Reimagining the $9 trillion tourism economy—what will it take?

Tourism made up 10 percent of global GDP in 2019 and was worth almost $9 trillion, 1 See “Economic impact reports,” World Travel & Tourism Council (WTTC), wttc.org. making the sector nearly three times larger than agriculture. However, the tourism value chain of suppliers and intermediaries has always been fragmented, with limited coordination among the small and medium-size enterprises (SMEs) that make up a large portion of the sector. Governments have generally played a limited role in the industry, with partial oversight and light-touch management.

COVID-19 has caused an unprecedented crisis for the tourism industry. International tourist arrivals are projected to plunge by 60 to 80 percent in 2020, and tourism spending is not likely to return to precrisis levels until 2024. This puts as many as 120 million jobs at risk. 2 “International tourist numbers could fall 60-80% in 2020, UNWTO reports,” World Tourism Organization, May 7, 2020, unwto.org.

Reopening tourism-related businesses and managing their recovery in a way that is safe, attractive for tourists, and economically viable will require coordination at a level not seen before. The public sector may be best placed to oversee this process in the context of the fragmented SME ecosystem, large state-owned enterprises controlling entry points, and the increasing impact of health-related agencies. As borders start reopening and interest in leisure rebounds in some regions , governments could take the opportunity to rethink their role within tourism, thereby potentially both assisting in the sector’s recovery and strengthening it in the long term.

In this article, we suggest four ways in which governments can reimagine their role in the tourism sector in the context of COVID-19.

1. Streamlining public–private interfaces through a tourism nerve center

Before COVID-19, most tourism ministries and authorities focused on destination marketing, industry promotions, and research. Many are now dealing with a raft of new regulations, stimulus programs, and protocols. They are also dealing with uncertainty around demand forecasting, and the decisions they make around which assets—such as airports—to reopen will have a major impact on the safety of tourists and sector employees.

Coordination between the public and private sectors in tourism was already complex prior to COVID-19. In the United Kingdom, for example, tourism falls within the remit of two departments—the Department for Business, Energy, and Industrial Strategy (BEIS) and the Department for Digital, Culture, Media & Sport (DCMS)—which interact with other government agencies and the private sector at several points. Complex coordination structures often make clarity and consistency difficult. These issues are exacerbated by the degree of coordination that will be required by the tourism sector in the aftermath of the crisis, both across government agencies (for example, between the ministries responsible for transport, tourism, and health), and between the government and private-sector players (such as for implementing protocols, syncing financial aid, and reopening assets).

Concentrating crucial leadership into a central nerve center is a crisis management response many organizations have deployed in similar situations. Tourism nerve centers, which bring together public, private, and semi-private players into project teams to address five themes, could provide an active collaboration framework that is particularly suited to the diverse stakeholders within the tourism sector (Exhibit 1).

We analyzed stimulus packages across 24 economies, 3 Australia, Bahrain, Belgium, Canada, Egypt, Finland, France, Germany, Hong Kong, Indonesia, Israel, Italy, Kenya, Malaysia, New Zealand, Peru, Philippines, Singapore, South Africa, South Korea, Spain, Switzerland, Thailand, and the United Kingdom. which totaled nearly $100 billion in funds dedicated directly to the tourism sector, and close to $300 billion including cross-sector packages with a heavy tourism footprint. This stimulus was generally provided by multiple entities and government departments, and few countries had a single integrated view on beneficiaries and losers. We conducted surveys on how effective the public-sector response has been and found that two-thirds of tourism players were either unaware of the measures taken by government or felt they did not have sufficient impact. Given uncertainty about the timing and speed of the tourism recovery, obtaining quick feedback and redeploying funds will be critical to ensuring that stimulus packages have maximum impact.

2. Experimenting with new financing mechanisms

Most of the $100 billion stimulus that we analyzed was structured as grants, debt relief, and aid to SMEs and airlines. New Zealand has offered an NZ $15,000 (US $10,000) grant per SME to cover wages, for example, while Singapore has instituted an 8 percent cash grant on the gross monthly wages of local employees. Japan has waived the debt of small companies where income dropped more than 20 percent. In Germany, companies can use state-sponsored work-sharing schemes for up to six months, and the government provides an income replacement rate of 60 percent.

Our forecasts indicate that it will take four to seven years for tourism demand to return to 2019 levels, which means that overcapacity will be the new normal in the medium term. This prolonged period of low demand means that the way tourism is financed needs to change. The aforementioned types of policies are expensive and will be difficult for governments to sustain over multiple years. They also might not go far enough. A recent Organisation for Economic Co-operation and Development (OECD) survey of SMEs in the tourism sector suggested more than half would not survive the next few months, and the failure of businesses on anything like this scale would put the recovery far behind even the most conservative forecasts. 4 See Tourism policy responses to the coronavirus (COVID-19), OECD, June 2020, oecd.org. Governments and the private sector should be investigating new, innovative financing measures.

Revenue-pooling structures for hotels

One option would be the creation of revenue-pooling structures, which could help asset owners and operators, especially SMEs, to manage variable costs and losses moving forward. Hotels competing for the same segment in the same district, such as a beach strip, could have an incentive to pool revenues and losses while operating at reduced capacity. Instead of having all hotels operating at 20 to 40 percent occupancy, a subset of hotels could operate at a higher occupancy rate and share the revenue with the remainder. This would allow hotels to optimize variable costs and reduce the need for government stimulus. Non-operating hotels could channel stimulus funds into refurbishments or other investment, which would boost the destination’s attractiveness. Governments will need to be the intermediary between businesses through auditing or escrow accounts in this model.

Joint equity funds for small and medium-size enterprises

Government-backed equity funds could also be used to deploy private capital to help ensure that tourism-related SMEs survive the crisis (Exhibit 2). This principle underpins the European Commission’s temporary framework for recapitalization of state-aided enterprises, which provided an estimated €1.9 trillion in aid to the EU economy between March and May 2020. 5 See “State aid: Commission expands temporary framework to recapitalisation and subordinated debt measures to further support the economy in the context of the coronavirus outbreak,” European Commission, May 8, 2020, ec.europa.eu. Applying such a mechanism to SMEs would require creating an appropriate equity-holding structure, or securitizing equity stakes in multiple SMEs at once, reducing the overall risk profile for the investor. In addition, developing a standardized valuation methodology would avoid lengthy due diligence processes on each asset. Governments that do not have the resources to co-invest could limit their role to setting up those structures and opening them to potential private investors.

3. Ensuring transparent, consistent communication on protocols

The return of tourism demand requires that travelers and tourism-sector employees feel—and are—safe. Although international organizations such as the International Air Transport Association (IATA), and the World Travel & Tourism Council (WTTC) have developed a set of guidelines to serve as a baseline, local regulators are layering additional measures on top. This leads to low levels of harmonization regarding regulations imposed by local governments.

Our surveys of traveler confidence in the United States suggests anxiety remains high, and authorities and destination managers must work to ensure travelers know about, and feel reassured by, protocols put in place for their protection. Our latest survey of traveler sentiment in China suggests a significant gap between how confident travelers would like to feel and how confident they actually feel; actual confidence in safety is much lower than the expected level asked a month before.

One reason for this low level of confidence is confusion over the safety measures that are currently in place. Communication is therefore key to bolstering demand. Experience in Europe indicates that prompt, transparent, consistent communications from public agencies have had a similar impact on traveler demand as CEO announcements have on stock prices. Clear, credible announcements regarding the removal of travel restrictions have already led to increased air-travel searches and bookings. In the week that governments announced the removal of travel bans to a number of European summer destinations, for example, outbound air travel web search volumes recently exceeded precrisis levels by more than 20 percent in some countries.

