- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Best Family Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Travel insurance company factors we considered

An overview of the best travel insurance for families, top options for travel insurance for a family, additional resources for family travel insurance shoppers.

Even the best-laid plans can sometimes go awry. This possibility doubles (or even triples) when traveling with a family, which can mean that purchasing family travel insurance may make sense for you.

This type of insurance will cover you and your loved ones if you miss your flight, your partner gets food poisoning, your children’s bags are lost and more. Here are the best family travel insurance plans and the factors we considered, and tips on choosing the best plan for you.

» Learn more: The best travel credit cards right now

We used the following criteria when choosing which travel insurance companies are best:

Cost . Cost can play a huge factor in choosing a travel insurance plan, especially when you’re traveling with multiple people. We compared costs for basic policies to choose the most affordable options.

Types of coverage . There is a wide variety of coverage options for insurance , including medical coverage and trip protection benefits. We chose those with the widest range of inclusions.

Coverage amounts . Many policies offer a variable level of coverage; more expensive policies can include higher policy limits, though this isn’t always the case.

Customizability . Different travelers have different types of needs, which means that we focused on policies that offer customizability as part of their benefits.

» Learn more: What does travel insurance cover?

To determine the best travel insurance for a family, we compared the price and benefits across multiple insurance companies for a sample trip taken by a family of three from New Hampshire — a 39-year-old father, 33-year-old mother and 3-year-old child. They are traveling to Germany during the winter and estimate a total trip cost of $12,000.

Overall, the average cost of a plan came out to $257.78, though one plan priced out far below the rest.

Here's a closer look at our top five recommendations for travel insurance for families.

Allianz Travel

What makes Allianz travel insurance great for families:

Family travel medical insurance that includes coverage for pre-existing conditions.

Customizability includes rental car insurance and Cancel For Any Reason (CFAR) insurance.

Provides up to $1,000 per person for lost baggage.

Here’s a snippet from our Allianz Travel insurance review:

“OneTrip Prime provides all the benefits of the Basic plan but with higher limits, a few extra coverage areas and complimentary coverage for children 17 and under when traveling with a parent or grandparent.”

The complimentary coverage is useful, especially for families with multiple kids.

» Learn more: Trip cancellation insurance explained

World Nomads

What makes World Nomads great for families:

Lower-than-average cost.

Includes adventure sports and activities.

Provides $25,000 non-medical emergency transportation.

World Nomads is a great fit for particularly adventurous families, as its plans include coverage for over 200 activities. So if you're taking the kids skiing this winter or are planning to backpack the Colorado Trail next summer, this might be a good choice.

» Learn more: Does travel insurance cover award flights?

What makes AXA great for families:

Covers 100% of trip cost for interruption or cancellation for covered reasons.

Provides $100 per person, per day for trip delay.

Includes $100 in coverage for airline reissue or cancellation fees.

Having kids invites a lot of unpredictability for trip planning. Will your oldest bring home a virus from day care? Will your baby suddenly enter a difficult sleep regression that renders you exhausted? Having 100% coverage for trip cancellation can bring families peace of mind when putting big trip deposits down.

What makes IMG great for families:

Hundreds of dollars cheaper than the other options.

$0 deductible for medical insurance.

Up to $5,000 for trip interruption.

Here’s a snippet from our IMG review:

“Some policies provide emergency medical evacuation coverage, while others skip this benefit entirely. This benefit may be more important to you if you travel to a remote location or engage in physical activity such as trekking.

More comprehensive plans may include other benefits such as assistance with acquiring a new passport, reimbursing reward mile redeposit fees or coverage for pre-existing conditions. If these are something you’re interested in, be sure to check that your policy includes these options.”

What makes Tin Leg great:

Lower-than-average cost.

150% reimbursed for trip interruption.

Customizability, including coverage for pre-existing conditions.

We like Tin Leg for its affordability. You can pocket the saved cash for more ice cream stops on your trip.

Interested in learning more about travel insurance, including annual family travel insurance and methods to make travel insurance less expensive? Start here.

How to find the right travel insurance for you

How annual or multi-trip travel insurance works

Do you need travel insurance in 2023?

10 credit cards that provide travel insurance

If you’re traveling with family and would like to make sure they’re insured, you can choose to include them in your insurance plan. Most companies will allow you to select the number of travelers in your group when generating a quote.

The definition for immediate family is going to vary based on your insurance provider. Generally speaking, you can expect that your spouse, children, parents, grandparents, in-laws, aunts and uncles all count as immediate family.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2023 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Find out what you really need to know, plus easily compare prices from hundreds of deals, no matter what insurance you need.

Our Top Picks

- Cheap Car Insurance

- Best, Largest Car Insurance Companies

- Cheap Motorcycle Insurance

- Cheap Home Insurance

- Cheap Moped Insurance

- Best Cheap Cruise Insurance

- Best Pet Insurance

- Best Insurance for Bulldogs

- Best Travel Insurance

- Pet Insurance

- Home Insurance

- Travel Insurance

- Car Insurance

- Motorcycle Insurance

- Caravan & Motorhome Insurance

- Campervan Insurance

- Health Insurance

- Van Insurance

Solar Panels

Get solar panels for your home.

- Best Solar Panels

- Solar Panel Installers

- Solar Panels for Home

- Solar Panel Comparison

- Solar Panel Installation

- Solar Panel Battery

The Financial Aspects

- Solar Panel Costs

- Solar Panel Grants

- Solar Panel Quotes

- Solar Panel Tariffs

Business Insurance

Find the best insurance deals for you and discover what you need to know, whatever your business.

Popular Types of Cover

- Public Liability Insurance

- Employers' Liability Insurance

- Professional Indemnity

- Directors and Officers

- Fleet Insurance

- Best Business Insurance Companies

- Guide to Small Business Insurance

- How Much Does Business Insurance Cost?

- Business Loans

By Type of Business

- Limited Company Insurance

- Self Employed Insurance

By Occupation

- Click for insurance by occupation!

Credit Cards

Read reviews and guides to get clarity over credit cards and see which is best for you.

Credit Card Categories

- Credit Builder Cards for Bad Credit

- Rewards Credit Cards

- Travel Credit Cards

- 0% Interest Credit Cards

- No Foreign Transaction Fee Credit Cards

- Balance Transfer Credit Cards

- Cashback Credit Cards

- Credit Cards with No Annual Fee

- Student Credit Cards

Helping you make the most of your money with our in-depth research on the topics that matter to you.

Stay up to date with the latest news that affects you.

Come say hi!

Connect with NimbleFins

- Follow NimbleFins on LinkedIn

Admiral Travel Insurance Review: Top Tiers Include Catastrophe Cover

- Can add £1,000 of Gadget cover

- Covering Personal Belongings/Baggage on all plans

- Trip Delay/Cancellation/Curtailment

- Long single trips

- Catastrophe cover for ash clouds, storms, etc. (Gold and Platinum Plans)

- Covering Insolvency of End Supplier

Editor's Rating

The guidance on this site is based on our own analysis and is meant to help you identify options and narrow down your choices. We do not advise or tell you which product to buy; undertake your own due diligence before entering into any agreement. Read our full disclosure here .

Compare Cheap Travel Insurance

Protect your holiday today. Quick quotes from 20 insurers.

Admiral offers three tiers of travel insurance cover, all for very competitive prices and including Personal Belongings protection (including Delayed Baggage on all plans). If you want cover for catastrophes (e.g., volcanic ash cloud and storms) then choose one of the top two tiers—Gold or Platinum. Policyholders also have the option to buy extras like Winter Sports, Gadget, Golf and Cruise (included on Platinum). End Supplier Failure is not covered on Admiral plans, however.

In This Review

- Admiral Travel Insurance Price Comparison

- Buying Admiral Direct or from a Comparison Site: What are the Differences?

Notable Features

- Policy Limits and Coverage Options

- Comparing Admiral to the Competition

- Policy Wording and Claims

Read our review to learn about features and prices of Admiral travel insurance—plus we'll explain the main differences between buying direct direct from the Admiral site versus buying through a travel insurance comparison engine , to help you decide where to buy. Choosing the best travel insurance for you will depend on factors like price points and features that you might find valuable. Please use the information in this review to help you narrow your choices.

