- Publications

- Key Findings

- Interactive Data and Economy Profiles

- Full report

Travel & Tourism Development Index 2021: Rebuilding for a Sustainable and Resilient Future

4. Key findings

Several key findings have been identified in the Travel & Tourism Development Index (TTDI) 2021 results and research. First, the need for T&T development has never been greater as it plays a critical role in helping the global economic recovery by supporting the livelihoods of some of the populations hardest hit by the pandemic and by building resilience, especially when it comes to lower-income countries. Moreover, by investing in the factors that help drive T&T, many economies can leverage tourism to further their overall development. The need for T&T development has never been greater as it plays a critical role in helping the global economic recovery.

Second, the key findings show not only how ongoing challenges such as reduced capacity and labour shortages are tempering the recovery but also how shifting demand has created opportunities, forcing many T&T businesses and destinations to adapt, highlighting the sector’s impressive flexibility. Third, the analysis explores in more detail how various aspects and drivers of T&T development can be more thoughtfully and effectively considered and employed to bolster the recovery and build a more inclusive, sustainable and resilient T&T sector.

4.1 The need for Travel and Tourism development has never been greater

The case for t&t development.

As already alluded to in the global context section above, the T&T sector’s significant contribution to global economic and social development makes its recovery and long-term growth paramount. In 2019, the sector’s direct, indirect and induced output accounted for about 10% of global GDP. Moreover, for many emerging economies, T&T is a major source of export revenue, foreign exchange earnings and investment. On average, out of the economies covered by the TTDI, T&T contributed 70% more towards the exports of middle-income economies than to the exports of high-income economies in 2019. 10 Consequently, restoring T&T sector growth will be particularly vital for developing economies’ recovery. For instance, the World Bank forecasts that emerging markets and developing economies (EMDEs) will not return to pre-pandemic economic output trends until after 2023, with more than 80% of tourism-reliant EMDEs still below their 2019 economic output at the end of 2021. 11 Recent concerns about the slowdown in globalization and trade due to the impact of the pandemic and geopolitical tensions 12 further enforce how important T&T is for global connectivity.

It is also important to note that T&T is vital not only to overall economic performance but also to the livelihood of some of the populations and businesses most vulnerable to, and hardest hit by, the pandemic. This sector contributed to about 10% of global jobs in 2019, 13 employs almost twice as many women as other sectors, has a large share of youth employment and is a major source of jobs for minorities, migrants, informal workers and low-skilled workers. 14 Moreover, SMEs account for more than 80% of T&T businesses. 15 Unsurprisingly, research has shown that T&T growth can support social progress and create opportunities and well-being for communities. 16 Consequently, investing in T&T could not only mitigate the impact of the pandemic but also improve socioeconomic progress and resilience.

Enabling the T&T development landscape

With the case for T&T’s recovery and development clear, it will be critical to focus on and invest in the factors and policies (beyond the critical need for vaccine distribution) that can help enable these goals, many of which are measured by the TTDI. World Economic Forum research shows that TTDI performance correlates with direct T&T GDP, international tourist arrivals and receipts. 17

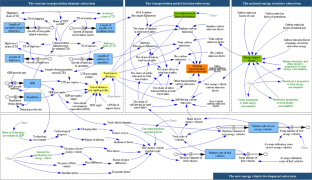

Figure 3: Travel and Tourism economic and enabling development landscape

Figure 3 can help us understand which economies are likely to be best positioned from a T&T recovery and resiliency point of view, and which may need to prioritize greater investment in T&T enabling factors. This is illustrated by comparing the TTDI scores to economic dependence on T&T. Low- and middle-income economies tend to score below the TTDI average, indicating a potential constraining factor for their economic recovery. In particular, economies in the bottom-right quadrant would gain the most by investing in the drivers of T&T development because they are more dependent on the sector for economic development. Such investment will help their economic recovery by enabling stronger tourism growth as well as supporting their overall economies to be more robust and resilient. On the other hand, while economies in the bottom left are less dependent on T&T, their below-average TTDI score may indicate that their conditions are leading to an underuse of the sector’s ability to drive development, weakening their economic potential – a resiliency issue in itself.

Higher TTDI scores for economies in the top two quadrants indicate that they are more mature markets and are best positioned for the sector’s recovery. Countries in the top-left quadrant are in a more optimal position from a resiliency point of view as they have favourable conditions for T&T operations but are also less reliant on it for their overall economic performance. However, that is not to say that T&T does not play an important role in their overall economic development, especially at the local level and for specific segments of the labour force and SMEs. Meanwhile, economies in the top-right quadrant, like those below them, have also been more vulnerable to the impact of the pandemic, especially given that analysis shows they are typically more reliant on the export of T&T services. These factors may limit their ability to recover economically from the pandemic, but they are also better positioned to generate tourism-led economic growth as international tourism returns. In general, for the most mature T&T countries such as those higher in the top quadrants, sector performance and resilience may be less about making major improvements in aspects of T&T development such as infrastructure and more about continuously calibrating their T&T strategies to adapt to changing demand dynamics, local needs and overall T&T trends.

Figure 4: TTDI 2021 pillar performance

Figure 4 shows in more detail what gaps remain to achieving improved T&T performance and development for various countries. High-income economies and countries in the Europe and Eurasia (Europe) and Asia-Pacific (APAC) regions tend to lead the overall index in results. Among the largest differentiators between index leaders and laggards are: the distribution and promotion of natural, cultural and non-leisure assets and activities; the availability of quality transport and tourist service infrastructure; the degree of international openness; and favourable factors such as (increasingly important) ICT readiness and health and hygiene. However, as shown in the Travel and Tourism Competitiveness Report 2019, because T&T growth is so dependent on factors such as infrastructure and health and hygiene, which if improved bring benefits to more than the tourism sector, sector leaders can play a valuable role in encouraging investment that benefits a country’s economy as a whole. This is especially true for developing economies that have innate natural and cultural assets around which to mobilize investment. 18 The next section detailing key findings will use the TTDI results to discuss the T&T challenges and opportunities created over the past few years, as well as examining how various drivers of T&T development can be employed to bolster T&T recovery and build a more inclusive, sustainable and resilient T&T sector, thereby unleashing its potential for economic and social progress.

4.2 Recovery challenges and shifting demand dynamics

The results highlight difficult operating conditions.

While varying greatly based on local, segment, national and regional conditions, the TTDI results and research help highlight some of the various and common operational challenges the T&T sector faces in its recovery.

With T&T activities being severely restricted over the past few years, the greatest decline in index performance has come from the contraction of related operations and investment. As such, average scores fell in the Air Transport Infrastructure (-9.4%), Prioritization of Travel and Tourism (-6.7%) and Tourist Service Infrastructure (-1.5%) pillars. Air route capacity and airport connectivity plummeted, especially in more mature and high-income economies. Similarly, the decline in tourist service infrastructure reflects initially reduced capacity in the accommodation and related segments. The average number of per capita short-term rental units dropped by about one-fifth between mid-2019 and 2021 across economies ranked in the index. 19 While not reflected in the TTDI results, STR data indicates that, over a similar timespan, the number of hotel rooms did not recover to pre-pandemic levels in many countries. 20 In line with these trends, both T&T capital investment and government T&T expenditures also fell. The decline in sector capacity has also been compounded by the fact that most businesses are SMEs and do not have the means to survive prolonged drops in demand or restrictions on person-to-person contact. The disproportionate impact of the pandemic on the sector is indicated by the direct T&T contribution to global GDP falling from 3.2% to 1.6% and the contribution to global employment falling from 3.8% to 3.1% between 2019 and 2020. 21

Figure 5: Select pillar 2019 to 2021 average score change

Yet, as demand resumes in line with easing travel restrictions and somewhat improving COVID-19 conditions, the initial reductions in capacity increase the potential for supply-side constraints. In advanced economies, in particular, rising demand, earlier layoffs that disproportionality hit T&T, and competition for talent with other sectors have resulted in widespread labour shortages. A WTTC report focusing on the United States, the United Kingdom, France, Spain, Italy and Portugal estimates that the T&T sectors in these countries experienced staff shortfalls ranging from 9% to 18% in 2021. 22 The interconnected nature of the T&T supply chain and ecosystem has also created challenges. Hotels, airlines, car rental firms, tour operators, cruise lines and others all form a chain of service providers dependent on each other along the traveller journey. Bankruptcies or other disruption issues at any point along this chain have the potential to negatively affect the others.