The case of Greece helps illustrate the importance of clear and consistent communication. Greece was one of the first EU countries to announce the date of, and conditions and protocols for, border reopening. Since that announcement, Greece’s disease incidence has remained steady and there have been no changes to the announced protocols. The result: our joint research with trivago shows that Greece is now among the top five summer destinations for German travelers for the first time. In July and August, Greece will reach inbound airline ticketing levels that are approximately 50 percent of that achieved in the same period last year. This exceeds the rate in most other European summer destinations, including Croatia (35 percent), Portugal (around 30 percent), and Spain (around 40 percent). 6 Based on IATA Air Travel Pulse by McKinsey. In contrast, some destinations that have had inconsistent communications around the time frame of reopening have shown net cancellations of flights for June and July. Even for the high seasons toward the end of the year, inbound air travel ticketing barely reaches 30 percent of 2019 volumes.

Digital solutions can be an effective tool to bridge communication and to create consistency on protocols between governments and the private sector. In China, the health QR code system, which reflects past travel history and contact with infected people, is being widely used during the reopening stage. Travelers have to show their green, government-issued QR code before entering airports, hotels, and attractions. The code is also required for preflight check-in and, at certain destination airports, after landing.

4. Enabling a digital and analytics transformation within the tourism sector

Data sources and forecasts have shifted, and proliferated, in the crisis. Last year’s demand prediction models are no longer relevant, leaving many destinations struggling to understand how demand will evolve, and therefore how to manage supply. Uncertainty over the speed and shape of the recovery means that segmentation and marketing budgets, historically reassessed every few years, now need to be updated every few months. The tourism sector needs to undergo an analytics transformation to enable the coordination of marketing budgets, sector promotions, and calendars of events, and to ensure that products are marketed to the right population segment at the right time.

Governments have an opportunity to reimagine their roles in providing data infrastructure and capabilities to the tourism sector, and to investigate new and innovative operating models. This was already underway in some destinations before COVID-19. Singapore, for example, made heavy investments in its data and analytics stack over the past decade through the Singapore Tourism Analytics Network (STAN), which provided tourism players with visitor arrival statistics, passenger profiling, spending data, revenue data, and extensive customer-experience surveys. During the COVID-19 pandemic, real-time data on leading travel indicators and “nowcasts” (forecasts for the coming weeks and months) could be invaluable to inform the decisions of both public-sector and private-sector entities.

This analytics transformation will also help to address the digital gap that was evident in tourism even before the crisis. Digital services are vital for travelers: in 2019, more than 40 percent of US travelers used mobile devices to book their trips. 7 Global Digital Traveler Research 2019, Travelport, marketing.cloud.travelport.com; “Mobile travel trends 2019 in the words of industry experts,” blog entry by David MacHale, December 11, 2018, blog.digital.travelport.com. In Europe and the United States, as many as 60 percent of travel bookings are digital, and online travel agents can have a market share as high as 50 percent, particularly for smaller independent hotels. 8 Sean O’Neill, “Coronavirus upheaval prompts independent hotels to look at management company startups,” Skift, May 11, 2020, skift.com. COVID-19 is likely to accelerate the shift to digital as travelers look for flexibility and booking lead times shorten: more than 90 percent of recent trips in China were booked within seven days of the trip itself. Many tourism businesses have struggled to keep pace with changing consumer preferences around digital. In particular, many tourism SMEs have not been fully able to integrate new digital capabilities in the way that larger businesses have, with barriers including language issues, and low levels of digital fluency. The commission rates on existing platforms, which range from 10 percent for larger hotel brands to 25 percent for independent hotels, also make it difficult for SMEs to compete in the digital space.

Governments are well-positioned to overcome the digital gap within the sector and to level the playing field for SMEs. The Tourism Exchange Australia (TXA) platform, which was created by the Australian government, is an example of enabling at scale. It acts as a matchmaker, connecting suppliers with distributors and intermediaries to create packages attractive to a specific segment of tourists, then uses tourist engagement to provide further analytical insights to travel intermediaries (Exhibit 3). This mechanism allows online travel agents to diversify their offerings by providing more experiences away from the beaten track, which both adds to Australia’s destination attractiveness, and gives small suppliers better access to customers.

Governments that seize the opportunity to reimagine tourism operations and oversight will be well positioned to steer their national tourism industries safely into—and set them up to thrive within—the next normal.

Download the article in Arabic (513KB)

Margaux Constantin is an associate partner in McKinsey’s Dubai office, Steve Saxon is a partner in the Shanghai office, and Jackey Yu is an associate partner in the Hong Kong office.

The authors wish to thank Hugo Espirito Santo, Urs Binggeli, Jonathan Steinbach, Yassir Zouaoui, Rebecca Stone, and Ninan Chacko for their contributions to this article.

Explore a career with us

Related articles.

Make it better, not just safer: The opportunity to reinvent travel

Hospitality and COVID-19: How long until ‘no vacancy’ for US hotels?

A new approach in tracking travel demand

- Understanding Poverty

- Competitiveness

Tourism and Competitiveness

- Publications

The tourism sector provides opportunities for developing countries to create productive and inclusive jobs, grow innovative firms, finance the conservation of natural and cultural assets, and increase economic empowerment, especially for women, who comprise the majority of the tourism sector’s workforce. Before the COVID-19 pandemic, tourism was the world’s largest service sector—providing one in ten jobs worldwide, almost seven percent of all international trade and 25 percent of the world’s service exports —a critical foreign exchange generator. In 2019 the sector was valued at more than US$9 trillion and accounted for 10.4 percent of global GDP.

Tourism offers opportunities for economic diversification and market-creation. When effectively managed, its deep local value chains can expand demand for existing and new products and services that directly and positively impact the poor and rural/isolated communities. The sector can also be a force for biodiversity conservation, heritage protection, and climate-friendly livelihoods, making up a key pillar of the blue/green economy. This potential is also associated with social and environmental risks, which need to be managed and mitigated to maximize the sector’s net-positive benefits.

The impact of the COVID-19 pandemic has been devastating for tourism service providers, with a loss of 20 percent of all tourism jobs (62 million), and US$1.3 trillion in export revenue, leading to a reduction of 50 percent of its contribution to GDP in 2020 alone. The collapse of demand has severely impacted the livelihoods of tourism-dependent communities, small businesses and women-run enterprises. It has also reduced government tax revenues and constrained the availability of resources for destination management and site conservation.

Naturalist local guide with group of tourist in Cuyabeno Wildlife Reserve Ecuador. Photo: Ammit Jack/Shutterstock

Tourism and Competitiveness Strategic Pillars

Our solutions are integrated across the following areas:

- Competitive and Productive Tourism Markets. We work with government and private sector stakeholders to foster competitive tourism markets that create productive jobs, improve visitor expenditure and impact, and are supportive of high-growth, innovative firms. To do so we offer guidance on firm and destination level recovery, policy and regulatory reforms, demand diversification, investment promotion and market access.

- Blue, Green and Resilient Tourism Economies. We support economic diversification to sustain natural capital and tourism assets, prepare for external and climate-related shocks, and be sustainably managed through strong policy, coordination, and governance improvements. To do so we offer support to align the tourism enabling and policy environment towards sustainability, while improving tourism destination and site planning, development, and management. We work with governments to enhance the sector’s resilience and to foster the development of innovative sustainable financing instruments.

- Inclusive Value Chains. We work with client governments and intermediaries to support Small and Medium sized Enterprises (SMEs), and strengthen value chains that provide equitable livelihoods for communities, women, youth, minorities, and local businesses.

The successful design and implementation of reforms in the tourism space requires the combined effort of diverse line ministries and agencies, and an understanding of the impact of digital technologies in the industry. Accordingly, our teams support cross-cutting issues of tourism governance and coordination, digital innovation and the use and application of data throughout the three focus areas of work.

Tourism and Competitiveness Theory of Change

Examples of our projects:

- In Indonesia , a US$955m loan is supporting the Government’s Integrated Infrastructure Development for National Tourism Strategic Areas Project. This project is designed to improve the quality of, and access to, tourism-relevant basic infrastructure and services, strengthen local economy linkages to tourism, and attract private investment in selected tourism destinations. In its initial phases, the project has supported detailed market and demand analyses needed to justify significant public investment, mobilized integrated tourism destination masterplans for each new destination and established essential coordination mechanisms at the national level and at all seventeen of the Project’s participating districts and cities.