Admiral Travel Insurance Review: What You Need to Know

Admiral offers three levels of Annual and Single Trip travel insurance—Admiral, Admiral Gold and Admiral Platinum. All policies include some level of cover for Trip Cancellation , Emergency Medical, Trip Delay/Missed Departure, Legal Assistance, Personal Accident and Personal Belongings. Mid-tier (Gold) and top-tier (Platinum) policies also include Catastrophe cover; top-tier plans include Hijack cover and Cruise cover as well. But there's no cover for financial failure of suppliers like airlines or hotel operators.

As for optional extras, Winter Sports can be added to all tiers of insurance for an additional cost. Gadget and Golf cover are optional add-on features available for the top two tiers for an additional cost —Admiral Gold and Admiral Platinum. You can't add these features to the lowest tier Admiral plan. Cruise cover is included as standard on Admiral Platinum policies, or available for an extra cost on the lower tiers.

Those going on a cruise can get optional cover for cabin confinement, emergency airlift to hospital, missed port and unused excursions. To learn more about market prices please see our article Average Cost of Cruise Travel Insurance UK .

How to Buy Admiral travel insurance plans can be purchased either via a comparison engine or direct from Admiral . The basic limits are the same, regardless of where you buy your policy. Differences between buying direct and buying from a comparison site mostly relate to excess and price: generally speaking, plans from a comparison site typically cost less (around 20% less, in fact, for Annual, Multi-trip policies according to our pricing analysis) BUT they have a higher excess for the same cover levels. A higher excess means you contribute more towards any claims. Those buying direct are sometimes offered a 10% discount for buying online, so it's good to check the website to see what discounts are offered today.

Are Gadgets (e.g., Mobile Phones) Covered? Gadgets including mobile phones are covered to some extent on all plans through the Valuables section of cover. However, the standard Valuables limit may be too low for you—it's only £200, £300 or £400, depending on which plan you choose. If you travel with multiple gadgets or more expensive gadgets, you might want to consider adding Admiral's Optional Gadget Cover to an Admiral Gold or Admiral Platinum policy. (Optional Gadget Cover is not available as an add-on to the lowest tier of cover, Admiral plans.) You're able to add this to your policy whether you buy direct or from the comparison site.

What is the cost of adding gadget cover to Admiral travel insurance? We checked in November 2023 and were quoted £4.30 for £1,500 of additional cover for a single trip for the loss, theft or damage of gadgets. Prices may vary.

To see a list of other companies that offer a gadget travel insurance add on please see our article, Travel Insurance Companies with Optional Gadget Cover .

Does Admiral Travel Insurance Cover Trips in the UK? Holidays in the UK are covered under Admiral policies, so long as you pre-booked at least 2 consecutive nights of commercially-operated accommodation more than 25 miles from your home.

Pre-Existing Conditions: Admiral may be able to offer cover for some pre-existing medical conditions , for which you'll pay a higher premium. Pre-existing conditions are only covered if they've been declared by you, Admiral has given written acceptance and you've paid an additional premium.

As part of the online quote process you can declare your conditions to see if cover can be offered, and for what added cost. Or you can call Admiral's Medical Screening number (0333 234 9913) to discuss your particular situation.

Over 65s: Now, the latest policy documents don't specify upper age limits. Previously, they said that the age limit for travellers on Admiral's Annual Multi-Trip policies was 75 years or under or 79 years or under for a Single Trip. Cover for Winter Sports was subject to an age limit of 65 years. Now they say 'the cover we can offer you will vary depending on our age limits, underwriting criteria, the cover you need and the details you provide.'

Covid Cover: You're covered for emergency medical treatment and repatriation if you contract Covid-19 abroad; for cancelling your trip if you are diagnosed with Covid-19 within the 14 days prior to your trip departure or the hospitalisation or death of a close relative within the 14 days prior to your trip departure, as a result of Covid-19 (Cover is subject to your policy being active at the time of the event and proof of a positive Covid-19 test.)

Admiral Price Comparison

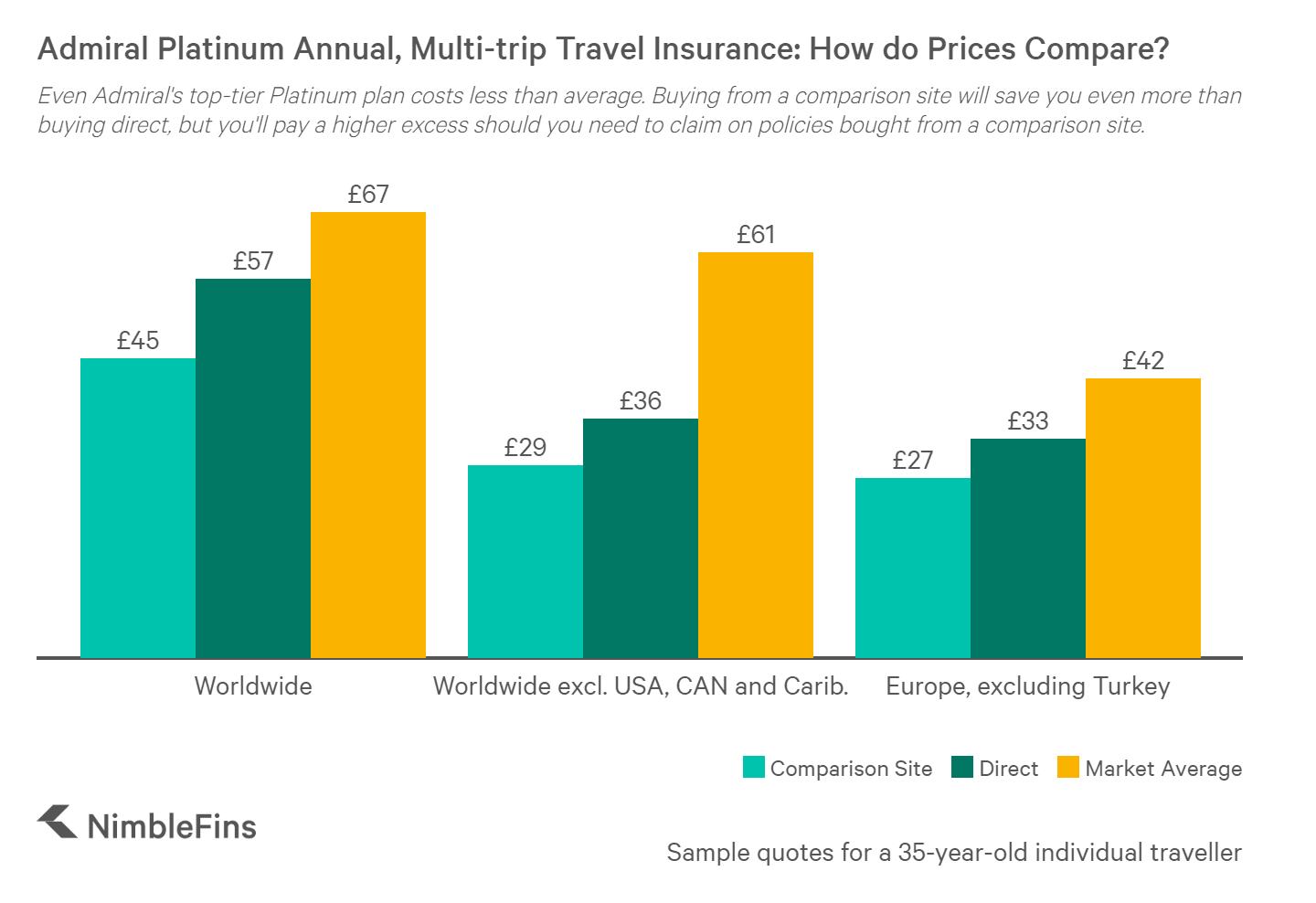

According to our data research in February 2018, prices of Admiral Travel Insurance were noticeably lower than the average cost of travel insurance in the UK. In fact, even Admiral's top-tier Platinum policies come in below average, as you can see in the following chart of Annual, Multi-trip plans by geography.

