U6-U10 TRAVEL PLUS PROGRAM

Travel plus spring camp 2024.

April 20 - May 18 2024

5-Week Camp

REGISTRATION LINK

TRAVEL PLUS SUMMER CAMP 2024

June 18 - July 25th 2024

5-Week Camp

TRAVEL PLUS FALL CAMP 2024

August - September 2024

REGISTRATION COMING SOON

Why Travel Plus?

Our new Travel Plus program offers beginning players the opportunity to jumpstart their soccer experience. Travel Plus players will develop their skills through our structured curriculum, play in-house scrimmage games, be coached directly by our licensed Campton Coaches, and work with assistant coaches that currently play within our Senior Elite program. These components will offer players a pathway to develop, enjoy the beautiful game, and decide if transitioning into one of our full-time travel teams is right for them. At this stage in player development, learning through fun is our most important component!

We introduce players to the basics of training, technique, skills, and rules of the game by following a carefully crafted curriculum. Our curriculum, fun skill-building activities, and games are based upon core elements written by US Youth Soccer for players aged 5-10. Travel Plus players play weekend inter-squad games amongst their Travel Plus peers. No traveling required.

Why Campton?

Our multifunctional indoor facility allows players to play and train year round. For 30 years, Campton's extensively trained, licensed coaches, and leading curriculum consistently produces numerous state, regional, and national championships. In 2015 & 2016 our U18 Boys NPL National Champions, in 2018 & 2019 our 2000 USYS Girls win and repeat as Champions of the USYS National League, in 2021 our 2003 USYS Red Boys were Illinois State Finalists, and most recently our 2009 USYS Red Girls won the 2022 Midwest Regional Title & participated in the final four of the 2022 Presidents Cup National Tournament!

SCHEDULE RESTRUCTER

Travel Plus practice schedule has been restructured from session you may have been involved in the past. Key Changes:

- 2 Training Session a week

- 1 hour long session

2024 Travel Plus- SUMMER

WHAT: Travel Plus

- 5 total sessions; 4 weekend practices; 1 weekend games (small sided in-house scrimmage tournament)

When: June 18th - July 25th, 2024

2 Weekday training session

Tues. & Thurs. Youngest (2019, 2018, 2017 ) : 5:00pm-6:00pm

Tues. & Thurs. Oldest (2016, 2015) : 5:15pm-6:15pm

Who: 5-9 Year old boys and girls (2019, 2018, 2017, 2016, 2015 Birth Years)

Where: Dean & Peck Park (3N800 Peck Rd. St. Charles, IL. 60174)

Sumer 2024 Session Price

5-week session: $175

Travel Plus Uniform Kit: $70 - uniform is a one-time purchase

- Nike Dri-Fit top

- Nike shorts

SUMMER 2024 - TUES. & THURS.

5 - Week Schedule

REGISTRATION OPEN:

WITHOUT UNIFORM

Roster Openings

Ready to transition into a full-time team?

There are openings for both our boys and girls Youth Elite teams. Ask about Campton's opportunities for players of 2017 birth year!

Currently we are looking to fill rosters for the following full-time teams:

-2018 Boys & Girls

- 2017 Boys & Girls

- 2016 Girls

-2015 Girls

If you are interested in having your player evaluated and placed on a Youth Elite team, reach out to our Youth Technical Director: Angel Pedraza

TAYLOR ORTIZ

OFFICE ADMINISTRATOR

Phone: 779-242-7066

Safe Travels

Incredible journeys and memorable getaways are all more enjoyable when you’re protected against the unforeseen.

Average cost of an air ambulance within the U.S.

Low annual membership rate

World Travel Protection

Emergency Travel Assistance Anywhere in the World

Emergency Assistance Plus® (EA+®) is an annual membership that provides cardholders with protection anytime they travel. Whether they’re thousands of miles away or merely a short road trip from home, EA+ members take with them the peace of mind knowing that should a medical emergency arise, there’s a team of highly skilled professionals at the ready to ensure they are receiving proper medical care and are provided necessary transportation home.

- Emergency Medical Evacuation: If you need specialized medical treatment at a more advanced hospital, EA+ will arrange ground or air ambulance transportation.

- Transportation Home: When your condition improves and you’re ready to leave the hospital, EA+ handles all the travel arrangements to get you home.

Sharon and Joe B., Florida

Slip and Fall Requires Air Ambulance Home

“All of you at Emergency Assistance Plus were there not only for Joe, but for me. I wanted to go home and felt I would be lost in Spain forever. They listened to me cry and comforted me by telling me I was not alone, and help was on the way, and I would not be left. I had a very emotional time with all of this. I can’t tell you enough how comforting all of you were to me.”

For more than 25 years, EA+ has provided almost 2 million travelers with global emergency travel assistance that’s available 24 hours a day, 365 days a year. The EA+ network of emergency professionals understands that there’s a strong human element at the core of every member emergency.

Member Center

When an emergency does occur, it can be overwhelming to know what you need to do or what’s covered. Here, we provide you with a list of FAQ’s, emergency numbers, and an overview of what you can expect when you need to take advantage of your EA+ services.

The DNA of Emergency Assistance Plus not only explains its significance, it also qualifies why the program is so valuable.

Average cost of a nurse escort

Transportation Home

Most frequently used service

Based Member Care & Emergency Response Teams

Without Boundaries

Protection is guaranteed, whether traveling domestic or abroad

Decades of experience protecting travelers

Partner Discounts

Emergency Assistance Plus is the travel assistance solution chosen by local and national affinity clubs, airline loyalty programs, professional organizations, auto clubs and alumni associations. Through these partnerships, members gain access to exclusive savings when they purchase EA+. Find out if your favorite organization is an EA+ partner.

Recent Blog Posts

Long-Distance Medical Transport: A Guide to 7 Different Options

Medical Evacuation

If you’re traveling and have medical concerns that require specialized transport, what are your options? Let’s dive in.

RV Like a Pro: The Ultimate RV Checklist Collection for Stress-Free Travel

Travel Tips

These RV checklists will ensure you are fully prepared for everything your trip may throw at you.

Flying ICUs: Inside the World of Air Ambulances

Let’s examine the world of air ambulances, where speed, expertise, and advanced medical care converge.

Stay in the Know

If knowledge is power, you’ll be at your strongest by subscribing to our newsletter, which will keep you informed of the latest updates and improvements to the EA+ programs, not to mention travel tips and member stories.

Subscribe to Newsletter

" * " indicates required fields

By subscribing, you give us permission to send you valuable content, expert advice, and exclusive EA+ offers. We will not sell or distribute your email address to any third party at any time. View our privacy policy .

Here are a few of the highlights of the Global Travel Plus Program:

Single point of service.

One phone call is all it takes to activate our powerful resources.

No Chargebacks

No surprises here. We pay for all the services we perform.

No Geographical Exclusions.

Our services are available anywhere on the globe regardless of geographic location or political climate. In today's rapidly changing world, that's an important comfort while traveling.

No Maximum Limits For Any Services

There is not financial limit on our assistance. You're protected. Period.

Medically-Trained, Multilingual Operations Center Accessible 24/7

Assistance anytime, anywhere, in any language. 24 hours a day. 365 days a year. The difference really is in the details. Make the smarted choice for your travels. Choose Global Travel Plus for these numerous other advantages.

No Exclusions For Extreme Sports Or Hazardous Hobbies.

It doesn't matter if you're climbing a mountain, white-water rafting, or diving with sharks. You're protected with Global Travel Plus.

No Exclusions For Pre-Existing Conditions.

Heart conditions, diabetes, cancer... there is no fine print about pre-existing conditions accompanying our services.

