- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

5 Best Travel Cards for South Korea

Getting an international travel card before you travel to South Korea can make it cheaper and more convenient when you spend in South Korean Won. You'll be able to easily top up your card in USD before you leave the US, to convert seamlessly to KRW for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from the US heading to South Korea, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

5 best travel money cards for South Korea:

Let's kick off our roundup of the best travel cards for South Korea with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from the US:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to South Korea.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in South Korea. Wise accounts can hold 40+ currencies, so you can top up in USD easily from your bank or using your card. Whenever you travel, to South Korea or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in KRW, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in KRW when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 9 USD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 - 21 days to arrive

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in the US:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 9 USD fee, confirm your mailing address, and your card will be on the way, and should arrive in 14 - 21 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in South Korea, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 25+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 25+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave the US and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Chime travel card

Use your Chime account and card to spend in South Korea with no foreign transaction fee. You’ll just need to load a balance in USD and then the money is converted to KRW instantly with the Visa rate whenever you spend or make a withdrawal. There’s a fee to make an ATM withdrawal out of network, which sits at 2.5 USD, but there are very few other costs to worry about. Plus you can get lots of extra services from Chime if you need them, such as ways to save.

Chime features

Chime travel card pros and cons.

- No Chime foreign transaction fees

- No ongoing charges for your account

- Lots of extra products and services if you need them

- Easy ways to manage your money online and in app

- Virtual cards available

- You'll need to inform Chime you're traveling to use your card abroad

- Low ATM limits

- Cards take 7 - 10 days to arrive by mail

How to apply for a Chime card

Here’s how to apply for a Chime account and order a travel card in the US:

Visit the Chime website or download the app

Click Get started and add your personal details

Add a balance

Your card will be delivered in the mail and you can use your virtual card instantly

Monzo travel card

Monzo cards can be ordered easily in the US and used for spending in South Korea and globally. Monzo accounts are designed for holding USD only - but you can spend in KRW and pretty much any other currency easily, with no foreign transaction fee. Your funds are just converted using the network exchange rate whenever you pay or make a withdrawal.

Monzo doesn’t usually apply ATM fees, but it’s worth knowing that the operator of the specific ATM you pick may have their own costs you’ll need to check out.

Monzo features

Monzo travel card pros and cons.

- Good selection of services available

- No foreign transaction fee to pay

- No Monzo ATM fee to pay

- Manage your card from your phone conveniently

- Deposits are FDIC protected

- You can't hold a foreign currency balance

- ATM operators might apply their own fees

How to apply for a Monzo card

Here’s how to apply for a Monzo account and order a travel card in the US:

Visit the Monzo website or download the app

Click Get Sign up and add your personal details

Check and confirm your mailing address and your card will be delivered in the mail

Netspend travel card

Netspend has a selection of prepaid debit cards you can use for spending securely in South Korea. While these cards don’t usually let you hold a balance in KRW, they’re popular with travelers as they’re not linked to your regular checking account. That increases security overseas - plus, Netspend offers virtual cards you can use to hide your physical card details from retailers if you want to.

The options with Netspend vary a lot depending on the card you pick. Usually you can top up digitally or in cash in USD and then spend overseas with a fixed foreign transaction fee applying every time you spend in a foreign currency. You’ll be able to view the terms and conditions of your specific card - including the fees - online, by entering the code you’ll find when your card is sent to you.

Netspend features

Netspend travel card pros and cons.

- Large selection of different card options depending on your needs

- Some cards have no overseas ATM fees

- Prepaid card which is secure to use overseas

- Manage your account in app

- Change from one card plan to another if you need to

- You may pay a monthly fee for your card

- Some cards have foreign transaction fees for all overseas use, which can be around 4%

- Selection of fees apply depending on the card you pick

How to apply for a Netspend card

Here’s how to apply for a Netspend account and order a travel card in the US:

Visit the Netspend website

Click Apply now

Complete the details, following the onscreen prompts

Get verified

Your card will arrive by mail - add a balance and activate it to get started

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your United States Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to South Korea or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app or on the web.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to South Korea. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday USD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for South Korea

We've picked out 5 great travel cards available in the US - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for South Korea include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in KRW can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for South Korea

The best travel debit card for South Korea really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in KRW.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for South Korea. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

For South Korea in particular, choosing a card which offers contactless payments and which is compatible with mobile wallets like Apple Pay could be a good plan. Card payments are extremely popular in South Korea - so having a card which lets you tap and pay easily can speed things up and make it more convenient during your trip.

Ways to pay in South Korea

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In South Korea card payments are common in most situations. You’ll be able to make Chip and PIN or contactless payments or use your favourite mobile wallet like Apple Pay to tap and pay on the go. It’s still worth having a little cash on you just in case - and for the odd situations where cash is more convenient, such as when tipping or buying a small item in a market.

Which countries use KRW?

You’ll find that KRW can only be used in South Korea. If you don’t travel to South Korea frequently it’s worth thinking carefully about how much to exchange so you’re not left with extra foreign currency after your trip. Or pick a travel card from a provider like Wise or Revolut which lets you leave your money in USD and convert at the point of payment with no penalty.

What should you be aware of when travelling to South Korea

You’re sure to have a great time in South Korea - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to South Korea before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Plan your currency exchange and payment methods - you can change USD to KRW before you travel to South Korea if you’d like to, but as card payments are common, and ATMs widely available, you can actually leave it until you arrive to get everything sorted as long as you have a travel money card. Top up your travel money card in USD and either exchange to KRW in advance or at the point of payment, and make ATM withdrawals whenever you need cash. Bear in mind that currency exchange at the airport will be expensive - so hold on until you reach South Korea to make an ATM withdrawal in KRW if you can.

3. Get clued up on any health or safety concerns - get travel insurance before you leave the US so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for South Korea

Ultimately the best travel card for your trip to South Korea will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

FAQ - best travel cards for South Korea

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Monzo.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in South Korea.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their USD / KRW rate to calculate how much South Korean Won you would receive when exchanging / spending $4,000 USD. The card provider offering the most KRW is displayed at the top, the next highest below that, and so on.

The rates were collected at 15:54:21 GMT on 19 February 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

South Korean Won card

Travelling from the UK to South Korea? Spend effortlessly in South Korean Won (KRW) with a multi-currency card.

40+ million worldwide customers use Revolut

Revolut offers so much more than a travel card. Exchange currencies, send money abroad, and hold 36 local currencies in-app. These are just some reasons why our customers rely on us for their travel spending.

How does a South Korean Won card work?

How to get your KRW card

Get your South Korean Won card in 3 steps

Get revolut.

Join 40+ million people worldwide saving when they spend abroad with Revolut.

Order your card

Order your free South Korean Won card. Top up your balance in GBP or 36 other currencies.

Spend like a local

Start spending in South Korean Won.

Currency exchange fees subject to fair-usage limits and weekend markups. Currency exchange shown is only an indicative example.

Why should I get a South Korean Won card?

Where is the South Korean Won card available?

Spend confidently with a South Korean Won card

How to save money when spending in South Korean Won

Tips for saving money in South Korea

Don't exchange at airports or at home.

No need to exchange cash before you travel — use your travel money card to spend or withdraw money from an ATM.

Choose KRW as the local currency

Choose the local currency when spending with your card in shops and restaurants.

Save with a travel money card

Spend in South Korean Won like a local with Revolut.

How to avoid unwanted ATM fees

Need to make KRW withdrawals in South Korea?

Fee-free South Korean Won ATM withdrawals

Fee-free atm withdrawals up to £200, fee-free atm withdrawals up to £400, fee-free atm withdrawals up to £800.