"In addition to labour shortages and capacity constraints, the sector has also been exposed to broader global disruptions that are complicating recovery."

Over the course of the pandemic, growth in merchandise trade coincided with production, worker, equipment and space shortages to create a global supply-chain crisis. For instance, hotels have faced shortages of items ranging from slippers for clients to kitchen equipment. 23

The recent outbreak of war in Ukraine and resulting sanctions and travel restrictions related to Russia have added further pressure on the recovery. Airlines around the world have had to reroute operations, increasing travel times and costs. Meanwhile, the still fragile recovery in international tourism demand could be tempered by increased hesitancy among travellers when it comes to visiting Europe. 24 Many T&T economies in Europe, Eurasia and beyond may also be hard hit due to reduced demand from Russia and Ukraine. Combined, these two economies account for about 3% of international tourism spending, with Russia having been a major source of visitors to destinations ranging from Azerbaijan, Georgia and Turkey to Israel, the United Arab Emirates and Thailand. 25

While not yet fully reflected in the TTDI’s Price Competitiveness pillar, rising travel demand, the stated labour, capacity and other shortages, global supply-chain disruptions and rises in fuel prices and inflation caused by factors such as the war in Ukraine will likely increase costs and service prices throughout the entire T&T supply chain and ecosystem. For example, as of 13 May 2022, jet fuel prices were more than double what they were a year ago, 26 and if they remain high, airline yields and ticket prices will likely rise. 27 Recent UNWTO analysis cites how conflict-induced uncertainty, higher energy and food prices and inflation, in general, are putting pressure on consumer purchasing power and tempering global economic growth, potentially affecting T&T sector performance. Moreover, as economies such as the United States combat inflation by increasing interest rates, consumer demand and T&T investment may be further hit by the rising cost of credit. 28

The pandemic shifts demand dynamics, creating opportunities and driving adaptation

With travel restrictions still common and traveller confidence hampered by pandemic concerns, the past few years have also seen a shift in demand trends in global T&T. According to the UNWTO Panel of Experts, the major trends driving the T&T recovery include domestic tourism, travel close to home, open-air activities, nature-based products and rural tourism. 29 The World Travel and Tourism Council (WTTC) data shows that, on average for the 117 economies covered by the index, domestic spending’s share of T&T spending increased from 50.8% in 2019 to 62.6% in 2020 as domestic demand fared better than collapsing international demand. 30 Moreover, current projections for 2021 show that domestic spending growth is expected to substantially outpace international spend in every region outside of the Caribbean and Middle East. 31

The TTDI results further reinforce the shift in demand dynamics that the world has witnessed. The second most improved pillar is Natural Resources (+2.5% average score increase). While this was driven largely by an expansion in the number of recognized UNESCO World Heritage natural sites and protected areas, such as national parks, the greatest improvement has come from destinations’ ability to garner interest in nature-related segments as illustrated by the 20.8% average growth in natural tourism Digital Demand value, a measure of online searches for topics such as natural wonders, outdoor activities and rural accommodation.

On the other hand, the Non-Leisure Resources pillar had one of the greatest declines in average performance (-1.9%) as business travel declined. While this sector is recovering, it has rebounded at a slower rate than leisure, with factors such as workplace flexibility and the availability of virtual alternatives for in-person meetings tempering demand and potentially leading to some permanent loss in corporate travel. This will force many T&T segments to adapt. For example, operators in the meetings, incentives, conferences and events (MICE) area may have to rely more on smaller and hybrid events. 32 T&T businesses and destinations are increasingly looking to capture opportunities offered by the changing nature of work. Over the course of the pandemic, more businesses have gone virtual, and an increasing share of the labour force is becoming independent.

"In 2020, 10.9 million Americans said they were digital nomads, a 49% increase from 2019."

This sample of independent workers is also increasingly willing to travel. A recent survey showed that the share of US independent workers doing business outside the country jumped from 12% in 2013 to 28% in 2020. 33 Additionally, the trend in “bleisure” travel – the addition of leisure activities to business trips – is also growing. 34

To cater to these growing markets, T&T businesses will have to become more flexible and create new, innovative products. For instance, some major hospitality groups are creating new long-stay properties that include kitchens and living spaces, while other have introduced packages that offer reduced rates for those staying longer, which include IT and boardroom services. 35 Furthermore, while virtual business may require less office space, corporations and their employees may need options for occasional company meetings and events that the sector could provide. However, it is important to note that these new market opportunities are primarily for the high-end travel market and are not likely to replace the overall loss in business travel. Lastly, T&T operators have also had to introduce more flexible booking and cancellation policies in order to address uncertainty about travel regulations and the pandemic, in addition to increased consumer desire to make last-minute changes or to add leisure stays to their business trips. 36

From a destination point of view, many governments have also adapted to changing conditions to take advantage of shifting demand dynamics. For one thing, many countries have provided various incentives to boost domestic tourism. For example, Hong Kong, Singapore, South Korea and Japan have rolled out various programmes that provide discounts, coupons and subsidies for domestic travel. 37 Meanwhile, Aruba targeted the digital nomad market through extended work visas and other benefits via its One Happy Workation programme. 38 The trends towards more rural and nature-based tourism also offer an opportunity for less-developed economies to harness the benefits of T&T given that the distribution and quality of natural assets are less tied to overall economic development, with Natural Resources being one of the few pillars where non- high-income economies typically outperform high- income countries (see Figure 6).

Figure 6: Composition of top quartile, by income group

Overall, the above adaptations to shifting demand and COVID-19 conditions help highlight how flexible T&T business and destinations can be in times of crisis. As the sector rebuilds and addresses future risks, its adaptability will become more crucial than ever. In particular, as can be seen in the key findings that follow, the shift to domestic and nature-based travel, as well as other trends, coincides with an increased emphasis on sustainable and safe travel. Therefore, T&T development will have to become increasingly sustainability-oriented.

4.3 Building back better

Given the current challenges, shifting demand dynamics and future opportunities and risks, it is vital that T&T development strategies are employed to rebuild the sector in a more inclusive, sustainable and resilient manner.

Restoring and accelerating international openness and consumer confidence, including investment in health and security

For starters, as travel restrictions are removed, ensuring that T&T markets are open to visitors and investors will become vital. In particular, it is important that the historical trend of ever greater international openness in T&T continues. Reduced visa requirements fuel international tourism and additional air service agreements open up markets to more airlines, routes, competition and, ultimately, better service (see Figure 7). Given the recent decline in international route capacity and travel demand, prioritizing visa and air service agreement liberalization will be important – with those economies most dependent on tourism exports and lacking large domestic markets standing to benefit the most. Financial openness and an increase in regional trade agreements can also help to facilitate necessary cross-border investment in T&T and beyond, which may also help encourage more international and intra-regional travel.