Why You Need Travel Assistance

"I've already purchased trip insurance." "I'm only traveling across the country and I've got great medical coverage already." "I've been overseas countless times and I've never experienced an emergency." All of those things may be true. However, emergencies do happen. Trip insurance can apply to trip cancellations only. Sometimes, even the best medical coverage may not provide the full scope of services you need in an emergency; even if your out of network medical expenses are included in your coverage. Even if you’ve purchased international medical insurance for a trip, there may be aspects of an emergency situation that aren’t included in that coverage.

That’s where Global Travel Plus comes in. If you have a medical emergency in an unfamiliar place, you need professionals to help you navigate through the challenges. You can rely on Global Travel Plus to refer you to a hospital or a doctor with the skills needed for your specific situation. You might need assistance with hospital admissions, or keeping your loved ones notified of your condition. You may have lost or forgotten an important prescription. Your luggage may not arrive, resulting in interrupted itineraries and lost time trying to locate your belongings. Global Travel Plus steps in to assist in all travel emergencies. These are the services that insurance may not provide. We offer unique peace of mind for travelers 365 days a year, 24 hours a day.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

United MileagePlus Program: The Complete Guide

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is United MileagePlus?

How much are united miles worth, united airlines vs. competitors, how to earn united miles, how to redeem united miles, united elite status, united airlines partners, credit cards that earn united miles, united fare classes, united baggage fees, united change and cancellation fees, need more help deciding.

United Airlines is among the largest airlines in the U.S. and the world, with domestic hubs in Chicago, Houston, Newark, Denver, San Francisco, Washington-Dulles, Los Angeles and Guam. MileagePlus is the name of the airline’s loyalty program.

The airline operates 4,500 daily flights to more than 300 cities across five continents. In addition, United has partnerships with 18 airlines and is also a member of Star Alliance , which has 26 member airlines. These relationships mean you can earn and redeem miles on 44 airlines, and travel to a great many destinations.

If your home airport is a United stronghold, you’ll want to familiarize yourself with its frequent flyer program so you can start reaping the benefits of the airline’s vast reach.

Follow along as we discuss ways to earn and redeem MileagePlus miles, elite status, the best United credit cards and the airline’s Star Alliance and other airline partners.

MileagePlus is United Airlines' frequent flyer loyalty program. When you fly on paid tickets on United Airlines, its airline partners and its Star Alliance partners, you can earn MileagePlus miles . You can also earn miles in many other ways, including using a United credit card, transferring from Chase Ultimate Rewards®, dining, shopping and much more.

Once you’ve accumulated enough miles, you can redeem them for free flights in first, business class and economy seats on United and its partner airlines. You can also redeem miles for flight upgrades.

United Airlines frequent flyer sign-up

Before you can start earning miles with United Airlines, you’ll need to sign up for a MileagePlus frequent flyer account. It’s free to join, and you can register for an account here .

United economy plus seats. (Photo courtesy of United Airlines)

Based on our most recent analysis, NerdWallet values United MileagePlus miles at 1.2 cents apiece. To determine the value of reward miles, we compared cash prices and reward redemptions for economy round-trip routes across several destinations and dates. We divided the cost of the cash ticket by the cost of the reward ticket to determine a “cent per mile” value for each flight, then averaged this value across several flights and dates. Read more about how we arrived at these figures .

Therefore, this is a baseline value for United miles, based on real-world data collected from hundreds of economy routes, not a maximized value. In other words, you should aim for award redemptions that offer 1.2 cents or more in value from your United miles.

To determine the value of your miles for specific flights, divide the cash value of the ticket (less any applicable taxes/fees if you redeem miles) by the number of miles required for the flight. So if the ticket costs either $100, or 15,000 miles + $10 in taxes/fees, the math would be as follows:

($100 – $10) / 15,000 = 0.006, or 0.6 cent per mile.

United MileagePlus miles value over time

During NerdWallet's last valuation, United MileagePlus miles increased in value for the first time.

While United MileagePlus can pay dividends for some travelers, here’s the bad news: United, as a whole, ranked seventh out of nine airlines in NerdWallet’s 2024 best overall airline analysis .

Its loyalty program, MileagePlus, didn’t fare much better, coming in fifth place in our airline rewards program analysis .

Here's a closer look at how United competed across subcategories:

Seventh in rewards rate .

Third in operations .

Fourth in elite status benefits .

Seventh in terms of total fees .

United tied for third with JetBlue, Hawaiian and Alaska when looking closer at the best basic economy tickets .

Tied for third with Southwest in in-flight experience .

Tied for last place in most pet-friendly airlines .

You can earn miles when you fly on United or its partner airlines, by using a United Airlines credit card and by shopping and dining with partners.

MileagePlus miles can be redeemed for award flights and many other uses, though none of which are as fruitful.

Earn MileagePlus miles when you fly

United’s economy cabin. (Photo courtesy of United Airlines)

The miles total you'll earn for a flight depends on how much you spent on the ticket and your status level within the MileagePlus program. All statuses above basic membership earn mile bonuses.

For example, the basic member rewards rate is 5 miles per dollar. But at Premier Silver level, you earn a 40% bonus, which turns your rate into 7 miles per dollar. We'll have more on status levels below — or you can jump ahead to that part now .

NOTE: You earn miles only on airfare and airline fees. Government-imposed taxes and fees do not earn miles. Generally, the most you can earn on a ticket is 75,000 miles.

Earning on other airlines: When the ticket is issued by United (ticket number starting with 016), you’ll earn miles based on the cost of the fare. But if your ticket is booked through one of United’s partners, miles are awarded based on a calculation involving the price and class of the ticket and the flight distance.

Earn United MileagePlus miles with a credit card

United Airlines offers co-branded credit cards through Chase. Bonuses between cards vary, so if you’re considering a credit card, take a look at its bonus history to take advantage of a high welcome offer.

» Learn more: The best airline credit cards right now

NerdWallet's favorite credit card for the MileagePlus program is the United℠ Explorer Card . It gives you 2 miles per dollar spent at restaurants, on hotel stays and on purchases from United, and 1 mile per dollar on all other purchases. You also get a great sign-up bonus to start. There's an annual fee, but the checked bag benefit on this card can make up for it quickly.

Here's a quick look at United card options:

on Chase's website

$0 intro for the first year, then $95 .

• 2 miles per $1 on United purchases, gas stations and local transit and commuting.

• 1 mile per $1 on all other purchases.

• 2 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and hotels (when booked directly with hotel).

• 3 miles per $1 on United purchases.

• 2 miles per $1 at restaurants, select streaming services and all other travel.

• 4 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and all other travel purchases.

• No foreign transaction fees.

• First checked bag free for you and one companion on your reservation.

• 2 United Club one-time passes each year.

• Credit of up to $100 every four years for TSA PreCheck, Global Entry or NEXUS.

• Priority boarding.

• First and second checked bag free for you and one companion on your reservation.

• $125 United purchase credit per year (good on airfare).

• Two 5,000-mile award flight credits per anniversary year.

• Access to United Club airport lounges.

Earn 20,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open.

Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

Earn 80,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening.

Here are more resources for shopping United credit cards:

The best benefits of United credit cards

Is a United credit card worth it?

Can you have 2 United credit cards?

Earn United MileagePlus miles through partners

Hotels. You can earn additional MileagePlus miles at most major hotel chains. In some cases, you earn 1 or 2 miles per dollar spent; in others, you earn a flat number of miles per stay. See partner hotels and the earning rules here .

Dining. Register a credit card with MileagePlus Dining , and every time you use that card at a participating restaurant, club or bar, you'll earn up to 5 miles per dollar spent. There are more than 11,000 participating locations.

Auto rentals and other transportation. Hertz-owned rental agencies, including Dollar and Thrifty, offer the option to earn MileagePlus miles. See the rules here . Amtrak rail service and select shuttles and car services are also partners.

Shopping. When you shop online through the MileagePlus Shopping mall, you earn miles for every dollar you spend at more than 850 retailers.