ATM withdrawals are subject to fair-usage fees depending on plan. Currency exchange fees may apply.

What are you waiting for?

Save when you travel with a KRW travel card

Rating as of 29 May 2024

717K Reviews

2.8M Reviews

Need a little more help?

South Korean Won currency card FAQs

Is it better to use a travel money card rather than cash in south korea.

There is no 'best' way to spend in South Korean Won, but here are some tips to help you save money:

- Don’t exchange cash at the airport. It’s much cheaper to withdraw money from an ATM with your South Korean Won card.

- Don't carry more cash than you need. When you return home to the UK, you’ll have to re-convert this cash back to GBP.

- Always choose KRW as the local currency when spending with your card in shops and restaurants.

- Download the Revolut app, then sign up to get instant notifications on what you spend and manage your balance.

Are travel money cards safe and secure?

Where can i use my krw travel money card, how much can i pay using my south korean won card.

There is no limit to the amount that you can spend using your South Korean Won card. Just top up in-app with however much you want and enjoy your travels.

How can I avoid unwanted ATM fees in South Korea?

There are tonnes of benefits to a South Korean Won card. Let’s look at a few:

- Send and spend in South Korean Won and 150+ other currencies.

- No need to exchange or carry cash. Pay with your South Korean Won card, either contactless or with chip and PIN.

- No need to wait for your physical card to arrive. Instantly add your card to Google Pay or Apple Pay.

- Create single-use virtual cards for safe online shopping or travel bookings.

- Enjoy fee-free ATM withdrawals between £200 and £2,000 monthly, depending on your plan.

- Get instant payment notifications to keep track of how much you spend.

- Stay in control of your card’s security, with card freezing and spending limit controls.

- Easily manage your spending around the world with the free Revolut app.

How do I get a South Korean Won travel money card?

To order your Revolut debit card and start spending in South Korean Won, simply:

- Download the Revolut app on your Android or iPhone and sign up for free.

- Order your free South Korean Won card. Top up your balance in GBP or 150+ other currencies.

- Get your card in the post or add it to Google Pay or Apple Pay to use it immediately.

- Start spending like a local in South Korean Won.

Travel Money Guide: South Korea

Sort out your currency and travel card options before your big trip for a stress-free holiday in south korea..

In this guide

Compare travel money options for South Korea

Travel card, debit card or credit card, how travel cards, credit cards and debit cards work in south korea, why we recommend a combination of travel money options., exchange rate history, buying currency in australia, how much won do i need to bring to south korea.

Travel Money Cards

South Korea boasts ancient villages, buzzing nightlife and some of Asia's best street food for you to indulge in.

While it's easy to get around South Korea with debit and credit cards, if you want to travel on a budget and indulge in some of Korea's best street eats then it's a good idea to have won (the currency of South Korea) for those smaller purchases.

If South Korea is your main destination then we reckon prepaid travel cards are not the best option. Instead, carry a combination of debit card, credit card and local currency for small purchases.

- Travel Credit Cards

- Travel Debit Cards

- Prepaid Travel Money Cards

What should I know about money for South Korea?

You can use your Visa or Mastercard branded credit card, debit card or travel money card almost everywhere in South Korean cities — rural areas are a different story. In fact, you'll find that South Korea is ahead of Australia when it comes to mobile payments. Young Koreans have taken up contactless and mobile technology in droves and you won't have issues finding places where you can use your cards. Having said this, you will need cash too, for example a lot of the cheaper restaurants are cash only. You'll need to factor in ATM withdrawal fees to your comparison of travel money products if you want to do like the locals.

Travel money options for South Korea at a glance

This table is a general summary of the travel money products in the market. Features and benefits can vary between cards.

Here's how the different travel money products are going to work in South Korea.

Using credit cards

Visa, Mastercard and American Express credit cards can be used in South Korea. Some of these cards are cheaper to use than others. Start your comparison by looking at the cards which waive currency conversion charges. This allows you to use your credit card in South Korea to make purchases for roughly the same price as Australia. The card scheme (Visa, Mastercard etc.) exchange rate applies, it's pretty close to the market rate and a touch better than the travel card exchange rate. Bankwest platinum credit cards waive the currency conversion fee; however, avoid withdrawing cash on credit, additional cash advance fees and interest applies and you won't get interest free days. Other perks include complimentary international travel insurance when you charge the cost of your air ticket to your credit card and purchase protection insurance.

- Tip: Some South Korean merchants won't accept a credit card payment for transactions under 10,000 won (about $10 AUD).

Using debit cards

It's hard to fault the Citibank Plus Transaction Account . You get a Visa debit card to use for over the counter purchases and ATM withdrawals where Visa is accepted, which is everywhere you can pay with your card in South Korea. You won't pay extra for currency conversion, you won't pay international ATM fees and Citi don't charge any monthly or account keeping fees. Plus, the best part: Citi has been in the South Korean market since the 60's so there are Citi branches and cash machines all over the country. You can make free ATM withdrawals from Citi ATMs using your Citibank Plus Transaction Account.

- Tip: In Seoul alone there are almost 100 Citi branches and about 40 standalone ATMs.

Using prepaid travel cards

There are no travel cards which let you hold South Korean won. Use a travel card to spend in South Korea and you'll incur the travel card currency conversion fee, which is higher than what's charged on credit and debit cards. There are a limited number of travel cards which do not charge for currency conversion; however, these cards will charge for international ATM withdrawals. The ATM withdrawal fee is comparable to what you'll pay using most debit and credit cards (some credit and debit card providers waive the international ATM fee) but when you factor in card issue fees, reload fees and inactivity fees, a travel card can end up costing you more than if you took a travel friendly debit or credit card. In saying so, you may still want to consider travel prepaid cards if you are visiting other countries whose currencies are covered.

Using traveller's cheques

Traveller's cheques once had a place — in a money belt tucked under your shirt. Today, this travel money product is a hassle to buy, carry and cash. The main benefit of a traveller's cheque is security. Only you can cash your traveller's cheques and they can be replaced if lost or stolen. Credit cards, debit cards and travel cards have the same features. Your bank will give you your money back if you're the victim of card fraud and an emergency replacement card can be sent to you anywhere in the world in a few days.

Getting a refund if you're the victim of a fraudulent transaction

Although card payments are the norm in South Korea, street food, small restaurants and some public transport are cash only — some merchants also won't take cards for purchases under 10,000 won (approx. $10 AUD).

You can make withdrawals at Cash Dispenser Machines or visit an exchange office or bank to get foreign currency changed when you arrive in South Korea. Banks are open from 9am to 4pm Monday to Saturday.

ATM withdrawals in South Korea

There are two types of ATMs in South Korea, those which accept foreign cards and those which don't — cash dispenser (CD) machines generally accept international cards. If you insert your card into an ATM and it gives you an error message, you'll need to search for another machine. Look for the global ATM logo on the front of the ATM and select the English option before you insert your credit, debit or travel card. These types of ATMs are common in public places such as bus and train stations.

Local ATM operator fees will apply. Local Australian and Korean banks do not have fee free partnerships; but you'll find Korean CD machines change the same as ATMs in Australia. If you're a Citi cardholder, you can use your Citi card to withdraw from Citi ATMs in South Korea and you will avoid the local ATM operator fee. There are ATMs throughout Seoul including the at the major airports.

- Tip: Citi are an international financial institution and you won't have a problem using your Australian credit, debit or travel card at a Citi ATM.

