboxes, Adorable Sweets, and Much More!

6 Surprisingly Cheap Things in Japan

Daimaru Sapporo: Best Souvenir Food Picks at Hokkaido's Famous Department Store!

- #best sushi japan

- #what to do in odaiba

- #what to bring to japan

- #new years in tokyo

- #best ramen japan

- #what to buy in ameyoko

- #japanese nail trends

- #things to do japan

- #onsen tattoo friendly tokyo

- #best coffee japan

- #best japanese soft drinks

- #best yakiniku japan

- #japanese fashion culture

- #japanese convenience store snacks

Simple and Convenient Japan Tax Refund for Foreigners (Updated 2024)

- On November 8, 2023

- In Japan , Travel

Japan tax refund is an incredible opportunity for foreign tourists to indulge in amazing shopping experiences across Japan while also saving substantial amounts of money during their trip.

Taking full advantage of Japan’s generous tax refund policies for visitors can allow travelers to enjoy discounts on a wide range of goods.

This comprehensive, up-to-date guide will clearly explain everything you need to know as a foreign tourist visiting Japan to successfully obtain tax refunds on your purchases, from luxury fashion items to Japanese souvenirs and electronics.

Table of Contents

Eligibility Criteria: Who Qualifies for Japan Tax Refund?

In order to be eligible for tax refunds on shopping in Japan, you must meet the following criteria:

- You must be a foreign tourist who is temporarily visiting Japan or a Japanese citizen who does not currently reside in Japan . Permanent residents of Japan do not qualify for the tax refund program.

- You must enter Japan through a manual immigration gate when you first arrive and get your passport physically stamped by the immigration officers. Entering through the automated gates makes you ineligible for tax refunds.

- Your purchases must total ¥ 5,000 or above to qualify for a tax refund. Multiple receipts can be combined from the same store to reach this minimum purchase amount.

Step-by-Step Guide to Getting Japan Tax Refund

There are two main methods you can use to claim your tax refund in Japan depending on the individual store’s policies:

1. Instant Japan Tax Refund at Time of Purchase

Many large retailers and luxury department stores in Japan offer the option of an instant tax refund at the register when you check out.

Simply request the tax refund from the cashier before paying and present your passport for identification.

The sales tax amount will be deducted from your total bill immediately, allowing you to only pay the duty-free price.

For example, if your shopping totals ¥10,000, about 8% sales tax would normally apply, increasing your bill to ¥10,800. But with the instant tax refund, they will deduct the ¥800 in sales tax at the register, so you only have to pay ¥10,000 even before filing the paperwork. This is the fastest and most convenient way to claim your refund.

2. File for Japan Tax Refund at Designated Tax Refund Counters

If the retailer does not offer instant tax refunds at the cash register, you can still get a refund by filing the paperwork at an official tax refund counter located inside most large stores, shopping malls, and department stores throughout Japan.

After purchasing your items, simply take the paper receipts and your passport to the tax refund counter located in the same mall or building.

The staff will verify your receipts, passport, and temporary visitor status to validate your eligibility. Once approved, they will process the refund. You can choose to receive the refunded amount back in cash or as a credit to your credit card.

For example, you may spend ¥15,000 at a small boutique shop. Since they don’t offer instant refunds, you would pay the full ¥15,000 up front. But you can file the paperwork immediately at a refund counter in the same mall to get the ¥1,200 sales tax amount returned to you.

Important Notes:

- You must file for the refund and complete the paperwork on the same day as your purchase.

- You can combine multiple receipts from the same store or mall. But usually one refund form is required per store.

- Not all shopping malls has tax refund counter.

Mistakes to Avoid When Getting Japan Tax Refunds

While clearly a great perk for tourists, there are some common mistakes travelers make that can jeopardize your tax refund eligibility:

- Forgetting to file for the refund and complete paperwork on the same day as purchasing the items. Refunds cannot be processed afterwards.

- Entering Japan through the automatic immigration gates instead of the manual gates. Passing through auto-gate makes you ineligible.

- Losing the receipts or paperwork before departing Japan. This evidence is required to receive your refund.

- Using a Japanese address or residence card when checking out. This flags you as a resident rather than tourist.

- Except for purchases made at duty-free shops inside the airports, you cannot get tax refunds for city purchases at Japan airports upon departure. Tax refunds for purchases made in cities must be processed in the city before leaving for the airport. No refunds can be done airside except at duty-free stores.

- When exiting the country, customs officials may request you present the items and receipts for any tax refunds received. If you cannot show proof of your tax refunded purchases, you may have the tax amount re-levied.

- Goods purchased for business or commercial purposes are not eligible for the tax-free program.

Popular Shopping Destinations for Tax-Free Shopping

Many major shopping areas and stores in Japan’s biggest cities offer duty-free shopping and participate in the tax refund program. Popular places known for tax-free shopping include:

- Busy retail streets like Shinsaibashi-suji in Osaka, lined with luxury boutiques and designer stores.

- Famous department stores such as Isetan, Takashimaya, and Mitsukoshi located in Tokyo, Osaka, Kyoto, and other major cities.

- Electronics mega-stores like Bic Camera, Yodobashi Camera, and Yamada Denki with multiple branches across Japan.

- Underground malls connected to train stations, like Odakyu Department Store at Shinjuku Station in Tokyo.

- Shopping complexes in airport terminals, like Haneda Airport International Terminal in Tokyo.

Other Helpful Tips for Traveling in Japan

Getting a tax refund is just one part of planning an amazing trip to Japan. Be sure to also check out these guides on using a JR Pass , navigating Shinkansen platforms , and reserving seats .

By combining tax-free shopping and rail pass travel, you can experience the best of Japan as a tourist while saving money!

Conclusion - Get Refunds and Enjoy Your Japan Shopping Spree!

