In My Korea

Korea’s T-Money Card Guide 2024: How To Buy And Use T-Money

Want to know where to buy a T-Money Card in Korea? Unfamiliar with how to use the T-Money Card and what the main advantages of it are? Not sure about how to pay for transportation tickets, what the fares will be, and whether you’ll have the right change? This guide to the T-Money Card, the best Korean transportation card, will solve all your problems.

Find out where to buy a T-Money Card at Incheon Airport and other locations in Korea, learn how to top-up a T-Money Card in Korea and where to top-up, and also discover the many benefits of using a T-Money Card. This in-depth article will answer all your T-Money Card queries quickly and easily.

This T-Money guide is updated regularly to bring you the latest information about changes and additional ways to use the T-Money Card. There are also lots of my own tips about how to use the T-Money Card, where it can be used, and lots of really useful travel advice for visiting Korea.

Table of Contents

Affiliate Disclaimer : This site contains affiliate links and I may earn commission for purchases made after clicking these links.

What Is The T-Money Card

The T-Money Card is a prepaid transportation card that can be used to pay for public transportation in cities across Korea, including buses and subways. It provides cash-free travel around Korean cities, and takes the hassle out of to get around Korea and buying tickets for each journey.

When you use the T-Money Card, you pay less for subway and bus fares. It literally pays for itself.

The T-Money Card can be used to pay for a range of items and services, including taxi charges, items in convenience stores, entrance fees for attractions, vending machines, and food and beverages in restaurants. Anywhere you see the T-Money logo (above), you can use the T-Money Card.

What Are You Looking For?

To help make it easier for you to find what you’re looking for, I’ve broken this article into the following sections. Click the quick links below to jump straight there or keep reading through all parts.

Where To Buy A T-Money Card

Where Can You Use T-Money In Korea

How To Top-Up A T-Money Card

How To Check Your T-Money Balance

How To Refund A T-Money Balance

Alternative Korean Transportation Cards

Is The T-Money Card Worth Buying

Tips For Using T-Money In Korea

Why do i need a t-money card in korea.

Korea is fast becoming a cash-free society and in recent years Korea’s buses have moved away from accepting cash payments. Almost a quarter of all buses in Seoul are now cash-free and you can’t pay with cash at all on Daejeon’s buses. This will likely be the norm everywhere in Korea very soon.

Even when you can buy tickets in cash, it’s inconvenient making sure you have the right cash available (no change is given on buses). Queueing up to buy a ticket at a crowded subway station is a real hassle when you could just touch-and-go straight through the barriers with a T-Money Card.

The biggest reason is the two rates to travel in Korea’s subways and buses – one for cash and one for transportation cards like the T-Money Card. The rate for the T-Money Card is lower, meaning you’ll save money when you travel with a T-Money Card, as you can see in the table below:

*Bus fares in Seoul rose to ₩1,500 from August 2023. However, it hasn’t been confirmed whether cash and T-Money costs will be the same now or not.

T-Money Card Quick Summary

Here’s a summary of the T-Money Card and why you should get one when you travel to Korea.

Planning to visit Korea? These travel essentials will help you plan your trip, get the best deals, and save you time and money before and during your Korean adventure.

Visas & K-ETA: Some travellers to Korea need a Tourist Visa , but most can travel with a Korean Electronic Travel Authorisation (K-ETA). Currently 22 Countries don’t need either one.

How To Stay Connected : Pre-order a Korean Sim Card or a WiFi Router to collect on-arrival at Incheon Airport (desks open 24-hours). Alternatively, download a Korean eSIM for you travels.

Where To Stay : For Seoul, I recommend Myeongdong (convenient), Hongdae (cool culture) or Gangnam (shopping). For Busan, Haeundae (Beach) or Seomyeon (Downtown).

Incheon Airport To Seoul : Take the Airport Express (AREX) to Seoul Station or a Limo Bus across Seoul. Book an Incheon Airport Private Transfer and relax to or from the airport.

Korean Tour Operators : Tour companies that have a big presence in Korea include Klook , Trazy , Viator , and Get Your Guide . These sites offer discounted entry tickets for top attractions

Seoul City Passes : Visit Seoul’s top attractions for free with a Discover Seoul Pass or Go City Seoul Pass . These passes are great for families and couples visiting Seoul – you can save lots.

How To Get Around : For public transport, grab a T-Money Card . Save money on Korea’s high speed trains with a Korea Rail Pass . To see more of Korea, there are many Rental Car Options .

Travel Money : Use money exchanges near Myeongdong and Hongdae subway stations for the best exchange rates. Order a Wise Card or WOWPASS to pay by card across Korea.

Flights To Korea : I use flight comparison sites such as Expedia and Skyscanner to find the best flights to Korea from any country. Air Asia is a good option for budget flights from Asia.

How To Learn Korean : The language course from 90 Day Korean or Korean Class 101 both have well-structured lessons and lots of useful resources to help you learn Korean.

T-Money Cards are available in many places in Korea, including at Incheon Airport, in convenience stores, and in public transportation stations. This section of the T-Money Guide will show you where to buy a T-Money Card in each of these different locations and extra services that include T-Money.

Buy T-Money At The Incheon Airport Transit Centre

The most convenient place for most travellers to get a T-Money Card is at Incheon Airport in the Transit Centre (Floor B1) of Terminal 1 or Terminal 2. There are vending machines that sell the Korea Tour Card , which is the tourist-friendly version of the T-Money Card that comes with extra benefits.

Follow the directions to the ‘ Airport Railroad ‘ in either terminal and it will lead you to the B1 Transit Centre. The T-Money Card vending machines will be well signposted and located next to the All-Stop subway train, which is the subway to central Seoul that you can pay for with T-Money.

Please note : If you arrive at Incheon Airport Terminal 1, the Transit Centre is the only place you can buy a T-Money Card (Korea Tour Card). The CU convenience stores in Terminal 1 don’t sell T-Money Cards. In Terminal 2, you can buy T-Money Cards from GS25 and 7/11 convenience stores.

How to buy T-Money card At Incheon Airport Transit Centre:

It’s easy to buy a T-Money Card from the Transit Centre. Head to the All-Stop train station where to the T-Money Card vending machines are located. You must have cash (KRW) to purchase the T-Money Card at the vending machines, as well as cash to top-up the T-Money balance afterwards.

Here are the 4 steps required to buy a T-Money Card from the vending machine:

1: Insert Cash

The cost of the Korea Travel Card (hereafter called T-Money Card) is ₩4,000. Insert cash into the machine. Change is available.

2: Press The Number

Like a normal vending machine, press the number of the T-Money Card you want to buy. Don’t select a number which is empty.

3: Press The Green Button

To confirm your purchase, press the green button at the bottom of the keypad.

4: Collect Your T-Money Card

The vending machine will collect your T-Money Card and dispense it to you.

Once the T-Money Card has been dispensed, don’t forget to collect any change from the vending machine. To top-up the T-Money Card, take it to the ticket machines outside the All-Stop terminal. Full details about how to top-up will be included in the section ‘ How To Top-Up A T-Money Card ‘

Need Cash For T-Money?

One issue with T-Money is that it can only be topped-up using cash (KRW). Unfortunately, airport money exchanges typically give bad exchange rates. You can get better rates by taking the Airport Express non-stop train into Seoul and changing money in Myeongdong or Hongdae, or by ordering a Korean sim card from Klook with a T-Money Card with a preloaded balance of 5,000 KRW or 10,000 KRW.

Where to Buy A T-Money Card In Korea

I recommend buying a T-Money Card at the Incheon Airport Transit Centre. However, if you’re not arriving in Korea at Incheon Airport, want to get a card with a cuter design, or want to save money by combining T-Money with other services, here are 6 other places where you can buy T-Money Cards.

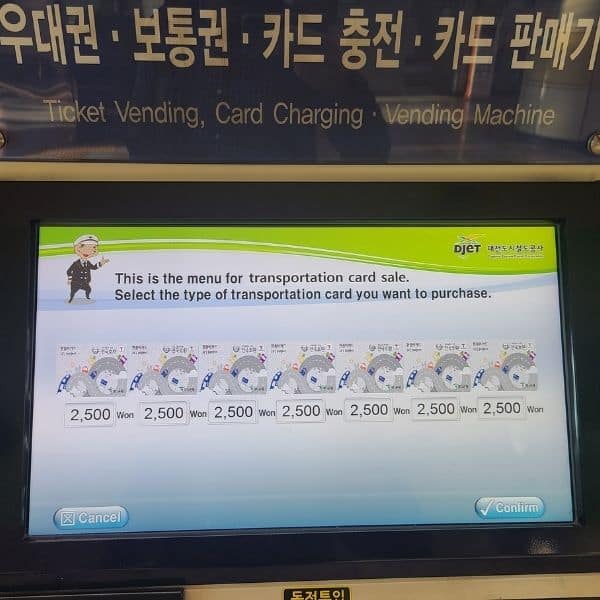

Buy T-Money At A Subway Station In Korea

Subway stations in Korea sell the basic version of the T-Money Card, which comes with no balance. You can usually top-up from the same machine that dispenses them.

Price : ₩2,500

Buy T-Money At A Convenience Store In Korea

Korean convenience stores, including GS25 and 7/11, sell T-Money Cards with their own designs. These come with no balance but can be topped up straight after purchase with cash.

Price : ₩3,000

Buy T-Money On The Airport Express

It is possible to buy a T-Money card inside the subway stations along the Airport Express all-stop train between Incheon Airport and other parts of Seoul. You can even personalise this card and add your own picture to the card.