- In Madagascar , a series of projects totaling US$450m in lending and IFC Technical Assistance have contributed to the sustainable growth of the tourism sector by enhancing access to enabling infrastructure and services in target regions. Activities under the project focused on providing support to SMEs, capacity building to institutions, and promoting investment and enabling environment reforms. They resulted in the creation of more than 10,000 jobs and the registration of more than 30,000 businesses. As a result of COVID-19, the project provided emergency support both to government institutions (i.e., Ministry of Tourism) and other organizations such as the National Tourism Promotion Board to plan, strategize and implement initiatives to address effects of the pandemic and support the sector’s gradual relaunch, as well as to directly support tourism companies and workers groups most affected by the crisis.

- In Sierra Leone , an Economic Diversification Project has a strong focus on sustainable tourism development. The project is contributing significantly to the COVID-19 recovery, with its focus on the creation of six new tourism destinations, attracting new private investment, and building the capacity of government ministries to successfully manage and market their tourism assets. This project aims to contribute to the development of more circular economy tourism business models, and support the growth of women- run tourism businesses.

- Through the Rebuilding Tourism Competitiveness: Tourism Response, Recovery and Resilience to the COVID-19 Crisis initiative and the Tourism for Development Learning Series , we held webinars, published insights and guidance notes as well as formed new partnerships with Organization of Eastern Caribbean States, United Nations Environment Program, United Nations World Tourism Organization, and World Travel and Tourism Council to exchange knowledge on managing tourism throughout the pandemic, planning for recovery and building back better. The initiative’s key Policy Note has been downloaded more than 20,000 times and has been used to inform recovery initiatives in over 30 countries across 6 regions.

- The Global Aviation Dashboard is a platform that visualizes real-time changes in global flight movements, allowing users to generate 2D & 3D visualizations, charts, graphs, and tables; and ranking animations for: flight volume, seat volume, and available seat kilometers. Data is available for domestic, intra-regional, and inter-regional routes across all regions, countries, airports, and airlines on a daily, weekly, or monthly basis from January 2020 until today. The dashboard has been used to track the status and recovery of global travel and inform policy and operational actions.

Traditional Samburu women in Kenya. Photo: hecke61/Shutterstock.

Featured Data

We-Fi WeTour Women in Tourism Enterprise Surveys (2019)

- Sierra Leone | Ghana

Featured Reports

- Destination Management Handbook: A Guide to the Planning and Implementation of Destination Management (2023)

- Blue Tourism in Islands and Small Tourism-Dependent Coastal States : Tools and Recovery Strategies (2022)

- Resilient Tourism: Competitiveness in the Face of Disasters (2020)

- Tourism and the Sharing Economy: Policy and Potential of Sustainable Peer-to-Peer Accommodation (2018)

- Supporting Sustainable Livelihoods through Wildlife Tourism (2018)

- The Voice of Travelers: Leveraging User-Generated Content for Tourism Development (2018)

- Women and Tourism: Designing for Inclusion (2017)

- Twenty Reasons Sustainable Tourism Counts for Development (2017)

- An introduction to tourism concessioning:14 characteristics of successful programs. The World Bank, 2016)

- Getting financed: 9 tips for community joint ventures in tourism . World Wildlife Fund (WWF) and World Bank, (2015)

- Global investment promotion best practices: Winning tourism investment” Investment Climate (2013)

Country-Specific

- COVID-19 and Tourism in South Asia: Opportunities for Sustainable Regional Outcomes (2020)

- Demand Analysis for Tourism in African Local Communities (2018)

- Tourism in Africa: Harnessing Tourism for Growth and Improved Livelihoods . Africa Development Forum (2014)

COVID-19 Response

- Expecting the Unexpected : Tools and Policy Considerations to Support the Recovery and Resilience of the Tourism Sector (2022)

- Rebuilding Tourism Competitiveness. Tourism response, recovery and resilience to the COVID-19 crisis (2020)

- COVID-19 and Tourism in South Asia Opportunities for Sustainable Regional Outcomes (2020)

- WBG support for tourism clients and destinations during the COVID-19 crisis (2020)

- Tourism for Development: Tourism Diagnostic Toolkit (2019)

- Tourism Theory of Change (2018)

Country -Specific

- COVID Impact Mitigation Survey Results (South Africa) (2020)

- COVID Preparedness for Reopening Survey Results (South Africa) (2020)

- COVID Study (Fiji) (2020) with IFC

Featured Blogs

- Fiona Stewart, Samantha Power & Shaun Mann , Harnessing the power of capital markets to conserve and restore global biodiversity through “Natural Asset Companies” | October 12 th 2021

- Mari Elka Pangestu , Tourism in the post-COVID world: Three steps to build better forward | April 30 th 2021

- Hartwig Schafer , Regional collaboration can help South Asian nations rebuild and strengthen tourism industry | July 23 rd 2020

- Caroline Freund , We can’t travel, but we can take measures to preserve jobs in the tourism industry | March 20 th 2020

Featured Webinars

- Destination Management for Resilient Growth . This webinar looks at emerging destinations at the local level to examine the opportunities, examples, and best tools available. Destination Management Handbook

- Launch of the Future of Pacific Tourism. This webinar goes through the results of the new Future of Pacific Tourism report. It was launched by FCI Regional and Global Managers with Discussants from the Asian Development Bank and Intrepid Group.

- Circular Economy and Tourism . This webinar discusses how new and circular business models are needed to change the way tourism operates and enable businesses and destinations to be sustainable.

- Closing the Gap: Gender in Projects and Analytics . The purpose of this webinar is to raise awareness on integrating gender considerations into projects and provide guidelines for future project design in various sectoral areas.

- WTO Tourism Resilience: Building forward Better. High-level panelists from Sri Lanka, Costa Rica, Jordan and Kenya discuss how donors, governments and the private sector can work together most effectively to rebuild the tourism industry and improve its resilience for the future.

- Tourism Watch

- [email protected]

Launch of Blue Tourism Resource Portal

How global tourism can become more sustainable, inclusive and resilient

A sanitary mask lies on the ground at Frankfurt Airport Image: Reuters/Ralph Orlowski

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Ahmed Al-Khateeb

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} The Great Reset is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, the great reset.

- Tourism rose to the forefront of the global agenda in 2020, due to the devastating impact of COVID-19

- Recovery will be driven by technology and innovation – specifically seamless travel solutions, but it will be long, uneven and slow

- Success hinges on international coordination and collaboration across the public and private sectors

Tourism was one of the sectors hit hardest by the global pandemic. 2020 was the worst year on record for international travel due to the global pandemic, with countries taking decisive action to protect their citizens, closing borders and halting international travel.

The result was a 74% decline in international visitor arrivals, equivalent to over $1 trillion revenue losses , and an estimated 62 million fewer jobs . The impact on international air travel has been even more severe with a 90% drop on 2019 , resulting in a potential $1.8 trillion loss. And while the economic impact is dire in itself, nearly 2.9 million lives have been lost in the pandemic.

The path to recovery will be long and slow

Countries now face the challenge of reopening borders to resume travel and commerce, while protecting their populations’ health. At its peak, the World Tourism Organization (UNWTO) reported in April 2020 that every country on earth had implemented some travel restriction , signalling the magnitude of the operation to restart travel.

Have you read?

Tourism industry experts fear long road to recovery, how we can prioritize sustainability in rebuilding tourism, covid-19 could set the global tourism industry back 20 years.

Consequently, the path to recovery will be long and slow. The resurgence of cases following the discovery of new variants towards the end of last year delivered another disappointing blow to the travel industry. Any pickup over the summer months was quashed following a second wave of lockdowns and border closures . Coupled with mixed progress in the roll-out of vaccination programs, I predict that we will not see a significant rebound in international travel until the middle of this year at best.