In summary, Japan makes it very attractive for foreign tourists and non-resident Japanese to shop tax-free by offering generous duty-free shopping policies.

Just be sure you confirm your eligibility, look for tax-free stores, save all receipts and paperwork, and promptly file for your refunds after purchase.

Following this guide will allow you to get refunds easily and maximise savings during an incredible shopping trip in Japan!

Related Posts

The Definitive Guide to Beppu Bus Passes (Mini or Wide Pass) – Boost Your Beppu Sightseeing (Updated 2024)

- March 8, 2024

A Perfect Day Trip to Mt. Aso Japan with Public Transportation (Updated 2024)

- February 8, 2024

Ultimate Guide to Effortlessly Travel by Train from Kansai Airport to Osaka City (Updated 2024)

- January 8, 2024

Trending now

JavaScriptが無効になっているため、一部機能が正常に動作しません。 お手数ですが、お使いのブラウザのJavaScriptを有効にしてから再度ご利用ください。

Takashimaya Department store

TAX REFUNDS

For customers who have shopped at takashimaya.

Foreign visitors staying in Japan for less than 6 months are eligible for tax-free shopping. Bring your purchased items to our in-store Tax Refund Counter after confirming the eligibility and conditions for a tax refund as follows:

Tax refund items

Eligibility and conditions for tax refund, general goods.

Bags, Shoes, Clothing, Watches, Accessories

Purchases of 5,000 JPY or more (excluding tax)

All tax-free goods must be taken out of Japan when leaving the country.

Consumables

Cosmetics, Food, Beverages, Medicines, Stationery *Cosmetics case, brush and some of stationery are classified as the general goods

Purchases of between 5,000 JPY and 500,000 JPY (excluding tax)

Your consumables will be placed in an official sealed bag. Please bring the items to the Tax Refund Counter. Do not open until you depart. All tax-free goods must be taken out of Japan when leaving the country.

General goods/consumables over 5,000 JPY (before tax) are eligible for duty-free tax exemption. Note that general goods/consumables under 5,000 JPY (before tax), or general goods/consumables whose total sum is above 5,000 JPY and below 500,000 JPY are eligible. General goods/consumables that have been tax-exempted through a combined purchase sum may not be used domestically. *Please be informed that the quantity of tax-free procedures per transaction will be limited. Contact our Tax Refund Counter for details.

*Effective July 2018, the Revised Consumption Tax Exemption Program for Foreign Visitors allows spending on general goods to be combined with spending on consumable goods on the condition that general goods are also packaged in a designated sealed bag and other requirements apply.

For foreign national – A person with a residence status of Temporary Visitor, and the term of visit in Japan is less than six months – A Person with Diplomat or Official visa status – A person who has entered Japan for less than 6 months with landing permission, etc. – Dependents of members of the U.S. armed forces and components who have a SOFA stamp in their passport

Even if a person has the “Temporary Visitor” status, those who have a residence or domicile in Japan, work in an office in Japan, or visit Japan in more than six months are not eligible for tax-free shopping.

For Japanese national – A person who can be confirmed by proof of continuous living abroad for two years or more and has only returned to Japan temporarily for less than six months.

・Certificate of overseas residence or a copy of a supplementary family register (both originals). ・For more information, please inquire at the Tax Refund Counter.

After purchasing goods, the person who made the purchase visit the tax-refund counter within the same day.

*Substitutes are not accepted. *If you have tailoring or order product which takes time, the tax will be refunded only the day you have received the product. Please ask the staff in shop for details.

TAX REFUND COUNTER

Please be informed that we cannot accept tax refund procedure during a certain period of time. Kindly contact our Tax refund counter for details.

- Nihombashi 2nd Floor, Main Building

- Shinjuku 11th Floor, Main Building

- Yokohama Basement 1st Floor

- Osaka 7th Floor

- Kyoto 7th Floor

- Tamagawa 3rd Floor, Main Building

- Omiya Basement 1st Floor

- Kashiwa 3th Floor, Main Building

- Takasaki 5th Floor

- Sakai 5th Floor

- Senboku 4th Floor

- Gifu 1st Floor

- Okayama 8th Floor

- JU Yonago Takashimaya Store 4th Floor, Main Building

At the Nihombashi, Tamagawa, Yokohama and Kashiwa Stores you can also claim a tax refund for purchases made at non-Takashimaya tenants in the adjacent Nihombashi Takashimaya Shopping Center, Tamagawa Takashimaya Shopping Center, Yokohama Joinus and Kashiwa Takashimaya Station Mall. Note that some tenants are not covered under this program. Contact each store for more information.

Necessary Items

Receipt of purchased goods

Passport of the person who made the purchase *1

Purchased products *2

Credit card *3 (only if used)

*1 Copies are unaccepted, must have a verification seal for landing. *Crew members must have a crew member’s landing permit.

*2 Consumables will be packaged and sealed, please bring the items to the Tax Refund Counter.

*3 The name on the passport and credit card must match. Credit cards without the card-holder’s signature will not be accepted. The back of the card must be signed by the card-holder on the designated line. Credit cards may not be used by other individuals. *When you use Takashimaya credit card to save up points(no matter you pay in cash or not), Please be careful that the card holder must be same with the name on your passport or you can’t receive the tax refund.

*4 The tax refund procedure is only available to the purchaser.

*5 There are quantity limits for your tax-free purchase.

*6 Tax exemption on items purchased for business purposes is not available.

Provided through the following method.

*Please note that 1.55% from your Tax Free purchases will be deducted as a handling fee.

– Cash(Japanese JPY)

– Credit card *please note that it is limited to the cardholders only. (Nihombashi, Shinjuku, Yokohama, Osaka, Kyoto)

Applicable Cards: VISA, Master, American Express, Diners Club, UnionPay (銀聯), JCB card Your refund will be issued within around a week at the earliest. A currency exchange fee will be applied to the amount of the refund.