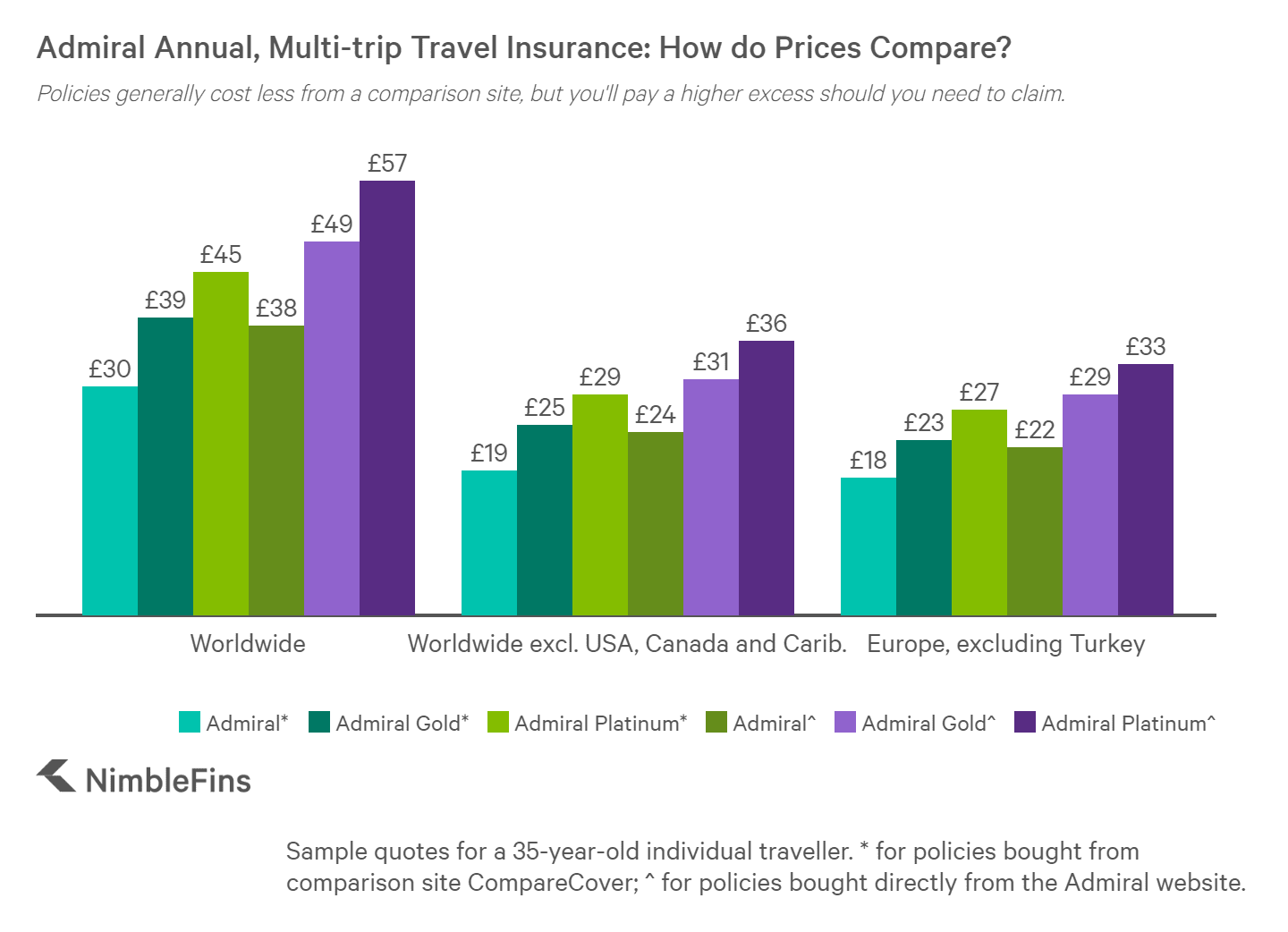

According to data we gathered, prices of Annual, Multi-trip policies from comparison sites were around £5 to £10 cheaper than policies bought direct from Admiral, depending on geography and type of plan, representing a savings of approximately 20%.

Insurance quotes can vary significantly from day to day and according to your individual details, so please just use the following data for general educational purposes only; your quotes may reflect a large degree of variation.

We also gathered quotes for Admiral plans for a family of four from the Admiral website—they'll pay on average 2X the cost of an individual policy (basically, kids go free). Below you can see how prices change across geographical locations like Europe and America and policy types for a family of four. Plans bought from a comparison site would be expected to cost less.

How much more expensive is travel insurance for a family of 4?

Cost of Add-On Extras

Winter Sports, Cruise, Gadget and Golf cover may be added for an extra cost to some of Admiral's travel insurance policies. We've gathered quotes across geographies and types of policies for a 30-year-old individual to give you an idea of the cost of travel insurance add-ons —these prices reflect policies bought directly from the Admiral website.

Buying Direct vs Using a Comparison Site

Generally speaking, you'll pay less for an Admiral travel insurance policy if you purchase it through a comparison engine ( try ours here ). Of course, there is a trade off. Policies—which are otherwise nearly identical—differ on a few points. First, the excess is higher on the comparison site policies. Second, the upper age limit is lower on policies via a comparison site.

Differences between Direct and Comparison Site Policies

You'll notice that the upper age limit for Winter Sports is the same regardless of where you buy (65 years), as is the maximum trip length on Annual, Multi-trip policies (31 days).

Protect your holiday today. Quick quotes from over 45 insurers.

Buying Admiral Direct from the Admiral Website

Those in their 70s or older may find more success buying direct, due to the higher upper age limits discussed above.

For an extra cost you can add golf cover to plans bought direct, if needed.

Here is a brief recap of some features available on Admiral travel insurance policies. Standard features like Medical and Personal Liability are also included on Admiral policies, limits for which can be found below in the Policy Limits section . For more complete details including inner limits and exclusions, please refer to the policy documents .

Types of Admiral Travel Insurance Policies

Admiral offers three tiers of travel insurance—Admiral, Admiral Gold and Admiral Platinum. All are available for Single Trips or as Annual, Multi-Trip policies. Admiral Single Trip travel insurance covers trips up to 365 days abroad. Admiral Annual Multi-Trip policies cover any number of trips a policy year, up to 31 days each. You may be able to extend the maximum trip duration for an extra charge, subject to the underwriter's approval. The following limits and plan details are consistent across policies purchased from the Admiral website and a comparison site.

Admiral Travel Insurance

The "Admiral" plan is their entry-level travel insurance offering. Emergency Medical expenses are covered up to £10 million and you get up to £1,000 of cover per insured person for Travel Delays, Trip Cancellation/Curtailment and Personal Belongings.

You can add Winter Sports or Cruise cover to Admiral's cheapest plans, but Golf and Gadget cover are not offered as add ons.

Admiral Gold Travel Insurance

As Admirals's mid-tier offering, Gold policies include higher limits and the addition of Catastrophe cover (e.g., volcanic ash, earthquake, storm, flood, tsunami, etc.). Cruise, Winter Sports, Golf and Gadget cover may be added for a cost.

Admiral Platinum Travel Insurance

Admiral Platinum is the top-tier travel insurance plan with the highest cover limits per person. If the Platinum premium fits in your budget, you'll get the highest coverage levels with this plan. In addition to features of the Gold plans, Cruise cover is included as standard on Platinum policies.

Cover Limits (Single & Annual Multi-Trip)

Please read some of our Travel Insurance Guides if you're trying to decide between Single Trip or Multi-Trip policies, learn about What May Not be Covered by Travel Insurance or decide if you Need Travel Insurance or Not .

How does Admiral Travel Insurance Compare to Competitors?

To better understand the value of Admiral travel insurance you need to look at it in the context of other available options. We compared it to other plans in the market so you can see which may be more suitable for you.

Admiral Travel Insurance vs Direct Line Travel Insurance

Direct Line travel insurance plans include cover for End Supplier Failure and Natural Disasters, plus cover for the replacement cost of used points or miles in case of Cancellation/Curtailment for a trip bought with air miles or another rewards structure. While prices are a bit higher than average, according to our analysis, you are getting these extra cover features. One surprising extra is Baggage—you'll need to pay extra to cover your personal belongings as they're not included as standard.

Bottom Line: If you really want cover for End Supplier Failure or Natural Disasters, or if you book trips with miles, then Direct Line might provide more comprehensive travel insurance for you.

Admiral Travel Insurance vs AXA Travel Insurance

AXA travel insurance offers good value for money, with all plans including Insolvency, Baggage, Cancellation/Delay/Curtailment and Catastrophe. Those who ski or snowboard will get longer Winter Sports cover with AXA (over 30 days, depending on the plan).

Bottom Line: If you really want cover for End Supplier Failure and Baggage included as standard, or you spend more than 17 on Winter Sports trips per year, then AXA might be a more comprehensive travel insurance option for you.