You must take more than one way to access your travel funds to Korea. Take a credit card and debit card combination so you know you won't be caught without cash. A credit card can be used for big ticket purchases and to pay for online bookings and a debit card can be used to make over the counter purchases and withdraw cash. All credit cards offer interest free days too, so if you manage your account correctly, you can use your credit card for interest free purchases between statement periods.

Korean culture punches above it's weight on the world stage, which is probably why it's is one of the most visited countries in Asia. Compare travel money options before you leave so you can make the right choices and save on paying unnecessary bank fees.

Australians received almost twice as much Korean won for every dollar exchanged in 2012 than 2006. And in recent years, the value of the Korean won relative to the Aussie dollar has settled back to 2006 levels. This represents a drop of about 30 cents to the dollar over the past 4 years. It can be difficult to predict forex rates; however, South Korea has a stable economy and Australians shouldn't be worried about currency fluctuations affecting the bottom line too much while on holiday.

*Exchange rates are accurate as of 1 January on each year listed above

There are no restrictions to the amount of foreign currency you can bring to Korea. But you must make a customs declaration if you're bringing more than $10,000 cash. Cash includes bank notes and traveller's cheques. You can bring up to 8,000,000 Korean won from Australia. This is approximately $10,000 AUD.

You have a few options for picking up won in Australia. Your bank will be able to sell you cash, you can pick it up at a branch, or you can use a foreign exchange specialist such as Travelex.

South Korea is pricey compared to budget destinations in the region such as Vietnam and Laos, but cheaper than other developed countries such as Japan or Australia. As with all overseas trips, South Korea can be as cheap or expensive as you like.

It all depends on how you eat, where you stay and what you do. Eating like a local offers savings as staple food such as rice and meats are inexpensive, and there are plenty of cafeterias and eateries (cash only) where you can dine for a couple of dollars.

Some of the daily costs for a South Korean holiday

*Prices are indicative and subject to change

More guides on Finder

The 4 things you can do right now to save money

Everything we know about the Piche Resources Limited IPO, plus information on how to buy in.

US Congress has passed its biggest crypto regulation bill, but what does this mean for the industry?

The important thing remains...you need to compare and save.

Building a home can be expensive, right? Modular homes are a more affordable way to build... if you can get the loan to pay for one.

Impulse purchases are costing people thousands of dollars every year, according to new research by Finder.

Save this winter by switching your energy plan.

Find all the weekly tips from our Dollar Saver newsletter and see how you could save.

Rumours of an about-turn on the approval of Ethereum ETFs saw crypto markets soar ahead of this week's deadline.

GME has retraced 75% after underwhelming Q1 results and new stock offering.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

In My Korea

Korea’s T-Money Card: The Ultimate Guide 2024

Want to know where to buy a T-Money Card in Korea? Unfamiliar with how to use it and what the main advantages of it are? Not sure about how to pay for transportation tickets, what the fares will be, and whether you’ll have the right change? This ultimate guide to the T-Money Card, the best Korean transportation card, will solve all your problems.

Find out where to buy a T-Money Card at Incheon Airport and other locations in Korea, learn how to top-up your card in Korea and where to top-up, and also discover the many benefits of using a T-Money Card. This in-depth article will answer all your T-Money queries quickly and easily.

This comprehensive guide is updated regularly to bring you the latest information about changes and additional ways to use the T-Money Card. There are also lots of my own tips about how to use the T-Money Card, where it can be used, and lots of really useful travel advice for visiting Korea.

For those who prefer to watch a video version of this article, please watch it here:

Affiliate Disclaimer : This site contains affiliate links and I may earn commission for purchases made after clicking these links.

Table of Contents

What Is The T-Money Card

The T-Money Card is a prepaid transportation card that can be used to pay for public transportation in cities across Korea, including buses and subways. It provides cash-free travel around Korean cities, and takes the hassle out of to get around Korea and buying tickets for each journey.

When you use the T-Money Card, you pay less for subway and bus fares. It literally pays for itself.

The T-Money Card can be used to pay for a range of items and services, including taxi charges, items in convenience stores, entrance fees for attractions, vending machines, and food and beverages in restaurants. Anywhere you see the T-Money logo (above), you can pay with T-Money Card.

Why Do I Need A T-Money Card In Korea?

Korea is fast becoming a cash-free society and in recent years Korea’s buses have moved away from accepting cash payments. Almost a quarter of all buses in Seoul are now cash-free and you can’t pay with cash at all on Daejeon’s buses. This will likely be the norm everywhere in Korea very soon.

Even when you can buy tickets in cash, it’s inconvenient making sure you have the right cash available (no change is given on buses). Queueing up to buy a ticket at a crowded subway station is a real hassle when you could just touch-and-go straight through the barriers with a T-Money Card.

The biggest reason is the two rates to travel in Korea’s subways and buses – one for cash and one for transportation cards like the T-Money Card. The rate for the T-Money Card is lower, meaning you’ll save money when you travel with a T-Money Card, as you can see in the table below:

*Bus fares in Seoul rose to ₩1,500 from August 2023. However, it hasn’t been confirmed whether cash and T-Money costs will be the same now or not.

Quick Summary

Here’s a summary of the T-Money Card and why you should get one when you travel to Korea.

Planning to visit Korea? These travel essentials will help you plan your trip, get the best deals, and save you time and money before and during your Korean adventure.

Visas & K-ETA: Some travellers to Korea need a Tourist Visa , but most can travel with a Korean Electronic Travel Authorisation (K-ETA). Currently 22 Countries don’t need either one.

How To Stay Connected : Pre-order a Korean Sim Card or a WiFi Router to collect on-arrival at Incheon Airport (desks open 24-hours). Alternatively, download a Korean eSIM for you travels.

Where To Stay : For Seoul, I recommend Myeongdong (convenient), Hongdae (cool culture) or Gangnam (shopping). For Busan, Haeundae (Beach) or Seomyeon (Downtown).

Incheon Airport To Seoul : Take the Airport Express (AREX) to Seoul Station or a Limo Bus across Seoul. Book an Incheon Airport Private Transfer and relax to or from the airport.

Korean Tour Operators : Tour companies that have a big presence in Korea include Klook , Trazy , Viator , and Get Your Guide . These sites offer discounted entry tickets for top attractions.

Seoul City Passes : Visit Seoul’s top attractions for free with a Discover Seoul Pass or Go City Seoul Pass . These passes are great for families and couples visiting Seoul – you can save lots.

How To Get Around : For public transport, grab a T-Money Card . Save money on Korea’s high speed trains with a Korea Rail Pass . To see more of Korea, there are many rental car options from Klook , EconomyBookings , and RentalCars .

Travel Money : Use money exchanges near Myeongdong and Hongdae subway stations for the best exchange rates. Order a Wise Card or WOWPASS to pay by card across Korea.

Flights To Korea : I use flight comparison sites such as Expedia and Skyscanner to find the best flights to Korea from any country. Air Asia is a good option for budget flights from Asia.

Travel Insurance : It is important to insure your trips to protect yourself against the unexpected. World Nomad is a specialized travel insurance provider with options for different coverage for travellers from around the world. You can also purchase cover when you are already travelling.

How To Learn Korean : The language course from 90 Day Korean or Korean Class 101 both have well-structured lessons and lots of useful resources to help you learn Korean.

Where To Buy A T-Money Card

T-Money Cards are available in many places in Korea, including at Incheon Airport, in convenience stores, and in public transportation stations. This section of the T-Money Guide will show you where to buy a T-Money Card in each of these different locations and extra services that include T-Money.

Buy T-Money At The Incheon Airport, Seoul

The most convenient place for most travellers to get a T-Money Card is at Incheon Airport in the Transit Centre (Floor B1) of Terminal 1 or Terminal 2. There are vending machines that sell the Korea Tour Card , which is the tourist-friendly version of the T-Money Card that comes with extra benefits.