Price : From ₩6,000

Buy T-Money From Klook

Klook offers a combined Korean sim card and T-Money package that comes with a T-Money Card with Klook’s own cute design. You save money on both the T-Money Card and sim card with this combined package.

Price : From ₩32,500

Get T-Money With The WOWPASS

The WOWPASS is a travel money card that allows you to pay for goods and services like a local. It includes T-Money functions and the WOWPASS Airport Package comes with ₩10,000 T-Money balance included.

Price : From ₩5,000

Get T-Money With The Discover Seoul Pass

The Discover Seoul Pass is a city-pass that offers free entry to dozens of premium attractions in Seoul. It also includes T-Money functions to allow you to travel on public transport without having to buy a separate T-Money Card.

Price : From ₩50,000

You can also buy T-Money cards from stationery stores like ArtBox. ArtBox is a popular place to buy souvenirs and cute stationery. They also have their own line of T-Money Cards with ever-changing fun designs for you to collect. There is no T-Money balance and the cards cost more.

How Much Does The T-Money Card Cost?

The price of the T-Money Card is ₩2,500 for the standard T-Money Card that is sold at public transportation stations in Korea. This does not include any credit and you will need to add funds to the card before you can use it. The cost of the Korea Travel Card at Incheon Airport is ₩4,000 .

T-Money Cards from other locations, such as convenience stores and stationery stores, which include special artworks, typically cost more money. The cost of T-Money can be free when it is included in another service, such as the WOWPASS or Discover Seoul Pass.

Where Can You Buy Special T-Money Designs?

If you want to buy a T-Money Card with an interesting design, there are several options in Korea. The stationery store ARTBOX offers some cute designs with their own characters, as do convenience stores. These cards have the same functions as a regular T-Money Card and work the same way.

Please note: T-Money Cards with unique designs are a bit more expensive – around ₩5,000 to ₩6,000 per card. The base cost of a T-Money Card is ₩2,500. These can make nice gifts or souvenirs and as the T-Money Card doesn’t expire, you can use them every time you visit Korea.

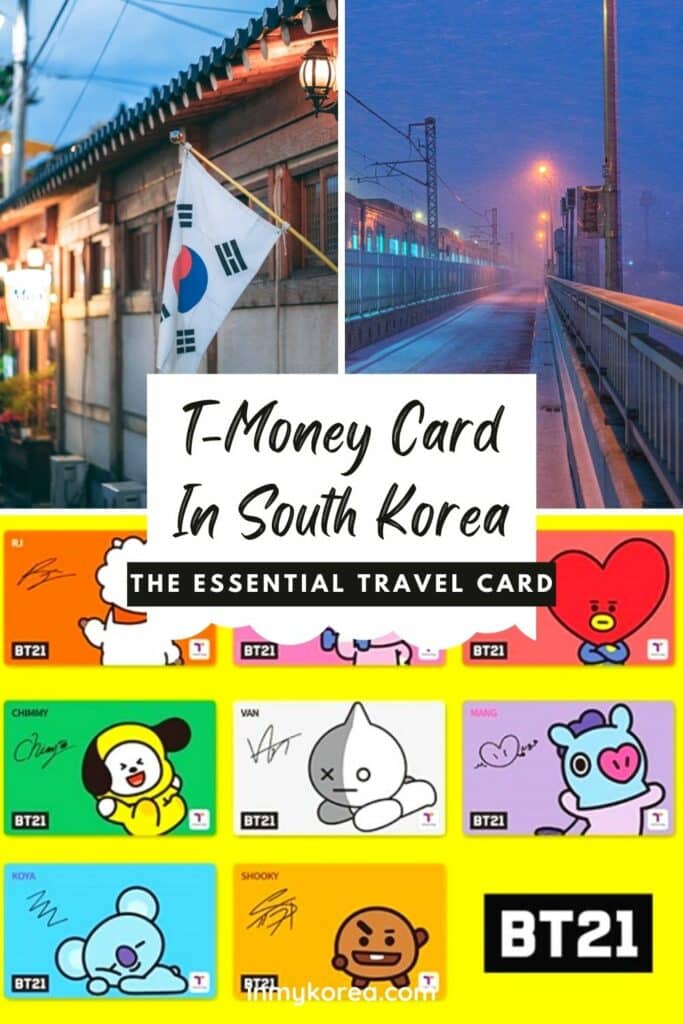

BTS-Themed T-Money Cards

BTS ARMY members may want to get a special souvenir of their time in Korea and can do so with a BTS-themed T-Money Card. These special edition BTS T-Money Cards work the same as regular T-Money Cards, but come with 7 different designs, one for each member of the hit group, BTS.

These aren’t widely available, and new versions replace older versions frequently. If you want to buy a BTS-themed T-Money Card, you can find them in some convenience stores or in K-Pop merchandise stores in areas such as Gangnam, Hongdae, or in the Dongdaemun Design Plaza.

Where Can You Use T-Money In Korea?

The T-Money Card is primarily a transportation card that can be used to pay for bus and subway journeys in most Korean cities . However, it also functions as a payment card that can be used to make small purchases in certain Korean shops, cafes, restaurants, and attractions.

If you bought the Korea Tour Card from the Incheon Airport Transit Centre, you will be eligible for discounts at tourist attractions, shops, entertainment, restaurants, and other locations. For example, you get 30% off entry fees at N Seoul Tower and 20% off entry fees at COEX Aquarium.

Here are the places you can use the T-Money Card in Korea:

Use T-Money On Buses

It’s really simple to use T-Money on Korea’s buses. Touch the T-Money Card to the card reader when you enter the bus to start your journey, then touch it again when you exit the bus. In most city buses in Korea you enter at the front of the bus and get off in the middle. There will be a T-Money Card reader in both locations.

Most bus journeys cost the same price, however, if your bus travels more than 10km, you will be charged an extra fee. If you don’t tap-off when you leave the bus, you may be charged this fee.

Use T-Money On The Subway

The T-Money Card is accepted on all subway systems in Korea, including in Seoul, Busan, Daejeon, and Gwangju, Touch the T-Money Card when you enter the security gates at the start of your journey, then touch again to exit. If you run out of credit, there are machines inside the gates to top-up (but you’ll need cash).

Like bus journeys, most short journeys on the subway will be the same fee. If you travel a long way on the subway, or make many transfers, the fee can be higher.

Transfer discounts : When you transfer between subway or bus rides within 30 minutes, you’ll get a discount on your next ride as long as you tapped-off when on your previous journey. Also, if you accidentally enter the wrong subway gate, you can leave within 10 minutes for free on some lines.

Use T-Money For Taxis

You can use a T-Money Card to pay for taxis in Korea . It’s quick, easy, and allows you to avoid using a credit card or having the right change. As long as the taxi driver has the T-Money logo displayed, you can pass your T-Money Card to the driver who will touch it to the card reader and complete the payment.

You can call taxis directly to you using the Kakao Taxi app, which is available on Android and iPhone and can be used in English, Korean, and Chinese. My guide to using Kakao Taxi will show you how to order and pay for a taxi in Korea.

Use T-Money For Shopping

The T-Money Card is really useful when you want to buy small items, such as a bottle of water, coffee, or some snacks. When you see the T-Money logo, you can use the card to pay for goods and services. You can use T-Money to pay for purchases in convenience stores (CU, GS25, Emart 24, 7/11).

You can use the T-Money Card in Korea’s supermarkets and chain stores, including Home Plus (supermarket) Emart (supermarket) Face Shop (cosmetics) Innisfree (cosmetics) Tony Moly (cosmetics) and others.

Using the T-Money Card for shopping : As the T-Money Card needs to be topped-up in cash (KRW), using it for shopping isn’t really that convenient. Instead, I recommend getting a WOWPASS in Korea, or bringing a travel money card like the Wise Travel Card or Revolut Travel Card .

Use T-Money In Cafes

Food and beverage outlets also accept the T-Money Card, including Starbucks, McDonald’s, Angel-in-Us Coffee, Ediya Coffee, Gong Cha Tea, and Paris Baguette and more.

It’s best to check for the T-Money logo before trying to pay with your T-Money Card or asking if T-Money is accepted. Again, using the T-Money Card is possible for this, but usually not the most convenient way to pay.

Use T-Money At Attractions

You can use T-Money to pay for entry fees for major attractions, including theme parks and sports stadiums, as well as other locations like pay-phones and vending machines.

Here are some of the locations you can use T-Money: vending machines, public pay-phones, Everland theme park, sports stadiums (including Wyverns Baseball Club), and at festivals (to pay for food and drinks).

Where Can’t You Use T-Money In Korea?

You can’t use T-Money to pay for intercity train tickets, including the KTX – Korea’s high speed train network. You also can’t enter intercity buses and pay with T-Money like you can when entering a regular city bus. However, you can use T-Money to buy intercity bus tickets and board with those.

Generally, the T-Money Card is accepted in major cities across Korea, especially destinations popular with tourists. If T-Money isn’t accepted, there will be other options available, such as using Cashbee or paying with cash.

The T-Money Card can be recharged (reloaded) at subway stations and convenience stores throughout Korea. Vending machines at subway stations are the easiest locations to recharge a T-Money Card and will also allow you to check your balance before or after the top-up

You can only top-up the T-Money Card with cash . Credit cards aren’t accepted for top-ups.

These machines can be found in each major city in Korea where you can use T-Money. They are available in Korean, English, Japanese, and Chinese. These T-Money recharging machines only accept cash and the T-Money Card can’t be reloaded with a credit card.