Financial partners. Earn miles when doing business with lending and insurance partners, among others. Details here .

Buy United miles

If you want to buy United miles, you can do so on the MileagePlus website, but this is generally not a good idea . You'll pay far more than the 1.2 cents per mile at which NerdWallet values MileagePlus miles. However, if you need a few thousand miles to top up your account for a valuable award, it could make sense.

» Learn more: How to earn United MileagePlus miles

United’s Premium Plus cabin. (Photo courtesy of United Airlines)

MileagePlus miles are redeemable for flights on United Airlines, on Star Alliance airlines and on United’s independent airline partners. Star Alliance has 26 member airlines and United has partnerships with 14 airlines. All of this means that you can use United miles to fly on 39 airlines, creating many opportunities for traveling the world.

MileagePlus members can pay for domestic United flights using a combination of miles and cash, called Money + Miles. You'll earn miles on the cash portion of the payment, excluding taxes and fees.

United has a user-friendly search engine, which means that In most cases, you can redeem miles directly on United’s website. Choose a flight, and you'll see what the price is in cash as well as miles.

United award tickets

United offers several levels of award seats, requiring more miles for more desirable seats and cabins. Flights can be booked as one-way tickets or round trips, and there is no benefit of booking a round-trip ticket.

Generally, there are two kinds of award redemptions:

Saver Awards seats are cheaper in terms of miles required to book them — ranging from 5,000 to 12,500 miles for domestic economy, for example. But they are scarcer and might not be available for the flight you want.

Everyday Awards seats are more available than Saver Awards seats but require more miles. Flyers with elite status, which United calls Premier, and eligible holders of MileagePlus credit cards have unrestricted access to book seats — even the last seat on the plane — at the Everyday Awards level.

United discontinued its published award chart for flights on Nov. 15, 2019, and does not have a set amount of miles required for each flight anymore. You can generally expect that prices that are cheaper with cash will also be cheaper with miles. It’s always best to compare the cost of each before booking.

Note that if you pay for a flight with miles, you don’t earn frequent-flyer miles for that flight.

Good redemption options

Free flights. Because we value MileagePlus miles at an average of 1.2 cents each, redemptions that give you at least that much value are a decent option. For example, break-even would be a flight that costs $480 or 40,000 miles (40,000 miles x .012 per mile). If you can book a $480 flight for 25,000 miles, that’s a better use of miles (1.9 cents per mile). United has many opportunities for sweet spot redemptions .

Upgrades. Upgrading your seat to a premium class can be another good use of miles because doing so can return a value greater than 1.2 cents per mile. Some upgrades to business or first class require payment in the form of a cash co-pay as well as miles. As with award seats, upgrades are based on one-way flights. The price of an upgrade depends on the fare class of your current ticket — upgrading from a cheaper fare will generally cost more.

» Learn more: How the United upgrade clearing order works

Bad redemption options

Generally, redemptions at a value lower than 1.2 cents per mile aren’t good. Other redemption options include United Club membership fees, hotel stays, car rentals, cruises and gift cards. These options tend to offer a lower value than 1.2 cents per mile, so we recommend avoiding them.

» Learn more: The complete guide to redeeming United MileagePlus miles

United Polaris business class. (Photo courtesy of United Airlines)

Anyone can sign up for the MileagePlus program. It's free to join. With basic membership, though, pretty much all you get is a frequent-flyer number and an account where your points accumulate.

The real goodies come when you fly or spend enough to earn United Airlines elite status. There are four levels of United MileagePlus elite status, which are (in order from lowest to highest):

Here’s what each level entails, and what it takes to get there:

MileagePlus elite levels and benefits

On United, elite statuses are called Premier levels.

With Premier statuses, you’ll qualify for mileage bonuses, seat upgrades, priority check-in, complimentary checked baggage , better award-seat availability, discounted and waived fees and other benefits. And if you get Gold status or better, you’ll also have lounge access when traveling internationally. Here’s a full list of all the perks you’ll receive at each level.

Note that some of the most valuable elite status perks are available through some of the airline’s co-branded credit cards. They include free checked bags, priority boarding, better access to award seats and even United Club airport lounge access.

» Learn more: 7 things to know about United Airlines lounges

How to get elite status on United

To earn MileagePlus Premier elite status, you need to do things the airline cares about as a business: fly often, fly far and spend money. This will earn you a combination of Premier Qualifying Points (PQPs) and Premier Qualifying Flights (PQFs).

PQPs are earned on the base fare, carrier surcharges, economy plus seats or subscriptions, preferred seat purchases, upgrade award co-pays, paid upgrades and flights ticketed and operated by Star Alliance partners.

A PQF is one flight. Each segment flown (except basic economy) will count as one PQF. Flights taken in basic economy will not earn any PQFs.

» Learn more: Guide to United Airlines Premier elite status

You don’t need to track all this math yourself; United does that and displays it in your online MileagePlus account. But the chart below shows how it works. United, like other airlines, labels fare classes with letter codes. For example, F is first class, Y is full-fare economy and N is basic economy. Your fare class for each flight segment is displayed during booking and when viewing a ticketed itinerary on united.com.

PQPs and PQFs are all credited to the person flying, not the person paying for the tickets. And if you used frequent flyer miles to pay for a flight, you won’t earn any PQPs or PQFs.

United elite status requirements

To become an elite member, you need a specific number of PQFs and PQPs or PQPs only. Here are the requirements to earn status in 2024:

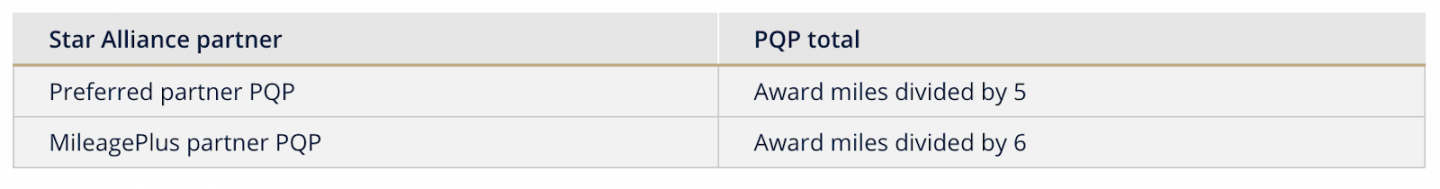

Since United can’t determine how much money you spend on flights with Star Alliance partners, if you choose to earn United miles on those flights, PQPs will be earned based on an airline’s designation as a “Preferred” or “MileagePlus” partner :

Earning Premier status is based on flying and spending during the previous calendar year. Once you qualify for a Premier status, it is valid from the date you qualified through the end of the following program year. So, it could last more than 12 months. For example, if you qualify for Premier Silver status in June 2024, you’ll keep your status through Jan. 31, 2026.

You can request a United status match up to United Premier Platinum for 120 days.

The United Airlines website identifies these as its partner airlines.

Star Alliance members

In general, you can earn MileagePlus miles on flights with Star Alliance partners and redeem your miles for flights on Star Alliance airlines.

Aegean Airlines.

Air Canada.

Air New Zealand.

All Nippon Airways (ANA).

Asiana Airlines.

Austrian Airlines.

Brussels Airlines.

Copa Airlines.

Croatia Airlines.

Ethiopian Airlines.

Lot Polish Airlines.

Scandinavian Airlines.

Shenzhen Airlines.

Singapore Airlines.

South African Airways.

TAP Air Portugal.

Thai Airways.

Turkish Airlines.

» Learn more: Plan your next redemption with our airline partner points tool

Other partner airlines

On airlines outside the Star Alliance, your ability to earn and/or redeem miles is more limited. For example, you may be able to earn miles but not redeem them, or you may be able to redeem only for certain flights.

Aer Lingus.

Air Dolomiti.

Boutique Air.

Discover Airlines.

Eurowings Discover.