TTDI results indicate that Western, Southern and Northern Europe are usually the most internationally open subregions due to the close integration that the European Union, the Schengen Area and similar blocs and agreements provide. Such systems allow T&T operators to benefit from factors such as a larger and more diverse consumer base and common market rules. It is also important to recognize that despite the pandemic and disrupted global trade, 83 economies ranked in the index increased their number of regional trade agreements in force between 2019 and 2021. Relevant recent developments include the African Continental Free Trade Area (AfCFTA), which came into force in 2021. Combined with related efforts such as the Free Movement Protocol and Single African Air Transport Market (SAATM), the sub-Saharan Africa region has the potential to unlock its untapped T&T potential and grow its underdeveloped intra- regional T&T market and air route capacity. 39

Figure 7: Correlation between air service agreement liberalization and air transport infrastructure, 2019

Endnotes 40 , 41

Of course, the pandemic, along with the recent rise in geopolitical tensions, also highlights just how important health and security conditions are to protecting the openness on which T&T relies and to restoring consumer confidence in travel. Economies with sophisticated healthcare systems are better equipped to mitigate the impact of pandemics on T&T and the wider economy by protecting their populations, including the T&T workforce and visitors, thus reducing the need for travel and lockdown restrictions. Meanwhile, access to clean water and sanitation facilities helps prevent diseases or their spread. Lastly, consumers and business travellers are likely to remain more sensitive to the health and hygiene conditions at destinations for some time. A recent survey shows that the majority of travellers consider safety protocols, restrictions and cleanliness to be key factors in travel decision- making. 42 In the short term, T&T business, destinations and international organizations have responded to these issues via actions such as the introduction of various protocols and certifications. For instance, the World Travel & Tourism Council has introduced the Safe Travels protocols and certification stamp that can be used by T&T to show customers they are following standardized global health and hygiene practices. 43

In general, underdeveloped health and hygiene infrastructure and access represents an acute challenge for many developing countries, with low- and lower-middle-income economies scoring 50.0% and 25.6% below average in the Health and Hygiene pillar. These states lack physicians and hospital beds (in terms of ratio to population size) and access to basic sanitation and drinking water, and such issues, combined with lower vaccination rates, mean that these economies will struggle to recover at the same pace as others and will have difficulty building adequate resilience against future health security risks. It is therefore crucial for the success of the global T&T sector that the challenges related to vaccine distribution and roll-out are addressed in an equitable and inclusive fashion. While further effort is required, public-private cooperation can provide a useful avenue to address this challenge. For example, the World Economic Forum’s Supply Chain & Transport Industry Action Group community, which consists of leading supply-chain companies, is supporting UNICEF and the COVAX Vaccine Distribution programme with “planning, preparedness and prioritized transportation and distribution of COVID-19 vaccines and related supplies”. 44

The above-mentioned introduction of travel bans, flight-route adjustments, increasing fuel and food prices and potentially hindered international travel demand caused by the war in Ukraine have also shown the degree to which international T&T can be affected by geopolitical tension and conflict. Overall, it is well established that crime and security issues such as terrorism and conflict have a negative impact on tourist arrivals and sector revenue. 45 The 2021 TTDI data shows that economies in the Americas, sub-Saharan Africa and South Asia tend to score the lowest for safety and security, thereby creating a further obstacle to the future development of T&T in these areas.

On the other hand, research has also shown that a sustainable and open tourism sector can be resilient to violence and conflict and that it may help foster positive peace, namely the “attitudes, institutions and structures that create and sustain peaceful societies”. More specifically, the mechanisms through which tourism can accomplish this include cultural and information exchange, encouragement of tolerance, better government functioning, human capital development, and local and cross-border economic gain that can reduce the risks to peace. 46 It is now more important than ever to leverage the T&T sector’s potential for peace through sustainable development.

"It is crucial for the success of the global T&T sector that the challenges related to vaccine distribution and roll- out are addressed in an equitable and inclusive fashion. While further effort is required, public- private cooperation can provide a useful avenue to address this challenge."

Building favourable and inclusive labour, business and socioeconomic conditions

Over the course of the pandemic, the T&T sector has received substantial support in the form of debt financing, tax policies, assistance with business costs, public-sector investment, employment support, incentivization of tourism demand and easing of regulations. 47 In the future, continued investment in human capital and the creation of more favourable labour, business and socioeconomic conditions will be vital components in making the sector more inclusive, addressing ongoing challenges such as labour shortages and driving T&T growth and resilience.

Factors such as accessible and quality education and staff training, supportive hiring and firing practices, programmes to source skilled labour, flexible working arrangements and efforts to improve labour productivity can help equip T&T companies with a workforce that can improve operating efficiency, provide quality services, maintain flexibility in the face of evolving business needs and challenges and take advantage of the growing role of ICT tools. For example, according to the World Economic Forum’s The Future of Jobs Report 2020 , skills gaps in the local labour market were the number one barrier to adoption of new technologies in the transport and storage, and consumer sectors, the two sectors most closely tied to T&T. 48 Furthermore, according to the WTTC, factors such as facilitation of labour mobility, upskilling and reskilling and promotion of education are vital elements in addressing the current labour shortage. 49 Meanwhile, the past few years have shown how important policy stability, access to credit and creating more business- friendly regulatory and tax environments have been in supporting the T&T sector, especially SMEs that typically do not have the same resources and access to capital as larger firms. 50

The 2021 TTDI results partially reflect some efforts by policy-makers to support their economies, with the average Business Environment score climbing 1.7% since 2019. In particular, perceptions of the burden of government regulations and SME access to finance were areas that saw some of the largest improvements. The average Human Resource and Labour Market pillar also improved by 1.5% between 2019 and 2021, due to overall progress made in areas such as staff training. Nonetheless, less developed economies still score well below the TTDI average for most indicators for both pillars.

The pandemic has also highlighted how important an economy’s socioeconomic resilience is for the T&T sector. In general, the ability of an economy to support its population through social protections such as unemployment and maternity benefits, keep youth employed or in training, effectively uphold workers’ rights and support a diverse and inclusive workforce may potentially help strengthen employee productivity, expand the labour pool and make it more resilient to risks such as pandemics. 51 This is particularly true for the T&T sector because it provides income for a large number of youth, women, informal workers, the self-employed and small enterprises, who do not always have access to social or worker protections. Figure 8 shows that there is a relationship between socioeconomic resilience and conditions and labour productivity in T&T. Recent survey data also reinforces how important issues such as benefits and working conditions are for attracting talent and addressing the ongoing labour shortage in the sector. One poll of former US hospitality workers showed that more than half won’t return to their old jobs and over a third are not planning on returning to the industry as they seek higher pay, better working conditions and benefits, and more flexibility. 52

Figure 8: Correlation between socioeconomic resilience and conditions and tourism labour productivity

The 2021 TTDI results show that, across the board, socioeconomic resilience has tended to improve due to the expansion of social protection coverage and spending in line with global efforts to mitigate the impact of COVID-19. High-income economies do tend to score far higher on the Socioeconomic Resilience and Conditions pillar, putting them in a better position to deal with future challenges and maximize their workforce potential. Conversely, low- and lower-middle-income countries have far lower socioeconomic resilience due to more limited social protection, higher rates of youth not in education, employment or training (NEET), fewer workers rights and greater inequality of opportunity for all. As a result, the T&T sector in these economies may face more obstacles to recovery and may be more vulnerable to future risks.