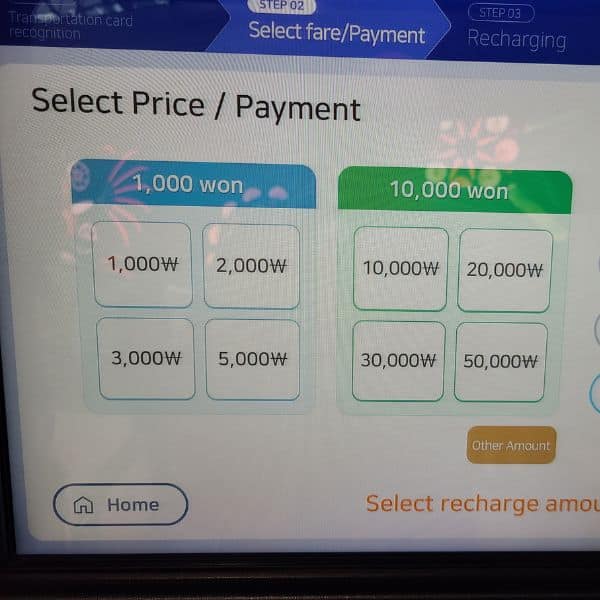

This is how to top-up a T-Money Card using a ticket machine in subway stations in Korea. The T-Money card can only be topped-up using cash and can’t be topped up using credit or debit cards or money transfers. This method works for other transportation cards in Korea, too.

1: Go to a ticket machine in a subway station

Go to a ticket vending or transportation card at a subway station. These machines are usually close to the entrance barriers to the subway inside the station.

2: Select ‘Recharge Transportation Card’

Change the language of the ticket recharge machine as desired, then select ‘Recharging the Transit Card’ or a similar option to begin to top-up your T-Money Card.

3: Select the value to top-up your T-Money Card

Select the amount of money that you wish to add to your existing T-Money balance. The screen should show you what balance the T-Money Card already has. New T-Money Cards usually have no balance. You can recharge the T-Money Card with as little as 1,000 Korean won.

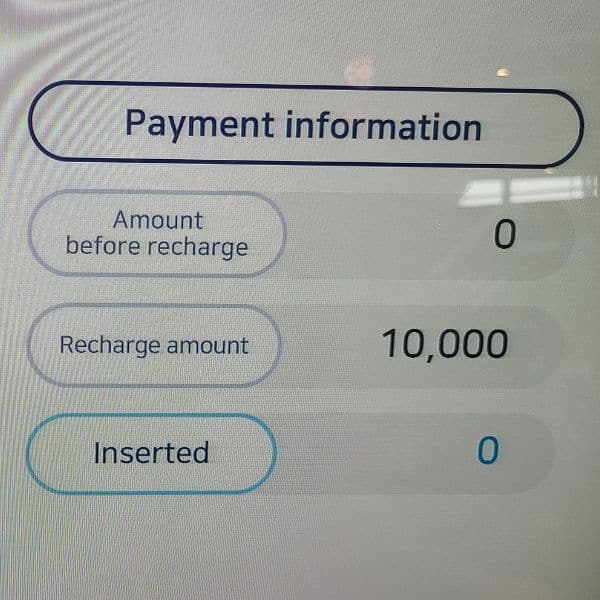

4: Confirm the value to top-up your T-Money Card

Once you’ve selected the desired amount you wish to top-up the T-Money Card with in Korean won, confirm the top-up value by pressing ‘confirm’ on the screen.. You should select the amount that you have available in cash as you can’t top-up the T-Money Card in any other way.

5: Insert cash to recharge your T-Money Card

To top-up a T-Money card, enter cash into the ticket vending machine up to the value you wish to top-up. Insert each bank note separately. Please note : only KRW can be used to top-up a T-Money Card.

6: Place the t-Money Card on the card reader

After inserting cash to top-up your T-Money Card, place your T-Money Card on the card recharge plate, which is usually located below the main screen of the recharging machine. Make sure the card is placed flat on the reader.

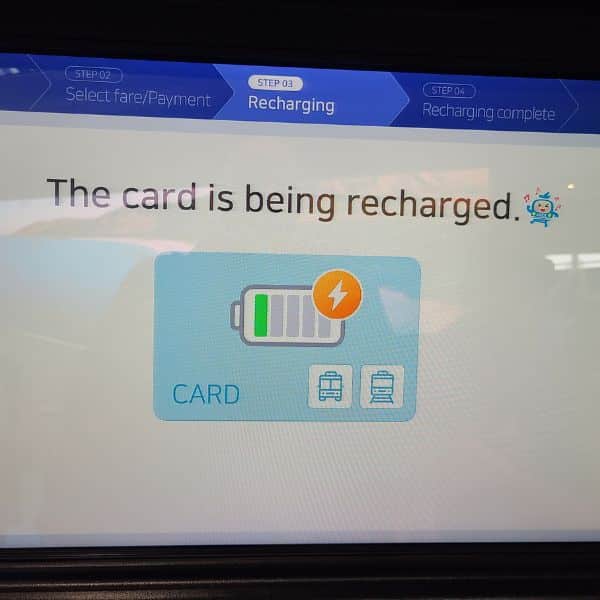

7: Wait for the T-Money Card to be recharged

The T-Money Card will be recharged once the recharging machine recognised the T-Money Card placed on the card recharge plate. Wait for the recharge to complete, which should take about 5 to 10 seconds in total.

8: Take the T-Money Card and start using it

Once the T-Money Card has been topped-up, take the card from the card recharge plate and you can use it to travel on the subway, on buses, and in other places. Tap to start your journey, and tap again when you finish.

Besides subway stations, you can also recharge a T-Money Card at a convenience store. The same rule about only charging with cash applies. You can’t recharge a T-Money Card with a credit or debit card. Here’s how to top-up the T-Money Card at convenience stores in Korea:

1: Go To A Convenience Store

Go to any major convenience store in Seoul or other towns and cities across Korea, including CU, GS25, Emart 24, and 7/11.

2: Ask To Top-Up T-Money

Show your T-Money Card to the cashier and ask to top-up the balance. Use Papago to translate into Korean if you’re not sure what to say.

3: Give the amount of cash to top-up to the cashier

You can only use cash to top-up T-Money balances, so make sure you have cash available to pay with. Give it to the cashier.

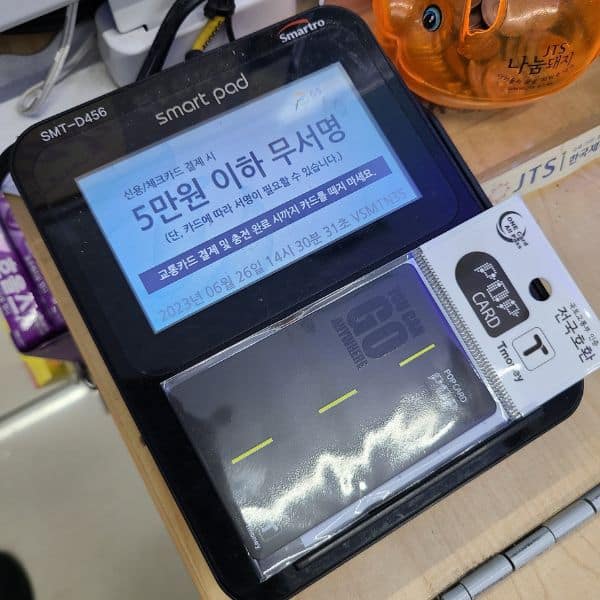

4: Place your T-Money Card On the Card Reader

Place your T-Money Card on the electronic card reader and wait for confirmation from the cashier that the balance has been updated.

There is a T-Money office at Seoul Station where you can ask for advice, purchase & reload the card, and get your remaining balance refunded when you leave Korea. T-Money Headquarters Address: 1st Floor. T-money Town, Seoul City Tower Building, Namdaemun-ro 5-Ga, Jung-gu, Seoul.

How Much Money Should I Add To A T-Money Card?

How much money to add to a T-Money Card depends on how you intend to use it. If you will use your T-Money Card mostly for transportation , I recommend adding ₩10,000 per day. This should cover all subway / bus travel costs within a city like Seoul, which cost ₩1,400 /₩1,500 per journey.

If you plan to use your T-Money Card to pay for small purchases , such as snacks, bottled water, and coffee, then add ₩20,000 per day, which includes transportation costs. A coffee in Seoul costs between ₩2,000 – ₩5,000, water is ₩1,000, and snacks from ₩1,000 – ₩5,000.

When you first top-up a T-Money Card, add ₩50,000 for the starting balance. This balance should last most travellers for a week if they use their T-Money Card just for bus and subway rides. You can check your balance during your travels and top-up when the balance gets low (under₩ 5,000).

Can You Recharge A T-Money Card With A Credit Card?

It is not possible to recharge a T-Money Card with a credit or debit card. Only cash can be used to top-up the T-Money Card. There are restrictions that only allow cash top-ups. The app version of T-Money can be topped-up by card payments or online transfers, but not physical T-Money Cards.

How To Your Check T-Money Card Balance

There are a number of ways to check your T-Money Card balance. When you use the T-Money Card on the subway or a bus, the electronic card reader will show you the fee for the ride and the remaining balance on your T-Money Card. This is the most common way to check your balance.