Follow the directions to the ‘ Airport Railroad ‘ in either terminal and it will lead you to the B1 Transit Centre. The T-Money Card vending machines will be well signposted and located next to the All-Stop subway train, which is the subway to central Seoul that you can pay for with T-Money.

Please note : If you arrive at Incheon Airport Terminal 1, the Transit Centre is the only place you can buy a T-Money Card (Korea Tour Card). The CU convenience stores in Terminal 1 don’t sell T-Money Cards. In Terminal 2, you can buy T-Money Cards from GS25 and 7/11 convenience stores.

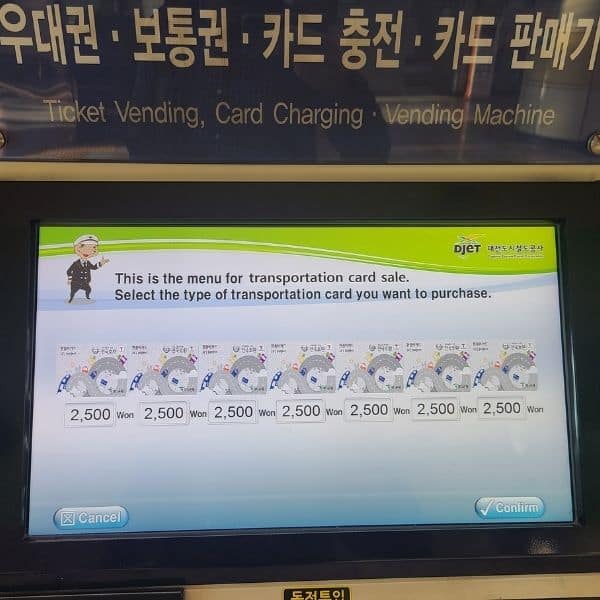

How to buy T-Money card At Incheon Airport Transit Centre:

It’s easy to buy a T-Money Card from the Transit Centre. Head to the All-Stop train station where the T-Money Card vending machines are located. You must have cash (KRW) to purchase at the vending machines, as well as cash to top-up the balance afterwards.

Here are the 4 steps required to buy a T-Money Card from the vending machine:

1: Insert Cash

The cost of the Korea Travel Card (hereafter called T-Money Card) is ₩4,000. Insert cash into the machine. Change is available.

2: Press The Number

Like a normal vending machine, press the number of the card you want to buy. Don’t select a number which is empty.

3: Press The Green Button

To confirm your purchase, press the green button at the bottom of the keypad.

4: Collect Your T-Money Card

The vending machine will collect your T-Money Card and dispense it to you.

Once the T-Money Card has been dispensed, don’t forget to collect any change from the vending machine. To top-up, take it to the ticket machines outside the All-Stop terminal. Full details about how to top-up will be included in the section ‘ How To Top-Up A T-Money Card ‘

Need Cash For T-Money?

One issue with T-Money is that it can only be topped-up using cash (KRW). Unfortunately, airport money exchanges typically give bad exchange rates. You can get better rates by taking the Airport Express non-stop train into Seoul and changing money in Myeongdong or Hongdae, or by ordering a Korean sim card from Klook with a T-Money Card with a preloaded balance of 5,000 KRW or 10,000 KRW.

Where to Buy A T-Money Card In Korea

I recommend buying a T-Money Card at the Incheon Airport Transit Centre. However, if you’re not arriving in Korea at Incheon Airport, want to get a card with a cuter design, or want to save money by combining T-Money with other services, here are 6 other places where you can buy T-Money Cards.

Buy T-Money At A Subway Station In Korea

Subway stations in Korea sell the basic version of the T-Money Card, which comes with no balance. You can usually top-up from the same machine that dispenses them.

Price : ₩2,500

Buy T-Money At A Convenience Store In Korea

Korean convenience stores, including GS25 and 7/11, sell T-Money Cards with their own designs. These come with no balance but can be topped up straight after purchase with cash.

Price : ₩3,000

Buy T-Money On The Airport Express

It is possible to buy a T-Money card inside the subway stations along the Airport Express all-stop train between Incheon Airport and other parts of Seoul. You can even personalise this card and add your own picture to the card.

Price : From ₩6,000

Buy T-Money From Klook

Klook offers a combined Korean sim card and T-Money package that comes with a T-Money Card with Klook’s own cute design. You save money on both the T-Money Card and sim card with this combined package.

Price : From ₩32,500

Get T-Money With The WOWPASS

The WOWPASS is a travel money card that allows you to pay for goods and services like a local. It includes T-Money functions and the WOWPASS Airport Package comes with ₩10,000 T-Money balance included.

Price : From ₩5,000

Get T-Money With The Discover Seoul Pass

The Discover Seoul Pass is a city-pass that offers free entry to dozens of premium attractions in Seoul. It also includes T-Money functions to allow you to travel on public transport without having to buy a separate T-Money Card.

Price : From ₩50,000

You can also buy T-Money cards from stationery stores like ArtBox. ArtBox is a popular place to buy souvenirs and cute stationery. They also have their own line of T-Money Cards with ever-changing fun designs for you to collect. There is no T-Money balance and the cards cost more.

How Much Does The T-Money Card Cost?

The price of the T-Money Card is ₩2,500 for the standard T-Money Card that is sold at public transportation stations in Korea. This does not include any credit and you will need to add funds to the card before you can use it. The cost of the Korea Travel Card at Incheon Airport is ₩4,000 .

T-Money Cards from other locations, such as convenience stores and stationery stores, which include special artworks, typically cost more money. The cost of T-Money can be free when it is included in another service, such as the WOWPASS or Discover Seoul Pass.

Where Can You Buy Special T-Money Designs?

If you want to buy a T-Money Card with an interesting design, there are several options in Korea. The stationery store ARTBOX offers some cute designs with their own characters, as do convenience stores. These cards have the same functions as a regular T-Money Card and work the same way.

Please note: T-Money Cards with unique designs are a bit more expensive – around ₩5,000 to ₩6,000 per card. The base cost of a T-Money Card is ₩2,500. These can make nice gifts or souvenirs and as the T-Money Card doesn’t expire, you can use them every time you visit Korea.