Hawaiian Airlines.

Olympic Air.

Silver Airways.

Virgin Australia.

» Learn more: The guide to United Airlines partners: earning and redeeming miles

United Airlines co-branded credit cards are issued by Chase. Cards that earn MileagePlus miles include:

United Gateway℠ Card

2 miles per dollar on eligible United Airlines purchases, gas, local transit and commuting.

1 mile per dollar spent on other purchases.

Annual fee: $0 .

United℠ Explorer Card

2 miles per dollar on eligible United Airlines purchases, hotel stays and at restaurants.

Annual fee: $0 intro for the first year, then $95 .

United Quest℠ Card

3 miles per dollar on eligible United Airlines purchases.

2 miles per dollar on restaurants, select streaming services and all other travel.

Up to $125 in annual United credit.

Annual fee: $250 .

United Club℠ Infinite Card

4 miles per dollar spent on United purchases.

2 miles per dollar spent on dining and all other travel.

1 mile per dollar on all other purchases.

United Club membership.

Annual fee: $525 .

United℠ Business Card

Earn 2 miles per dollar spent on restaurants, gas stations, office supplies stores, transit and United purchases.

Earn 1 mile per dollar spent on all other purchases.

Annual fee: $0 intro for the first year, then $99 .

United Club℠ Business Card

2 miles per dollar on United ticket purchases.

1.5 miles per dollar on every purchase.

Annual fee: $450 .

Another United co-branded card for consumers, the United℠ TravelBank Card , does not earn MileagePlus miles. This card is no longer accepting applications.

The United fare classes are (in order from finest to most basic) are:

United First Class.

United Polaris.

Premium Economy.

Economy Plus.

Basic Economy .

All United fare classes (aside from basic economy) allow you to pick your own seat. Here’s your ultimate guide to selecting seats on United .

On United, your free baggage allowance depends on factors including your elite status, whether you paid with a United credit card, your route and the fare type you’ve purchased.

Typically, economy class passengers on domestic flights owe $40 (or $35 if prepaid) for the first checked bag and $50 ($45 if prepaid) for the second checked bag on domestic flights. Business and first class passengers typically receive up to two checked bags free of charge.

» Learn more: United Airlines bag fees: How they work and how to avoid them

These two types of fees can affect your trip, so it's best to know what you can expect to pay ahead of time if plans change.

If you need to change or cancel a United flight

If you need to cancel a United flight , terms vary by the type of airfare you bought. Most United tickets are technically nonrefundable, but there’s an exception if the cancellation request is made within 24 hours of booking.

Some tickets are refundable, but you may need to pay a cancellation fee.

With most United nonrefundable tickets (except basic economy), there’s also a silver lining: Typically, you can apply the value of your ticket toward the price of a new ticket. If you cancel your nonrefundable ticket, you'll receive United travel funds that you can apply toward a new reservation. Flight credits expire a year after the original issue date of the ticket, and you can find travel funds in your United account's Wallet.

If United cancels your flight (or just delays it)

If the canceled flight was United’s choice, not yours, you have more options. You’re entitled to a full refund on flights canceled by United , regardless of fare class, if you choose to not take another flight when the airline cancels. If you still need to get to your destination, United will accommodate you on another departing flight at no additional cost — even if the cash fare is more expensive.

If you opt not to fly and want a refund, contact United customer service by calling the airline at 800-864-8331.

If your flight is canceled, you can rebook on United's website or app by choosing an alternate flight or sometimes another departure or arrival airport other than your original one.

If your United flight is delayed , you’re not necessarily entitled to compensation ; it depends on the situation. Sometimes United will cover a hotel room night (or at least a discount). It also doesn’t hurt to ask to join the standby list of other flights or to switch to another flight to another nearby airport, as United will typically accommodate such requests for no additional charge.

The simplest way to redeem United miles is to use them for award flights on United and its partner airlines. You will need to log in to your United MileagePlus account to search for available flights. Other ways to use United miles include: flight upgrades, hotel bookings, shopping and gift cards.

No, you cannot transfer your United miles to other airlines. However, you can use your United miles to book flights on partner and Star Alliance airlines.

United no longer has an award chart and instead uses dynamic pricing, so the price of an award ticket fluctuates based on the date of travel and the airline. To see a list of the lowest award fares, check out United’s flight award deals to various destinations for as low as 5,000 miles.

United has a Money + Miles payment option, giving flyers the ability to pay for domestic United flights using a combination of miles and cash. If you’re short on miles when paying for an award ticket, choose the Money + Miles option when submitting your payment info and designate the amount of miles you want to use. The remaining amount can be paid for in cash, which will also earn miles.

NerdWallet values United miles at 1.2 cents each, which means that 10,000 United miles are worth $120. Although there is no hard and fast rule that applies in every instance, generally it makes sense to use your miles when you can extract a value greater than 1.2 cents from each mile. So, if a flight costs 10,000 miles or $50, you’d be better off paying cash. However, if that same 10,000-mile flight costs $200, it would be preferable to use your miles.

It's free to join United’s MileagePlus loyalty program. All you need to do is head over to United’s website and sign up for an account.

United no longer has an award chart and instead uses dynamic pricing, so the price of an award ticket fluctuates based on the date of travel and the airline. To see a list of the lowest award fares, check out United’s

flight award deals

to various destinations for as low as 5,000 miles.

NerdWallet values United miles at

each, which means that 10,000 United miles are worth $120. Although there is no hard and fast rule that applies in every instance, generally it makes sense to use your miles when you can extract a value greater than

from each mile. So, if a flight costs 10,000 miles or $50, you’d be better off paying cash. However, if that same 10,000-mile flight costs $200, it would be preferable to use your miles.

It's free to join United’s MileagePlus loyalty program. All you need to do is head over to

United’s website

and sign up for an account.

We've covered all the basic details of the United Airlines MileagePlus program. But if you still aren't sure whether a frequent flyer program is worth the effort, see our absolute beginner's guide to frequent flyer programs .

The information related to the United℠ TravelBank Card and United Club℠ Business Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-2x Earn 2 miles per $1 spent on dining, hotel stays and United® purchases. 1 mile per $1 spent on all other purchases

50,000 Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

1x-2x Earn 2 miles per $1 spent on United® purchases, dining, at gas stations, office supply stores and on local transit and commuting. Earn 1 mile per $1 spent on all other purchases.

75000 Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

1x-3x Earn 3x miles on United® purchases, 2x miles on dining, select streaming services & all other travel, 1x on all other purchases

60,000 Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

Make every trip more rewarding with Walmart+

GET UP TO 5% WALMART CASH Walmart+ members get 2% on air travel, plus 5% on hotel, car rentals, tours & more.

Discover your next beach getaway

Save more on quick escapes

Find your fam's perfect home away from home

Redeem your Walmart Cash to prep for your next trip.

Discover hotels at popular road trip destinations in the U.S.

Top destinations for you.

Los Angeles

Explore Your Next Adventure with Walmart+ Travel!

Atlanta hotels

Dallas hotels

Chicago hotels

Houston hotels

Las Vegas hotels

Los Angeles hotels

Phoenix hotels

San Diego hotels

San Francisco hotels

Seattle hotels

Introduction to Walmart+ Travel:

Walmart+ Travel puts everything you need in one account, from car rental to hotels to flights. And you don't need to spend forever searching for a Walmart discount for a hotel, because as a Walmart+ member, you get Walmart Cash on eligible purchases credited automatically to your account. Your Walmart+ benefits include 2% Walmart Cash on all air travel and 5% on other travel expenses like a vacation rental and things to do.

Unleash your wanderlust with Walmart+ Travel

Experience top destinations with Walmart+ Travel and go on a unique vacation your whole family will enjoy. From exciting attractions and theme parks to the nation's top museums and wildlife parks, your next vacation's activities and tickets can be booked in the same place as your flights and hotel with Walmart+ Travel deals.