You can also check your T-Money Card balance at subway ticket machines and T-Money recharge stations. When you recharge your card, it will show your balance before you add credit. This is a good way to check your balance, even if you don’t intend to recharge the T-Money Card right then.

Using T-Money Mobile App To Check Your Balance

The T-Money mobile app is an online-only version of T-Money that doesn’t come with a card. Instead, you can use your phone’s NFC function to use your T-Money balance. You can also use your phone’s NFC function to scan a physical T-Money Card and check the balance when logged into the app.

However, I don’t recommend using the T-Money mobile app to check your T-Money balance. There have been reports by travellers in Korea that the app sometimes accidentally wipes the T-Money Card, making it useless. I can’t confirm this myself, but it is much easier to check your balance elsewhere.

How To Refund A T-Money Card Balance

You can refund the existing balance of your T-Money Card at major convenience stores and subway stations across Korea, as well as at the T-Money headquarters in Seoul. These are the locations you can top-up a T-Money Card. Refunds will be paid in cash and partial refunds aren’t possible.

There’s a ₩500 fee to refund a T-Money balance, which is deducted from the existing balance. The cost of the T-Money Card won’t be refunded, but you can keep the T-Money Card after the balance is refunded. The T-Money Card doesn’t expire, so you can use it if you visit Korea again.

The T-Money Card doesn’t expire. Keep it for future trips or give it to a friend who is visiting later.

Tip : The credit balance on the T-Money Card will stay active for 5 years from the date of the last top-up. If you plan to visit Korea again in the next 5 years and have a small balance left, it might be best to keep the balance on your T-Money Card so you don’t need to top-up the card when you return.

There are several alternative transportation cards to T-Money, including the Cashbee Card (pictured above), Namane Card, which uses Rail+, and varieties of the T-Money Card that offer slightly different benefits from the original T-Money Card. Here’s a summary of those cards and what they offer:

Cashbee Card

The Cashbee Card by Lotte can be purchased and used in most of the same locations as T-Money. You can purchase a Cashbee Card at convenience stores and subway stations across Korea. The CU chain of convenience stores only offers the Cashbee Card, not T-Money.

Like T-Money, the Cashbee card can be used to pay for journeys on buses and subway across Korea. Tap the card when you enter the bus or subway, then tap again when you finish your journey. Transfer discounts should also be applied. Cashbee can be used in Lotte shops, including Lotte Department Store and Lotte Cinema.

Where to buy : Convenience stores, subway

Namane Card

The Namane Card by KB Bank uses the Rail+ transportation card system by Korail, Korea’s national train service. One big advantage the Namane Card has over T-Money and Cashbee is you can use it to pay for train services, including Korea’s high-speed KTX trains.

The other big difference with the Namane Card is that you can personalise your card by uploading pictures of yourself or other designs you upload using the Namane app. The Namane Card is available from locations across Korea , including inside major train stations, department stores, stationery stores, and book shops.

Price : ₩7,000

Where to buy : Convenience stores, subway, Namane machines, online from Klook

Korea Tour Card

The Korea Tour Card was designed for tourists travelling to Korea and provides not only with the standard T-Money functions, but also offers lots of discounts . This is the version of T-Money that’s available at Incheon Airport.

Price : ₩4,000

Buy : Incheon Airport

Discover Seoul Pass

Price : from ₩50,000

Buy : Online from Klook

Creatrip X Bellygom Transportation Card

The Creatrip X Bellygom transportation card is a colourful travel card from Creatrip, which really stands out thanks to its bright pink picture of Bellygom, a popular Korean character that’s big on YouTube. With the ‘Decoration Card’ feature, you can make your own special transportation card, too. This makes it a lovely souvenir of your trip.

Please note : this card is a version of Cashbee and can be used and charged in all the same locations as Cashbee can.

This card comes with ₩5,000 loaded, which means you don’t need to worry about charging it at the airport (which should be done in cash). Simply collect the card at Incheon Airport (either terminal) or Gimpo Airport and then take the all-stop train straight into Seoul with it. It’s really convenient.

You can use the Creatrip X Bellygom transportation card to pay for public transportation across Korea, as well as in franchises such as Paris Baguette, Baskin Robbins, Angel In Us, and Lotte Mart.

Price : Around ₩10,200 (includes ₩5,000 balance)

Buy : Online from Creatrip .

Tip: The Discover Seoul Pass includes a free Airport Express journey from Incheon Airport to Seoul. This can be useful to get yourself into the city before you top-up the T-Money balance on the card. Find out more tips and ways to use the pass in my list of Discover Seoul Pass itineraries .

Is The T-Money Card Worth Buying?

So, if you’ve read all this and you’re still not sure if you should get a T-Money Card or not, here is a simple summary to show why you might want to get one. This is based on my personal experience of using a T-Money Card, as well as opinions shared from members of my Korea Travel Group .

For travellers who want to pay for transportation across Korea’s bus and subway networks, the T-Money Card will be perfect and an essential purchase. However, if you’re looking for a way to pay for goods, services, and attractions in Korea, then the T-Money Card isn’t really what you’re looking for.

Instead of the T-Money Card to pay for things in Korea, I recommend getting a WOWPASS or Wise Travel Money Card . These are both more convenient and allow you pay in Korea using your card’s balance, which can be topped up in foreign currency (WOWPASS) or by bank transfer (Wise).

Learn more : Check out my guide to using Wise in Korea to learn how to get a Wise card, who is eligible, how to activate the Wise card, and all the ways it can save on your travel money expenses.

The T-Money Card is really useful and I can’t imagine travelling in Korea without one. I’d recommend buying one when you arrive in Korea. If you want to know more about T-Money and its alternatives, you can find lots of useful information in my complete South Korea travel guide .

Here are a few quick tips to help you use the T-Money Card more effectively when in Korea:

1: Check the remaining balance as you travel so that you don’t run out by accident.

2: Don’t top-up too much. I’d recommend adding ₩50,000 starting balance and then ₩20,000 – ₩30,000 each time after that. Maybe less if you don’t plan to travel much.

3: Buy one as soon as you arrive. Get a Korea Tour Card at Incheon Airport.

4: Make use of the T-Money Card when you are shopping in convenience stores. You’ll end up with a lot less change.

5 : Store the T-Money Card away from other cards that can be used to pay by touch as card readers can be confused by multiple cards.

Frequently Asked Questions

Finally, here are a few FAQs about using the T-Money card in Korea, in case the above information didn’t cover enough for you. If you have any other questions you’d like to ask, feel free to leave a comment.

Where can I use the T-Money Card?

The T-Money Card can be used on public transportation in Korea, including for subway and bus journeys. Furthermore, the T-Money Card can be used to make purchases in convenience stores, cafes, shops, at vending machines, and in a range of attractions.

Can I use a T-Money Card on the subway?

The T-Money Card can be used on the subway in several cities in Korea, including Seoul, Busan, Daegu, Gwangju, Daejeon, and Incheon.

Can I use a T-Money Card to pay for taxis?

The T-Money Card can be used to pay for taxis where the T-Money logo is displayed. Be sure to check the card has the correct balance remaining to cover the taxi fare before using a taxi.

What happens if I run out of credit when using the T-Money Card?

If you run out of money on your T-Money Card when using the subway, you can top-up at a payment machine inside the subway stations before you enter or exit the station. When travelling on buses, you won’t be able to use the T-Money Card on the bus if there isn’t enough credit available. You will need to top-up your T-Money balance before boarding a bus.

Can I use the T-Money Card outside of Seoul?

The T-Money Card can be used across Korea, not just in Seoul. It can be used for public transportation in all major cities, as well as on Jeju Island. The T-Money Card can also be used for purchases in convenience stores, shops, cafes, restaurants, and attractions where the T-Money logo is displayed.

How much does the T-Money Card cost?

The base cost of the T-Money Card is 2,500 Korean won. This doesn’t include credit, which must be purchased separately. The cost of the card is non-refundable, but outstanding balances on the card can be refunded. T-Money Cards with unique designs cost more and the Korea Tour Card, which is available at Incheon Airport, costs ₩4,000.

Can I pay for the T-Money Card with a credit card?

You can purchase the original T-Money Card with a credit card, but you won’t be able to add credit or reload the T-Money Card with a credit card. Only cash is accepted for T-Money Card recharging.

Does the T-Money Card expire?

The T-Money Card doesn’t expire and can be used on multiple trips to Korea. However, credit balances on the card will expire after 5 years after the date of the last top-up or usage if not used. Once used, the 5 year period will be extended.

Which cities can you use the T-Money Card in?

You can use the T-Money card to ride the subway in Seoul and the surrounding Gyeonggi Province, Incheon, Daejeon, Daegu, Busan, and Gwangju. You can also use the T-Money card on bus networks across Korea, including all major cities. The T-Money can also be used for intercity buses. However, unlike city buses, it is necessary to buy tickets for these buses before you ride.

Where can you buy a T-Money Card at Incheon Airport?

You can buy the T-Money Card from multiple locations at terminals 1 and 2 of Incheon Airport. There is a transportation centre on Basement 1 level of Terminal 1 that sells T-Money Cards (Korea Tour Cards) in a vending machine. You can also buy T-Money Cards at Incheon Airport from convenience stores, such as 7-11 and GS25. The CU convenience store chain in Terminal 1 doesn’t sell T-Money Cards, only Cashbee Cards, which are similar.

Where can I create a personalised T-Money Card?