– Mobile payment:Alipay, WeChat Pay (Nihombashi, Shinjuku, Yokohama, Osaka, Kyoto) Your refund will be issued immediately upon completion of the tax exemption form. A currency exchange fee (5%) will be applied to the amount of the refund.

This store digitizes Tax free procedures based on the law.

*Signature is not required. Documents will not be attached to passport.

- If the items is not taken out of the country, consumption tax fees will be levied.

- The consumable goods which have been packed in the designated bags. Please do not open the designated bag until you leave Japan.

- If you wish to put in the items in your suitcase which has finished tax exemption procedure, you must declare it to the airline’s ground staff when checking-in. In addition, when going through the customs, your cooperation is more than appreciated to have the luggage checked.

- Agricultural and livestock products will be needed to get export inspection. There are countries and areas where bring those items in is forbidden under law and regulation.

- Account Details

- Newsletters

- Group Subscription

Japan eyes revamp to way tourists are reimbursed for tax-free sales

Tourists would be repaid for taxes at airports, not at point of sale, to fight fraud

TOKYO -- The Japanese government is considering an overhaul to the way tourists make tax-free purchases, Nikkei has learned, in a bid to stop abuse of the system.

Currently, tourists in Japan have the consumption tax deducted when purchasing items at special duty-free stores and sales counters. But some people take advantage of system and resell products within the country.

Duty-free sales at Japan department stores hit record high

Foreign tourists in japan recover to pre-covid levels, japan to allow nearly all over-the-counter drugs to be sold online, apple japan hit with $98m in back taxes for missing duty-free abuses, foreign tourists in japan snap up leather products from kobe beef cattle, tourists flood back to tokyo, but not elsewhere in japan, japan uses international cycling races to break from tourism pack, medicine, sweets, whisky, even stationery hot souvenirs in japan, surging e-commerce imports threaten japan's retail sector, japanese airlines' profits recover to pre-pandemic levels, asian ultraluxury resort brands make inroads in japan, latest on travel & leisure, tokyo disney unveils luxury hotel with rooms from $2,200 a night, china may day travel set to test consumer appetite for spending, niseko gin shows japanese resort offers more than skiing, sponsored content, about sponsored content this content was commissioned by nikkei's global business bureau..

Nikkei Asian Review, now known as Nikkei Asia, will be the voice of the Asian Century.

Celebrate our next chapter Free access for everyone - Sep. 30

Japan eyes revamping tax-free shopping rule to stem illicit resale

Japan is considering overhauling its tax-free shopping scheme for foreign visitors in response to a growing number of cases of tax-free items being resold overseas for profit at tax-inclusive prices, sources close to the matter said Monday.

At present, visitors who stay in Japan for less than six months can purchase merchandise with the consumption tax already deducted. The government is now considering shifting to a scheme where they pay tax-inclusive prices and apply for refunds afterward, the sources said.

Formal government discussions on the tax-free shopping rule may start later this year when an annual tax system review for fiscal 2024 begins, the sources said.

In the European Union, for instance, tourists pay prices including value-added tax and get a refund after complying with required formalities.

In Japan, travelers are exempted from paying the consumption tax when purchasing goods totaling 5,000 yen ($36) or more as long as they intend to use the items in their home countries.

But there have been cases where travelers purchased massive amounts of tax-free items for resale purposes, the sources said.

Last year, Apple Inc.'s Japan branch was slapped with 14 billion yen in additional taxes after authorities found it sold iPhones and other items in bulk without charging the consumption tax to foreign visitors suspected of purchasing the products for resale purposes.

Purchasing records at tax-free stores are shared with customs, and the consumption tax is collected from travelers who do not carry tax-free items they bought with them at the time of departure.

According to the Finance Ministry, it is usually difficult to collect the tax from such travelers because they often do not have the money to make the payment when they are departing the country.

The government has ramped up efforts to prevent illicit tax-free purchases, such as by requiring from May businesses that have purchased tax-free items for resale purposes to pay the consumption tax.

May 22, 2023 | KYODO NEWS

Japanese opt for short, cheap overseas trips for Golden Week holidays

May 1, 2024 | KYODO NEWS

Japan likely conducted forex intervention worth around 5 tril. yen

Apr 30, 2024 | KYODO NEWS

90% in Japan support idea of reigning empress: survey

Apr 28, 2024 | KYODO NEWS

Japan disappointed by Biden's "xenophobic" comments

May 4, 2024 | KYODO NEWS

2 more arrested in case of burned bodies found outside Tokyo

More from Japan

Kyodo News Digest: May 6, 2024

41 minutes ago | KYODO NEWS

Japan Post, Seino to team up on deliveries to counter driver shortage

2 hours ago | KYODO NEWS

Audi builds first charging hub outside of Europe in Tokyo in EV push

May 6, 2024 | KYODO NEWS

Kyodo News Digest: May 5, 2024

May 5, 2024 | KYODO NEWS

Trains restart at Kyoto Station after report of suspicious items

Japan left to rethink COVID grants as telework facilities empty out

Japan PM says no plan to dissolve Diet after defeat in by-elections

Japan PM Kishida vows to tackle global challenges with South America

Subscribe to get daily news.

To have the latest news and stories delivered to your inbox, subscribe here. Simply enter your email address below and an email will be sent through which to complete your subscription.

* Something went wrong

Please check your inbox for a confirmation email.

If you wish to change your message, press 'Cancel' to go back and edit.

Thank you for reaching out to us. We will get back to you as soon as possible.

- What is the eligibility for tax refunds?

The terms and conditions of tax refunds depend on the type of product.

Please see the following page for details:

Japan's Tax Exemption

Have more questions?

Was this article helpful.