Others echo my fears. The International Air Transport Association (IATA) forecasts a 50.4% improvement on 2020 air travel demand, which would bring the industry to 50.6% of 2019 levels . However, a more pessimistic outlook based on the persistence of travel restrictions suggests that demand may only pick up by 13% this year, leaving the industry at 38% of 2019 levels. McKinsey & Company similarly predict that tourism expenditure may not return to pre-COVID-19 levels until 2024 .

How to enhance sustainability, inclusivity and resilience

Given its economic might – employing 330 million people, contributing 10% to global GDP before the pandemic, and predicted to create 100 million new jobs – restoring the travel and tourism sector to a position of strength is the utmost priority.

The Great Reset provides an opportunity to rethink how tourism is delivered and to enhance sustainability, inclusivity and resilience. We must also address the challenges – from climate change and “ overtourism ” to capacity constraints – that we faced before the pandemic, while embracing traveller preferences, as we rebuild.

A 2018 study found that global tourism accounted for 8% of global greenhouse gas emissions from 2009 to 2013 ; four times higher than previous estimates. Even more worryingly, this puts progress towards the Paris Agreement at risk – recovery efforts must centre around environmental sustainability.

Furthermore, according to a study on managing overcrowding, the top 20 most popular global destinations were predicted to add more international arrivals than the rest of the world combined by 2020 . While COVID-19 will have disrupted this trend, it is well known that consumers want to travel again, and we must address the issues associated with overcrowding, especially in nascent destinations, like Saudi Arabia.

The Great Reset is a chance to make sure that as we rebuild, we do it better.

Seamless solutions lie at the heart of travel recovery

Tourism has the potential to be an engine of economic recovery provided we work collaboratively to adopt a common approach to a safe and secure reopening process – and conversations on this are already underway.

Through the G20, which Saudi Arabia hosted in 2020, our discussions focused on how to leverage technology and innovation in response to the crisis, as well as how to restore traveller confidence and improve the passenger experience in the future .

At the global level, across the public and private sectors, the World Economic Forum is working with the Commons Project on the CommonPass framework , which will allow individuals to access lab results and vaccination records, and consent to having that information used to validate their COVID status. IATA is trialling the Travel Pass with airlines and governments , which seeks to be a global and standardized solution to validate and authenticate all country regulations regarding COVID-19 travel requirements.

The provision of solutions that minimize person-to-person contact responds to consumer wants, with IATA finding that 85% of travellers would feel safer with touchless processing . Furthermore, 44% said they would share personal data to enable this, up from 30% months prior , showing a growing trend for contactless travel processes.

Such solutions will be critical in coordinating the opening of international borders in a way that is safe, seamless and secure, while giving tourists the confidence to travel again.

Collaboration at the international level is critical

The availability of vaccines will make this easier, and we have commenced our vaccination programme in Saudi Arabia . But we need to ensure processes and protocols are aligned globally, and that we support countries with limited access to vaccinations to eliminate the threat of another resurgence. It is only when businesses and travellers have confidence in the systems that the sector will flourish again.

In an era of unprecedented data and ubiquitous intelligence, it is essential that organizations reimagine how they manage personal data and digital identities. By empowering individuals and offering them ways to control their own data, user-centric digital identities enable trusted physical and digital interactions – from government services or e-payments to health credentials, safe mobility or employment.

The World Economic Forum curates the Platform for Good Digital Identity to advance global digital identity activities that are collaborative and put the user interest at the center.

The Forum convenes public-private digital identity collaborations from travel, health, financial services in a global action and learning network – to understand common challenges and capture solutions useful to support current and future coalitions. Additionally, industry-specific models such as Known Traveller Digital Identity or decentralized identity models show that digital identity solutions respecting the individual are possible.

The approach taken by Saudi Arabia and its partners to establish consensus and build collaborative relationships internationally and between the public and private sectors, should serve as a model to be replicated so that we can maximize the tourism sector’s contribution to the global economic recovery, while ensuring that it becomes a driver of prosperity and social progress again.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Industries in Depth .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

Robot rock stars, pocket forests, and the battle for chips - Forum podcasts you should hear this month

Robin Pomeroy and Linda Lacina

April 29, 2024

Agritech: Shaping Agriculture in Emerging Economies, Today and Tomorrow

Confused about AI? Here are the podcasts you need on artificial intelligence

Robin Pomeroy

April 25, 2024

Which technologies will enable a cleaner steel industry?

Daniel Boero Vargas and Mandy Chan

Industry government collaboration on agritech can empower global agriculture

Abhay Pareek and Drishti Kumar

April 23, 2024

Nearly 15% of the seafood we produce each year is wasted. Here’s what needs to happen

Charlotte Edmond

April 11, 2024

UN Tourism | Bringing the world closer

Share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Tourism’s Importance for Growth Highlighted in World Economic Outlook Report

- All Regions

- 10 Nov 2023

Tourism has again been identified as a key driver of economic recovery and growth in a new report by the International Monetary Fund (IMF). With UNWTO data pointing to a return to 95% of pre-pandemic tourist numbers by the end of the year in the best case scenario, the IMF report outlines the positive impact the sector’s rapid recovery will have on certain economies worldwide.

According to the World Economic Outlook (WEO) Report , the global economy will grow an estimated 3.0% in 2023 and 2.9% in 2024. While this is higher than previous forecasts, it is nevertheless below the 3.5% rate of growth recorded in 2022, pointing to the continued impacts of the pandemic and Russia's invasion of Ukraine, and from the cost-of-living crisis.

Tourism key sector for growth

The WEO report analyses economic growth in every global region, connecting performance with key sectors, including tourism. Notably, those economies with "large travel and tourism sectors" show strong economic resilience and robust levels of economic activity. More specifically, countries where tourism represents a high percentage of GDP have recorded faster recovery from the impacts of the pandemic in comparison to economies where tourism is not a significant sector.

As the report Foreword notes: "Strong demand for services has supported service-oriented economies—including important tourism destinations such as France and Spain".

Looking Ahead

The latest outlook from the IMF comes on the back of UNWTO's most recent analysis of the prospects for tourism, at the global and regional levels. Pending the release of the November 2023 World Tourism Barometer , international tourism is on track to reach 80% to 95% of pre-pandemic levels in 2023. Prospects for September-December 2023 point to continued recovery, driven by the still pent-up demand and increased air connectivity particularly in Asia and the Pacific where recovery is still subdued.

Related links

- Download the News Release on PDF

- UNWTO World Tourism Barometer

- IMF World Economic Outlook

Category tags

Related content, international tourism to reach pre-pandemic levels in 2024, international tourism to end 2023 close to 90% of pre-p..., international tourism swiftly overcoming pandemic downturn, tourism on track for full recovery as new data shows st....

An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2018-2022.