You can create your own T-Money Card with your own photos on the card at certain subway and train stations in Seoul. These include Seoul Station, Hongik University Subway Station, and Digital Media City Subway Station. Upload photos from your phone or take a photo in front of the machine. Once you’ve chosen your design, the card will be printed and will be ready to use once you’ve topped it up. You can top-up the personalised T-Money Card at nearby top-up machines at Seoul Station or subway stations across Seoul.

Support In My Korea Thanks for reading. If you want to help me to create more great content in the future, why not buy me a coffee? A strong coffee helps me write more and is a simple way to show gratitude for this free content.

Liked This? Pin It For Others

If you enjoyed reading this article, then please share this with your friends on Pinterest.

Related Articles

15 Best Places To Go Cycling In Korea: From Coast To Mountains

Korean Public Toilets: What Are Restrooms In Korea Like?

30 Best Korean Street Food: Seoul Street Eats To Try In 2024

Hi! My name is Joel, I'm the author of In My Korea and writer of this article. I've lived, worked and travelled in Korea since 2015 and want to share my insights, stories and tips to help you have the best experience during your trip to Korea.

I love learning more about Korean culture, hiking the many mountains, and visiting all the coolest places in Korea, both modern and traditional. If you want to know more about my story, check out the ' about me ' section to learn why I love living in Korea.

21 thoughts on “Korea’s T-Money Card Guide 2024: How To Buy And Use T-Money”

Quick question… For the Korean T-Card, is there ability to get a transaction history (or Ride History) of where I tapped my card?

For example, my Los Angeles Tap Card for my and kids use for Buses and Trains, I register the TAP Card… If I need to know Ride History, I can go the TAP card website and obtain “Ride History.”

I’ve not actually tried it, but you might be able to see the history if you use the T-Money app with the mobile version of the card.

I had a look on the T-Money site (which is very basic), but couldn’t see any details about it. I guess just try it and see is the best answer I can give, sorry. I use the card function myself but never see the history of it.

Great article. Plan on trip starting at Incheon Airport Apr 2023. Can both myself and my wife use the same card at the same time. ie. we get on and off a bus together. Like scan twice or will we each need a separate card? Thanks-Mark.

Hi, thanks for reading. You will need a separate card for each person travelling. On some buses you can ask to charge for two people, but that won’t work on the subway, so it’ll be easier to get one each.

Thanks for the info. Will get two cards, myself and wife. If people were traveling as a family, such as with children, using a “Family Card” of some type would be much easier. Thanks again. -Mark.

It would be much easier, yeah, I hope they consider it in the future.

Hi! I really appreciate the detailed information you’ve included about T-money!

I have some questions. I’m a foreigner and I’ll be teaching English soon. I’m already in South Korea (I arrived beginning of March).

I didn’t manage to get a T-money card at the airport as I had to quickly be picked up. I’m aware that I can purchase one at a convenience store near me.

As I have just arrived, there are things I don’t have yet, such as: 1) My ARC (Alien Registration Card) 2) Korean bank card – I have my home debit bank card (Mastercard). I also have cash in ₩ on me. 3) Korean SIM plan

Will any of this affect me buying and topping up my T-money card?

Thank you in advance!

Hi, welcome to Korea. None of those things will stop you getting a T-Money card or topping it up. However, if you’re going to sign up for a Korean bank card, you can ask to have the ‘pay-on’ feature in your bank card so it will work just like a T-Money card. Therefore, you won’t need to get a T-Money card once you have your bank account. People here don’t really use T-Money cards when they can use their bank cards.

Hi, thank you for this article. I just got a T-Money card from a Korean store here in India. It’s the BTS PROOF edition T-Money card. Sitting in India, I was wondering how I could recharge it right away? I am visiting Korea next month. 🙂

Hi, thanks for reading. You can recharge the T-Money card as soon as you arrive in Korea at the airport. Either recharge it at the travel centre at Incheon Airport, or go to any convenience store and ask them to add credit to it. You can only top up with cash, so you’ll need some Korean won to do that. Have a good trip.

Thanks for the info… We’re a family of 4(2 adults & 2 teens), do we need to purchase 4 T-Money cards?

Hi, yes, each person will need a T-Money card.

A detailed guide of someone who has done his research/has a lot of experience with the card. Well done!

Thanks very much 🙂

Hi there! I have Cashbee cards from a previous trip, I can’t remember why I picked those over T-money cards last time around but suppose if I did it’s because they were fairly equivalent. Do you know if that’s still the case? No reason for me to leave them at home and get T-money cards, right?

Cashbee does work, yeah, but it’s not as widely used outside of the major cities. As per their own website “Transportation : Bus, Subway, Taxi (Some buses at Jeonnam, Jeonbuk, Gyeongbuk, and Gyengnam Will be available later on.)” Those are all large provinces in Korea and if you plan to travel to more places in Korea, T-Money might be a better option as it works in those places (as far as I know). The only place I’ve had a problem with T-Money is Sokcho, so maybe bring both just in case.

Hi! Thank you so much for the info. For the T-money vending machines in the airport, do they open 24 hours? My flight arrives at 2AM-ish, and I wonder if I can still get the t-money 😀 Thank you

Yes, they should be open 24 hours. I haven’t actually checked in the early hours of the morning, but I don’t see any reason for them to turn them off. If the machines aren’t available, you can always try at a convenience store instead.

Thanks a lot!

Is it still 2,500 Korean won, (Feb 2024) if you know?

I believe the base card is still 2,500 KRW, but the cost depends on where you buy it. Most places at Incheon Airport charge a bit more because they offer T-Money cards with their own designs, but usually no more than 3,000 or 4,000 KRW. If you get a WOWPASS , which is only 5,000 KRW, you get a T-Money card included with that.

Leave a comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

- Interactive Map

GNB menu Open Search box Show

- Visit KOREA Instagram

- Visit KOREA Twitter

- Visit KOREA Facebook

- Visit KOREA Youtube

Interactive Map GNB menu Open Search box Show

Weather 04-29-2024

Seoul/Gyeonggi-do/Incheon

Temperatures

Exchange Rates Travel Calendar

Sign in as a member

Link one of the following accounts to sign in as a VisitKorea member

Notice on Gathering Information

Done Cancel

Enter your personal information from the list below.

Field of Interest

※Pick at least three fields of interest.

- Accommodations

- Transportation

- History / Tradition

- Urban travel

- Festivals / Performances / Events

- Leisure / Sports

- Entertainment / Arts

- Theme parks

Transportation Cards

Home Transportation Useful Tips Transportation Cards

Some attractions subject to closure or limited entrance due to COVID-19. Please check before visiting.

Tmoney and Cashbee are transportation cards that can be used on public buses and subways in several different metropolitan cities and locations throughout the nation. With this transportation card, travelers can save the hassle of purchasing single journey subway tickets for every ride and enjoy discounts on rides during transfers from one bus to another, one subway line to another, or from bus to subway or vice versa (within a transfer time limit). Tmoney cards can be divided into a basic Tmoney card, integrated cards, foreigner exclusive cards, customized card, and mobile Tmoney. Tmoney cards can be used as a transportation card as well as a method of payment at affiliated stores. Cashbee card also functions as a transportation card and a method of payment at affiliated shopping centers and convenience stores.

From 2,500 won

Areas of use

Retail locations.

Convenience stores (GS25, CU, 7-Eleven, Ministop, etc.) bearing the Tmoney or Cashbee logo in areas of use listed above. * Tmoney card can also be purchased from ticket vending and card reload devices inside subway stations within the Seoul metropolitan area.

Reload & refund locations

All retail locations * Card price and service fee of 500 won are not refundable. Travelers are advised to load their card in small amounts as the refund process for over 50,000 won can be complicated and time-consuming.

To use the card for public transportation in Seoul, you must tap your card when boarding and getting off buses or entering and exiting subway stations. Transfer discounts are also available, limited to four times a day, within a transfer time limit of 30 minutes (up to 1 hour from 21:00 to 07:00 next day). However, the transfer discount will not apply if you are transferring to the same numbered bus even if it’s within 30 minutes or re-entering the same subway station after exiting.

Upon boarding the bus, place your card on the sensor located at the front of the bus until it beeps. The sensor will display the amount charged on the top and the remaining balance at the bottom. Before getting off the bus, place the transportation card on the sensor located at the rear doors of the bus until it beeps. If you do not tap your card before getting off the bus, you will not be able to benefit from the transfer discount.

Place your card on the sensor located on top of the subway turnstile until it beeps. The sensor will display the amount charged on the top and the remaining balance at the bottom. If you are transferring, the amount charge may appear as “0” (zero). Upon arriving at your destination, tap your card at the sensor on the turnstile again in order to exit.

In a taxi with the Tmoney or Cashbee logo affixed, inform the taxi driver that you want to pay with a transportation card, tap your card on the terminal, and your taxi fare will be automatically paid from your transportation card’s balance. However, please note that this payment method will only work if there is enough balance on your card to pay the full fare.

Seoul Transportation Fare Information (Transportation Card vs. Cash)

<mode of transportation>.