Search 19 out of 46 found this helpful

Articles in this section

- You often see“ duty free” at airports and other locations. What is the difference between Tax-free and Duty-free?

- Can I get both the liquor tax and consumption tax refunded at a sake brewery?

- I left my passport at my hotel. Can I apply for tax exemption tomorrow?

- Is it true that purchases made at shopping malls and shopping streets can be consolidated for tax exemption purposes?

- I understand that liquids cannot be brought onto the airplane, so how can I apply for tax exemption for cosmetics and so on?

- If I don’t get an entry stamp on my passport because I use the automatic gates when entering Japan, am I still eligible for tax exemption?

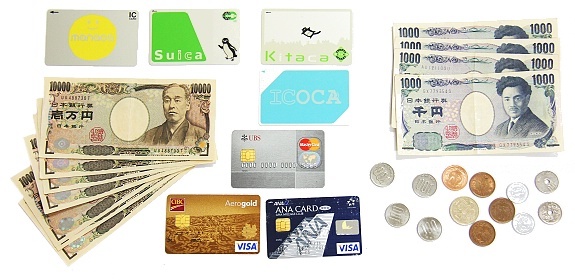

- Are credit cards widely accepted? Would you recommend bringing cash or credit cards?

- What can I bring through Customs?

- Where do I find tax free shops?

- Do I need to take yen with me when I depart my country?

- Where can I find ATMs?

- General Information

- Climbing Mt. Fuji

- Pass/Tickets

- Safe Travel

- Maps & Brochure Request

- Novel coronavirus (COVID-19)

- Home (Japanese)

Information for Taxpayers

- Indirect Taxes

Information about International Tourist tax

- Basic knowledge

- Q&A(April 2018)(Revised in December 2018)(PDF/1,153KB)

- Leaflet(for business operators)(June 2018)(PDF/477KB)

- Leaflet(for individuals departing from Japan)(June 2018)(PDF/297KB)

- Leaflet(International Tourist Tax Exemption for Foreign Ambassadors upon departure from Japan)(May 2019)(PDF/617KB)

- Leaflet(International Tourist Tax Exemption for State Guests upon departure from Japan)(May 2019)(PDF/276KB)

Some of the publications on this site are in PDF. To view them you will need to have Adobe Reader. Please download Acrobat Reader .

National Tax Agency JAPAN

- Individual Income Tax

- Corporation Income Tax

- Consumption Tax

- Withholding Tax

- Tax Payment

- International Taxation

- Information on Liquor Administration

- Information about the Corporate Number

- main notifications,etc

- About the Office of Tax Collections Call Center("Tax Payment Call Center")

Publication

- Tax Statistics

- National Tax Agency Report

Press Release

- Organization

- Related Sites

- If You Need Further Information.Please Contact

Tax-Free Shopping in Japan

Tax-free shopping in Japan refers to the 10% consumption tax, also known as VAT, which can be claimed back by foreign travelers. There are also tax-free stores dispersed throughout Japan, which offer their products at tax-free prices. More and more stores are offering tax-free items given the rise of tourists shopping in Japan. Shopping in Japan is an experience unto itself given the many shopping districts , large-scale department stores , outlet malls , and regular malls . If you are a foreigner, you are most likely eligible for said tax-free benefits, making your shopping adventure even more enticing. To help you get the best deal out there, we’ve prepared this guide to tax-free shopping in Japan.

Tax-Free Shopping Sticker

You will likely spot this sticker throughout your shopping experience. The Tax-Free stickers indicate whether or not a shop can offer tax-free items, meaning they have received the appropriate permission. Looking out for the sticker is a good way to choose which stores to go into! Finding the red emblem outside stores is more common in shops near the airpo r t and at malls and department stores. If you’re not sure a store offers this service, there’s no harm in asking!

Are You Eligible To Receive Tax-Free Shopping in Japan?

Only foreign visitors , in Japan for less than 6 months , are eligible for tax exemptions and tax-free shopping in Japan. It is important to take note when you arrive at the airport that you receive a stamp in your passport. This stamp will be vital in proving your visitor status when claiming your tax benefits. Sometimes when travelers use automated passport machines at the airport, it will not indicate in their passport correctly, so keep this in mind when you arrive. If you work in Japan, you are not eligible for tax-free shopping.

What Items Can Be Purchased Tax-Free in Japan?

Two categories of goods can be purchased tax-free. The first are categorized as ‘consumables’. These are things like food and drinks, cigarettes, medicine, health food products, and cosmetics. If you are purchasing a consumable good and want a tax exemption – you cannot consume it in Japan. This means that the item will be sealed and labeled upon purchase and cannot be opened until you have left Japan. The minimum amount of money that must be spent is 5000 Yen, purchased on the same day in the same store, and taken out of Japan within 30 days.

Other goods are categorized as ‘general goods.’ These are items such as clothing, jewelry, electronics, and housewares, and they do not require any special packaging or labels. You can use these items while in Japan, but they must be taken out of the country less than 6 months after you enter the country. Like consumable goods, the minimum amount to get a tax refund is 5000 Yen. The maximum amount is 500,000 Yen.

What Is the Process for Receiving the Tax-Refund While Shopping?

For starters, it is important to always have your passport with you when shopping in Japan. This will indicate to the store that you are a foreign shopper. You can only receive the tax exemption on the same day of purchasing, so you must have your passport with you.

- The first is to show your passport to the shop owner when making the purchase and they will apply the discount on the spot.

- Depending on the store, on-the-spot reductions are not always possible. If it is not an option, the second approach is to pay the full price and then visit a tax-free counter to receive the refund. Make sure you have the receipt, passport, and credit card used for payment. The card name must match the name on the passport.

- If you are using the tax-free counter, make sure that you ask for a Record of Purchase. Having this is necessary when going through airport customs on the way out. Keep it safe!