Avios

Hello

Avios balance:

Choose from your different Plans

Register with Iberia Plus and start enjoying all the advantages.

Points

Hello On Business Customer

Level:

Points:

- Card management

- Invoice management

- Book flights with On Business Points

Iberia Plus access

Start session to see the exclusive promotions and use your Avios.

Country selection

Access special offers and content for your country

- Iberia Plus

- Learn about Iberia Plus

- All Iberia Plus

Click to show social networks

The journey of pleasure starts here

Discover unique benefits before, during and after every flight

Benefits of being an iberia plus member.

With Iberia Plus, travelling is something else. Enjoy a unique flying experience and unlock fantastic benefits every day.

The more you fly, the more you enjoy

Different card tiers to enjoy greater comfort and exclusive services.

View benefits

How to earn and spend your Avios

With Avios, the loyalty programme currency, you'll never be short of things to do. Find out how to earn them and then swap them for flights, discounts and leisure experiences.

How to earn Avios

More Avios with partners

Spend your Avios

Featured partners

AVIS offers special rates on the cars in its fleet to members of the Iberia Plus programme, and you'll also collect Avios (Up to 5 Avios per €1 spent).).

Iberia Visa Signature® Card

Earn up to 100,000 Avios

Your purchases in Spain also give Avios

On Business programme for companies

Not heard about On Business ? It's Iberia's programme for companies that lets you add more extras to your flights because it's compatible with Iberia Plus membership . Start collecting On Business points today.

- Financing and savings products

A Multi-Currency Card with exclusive features

Don’t have an alrajhi bank account? Create one now

Travel Plus

A Multi-Currency Card with exclusive feature.

Enjoy exclusive travel and shopping experience Travel Plus card is an innovative way to carry multiple currencies in one single card. It will allow you to use it in purchases through Point-of-Sale machines and electronic stores, as well as cash withdraw anywhere in the world

Add and Charge your card in the following currencies:

Cards Benefits

Earn 1,000 mokafaa Points when you apply for Travel Plus through alrajhi bank app

Free Card Issuance Fee.

Free access to over 1000 Airport Lounges globally through Loungekey Program

Fixed buy rate for US Dollar 3.75 SAR

Complimentary Travel Insurance provided by Visa International, for details and how to avail the insurance policy.

24/7 global Concierge services that can assist you with your needs flights bookings, hotels, car rental, and events tickets etc. Please call +97143611234 or +442078502829 or through WhatsApp services +447874023129 to take advantage of this service.

Instant discounts , Enjoy a unique collection of offers and experiences across travel, dining, wellness and more with your Travel Plus Card

Easy transfer from current account to any card currency through Almubasher and alrajhi bank App

Multiple currencies with best exchange rate

“Visa Checkout” The Easier Pay Online Service

Card Features

Cash Withdrawal, Local & international cash withdrawal up to 30% of your credit limit.

Accepted at over 30 million local & international POS including 900,000 ATMS worldwide.

Near-field Communication (NFC), madaPay, mada Atheer and Apple Pay services, make your payments by simply waving or tapping your card on the POS terminal.

Instant Notifications. A free service that sends you a notification messages to stay on the top of your finances with ease and convenience.

3D Secure. More secure than cash, 3D secure uses a verification process, one time password for online shopping and EMV chip to protect your information.

Fees and Charges

Required documents:.

Existing bank account with Al Rajhi bank.

Copy Of Valid ID (National ID/Iqama)

Fill & submit application form Submit Now

Approve the Terms & Conditions.

You can apply easily through

alrajhi bank app

Download Now →

You can also apply through the following channels

You can apply through alrajhi bank Online

We are here for your service give us a call

Via Branches

There is always a branch nearby

Tutorial Videos

Frequently asked questions:, are there any conditions for obtaining the card, are there any fees for loading funds from c/a to the travel plus card, what do i do in case i lost my card, or it got stolen, can i unload money back to my current account, can i use my card in countries that don’t accept one of the currencies in the travel plus card, how easy it is to load or transfer funds to the travel plus card.

Auto Lease Offer

alrajhi bank is pleased to offer you the best car leasing offer for the car luxury brands

travel plus offer

with travel plus card.. Zero% international transaction fees on all global currencies

personal finance offer

Now you can get mokafaa loyalty points on personal finance

allows you to withdraw cash without having to write a cheque or visit a teller.

Self Service “ASRAA”

innovative solutions for all your banking operations and transactions.

There is always branch near you

Need some help? call 800 124 1222.

Make your life easier and faster with our 24/7 banking options. alr ajhi bank App Anytime Anywhere.

Login to your account

If there is an account registered under that email address, a password reset email will be sent to your address.

If you are having problems try resetting your password or call 1300 165 765 for help.

Welcome to the Ultimate in Travel Perks

What’s your travel style? Maybe you’re an avid cruise traveller, or perhaps your dream vacation is relaxing poolside at a luxury resort and spa, or maybe you prefer to venture out and explore on short holiday breaks all throughout the year. Whatever your travel style, to destinations near and far, this is the programme for you!

TravelPerks+ is designed to save you, the adventurer, the cruiser, the dreamer, or the explorer, thousands on all your travel plans. Enjoy a wide range of travel perks that will give you access to member exclusive travel offers and saving every day on accommodations, tours, cruises, packaged holidays, car rentals and so much more.

Membership Tiers

Each level of membership is packed with great perks and travel and lifestyle benefits. Plus, Premium, and Platinum members all save thousands of dollars on a wide range of discounted travel products.

As an added benefit, all members will receive at least one Preferred Resort Certificate, which entitles you to an up to 7 night resort stay, free of charge, at a selection of hand-picked resorts worldwide.

If you’re a cruiser or always wanted to give cruising a go, you will also receive one or more Buy One Get One Half Off Cruise Certificates to fulfill your sailing dreams all at reduced prices.

Additionally, depending on your membership level, you will also receive varying amounts of Vacation Cash that you can apply to pay for your already discounted travel transactions.

TRAVEL PERKS DISCOUNTS

Hotel, cruise, tours, packages, car hire, activities

LIFESTYLE PERKS DISCOUNTS

Shopping, gift cards, wellness, gifts and more

VACATION CASH

Use vacation cash just like real cash when applied to your travel purchases

BOGOHO CRUISE CERTIFICATE

Buy one passenger at retail/market rate, get second passenger half off

PREFERRED RESORT CERTIFICATE

Up to 7-night resort stay at select resort properties worldwide

QUARTERLY SPECIALS

Gain exclusive access to a limited time only travel sale with jaw-dropping deals every quarter

No-one likes paying full price on travel or having to search for ages to find the best deal. Take the hassle out of planning holidays and see the world for less. Have all your travel perks in one place and know you are saving every time you use a certificate, book a hotel, or plan that once-in-a-lifetime holiday.

Stay at one of over 250,000 hotels worldwide, discounted to our members.

Explore the world with these great tours and guided holidays.

Sail away on a river, ocean or small-ship cruises with exclusive member discounts.

Take the stress out of your holiday with these packages with cruise, tour, flight and hotel inclusions.

Feel right at home with the best deals on boutique lodging and luxury homes.

Make long-lasting memories on your holiday with popular activities in the destination.

Drive away with more flexibility on your holiday with a car hire.

Fly away with the best deals on all major airlines globally.

Splurge on a 7-night resort stay in exotic destinations around the world.

Unlock amazing savings on top high street, entertainment, electrical, home and garden, food and drink and much more. Also save on gift cards to use in store or online.

Enjoy discounts on gift cards and cash back offers at Australian retailers and major brands. Save on everyday purchases.

Relax into a facial or Swedish massage with great savings at Australia’s most loved wellness brand, Endota Spa.

From a simple “thank you” to a wedding anniversary, save on a large range of edible blooms that are the perfect way to spoil someone you love.