- Adults: Tmoney: 1,250 won / Cash: 1,350 won

- Teenagers: Tmoney: 720 won /Cash: 1,350 won

- Children: Tmoney: 450 won /Cash: 450 won

Blue Bus (main line bus) / Green Bus (branch bus)

- Adults: Tmoney: 1,200 won / Cash: 1,300 won

- Teenagers : Tmoney: 720 won /Cash: 1,000 won

Green Bus (village bus)

- Adults: Tmoney : 900 won / Cash : 1,000 won

- Teenagers: Tmoney: 480 won / Cash: 550 won

- Children: Tmoney: 300 won / Cash: 300 won

Yellow Bus (circulation bus)

- Adults: Tmoney: 1,100 won / Cash: 1,200 won

- Teenagers: Tmoney: 560 won / Cash: 800 won

- Children: Tmoney: 350 won / Cash : 350 won

Red Bus (rapid bus)

- Adults: Tmoney: 2,300 won / Cash: 2,400 won

- Teenagers : Tmoney: 1,360 won / Cash : 1,800 won

- Children: Tmoney: 1,200 won / Cash: 1,200 won

- Adults: Tmoney: 2,150 won / Cash: 2,250 won

- Teenagers : Tmoney : 1,360 won / Cash: 1,800 won

* Children and teenagers are eligible for discounts only upon registration of their date of birth at the retail location after card purchase. (ID required. Adults who take advantage of youth discount privilege are subject to a fine of 30 times or more of the card price.)

* To use the subway with cash, purchase a single journey ticket from the ticket vending machines. The fare will depend on the final destination, in addition to a 500 won deposit. The deposit can be obtained by returning the card to a Card Refund Deposit machine after exiting at the final station.

* Distances under 10 km by subway cost the base fare, with an additional 100 won charged for each 5 km increment for travel distance 10-50 km, and 100 won additional for each 8 km increment over 50 km.

How to Use Tmoney Card Reloading Device

- Tmoney: www.tmoney.co.kr (Korean, English) - Cashbee: www.cashbee.co.kr (Korean, English, Chinese)

Related pages

- City Buses - Subways - Taxi

This page was last updated on September 10, 2021, and therefore information may differ from what is presented here.

T-Money Cards in Seoul – A Complete Overview for Foreigners

Overview hide, where can you buy t-money cards, how much do t-money cards in seoul cost, how/where can you recharge your card, can i get a refund for the balance left on my t-money card, how do i use my t-money card, should i rescan my card when exiting the bus.

A rechargeable transportation card is a must for any foreigner traveling to Korea . South Korea’s transportation system runs on rechargeable smart cards and smart devices. These smart cards are called T-Money cards in Seoul . They are used for subways, buses, taxis, and at some convenience stores like CU/GS25/7-Eleven. T-Money cards are embedded with chips that are readable by card-reading machines. These machines are installed in all Seoul subways, buses, and taxis. However, you don’t have to get a card as this chip technology can be put into key chains, rings, bands, and even portable memory sticks. Below we will guide you through the most commonly asked questions regarding T-Money cards in Seoul . If you have any additional questions, feel free to leave your questions in the comments below.

You can buy T-Money cards at most retail convenience stores, such as GS25 , CU, 7-Eleven, and kiosks near bus stops. They can also be purchased inside subway stations if they have T-Money Card machines that dispense Them. The newer rechargeable machines will all have options for buying a T-Money card.

If you want to immediately buy your T-Money card when arriving at Incheon International Airport, there will be a CU convenience store near Gates 5 and 10 of the Arrival section.

Depending on the design, a T-Money card will cost between 2,500 and 5,000. You can get your T-Money Card with your favorite K-pop star or group.

You can recharge your T-Money card at most retail convenience stores, such as GS25, CU, Ministop, and 7-Eleven. Place the card on the card reader and pay the cashier the amount you want to go on the card. However, most people charge their T-Money cards at subway stations. There are charging machines inside all subways.

There will be an English option that will guide you through the process. Through this machine, you can reload your T-money card or even purchase a new T-money card. In order to recharge your T-money card, simply place your T-money card in the charging area and select the amount of money you would like to add, insert your cash and the T-money card will be loaded with that amount.

Yes! This is something most foreigners who visit Korea don’t know. Most take their T-Money card with a balance when they leave Korea. However, you can get a refund by handing your T-Money card to any staff member inside Subway Station’s help desk. The refund will be given in cash (Korean won) along with the card. Just ensure it is not over 20,000 won, as that is the max they will be allowed to refund.

For subways, there will be an area with a “tab here” sign where you can put the T-Money Card. Tap your T-Money Card, allowing you to go through the turn gate once scanned. The card balance will be shown immediately, so you will know exactly how much you have remaining on your card. All you have to do for buses and taxis is tap the NFC area. You can even pay with your T-Money card at convenience stores. Therefore, if you ever need a quick Korean snack , pay using your T-Money card.

Yes! When transiting to another bus or subway, you will get a 100 won fare discount. You will get the added discount if you’re transferring within 30 minutes. Make it a habit of scanning your T-Money card when exiting a bus, even if you don’t think you will be transferring.

Now armed with this information, it is time for you to check out all the free things to do in Seoul .

SeoulSpace covers Korean Culture, Lifestyle, Kpop, and Korean Entertainment. Bringing you a complete overall view of the Korean Wave.

The Best Korean Dramas from the Year 2000 to Present

- July 17, 2023

Top 20 Kpop Entertainment Companies – Ranked

- July 19, 2023

You May Also Like

Top 10 Best Korean Variety Shows and Reality Shows of all time

10 Tips for the Boryeong Mud Festival – Best Festival in Korea

- April 1, 2024

5 Amazing Cultural Experiences in South Korea to Try When Visiting Korea

The 10 Best Pensions in Korea to Visit

- March 15, 2024

Top 10 Coolest Places to Visit in Seoul – Updated

- March 7, 2024

- Influencers

Top 10 Korean Mukbang Youtubers with the Most Subscribers

10 Best Gifts From Insadong Recommended by Locals

10 Things to do in Dongdaemun for locals and tourists

Hallo, Can I use the TMoney Card also to travel form Seoul to other places in Korea and in other provinces? What is the best deal to buy separate cards for sim and transport or 2 in 1?

Leave a Reply Cancel reply

You must be logged in to post a comment.

Input your search keywords and press Enter.

Unlock more content

All the insider's travel tips in Korea

Survival Tips for Travelers to Seoul: T-money Card

In South Korea, travelers can buy a Single Journey Ticket or a rechargeable card called T-money Card . We advise you to get a T-money Card as it is a magic wand that will make your journey super convenient!

These cards can be used not only for all the buses, subway, and taxis but also as a method of payment at affiliated stores.

1. Where to Buy Your T-money Card

You can easily purchase the basic T-money Card at retail convenience stores, such as CU, GS25, Ministop, and 7-Eleven. The card itself costs KRW 3,000 . There is a variety of T-money cards with cute designs from Kakao Friends, BT21, and many more. These special T-money cards can cost extra money.

If you’re already in Seoul, you can even find T-money cards of your favorite idols and celebrities at vendors in Myeongdong and Hongdae underground shopping centers.

2. How to Reload or Refund T-Money

There are 3 ways to recharge your T-money Card.

1) Use a ticket vending machine that is located inside all the subway stations and train stations.

- Select your preferred language on the screen (Korean, English, Japanese, Chinese).

- Click the third button with the T-money logo on the far right and touch the “Reloading the transit card” button.

- Place your card on the loading pad and then select the amount of money you want to add.

- Insert a coin or cash and wait briefly while your T-money card completes reloading.

- Confirm your T-money card’s balance.

2) Newstands near a bus stop with a display of the T-money sign. You can find them usually next to the subway station exits and entrances.

3) Head over to almost any convenience stores. This is the easiest way to recharge your card! Just hand your card to the cashier, let them know how much you’d like to add and pay.

Tip: Some Student IDs offer the T-money card service, but may not be recharged at convenience stores. Therefore, find the closest subway station to reload your card.

Top-up: You can top-up the card in the unit of KRW 1,000, in the range of KRW 1,000 to KRW 90,000. The amount of money deposited in the Tmoney card may not exceed KRW 500,000.

Refunds: You can get a refund at all retail locations, however, the card price and service fee of KRW 500 are nonrefundable. Partial refunds are available only for amounts between KRW 10,000 and KRW 50,000 and will be refunded in units of KRW 10,000. (Plate money cards only) Therefore, it is suggested to charge your T-money card up to KRW 50,000.

3. How to Use T-Money

First, you should keep in mind that you must tap your card when boarding and getting off buses or entering and exiting subway stations. Transfer discounts are available, but they are limited to four times a day , within a transfer time limit of 30 minutes (up to 1 hour from 9pm to 7am the next day). If you are transferring to the bus with the same numbers or re-entering the same subway station after exiting, the transfer discounts won’t be applied even if you are transferring within 30 minutes.

1) Bus: When you get on the bus, place the card on the sensor. It will tell you how much money has been charged and remained. If an error occurs, give it a second or two, and try again. If this continues, the bus driver will let you know what the issue is. When you exit the bus, tap the sensor one more time to get a discount on the transfer. If you don’t tap your card before getting off the bus, you won’t be able to get the benefit of a transfer discount. You can enjoy 4 discount transfers in a day.

- Tip : Make sure you tap your card again and you hear a beep. If you don’t, you will be charged extra for the distance traveled.

2) Subway : When you enter the subway station, place the card on the sensor until it beeps. It will show the amount charged on the top and the remaining balance at the bottom. If you are transferring, you won’t be charged and the amount that appears on the sensor will be zero. Tap your card again upon arriving at your destination and then you will be able to exit the gate. If an error occurs, press the red “help” button, and the staff will come and help you.

3) Taxi: Not all but some taxis do accept T-money as a form of payment. Look out for the signs of the “T money” logo on the taxi and inform the driver that you want to pay with a T-money card. Please be aware that you should have enough balance on your T-money card in advance to pay the full fare.