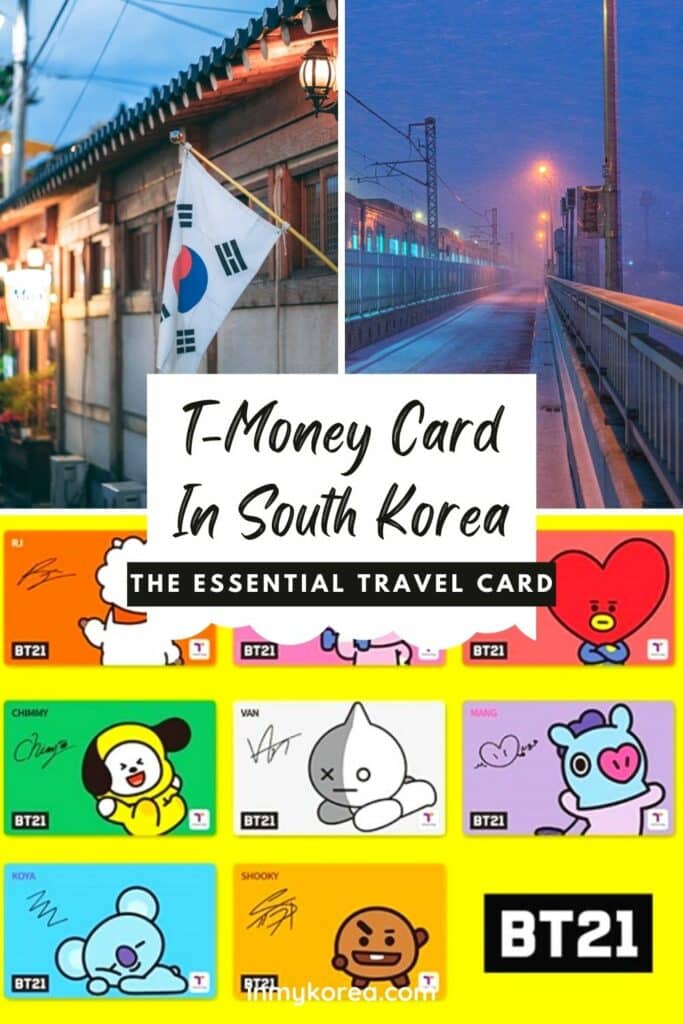

BTS-Themed T-Money Cards

BTS ARMY members may want to get a special souvenir of their time in Korea and can do so with a BTS-themed T-Money Card. These special edition BTS T-Money Cards work the same as regular T-Money Cards, but come with 7 different designs, one for each member of the hit group, BTS.

These aren’t widely available, and new versions replace older versions frequently. If you want to buy a BTS-themed T-Money Card, you can find them in some convenience stores or in K-Pop merchandise stores in areas such as Gangnam, Hongdae, or in the Dongdaemun Design Plaza.

Where Can You Use T-Money In Korea?

The T-Money Card is primarily a transportation card that can be used to pay for bus and subway journeys in most Korean cities . However, it also functions as a payment card that can be used to make small purchases in certain Korean shops, cafes, restaurants, and attractions.

If you bought the Korea Tour Card from the Incheon Airport Transit Centre, you will be eligible for discounts at tourist attractions, shops, entertainment, restaurants, and other locations. For example, you get 30% off entry fees at N Seoul Tower and 20% off entry fees at COEX Aquarium.

Here are the places you can use the T-Money Card in Korea:

It’s really simple to use T-Money on Korea’s buses. Touch the T-Money Card to the card reader when you enter the bus to start your journey, then touch it again when you exit the bus. In most city buses in Korea you enter at the front of the bus and get off in the middle. There will be a T-Money Card reader in both locations.

Most bus journeys cost the same price, however, if your bus travels more than 10km, you will be charged an extra fee. If you don’t tap-off when you leave the bus, you may be charged this fee.

On The Subway

The T-Money Card is accepted on all subway systems in Korea, including in Seoul, Busan, Daejeon, and Gwangju, Touch the T-Money Card when you enter the security gates at the start of your journey, then touch again to exit. If you run out of credit, there are machines inside the gates to top-up (but you’ll need cash).

Like bus journeys, most short journeys on the subway will be the same fee. If you travel a long way on the subway, or make many transfers, the fee can be higher.

Transfer discounts : When you transfer between subway or bus rides within 30 minutes, you’ll get a discount on your next ride as long as you tapped-off when on your previous journey. Also, if you accidentally enter the wrong subway gate, you can leave within 10 minutes for free on some lines.

You can use a T-Money Card to pay for taxis in Korea . It’s quick, easy, and allows you to avoid using a credit card or having the right change. As long as the taxi driver has the T-Money logo displayed, you can pass your T-Money Card to the driver who will touch it to the card reader and complete the payment.

You can call taxis directly to you using the Kakao Taxi app, which is available on Android and iPhone and can be used in English, Korean, and Chinese. My guide to using Kakao Taxi will show you how to order and pay for a taxi in Korea.

For Shopping

The T-Money Card is really useful when you want to buy small items, such as a bottle of water, coffee, or some snacks. When you see the T-Money logo, you can use the card to pay for goods and services. You can use T-Money to pay for purchases in convenience stores (CU, GS25, Emart 24, 7/11).

You can use the T-Money Card in Korea’s supermarkets and chain stores, including Home Plus (supermarket) Emart (supermarket) Face Shop (cosmetics) Innisfree (cosmetics) Tony Moly (cosmetics) and others.

Using the T-Money Card for shopping : As the T-Money Card needs to be topped-up in cash (KRW), using it for shopping isn’t really that convenient. Instead, I recommend getting a WOWPASS in Korea, or bringing a travel money card like the Wise Travel Card or Revolut Travel Card .

Food and beverage outlets also accept the T-Money Card, including Starbucks, McDonald’s, Angel-in-Us Coffee, Ediya Coffee, Gong Cha Tea, and Paris Baguette and more.

It’s best to check for the T-Money logo before trying to pay with your T-Money Card or asking if T-Money is accepted. Again, using the T-Money Card is possible for this, but usually not the most convenient way to pay.

At Attractions

You can use T-Money to pay for entry fees for major attractions, including theme parks and sports stadiums, as well as other locations like pay-phones and vending machines.

Here are some of the locations you can use T-Money: vending machines, public pay-phones, Everland theme park, sports stadiums (including Wyverns Baseball Club), and at festivals (to pay for food and drinks).

Where Can’t You Use T-Money In Korea?

You can’t use T-Money to pay for intercity train tickets, including the KTX – Korea’s high speed train network. You also can’t enter intercity buses and pay with T-Money like you can when entering a regular city bus. However, you can use T-Money to buy intercity bus tickets and board with those.

Generally, the T-Money Card is accepted in major cities across Korea, especially destinations popular with tourists. If T-Money isn’t accepted, there will be other options available, such as using Cashbee or paying with cash.

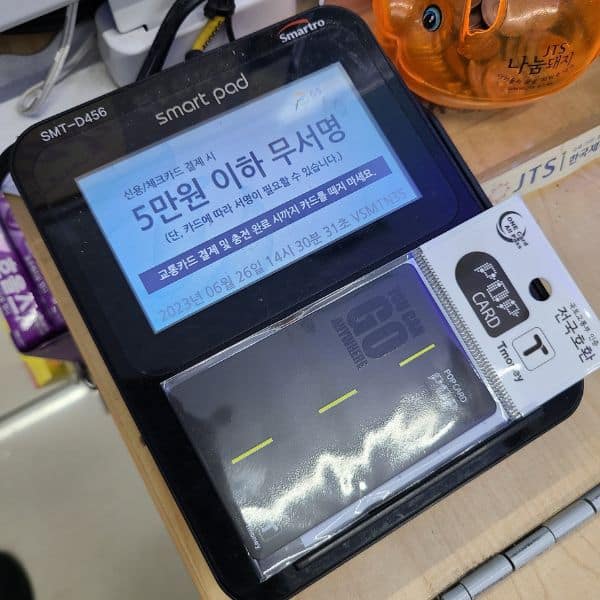

How To Top-Up A T-Money Card

The T-Money Card can be recharged (reloaded) at subway stations and convenience stores throughout Korea. Vending machines at subway stations are the easiest locations to recharge a T-Money Card and will also allow you to check your balance before or after the top-up

You can only top-up the T-Money Card with cash . Credit cards aren’t accepted for top-ups.

These machines can be found in each major city in Korea where you can use T-Money. They are available in Korean, English, Japanese, and Chinese. These T-Money recharging machines only accept cash and the T-Money Card can’t be reloaded with a credit card.