Treat yourself to the latest suitcases, backpacks and bags for your next travel adventure with great savings on Samsonite, High Sierra and American Tourister luggage.

From Zoos to Hot Air Balloon rides and everything in between. Save on tours and attractions throughout Australia and New Zealand.

Premium and Platinum members get access to Quarterly Specials at large discounts. Login to see the latest specials.

Quarterly Specials are an exclusive benefit available for Premium and Platinum Membership levels only.

Once a quarter you will be invited to a special sale event featuring a range of specially curated, undeniable deals, unlocking the very best savings we have to offer for a limited time only.

Look out for your “Count Down to Quarterly Specials” email communication announcing our next exclusive sale event.

Here’s a sample of our last Quarterly Specials Offers

Welcome to Travel Perks +

Login to your account below.

- Terms & Conditions

- Privacy Policy

- Reservations Process & Conditions

How to get maximum value from the United MileagePlus program

MSN has partnered with The Points Guy for our coverage of credit card products. MSN and The Points Guy may receive a commission from card issuers.

Editor’s note: This is a recurring post, regularly updated with new information.

A few weeks ago, United massively devalued its miles by increasing award rates on some flights by up to 122% .

Despite its numerous devaluations, we’ll help you get some great redemptions from the MileagePlus program. The carrier’s Star Alliance membership allows you to earn and redeem miles on partner airlines.

United MileagePlus is a 1:1 transfer partner of Chase Ultimate Rewards and Bilt Rewards , so travelers with cards like the Chase Sapphire Reserve®, the Chase Sapphire Preferred® Card and the Bilt Mastercard® (see rates and fees) can easily boost their MileagePlus balances through various travel and dining purchases. That said, we generally don’t recommend transferring Chase and Bilt points to United since we value United miles at just 1.1 cents each.

However, earning United miles is just one part of the puzzle. Knowing which redemptions to target can ensure you get a solid value from your United credit card sign-up bonus.

United MileagePlus overview

United’s MileagePlus program is free to join and miles never expire . Even if you don’t earn or redeem miles for a while, you don’t have to worry about losing your account balance due to inactivity .

The carrier has hubs at airports in seven cities across the U.S. — Newark Liberty International Airport (EWR) in New Jersey; Washington’s Dulles International Airport (IAD); Chicago’s O’Hare International Airport (ORD) in Chicago; Houston’s George Bush Intercontinental Airport (IAH); Denver International Airport (DEN); Los Angeles International Airport (LAX); and San Francisco International Airport (SFO) — and offers service to hundreds of destinations around the world. However, as a Star Alliance member, you can earn and redeem MileagePlus miles on carriers like Lufthansa , Air New Zealand and Singapore Airlines .

Related: The best websites to search for Star Alliance award availability

How to earn United miles

The simplest way for most people to earn United miles will be by flying with the carrier or one of its Star Alliance partners and crediting the flights to your MileagePlus account.

When you book a flight through United, you’ll typically earn miles based on the ticket’s base fare, with bonuses for elite members . However, flights booked directly with partner airlines and credited to your United MileagePlus account will earn miles based on the distance flown and your booked fare class. You can view this page on United’s website for full details.

As mentioned above, United is a 1:1 transfer partner of Chase Ultimate Rewards and Bilt Rewards. That means you can transfer points to your United MileagePlus account — a process that should be completed within minutes .

Marriott Bonvoy points transfer to United at a 3:1 ratio thanks to United and Marriott’s RewardsPlus partnership . You’ll get 10,000 bonus miles for every 60,000 points transferred to United MileagePlus. Transfers from Marriott Bonvoy to United MileagePlus take around three days .

If you’re starting from scratch or looking to save up for an expensive award, consider signing up for a United credit card . You’ll have your choice among entry-level and premium cards, as well as personal and business options:

- United Infinite Card: 80,000 bonus miles and 1,000 Premier qualifying points (PQP) after you spend $5,000 on purchases in the first three months from account opening.

- United Quest Card: Earn 70,000 bonus miles + 500 Premier qualifying points after you spend $4,000 on purchases in the first three months your account is open.

- United Explorer Card: Earn 60,000 bonus miles after you spend $3,000 on purchases in the first three months your account is open.

- United Gateway Card: Earn 30,000 bonus miles after you spend $1,000 on purchases in the first three months your account is open.

- United Business Card: Earn 50,000 bonus miles after you spend $5,000 on purchases in the first three months your account is open.

United’s cobranded cards are issued by Chase, meaning they’re subject to the 5/24 rule for new applicants.

Related: Earn up to 3,000 bonus miles when you join United MileagePlus Dining

Benefits of United Premier status

You can qualify for United elite status by earning Premier qualifying points (PQPs) and Premier qualifying flights (PQFs). To qualify for any status, you must fly at least four United and/or United Express segments annually. Earlier this year, United deposited extra PQPs into Premier members’ accounts. By spending on your United cobranded credit card , you can also earn bonus PQPs.

There are four published tiers of United Premier elite status that offer bonus miles and other perks. All United elites get placed on the list for complimentary premier upgrades , with higher priority for upper-tier elites. United elites also get access to complimentary Economy Plus seating, though depending on your tier, that might be available only at check-in or at the time of booking.

Related: What is United Airlines elite status worth?

Dynamic pricing for all flights

In 2019, United formally switched to dynamic award pricing for its own flights. In April 2020, the carrier pulled its Star Alliance partner award chart without advanced notice and increased prices on most routes by 10% .

With no award chart to reference, United is free to increase the prices on some of the most popular MileagePlus redemptions without warning. This happened in May and June 2023, when United significantly increased award rates without notice .

Related: Why I consider my United miles to be worth 5 cents apiece

Award sales

There’s plenty of doom and gloom news about devaluations, decreased award availability and the stripping of benefits from award tickets. However, one positive trend over the last few years is the launch of limited-time, discounted award sales. Historically, Delta has been one of the best airlines at offering award sales , but United is making progress on that front.

Earlier this year, United offered round-trip flights to the South Pacific from just 42,000 miles to celebrate its 42nd anniversary. We hope to see more of these sales in the future.

After working hard to build your stash of miles, keep your eyes on our website for deal alerts so you can jump on the next sale and stretch your miles even farther.

Related: The ultimate guide to getting upgraded on United Airlines

Premium cabin redemptions

United has heavily invested in its international premium experience , between Polaris lounges , taking delivery of new planes with sleek Polaris cabins and retrofitting its existing long-haul fleet. Best of all, booking United Polaris through MileagePlus is often cheaper than booking a partner airline’s business-class cabin.

Let’s look at a flight from Washington, D.C.’s Dulles International Airport (IAD) to Frankfurt Airport (FRA), a premium United route operated by its Star Alliance partner Lufthansa. A one-way business-class award on Lufthansa’s 747-8 would cost you 88,000 United MileagePlus miles. However, you may be able to book the same route on a United-operated flight for as low as 80,000 miles depending on the dynamic pricing calculator. Those 8,000 miles you save are worth $88 based on TPG’s most recent valuations .

The savings can be even more significant on other routes, like from the U.S. to South Asia. A business-class award on a Star Alliance partner can cost an extra 10,000 miles or more on these routes. Of course, this won’t always be true due to the unpredictable nature of dynamic pricing. Plus, some of United’s partners, like EVA and ANA , are worth paying a premium for. Still, these potential savings are worth keeping an eye out for.

Unfortunately, United is often stingy with its business-class award space, so you might be forced to book with a partner. However, you can use ExpertFlyer (owned by TPG’s parent company, Red Ventures) to set alerts for United and its Star Alliance partners if there’s no business-class award space on your desired date(s) of travel.