When you arrive at your destination, simply tap your card on the sensor and the screen above the gray box (see picture below) will let you know your remaining balance.

4. T-Money Only for Foreigners

1) unlimited data sim card (5~60 days) + t-money card.

If you need a SIM card and T-money, get this data-only SIM card & T-money combo to stay connected 24/7! You can conveniently pick it up at Incheon International Airport Terminals 1 & 2, Gimpo International Airport, and Gimhae International Airport (Busan). You can still use the T-money card even after your SIM card expires. Click here to get 17% OFF on Trazy!

2) Discover Seoul Pass

With Discover Seoul Pass , you can explore the tourist attractions in Seoul with special discounts! You can gain free admission to over 50 major tourist destinations in Seoul including palaces, museums, and more. Check out the free admission attractions here . Also, you can take advantage of getting 10~15% discounts at over 100 tourist sites including traditional experience and DIY activities. Check out the special discount benefits here . The pass duration options are 24, 48, and 72 hours . You can pick it up at Incheon International Airport Terminals 1 & 2, Gimpo International Airport, and Myeongdong Tourist Information Center. The t-money card function is optional.

3) Korea Tour Card

With this card, you can enjoy various discount benefits for shopping, F&B, culture, tour, and entertainment, such as ski resorts, aquariums, theme parks, and many more! It costs KRW 4,000 and you can buy it online on the Korea Tour Card website or on-site at various service points . To pay public transport fares using this card, you should top-up it at a convenience store or a subway station. Up to KRW 500,000 can be loaded and only Korean Won is accepted. Check out more information here .

4) AmazingPay T-money

With this card, you can get a 10% discount when taking an airport limousine! There are also discount benefits for various tourist attractions, F&B, and cultural performances, such as Lotte World, 63 Square, NANTA, and many more. It costs KRW 50,000 (credit KRW 46,000 + card fee KRW 4,000) in cash only (Korean currency). You can buy it at the airport bus ticket office (No. 4 & 9 gates at 1F Incheon Airport Passenger Terminal) or CU Incheon International Airport branch. Check out more information here .

5) Alipay T-money

This is a T-money card for Alipay users, the payment app used by most Chinese people. It’s KRW 23,500 (credit KRW 20,000 + card fee KRW 3,500) and it’s available for purchase on the Alipay in Chinese Yuan. The price in Yuan is subject to change according to the daily exchange rate. It can be used for shopping at retail brands, including convenience stores, marts, bakeries, cafes, theme parks, cosmetic shops, and many more. Check out more information here .

If you’re looking for a train pass that travels throughout all Korean regions, we recommend a KR Pass or an Express Bus ! Also, don’t forget to read the blogs below to learn more about the transportation system in Korea for your hassle-free trip.

A Complete Guide to Public Transportation in Seoul

- Getting Around Seoul: Finding the Right Travel Pass

- How to Travel by Train in South Korea Pain-Free with KR Pass

Don’t forget to visit Trazy.com , Korea’s #1 Travel Shop , for more tips and advice about new locations and things to do in Korea!

[Photo Credit]

- Newsis.com (https://newsis.com/ar_detail/view.html?ar_id=NISX20160502_0014058544&cID=10401&pID=10400)

- Business Korea (https://trazy.com/things-to-do/korea?ch=0004&label=tmoney card guide&link_id=14786)

- inews24.com (http://www.inews24.com/view/738044)

- News Wire (https://www.newswire.co.kr/newsRead.php?no=306729)

- VisitKorea Official Website

- Korea Smart Card

- T-money Official Website

61 thoughts on “ Survival Tips for Travelers to Seoul: T-money Card ”

- Pingback: Know more about Transportation Card in Seoul | Tourders Story

- Pingback: Know more about Transportation Card in Seoul | 360 Travelling

Thanks for the run down on t-money cards! We’re on a bus in Busan now and your post helped us immensely. 🙂

Hello Thomas & Katherine! Very glad to hear that it helped you guys out. 🙂 Have a great trip in Busan!!

If you need to purchase a t-money card once you are in s.korea, is the money you pay for the card in us dollars or korean dollars. I will be going to S.K in a few months and will be there for about 10 days

Thanks so much for this! I will be traveling to SoKor for the first time and I am gathering as much info as possible. Thanks again!

You’re welcome. Hope you have a great time in South Korea! 🙂

- Pingback: Trazy’s Survival Tips for Travelers to Korea: Seoul’s Public Transportation System – TRAZY.COM

Hi, thank you for your informative post! I have a question though, it is possible to recharge the T-money in Busan? I have read somewhere that you can use the T-money in Busan but not able to recharge it there.

Hello! The T-money card itself is rechargeable, so it is possible to recharge T-money in Busan as well. 🙂

Thank you so much for your prompt reply!

You’re welcome!

Hi, I was wondering because we are travelling to Busan first before heading to Seoul. Would we still be able to get a T-money card or do we need to purchase another card instead in Busan?

Hello jbeano! If you are going to travel both Seoul and Busan, we recommend you to purchase T-money card as you can use the card in both cities. Hope this answers your question! 🙂

hi there is it possible to recharge t money card using my credit card as payment? thank you

Hi memee manaol! Credit card option is not available for tourists. Please be noted that it’s available only for very limited credit cards which are issued in Korea. Instead, you can recharge T-money card at any subway stations and convenience store with T-money sign with cash.

HI THERE TRAZY THANK YOU SO MUCH. YOURE REPLY WAS SUCH A RELIEF! SO HELPFUL. THANKS AGAIN.

HI AGAIN TRAZY IM PANNING TO GET AN EG SIM CARD BUT NOT SURE WHICH ONE TO GET. MAY I ASK THAT IF I GET THE UNLIMITED ALL DATA WILL I BE ABLE TO USE VIBER ON THAT SIM. BECAUSE ALL DATA SIM CARD DOESNT ALLOW CALLS INCOMING OR OUTGOING. I WANT TO KNOW HOW IT IS WITH VIBER? THANKS AGAIN

Hi memee manalo! We advise you to purchase this SIM card via the link, https://www.trazy.com/experience/detail/korea-sim-card-prepaid-mobile-data-eg-sim-card . With this SIM Card, you are able to use mobile data and also make or receive local and overseas voice calls. Hope this info helps!

Hi, I am traveling to Busan first, before going to Jeju & Seoul. Is it possible to buy T-money card in Busan? Where can I buy it in Busan? According to some references I found, there are Hanaro Card & MyBi Card available in Busan.

Hello Lilik! Sorry for the belated reply. Yes, it’s possible to buy T-money card in Busan at convenience store chains like GS25, CU and Seven Eleven, or from ticket vending and card recharging devices inside subway stations as well. We highly recommend T-money Card because you can use it in both cities, Busan and Seoul, where as the usage of Hanaro Card and MyBi Card is limited to Busan and its neighboring cities. Hope this info helps! 🙂

Hi thank you very much. Your information is really helpful.

Hello! May i check if the T-money card price is still 2500won and is it possible to top-up ~10,000won for the first time or is there an fixed amount? Thanks!!

Hello JyKel! Yes, the basic T-money Card costs 2,500 KRW and there is no fixed amount when you charge for the first time. You can top up any amount from 1,000 KRW to 90,000 KRW at a time and up to 500,000KRW in one day. Hope this answers your question! 🙂

Kindly update your article please! the basic card itself is 4,000 won and maybe your article is too old and you haven’t updated the new price.

Hello, thank you for your comment. The basic card itself is 3,000 won. We will make every effort to update the article as often as we can. Thank you!

Hi Trazy, I would like to recharge my T-money card with credit card. You mentioned that it is possible to do that in convenience stores. Do all stores accept that? 7-11, GS25, CU? Could you teach me how to request for credit card topup in Korean? Would be really helpful!

+are there any extra charges by using credit card to recharge the T-money card?

Hi Kinlet 🙂 Unfortunately, the credit card option is available only for those who have a specific credit card (Pop-new Woori V Card), which is issued in one of the banks in Korea. If you are planning to visit T-money card during your trip in Korea, please top up the balance at any convenience store/subway stations in cash. Recharging is available at any convenience store that has the T-money sign at the entrance.

Thank you Trazy! was hoping to not bring so much cash but no choice ><

Where can I top-up a T-Money card using Credit Card for payment?

Hi Garry 🙂 If you are a traveler, credit card option is not available. Please recharge your T-money card at subway stations or at a convenience store with cash. If you have a credit card issued from Woori Bank (one of the banks in Korea), you can top up at Woori bank ATMs or at GS convenience store.

hi trazy, i am travelling from seoul to busan. i have purchased from your guys the Seoul Discovery Pass which also acts as a T-Money Card. As i understand from your replies above, the T-money option is available in Busan for top up and usage in Metro and Buses. How about using the T-money for purchases at shops? Also how about refunds? if i have balance money, how do i get a refund?

Hi Bob Yu, Unfortunately, we do not provide booking service for the Discover Seoul Pass at the moment. T-money purchase is available depending on the shop. We highly recommend you to check the details directly with each shop 🙂

My family of 4 is traveling in Korea next week. Can we all use the same T-money card and scan it 4 times to ride the subway, or do we each need a card? Can we purchase it with U.S. dollars, or do we need to convert to KRW first? Thanks.

Hi Janel 🙂 Unlike public buses, each person must have their own T-money card to use the subway. T-money card can easily be purchased at retail convenience stores such as CU, GS25 and 7-Eleven. The card itself costs from 2,500~4,000 KRW (USD not available) depending on the design.