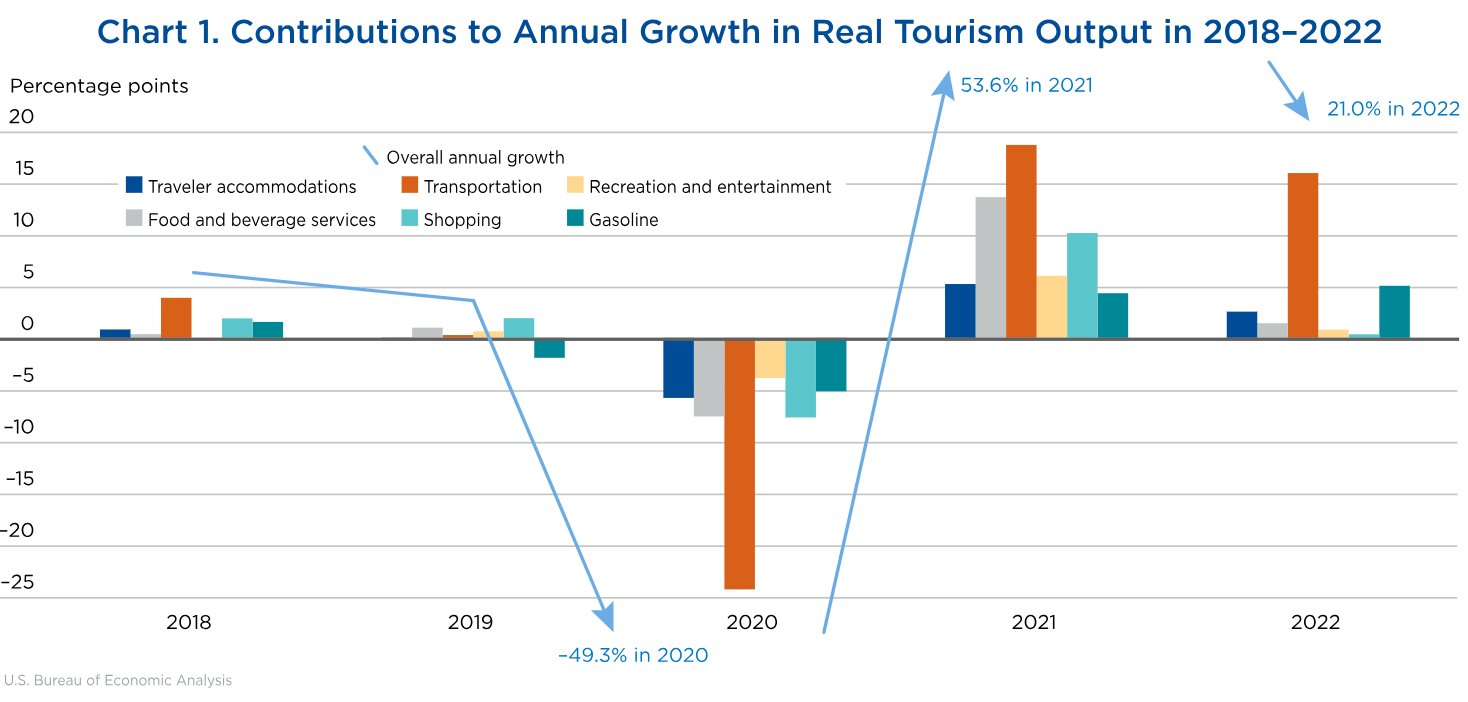

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

Future Changes and Challenges for Post-Covid-19 Tourism

- First Online: 29 April 2024

Cite this chapter

- Anna Trono 4

In conformity with the priorities established in the UNWTO’s global guidelines, today more than ever, the recovery of the tourism sector can contribute to the development and implementation of plans that serve the sustainable development objectives laid out in Agenda 2030. The new tourism sector will thus have a responsible vision of the objectives in terms of public health, social inclusion, conservation of biodiversity, climate safeguards, the circular economy, good governance and sustainable finance. The current vulnerability of tourism could thus create the conditions for a recalibration of the world economic structure, contributing to recovery plans on a broader scale. Like all crises, the current one also represents an opportunity, in this case to accelerate the creation of sustainable tourism models. The resilience of this tourism will depend on the sector’s ability to balance the needs of communities and the planet with the socio-economic advantages it generates.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Becken, S., & Loehr, J. (2022). Tourism governance and enabling drivers for intensifying climate action. Journal of Sustainable Tourism . https://doi.org/10.1080/09669582.2022.2032099

Bizzarri, C., & Pedrana, M. (Eds.). (2018). Gli impatti dei cambiamenti climatici sul turismo. Un’analisi delle politiche di intervento . Led Edizioni Universitarie. https://doi.org/10.7358/rst-2017-01-bipe

Book Google Scholar

Bosselmann, K. (Ed.). (2008). The principle of sustainability: Transforming law and governance . Ashgate.

Google Scholar

Buhalis, D., & Darcy, S. (Eds.). (2011). Accessible tourism: Concepts and issues . Channel View Publications.

Cardillo, M. C., Cavallo, F. L., Arturo, G., & Stefano, M. (2023). Isole, turismo e ambiente. Geotema, 67 , 3–7.

Castronuovo, V. (2022). Le destinazioni turistiche diffuse: resilienza e sviluppo. In A. Marasco, G. Maggiore, A. Morvillo, & E. Becheri (Eds.), Rapporto su Turismo Italiano. XXV edizione. 2020–2022 (pp. 171–186). CNR Edizioni.

Cdp, Ey, & Luiss. (2020). L’impatto del Covid-19 sul turismo – Studio di Cdp, EY e LUISS . https://www.confindustria.ge.it/download-imprese/38-studi-e-ricerche/368-l-impatto-del-covid-19-sul-turismo-studio-di-cdp-ey-e-luiss-giugno-2020.html

Dall’Ò, E., Falconieri, I., & Gug, G. (2022). Il tempo delle emergenze. Prospettive teoriche e campi di ricerca per l’antropologia tra disastri e cambiamenti climatici. Antropologia, 9 (2), 45–71.

Durigon, C. (2022). Transition pathways for tourism: 27 actions for a long-term transition . https://twissen.com/en/trends-en/policies-funding/transition-pathways-for-tourism/

European Commission, Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs. (2022). Transition pathway for tourism . Publications Office of the European Union. https://data.europa.eu/doi/10.2873/344425

Farsari, I. (2023). Exploring the nexus between sustainable tourism governance, resilience and complexity research. Tourism Recreation Research, 48 (3), 352–367. https://doi.org/10.1080/02508281.2021.1922828

Article Google Scholar

Gössling, S., Scott, D., & Hall, M. C. (2021). Pandemics, tourism and global change: A rapid assessment of COVID-19. Journal of Sustainable Tourism, 29 (1), 1–20. https://doi.org/10.1080/09669582.2020.1758708

Hall, C. M. (2010). Climate change and its impacts on tourism: Regional assessments, knowledge gaps and issues. In A. Jones & M. Phillips (Eds.), Disappearing destinations: Climate change and future challenges for coastal tourism (pp. 10–29). CABI.

Martini Barzolai, M., & Moretti, A. (2020). Le reti in ambito turistico: un buono strumento per ripartire? In A. Morvillo & E. Becheri (Eds.), Rapporto Sul Turismo Italiano (XXIV ed.). CNR Edizioni.

Meler, M., & Ham, M. (2012). Green marketing for green tourism. In Tourism & hospitality management, conference proceedings (pp. 130–139).

Michelozzi, P., De Sario, M., & de Donato, F. (2020). Cambiamenti climatici ed epidemie. Siamo vicini al punto di non ritorno? Forward , 20. https://forward.recentiprogressi.it/it/rivista/numero-20-avviene/articoli/cambiamenti-climatici-ed-epidemie-siamo-vicini-al-punto-di-non-ritorno/

Mihalic, T., Mohamadi, S., Abbasi, A., & Dávid, L. D. (2021). Mapping a sustainable and responsible tourism paradigm: A bibliometric and citation network analysis. Sustainability, 2021 (13), 853. https://doi.org/10.3390/su13020853

Ministero dell’Ambiente e della Sicurezza Energetica. (2022). Piano Nazionale di Adattamento ai Cambiamenti Climatici 61/103. https://www.mase.gov.it/sites/default/files/archivio/allegati/clima/PNACC_versione_dicembre2022.pdf

Ministero delle infrastrutture e della mobilità sostenibili. (2022). Piano Nazionale di Adattamento ai Cambiamenti Climatici . https://www.mase.gov.it/

Ministry of Environment and Energy Security, (2023). National Climate Change Adaptation Plan ANNEX II. Methodologies for establishing local climate change adaptation strategies and plans . https://www.mase.gov.it/sites/default/files/PNACC_II_Allegato_Metodologie_Strategie_Piani_Locali.pdf

Rizzo, L. S., Rizzo, R. G., & Trono, A. (2013). Religious itineraries as the driving forces behind sustainable local development in the Veneto? Towards a proposal for promoting an unusual and often “subliminal” form of heritage: Sanctuaries and minor churches. AlmaTourism, 7 , 59–92.