While rising interest rates and debt levels represent a growing obstacle, government responses to the pandemic demonstrated their capacity to provide more comprehensive socioeconomic support, and the benefits of doing so, albeit during an unprecedented situation. While the pandemic has certainly disproportionately affected SMEs, entrepreneurs or more vulnerable populations, strengthening such mechanisms, especially in the T&T sector, could have compound benefits for the sector and economies as a whole.

The growing role of environmental sustainability

In the coming years, the success of T&T businesses and destinations will be increasingly tied to their ability to manage and operate under ever greater ecological and environmental threats. According to surveys conducted for the World Economic Forum’s Global Risks Report 2022 , environmental risks represent half of the top 10 global risks, with climate action failure, extreme weather and biodiversity role natural assets play in generating T&T demand and spend, these environmental risks represent a serious threat to long-term growth for the sector. Moreover, within this context, travellers increasingly value environmentally sustainable options. 54 df

The 2021 TTDI results indicate the extent of environmental sustainability threats and challenges. For instance, comparing the Natural Resources and Environmental Sustainability pillar scores helps to pinpoint where some of the greatest risks to nature-based tourism might lie. Out of the 30 economies that rank in the top quartile for natural resources, 17 score below the global average for environmental sustainability and eight rank in the bottom 25.

Figure 9 provides a regional view of the challenge. While most economies in the Americas and Asia- Pacific and almost half of those in sub-Saharan Africa score above average for natural resources, they commonly underperform in environmental sustainability, making it a critical problem for future T&T development. Environmental issues differ in these regions, but some examples include elevated climate-related risk (as measured by the Global Climate Risk Index), air and sea pollution, deforestation, poor wastewater treatment and inadequate preservation policies. In the Middle East and North Africa, common problems include water stress and air pollution. On the other hand, economies in the Europe and Eurasia region are world leaders in environmental sustainability, accounting for more than half of countries in the TTDI that score above average for this pillar. Combined with the fact that natural resources are not its greatest strength or dependency, the region and its tourism sector may be the better positioned to deal with future ecological risks.

Figure 9: Share of regional economies scoring above average for natural resources and environmental sustainability

Nonetheless, while there are some economies that have better environmental conditions, the challenge is widespread and is not easing. The difference in average score between the top and bottom quartiles for the Environmental Sustainability pillar is the second-lowest among the pillars. Moreover, performance for many indicators in this pillar has been mixed. For example, scores for deforestation continued to worsen. On the other hand, efforts to preserve the environment and T&T-generating natural assets got a boost from continued expansion in the share of protected territories and the number of environmental treaties signed.

A recent UNWTO and One Planet report reiterated the importance of a healthy environment for T&T competitiveness and development and recommended several actions to help the T&T sector produce a greener recovery. This included biodiversity protection actions such as putting tourism at the forefront of conservation efforts and ensuring that the value tourism provides for conservation efforts via monitoring mechanisms and investing in nature-based solutions is captured. Climate action efforts in T&T can be accelerated through the likes of monitoring and reporting emissions from tourism operations, accelerating decarbonization through the development of low-carbon transport options and greener infrastructure, and engaging in carbon removal via the restoration of carbon-density ecosystems and carbon-removal technologies. Finally, circular economy actions are recommended.

These include investing in transforming tourism value chains by reducing, reusing, repairing, refurbishing, remanufacturing, recycling and repurposing whenever possible; prioritizing sustainable food approaches such as local and organic procurement; creating sustainable menus and focusing on reducing food loss; and shifting towards a circularity of plastic in tourism. 55

At the World Economic Forum, efforts in this field are plentiful, and cover multistakeholder actions on decarbonizing transportation, accelerating action on plastics, ensuring the long-term, sustainable use of the ocean, and developing the circular economy. In particular, the Clean Skies for Tomorrow Coalition 56 is working with stakeholders in the aviation ecosystem, including buyers of corporate travel, to accelerate the production and use of sustainable aviation fuels, all while better distributing the green premium for these fuels. The Forum also hosts the Global Future Council on Sustainable Tourism, 57 a community of experts from academia, business, civil society and governments who are developing a set of principles for sustainable destinations to guide decision-making on rebuilding the sector in the wake of the pandemic. The Council is also researching customer behaviour changes that can incentivize the development and delivery of more sustainable travel products and services, articulating the value of investment in the blue and green economies in tourism, and providing guidance on the ambition of achieving net-zero emissions across the various verticals in the T&T sector.

Managing tourism demand and impact

Sustainable management of tourism demand that maximizes benefits for local communities, while also mitigating negative side effects such as overcrowding, will also become a vital component of T&T development as the sector recovers.

The TTCR 2019 discussed how long-term T&T growth was starting to put pressure on local infrastructure and housing, as well as degrading cultural and natural assets that attract visitors and fuelling uneven distribution of T&T benefits. This ultimately led to falling liveability standards for residents, local backlash against tourism and diminished visitor experience. 58 Although recent lockdowns and travel restrictions led to this sustainability challenge being discussed less, it is likely to become a more common topic as demand continues to recover. In many areas, the pandemic-fuelled travel demand push towards outdoor attractions, rural communities and secondary destinations has already revealed capacity constraints. For instance, the rise in nature travel had already led to more overcrowding at many national parks, with many US national parks monthly visitation number hitting all-time highs, leading to issue such as littering, wildlife disruption and traffic jams. 59 Visitors also show signs of wanting to reduce their footprint and improve the social impact on the destinations they visit, with just over half of global travellers in a recent survey indicating that they would be willing to switch their original destination for a lesser-known one if it led to a reduced footprint and greater community impact. 60

While issues such as overcrowding and other effects of T&T on communities are typically a local rather than national-level concern, the TTDI looks at the existence of, or risk related to, overcrowding and demand volatility, as well as the quality and impact of T&T via the T&T Demand Pressure and Impact pillar. In general, pillar results indicate that T&T Demand Pressure and Impact challenges affect economies of all levels of development. For instance, the difference in the average pillar score between low- and lower-middle-income and high-income economies covered by the index is just 0.8% and 2.5%, respectively.

High-income European countries tend to be some of the top TTDI performers and include rich cultural and non-leisure assets and quality transport and tourism infrastructure that allow for the absorption of large quantities of visitors. However, they still tend to score below average for the T&T Demand Pressure and Impact pillar due to factors such as shorter lengths of stay, higher seasonality and a very high level of concentration of interest in a small number of attractions, as shown by Tripadvisor page views and backed by at times unfavourable perceptions of the dispersions of tourism. Unsurprisingly, this region has often claimed headlines for tourism overcrowding. On the other hand, less-developed economies and those ranking lower on the TTDI tend to bring in fewer tourists, but still score below average for perception of tourism dispersion and town- and city-centre accessibility and crowding, an issue that may be partially explained by these economies’ typically below-average scores for transport infrastructure.

Figure 10: T&T Demand Pressure and Impact pillar component scores, 1–7 (best)

In summary, the relatively close distribution of T&T Demand Pressure and Impact pillar scores among economies of different incomes and tourist arrival levels highlights the fact that challenges such as overcrowding have less to do with visitor numbers and more to do with local conditions and policies.

Yet, as the sector rebuilds, there is an opportunity to use increasing domestic and nature-based T&T demand, consumers’ rising preference to manage their footprint and the need to address historical issues such as overcrowding by making investments and policies that help disperse T&T, thus making the sector more resilient. For one, proper care must be paid to developing transport, tourism, health and ICT infrastructure in rural, nature and secondary destinations. This can help funnel tourism and its benefits to more communities, make them more attractive destinations and increase their capacity to absorb more visitors. Within urban centres, improved road and public transport infrastructure and access to efficient, accessible, safe and affordable transport options can reduce the chances of overcrowding and lead to both greater liveability for residents and a better visitor experience (see Figure 11).