- You may also be required to sign a Purchaser’s Pledge. Here, you are agreeing to follow the rules and take the general goods out of Japan. You declare that you will not use the consumable goods while in Japan and will take them out of the country within 30 days. You will also be asked to present this document at the airport.

Please note:

This tax-free process is slowly being digitalized with the Visit Japan Web app. This app is predominantly used for visa purposes and to help visitors enter and exit the country smoothly. But, it now has an additional tax-free purchase function to use when shopping at tax-free shops. If you register for this service before arriving, you will be able to shop and claim your tax exemption by simply showing your tax-free 2D code to the staff instead of your passport. It is only currently available in stores that can read tax-free 2D codes.

Is Alcohol Tax-Free in Japan?

Yes! Alcohol is tax-free in Japan but it must be purchased from selected retailers. Items such as sake, wine , and whiskey are produced in specific facilities. They are then purchased by direct sales stores which are approved to receive the tax redemption. When you are choosing which category at the airport, alcohol is considered a consumable.

What Is the Difference Between Duty-Free and Tax-Free?

There is a distinction between tax-free and duty-free in Japan which is important to take note of. Tax-free refers to the VAT (consumption tax). Duty-free refers to the government tax exemption which can be taken advantage of by anyone who has gone through the airport immigration border.

Other Important Tips

- The name on your passport must match your credit card. This means that only the cardholder will be exempt from the taxes. So keep this in mind when deciding which card to use!

- Be careful about combining consumables with general goods. For example, if you spent only 3000 yen on consumables but 7000 on general goods, it would not count for tax-free shopping. You must spend over 5000 yen for each category for the exemption to be applied.

- Remember, you cannot open the consumables in Japan. If you wish to use the consumables while in Japan then you cannot receive the tax exemption.

Keep these tips in mind, and always remember to have your passport with you. Happy shopping!

Subscribe for insider tips to Japan Enter your email address to stay in-the-know of what's new in Japan. We promise to only send you guides to the best experiences. Email Keep Me Updated

Recommended

Related Articles

Best Shopping Malls Tokyo

5 Reasons To Shop at Gotemba Premium Outlets

11 Days in Japan Itinerary

Do I Need a Visa for Japan?

How To Plan the Perfect Trip to Japan: A Comprehensive Guide

Tokyo Shopping Guide

Kyoto Shopping Guide

Japan Packing Guide: What To Pack for Japan?

Japanese Chopstick Etiquette

How To Use a Japanese Toilet (Washlet)

- Subscribe Digital Print

- Tourism in Japan

- Latest News

- Deep Dive Podcast

Today's print edition

Home Delivery

- Crime & Legal

- Science & Health

- More sports

- CLIMATE CHANGE

- SUSTAINABILITY

- EARTH SCIENCE

- Food & Drink

- Style & Design

- TV & Streaming

- Entertainment news

Japan considers revamping tax-free shopping rule to stem illicit resales

Japan is considering overhauling its tax-free shopping program for foreign visitors in response to a growing number of cases of tax-free items being resold overseas for profit at tax-inclusive prices, sources close to the matter said Monday.

Formal government discussions on the tax-free shopping rule may start later this year when an annual tax system review for fiscal 2024 begins, the sources said.

In the European Union, for instance, tourists pay prices including value-added tax and get a refund after complying with required formalities.

In Japan, travelers are exempted from paying the consumption tax when purchasing goods totaling ¥5,000 ($36) or more as long as they intend to use the items in their home countries.

But there have been cases where travelers purchased massive amounts of tax-free items for resale purposes, the sources said.

Last year, Apple's Japan branch was slapped with ¥14 billion in additional taxes after authorities found it sold iPhones and other items in bulk without charging the consumption tax to foreign visitors suspected of purchasing the products for resale purposes.

Purchasing records at tax-free stores are shared with customs, and the consumption tax is collected from travelers who do not carry tax-free items they bought with them at the time of departure.

According to the Finance Ministry, it is usually difficult to collect the tax from such travelers because they often do not have the money to make the payment when they are departing the country.

The government has ramped up efforts to prevent illicit tax-free purchases, such as by requiring, from May, businesses that have purchased tax-free items for resale purposes to pay the consumption tax.

In a time of both misinformation and too much information, quality journalism is more crucial than ever. By subscribing, you can help us get the story right.

Everything you want to know about Japan

How much tax refund will I get in Japan?

1. introduction.

Tax refunds can be a great way to get some of your money back from the Japanese government. For foreigners living in Japan, tax refunds are available for a variety of reasons, and understanding how much you can receive back is key to making the most of your financial situation. In this article, Charles R. Tokoyama, CEO of Japan Insiders, will explain how much tax refund you can get in Japan and how to go about claiming it.

2. Tax Refunds for Foreigners in Japan

Foreigners living in Japan may be eligible for tax refunds depending on their residency status and other factors such as length of stay in the country and income level. Generally speaking, if you have earned income while living in Japan, then you may be eligible for a tax refund. The amount of the refund depends on a variety of factors such as your income level and taxes paid during the year.

3. Types of Japanese Taxes

In order to understand how much tax refund you can get in Japan, it’s important to understand the different types of taxes that exist in the country. The two main types are direct taxes such as income tax and indirect taxes such as consumption tax (VAT). Income taxes are generally progressive, meaning that higher earners pay more than lower earners; however, there are also deductions and exemptions that can reduce your taxable income amount. Consumption taxes are applied to goods and services purchased within Japan and vary depending on what is being purchased or consumed.

4. Calculating Your Tax Refund in Japan

The amount of your tax refund will depend on several factors including your total taxable income for the year, any deductions or exemptions applied during filing season, and any applicable credits or rebates from the government. Generally speaking, if you have paid more taxes than you owe due to deductions or exemptions then you may be eligible for a refund from the Japanese government. To calculate an estimate of your potential refund amount it is best to use an online calculator or speak with a qualified accountant who specializes in Japanese taxation laws.