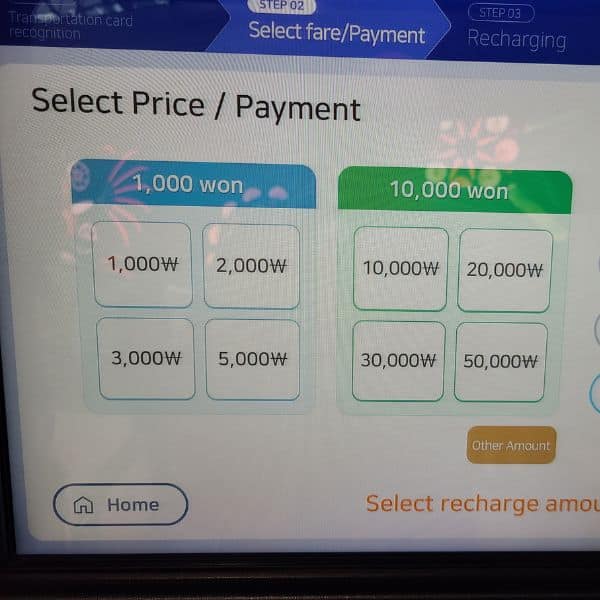

This is how to top-up a T-Money Card using a ticket machine in subway stations in Korea. The T-Money card can only be topped-up using cash and can’t be topped up using credit or debit cards or money transfers. This method works for other transportation cards in Korea, too.

1: Go to a ticket machine in a subway station

Go to a ticket vending or transportation card at a subway station. These machines are usually close to the entrance barriers to the subway inside the station.

2: Select ‘Recharge Transportation Card’

Change the language of the ticket recharge machine as desired, then select ‘Recharging the Transit Card’ or a similar option to begin to top-up your T-Money Card.

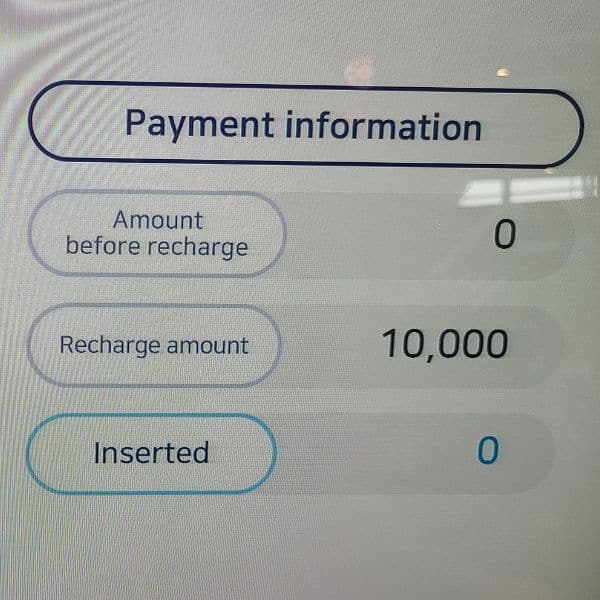

3: Select the value to top-up

Select the amount of money that you wish to add to your existing T-Money balance. The screen should show you what balance the T-Money Card already has. New T-Money Cards usually have no balance. You can recharge the T-Money Card with as little as 1,000 Korean won.

4: Confirm the value to top-up

Once you’ve selected the desired amount you wish to top-up the T-Money Card with in Korean won, confirm the top-up value by pressing ‘confirm’ on the screen.. You should select the amount that you have available in cash as you can’t top-up the T-Money Card in any other way.

5: Insert cash

To top-up a T-Money card, enter cash into the ticket vending machine up to the value you wish to top-up. Insert each bank note separately. Please note : only KRW can be used to top-up a T-Money Card.

6: Place your t-Money Card on the card reader

After inserting cash to top-up your T-Money Card, place your T-Money Card on the card recharge plate, which is usually located below the main screen of the recharging machine. Make sure the card is placed flat on the reader.

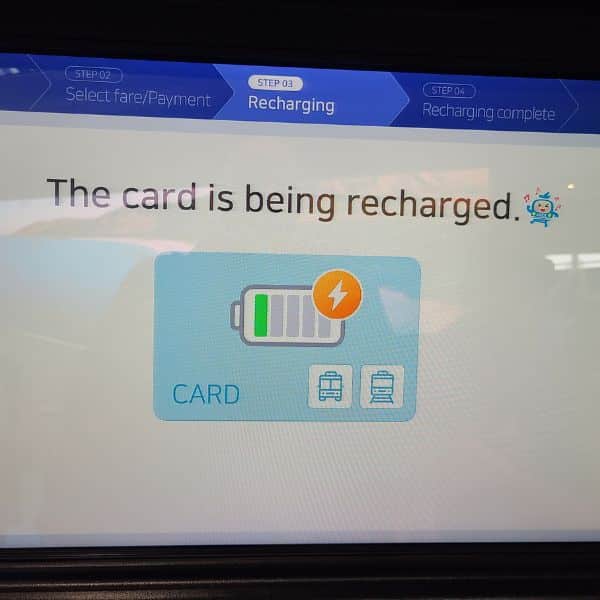

7: Wait for the T-Money Card to be recharged

The T-Money Card will be recharged once the recharging machine recognised the T-Money Card placed on the card recharge plate. Wait for the recharge to complete, which should take about 5 to 10 seconds in total.

8: Take your T-Money Card and start using it

Once the T-Money Card has been topped-up, take the card from the card recharge plate and you can use it to travel on the subway, on buses, and in other places. Tap to start your journey, and tap again when you finish.

Besides subway stations, you can also recharge a T-Money Card at a convenience store. The same rule about only charging with cash applies. You can’t recharge a T-Money Card with a credit or debit card. Here’s how to top-up the T-Money Card at convenience stores in Korea:

1: Go To A Convenience Store

Go to any major convenience store in Seoul or other towns and cities across Korea, including CU, GS25, Emart 24, and 7/11.

2: Ask To Top-Up T-Money

Show your T-Money Card to the cashier and ask to top-up the balance. Use Papago to translate into Korean if you’re not sure what to say.

3: Give the amount of cash to top-up to the cashier

You can only use cash to top-up T-Money balances, so make sure you have cash available to pay with. Give it to the cashier.

4: Place your T-Money Card On the Card Reader

Place your T-Money Card on the electronic card reader and wait for confirmation from the cashier that the balance has been updated.

There is a T-Money office at Seoul Station where you can ask for advice, purchase & reload the card, and get your remaining balance refunded when you leave Korea. T-Money Headquarters Address: 1st Floor. T-money Town, Seoul City Tower Building, Namdaemun-ro 5-Ga, Jung-gu, Seoul.

How Much Money Should I Add To A T-Money Card?

How much money to add to a T-Money Card depends on how you intend to use it. If you will use your T-Money Card mostly for transportation , I recommend adding ₩10,000 per day. This should cover all subway / bus travel costs within a city like Seoul, which cost ₩1,400 /₩1,500 per journey.

If you plan to use your T-Money Card to pay for small purchases , such as snacks, bottled water, and coffee, then add ₩20,000 per day, which includes transportation costs. A coffee in Seoul costs between ₩2,000 – ₩5,000, water is ₩1,000, and snacks from ₩1,000 – ₩5,000.

When you first top-up a T-Money Card, add ₩50,000 for the starting balance. This balance should last most travellers for a week if they use their T-Money Card just for bus and subway rides. You can check your balance during your travels and top-up when the balance gets low (under₩ 5,000).

Can You Recharge A T-Money Card With A Credit Card?

It is not possible to recharge a T-Money Card with a credit or debit card. Only cash can be used to top-up the T-Money Card. There are restrictions that only allow cash top-ups. The app version of T-Money can be topped-up by card payments or online transfers, but not physical T-Money Cards.