Ruggeri, B., & Magnani, E. (2019). Turismo, piccole isole e cambiamenti climatici: le politiche della Repubblica di Fiji tra mitigazione e adattamento. Geotema, 67 , 91–100.

Sabatini, F. (2023). Dalla remoteness all’attrattività turistica. Un’analisi di discorsi nazionali e locali sulle aree interne. Rivista geografica italiana, CXXX (2), 5–21. https://doi.org/10.3280/rgioa2-2023oa15919

Schmude, J., & Namberger, P. (2022). From “Overtourism” to “tourism over”? The development of selected market segments in times of COVID-19 with the example of Germany. In A. Trono, T. Duda, & J. Schmude (Eds.), Tourism recovery from COVID-19. Prospects for over- and under-tourism regions (pp. 147–158). World Scientific.

Chapter Google Scholar

Silva, C. N. (Ed.). (2022). Local government response towards Covid-9 pandemic . Springer.

Souca, L. (2010). Accessible tourism – The ignored opportunity. Annals of the University of Oradea. Economic Science, 1 , 1154–1157

Tanzarella, A. (2014). La declinazione della sostenibilità al turismo. In G. J. Marafon, M. A. Sotratti, & M. Faccioli (Eds.), Turismo e território no Brasil e na Itália: Novas perspectivas, novos desafios (pp. 253–272). SciELO – EDUERJ.

Trono, A., & Castronuovo, V. (2022). Reorganisation of businesses and processes and development of policies for safely emerging from the Covid-19 pandemic in Italy. In C. N. Silva (Ed.), Local government response towards Covid-9 pandemic (pp. 341–362). Springer.

Trono, A., & Castronuovo, V. (2023). Pilgrimage tourism, accessibility and local communities in Western countries. In X. M. Santos Solla & R. N. Progano (Eds.), Host communities and pilgrimage tourism: Asia and beyond (pp. 143–161). Springer.

Trono, A., Duda, T., & Schmude, J. (Eds.). (2022). Over tourism and “tourism over”. Recovery from COVID19 tourism crisis in regions with over and under tourism . World Scientific Publisher.

UNWTO. (2008). Climate change and tourism: Responding to global challenges . UNWTO.

UNWTO. (2020). Impact Assessment of the COVID-19 outbreak on international tourism . Retrieved March 27, 2020. http://www.ekof.bg.ac.rs/wp-content/uploads/2014/05/06-Dodatni-materijal_uticaj-covid19-na-turizam.pdf

UNWTO. (2023). World Tourism Barometer, 21(1). https://webunwto.s3.eu-west-1.amazonaws.com/s3fs-public/2023-05/UNWTO_Barom23_02_May_EXCERPT_final.pdf?VersionId=gGmuSXlwfM1yoemsRrBI9ZJf.Vmc9gYD

Zsarnoczky, M. (2017). Accessible tourism in the European Union. In Conference paper 6 th Central European conference in regional science – CERS, 2017. https://www.researchgate.net/publication/320226151

Download references

Author information

Authors and affiliations.

Department of Cultural Heritage, University of Salento, Lecce, Italy

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Anna Trono .

Editor information

Editors and affiliations.

Department of Linguistic-Literary, Historical-Philosophical and Legal Studies (DISTU), University of Tuscia, Viterbo, Italy

Valentina Castronuovo

Faculty of Tourism Management, Hospitality and Entrepreneurship, Cyprus University of Technology (CUT), Paphos, Cyprus

Petros Kosmas

Rights and permissions

Reprints and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Trono, A. (2024). Future Changes and Challenges for Post-Covid-19 Tourism. In: Trono, A., Castronuovo, V., Kosmas, P. (eds) Managing Natural and Cultural Heritage for a Durable Tourism. Springer, Cham. https://doi.org/10.1007/978-3-031-52041-9_5

Download citation

DOI : https://doi.org/10.1007/978-3-031-52041-9_5

Published : 29 April 2024

Publisher Name : Springer, Cham

Print ISBN : 978-3-031-52040-2

Online ISBN : 978-3-031-52041-9

eBook Packages : History History (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Government commitment to tourism and hospitality sector during COVID-19 pandemic

Tourism Critiques

ISSN : 2633-1225

Article publication date: 8 July 2021

Issue publication date: 7 December 2021

The purpose of this study is to explore the tourism policy commitment of the government of Uzbekistan to bring back the tourists and sustain the tourism and hospitality sector during the Covid-19 pandemic. The study employed qualitative documentary research methodology using the thematic analysis with the support of the Nvivo 12 to analyze Google news articles published in the English language. The results demonstrated that the government of Uzbekistan employed a variety of policies and measures geared towards tourists and businesses during the pandemic. Mainly, the government showed confidence and trust in its policies by providing financial compensation to tourists if they get the Covid-19 infection, improved sanitary conditions and travel restrictions to prevent the spread of the virus. In terms of businesses, the government was dedicated to restoring and mitigating the adverse outcomes of Covid-19 in the tourism and hospitality sector by providing subsidies and certification that the company is following the sanitary protocols. The findings of this study illustrate that the government of Uzbekistan should continue feeding the media with the information related to strategies implemented towards reviving the tourism and hospitality sector, which will build the confidence of the tourists and businesses during the pandemic period.

- Hospitality

- Government of Uzbekistan

- Tourism messages

- Tourism policies

Allaberganov, A. , Preko, A. and Mohammed, I. (2021), "Government commitment to tourism and hospitality sector during COVID-19 pandemic", Tourism Critiques , Vol. 2 No. 2, pp. 153-169. https://doi.org/10.1108/TRC-02-2021-0004

Emerald Publishing Limited

Copyright © 2021, Azizbek Allaberganov, Alexander Preko and Iddrisu Mohammed.

Published in Tourism Critiques: Practice and Theory . Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence may be seen at http://creativecommons.org/licences/by/4.0/legalcode

Introduction

Since the emergence of the COVID-19 pandemic in the first quarter of 2020, as many as 96% of the world travel destinations, consistent across the continents, have imposed some form of travel restrictions to contain the spread of the virus. Some of the major restrictions that were implemented by various governments were partial or complete border shutdowns, destination-specific restrictions and self-quarantine for a number of days ( UNWTO, 2020b ). Because of these restrictions, many sectors of the economy in countless countries were challenged and among the highly impacted ones were the tourism and hospitality industry. According to the UNWTO’s (2020a) statistics on the international travel industry, in the first 10 months of 2020, international travel decreased by 900 million travelers equaling to a loss of $935bn in export revenue worldwide, surpassing the losses of the world economic crisis in 2009. It is expected that the rebound of the tourism and hospitality sector will most likely occur in the second half of 2021; however, full recovery is forecasted to take up to four years.

To identify the specific tourism policies that were undertaken by the government to bring back the tourists to destination sites.

To explore the support provided to the businesses in the tourism and hospitality sector by the government.

To understand the overall key tourism messages delivered by the government of Uzbekistan to the tourists and businesses during the COVID-19 pandemic.

The motivation for conducting this study is threefold. First, as various stakeholders in the tourism and hospitality sector are using strategies to attract the tourists back into the hospitality business ( Gursoy et al. , 2020 ), more research is called to study the significance and the effectiveness of these approaches ( Gursoy and Chi, 2020 ). Second, Uzbekistan, as one of the many fastest-growing tourism destinations prior to the COVID-19 outbreak ( WTTC , 2020a, 2020b ), was also severely impacted by this pandemic. The country officially acknowledged its first cases of COVID-19 on March 15, 2020, and restrictions on public gatherings and international travel were followed ( US Embassy, 2020 ). To restore the tourism and hospitality sector, the Uzbek Government has launched various steps that were aimed to support the struggling businesses, as well as an initiative geared toward increasing the international tourists’ confidence in the country as a safe travel destination such as “Uzbekistan. Safe travel GUARANTEED” ( Uzbekistan, 2021 ). The third perspective, the government is actively engaged in promoting tourism and hospitality during the pandemic, this is because tourism is an important and growing sector of the country’s economy, comprising 2.61% of the GDP in 2018 increasing from 0.71% in 2016 ( The Global Economy, 2020 ). Indeed, investigating the government’s policies and approach in managing the impact of COVID-19 on the tourism and hospitality sector in Uzbekistan is imperative. The findings of this study will assist the practitioners, businesses, managers, investors, tourists and policymakers in the tourism and hospitality sector with the necessary information to understand the government’s message and dedication toward the industry and guide them to formulate crucial strategies to mitigate this health crisis.