5 How to Claim a Tax Refund in Japan

The process for claiming a tax refund in Japan is relatively straightforward but requires careful attention to detail when submitting all necessary paperwork and documentation required by the government agency responsible for collecting taxes (National Tax Agency). First off, make sure that all necessary documents have been submitted correctly before filing your claim; this includes proof of residency status (such as visa) as well as proof of income earned during the year (such as pay stubs). Once all documents have been submitted correctly then you will need to file an official claim form with the National Tax Agency which will include details about why you believe you are entitled to receive a refund from them.

6 Benefits of Claiming a Tax Refund in Japan

Claiming a tax refund from the Japanese government can provide several benefits including reducing overall taxable income levels which could result in lower future payments due at filing time; additionally it could provide extra funds which could be used towards investments or other long-term goals such as retirement planning or college tuition payments for children/grandchildren etc…

7 Tips for Maximizing Your Tax Refund in Japan

To maximize your potential tax refund there are several tips that should be followed: first off make sure all necessary documents have been filed correctly with no mistakes; secondly make sure that any applicable credits or deductions have been taken into account when calculating total taxable income; finally make sure that any applicable rebates or special offers from the government have been taken advantage off when possible (such as energy saving credits etc…)

8 Common Mistakes to Avoid When Claiming a Tax Refund in Japan

When claiming a tax refund from the Japanese government there are several common mistakes that should be avoided: first off do not submit incorrect documents which could lead to delays or errors when processing claims; secondly do not underestimate total taxable income amounts which could result in underpayment when filing returns; thirdly do not overpay when filing returns which could result in lower refunds than expected; finally do not forget about special offers or rebates provided by local governments which could increase overall refunds received at filing time

9 Conclusion

Is there tax refund for tourists in Japan?

Foreign tourists who stay in Japan for less than 6 months are eligible for tax-free shopping. Bring your purchased items to the in-store tax refund counter after we verify eligibility and tax refund terms: Tax Refund Items.

Who is eligible for tax refund in Japan?

Who is taxed for tax-free shopping? Those who have already purchased (ie not acting on behalf of someone else) and those who do not live in Japan (ie not a resident). You must claim the tax from the same store where the goods were purchased. Income tax should be claimed on the same day of purchase.

How do I claim tax free at Japan airport?

Duty Free Purchase (a) Present your passport at the time of purchase and pay the total with withheld customs duties. (b) Refunds by visiting a designated tax rebate counter and presenting your receipt and passport for tax exemption.

How do foreigners save tax in Japan?

Charitable contributions are 40 percent of gross deductible income minus 2000 JPY. For example if you donate 10000 JPY you will get 3200 JPY tax credit. Japans Tax Reform Act defines this capital surplus. So if you donate you can reduce your tax burden.

What is the maximum tax refund you can get?

There is no limit on the amount of tax refund. However in some cases a large tax refund may be sent as a paper check instead of a direct deposit. LIRS does not publish a threshold for issuing a check in lieu of a direct deposit but limits direct deposits to three deposits per account.

What’s the biggest tax refund ever?

Ramon Christopher Blanchett of Tampa Fla. who describes himself as a freelancer was able to claim a $980000 tax refund after submitting tax returns that he prepared himself.

Related posts:

- Who is eligible for tax-free in Japan?

- Is Japan tax-free for foreigners?

- Do foreigners pay tax in Japan?

- Do foreigners have to pay taxes in Japan?

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Ads Blocker Detected!!!

We have detected that you are using extensions to block ads. Please support us by disabling these ads blocker.

Guide to Tax-Free Shopping in Japan

Stefanie Akkerman moved from the Netherlands to Japan in 2013 with her Japanese husband and son. She jumped into the niche of Dutch tour guiding in Tokyo and Kamakura in 2015 and occasionally writes articles about all the great sights and activities Japan has to offer. She loves (Japanese) food, and to work that all off she goes diving, snorkeling, cycling, or hiking.

This post may contain some affiliate links. When you click through and make a purchase we may receive some commission, at no extra cost to you .

Tourists come to Japan for many reasons: the food , the interesting history , the pop culture , the beautiful cultural heritage sites , the winter sports , the diving , and the list goes on and on.

Besides all the other reasons to travel to Japan, shopping is a popular motive for many to come to Japan. This is with good reason, as Japan is a true shopper’s paradise for everyone looking for things ranging from luxury goods to cheap bargains . However, did you know that tourists can shop tax-free in Japan? Let’s have a closer look at this wallet-friendly way to shop till you drop!

1. What is Tax-Free Shopping

2. who can shop tax-free in japan, 3. how to shop tax-free in japan, 4. where to tax-free shop in japan, 5. what is duty-free shopping, japan wonder travel tours in tokyo, some other articles you may enjoy.

Most countries have a law that states that companies have to levy a sales tax on their products and services in order to collect tax revenue. Companies and shops charge this sales tax or consumption tax on top of their actual product price. This sales tax is then paid by the company to the country’s internal revenue service.

In Japan, the amount of sales tax is set at 10% (8% for food and drinks). Sometimes, the prices shown in the shop are tax-included, and sometimes the prices on the labels are not yet inclusive of sales tax. In Japan, most shops show both prices on product labels; the larger price you see is exclusive of tax, and the smaller price shows the price with sales tax included.

Japan, like many countries, exempts temporary visitors from having to pay sales tax under certain conditions.

Anyone who comes to Japan as a temporary visitor and fulfills certain conditions can enjoy tax-free shopping. Here are the rules about who is eligible for tax-free shopping in Japan:

- Non-residents : Tax-free shopping is only available for people who come to Japan as a non-resident. You are not allowed to shop on a Japanese resident’s behalf and then sell them back the goods at the tax-free price.