Figure 11: Correlation between public transport and quality of town and city centres

In general, TTDI 2021 results show an improvement in the Ground and Port Infrastructure pillar (+2.2%) since 2019. In particular, middle-income economies have experienced some of the strongest growth in areas such as perceptions of road quality and efficiency of train services. Nevertheless, as already alluded to, less-developed economies still have gaps in their infrastructure, ranging from lower road and rail density to a lack of access to efficient and quality public transport. Combined with lower marks for factors such as tourist and health infrastructure, these economies will face some of the greatest challenges in distributing tourism and its benefits throughout their communities. However, they also have the most to gain from overcoming these obstacles.

Aside from investment in infrastructure, policies are also a fundamental part of proper tourism demand management and dispersion. The above subsections of the key findings section explored how governments and destinations can institute policies to develop domestic and other forms of tourism. Moreover, there are specific efforts that can be made to manage T&T to prevent overcrowding and efficiently use a destination’s carrying capacity. For instance, the UNWTO has set out strategies and measures that can combat challenges such as these in cities. Some of these include the promotion of attractions and events that disperse visitors so they are not concentrated only in certain areas, time-based dynamic pricing, the creation of pedestrian-only zones, defining the carrying capacity of city areas, focusing on lower-impact visitor segments, ensuring local communities benefit from tourism, engaging with local stakeholders and monitoring the impact of tourism, including through the use of big data. 61

T&T stakeholders can also play a more active role in broader sustainable mobility efforts and trends that can help to reduce the sector’s environmental impact, manage demand and make destinations more attractive for visitors and residents. For example, the World Economic Forum’s Global New Mobility Coalition (GNMC) is a multistakeholder community for “accelerating the shift to a Shared, Electric and Autonomous Mobility (SEAM) system”. The synchronization of high-occupancy, electric and autonomous transport options can lead to better traffic flow, higher efficiency of road usage, more equitable mobility systems, better air quality, lower carbon emissions and improved grid resilience. More specifically, SEAM may reduce carbon emissions by 95%, improve mobility efficiency by 70% and decrease commuting costs by 40%. Given SEAM’s clear potential to create more sustainable destinations, a case can be made for T&T sector involvement this area. 62

The crucial role of digital technology

All of the aforementioned efforts to build back a better T&T sector will depend on effective leveraging of the growing role of digitalization in T&T.

More T&T services are being accessed by digital systems through online travel agencies (OTAs) and sharing economy platforms, direct online bookings, digital payment systems and mobile devices, and thus consumers tend to expect the greater convenience, increased options, reduced person- to-person contact and seamless experience that these systems provide. Furthermore, digitalization enables T&T businesses to gather consumer insights and preferences, optimize operations, cut transaction costs and automate processes. 63 Online platforms also enable T&T service providers, including SMEs, to reach beyond their local markets and connect with broader domestic and international markets. Due to the above- mentioned factors, it is not surprising that a positive relationship has been found between ICT readiness and international tourism receipts. 64 In the context of shifting demand dynamics, destinations with greater ICT readiness will be better positioned to diversify their markets and take advantage of trends such as the rising numbers of digital nomads and growth in nature-related travel. For instance, research shows a clear relationship between the ICT Readiness pillar and natural tourism online searches in economies with rich natural resources. 65

A recent report by the Asia Development Bank (ADB) and UNWTO outlines how the T&T sector can use big data and digitalization for better and more sustainable tourism management and recovery. Tourism-specific data coming from sources such as T&T operators and online platforms, and non-tourism-specific data coming from sources such as credit card transactions, mobility services and sensors can help T&T stakeholders track and manage the social, economic and environmental impacts of T&T, complement more traditional data-collection efforts, manage tourism flows and target preferred source markets, thereby helping to create smart destinations.

For instance, the Macao Government Tourism Office has worked with a major Chinese multinational technology company to “optimize visitors’ travel experiences before, during and after trips; obtain insights into travellers’ behaviour through in-depth analysis of big data; and monitor, divert and disperse visitor flows at tourist districts and congested areas”. The use of big data and various digital platforms and technology can also help seamless travel and act as health and security tools by enabling safety protocols, biosecurity technologies and digital health certificates, thereby boosting traveller confidence. However, the report also highlights the various barriers to greater use of big data and digitalization within the T&T sector. Some of these challenges include privacy concerns, data reliability, governance issues, disincentives for public-private collaboration, the digital divide, skills gaps and greater efforts to include SMEs. 66

Figure 12: ICT Readiness by economic income group, 2019–2021

Figure 12 helps to illustrate the digital divide among economic income groups. Developing economies typically lag when it comes to ICT infrastructure, internet connectivity and mobile network coverage, which hampers the use of digital platforms in financial services, transport and tourism activities. On the other hand, the ICT Readiness pillar is the most improved (+3.0%) since 2019 largely due to continued improvement in low- and middle-income economies. These results indicate that while high-income economies are best positioned to leverage digitalization and create smart destinations, developing economies are building capacity. In addition, as already mentioned, creating a more highly skilled labour force will be an essential element and challenge in maximizing the use of ICT tools in T&T.

The growing role of digitalization and, in particular, digital platforms, within the T&T space can also create other labour and socioeconomic challenges. Globally, the number of active digital labour platforms, which include ride-hailing taxi and delivery services, has grown from fewer than 200 in 2010 to at least 777 at the start of 2021. As stated, these platforms create new avenues for flexible employment for people, allow business to access wider markets and talent pools, improve productivity and provide convenience for customers. However, they could also lead to greater income and job insecurity. Commonly raised issues include less favourable working conditions, deficient social protection and employment benefits and a lack of access to fundamental rights of freedom of association and collective bargaining. 67 The growth in popularity of digital platforms offering short-term rentals has also led to concerns about residents’ access to housing at destinations where housing capacity is increasingly taken up by the T&T sector. 68 The concentration of market share in the hands of digital platforms may also lead to imbalances in the bargaining and pricing power of the various stakeholders, including workers and SMEs. 69

If proper efforts are made, from employee training and supporting SMEs’ use of ICT to fair and effective regulation of digital platforms and their impact on workers and destination communities, digitalization in T&T will become one of the driving forces in growing the sector’s role in inclusive, sustainable and resilient development. However, failing in these areas could also transform this key aspect of T&T operations into an increasingly acute barrier to future T&T growth.

4.4 Conclusion to the key findings

The COVID-19 pandemic and its impact have underscored the T&T sector’s vital role in global connectivity and development. In the coming years it will therefore be crucial for T&T stakeholders to devise strategies that make the sector more inclusive, sustainable and resilient.

As the TTDI 2021 results reveal, any such enterprise will require a comprehensive and holistic approach. Creating a better T&T economy is not just about improving infrastructure or offering favourable pricing. It also involves creating better health and hygiene conditions, ensuring natural resources are protected and that the workforce on which the sector depends has access to training and social protection. This necessitates the active participation and coordination of sector and non-sector business, employers and employees, government agencies ranging from tourism and health ministries to local authorities, environmental and conservation groups, and international organizations. Over the course of the pandemic, often uncoordinated travel restrictions and health protocols revealed the difficulty and necessity of such cooperation.

In the future, efforts will need to be made to devise common frameworks for defining and measuring T&T sustainability, including the creation of commonly accepted environment, social and governance metrics. The safe and ethical use of big data will prove fundamental to this cause. Moreover, in an increasingly complex and technology-enabled environment, it will be vital to ensure that developing economies, workers and SMEs are not left behind.