Admiral Travel Insurance vs Sainsbury's Travel Insurance

Sainsbury's travel insurance offers solid travel cover at decent prices, especially when purchased through a comparison site. All plans include Baggage, Cancellation and Emergency Medical, but you also get Scheduled Airline Failure, Delayed Departure and Trip Abandonment. Extended Gadget cover can be added to all plans, to cover mobile phones, iPads, etc. Trip lengths are longer than average (notably up to 92 days on top-tier plans bought direct).

Bottom Line: Those needing cover for longer trips might find more suitable travel insurance from Sainsbury's Bank.

Other Useful Information: Policy Wording and Claims

Admiral's 24-hour Emergency Assistance Helpline can be reached on +44 (0)292 010 7777. Use this number if you have a medical emergency while you're abroad or you're injured, become ill or have to cut your trip short. If you need medical treatment, you're supposed to call this number before you seek medical treatment.

For other non-emergency claims on Admiral travel insurance, call their claims team on 0333 234 9914 between 8am and 8pm Monday to Friday, or between 9am and 4pm Saturday (closed Sundays and Bank Holidays).

- Admiral Travel Insurance Key Facts, Direct

- Admiral Travel Insurance Policy Book, Direct

Compare Cheap Insurance in Your Area

Quick quotes from 20 insurers.

Erin Yurday is the Founder and Editor of NimbleFins. Prior to NimbleFins, she worked as an investment professional and as the finance expert in Stanford University's Graduate School of Business case writing team. Read more on LinkedIn .

- 4.8 out of 5 stars**

- Quotes from 20 providers

Our Top Insurance Picks

- Cheap Travel Insurance

Cheap Travel Insurance by Destination

- Travel Insurance to Australia

- Travel Insurance to Ireland

- Travel Insurance to Canada

- Travel Insurance to Turkey

- Travel Insurance to India

Articles on Travel Insurance Costs

- Average Cost of Travel Insurance

- Average Cost of Travel Insurance to USA

- Cost of Travel Insurance with Pre-Existing Medical Conditions

- Average Cost of Travel Insurance to India

- Average Cost of Travel Insurance to Ireland

Recent Articles on Travel Insurance

- Travel Insurance with Optional Gadget Cover

- Top Tips for Travel Insurance with Medical Conditions

- Can Travel Insurance Help if Natural Disaster Strikes?

- Should You Buy Travel Insurance from a Comparison Site?

- Should You Buy Single-Trip or Annual Multi-Trip Travel Insurance?

Travel Insurance Guides

- Do I Need Travel Insurance? 3 Key Questions

- Will Your Travel Insurance Claim be Rejected? Boost Your Odds with These Tips

- 7 Things Your Travel Insurance May Not Cover

- Travel Insurance Guide

Travel Insurance Reviews

- AA Travel Insurance Review

- Admiral Travel Insurance Review

- Aviva Travel Insurance Review

- AXA Travel Insurance Review

- Cedar Tree Travel Insurance Review

- CoverForYou Travel Insurance Review

- Coverwise Travel Insurance Review

- Debenhams Travel Insurance Review

- Direct Line Travel Insurance Review

- Holidaysafe Travel Insurance Review

- Insure & Go Travel Insurance Review

- Sainsbury's Bank Travel Insurance Review

- Tesco Travel Insurance Review

- Travelinsurance.co.uk Travel Insurance Review

- Zurich Travel Insurance Review

Reviews of Travel Insurance for Pre-Existing Conditions

- Fit2Travel Travel Insurance Review

- Free Spirit Travel Insurance Review

- goodtogoinsurance.com Review

- JustTravelcover.com Insurance Review

- OK To Travel Insurance Review

- Saga Travel Insurance Review

- Virgin Money Travel Insurance Review

- Privacy Policy

- Terms & Conditions

- Editorial Guidelines

- How This Site Works

- Cookie Policy

- Copyright © 2024 NimbleFins

Advertiser Disclosure : NimbleFins is authorised and regulated by the Financial Conduct Authority (FCA), FCA FRN 797621. NimbleFins is a research and data-driven personal finance site. Reviews that appear on this site are based on our own analysis and opinion, with a focus on product features and prices, not service. Some offers that appear on this website are from companies from which NimbleFins receives compensation. This compensation may impact how and where offers appear on this site (for example, the order in which they appear). For more information please see our Advertiser Disclosure . The site may not review or include all companies or all available products. While we use our best endeavours to be comprehensive and up to date with product info, prices and terms may change after we publish, so always check details with the provider. Consumers should ensure they undertake their own due diligence before entering into any agreement.

Note regarding savings figures: *For information on the latest saving figures, pay-less-than figures, and pay-from figures used for promotional purposes, please click here .

**4.8 out of 5 stars on Reviews.co.uk is the rating for our insurance comparison partner, QuoteZone.

+1 (123) 456 7890 OR [email protected]

- Follow Us On:

Admiral Travel Insurance Review – Is it the Complete Package?

Home » Blog » Admiral Travel Insurance Review – Is it the Complete Package?

- Anokye Miller

- June 29, 2023

- No Comments

Admiral Travel Insurance Review – Is it the Complete Package?

Key takeaway:.

- Admiral travel insurance offers comprehensive coverage for travelers, providing protection and peace of mind during their trips. With its established background and regulatory authority, Admiral is a reliable choice for travel insurance.

- Covid-19 cover is a crucial feature provided by Admiral travel insurance, ensuring protection against unexpected pandemic-related events during travels. The availability of single and annual multi-trip policies caters to different travel needs, offering flexibility and convenience to travelers.

- Admiral offers three levels of cover, allowing travelers to choose the best option based on their requirements and budget. Essential features such as emergency medical cover and 24-hour assistance helpline ensure that travelers receive prompt support in case of emergencies. Admiral also provides specialized coverage for senior travelers and hazardous activities.

- Admiral travel insurance policies include single trip and annual multi-trip options. Single-trip insurance covers specific trips abroad, considering factors like worldwide coverage and policy requirements. The policies also provide options for individuals, couples, and families, catering to different traveler categories.

- Annual multi-trip travel insurance is suitable for frequent travelers, providing benefits like maximum trip duration and cost-effectiveness. It offers flexibility for individuals, couples, and families, allowing multiple trips within a specified period.

- Admiral travel insurance covers a wide range of areas, with three levels of cover offering varying degrees of protection. Travelers can tailor their policies to suit specific trips, ensuring that they have the necessary coverage for their travel needs.

- Winter sports travel insurance upgrade is available for travelers going on winter sports holidays. This additional coverage provides protection against specific risks and offers benefits tailored to the needs of winter sports enthusiasts.

- Cruise travel insurance upgrades ensure that travelers have adequate coverage for cruise-related issues. Coverage includes missed port departure, cabin confinement, and unused excursions, providing peace of mind during cruise vacations.

- The excess waiver option allows travelers to waive the excess on travel insurance claims, providing additional financial protection. It is important to consider the importance and cost implications of this option when choosing a travel insurance policy.

- Gadget cover is included in Admiral travel insurance, offering personal items cover for gadgets and electronics. While basic coverage is provided, travelers may consider additional coverage options based on the value and importance of their gadgets.

- What is Admiral travel insurance?

Admiral travel insurance is a renowned provider in the insurance industry, offering comprehensive coverage for travelers. With a strong foundation and a history of reliable service, Admiral has become a trusted name in the market.

Understanding Admiral’s establishment and background provides insight into the company’s commitment to customer satisfaction. Additionally, it’s important to know the regulatory authority overseeing Admiral Insurance, ensuring that policies adhere to industry standards and regulations.

Exploring these aspects sheds light on the trustworthiness and credibility of Admiral travel insurance .

Admiral’s establishment and background

Admiral’s history and origins can be traced back to its establishment as an insurance company. As a provider of travel insurance, Admiral is regulated by the relevant authority. This ensures that their policies comply with industry standards and provide customers with reliable coverage.

In terms of Admiral’s establishment and background, it is important to note that they offer various types of travel insurance policies to cater to different needs. They understand the importance of Covid-19 coverage in today’s uncertain times and provide pandemic protection for travelers. Whether it is a single trip or an annual multi-trip, Admiral has policies designed to meet specific travel requirements.

Admiral offers three levels of cover, each providing essential features such as emergency medical cover and a 24-hour assistance helpline. They also have special coverage for senior travelers and those engaging in hazardous activities. Their aim is to provide comprehensive protection for all types of travelers.