- Less than six months : You can only shop tax-free if you stay in Japan for less than six months and are not registered at a City Hall in Japan

- Passport stamp : You need to have a stamp in your passport that shows your date of entry. This means that you can’t have entered through an automated gate.

The products have to be taken out of Japan for personal use or given away as presents at home. This might be checked at the airport as the shop will send your electronic purchase record to the Japanese authorities, and they may request you to show them the unopened and unused product at the airport when you are leaving Japan. If you can’t show them the product in that state, they will charge you the sales tax before you leave the country.

Not all shops are able to deal with the administration that comes with tax-free shopping. So how can you tell which shop in Japan is eligible for tax-free shopping? Look out for the handy stickers with a red/white logo and the words “Japan. Tax-free Shop,” and you can conveniently see where to go. Once you find a tax-free shop, you should keep in mind that there is a price limit that you need to stay below or above in order to fall into the tax-free bracket.

For tax-free, there are two main categories of goods; general goods (clothes, bags, watches, household items, etc.) and consumable goods (foods, drinks, cosmetics, etc.)

For general goods, you have to spend a minimum of 5000 JPY at one store on the same day to be eligible for tax-free shopping. For consumable goods, the total amount you are spending has to be between 5000 and 500,000 JPY at one store on the same day. In the case of consumable goods, all goods have to exit Japan within the next 30 days.

Once you have made your eligible purchases, you have to go to the store’s tax-free counter with your passport, your receipt, the purchased goods, and your credit card, which must have the same name as in your passport (corporate credit cards are not eligible). At this counter, they will refund you the sales tax, pack your goods as required by the government, and make a digital record for the Japanese government that will automatically show up when you leave the country. Some stores also offer a direct discount at the cashier when showing your foreign passport, but it depends on the store whether they offer this option.

There are many kinds of stores where you can shop tax-free in Japan, and especially stores that are very popular with overseas tourists tend to advertise their tax-free shopping options clearly. Think about stores like Bic Camera (electronics), Uniqlo (apparel), Don Quijote (variety store), large chain drug stores, cosmetic stores, and department stores such as Mitsukoshi.

Some smaller stores also have tax-free shopping options, especially now many shopping streets and malls have set up tax-free counters that can be easily used by smaller shops as well. This means that in areas like Nakano Broadway , where many tourists love to shop, there are plenty of smaller stores that also participate in the tax-free shopping program. You can use a website like Taxfreeshops to find stores near where you are staying in Japan.

Many people often confuse tax-free shopping with duty-free shopping. While they are similar in that both options make it cheaper for international tourists to shop at their travel destinations, the type of product and type of tax exemption is different. If you shop at a duty-free shop, which can usually be found at the airport and select shopping malls like T Galleria in Naha, Okinawa , you can buy products like tobacco, alcohol, and certain cosmetics duty-free. The price you pay should be lower than elsewhere because duty tax and consumption tax are not added. Tax-free shopping only refers to shopping where consumption tax (VAT) is subtracted.

Japan Wonder Travel is a travel agency that offers guided tours throughout Japan. From private walking tours to delicious Food and Drink tours, we can help organize the best tours just for you! If you want to explore Japan and learn more about the history and backstories of each area you are traveling in, our knowledgeable and friendly guides will happily take you to the best spots! In addition, we can provide you with any assistance you may need for your upcoming trip to Japan, so please feel free to contact us if you have any questions or need some help!

▶ Tokyo Tsukiji Fish Market Food and Drink Tour Explore the most lively and popular fish market in Tokyo, where you will have the chance to try some of the local’s favorite street foods and sake along with your friendly English-speaking guide!

▶ Tokyo 1–Day Highlights Private Walking Tour (8 Hours) There’s no better way to explore an area than taking a tour with a knowledgeable local guide. You will have the chance to learn about the history and interesting background stories of Tokyo, as well as discover some hidden gems which can be hard to do without a guide.

▶ Shinjuku Bar Hopping Tour: Experience Tokyo’s Nightlife in Izakaya Check out the best spots in Shinjuku while bar hopping through the lively and vibrant area. Try some delicious local food and drink as you explore the narrow yet photogenic alleys that the town has to offer. Experience Japanese izakaya culture and drink in Shinjuku like the locals!

Follow us on Instagram , Facebook , Twitter , and TikTok for more travel inspiration. Or tag us to get featured!

Happy traveling!

Stay informed of the best travel tips to Japan, the most exciting things to do and see, and the top experiences to have with the Japan Wonder Travel Newsletter. Once every two weeks we will introduce you to our latest content.

- Popular destinations

- Hidden places in Japan

- Tours and workshop

- Food and drink in Japan

- Itinerary in Japan

- Places to visit in Tokyo

- Food and drink in Tokyo

- Seasonal events

- Tours & workshops

- Tokyo This Week

- Day trip from Tokyo

- Itinerary in Tokyo

- Places to visit in Kyoto

- Food and drink in Kyoto

- Itinerary in Kyoto

- Day trip from Kyoto

- Travel tips

- Accommodation

- Cultural tips

- Transportation

- Tokyo Tours

- Kyoto Tours

- Kimono Rental

- Fukushima Tours

- Mount Fuji Tours

- Tour Package

- Media Kit(English/日本語)

Guide To Tax Refund In Japan

Updated on: March 17, 2019

What is Shōhizei?

Who are eligible for tax refund, minimum purchase.

How to claim your Tax Refund?

- Some stores do their own tax refund. If this is the case, then you will get your tax refund immediately. Proceed to 1. for details.

- When a store do not do their own tax refund, you need to apply tax refund at the Tax Refund Service Counters. Proceed to 2 for details.