While these challenges may be difficult, the flexibility and adaptation the T&T sector has shown in the past few years also indicates that sector stakeholders are more than capable of rising to the occasion.

UN Tourism | Bringing the world closer

- SUSTAINABLE DEVELOPMENT

- Competitiveness

- Innovation and Investments

- ETHICS, CULTURE AND SOCIAL RESPONSIBILITY

- TECHNICAL COOPERATION

- UN Tourism ACADEMY

share this content

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Sustainable development

"Tourism that takes full account of its current and future economic, social and environmental impacts, addressing the needs of visitors, the industry, the environment and host communities"

Sustainable tourism development guidelines and management practices are applicable to all forms of tourism in all types of destinations, including mass tourism and the various niche tourism segments. Sustainability principles refer to the environmental, economic, and socio-cultural aspects of tourism development, and a suitable balance must be established between these three dimensions to guarantee its long-term sustainability.

Thus, sustainable tourism should:

- Make optimal use of environmental resources that constitute a key element in tourism development, maintaining essential ecological processes and helping to conserve natural heritage and biodiversity.

- Respect the socio-cultural authenticity of host communities, conserve their built and living cultural heritage and traditional values, and contribute to inter-cultural understanding and tolerance.

- Ensure viable, long-term economic operations, providing socio-economic benefits to all stakeholders that are fairly distributed, including stable employment and income-earning opportunities and social services to host communities, and contributing to poverty alleviation.

Sustainable tourism development requires the informed participation of all relevant stakeholders, as well as strong political leadership to ensure wide participation and consensus building. Achieving sustainable tourism is a continuous process and it requires constant monitoring of impacts, introducing the necessary preventive and/or corrective measures whenever necessary.

Sustainable tourism should also maintain a high level of tourist satisfaction and ensure a meaningful experience to the tourists, raising their awareness about sustainability issues and promoting sustainable tourism practices amongst them.

COMMITTEE ON TOURISM AND SUSTAINABILITY (CTS)

Biodiversity

UN Tourism strives to promote tourism development that supports, in equal measure, the conservation of biodiversity, the social welfare and the economic security of the host countries and communities.

Climate Action

Tourism is both highly vulnerable to climate change while at the same time contributing to it. Threats for the sector are diverse, including direct and indirect impacts such as more extreme weather events, increasing insurance costs and safety concerns, water shortages, biodiversity loss and damage to assets and attractions at destinations, among others.

Global Tourism Plastics Initiative

The problem of plastic pollution in tourism is too big for any single organisation to fix on its own. To match the scale of the problem, changes need to take place across the whole tourism value chain.

Hotel Energy Solutions (HES)

Hotel Energy Solutions (HES) is a UN Tourism -initiated project in collaboration with a team of United Nations and EU leading agencies in Tourism and Energy .

Observatories (INSTO)

The UN Tourism International Network of Sustainable Tourism Observatories (INSTO) is a network of tourism observatories monitoring the economic, environmental and social impact of tourism at the destination level.

When responsibly planned and managed, tourism has demonstrated its capacity to support job creation, promote inclusive social integration, protect natural and cultural heritage, conserve biodiversity, generate sustainable livelihoods and improve human wellbeing. As the sector is experiencing tremendous growth, collective efforts to ensure its long-term sustainability are essential.

Resource Efficiency in Tourism

The report aims to inspire stakeholders and encourage them to advance the implementation of the SDGs through sustainable tourism.

Small Islands Developing States (SIDS)

Small Island Developing States face numerous challenges. For a significant number, their remoteness affects their ability to be part of the global supply chain, increases import costs - especially for energy - and limits their competitiveness in the tourist industry. Many are increasingly vulnerable to the impacts of climate change - from devastating storms to the threat of sea level rise.

Travel facilitation

Travel facilitation of tourist travel is closely interlinked with tourism development and can be a tool to foster increased demand and generate economic development, job creation and international understanding.

UNGA Sustainable Tourism Resolutions

The UN Tourism is regularly preparing reports for the General Assembly of the United Nations providing updates on sustainable tourism policies both from UN Tourism member States and States Members of the United Nations, as well as relevant agencies and programmes of the United Nations system.

unwto tourism highlights 2022

Un tourism | bringing the world closer.

Unwto 2021: a year in review, 2021: tourism united, resilient and determined.

2021 has been a year of learning and adapting for tourism. It has proven that only by working together can the sector overcome challenges and embrace opportunities.

Gathering the global tourism community and developing concrete actions, UNWTO has led tourism’s response with the vision of not only restarting, but doing so in a more inclusive, innovative and sustainable way.

January - March

As global tourism faced up to a second year of unprecedented crisis , UNWTO began 2021 by counting the cost so far . At the same time, however, the emergence of vaccines brought hope . The Global Tourism Crisis Committee met to explore what this meant for safe travel and the restart of tourism, while the announcement of the winners of the UNWTO Global Start-up Competition recognized the role culture and creativity will play in tourism’s restart and recovery .

April - June

Collaboration and innovation were the focusat the start of the second quarter. UNWTO partnered with IATA on a new Destination Tracker to give both tourists and destinations clear, impartial and trusted advice. And a new Start-up Competition was launched to find the best ideas for accelerating rural development through tourism. In May, the launch of the Best Tourism Villages by UNWTO generated significant interest from Members in every global region.

July - September

As destinations in Europe welcomed tourists back for the peak summer season, UNWTO highlighted the role of digital solutions for the safe restart of the sector. But UNWTO also looked ahead, to a more sustainable future , working with key partners to reduce plastic waste and consumption across every part of the sector. Together, we celebrated World Tourism Day around the theme of Tourism for Inclusive Growth, a message of solidarity and determination that was echoed on a global scale.

October - December

The final quarter of 2021 began with cautious optimism as UNWTO’s Barometer showed signs of improvement in tourist arrival numbers during the summer season in the northern hemisphere. A new partnership with Netflix will bring the message of tourism as a driver of opportunity to a massive global audience, while in November, UNWTO was tourism’s voice at COP26 and signatories to the landmark Glasgow Declaration keep growing. Finally, against the backdrop of the UNWTO General Assembly , the programme of work for the coming biennium was approved and 77% of Members voted to secure a second mandate for the Secretary-General from 2022-2025.

Growing and Moving Forward

UNWTO brings together political leaders from across the globe to deliver a strong, coordinated response. Governments, destinations, fellow UN agencies and international organizations met at key international events joining efforts to rethink tourism. Institutional coordination has proven crucial to find the solutions that build a smarter, greener and safer tourism.

Leaving Nobody Behind

The pledge to ‘ leave nobody behind ’ means nobody should miss out : Not now as we support the sector in the face of crisis, and not in the future as tourism starts again. Tourism is a proven driver of equality and opportunity. And that’s why we turn words into actions, delivering guidelines and action plans , to ensure everyone can enjoy the opportunities tourism brings.

A Shared Vision

Advancing the transformation of the tourism sector , partnerships are the only way forward. In 2021, UNWTO signed agreements with international organizations and the private sector to step our vision for the future of tourism: innovation , education , sustainability , green investment , rural development.

From business as usual to Covid-19

Looking to the future

- Regional Support Office for Asia and the Pacific (RSOAP)

- Member States in Asia and the Pacific

- SUSTAINABLE TOURISM OBSERVATORIES (INSTO)

World Tourism Barometer: September 2022

UNWTO updates World Tourism Barometer and reports international tourism back to 60% of pre-pandemic levels from January to July 2022

Below are excerpts from the September 2022 release of the UNWTO Tourism Barometer :

- The steady recovery reflects strong pent-up demand for international travel, especially in the months of June and July which are part of the Northern Hemisphere summer season. The easing or lifting of travel restrictions in an increasing number of countries also contributed to boost results.