This study first presents the literature review on the tourism context of Uzbekistan, the impact of COVID-19 pandemic on tourism and hospitality sector, the response to this crisis by the government and the news articles in tourism research. Next, anchored in the stand-alone documentary research method (DRM), the methodology applied by this study will be discussed, followed by the analysis of the result. Finally, the study ends with the discussion and the recommendation based on the outcome of this research.

Literature review

Contextual background of tourism in uzbekistan.

Located in the heart of Central Asia, Uzbekistan has been actively pursuing the development of its tourism and hospitality sector since its inception in 1991 ( Sha and Cekuta, 2018 ). The country possesses attractive tourism destinations such as UNESCO-listed unique and historical towns of Bukhara, Samarqand, Itchan Kala and Shakhrisabz ( Airey and Shackley, 1997 ) as well as sport-related leisure activities and pilgrimage sites ( Kantarci, 2014 ) to potential international and domestic tourists. International tourists all around the world are motived to visit Uzbekistan to witness these historical attractions and the adventure that the country provides ( Allaberganov and Preko, 2021 ).

In 2016, various reforms and improvement policies were used in Uzbekistan to improve the tourism and hospitality sector further. First, to eliminate the obstacles encountered before traveling to Uzbekistan, the country abolished the old visa procedures and began introducing electronic visas (e-visas) for a single stay of 30 days ( UzReport, 2018 ). Second, as transportation is an essential element of the travel and tourism sector, Uzbekistan has executed measures to improve its aviation industry and further travel routes were opened with additional 39 countries ( Sha and Cekuta, 2018 ). As an outcome of these policy change reforms, the inbound tourists’ volume in Uzbekistan has increased. For instance, in 2019 alone, approximately 6,748,500 tourists visited Uzbekistan equaling to US$1,313,032 of tourism service export, an increase from 5,346,200 visitors in 2018 ( UzDaily, 2020 ).

Similar to other global tourism destinations, Uzbekistan was not spared from the economic consequences of COVID-19. The Uzbek Government acknowledged and confirmed its first coronavirus case on March 15, 2020 and, as of March 20, 2021, there are 81,221 COVID-19 cases and 622 deaths ( Worldometers, 2021 ). The Uzbek policymakers launched various programs as a preventive measure to contain the spread of the virus such as restrictions of movement and border controls ( US Embassy, 2020 ), which ultimately led to socio-economic challenges in the country. The tourism and hospitality sector suffered the most, for instance, because of travel restrictions, inbound tourist arrivals in Uzbekistan decreased by a whopping 60% compared to the same figures in 2019 ( Kun.uz, 2020 ). On January 19, 2020, to combat the impact of COVID-19 on tourism and ensure its revival, the President of Uzbekistan Shavkat Mirziyoyev signed a decree aimed at restoring the tourism and hospitality sector in the country with strict observance of sanitation and safety protocols. To attract the tourists further, “Uzbekistan. Safe travel GUARANTEED” program was introduced by the government to ensure the tourists traveling in Uzbekistan are safe and all the sanitary and safety measures are followed ( Uzbekistan, 2021 ). Truly, the government’s role in the survival of the tourism and hospitality sector and its ultimate recovery is of utmost importance. The survival of the tourism industry will revitalize, promote destination image and brand the country among the world tourist destinations. Marketing the destination image and branding are important ingredients to the growth of the tourism industry ( Lam and Ryan, 2020 ). To fulfill this knowledge gap, this study aims at uncovering the news articles related to the government’s policy and commitment in support of its tourism and hospitality sector to have an overall understanding of the message and the strategies used by Uzbekistan.

Tourism during COVID-19

The international travel and tourism sector is sensitive and highly influenced by external factors such as political instability, social and economic risks and environmental disasters ( Novelli et al. , 2018 ; Preko , 2020a, 2020b ), and the COVID-19 outbreak in 2020 is no different ( Sigala, 2020 ). Initially, the negative impact of COVID-19 pandemic on the tourism and hospitality sector was largely underestimated by the policymakers and stakeholder and the magnitudes of this crisis can be unprecedented ( Škare et al. , 2020 ). As countries began to impose travel restrictions in the form of border controls and travel bans to contain the viral outbreak ( UNWTO, 2020b ), tourism and hospitality sector took a worldwide hit ( Kreiner and Ram, 2020 ; Sharma et al. , 2020 ) as the number of travelers began to decline.

In Malaysia, for instance, because of restrictions such as border controls and travel bans, many tours were canceled as a big portion of the travelers originated from China ( Foo et al. , 2020 ). With a record of 26 million tourists and ranking 15th in the world in 2018 ( WorldData, 2020 ), Malaysia was expecting another promising tourism season in 2020. However, with the impact of COVID-19 on the global economy, Malaysia was one of the hardest-hit tourism destinations. As many as 3.5 million people could be affected in the tourism sector of Malaysia and it is predicted that 60% of the country’s tourism businesses can be eliminated ( Bethke, 2020 ). Likewise, Chinese tourism and hospitality has also suffered tremendously from the COVID-19 pandemic. Countless tours were canceled in China and Chinese tourists were banned because of border controls to enter many destinations because of fear of the virus, putting a paramount stress on international and domestic tourism in the country ( Hoque et al. , 2020 ). For instance, according to the China Tourism Academy, domestic tourism revenue is expected to decline by 52% equaling to the US$394bn in 2020 ( Reuters, 2020 ). A similar case can be observed in India, another rising star in the tourism and hospitality industry. Because of the decline in international travel, overall job opportunities and regional development, as well as the country’s ability to raise foreign exchange earnings, were disrupted ( Jaipuria et al. , 2020 ). Consequently, it is forecasted that India could lose up to 40 million direct and indirect jobs in the tourism and hospitality sector, which amounts to the US$40bn ( FICCI, 2020 ). Further impacts of COVID-19 on the tourism and hospitality sector were discussed in Nepal ( Sah et al. , 2020 ), Ukraine ( Rutynskyi and Kushniruk, 2020 ), Bangladesh ( Deb and Nafi, 2020 ) and Indonesia ( Dinarto et al. , 2020 ).

COVID-19 pandemic has exposed the vulnerability of the tourism and hospitality sector, having much more serious impact on the lower-income countries, and provided valuable lessons to the policymakers and stakeholders ( Gössling et al. , 2020 ). Ultimately, tourism and hospitality sector will rebound in the near future; however, the speed of recovery and to what extent the industry will resume its former glory is unknown ( Baum and Hai, 2020 ). As studying tourism and hospitality sector during a health-related crisis is essential ( Rivera, 2020 ), it creates the necessity to study the state response to tackle the impact of COVID-19 on the international travel and tourism sector of Uzbekistan. Findings of this study can enable a better understanding of the communication by the Government of Uzbekistan during the COVID-19 pandemic toward the tourism and hospitality sector, allowing the stakeholders, practitioners and business in this industry to formulate proper policies and strategies.

Government policies for tourism and hospitality sector during pandemic

As the impact of COVID-19 on tourism and hospitality is paramount, stakeholders and businesses in this sector are at risk, hence making the government support during this crisis essential ( OECD, 2020 ; Fong et al. , 2020 ). The pandemic has reduced the international travel, causing a huge blow to many international and local economies in the world, which is ultimately affecting the global economy overall ( Dupeyras et al. , 2020 ). For instance, because of pandemic and restrictions on movement, consumer-buying behavior changed dramatically, causing a 69% drop in purchase of non-essential items in Sub-Saharan Africa ( GeoPoll, 2020 ). As a result, a plethora of tourism-related businesses such as hotels, restaurants and airlines witnessed lower demand by tourists ( Nhamo et al. , 2020 ). World Travel and Tourism Council strongly encourages governments to formulate policies and programs to provide necessary support for the struggling tourism and hospitality sector by protecting the livelihood of the workers involved in this industry as well as laying out financial stimulus for the companies and businesses affected by this crisis ( WTTC , 2020a, 2020b ).