1. When a store do their own tax refund.

1a. first check the store whether they participate to the tax refund program, 1b. at the check-out: show your passport, 1c. the tax refund form, 1d. pay the goods without tax, 1e. at the airport: the customs, 2. when a store do not do their own tax refund, 2a. at the store: do they participate to tax refund program, 2b. your passport please, 2c. the covenant of purchase of consumption tax exempt of ultimate export form aka tax refund form, 2d. don’t forget your receipts, 2e. find the nearest tax refund service counter.

- The purchased goods

- Your passport

- Receipts (handwritten receipt will not be accepted)

- Completed Tax Fefund Forms

- The credit card that you’ve used to purchase the goods (if you’ve paid in cash, then you can ignore this step)

2f. Collect the money and Tax Refund Papers

2g. the purchased goods will be sealed in bags, 2h. at the airport: leaving japan, tax refund overview in japan, you might also like:.

Guide To Tax Refund In Canada

Guide To Tax Refund In Czech Republic

Guide To Tax Refund In Malaysia

Leave a comment cancel reply.

Optionally add an image (JPEG only)

Louis Vuitton

Chanel Bag Prices

Louis Vuiton Bag Prices

Dior Bag Prices

Hermes Bag Prices

Goyard Bag Prices

Celine Bag Prices

Chanel Wallet Prices

Chanel Bag Collections

Hermes Wallet Prices

Tax-Refund Guide

Shopping Guide in Airports

Heathrow airport guide.

Leather Guides

© 2024 Bragmybag.com. All Rights Reserved.

Louis Vuitton Bag Prices

Chanel Collection Prices

Shopping Guide In Airports

Heathrow Airport Guide

PH +1 000 000 0000

24 M Drive East Hampton, NY 11937

© 2024 INFO

How to Shop

Shopping in Japan is usually a pleasant experience. The sales staff are generally polite, friendly and attentive, and great care is taken to provide a high level of customer service. Although foreign language services are rarely available, some stores that regularly serve foreign customers may have some staff that speak English or other languages.

Shopping hours and closures

In general, large shops and department stores are open daily from 10:00 to 20:00. Smaller stores and shops around tourist attractions may have shorter hours. Most stores are open on weekends and national holidays (except January 1 when many stores close). Large chain stores open everyday, however smaller independent stores may close one day a week or month.

When you walk into a store, the sales staff will greet you with the expression "irasshaimase" meaning "welcome, please come in". Customers are not expected to respond.

Consumption tax and tax-free shopping

Consumption tax in Japan, known in other countries as VAT, GST or sales tax, is a flat 10 percent on all items except food, drinks and newspaper subscriptions for which it is 8 percent (not including alcoholic drinks and dining out ). Shops are required to show price tags that include the tax; however, pre-tax prices may also be listed alongside the total amounts, resulting in some price tags that list two prices.

Tax-free shopping is available to foreign tourists at licensed stores when making purchases of over 5000 yen at a given store or mall on one calendar day. A passport is required when shopping tax-free. Note that at many shops, it is necessary to first pay the full price (including the consumption tax) at the cashier and then obtain a refund at a customer service desk.

Because some visitors have been abusing the system by illegally reselling purchased goods within Japan, the government is planning to change the system into one in which customers will get the tax refund at the airport before departure rather than at the shop itself. The changes are expected to be put into effect from spring 2025 at the earliest.

Be aware that goods purchased in Japan may be subject to import duties in your home country. Also be aware of the differences in operating voltages, language settings and other standards that may exist in products bought in Japan.

Cash is accepted everywhere, and it is usually no problem to use large bills to pay for small items, except at small street vendors or dusty mom and pop shops. Japanese yen can be withdrawn from foreign bank accounts through ATMs .

Although not as universally accepted as cash, credit cards can also be used in most shops, especially major retail stores, electronics shops and department stores. Visa, Mastercard, JCB, American Express and Union Pay are among the most widely accepted types of cards.

Suica and other IC cards as well as other mobile payment methods are also accepted widely for purchases at shops and restaurants across Japan.

Shopping manners

- When paying, put the money onto the provided tray (preferably with bills neatly unfolded). Your change may be returned in the same way.

- Bargaining is neither common nor appreciated in most stores.

Once you have paid for an item, it will be bagged or marked with colored tape. Many stores will charge a few yen for bags. Clothing stores, department stores and gift shops, among others, will wrap your items if you indicate that they are for a gift. While this is often a free service, some stores charge a minimal fee for wrapping.

Questions? Ask in our forum .

Let's make your shopping in Japan tax free!

Tax Refund is Limited to Licensed Stores

Tourists can only get consumption tax return for any purchase made at the tax free stores during their travel to Japan. We're here to change it.

What is REFUND.jp?

We make it possible for tourists to receive tax refund on items purchased from ordinary stores., for a nominal fee of 3.50% on the purchase price, now you can shop hassle free, and tax free, the process is very simple..

1. Shopping

2. Visit our Shop

3. Proceed to Customs

4. Validate your Transaction

6. Refund Completed!

Our payment options.

Note: Any transfer charges, transaction fees, FX margin shall be deducted, as REFUND made in JPY. We are continuously adding more transfer options.

Our Company

REFUND.jp Counters

Our counter is currently available at H.I.S. Tourist Information Center, Harajyuku. We will be expanding to more locations soon!

Contact REFUND.jp

Our team will get back to you within 2~3 days. The data entered by the customer will not be used for any other purpose than REFUND.jp.

Tourists to Korea complain most about being ripped off, poor taxi service: KTO report

F oreign tourists to Korea are least happy with its shopping and taxi experiences, a Korea Tourism Organization (KTO) report showed Sunday.

The KTO said its Tourist Complaint Center received 902 complaints last year, seeing a significant increase compared to 288 in 2022.

It said the number of complaints decreased between 2020 and 2022 during the COVID-19 pandemic but rose last year as the tourism industry recovered.