- International tourist arrivals almost tripled (+172%) in January-July 2022 compared to the same period of 2021. Numbers climbed from -64% in January 2022 (versus 2019) to -28% in July, the strongest month since the start of the pandemic.

- Asia and the Pacific (+165%) saw arrivals more than double in the first seven months of 2022, though they remained 86% below 2019 levels.

- The ongoing recovery can also be seen in outbound tourism spending from major source markets. Expenditure from France was at -12% in January-July 2022 compared to 2019 while spending from Germany stood at -14%. International tourism spending remained at -10% in Belgium, -23% in Italy and -26% in the United States.

- The uncertain economic environment seems to have reversed prospects for a return to pre-pandemic levels in the near term. 61% of UNWTO Panel of Experts now see a potential return of international arrivals to 2019 levels in 2024 or later while those indicating a return to pre-pandemic levels in 2023 has diminished (27%) compared to the May survey (48%).

Know more about the global tourism sector performance from January to July 2022 by checking the UNWTO World Tourism Barometer Volume 20, Issue 5 .

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Regional Support Office in Asia and the Pacific (RSOAP)

Rsoap a to z.

- Sustainable Tourism Observatories(INSTO)

UNWTO A to Z

- About UNWTO

- Affiliate Members

- Member States

- Tourism in the 2030 Agenda

- World Tourism Day

- Technical Cooperation

- ASIA AND THE PACIFIC

- MIDDLE EAST

- RESOURCES/SERVICES

- Sustainable Development of Tourism

- Ethics, Culture and Social Responsibility

- Market Intelligence

- Tourism Data Dashboard

- Publications

- UNWTO Academy

Partners links

© UNWTO Regional Support Office for Asia and the Pacific (RSOAP)

- Course Catalog

TOURISM TRENDS 2022

11 Aug TOURISM TRENDS 2022

The situation for tourism remains rather unusual as a result of the ongoing COVID-19 pandemic.

The crisis has marked a significant change for everyone, and above all for tourism, one of sectors hit hardest by the virus. 2020 was the year in which international tourism came to a near-complete standstill, and the only alternatives were domestic and local tourism.

2021 has seen some improvements, but only in a very subtle way as restrictions are still in place and many countries keep their borders fully or partially closed.

It is difficult to make an estimate for 2022 as it is not known how the pandemic will evolve. However, it is possible to talk about the new tourism trends that are likely to emerge over the coming year: – International travel with restrictions still maintained by both destinations and airlines in order to offer 100% security to the consumer.

– Reinforcement of COVID-19 testing; two years after the pandemic, COVID testing will still be in place as a preventive measure. – Conscious travel will be advocated. Travel to more distant destinations, but with prolonged durations of stay, as consumers look to enjoy as much of each place they visit as possible. – Green travel. Climate change is a problem that is present and growing. Consumers now are much more responsible and aware of the reality they live in on daily basis.

– A new trend is the “ed-ventures”. It is about combining education and holidays for the youngest members of the family. While adults may need to telework or attend meetings, their children can be doing workshops and learning in a playful way.

- Client log in

Metallurgicheskii Zavod Electrostal AO (Russia)

In 1993 "Elektrostal" was transformed into an open joint stock company. The factory occupies a leading position among the manufacturers of high quality steel. The plant is a producer of high-temperature nickel alloys in a wide variety. It has a unique set of metallurgical equipment: open induction and arc furnaces, furnace steel processing unit, vacuum induction, vacuum- arc furnaces and others. The factory has implemented and certified quality management system ISO 9000, received international certificates for all products. Elektrostal today is a major supplier in Russia starting blanks for the production of blades, discs and rolls for gas turbine engines. Among them are companies in the aerospace industry, defense plants, and energy complex, automotive, mechanical engineering and instrument-making plants.

Headquarters Ulitsa Zheleznodorozhnaya, 1 Elektrostal; Moscow Oblast; Postal Code: 144002

Contact Details: Purchase the Metallurgicheskii Zavod Electrostal AO report to view the information.

Website: http://elsteel.ru

EMIS company profiles are part of a larger information service which combines company, industry and country data and analysis for over 145 emerging markets.

To view more information, Request a demonstration of the EMIS service

Turn Your Curiosity Into Discovery

Latest facts.

11 Facts About National Numeracy Day May 22nd

9 Facts About Workers Memorial Day April 28th

40 facts about elektrostal.

Written by Lanette Mayes

Modified & Updated: 02 Mar 2024

Reviewed by Jessica Corbett

Elektrostal is a vibrant city located in the Moscow Oblast region of Russia. With a rich history, stunning architecture, and a thriving community, Elektrostal is a city that has much to offer. Whether you are a history buff, nature enthusiast, or simply curious about different cultures, Elektrostal is sure to captivate you.

This article will provide you with 40 fascinating facts about Elektrostal, giving you a better understanding of why this city is worth exploring. From its origins as an industrial hub to its modern-day charm, we will delve into the various aspects that make Elektrostal a unique and must-visit destination.

So, join us as we uncover the hidden treasures of Elektrostal and discover what makes this city a true gem in the heart of Russia.

Key Takeaways:

- Elektrostal, known as the “Motor City of Russia,” is a vibrant and growing city with a rich industrial history, offering diverse cultural experiences and a strong commitment to environmental sustainability.

- With its convenient location near Moscow, Elektrostal provides a picturesque landscape, vibrant nightlife, and a range of recreational activities, making it an ideal destination for residents and visitors alike.

Known as the “Motor City of Russia.”

Elektrostal, a city located in the Moscow Oblast region of Russia, earned the nickname “Motor City” due to its significant involvement in the automotive industry.

Home to the Elektrostal Metallurgical Plant.

Elektrostal is renowned for its metallurgical plant, which has been producing high-quality steel and alloys since its establishment in 1916.

Boasts a rich industrial heritage.

Elektrostal has a long history of industrial development, contributing to the growth and progress of the region.

Founded in 1916.

The city of Elektrostal was founded in 1916 as a result of the construction of the Elektrostal Metallurgical Plant.

Located approximately 50 kilometers east of Moscow.

Elektrostal is situated in close proximity to the Russian capital, making it easily accessible for both residents and visitors.

Known for its vibrant cultural scene.

Elektrostal is home to several cultural institutions, including museums, theaters, and art galleries that showcase the city’s rich artistic heritage.

A popular destination for nature lovers.

Surrounded by picturesque landscapes and forests, Elektrostal offers ample opportunities for outdoor activities such as hiking, camping, and birdwatching.

Hosts the annual Elektrostal City Day celebrations.

Every year, Elektrostal organizes festive events and activities to celebrate its founding, bringing together residents and visitors in a spirit of unity and joy.

Has a population of approximately 160,000 people.

Elektrostal is home to a diverse and vibrant community of around 160,000 residents, contributing to its dynamic atmosphere.

Boasts excellent education facilities.

The city is known for its well-established educational institutions, providing quality education to students of all ages.

A center for scientific research and innovation.

Elektrostal serves as an important hub for scientific research, particularly in the fields of metallurgy, materials science, and engineering.

Surrounded by picturesque lakes.

The city is blessed with numerous beautiful lakes, offering scenic views and recreational opportunities for locals and visitors alike.

Well-connected transportation system.