Many governments and their agencies have used measures to restore the tourism and hospitality sector such as communication with the industry, providing subsidies and improved health-care monitoring. For instance, in China, numerous policy measures were implemented to support the tourism sector by the government that varied from region to region. Eastern China, where the population is denser compared to other parts, emphasized mainly tax reduction and financial incentives whereas tourist protection and inspection was the primary objective of central regions ( Shao et al. , 2020 ). The neighboring country of Vietnam has also proposed several relief policies to support its struggling tourism and hospitality sectors. Some of the major communications by the Vietnamese state during the pandemic were the promotion of the domestic tourism in Vietnam, followed by reevaluation of the country’s visa policies as well as subsidies in the form of tax relief and financial support packages for the businesses in the tourism sphere ( Quang et al. , 2020 ).

It is evidenced that the tourism and hospitality sector is highly sensitive to global crisis such as COVID-19 ( Uğur and Akbıyık, 2020 ) and for the survival of this industry, clear communication and support by the state become ever more crucial ( Yeh, 2020 ). However, the survival of tourism and hospitality or its ultimate reemergence will likely vary from country to country. Some destinations might reevaluate their tourism sector and practices to become more sustainable without the immediate assistance of the state, whereas others will simply resume the regular course of business with the help of the government ( Hall et al. , 2020 ). There is a lack of studies on health crisis and tourism in the context of developing countries, creating a knowledge gap in the tourism and hospitality literature to explore the government’s role in managing the tourism and hospitality sector in Uzbekistan during the pandemic. Thus, following the literature, this study attempts to explore and analyze news articles to uncover the support provided to tourism and hospitality sector by the Government of Uzbekistan during the COVID-19 pandemic.

News articles in tourism research

As a document source, news articles are cheap and easily available for the researchers ( Mogalakwe, 2006 ) while playing an essential role in the tourism industry ( Chen et al. , 2020 ). The news coverage and articles can be detrimental in shaping the destination image while promoting the location to potential tourists. Practitioners are highly encouraged to feed the media constantly with crucial information to build the image of the location ( Gabbioneta and De Carlo, 2019 ). A plethora of previous studies have analyzed news articles in relation to the tourism and hospitality sector and the method is becoming popular in academic literature. For instance, Phi (2020) has used news articles analysis in the study of “overtourism” media coverage. Jun and Oh (2015) studied newspaper coverage of risks and benefits associated with medical tourism being serviced in Korea using 149 articles. Dioko and Harrill (2019) analyzed English news reports between 2000 and the first half of 2017 on tourism-related fatalities and injuries to provide effective management efforts for the practitioners in the field.

News articles related to the COVID-19 pandemic and tourism were evidenced in the media as well during the recent health crisis ( Şengel et al. , 2020 ). Seraphin and Dosquet (2020) used news source coverage of pandemic impact and how it is contributing to the development of home and mountain tourism. Chen et al. (2020) performed content analysis of Chinese news during the COVID-19 pandemic investigating newspaper articles to gain a deeper understanding of news coverage during the health crisis. These authors concluded by recommending that further studies on crisis response efficiency and people’s opinion during the outbreak are necessary. Thus, motivated by this, this study uses the Google News search engine to uncover published news articles in international media sources that are associated with the government approach in dealing with the tourism and hospitality recovery during and post-COVID-19 pandemic in Uzbekistan.

Methodology

This study uses a documentary qualitative method in analyzing news articles on Uzbek Government’s messages and strategies to bring back the tourists to sites during the COVID-19 pandemic. DRM is a procedure where printed and online materials are systematically reviewed and analyzed ( Bowen, 2009 ). This research method is not new and has been used in previous studies in tourism ( Chen et al. , 2020 ; Phi, 2020 ; Seraphin and Dosquet, 2020 ). Again, DRM is useful when the researcher wants to study documents that contain information regarding a phenomenon ( Bailey, 1994 ). Being under-used in science, DRM also has its own disadvantages such as lack of detail, difficulties associated with retrieving data and selection bias. However, because of its cost-effectiveness and efficiency, the advantages of using DRM outweigh its limitations ( Bowen, 2009 ). Following the merits that are suggested by Mogalakwe (2006) , DRM is highly cost-effective and as good as other research methods such as surveys and interviews, which usually include data from organizations, libraries, newspapers and online news.

The news articles analyzed in this study were extracted from Google News from April 1, 2020 to December 31, 2020, covering nine months period (see Figure 1 ). To mine data, this study has used combined keywords such as “Uzbekistan,” “Tourism,” “Hospitality,” “Covid-19,” “Pandemic,” “Government approach,” “Strategies” and “Uzbek government.” The search resulted in articles about COVID-19 and tourism in Uzbekistan in the English language. Only news articles with the narrative of tourism and COVID-19 in Uzbekistan with rich content were considered and kept for this study. To ensure reliability and validity of the news articles, the united resource locators of the websites were checked and only sources from reliable media were used for analysis.

Overall, 49 newspaper articles were retrieved from the Google News search engines. Because of content and relation to the subject matter set forth in this study, only 40 news articles were useful and used for the analysis. All the news articles were compiled together in a table ( Table 1 ) with the indicative title of the article, the source of the document and the publication date. Following the recommendation of Braun and Clarke (2006) , thematic analysis was used in this study, where the articles were explored to search for common patterns by using NVivo 12 software. Authors first independently read each article thoroughly to be familiar with the texts. Next, common patterns that emerged were highlighted and coded in similar themes known as nodes. Nodes that were similar in content were grouped together and merged to develop larger themes. Next, to validate the findings, the authors compared their data and themes to reach the same conclusions. These stages allowed the researchers to validate their findings and to be consistent. In qualitative research, two or more researchers must reach the same conclusions after reviewing the same data ( Lazaraton, 2017 ).

The findings of the research showed that government strategies, supports and messages for businesses and tourists were relevant to the survival of the sector within the pandemic. The study’s analysis identified three major themes such as the government’s support for the return of the tourists, uplifting the difficulties associated with the pandemic on the businesses and overall message of the government to the stakeholders at large.

Government approach to return the tourists

Most of the news articles examined in the study illustrated interesting highlights in regards to the government’s approach in managing the tourism and hospitality sector in Uzbekistan during the pandemic. Based on the findings, the main strategies that were implemented by the Government of Uzbekistan to ensure the return of the tourists to the country were certification to businesses that they are following sanitary measures and ensuring strict adherence of sanitation protocols:

[…] Tourist sites and accommodation will also be required to gain certification from the government to ensure that they’re meeting the new standards of sanitary and epidemiological safety. (Emerging Europe)

The guides, hotels, and tourist sites will have to get a certification from the local government showing they are following all the virus safety guidelines. (Times of India)

Uzbekistan, a country of 33 million that has had just a small number of Covid-related deaths, wants to assure travelers they will not be infected with the coronavirus during their stay. (The New York Times)

“We want to reassure tourists they can come to Uzbekistan,” Sophie Ibbotson, Uzbekistan’s tourism ambassador to the UK, said in a statement. (Vice)

In addition to the increased sanitation and ensuring the trust of the travelers, Uzbek Government went even further by promising financial compensation for medical treatment for those who may end of getting the virus. This ultimately evidences that the Government of Uzbekistan was active in restoring its tourism industry as well as confident in its safety measure:

With countries currently trying to revive their tourism industries, Uzbekistan has come up with a very innovative solution that might pique the interest of travellers. Their newly-launched “Safe Travel Guaranteed” campaign provides $3,000 to anyone who gets the coronavirus while travelling in the country. (Outlook India)