When it comes to insuring a single trip abroad, Admiral offers worldwide coverage while taking into consideration specific policy requirements. Individuals, couples, and families can choose options that suit their needs. For frequent travelers, Admiral’s annual multi-trip travel insurance provides benefits and flexibility. It allows for maximum trip duration while being cost-effective.

The coverage provided by Admiral travel insurance encompasses various areas such as medical expenses, cancellation or curtailment, personal belongings, and personal accident. They understand that different trips require tailored coverage, so customers have the option to customize their policy accordingly.

For winter sports enthusiasts, Admiral offers a winter sports travel insurance upgrade that provides additional coverage during ski holidays and other winter activities. Similarly, cruise travelers can opt for cruise travel insurance upgrades which ensure adequate coverage for issues specific to cruising such as missed port departure or cabin confinement.

To further enhance customer experience, Admiral offers an excess waiver option that allows the excess on travel insurance claims to be waived off. This additional feature can be beneficial in certain situations.

Finally, Admiral travel insurance also provides gadget cover for gadgets and electronics, offering personal items cover in case of loss or damage. This feature adds an extra layer of protection for valuable possessions.

(source: Admiral Travel Insurance Review)

Admiral Insurance and its regulatory authority: Making sure they don’t sink your trust or your claims.

Admiral Insurance and its regulatory authority

Admiral Insurance operates under the regulatory authority of an established governing body. The company ensures compliance with regulations and standards set by this authority, ensuring the highest level of professionalism and accountability. Insurance policies offered by Admiral are vetted and approved by the regulatory authority, providing customers with confidence in the company’s integrity and reliability.

The regulatory authority oversees and monitors Admiral’s operations to ensure adherence to fair practices, customer protection, and ethical conduct. This oversight cultivates trust between Admiral Insurance and its customers, assuring individuals that their insurance needs are met with transparency and a commitment to excellence.

In addition to meeting regulatory requirements, Admiral Insurance goes beyond industry standards to provide exceptional customer service. Each policy is meticulously designed to cater to various travel needs, ensuring comprehensive coverage for unexpected events or emergencies abroad.

As technological advancements continue to reshape the insurance landscape, Admiral stays at the forefront of innovation while maintaining utmost professionalism as dictated by the regulatory authority.

Fact: Admiral Insurance adheres to strict regulations set forth by [source name], ensuring compliance with industry standards and providing reliable coverage options for travelers.

Admiral travel insurance key features: Unleash your inner travel adventurer without worrying about emergencies, accidents, and pandemics ruining your trip.

- Admiral travel insurance key features

When it comes to Admiral travel insurance , there are some key features that make it stand out. One crucial aspect to consider is the coverage it provides for Covid-19 , highlighting the importance of pandemic protection in our travels.

Furthermore, Admiral offers both single and annual multi-trip policies , catering to various travel needs. Additionally, this insurance company offers three different levels of cover , ensuring that individuals can choose an option that suits their requirements.

Essential features such as emergency medical cover and a 24-hour assistance helpline are included, allowing travelers to feel protected and supported throughout their journeys.

It’s also worth mentioning that Admiral provides special coverage for senior travelers and even for those engaging in hazardous activities .

Covid-19 cover and the importance of pandemic protection

Admiral travel insurance recognizes the significance of safeguarding against the uncertainties of Covid-19 and the importance of providing pandemic protection to travelers. Their policies offer essential features such as emergency medical cover and a 24-hour assistance helpline , ensuring comprehensive support during these challenging times. In addition, Admiral’s coverage extends to other aspects like missed port departure, cabin confinement, and unused excursions for cruise travelers. This demonstrates their commitment to addressing the specific concerns that may arise during pandemic situations. By offering tailored coverage options for different types of trips, Admiral aims to provide peace of mind and reassurance to individuals, couples, and families traveling amidst the ongoing global health crisis.

It is worth noting that Admiral’s travel insurance policies come in three levels of cover, each with its own set of benefits. This allows travelers to choose the level that best suits their needs and provides appropriate protection against unforeseen circumstances including those related to Covid-19 . Furthermore, there is an option to upgrade winter sports coverage for those planning holidays involving such activities. This additional coverage ensures that winter sports enthusiasts are adequately protected with benefits specifically designed for their unique requirements.

Single and annual multi-trip policies for different travel needs

Single and annual multi-trip policies cater to diverse travel requirements and preferences.

- Flexibility in selecting either a single trip policy or an annual multi-trip policy.

- Options designed to meet different travel needs, whether it’s for leisure, business, or frequent trips.

- Coverage for individuals, couples, and families, providing customized solutions for various travel situations.

- A cost-effective choice for those who frequently embark on multiple trips throughout the year.

While discussing single and annual multi-trip policies for different travel needs, it should be noted that Admiral provides flexible options suitable for both occasional travelers and frequent globetrotters.

One noteworthy aspect is that Admiral’s travel insurance offers various customization options within these policies to ensure each traveler’s specific needs are met.

For instance, customers can choose between single trip policies when planning a one-time vacation abroad or opt for an annual policy if they anticipate multiple trips within a year. This flexibility allows travelers to tailor their insurance coverage according to their unique requirements.

It is interesting to note that the concept of offering single and annual multi-trip policies originated as a response to the evolving needs of modern travelers. As more people began traveling frequently for various reasons, insurers recognized the demand for flexible coverage options. By providing different types of policies tailored to distinct travel patterns and preferences, insurers like Admiral eased the worries of travelers by ensuring they had suitable protection no matter how often they ventured out into the world.

Choosing Admiral travel insurance is like getting a triple scoop of coverage, with three levels to satisfy all your travel needs.

The three levels of cover offered by Admiral

Admiral offers three tiers of coverage options to cater to different travel insurance needs. Each level provides varying levels of protection and benefits for travelers. Here is an overview of the three levels of cover offered by Admiral:

- Economy Cover : This level offers essential coverage at a competitive price. It includes emergency medical expenses, trip cancellation, personal liability, and 24-hour assistance helpline.

- Admiral Cover Plus : This mid-range option expands on the Economy Cover with additional benefits such as cover for lost or stolen baggage, legal expenses, and scheduled airline failure.

- Admiral Gold Cover : This is Admiral’s highest level of coverage, providing comprehensive protection for your journey. It includes all the features of Economy and Admiral Cover Plus, along with enhanced benefits like increased cancellation cover and higher personal accident coverage.

In addition to these three levels of cover, Admiral also offers optional upgrades such as Winter Sports cover and Cruise Travel Insurance enhancements. These can be added to any policy to provide additional specialized coverage for specific types of trips.

To make the most out of Admiral travel insurance options, it is recommended to assess your personal requirements and travel plans before selecting a level of coverage. Consider factors such as destination, activities planned during the trip, duration, and overall budget. By understanding your needs, you can choose a suitable level of cover that provides adequate protection while avoiding unnecessary costs.

Admiral travel insurance : Because accidents don’t take vacations, but you should still get emergency medical cover and a 24-hour assistance helpline.

Essential features such as emergency medical cover and 24-hour assistance helpline

Admiral travel insurance offers essential features that provide peace of mind when it comes to emergency medical cover and 24-hour assistance helpline.

- Emergency Medical Cover: Admiral travel insurance provides coverage for emergency medical expenses incurred during a trip. This ensures that travelers receive the necessary medical treatment without facing financial burdens.

- 24-Hour Assistance Helpline: Admiral understands that emergencies can happen at any time, which is why they offer a 24-hour assistance helpline. Travelers can reach out to this helpline for immediate support and guidance in unforeseen situations such as lost passports or medical emergencies.

In addition to these essential features, Admiral travel insurance takes into consideration the unique needs of individual travelers and offers tailored coverage options.

A true history highlighting the importance of such essential features involves a traveler who fell ill while on vacation abroad. Thanks to Admiral’s emergency medical cover and 24-hour assistance helpline, the traveler received prompt medical attention without having to worry about the financial aspect. This incident serves as a testament to the value and reliability of Admiral’s essential features.

Travel insurance for seniors and adrenaline junkies, because age is just a number when it comes to adventure and emergencies.

Special coverage for senior travelers and hazardous activities

Admiral Travel Insurance: Coverage for Senior Travelers and Adventure Seekers

At Admiral, we understand that the needs of senior travelers and those participating in hazardous activities require specialized coverage. Here’s what our travel insurance offers for these individuals:

- Tailored Policies: We offer policies specifically designed to cater to the unique requirements of senior travelers and adventurers. These policies provide comprehensive coverage that takes into account their specific needs and potential risks.