Hi. does my son (below 2 years old) need to have t-money card to use the subway too? or he can travel using the subway for free?

Hi Dye, Children under 6 years old are free of charge (up to 3 children). Your son may use the subway for free in Seoul.

Hi, Can i use the T-money card to take intercity bus from Busan to Gyeongju and local buses in Gyeongju? Thank you.

Hi May, It is not possible to purchase intercity bus tickets with T-money card but you can use it for local buses in Gyeongju.

Hi Trazy. I have two tmoney cards, one is empty and the other has some cash. Can I pass the money from one to another?

Hi, Vitoria! Please inquire it to T-money customer center.

Hi, I live in Muju and want to try using it on the buses (they use Cashbee but I know its interchangeable). Do I need to tap on AND off? I have seen people who use Cashbee only tap on and NOT off. I’m just confused, I don’t want to be charged twice. Thank you!

Hi Ayunda! We are sorry for the late reply. If you aren’t transferring to another bus or metro, you don’t need to tag the card when you get off from the bus.

Hi Trazy! Do you happne to know where to get the tmoney cards from gimhae airport? I’ve read online that it is pretty difficult to get it there a few years back. So I’m wondering if its more common now. Look forward to your reply!

Hi Joshua! You can purchase the Tmoney card at most of the convenience stores in Korea.

Hi, If I use the Discover Seoul Pass as a Tmoney does the first use of Tmoney start the countdown of my 72 hours or does it only begin after I use it for free admission to an attraction?

Hello, please send your inquiries to [email protected] Thank you!

Can I top up my T money card with American Credit cared or debit card or you have to use only cash? If cash, can I use US dollars?

Hello, we couldn’t find information that T money card can be recharged with overseas credit card or debit card. We recommend you to use cash in Korean won. Please check the link https://www.t-money.co.kr/ncs/pct/ugd/ReadFrgnGd.dev for more accurate information. Thank you!

Hi.. ive had a problem with my tmoney today.. ive been lacked of balance when i exit.. and i had no choice but to exit and reload my card.. when i enter again the subway it works.. but when i exit again error comes.. whenever i tap it it says error.. i had no xhoice but to exit again.. would there be a problem for me here in korea?

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- All about SIM Card

- All about WiFi

- Korea Travel Itineraries

- Getting Around Korea

- National Holidays

- Top 10 Things to Do

- Deoksugung Palace & Jeongdong Walking Tour

- Secret Garden & Bukchon Hanok Village Walking Tour

- Seoul K-drama Shooting Spots Walking Tour

- Namsan Park & N Seoul Tower Evening Hiking Tour

- Seoul City Wall & Ihwa Mural Village Walking Tour

- Seochon Village Walking Tour

- Seoul Hiking Tour: Inwangsan & Bugaksan

- Everland Guide

- Everland Ticket & Packages

- Lotte World Guide

- Discount Tickets

- Han River Cruise Guide

- Han River Cruise Ticket

- Hanbok Rental Service

- Hanbok Rental Guide

- Nami Island Guide

- Nami Island Tours

- The Garden of Morning Calm

- DMZ & JSA

- DMZ & JSA Tours

- Mt. Seoraksan

- Jeju Popular Attractions

- Busan Popular Attractions

- Rest of Korea

- Cherry Blossoms

- Spring Must-Dos

- Water Activities

- Summer Must-Dos

- Autumn Foliage

- Autumn Must-Dos

- Ski & Snowboard

- Winter Must-Dos

- Festivals & Events

- K-Pop & K-Drama

- K-Beauty Guide

- Visit Trazy.com

- General Tips

- Beauty, Hair & Skin Care Service

- Korea Shopping Guide

- Food & Restaurant Guide

- Cooking Class & Food Tours

- Survival Tips

Related Post

Waste disposal & recycling in korea, getting around seoul: finding the right travel pass in 2024, how to get a residence card (formerly arc) in seoul, guide to sim cards in korea | by pick-up location, all about korea sim card 2024.

Korean T-money Card Quick Guide

Korea is a country where cash is rarely used, even when using public transportation. Instead, most people use credit cards with transportation card functionality. By using a T-money card , you can enjoy a more convenient and affordable trip in Korea!

1.1 What is T-money?

Think of T-money as a transportation card used in Korea. It can be used on buses, subways, taxis , and more throughout the country. You can also use it at convenience stores, vending machines, Starbucks, Dunkin’ Donuts, and other places displaying the T-money mark.

1.2 How to Use

Tmoney is a rechargeable card that eliminates the hassle of purchasing bus and subway tickets each time. When you use the card for transportation, you automatically receive a discount of around 100 won. Additionally, if you transfer within 30 minutes (between bus-subway or bus-bus), you can use the transfer with just a small additional fee. However, transfers within the same bus route are excluded.

To Purchase and Recharge

2.1 how can i purchase t-money in korea.

You can purchase and recharge T-money at convenience stores with the T-money mark and subway self-service machines . The transportation cards are sold for around 3,000 to 5,000 won. Purchasing and recharging can only be done with cash , and you can recharge in increments of 1,000 won (ranging from a minimum of 1,000 won to a maximum of 90,000 won per recharge). Using the self-service machines at subway stations is a convenient way to recharge.

2.2 Additional Discounts for Children and Teens!

If you are traveling with children or teens, pay attention to this. When purchasing the card, you can register their date of birth at the point of purchase to receive additional fare discounts for children and teens. While it’s also possible to register on the Tmoney website, it doesn’t support English, so it’s recommended to register at the point of purchase. You can receive discounts ranging from 20% to 50% , so don’t miss out on the benefits!

When using buses or subways and getting off, don’t forget to tap your transportation card! Otherwise, additional fees may be charged.

3.1 Transfers

With T-money, you can make transfers within 30 minutes . If you transfer between buses and subways or switch to a different bus route, you can enjoy discounted fares. Depending on the distance, you can use other modes of transportation for a reduced additional fee of around 100 to 400 won.

3.2 Refunds

If you still have a remaining balance on your Tmoney card when you’re leaving Korea, there’s no need to worry too much. You can receive a refund for the entire amount, excluding a refund fee of 500 won, as long as your card is still functional. You can utilize this refunds service at convenience stores or customer service centers within subway stations.

Korea Tour Card: T-money Card for Foreigners

Among the T-money cards, there is a T-money card specifically for foreigners. It can be purchased directly at Incheon Airport and Gimpo Airport for 4,000 won . In addition to the same transportation card discounts, it provides additional discounts for shopping, restaurants, performances, and more!

Please refer to the Korea Tour Card website and the accompanying leaflet for more details on how to make the most of this card.

Leave a Comment 응답 취소

다음 번 댓글 작성을 위해 이 브라우저에 이름, 이메일, 그리고 웹사이트를 저장합니다.

- Accomodation

- Attractions

- Food & Drink

- K-Entertainment Tours

- Korean Culture

- Shopping Destinations

- Transportation

- Travel Essentials

- Travel Tips

- Travel News in Korea

- Gyeonggi-do

- North Gyeongsang (Gyeongsangbuk-do)

- North Jeolla (Jeollabuk-do)

- South Chungcheong (Chungcheongnam-do)

- South Gyeongsang (Gyeongsangnam-do)

- South Jeolla (Jeollanam-do)

A Complete Overview of T-Money Card

31,376 total views, 7 views today

Make your trip to South Korea hassle-free with convenient cashless payments using the T-Money Card which doubles up as a transportation card as well.

T-money is a type of rechargeable card that can be used to pay for transportation fares in and around Seoul and other areas in South Korea. It can also be used to pay for items in convenience stores and other businesses instead of using cash or credit cards. T-money works like a debit card. T-money Co., Ltd, which is operated by Seoul Special City Government, LG CNS, and Credit Card Union, manages the T-money System.

Table of Contents

Why is It Necessary in Korea?

The T-money card makes public transportation in Korea much more convenient. Instead of fumbling for coins or paper tickets every time you take the bus or subway, you can just tap your card and go. The cards can also be used on taxis, some private buses, and even at some stores and vending machines.

It can be used for a lot more than just travel in Korea. With it, you can now purchase things such as bottles of water and taxis on various islands. This is especially helpful for visitors who don’t want to carry a lot of cash around.

How to Get a T-money Card?

Many convenience stores sell T-Money cards, such as GS25, 7-Eleven, and CU. In some subway stations, T-Money payment terminals are available. You can buy a T-Money card from any of the newer devices that recharge them. If you want to get your T-Money card right after landing at Incheon International Airport , you can go to a CU grocery store near Gates 5 and 10 in the Landing area.

What are the rates of T-Money Cards in Seoul?

The card costs 2,500 KRW. There are many different types of T-money cards, each with its own unique design. You may even get it with your favorite K-pop star or group.

How to recharge?

Recharging your T-money Card is possible in three ways.

- Use a ticket vending machine installed inside all subway and train stations.

- Choose your preferred language (Korean, English, Japanese, Chinese) on the screen.

- Touch the “Reloading the transit car” button after clicking the third button with the T-money logo on the far right.

- Slide the card onto the loading surface and then enter the amount of money you wish to spend.

- Insert your T-money card and wait for it to reload.

- Confirm the balance of your T-money card.

- You can find newsstands near a bus stop that display the T-money sign. They are usually next to the subway station exits and entrances.

- Some convenience stores, such as GS25 and CU, have machines where you can reload your card. This is the simplest method to charge your card!

View this post on Instagram A post shared by 티머니 l Tmoney (@tmoney_insta)

T-Money Card: How to Use It?