Related: Your ultimate guide to the United MileagePlus program

No fuel surcharges

The excitement of snagging a “free” trip using your miles can be dampened significantly by fuel surcharges . Those extra costs that many programs will add to award tickets. Other Star Alliance programs can add hundreds of dollars in fuel surcharges to their award tickets, but you can keep some serious cash in your pocket by booking through United, as it’s one of the few programs out there that doesn’t add these.

Of course, United’s award rates are generally higher than many of its partners. While the airline technically eliminated its close-in award booking fee, you might find award rates higher for close-in travel.

However, if you can save $500 or even $1,000 in fees on a single award ticket by booking through United, it can easily be worth it. Savings like that are easy to come by if you’re looking at certain awards, like Lufthansa first class between the U.S. and Europe, where taxes from other Star Alliance frequent flyer programs can easily exceed $1,000.

Related: United’s best kept elite status secret: How to earn PQP faster with partner flights

United Excursionist Perk

United MileagePlus doesn’t offer an unrestricted stopover like other frequent flyer programs, but it does offer the Excursionist Perk . If used strategically, it has the potential to be even more valuable. It allows you to add a qualifying, one-way flight to a round-trip award ticket without additional miles at its most basic level. Here are the rules United lists on its website:

- The Excursionist Perk cannot be in the MileagePlus-defined region where your travel originates (For example, if your journey begins in North America, you will only receive the Excursionist Perk if travel is within a region outside of North America.).

- Travel must end in the same MileagePlus-defined region where travel originates.

- The origin and destination of the Excursionist Perk are within a single MileagePlus-defined region.

- The cabin of service and award type of the free, one-way award is the same or lower than the one-way award preceding it.

- Only the first occurrence will be free if two or more one-way awards qualify for this benefit.

This perk’s simplest and most obvious use would be for a round-trip award from the U.S. to Europe or Asia. You could fly from Washington, D.C., to Frankfurt, use the Excursionist Perk for a free flight from Frankfurt to Paris, and then complete your round-trip award booking with a flight back to Washington, D.C.

In this case, you’d pay the normal award rate for a round-trip flight from the U.S. to Europe, while the leg from Frankfurt to Paris would be “free.”

Of course, you could get much more creative than this. Maybe you add an open jaw and fly back to Chicago instead of Washington.

That’s still pretty tame in the grand scheme of what’s possible with this perk. To learn about crazy routing possibilities like “the time machine” or the “Southern North America/South of Central America/North of South America/West of Everywhere Turtler,” check out TPG’s complete guide to the Excursionist Perk .

Related: How to unlock additional award availability with United Airlines

Flights outside the US

With so many United flyers using miles for travel from the United States, U.S. redemptions have been disproportionately devalued compared to the rest of the world. Some impressive non-U.S. redemptions include Melbourne Airport (MEL) to Singapore Changi Airport (SIN) for 55,000 miles in business class on Singapore Airlines , São Paulo-Guarulhos International Airport (GRU) to Buenos Aires’ Ezeiza International Airport (EZE) for 27,500 miles in business class (or 38,500 miles in first class) on Swiss and Seoul to Tokyo for 8,800 miles in economy class on Asiana Airlines .

If you’re planning a trip outside of the United States, it’s worth comparing the cash price of your flight to the award price. Remember, just because you’re flying a route that United doesn’t operate doesn’t mean you can’t use your United miles.

Last-minute bookings

If you’re like me, it might be worth keeping a healthy “just in case” sum of miles in my MileagePlus account for last-minute situations. A year ago, I was traveling in Belgium and had to return immediately to the United States due to a family emergency. The urgent nature of the situation meant that I needed to be on the first flight that would get me home to San Francisco.

Shopping on my phone for a flight back while en route to the Brussels airport by taxi, I found a United flight in Polaris business class for 62,800 miles connecting through Chicago. Miraculously, this flight was scheduled to depart Brussels in two hours and had the soonest arrival in San Francisco. The cash price was over $8,000.

Even with the increase in award prices for close-in bookings, this flight was a bargain and I avoided paying for an expensive last-minute paid fare.

Bottom line

Despite negative changes to the United MileagePlus program, plenty of high-value options remain for redeeming your miles.

Knowing which award types, cabins and routing rules to utilize can help you boost your redemption values every time. At the very least, review the Excursionist Perk to add a free second destination to your next vacation booked with United MileagePlus miles.

See Bilt Mastercard rates and fees here.

See Bilt Mastercard rewards and benefits here.

Additional reporting by Ethan Steinberg.

SPONSORED: With states reopening, enjoying a meal from a restaurant no longer just means curbside pickup.

And when you do spend on dining, you should use a credit card that will maximize your rewards and potentially even score special discounts. Thanks to temporary card bonuses and changes due to coronavirus, you may even be able to score a meal at your favorite restaurant for free.

These are the best credit cards for dining out, taking out, and ordering in to maximize every meal purchase.

Editorial Disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Start typing...

Please enter data..., top searches, credit card, saving account, fixed deposit.

Nexxt Credit Card

SFlexible options to pay through EMI, Reward points or Credit.

This first-of-its-kind card in India brings together a variety of benefits that treat you to the very best of a Credit and Debit Card.

- A- A A+ A A

- Savings Account Individual Saving Account

- Salary Account Uniformed Personnel Account Corporate Salary Account

- Current Account Indus Current Account

- Fixed Deposit Recurring Deposit Safe Deposit Locker

- Sweep in / Sweep Out Senior Citizen Fixed Deposit

- Vehicle Loans Affordable Home Loans Loan Against Property

- Gold Loan Loan against Securities Home Loan

- Agri Loan Personal Loan

- Professional Loans to Doctors Medical Equipment Loan

- Credit Card Loan on Credit Card Duo Card

- Debit Card Commercial Cards Business Cards

- Prepaid Card Forex Card E-Mandate on Debit Cards

- My Family & Me

- My Business

Investments

- Your Investment Planner Goal Calculator Systematic Investments Calculator Retirement Calculator

- Mutual Funds

- Sovereign Gold Bonds Alternate Products Invest in Government Securities

- National Pension System ASBA

Payments Products

- Debit Card Prepaid Card Forex Card

- FASTag Quick Pay Bharat QR

- UPI BHIM IndusPay Digital Rupee (e₹) Indus PayWear

- Debit Card EMI UPI on IndusMobile

Foreign Exchange

- Forex Card Inward Remittances

- Outward Remittances

- IndusForex-Online Forex Portal Fx Retail – Online

Financial Inclusion

- What is PMJDY

- Social Security

- Financial Literacy

- Business Correspondent Services

Make Payments

- Credit Card Payment Click Pay Send Money Abroad

- Loan Repayment SecurePay Digital Rupee (e₹)

- Bill Payment E-Mandate

- Payment NEFT / RTGS Facility Tax Payment

Digital Banking

- Indusnet IndusAssist- Voice Banking on Alexa Samsung Wallet

- IndusMobile Banking on WhatsApp IndusForex Online Portal Set Up E-Mandate

- Video Branch IndusSmart

- IndusAssist – Virtual Assistant Google Pay

Apply Online

- Savings Account Govt. Social Security Schemes Personal Loan Vehicle Loans

- Fixed Deposit Mutual Funds Insurance - IndiQwik Set Up E-Mandate

- Forex Card Affordable Home Loans MSME Loans Credit Card

- FASTag Send Money Abroad Udyam Registration

Vehicle Auction

- Indus EasyWheels Register Now Login

- Blogs View all LIVE auctions View all vehicles

- View all Two-Wheelers View all Cars FAQs

- Partner Services

- Help Centre Aadhaar Enrolment Branches Forms & Documents Charges & Fees

- Contact Us Locate Us Digital Payment Complaint

- FAQ's Feedback Complaint Redressal

- Report Unauthorized Transaction Grievance Redressal

- Savings Account (up to) 6.75%

- Fixed Deposit 7.75%

- Fixed Deposit Sr. Citizen 8.25%

Quick Links

- Debit Card Related

- Credit Card Related

- CASA Welcome Kit

- Manage Mandate(s)

- Get Mini Statement

- Refer A Friend

- Fund my account

INCLUSIVE BANKING

Indus paywear.