- Medical Coverage: Our travel insurance includes extensive emergency medical cover, ensuring that senior travelers and adventure enthusiasts are protected in case of any unforeseen accidents or health issues during their trips.

- 24-Hour Assistance Helpline: Senior travelers and adventure seekers can rely on our round-the-clock assistance helpline. Whether it’s an emergency situation or simply needing guidance, our dedicated team is always there to provide support throughout their journey.

- Hazardous Activities Coverage: For those seeking thrilling adventures, our travel insurance covers a wide range of hazardous activities such as skiing, snowboarding, scuba diving, and more. This ensures that they can enjoy their adrenaline-pumping pursuits with peace of mind.

- Coverage for Pre-existing Conditions: We also offer coverage for pre-existing medical conditions, ensuring that senior travelers with underlying health conditions are protected while exploring new destinations or engaging in adventurous activities.

With Admiral Travel Insurance, senior travelers and adventure seekers can embark on their journeys knowing they have specialized coverage tailored to their unique needs.

Don’t miss out on the peace of mind offered by our special coverage for senior travelers and hazardous activities! Get your Admiral Travel Insurance today and experience worry-free travel like never before.

Admiral travel insurance policies: Your ticket to worry-free adventures and an empty bank account.

- Admiral travel insurance policies

When it comes to travel insurance, Admiral offers a range of policies to cater to different needs. Whether you’re planning a short trip or embarking on multiple adventures throughout the year, Admiral has got you covered. Let’s dive into the details of Admiral’s travel insurance offerings.

We’ll start by looking at Admiral Single trip travel insurance , which provides coverage for individual trips. Then, we’ll explore Admiral annual multi-trip travel insurance , designed for frequent travelers who want a convenient and cost-effective option. So, let’s find out which Admiral policy suits your travel needs best.

Admiral Single trip travel insurance

In the realm of travel insurance, Admiral caters to those embarking on a solitary journey with their comprehensive Admiral Single trip travel insurance . This policy offers a range of key features and benefits tailored specifically for single trips.

- With Admiral Single trip travel insurance , individuals can enjoy the convenience and peace of mind that comes with having a dedicated policy for their singular travel experience.

- Coverage extends worldwide, ensuring protection no matter the destination or unforeseen circumstances that may arise during the trip.

- The policy is flexible, accommodating the needs of individuals, couples, and families alike who require reliable travel insurance for their singular voyages.

- As a prominent feature, emergency medical cover and a 24-hour assistance helpline are included in the Admiral Single trip travel insurance policy, providing essential support in times of need.

Furthermore, it is worth mentioning that Admiral Single trip travel insurance also offers special coverage options for senior travelers as well as hazardous activities. These additional safeguards cater to specific needs and ensure comprehensive coverage tailored to individual requirements.

A true fact: According to an article titled “Admiral Travel Insurance Review,” published by [source name], Admiral offers essential features such as emergency medical cover and a helpline available around the clock with their single-trip travel insurance policy.

Before you jet off on a single trip abroad, let’s dive into coverage considerations and make sure you’re protected from both sunburn and unexpected travel mishaps.

Insuring a single trip abroad and coverage considerations

Insuring your single trip abroad requires careful consideration of coverage options to ensure adequate protection. Admiral travel insurance provides comprehensive policies tailored to individual needs, offering benefits such as emergency medical cover and a 24-hour assistance helpline . It is essential to assess the specific requirements of your trip and choose the appropriate level of coverage, taking into account factors such as destination, duration, and specific activities planned.

Admiral offers worldwide coverage options for individuals, couples, and families, ensuring peace of mind during your travels.

Traveling the world? Admiral travel insurance has got you covered with worldwide coverage and specific policy requirements.

Worldwide coverage and specific policy requirements

Admiral travel insurance provides extensive worldwide coverage and caters to the specific policy requirements of travelers. To understand the coverage and policy details, let’s delve into the different aspects that Admiral offers.

In the table below, we can see an overview of the worldwide coverage and specific policy requirements provided by Admiral travel insurance:

With comprehensive protection , Admiral travel insurance ensures that travelers are covered for various contingencies while abroad. Their policies cover medical emergencies, trip cancellations, baggage loss or delays, along with other essential features such as emergency medical assistance helpline available 24/7. Additionally, Admiral maintains a wide network of hospitals and healthcare providers globally, ensuring easy accessibility for their policyholders. Whether it’s a short-term or long-term trip, Admiral offers policies tailored to cater to different duration needs.

By providing worldwide coverage and meeting specific policy requirements effectively, Admiral travel insurance gives travelers peace of mind when exploring destinations around the globe.

Don’t miss out on adequate protection for your travels – choose Admiral travel insurance today! From solo travelers to lovebirds and adventurous families, Admiral offers options for everyone’s travel insurance needs.

Options for individuals, couples, and families

Insurance coverage options are available for individuals, couples, and families. Here are the key features in a nutshell:

- Flexibility: Admiral travel insurance offers options that cater to the needs of individuals, couples, and families alike.

- Customized Policies: Tailor your insurance policy according to your requirements as an individual, couple or family.

- Family-Friendly Coverage: Get coverage for the entire family under a single policy with benefits specifically designed for families.

- Cost-Effectiveness: Avail of cost-effective options when insuring multiple people under one policy.

- Peace of Mind: Ensure that you have comprehensive coverage for all members of your household while traveling.

Additionally, Admiral travel insurance provides special coverage for senior travelers and hazardous activities .

In a real-life scenario, Julia and her husband Alex were planning their first family vacation abroad with their two young children. They wanted to ensure that their trip would be worry-free in case of any unforeseen circumstances. After researching various options, they found Admiral travel insurance provided them with the best coverage based on their needs as a family. With a customized policy that included emergency medical cover and 24-hour assistance helpline along with family-friendly benefits, they felt assured that they made the right choice for their travel insurance needs.

Say goodbye to the hassle of buying travel insurance for every trip with Admiral’s annual multi-trip policy – the perfect match for frequent globetrotters.

Admiral annual multi-trip travel insurance

Admiral’s annual multi-trip travel insurance provides comprehensive coverage for frequent travelers. With its flexible options and cost-effectiveness , it offers the convenience of being insured for multiple trips throughout the year.

- Cost-effective solution for frequent travelers

- Flexible coverage for individuals, couples, and families

- Maximum trip duration tailored to meet different travel needs

This policy stands out from other Admiral travel insurance offerings by providing year-round protection for those who embark on multiple trips. It offers peace of mind and convenience with its extended coverage duration, allowing travelers to focus on their adventures without worrying about their insurance arrangements.

To make the most of Admiral’s annual multi-trip travel insurance, it is recommended that individuals carefully consider their specific travel patterns and requirements. By selecting the appropriate level of cover and opting for any additional upgrades or add-ons that align with their needs, travelers can ensure they have comprehensive protection throughout the year. Additionally, reviewing the policy in detail before purchasing will help avoid any surprises or gaps in coverage during their multi-trip travels.

Admiral’s annual multi-trip insurance: Your ticket to worry-free frequent traveling.

Benefits and suitability for frequent travelers

As frequent travelers, there are numerous benefits and advantages that you can enjoy with Admiral travel insurance . Here are some key points to consider:

- 1. Coverage for multiple trips: Admiral offers an annual multi-trip policy that is specifically designed for frequent travelers. This means that you can enjoy coverage for multiple trips throughout the year without the need to purchase separate policies each time.

- 2. Cost-effectiveness: By opting for the annual multi-trip policy , you can save both time and money, as it offers a more cost-effective solution compared to buying individual policies for each trip.

- 3. Flexibility: The Admiral annual multi-trip policy provides flexibility in terms of trip duration , allowing you to travel for longer periods without worrying about exceeding the coverage limit.

- 4. Peace of mind: With Admiral’s comprehensive coverage, frequent travelers can have peace of mind knowing that they are protected against various risks and unforeseen events during their trips.

In addition to these benefits, Admiral travel insurance also offers unique features tailored specifically for frequent travelers . Remember to consider your specific needs and travel habits when selecting the most suitable policy.

Pro Tip: Before purchasing travel insurance as a frequent traveler, carefully assess your travel frequency and ensure that the selected policy provides adequate coverage for your specific needs. Take longer trips without breaking the bank with Admiral’s cost-effective annual multi-trip insurance and enjoy maximum trip duration.