How To Your Check T-Money Card Balance

There are a number of ways to check your balance. When you use the T-Money Card on the subway or a bus, the electronic card reader will show you the fee for the ride and the remaining balance. This is the most common way to check your balance.

You can also check your card balance at subway ticket machines and T-Money recharge stations. When you recharge your card, it will show your balance before you add credit. This is a good way to check your balance, even if you don’t intend to recharge the T-Money Card right then.

Using T-Money Mobile App To Check Your Balance

The T-Money mobile app is an online-only version of T-Money that doesn’t come with a card. Instead, you can use your phone’s NFC function to use your T-Money balance. You can also use your phone’s NFC function to scan a physical T-Money Card and check the balance when logged into the app.

However, I don’t recommend using the T-Money mobile app to check your T-Money balance. There have been reports by travellers in Korea that the app sometimes accidentally wipes the T-Money Card, making it useless. I can’t confirm this myself, but it is much easier to check your balance elsewhere.

How To Refund A T-Money Card Balance

You can refund the existing balance of your T-Money Card at major convenience stores and subway stations across Korea, as well as at the T-Money headquarters in Seoul. These are the locations you can top-up a T-Money Card. Refunds will be paid in cash and partial refunds aren’t possible.

There’s a ₩500 fee to refund a T-Money balance, which is deducted from the existing balance. The cost of the T-Money Card won’t be refunded, but you can keep the T-Money Card after the balance is refunded. The T-Money Card doesn’t expire, so you can use it if you visit Korea again.

The T-Money Card doesn’t expire. Keep it for future trips or give it to a friend who is visiting later.

Tip : The credit balance on the T-Money Card will stay active for 5 years from the date of the last top-up. If you plan to visit Korea again in the next 5 years and have a small balance left, it might be best to keep the balance on your T-Money Card so you don’t need to top-up the card when you return.

Alternative Korean Transportation Cards & 1 bonus

There are several alternative transportation cards to T-Money, including the Cashbee Card (pictured above), Namane Card, which uses Rail+, and varieties of the T-Money Card that offer slightly different benefits from the original T-Money Card. Here’s a summary of those cards and what they offer:

Cashbee Card

The Cashbee Card by Lotte can be purchased and used in most of the same locations as T-Money. You can purchase a Cashbee Card at convenience stores and subway stations across Korea. The CU chain of convenience stores only offers the Cashbee Card, not T-Money.

The Cashbee card can be used to pay for journeys on buses and subway across Korea. Tap the card when you enter the bus or subway, then tap again when you finish your journey. Transfer discounts should also be applied. Cashbee can be used in Lotte shops, including Lotte Department Store and Lotte Cinema.

Where to buy : Convenience stores, subway

Namane Card

The Namane Card by KB Bank uses the Rail+ transportation card system by Korail, Korea’s national train service. One big advantage the Namane Card has over T-Money and Cashbee is you can use it to pay for train services, including Korea’s high-speed KTX trains.

The other big difference with the Namane Card is that you can personalise your card by uploading pictures of yourself or other designs you upload using the Namane app. The Namane Card is available from locations across Korea , including inside major train stations, department stores, stationery stores, and book shops.

Price : ₩7,000

Where to buy : Convenience stores, subway, Namane machines, online from Klook

Korea Tour Card

The Korea Tour Card was designed for tourists travelling to Korea and provides not only with the standard T-Money functions, but also offers lots of discounts . This is the version of T-Money that’s available at Incheon Airport.

Price : ₩4,000

Buy : Incheon Airport

Discover Seoul Pass

The Discover Seoul Pass is a city-pass that offers free entry to more than 50 premium attractions in Seoul. It also includes T-Money functions to allow you to travel on public transport without having to buy one. Discover Seoul Pass comes in flavours of 24, 48, and 72 hours validity, and only starts counting down starting when you use it for the first free benefit.

Price : from ₩50,000

Buy : Online from Klook

Creatrip X Bellygom Transportation Card

The Creatrip X Bellygom transportation card is a colourful travel card from Creatrip, which really stands out thanks to its bright pink picture of Bellygom, a popular Korean character that’s big on YouTube. With the ‘Decoration Card’ feature, you can make your own special transportation card, too. This makes it a lovely souvenir of your trip.

Please note : this card is a version of Cashbee and can be used and charged in all the same locations as Cashbee can.

This card comes with ₩5,000 loaded, which means you don’t need to worry about charging it at the airport (which should be done in cash). Simply collect the card at Incheon Airport (either terminal) or Gimpo Airport and then take the all-stop train straight into Seoul with it. It’s really convenient.

You can use the Creatrip X Bellygom transportation card to pay for public transportation across Korea, as well as in franchises such as Paris Baguette, Baskin Robbins, Angel In Us, and Lotte Mart.

Price : Around ₩10,200 (includes ₩5,000 balance)

Buy : Online from Creatrip .

Bonus: Driving in Korea

If taking public transport is not your style of travelling, consider driving in South Korea . You’ll get to see things outside of the bigger cities, and also added convenient of not following rigid timetables. Check out our guide on driving in Korea for foreigners!

Tip: The Discover Seoul Pass includes a free Airport Express journey from Incheon Airport to Seoul. This can be useful to get yourself into the city before you top-up the T-Money balance on the card. Find out more tips and ways to use the pass in my list of Discover Seoul Pass itineraries .

Is The T-Money Card Worth Buying?

So, if you’ve read all this and you’re still not sure if you should get a T-Money Card or not, here is a simple summary to show why you might want to get one. This is based on my personal experience of using a T-Money Card, as well as opinions shared from members of my Korea Travel Group .

For travellers who want to pay for transportation across Korea’s bus and subway networks, the T-Money Card will be perfect and an essential purchase. However, if you’re looking for a way to pay for goods, services, and attractions in Korea, then the T-Money Card isn’t really what you’re looking for.

Instead of the T-Money Card to pay for things in Korea, I recommend getting a WOWPASS or Wise Travel Money Card . These are both more convenient and allow you pay in Korea using your card’s balance, which can be topped up in foreign currency (WOWPASS) or by bank transfer (Wise).

Learn more : Check out my guide to using Wise in Korea to learn how to get a Wise card, who is eligible, how to activate the Wise card, and all the ways it can save on your travel money expenses.

The T-Money Card is really useful and I can’t imagine travelling in Korea without one. I’d recommend buying one when you arrive in Korea. If you want to know more about T-Money and its alternatives, you can find lots of useful information in my complete South Korea travel guide .

Tips For Using T-Money In Korea

Here are a few quick tips to help you use the T-Money Card more effectively when in Korea:

1: Check the remaining balance as you travel so that you don’t run out by accident.

2: Don’t top-up too much. I’d recommend adding ₩50,000 starting balance and then ₩20,000 – ₩30,000 each time after that. Maybe less if you don’t plan to travel much.

3: Buy one as soon as you arrive. Get a Korea Tour Card at Incheon Airport.

4: Make use of the T-Money Card when you are shopping in convenience stores. You’ll end up with a lot less change.

5 : Store the T-Money Card away from other cards that can be used to pay by touch as card readers can be confused by multiple cards.

Frequently Asked Questions

Finally, here are a few FAQs about using the T-Money card in Korea, in case the above information didn’t cover enough for you. If you have any other questions you’d like to ask, feel free to leave a comment.

Where can I use the T-Money Card?

The T-Money Card can be used on public transportation in Korea, including for subway and bus journeys. Furthermore, the T-Money Card can be used to make purchases in convenience stores, cafes, shops, at vending machines, and in a range of attractions.

Can I use a T-Money Card on the subway?