- A+ Reset A-

- High Contrast Reset

- Terms and conditions: Access to Airport Lounges with Priority Pass - IndusInd Bank

Airport Lounges Priority Pass

- The Priority Pass Card will be delivered to the Cardholder at the registered mailing address. To get access to a Priority Pass lounge, the Cardholder will need to have the Priority Pass Card.

- A lounge usage fee of USD 27 or applicable charges as per priority pass per visit per member for the Cardholder and the Guests will be charged to the card subsequent to the Cardholder's visit.

- For any disputes regarding the billing of this lounge usage fee, the Cardholder needs to contact Priority Pass directly.

- Priority Pass membership is complimentary for all IndusInd Bank Signature Credit Cardholders

- A usage charge of USD 27 per person is applicable each time a Cardholder visits any lounge, within or outside India. This charge is billed to your IndusInd Bank Credit Card .

- As a part of the Travel Plus programme, the usage charge of USD 27 is waived off for the Cardholder when he visits any international lounges outside India.

- Usage charges of USD 27 for visits any lounge within India shall not be waived off.

- Usage charges of USD 27 for visits of Guests of Cardholders to any lounge within or outside India shall not be waived off.

- The usage charges for lounge access are subject to change as governed by Priority Pass.

- IndusInd Bank reserves the right to change the benefits offered as part of the Travel Plus programme without notice.

IMAGES

COMMENTS

TravelPlus gives you 5% cash back on all of your travel reservations. Plus, get rebates on travel services every time you travel. Contact Us: 800-254-5597.

The Travel Plus Program is offered by IndusInd Bank at an annual fee of Rs. 5,000. Access to airport lounges on all domestic and international airports is available for Cardholders under the Program. Usage charges shall be waived for a maximum of 8 international visits per year for Travel Plus Program.

Why Travel Plus? Our new Travel Plus program offers beginning players the opportunity to jumpstart their soccer experience. Travel Plus players will develop their skills through our structured curriculum, play in-house scrimmage games, be coached directly by our licensed Campton Coaches, and work with assistant coaches that currently play within our Senior Elite program.

The world is digitising. Employees are tired of offline processes. It's time to make a change. Get a free demo. Simplify your business travel & expense management today. Get TravelPlus. Get a free demo. 4.9/5. TravelPlus is a business travel platform to help you plan your business trips, events & conferences flights, and hotels, guaranteeing ...

Build your mileage balance with the MileagePlus X app. Earn miles on shopping, dining, and eGift Card purchases with our free and easy to use app. Earn up to 1,000 bonus miles when you join MileagePlus Shopping SM and spend $25 within two weeks. Book hotels on Rocketmiles and get up to 10,000 miles per night, every time.

Airport Lounge Access on IndusInd Bank Signature Visa Credit Card. With the complimentary Priority Pass membership, the Signature cardholder can avail access to over 600+ lounges across the globe. With the Travel Plus Program, cardholders can get a maximum of 8 lounge visits worth $27 per year provided they pay an enrolment fee.

The subscription is currently available in the United States with new benefits and added-value rewards as tourism continues to recover, globally.. For just $99 per year, Tripadvisor Plus unlocks endless travel savings with one simple membership:. Member-only prices and perks on hundreds of thousands of hotels around the world with an average of $350 savings per stay.

Emergency Assistance Plus is the travel assistance solution chosen by local and national affinity clubs, airline loyalty programs, professional organizations, auto clubs and alumni associations. Through these partnerships, members gain access to exclusive savings when they purchase EA+. Find out if your favorite organization is an EA+ partner.

Medically-Trained, Multilingual Operations Center Accessible 24/7. Assistance anytime, anywhere, in any language. 24 hours a day. 365 days a year. The difference really is in the details. Make the smarted choice for your travels. Choose Global Travel Plus for these numerous other advantages.

United economy plus seats. (Photo courtesy of United Airlines) Based on our most recent analysis, NerdWallet values United MileagePlus miles at 1.2 cents apiece. To determine the value of reward ...

IndusInd Bank understands it all too well! Travel Plus brings you a set of unique travel assist program. You already have access to over 600 VIP airport lounges around the world as part of the Priority Pass program. With the Travel Plus program, you can also enjoy special waivers on lounge usage charges outside India.

From exciting attractions and theme parks to the nation's top museums and wildlife parks, your next vacation's activities and tickets can be booked in the same place as your flights and hotel with Walmart+ Travel deals. Walmart+ members get up to 5% Walmart Cash on hotel bookings, vacations, car rentals, tours, activities & more.

Plus you can enjoy all the one world® advantages. As a member of a frequent flyer programme of an airline in the one world alliance you can gain Avios and Elite Points corresponding to your card level every time you travel on a one world flight. one world alliance. American Airlines. British Airways.

How to earn Avios. More Avios with partners. Spend your Avios. AVIS offers special rates on the cars in its fleet to members of the Iberia Plus programme, and you'll also collect Avios (Up to 5 Avios per €1 spent).). Earn up to 100,000 Avios. Your purchases in Spain also give Avios.

Cards Benefits. Earn 1,000 mokafaa Points when you apply for Travel Plus through alrajhi bank app. Free Card Issuance Fee. Free access to over 1000 Airport Lounges globally through Loungekey Program. Fixed buy rate for US Dollar 3.75 SAR. Complimentary Travel Insurance provided by Visa International, for details and how to avail the insurance ...

The Travel Plus Program is offered by IndusInd Bank at an annual fee of INR 5,000. Access to airport lounges on all domestic and international airports is available for Cardholders under the Program. Usage charges shall be waived for a maximum of 8 international visits per year for Travel Plus Program. Usage charges of $27 for visits to any ...

Each level of membership is packed with great perks and travel and lifestyle benefits. Plus, Premium, and Platinum members all save thousands of dollars on a wide range of discounted travel products. As an added benefit, all members will receive at least one Preferred Resort Certificate, which entitles you to an up to 7 night resort stay, free ...

Star Alliance connecting partners. All members can earn and redeem MileagePlus miles on eligible connecting partner flights. Premier ® Gold, Platinum and 1K ® customers traveling on a Star Alliance itinerary that includes a flight on a connecting partner will be offered a tailored set of privileges detailed on the specific connecting partner ...

What's more, the bank's unique 'Travel Plus' programme provides you with an array of amenities to make your wait for connecting flights an absolute pleasure. Additionally, the IndusInd Bank Legend Credit Card offers a 1.8% discounted foreign currency mark-up fee on international transactions, making your global adventures not only ...

United Airlines - Airline Tickets, Travel Deals and Flights If you're seeing this message, that means JavaScript has been disabled on your browser, please enable JS ...

The Travel Plus Program is offered by IndusInd Bank at an annual fee of Rs. 5,000. Access to airport lounges on all domestic and international airports is available for Cardholders under the Program. Usage charges shall be waived for a maximum of 8 international visits per year for Travel Plus Program. Usage charges of $27 for visits to any ...

Bottom line. Leveraging travel credit cards and loyalty programs can make your summer vacation a lot more affordable. Most travelers should focus on earning flexible rewards points that can be ...

A one-way. business-class award on Lufthansa's 747-8. would cost you 88,000 United MileagePlus miles. However, you may be able to book the same route on a United-operated flight for as low as ...

Priority Pass membership is complimentary for all IndusInd Bank Signature Credit Cardholders. A usage charge of USD 27 per person is applicable each time a Cardholder visits any lounge, within or outside India. This charge is billed to your IndusInd Bank Credit Card. As a part of the Travel Plus programme, the usage charge of USD 27 is waived ...