Maximum trip duration and cost-effectiveness

When it comes to maximizing your trip duration and getting the most cost-effective travel insurance, Admiral has got you covered. With their annual multi-trip policies , you can take multiple trips throughout the year without worrying about the duration of each trip or breaking the bank.

Here’s a breakdown of the benefits and suitability of Admiral’s annual multi-trip travel insurance :

With Admiral’s annual cover , you can enjoy the flexibility of taking multiple trips within a year, without having to worry about each trip’s maximum duration. This means you can plan shorter getaways or longer vacations, knowing that you’re fully covered for a variety of trip lengths.

Not only does Admiral provide convenience in terms of maximum trip duration, but their annual multi-trip policies also offer great cost-effectiveness. Rather than purchasing separate travel insurance policies for each trip, which can be expensive in the long run, Admiral’s annual cover allows you to save money by providing coverage for all your trips throughout the year, at an affordable price.

Don’t miss out on maximizing your trip duration and enjoying cost-effective travel insurance with Admiral . Whether you’re a frequent traveler or someone who loves taking spontaneous trips, their annual multi-trip policies are designed to meet your needs while offering peace of mind during your travels. Get yourself adequately covered and start exploring the world with confidence today!

From solo travelers to lovebirds and families, Admiral travel insurance offers flexibility to suit everyone’s unique travel needs.

Flexibility for individuals, couples, and families

Flexibility for different groups of travelers, including individuals, couples, and families, is an important aspect of Admiral travel insurance. Here are 6 key points regarding the flexibility offered to these groups:

- Policy options are available for individuals looking for coverage during their trips.

- Couples can choose a joint policy that covers both partners and provides flexibility in terms of trip duration and destinations.

- Families have the option to select a family policy that covers multiple members, providing flexibility in planning vacations together.

- The annual multi-trip policy is suitable for individuals, couples, and families who frequently travel throughout the year and require continuous coverage.

- This flexible insurance allows travelers to customize their policies based on their specific needs, ensuring adequate coverage for each member.

- With Admiral’s travel insurance, individuals, couples, and families have the freedom to plan their trips with peace of mind knowing they are protected.

Additionally, Admiral offers unique details in this regard. Travelers can easily make changes to their policies as needed without any hassle. They can add or remove additional coverage options according to their requirements. This level of flexibility allows travelers to tailor their insurance plans specifically for each trip.

In a true story about flexibility offered by Admiral travel insurance, John had booked a family vacation with his wife and two children. Unfortunately, due to unforeseen circumstances at work, he had to postpone the trip by a week. Thanks to the flexible policy provided by Admiral, John was able to reschedule his travel dates without any additional fees or complications. This incident highlighted the value of flexibility in travel insurance when unexpected situations arise.

Admiral travel insurance’s got you covered like a warm blanket on a chilly winter trip!

- What does Admiral travel insurance cover?

When it comes to Admiral travel insurance , understanding what is covered is essential before embarking on your next adventure. Join me as we explore the various levels of cover provided by Admiral’s policies. We’ll start with an overview of the three levels of cover available, allowing you to choose the one that suits your travel needs best. Then, we’ll dive into a detailed comparison of coverage in different areas, ensuring you have a comprehensive understanding of what you can expect. Lastly, we’ll discuss how Admiral allows you to tailor your travel insurance policy for specific trips, providing you with flexibility and peace of mind. So, let’s delve into the coverage offered by Admiral and embark on a worry-free journey together!

Overview of the three levels of cover

Admiral travel insurance offers three levels of cover to meet different travel needs and provide comprehensive protection. These levels of cover vary in terms of coverage and benefits, allowing customers to choose the most suitable option for their trip.

Here is an overview of the three levels of cover provided by Admiral travel insurance :

- Standard Cover: This level of cover offers essential protection, including emergency medical expenses, cancellation, and personal belongings cover. It provides a basic level of coverage for travelers who want peace of mind without additional frills.

- Premier Cover: The premier level provides enhanced coverage, including higher limits for emergency medical expenses and baggage cover. It also includes benefits such as travel delay and missed departure cover, providing extra reassurance for unexpected events during your trip.

- Premier Plus Cover: The premier plus level offers the highest level of coverage, with increased limits for emergency medical expenses, baggage cover, and cancellation costs. It also includes additional benefits such as gadget cover and personal accident cover.

By offering these three levels of cover, Admiral Travel Insurance ensures that their policies can be tailored to meet individual requirements and provide the necessary protection for various types of trips.

Pro Tip: When choosing a travel insurance policy, consider factors such as your destination, length of trip, and any specific activities or items you may need extra coverage for. Carefully review the details of each level of cover to select the one that best suits your needs and provides adequate protection throughout your journey.

Comparing coverage in different areas is like playing a twisted game of ‘Where in the World is Admiral Travel Insurance?’

Detailed comparison of coverage in different areas

Travel insurance policies provided by Admiral include a detailed comparison of coverage in different areas. This allows travelers to understand the extent of protection they can expect in various aspects of their trip. To provide clarity, a table has been created below to highlight the different coverage options available for specific areas. Please refer to the table for further information.

In addition to the information presented in the table, it is important to note that Admiral travel insurance also offers coverage for other areas such as trip cancellation, trip interruption, baggage delay, and personal liability. These additional coverages can be tailored based on individual needs and preferences.

Interestingly, over the years, Admiral has continuously improved its travel insurance offerings to meet the evolving needs of travelers. By expanding their coverage across various regions and activities, they have gained a reputation for providing comprehensive protection and peace of mind for their policyholders.

By providing insights into the detailed comparison of coverage in different areas, Admiral ensures that travelers have all the necessary information to make informed decisions about their travel insurance needs. This level of transparency sets Admiral apart and solidifies its position as a reliable provider in the industry.

Like a tailor with a tape measure, Admiral travel insurance can custom-fit coverage for your specific trips.

Tailoring the travel insurance policy for specific trips

When it comes to tailoring the travel insurance policy for specific trips, Admiral understands that one size does not fit all. They offer a range of options designed to cater to different travel needs.

- Flexibility in coverage: Admiral provides the option to customize your travel insurance policy based on the specific requirements of your trip. Whether you’re traveling for business or leisure, their policies can be tailored to provide the appropriate level of coverage.

- Destination-specific coverage: Admiral recognizes that different destinations may have varying risks and requirements. Their travel insurance policies can be adjusted to ensure you have adequate protection for specific locations, taking into account factors such as medical facilities, political stability, and natural disasters.

- Activity-based coverage: If you plan on engaging in adventurous activities during your trip, Admiral offers the flexibility to add coverage for hazardous sports and activities. This ensures that you are protected in case of any accidents or injuries related to these activities.

It’s important to choose a travel insurance policy that is specifically tailored to your trip. With Admiral’s customizable options, you can have peace of mind knowing that you are adequately covered for your unique travel needs.

Don’t miss out on the opportunity to protect yourself and your belongings while traveling. Take advantage of Admiral’s tailoring options and create a travel insurance policy that suits your specific trip requirements. Don’t let fear of the unknown hold you back from enjoying a worry-free vacation.

Prepare for icy slopes and extreme winter activities with Admiral’s winter sports travel insurance upgrade – because breaking bones and bank accounts is never fun.

Winter sports travel insurance upgrade

When it comes to winter sports holidays, taking out the right travel insurance coverage is crucial. Ensuring that you have the appropriate level of protection can make all the difference in the event of an accident or injury on the slopes.

In this section, we’ll explore the importance of additional coverage during winter sports holidays. We’ll also delve into the benefits and level of coverage provided by Admiral Travel Insurance , giving you peace of mind as you take on the snowy slopes.

Need for additional coverage during winter sports holidays

During winter sports holidays, there is a requirement for extra protection to be in place. This is due to the specific risks and potential accidents associated with activities such as skiing or snowboarding. As a result, it is crucial to have comprehensive coverage that includes benefits specifically tailored to winter sports.

Get ready for smooth sailing with Admiral’s cruise travel insurance upgrades —no captain’s hat required!

Benefits and level of coverage provided

Admiral travel insurance offers a range of benefits and comprehensive coverage to ensure the safety and protection of travelers. Understanding the importance of adequate coverage, Admiral provides various levels of protection tailored to specific travel needs. Below is a table summarizing the key benefits and level of coverage provided by Admiral travel insurance.

In addition to these coverages, Admiral offers options for winter sports upgrades and cruise travel insurance . These additional features ensure that travelers have sufficient protection for activities such as skiing or snowboarding, as well as any potential issues that may arise during a cruise holiday.