The T-Money Card can be used on the subway in several cities in Korea, including Seoul, Busan, Daegu, Gwangju, Daejeon, and Incheon.

Can I use a T-Money Card to pay for taxis?

The T-Money Card can be used to pay for taxis where the T-Money logo is displayed. Be sure to check the card has the correct balance remaining to cover the taxi fare before using a taxi.

What happens if I run out of credit when using the T-Money Card?

If you run out of money on your T-Money Card when using the subway, you can top-up at a payment machine inside the subway stations before you enter or exit the station. When travelling on buses, you won’t be able to use the T-Money Card on the bus if there isn’t enough credit available. You will need to top-up your T-Money balance before boarding a bus.

Can I use the T-Money Card outside of Seoul?

The T-Money Card can be used across Korea, not just in Seoul. It can be used for public transportation in all major cities, as well as on Jeju Island. The T-Money Card can also be used for purchases in convenience stores, shops, cafes, restaurants, and attractions where the T-Money logo is displayed.

How much does the T-Money Card cost?

The base cost of the T-Money Card is 2,500 Korean won. This doesn’t include credit, which must be purchased separately. The cost of the card is non-refundable, but outstanding balances on the card can be refunded. T-Money Cards with unique designs cost more and the Korea Tour Card, which is available at Incheon Airport, costs ₩4,000.

Can I pay for the T-Money Card with a credit card?

You can purchase the original T-Money Card with a credit card, but you won’t be able to add credit or reload the T-Money Card with a credit card. Only cash is accepted for T-Money Card recharging.

Does the T-Money Card expire?

The T-Money Card doesn’t expire and can be used on multiple trips to Korea. However, credit balances on the card will expire after 5 years after the date of the last top-up or usage if not used. Once used, the 5 year period will be extended.

Which cities can you use the T-Money Card in?

You can use the T-Money card to ride the subway in Seoul and the surrounding Gyeonggi Province, Incheon, Daejeon, Daegu, Busan, and Gwangju. You can also use the T-Money card on bus networks across Korea, including all major cities. The T-Money can also be used for intercity buses. However, unlike city buses, it is necessary to buy tickets for these buses before you ride.

Where can you buy a T-Money Card at Incheon Airport?

You can buy the T-Money Card from multiple locations at terminals 1 and 2 of Incheon Airport. There is a transportation centre on Basement 1 level of Terminal 1 that sells T-Money Cards (Korea Tour Cards) in a vending machine. You can also buy T-Money Cards at Incheon Airport from convenience stores, such as 7-11 and GS25. The CU convenience store chain in Terminal 1 doesn’t sell T-Money Cards, only Cashbee Cards, which are similar.

Where can I create a personalised T-Money Card?

You can create your own T-Money Card with your own photos on the card at certain subway and train stations in Seoul. These include Seoul Station, Hongik University Subway Station, and Digital Media City Subway Station. Upload photos from your phone or take a photo in front of the machine. Once you’ve chosen your design, the card will be printed and will be ready to use once you’ve topped it up. You can top-up the personalised T-Money Card at nearby top-up machines at Seoul Station or subway stations across Seoul.

Support In My Korea Thanks for reading. If you want to help me to create more great content in the future, why not buy me a coffee? A strong coffee helps me write more and is a simple way to show gratitude for this free content.

Liked This? Pin It For Others

If you enjoyed reading this article, then please share this with your friends on Pinterest.

Related Articles

50 Unique Korean Experiences In Korea You’ll Definitely Love

I Tried Kimjang! Korean Kimchi Making Day Is Tough But Fun

10 Things To Do In Buyeo 2024: UNESCO World Heritage City

Hi! My name is Joel, I'm the author of In My Korea and writer of this article. I've lived, worked and travelled in Korea since 2015 and want to share my insights, stories and tips to help you have the best experience during your trip to Korea.

I love learning more about Korean culture, hiking the many mountains, and visiting all the coolest places in Korea, both modern and traditional. If you want to know more about my story, check out the ' about me ' section to learn why I love living in Korea.

21 thoughts on “Korea’s T-Money Card: The Ultimate Guide 2024”

Quick question… For the Korean T-Card, is there ability to get a transaction history (or Ride History) of where I tapped my card?

For example, my Los Angeles Tap Card for my and kids use for Buses and Trains, I register the TAP Card… If I need to know Ride History, I can go the TAP card website and obtain “Ride History.”

I’ve not actually tried it, but you might be able to see the history if you use the T-Money app with the mobile version of the card.

I had a look on the T-Money site (which is very basic), but couldn’t see any details about it. I guess just try it and see is the best answer I can give, sorry. I use the card function myself but never see the history of it.

Great article. Plan on trip starting at Incheon Airport Apr 2023. Can both myself and my wife use the same card at the same time. ie. we get on and off a bus together. Like scan twice or will we each need a separate card? Thanks-Mark.

Hi, thanks for reading. You will need a separate card for each person travelling. On some buses you can ask to charge for two people, but that won’t work on the subway, so it’ll be easier to get one each.

Thanks for the info. Will get two cards, myself and wife. If people were traveling as a family, such as with children, using a “Family Card” of some type would be much easier. Thanks again. -Mark.

It would be much easier, yeah, I hope they consider it in the future.

Hi! I really appreciate the detailed information you’ve included about T-money!

I have some questions. I’m a foreigner and I’ll be teaching English soon. I’m already in South Korea (I arrived beginning of March).

I didn’t manage to get a T-money card at the airport as I had to quickly be picked up. I’m aware that I can purchase one at a convenience store near me.

As I have just arrived, there are things I don’t have yet, such as: 1) My ARC (Alien Registration Card) 2) Korean bank card – I have my home debit bank card (Mastercard). I also have cash in ₩ on me. 3) Korean SIM plan

Will any of this affect me buying and topping up my T-money card?

Thank you in advance!

Hi, welcome to Korea. None of those things will stop you getting a T-Money card or topping it up. However, if you’re going to sign up for a Korean bank card, you can ask to have the ‘pay-on’ feature in your bank card so it will work just like a T-Money card. Therefore, you won’t need to get a T-Money card once you have your bank account. People here don’t really use T-Money cards when they can use their bank cards.

Hi, thank you for this article. I just got a T-Money card from a Korean store here in India. It’s the BTS PROOF edition T-Money card. Sitting in India, I was wondering how I could recharge it right away? I am visiting Korea next month. 🙂

Hi, thanks for reading. You can recharge the T-Money card as soon as you arrive in Korea at the airport. Either recharge it at the travel centre at Incheon Airport, or go to any convenience store and ask them to add credit to it. You can only top up with cash, so you’ll need some Korean won to do that. Have a good trip.

Thanks for the info… We’re a family of 4(2 adults & 2 teens), do we need to purchase 4 T-Money cards?

Hi, yes, each person will need a T-Money card.

A detailed guide of someone who has done his research/has a lot of experience with the card. Well done!

Thanks very much 🙂

Hi there! I have Cashbee cards from a previous trip, I can’t remember why I picked those over T-money cards last time around but suppose if I did it’s because they were fairly equivalent. Do you know if that’s still the case? No reason for me to leave them at home and get T-money cards, right?

Cashbee does work, yeah, but it’s not as widely used outside of the major cities. As per their own website “Transportation : Bus, Subway, Taxi (Some buses at Jeonnam, Jeonbuk, Gyeongbuk, and Gyengnam Will be available later on.)” Those are all large provinces in Korea and if you plan to travel to more places in Korea, T-Money might be a better option as it works in those places (as far as I know). The only place I’ve had a problem with T-Money is Sokcho, so maybe bring both just in case.