Elektrostal benefits from an efficient transportation network, including highways, railways, and public transportation options, ensuring convenient travel within and beyond the city.

Famous for its traditional Russian cuisine.

Food enthusiasts can indulge in authentic Russian dishes at numerous restaurants and cafes scattered throughout Elektrostal.

Home to notable architectural landmarks.

Elektrostal boasts impressive architecture, including the Church of the Transfiguration of the Lord and the Elektrostal Palace of Culture.

Offers a wide range of recreational facilities.

Residents and visitors can enjoy various recreational activities, such as sports complexes, swimming pools, and fitness centers, enhancing the overall quality of life.

Provides a high standard of healthcare.

Elektrostal is equipped with modern medical facilities, ensuring residents have access to quality healthcare services.

Home to the Elektrostal History Museum.

The Elektrostal History Museum showcases the city’s fascinating past through exhibitions and displays.

A hub for sports enthusiasts.

Elektrostal is passionate about sports, with numerous stadiums, arenas, and sports clubs offering opportunities for athletes and spectators.

Celebrates diverse cultural festivals.

Throughout the year, Elektrostal hosts a variety of cultural festivals, celebrating different ethnicities, traditions, and art forms.

Electric power played a significant role in its early development.

Elektrostal owes its name and initial growth to the establishment of electric power stations and the utilization of electricity in the industrial sector.

Boasts a thriving economy.

The city’s strong industrial base, coupled with its strategic location near Moscow, has contributed to Elektrostal’s prosperous economic status.

Houses the Elektrostal Drama Theater.

The Elektrostal Drama Theater is a cultural centerpiece, attracting theater enthusiasts from far and wide.

Popular destination for winter sports.

Elektrostal’s proximity to ski resorts and winter sport facilities makes it a favorite destination for skiing, snowboarding, and other winter activities.

Promotes environmental sustainability.

Elektrostal prioritizes environmental protection and sustainability, implementing initiatives to reduce pollution and preserve natural resources.

Home to renowned educational institutions.

Elektrostal is known for its prestigious schools and universities, offering a wide range of academic programs to students.

Committed to cultural preservation.

The city values its cultural heritage and takes active steps to preserve and promote traditional customs, crafts, and arts.

Hosts an annual International Film Festival.

The Elektrostal International Film Festival attracts filmmakers and cinema enthusiasts from around the world, showcasing a diverse range of films.

Encourages entrepreneurship and innovation.

Elektrostal supports aspiring entrepreneurs and fosters a culture of innovation, providing opportunities for startups and business development.

Offers a range of housing options.

Elektrostal provides diverse housing options, including apartments, houses, and residential complexes, catering to different lifestyles and budgets.

Home to notable sports teams.

Elektrostal is proud of its sports legacy, with several successful sports teams competing at regional and national levels.

Boasts a vibrant nightlife scene.

Residents and visitors can enjoy a lively nightlife in Elektrostal, with numerous bars, clubs, and entertainment venues.

Promotes cultural exchange and international relations.

Elektrostal actively engages in international partnerships, cultural exchanges, and diplomatic collaborations to foster global connections.

Surrounded by beautiful nature reserves.

Nearby nature reserves, such as the Barybino Forest and Luchinskoye Lake, offer opportunities for nature enthusiasts to explore and appreciate the region’s biodiversity.

Commemorates historical events.

The city pays tribute to significant historical events through memorials, monuments, and exhibitions, ensuring the preservation of collective memory.

Promotes sports and youth development.

Elektrostal invests in sports infrastructure and programs to encourage youth participation, health, and physical fitness.

Hosts annual cultural and artistic festivals.

Throughout the year, Elektrostal celebrates its cultural diversity through festivals dedicated to music, dance, art, and theater.

Provides a picturesque landscape for photography enthusiasts.

The city’s scenic beauty, architectural landmarks, and natural surroundings make it a paradise for photographers.

Connects to Moscow via a direct train line.

The convenient train connection between Elektrostal and Moscow makes commuting between the two cities effortless.

A city with a bright future.

Elektrostal continues to grow and develop, aiming to become a model city in terms of infrastructure, sustainability, and quality of life for its residents.

In conclusion, Elektrostal is a fascinating city with a rich history and a vibrant present. From its origins as a center of steel production to its modern-day status as a hub for education and industry, Elektrostal has plenty to offer both residents and visitors. With its beautiful parks, cultural attractions, and proximity to Moscow, there is no shortage of things to see and do in this dynamic city. Whether you’re interested in exploring its historical landmarks, enjoying outdoor activities, or immersing yourself in the local culture, Elektrostal has something for everyone. So, next time you find yourself in the Moscow region, don’t miss the opportunity to discover the hidden gems of Elektrostal.

Q: What is the population of Elektrostal?

A: As of the latest data, the population of Elektrostal is approximately XXXX.

Q: How far is Elektrostal from Moscow?

A: Elektrostal is located approximately XX kilometers away from Moscow.

Q: Are there any famous landmarks in Elektrostal?

A: Yes, Elektrostal is home to several notable landmarks, including XXXX and XXXX.

Q: What industries are prominent in Elektrostal?

A: Elektrostal is known for its steel production industry and is also a center for engineering and manufacturing.

Q: Are there any universities or educational institutions in Elektrostal?

A: Yes, Elektrostal is home to XXXX University and several other educational institutions.

Q: What are some popular outdoor activities in Elektrostal?

A: Elektrostal offers several outdoor activities, such as hiking, cycling, and picnicking in its beautiful parks.

Q: Is Elektrostal well-connected in terms of transportation?

A: Yes, Elektrostal has good transportation links, including trains and buses, making it easily accessible from nearby cities.

Q: Are there any annual events or festivals in Elektrostal?

A: Yes, Elektrostal hosts various events and festivals throughout the year, including XXXX and XXXX.

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.

Share this Fact:

- Victor Mukhin

Victor M. Mukhin was born in 1946 in the town of Orsk, Russia. In 1970 he graduated the Technological Institute in Leningrad. Victor M. Mukhin was directed to work to the scientific-industrial organization "Neorganika" (Elektrostal, Moscow region) where he is working during 47 years, at present as the head of the laboratory of carbon sorbents. Victor M. Mukhin defended a Ph. D. thesis and a doctoral thesis at the Mendeleev University of Chemical Technology of Russia (in 1979 and 1997 accordingly). Professor of Mendeleev University of Chemical Technology of Russia. Scientific interests: production, investigation and application of active carbons, technological and ecological carbon-adsorptive processes, environmental protection, production of ecologically clean food.

Title : Active carbons as nanoporous materials for solving of environmental problems

Quick links.

- Conference Brochure

- Tentative Program

2022 has been the year to rethink tourism. Countries around the world turned UNWTO's vision for a greener, smarter and more inclusive sector into real action. 2020 showed the relevance of tourism for sustainable development. 2021 laid the foundations for the transformation of the sector. In 2022, we made it happen. 2022 began on a positive note.

According to the latest UNWTO World Tourism Barometer, international tourism saw a strong rebound in the first five months of 2022, with almost 250 million international arrivals recorded. This compares to 77 million arrivals from January to May 2021 and means that the sector has recovered almost half (46%) of pre-pandemic 2019 levels. UN ...

International Tourism Highlights, 2023 Edition - The Impact of COVID-19 on Tourism (2020-2022) ISBN (printed version): 978-92-844-2497-9 ISBN (electronic version): 978-92-844-2498-6 DOI: 10.18111/9789284424986 Published by the World Tourism Organization (UNWTO), Madrid, Spain First published: September 2023 Revised and updated: October 2023