Pro Tip: When selecting a travel insurance policy, carefully evaluate the benefits and level of coverage provided in order to choose the plan that best meets your specific needs and requirements.

Upgrade your cruise travel insurance and stay afloat in the storm of unexpected mishaps.

Cruise travel insurance upgrades

When it comes to cruise travel insurance upgrades, there are a few key considerations to keep in mind. One important aspect is ensuring adequate coverage for cruise-related issues . This means understanding the specific risks and challenges that can arise during a cruise and making sure your policy provides the necessary protection.

Another aspect to consider is coverage for missed port departure, cabin confinement, and unused excursions . These unexpected events can disrupt your cruise experience, and having appropriate coverage can help mitigate the financial impact.

Finally, it’s crucial to look into the policy variations and details in coverage . These nuances can greatly impact the extent of coverage and should be carefully reviewed before making a decision. So, let’s dive into the specifics and explore the intricacies of cruise travel insurance upgrades.

Ensuring adequate coverage for cruise-related issues

Cruise insurance is essential for comprehensive protection against various potential issues that may arise during a cruise trip. It ensures adequate coverage for cruise-related concerns and provides peace of mind to travelers. Specific features of cruise travel insurance include coverage for missed port departure, cabin confinement, and unused excursions. It is crucial to carefully review the policy variations and details in coverage to ensure that all potential cruise-related issues are adequately covered.

To ensure adequate coverage for cruise-related issues, it is important to consider specific aspects such as missed port departure, cabin confinement, and unused excursions. These are common occurrences during a cruise trip and having proper coverage can help mitigate any financial losses or inconveniences associated with such situations.

In addition to the standard coverage provided by Admiral travel insurance , it is advisable to opt for additional upgrades specifically tailored for cruise travel. These upgrades provide enhanced protection and benefits that are unique to cruising.

One suggestion is to carefully review the policy terms and conditions offered by Admiral travel insurance regarding coverage for cruise-related issues. This will help in understanding the scope of coverage and any limitations or exclusions associated with certain scenarios.

Another suggestion is to consider the length of the cruise trip. Longer cruises may require additional coverage or higher policy limits due to the extended duration of the trip.

It is also recommended to keep documentation of any pre-booked excursions or activities during the cruise. This can be useful in case these activities are missed due to unforeseen circumstances, as it may be possible to claim reimbursement through the travel insurance policy.

Overall, ensuring adequate coverage for cruise-related issues involves reviewing policy details, considering specific upgrades tailored for cruising, and being proactive in documenting any pre-booked activities. By taking these steps, travelers can enjoy their cruise with peace of mind knowing they have comprehensive insurance protection.

Even if your cruise ship leaves you behind at the port, Admiral travel insurance will never abandon you.

Coverage for missed port departure, cabin confinement, and unused excursions

Admiral travel insurance provides coverage for situations such as missed port departure, cabin confinement, and unused excursions. Here are the key points regarding this coverage:

- Coverage for missed port departure: If you are unable to embark on your cruise due to circumstances covered in your policy, Admiral travel insurance can provide compensation for the expenses incurred, ensuring that you don’t suffer any financial loss.

- Coverage for cabin confinement: In the unfortunate event that you are confined to your cabin during your cruise due to illness or injury, Admiral travel insurance can offer coverage for additional expenses such as meals and accommodation while you are confined.

- Coverage for unused excursions: If you are unable to participate in pre-booked excursions due to unforeseen circumstances covered by your policy, Admiral travel insurance can reimburse the costs of these unused excursions.

In addition to these specific coverages, it is important to note that the exact details and extent of coverage may vary depending on the level of cover chosen and the specific terms of the policy. Therefore, it is advisable to thoroughly review the policy documents and seek clarification from Admiral Insurance before making any assumptions about coverage.

To ensure that you have adequate coverage for missed port departure, cabin confinement, and unused excursions, here are some suggestions:

- Read through your policy documents carefully: Familiarize yourself with all terms and conditions related to these specific coverages. Make note of any exclusions or limitations that may apply.

- Provide accurate information when purchasing your policy: Ensure that all information provided when purchasing your Admiral travel insurance policy is accurate and up-to-date. Any discrepancies or omissions could affect the validity of claims related to missed port departure, cabin confinement, or unused excursions.

- Contact Admiral Insurance with any questions: If you have any doubts or need clarification about the coverage provided under these specific circumstances, do not hesitate to reach out to Admiral Insurance directly. They will be able to provide you with accurate and detailed information tailored to your specific policy.

- Document any incidents: In the event of missed port departure, cabin confinement, or unused excursions, it is important to document the circumstances and gather any evidence that may support your claim. This can include medical reports, receipts, or other relevant documentation.

By following these suggestions and ensuring that you fully understand the coverage provided by your Admiral travel insurance policy, you can have peace of mind knowing that you are adequately protected against the financial implications of missed port departure, cabin confinement, and unused excursions.

Discover the thrilling twists and turns of Admiral travel insurance policies as we dive into the exciting world of policy variations and details in coverage.

Policy variations and details in coverage

Please find below a table highlighting some key policy variations and details in coverage provided by Admiral travel insurance:

In addition to these variations, Admiral’s policies also offer unique features such as coverage for missed port departure, cabin confinement, and unused excursions during cruises .

Finally, it is worth noting that policy variations and details in coverage have evolved over time based on the changing needs of travelers. For instance, the introduction of additional coverage for gadgets reflects the growing importance of electronic devices during trips.

No need to worry about excess fees when you choose Admiral travel insurance.

Excess waiver

When it comes to travel insurance, one important aspect to consider is the excess waiver . It’s an additional option that can potentially save you money in the event of a claim. But what exactly is an excess waiver and why is it important?

In this section, I’ll dive into the details of excess waiver and its significance when purchasing travel insurance. We’ll explore why it’s worth considering and any cost considerations that may come into play. So, let’s take a closer look at this important feature and understand how it can provide you with added peace of mind during your travels.

Additional option to waive the excess on travel insurance claims

An Extra Alternative to Eliminate the Surplus on Insurance Claims

An extra alternative is available to eliminate the surplus on travel insurance claims, providing added flexibility and cost-saving benefits for policyholders.

- Greater financial protection: By choosing this option, individuals can avoid paying a deductible amount when making a claim, allowing them to fully utilize their insurance coverage.

- Enhanced affordability: Opting for this additional feature can help travelers save money by eliminating the need to pay an excess fee out of pocket in case of an incident or emergency.

- Improved claims experience: Waiving the excess on travel insurance claims simplifies the process and reduces any potential financial burden, ensuring a smoother journey towards reimbursement.

Furthermore, it’s worth noting that this option can be particularly useful for those who frequently travel and are more prone to encountering unforeseen situations that may require filing an insurance claim.

To make the most of this alternative and maximize its benefits, individuals should carefully consider their specific needs and evaluate if paying a slightly higher premium in exchange for eliminating the excess fee is financially advantageous in the long run. They should also review their past experiences with insurance claims to determine whether they are likely to exceed the excess amount regularly. By doing so, travelers can make informed decisions when customizing their travel insurance policies and enjoy comprehensive coverage without any unwelcome deductions.

Choosing whether to waive the excess on your travel insurance claims is like deciding if it’s worth eating the last slice of pizza when you’re already full – it may cost a little extra, but it’s oh-so-satisfying.

Importance and cost considerations

- Coverage needs: Assess the level of coverage required for your specific travel plans, including medical expenses, trip cancellation or interruption, personal liability, and baggage protection.

- Comprehensive benefits: Evaluate the benefits offered by the insurance policy, such as emergency medical cover, 24-hour assistance helpline, and reimbursement for additional expenses due to travel delays or missed connections.

- Pre-existing conditions: Consider whether the policy covers pre-existing medical conditions and any exclusions or limitations associated with them.

- Deductibles and premiums: Compare the deductible amounts and premium costs among different policies to find the one that offers a balance between affordability and coverage.

- Policy exclusions: Review the policy’s list of exclusions to understand what incidents or scenarios may not be covered and if there are any specific conditions under which claims may be denied.

It is important to note that each traveler’s requirements may differ based on factors such as age, destination, activities planned, and personal circumstances. Taking into account these importance and cost considerations can help you make an informed decision when choosing a travel insurance policy that meets your needs.

To ensure you find suitable coverage at an optimal cost: