Stay Safe & Secure Online: 10 Essential Benefits Of Using VPN!

Streamline Your Digital Life: Choosing The Best Multiple Device VPN

Get Ready To Feel The Musical Euphoria With Olivia Rodrigo GUTS Tour 2024

Guardians Of The Journey: Understanding The Basics Of Admiral Travel Insurance

Create Memories In US Virgin Islands Resorts With Sun, Sea, And Serenity

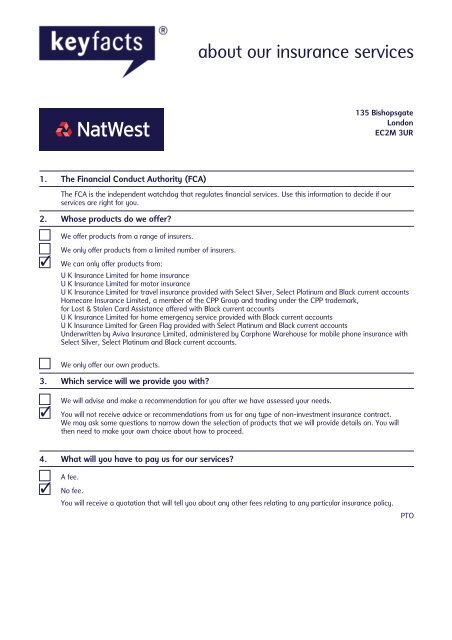

Natwest travel insurance: protecting you and your travels.

Travel insurance is necessary when you are planning a trip abroad. It provides you protection against unforeseen scenarios and losses you might suffer on a trip and give you the financial means to deal with it. If you are looking for reliable, comprehensive and affordable travel insurance, then NatWest Travel Insurance is a popular option. In this blog, we’ll cover what NatWest Travel Insurance, what coverages and policies it provides, and most importantly, if it’s the right travel insurance provider for you.

What is NatWest travel insurance?

NatWest Travel Insurance is a product offered by NatWest, a popular UK-based bank that offers a variety of financial services to customers. Like most leading travel insurance, NatWest travel insurance is designed to protect policyholders against unexpected events that might occur during a trip or a holiday.

Travel insurance by NatWest can be bought as a part of their packaged bank account. The company offers a range of covers, including single-trip, annual multi-trip, backpacker, and winter sports. Read on to find out about these covers in detail and how you can get NatWest travel insurance as a part of their packaged bank account.

Covers offered by NatWest travel insurance

NatWest offers a range of travel insurance covers to suit the diverse travel needs and budgets of its customers. Here are the main types of coverages that you can avail from NatWest:

NatWest Single-Trip Travel Insurance

NatWest’s Single-Trip Travel Insurance is for those who travel less and far in between. The policy covers a single trip, usually up to 90 days in duration. The policy covers medical expenses, cancellation, personal liability, baggage loss, and travel delays.

NatWest Annual Multi-Trip Insurance

NatWest’s Annual Multi-Trip Insurance is for those who frequently travel throughout the year. This is a cost-effective way of securing your travels, where you buy a collective plan instead of paying for each trip separately. This policy covers an unlimited number of trips during the year. Your trip duration can be up to 31-45 days at the maximum, depending on the policy you choose.

NatWest Backpacker Travel Insurance

If you are taking a gap year or want to travel for an extended period of time, then this cover will be the right choice for you. Whether you are taking a gap year or on a mission to travel around the world, NatWest will tailor the policy to your needs. The policy cover trips for up to 18 months, where you can avail protection against medical emergencies, trip cancellations and personal liability.

NatWest Winter Sports Travel Insurance

Winter sports like skiing and snowboarding are popular amongst travellers. They are not only exhilarating but also bring you one of a kind experience. If you are planning on participating in this excitement on your next trip, then NatWest’s Winter Sports Travel Insurance is meant for you. This policy offers you additional coverage for winter sports equipment, ski passes and piste closure.

NatWest Bank Accounts for travel insurance

NatWest offers three types of bank accounts: Silver, Platinum and black. Each of these accounts comes with travel insurance coverage as well as additional benefits such as mobile insurance, car breakdown coverage and airport lounge access. Find the details of the travel insurance cover under each account below.

1. NatWest Silver Travel Insurance

The NatWest Silver account comes with Silver travel insurance which provides cover for the usual, including cancellation or cutting off your trip earlier than planned and medical emergencies and treatment. For medical expenses, you can get up to £10 million in cover, and for cancellations and curtailment, you can get up to £5,000. You can also avail of additional benefits for an added cost like baggage loss or travel delay.

As we mentioned earlier, you can also get a mobile phone cover of up to £1,500 for repair or replacement. Another cover that the NatWest Silver account provides is the car breakdown cover that includes roadside assistance and recovery in the UK & Europe.

2. NatWest Platinum Travel Insurance

The NatWest Platinum account comes with Platinum travel insurance but with higher levels of coverage for medical expenses, cancellations and curtailments. The policy includes up to £10 million for medical expenses and £10,000 for cancellations. The policy also includes a cover of up to £2 million for personal liability and £50,000 for personal accidents.

Coming to mobile insurance, which covers loss, theft or accidental damage, you can avail of up to £2,000. Like the Silver account, you will receive car breakdown cover and additional lifestyle benefits like discounts on travel and entertainment.

3. NatWest Black Travel Insurance

The NatWest Black account comes with Black travel insurance with the highest levels of coverage for medical expenses, cancellations and curtailments. The policy includes up to £15 million for medical expenses and £20,000 for cancellations. As for the cover for personal liability and personal accidents, you will get up to £2 million and £100,000, respectively.

The mobile phone cover is also more in NatWest Black travel insurance, summing up to £2,500. As a standard, this policy, too, includes car breakdown cover along with other benefits like airport lounge access and discounts on travel and entertainment.

NatWest is a premium travel insurance provider that offers comprehensive policies and covers, leaving no stone unturned. The level of coverage and benefit you receive will depend on which cover you have invested in. Before you sign up for any of their covers, make sure to read the fine print carefully so that you are not blindsided. For more information on travel insurance, visit Tripcoloumn.

Do I need to register for travel insurance?

NatWest account owners don’t have to register for travel insurance as they are already covered. If you want to extend your cover to include pre-existing medical conditions, then connect with NatWest’s support team, as that might require some additional costings.

Do I need to inform NatWest about my travel plans?

No, you don’t have to inform NatWest about your travelling plans. If you have one of their bank accounts – Silver, Platinum, or Black, then you are already covered by your travel insurance.

How can I make a claim?

To make a claim for your NatWest travel insurance, you can log in to Membership Services and complete the online form. This is where you can manage all your account details. You can also call the NatWest support team for further assistance.

Advertisement

Sign in to your account

Username or Email Address

Remember Me

- Jump to Accessibility

- Jump to Content

Travel & International

On this page

Help with overseas payments

Helpful information about sending or receiving international payments including what you'll need before making a payment and how to check an International Bank Account Number (IBAN).

Sending money abroad

Using your debit card abroad

Most debit card providers will charge a foreign purchase fee of up to 2.99%.

- Cards are widely accepted overseas, look out for the Visa and MasterCard logos. Exchange rates are set by Visa and MasterCard and can change every day.

- When you use your card abroad, you can sometimes pay in sterling rather than local currency. Paying this way is often more expensive than paying in the local currency as there could be a local charge.

- If your debit card is contactless, you can use it abroad like you can at home. Just look for the contactless symbol. Limits can vary when you’re in another country.

- Let us know that you're going away at least 24 hours before you leave and we'll do our best to make sure that none of your payments are blocked.

Let us know your travel plans

Card fees and charges, tips to protect your money when booking travel, paying for your travel booking.

Use a credit card to pay for at least some of the booking, if you live in the UK and the booking value is at least £100. This will ensure the booking is covered under Section 75 of the Consumer Credit Act in the event the booking has not been fulfilled or provided by the company you have booked with.

If you don’t wish to use a credit card, bear in mind that PayPal offer buyer protection when payments are made through their system.

Where a debit card is used to make payment, you may be entitled to request a chargeback from your card issuer where the booking has not been fulfilled or provided by the company you have booked with.

More about our debit card chargeback process

Explore flexible booking options

Choose a flexible booking option to ensure you can make changes should you need to.

For accommodation, many providers offer free cancellation on reservations. Although it can sometimes cost a little more than a non-refundable booking, this guarantees you a refund if you need to cancel for any reason after making the reservation.

ATOL protection

When booking a package trip, check if the provider is ATOL bonded (UK based providers only). This gives you the peace of mind in knowing the cost of your booking will be refunded if the provider cannot fulfil the contract or goes into liquidation before you travel.

It also offers protection if the travel provider goes into liquidation whilst you are on your trip, as assured assistance for any additional accommodation or transport needed to ensure a safe return to the UK.

Always check the terms of booking

Always check the terms of booking to ensure you are satisfied with the conditions being applied. Some providers include ‘force majeure’ clauses which can leave you out of pocket with no entitlement to a refund if the provider cannot fulfil the booking due to extraordinary reasons that are beyond their control. Please be aware that this is more common with companies based outside of the UK.

Common questions

Do you offer foreign currency exchange.

We no longer offer a foreign currency service at our branches.

Can I deposit non-Sterling cheques or traveller cheques?

We are unable to accept the following types of cheques:

- non-Sterling cheques

- international or domestic drafts

- travellers cheques

- Sterling cheques issued by a bank or building society branch based outside the UK, Channel Islands, Isle of Man or Gibraltar

Do you issue international drafts?

No, we don't issue international drafts.

Something else we can help you with today?

- Privacy Policy

Sea France Holidays Best French Holiday Destinations Honest Guide

- The Ultimate Guide to Disney Springs: Everything You Need to Know

- Planning Your Ski Spring Break: Top Resorts, Deals, and Tips

- The Ultimate Guide to Finding Cheap Property With Gites Complex For Sale In France

- LOT Polish Airlines Business Class and Premium Economy Review on Boeing 787 Dreamliner

- Air Canada’s Business Class and First Class Review – Seats, Beds & Meals

- Chinese Airlines Review – A Guide to China Southern, China Eastern, and Air China

- Air France Airline Premium Economy Review – Is It Worth It?

- Current French Mortgage Interest Rates – A Guide for France Residents and Non-Residents

- MOE Changi Coast Outdoor Adventure Learning Centre and Campsite CCOALC

- How Much Does It Cost to Move to Paris France?

NatWest Platinum Travel Insurance Policy: Protect Your Trip with Comprehensive Coverage

Travel Insurance

- Stumbleupon

Have you ever had the misfortune of having your travel plans disrupted due to unforeseen circumstances? Maybe you lost your luggage, missed your flight or got sick while abroad. Travel mishaps can be a real bummer, but with the right travel insurance policy, you can have peace of mind when you’re on the go. One such policy, the Natwest Platinum Travel Insurance Policy, is designed to offer comprehensive coverage for all kinds of travel-related incidents. In this blog post, we’ll take a closer look at what the Natwest Platinum Travel Insurance Policy entails, what you can expect from its coverage, and the importance of reviewing the policy document before you purchase it. Read on to find out more!

Table of Contents

1. NatWest Travel Insurance Overview

NatWest offers travel insurance as part of its packaged bank accounts, which are only available to existing NatWest current account customers. Depending on the level of cover, their European and Worldwide travel insurance can protect you and your property against unforeseen circumstances while you’re travelling or on holiday, such as medical care, cancelled flights, or lost luggage. Customers over 70 or with pre-existing medical conditions may have to pay extra for extended cover, but it’s worth checking with NatWest, as their insurers may be able to offer help.

The Silver, Platinum, and Black bank accounts offer European, Worldwide, and Worldwide Plus travel insurance, respectively. The family cover for Platinum and Black account customers provides cover for the account holder, their partner, and dependent children under 18, while Silver account customers are only covered along with their joint account holder. NatWest’s travel insurance also covers trip cancellations, delayed or missed departure, cutting your trip short, personal accident, personal liability, and lost or delayed baggage.

It’s a good idea to have travel insurance because some tour operators may require it before confirming your booking, especially in countries like the USA where there’s no public health service. The cover provided by NatWest’s travel insurance is subject to policy terms and conditions, so customers should review, print, and/or save a copy of them. In addition, customers should check the latest advice from the Foreign Commonwealth and Development Office (FCDO) and the Government about travel and Coronavirus (Covid-19), as coverage related to pandemics may vary. If a customer needs to cancel their trip for one of the cancellation reasons covered by the policy, they can submit a claim. However, the policy won’t cover expenses that can be recovered from elsewhere, so customers should first consider seeking a refund from their travel provider or their card issuer under Section 75 or chargeback rules. [*] [**]

2. Benefits of Packaged Bank Accounts

Packaged bank accounts can be a great option for travelers looking for financial protection while they’re away. With a NatWest account, customers can access European or worldwide travel insurance, depending on their account level. This insurance can cover a range of unforeseen circumstances, such as medical emergencies, canceled flights, or lost luggage. Additionally, those with pre-existing medical conditions can have them added to their policy for extra peace of mind. It’s not a legal requirement to have travel insurance, but some tour operators may insist on it, particularly when traveling to countries without a public health service, such as the USA.

NatWest offers Silver, Platinum, and Black accounts with varying levels of travel insurance cover. Only existing current account customers are eligible for these packaged accounts. While Silver accounts come with European travel insurance, Platinum and Black customers can access worldwide insurance. Family cover is included for Platinum and Black customers, providing protection for partners and dependent children under 18, or under 23 if in full-time education. Silver account customers are only covered themselves and any joint account holder.

For those over 70 or with pre-existing medical conditions, NatWest offers extra help and support. Customers can contact the bank to find out if they can extend their travel insurance to cover someone who’s over 70 or has a pre-existing condition. However, it’s important to note that pre-existing medical conditions may not be covered by the insurance and may require an additional premium or specialist policy. NatWest’s travel insurance offers peace of mind for travelers, ensuring they’re protected against a range of potential problems that could arise while on a trip.

3. Types of Travel Insurance Coverage

Travel insurance is an important aspect to consider when planning a trip, as it offers financial protection against unforeseen incidents while travelling. NatWest offers travel insurance through their packaged bank accounts, which are available to existing NatWest current account customers. Depending on the level of cover selected, the insurance can protect against medical care, cancelled flights, and lost luggage, among other things. The Silver account comes with European travel insurance, while the Platinum and Black accounts come with worldwide coverage. Family cover is included for Platinum and Black account holders, providing protection for the customer, their partner, and dependent children under 18. The policy also covers winter sports and other holiday-related expenses.

Although travel insurance is not a legal requirement, some tour operators may require it before confirming a booking, especially when travelling to countries where there is no public health service, such as the USA. Silver account holders and their joint account holders are the only ones covered under their respective policies. For those aged 70 or over, an annual premium of £75 per person is required to renew the policy, and pre-existing medical conditions may not be covered. However, customers can extend their insurance to cover someone over 70 or with a pre-existing medical condition by completing an online form or contacting NatWest directly.

Overall, NatWest’s travel insurance policies offer a range of cover across their packaged bank accounts, providing peace of mind for customers while travelling. The policies may be particularly beneficial for frequent travellers, as they provide coverage for a variety of incidents, including emergency medical costs, cancellations, personal accidents, personal liability, and lost or delayed baggage. While the Silver account offers European travel insurance, the Platinum and Black accounts offer worldwide coverage and family cover for the customer, their partner, and dependent children under 18.

4. Travel Insurance Requirements

Travel insurance is a crucial requirement for any traveler. Luckily, most banks and insurance companies offer travel insurance policies to make the process simpler. One such policy is the NatWest International Gold Account. For a monthly fee of £18, customers can access a range of benefits, including travel insurance with comprehensive worldwide cover, including winter sports. This policy covers you and your partner plus any dependent children under 18, and even those up to 23 if they are in full-time education. Emergency medical assistance is available 24/7, providing peace of mind during your travels. However, it’s important to note that this policy is only available to residents of Jersey, Guernsey, Gibraltar, or the Isle of Man, and Gibraltar residents must be existing NatWest customers.

In comparison, FlexPlus Worldwide Family Travel Insurance, offered by Nationwide, covers you and your family, including business, wedding, golf, and winter sports cover. This policy grants you access to an online portal, allowing you to manage your insurance on the go. An extension upgrade is required for trips longer than 31 days, and the policy is only for UK residents who live in the UK for at least six months of any 12-month period. The ages of the insured people also matter, and those over 70 must pay for an age upgrade to cover them. This policy covers medical conditions declared and accepted by the insurer and is only valid if your trip starts and ends in the UK. As with any insurance policy, it’s vital to read the policy documents carefully to avoid any surprises.

As with any policy, each policy has its pros and cons. For instance, the NatWest International Gold account offers preferential rates for a fee-free overdraft, VIP treatment from a concierge service, and private motor excess insurance. Their gold standard features make clients feel like a VIP. Whereas, the FlexPlus Worldwide Family Travel Insurance policy may work better for those with children and those looking for a more comprehensive policy. They even cover travel documents costs and offer coverage for wedding essentials. This policy also grants you access to an online portal, making managing your insurance more convenient.

In conclusion, both the NatWest International Gold Account and FlexPlus Worldwide Family Travel Insurance offer robust policies with their own unique benefits. Before selecting either policy, it’s essential to assess your travel requirements carefully. Factors like the length of your travels, the age of the insured party, and your destination can impact the type of coverage you need. However, both policies come with extensive coverage that will cater to most domestic and international travelers.

5. coverage for Individuals Over 70

NatWest offers travel insurance as part of their packaged bank accounts, which is available for existing customers. The European travel insurance is included in their Silver bank accounts, while their Platinum and Black bank accounts offer Worldwide travel insurance. The insurance covers unforeseen circumstances such as medical care, cancelled flights, or lost luggage. It is not a legal requirement to have travel insurance, but it is highly recommended, especially when travelling to countries without a public health service.

For those over 70 years of age or with pre-existing medical conditions, there may be extra charges or restrictions on coverage. NatWest requires notification of any individual aged 70 or over and each year the individual must contact NatWest to get a cover extension at an annual premium of £75 per person. No coverage for pre-existing medical conditions is provided. If a customer cannot get an upgrade to extend their coverage level or their premium upgrade is unexpectedly high due to medical conditions, NatWest’s insurers, UK Insurance Limited, suggest seeking help from the Financial Conduct Authority and MoneyHelper directory.

On the other hand, InsureandGo is an alternative provider for travel insurance that aims to keep things simple and offer comprehensive coverage even for those over 70 years old or with pre-existing medical conditions. Children can also be covered for free under a policy. Their policies come with standard coverage of over 50 activities and sports. InsureandGo is licensed and regulated by the Financial Conduct Authority and has been specialising in travel insurance for over ten years.

Travel insurance is a wise investment for any trip, and NatWest and InsureandGo offer competitive options with different coverage for various types of travel.

6. Pre-Existing Medical Conditions Coverage

Travel insurance is crucial when going abroad, especially if you have pre-existing medical conditions. NatWest offers travel insurance, but for those over 70 or with pre-existing medical conditions, an additional charge may apply. It is important to check if your medical condition is covered, as some medical needs may not be included in the policy. Be sure to review the policy document thoroughly to know what the policy covers and what it doesn’t.

If you have pre-existing medical conditions and are unable to get travel insurance for your trip, you may need to reconsider your travel plans. However, there are options available to you, such as working with an insurance broker or looking at specialist travel insurance providers that cater to those with pre-existing medical conditions. Getting several quotes from multiple providers can also help you find coverage that is right for you.

When speaking with brokers and insurance providers, they may ask for detailed information about your medical condition. It is important to be truthful and as specific as possible about your condition and any treatment you may be undergoing. You should also ask about the coverage amount, excess, and any exclusions that may apply to your policy. This way, you will have a clear understanding of what is covered and what is not, providing you with peace of mind when travelling.

It is also worth knowing that having a UK European Health Insurance Card or a UK Global Health Insurance Card can provide you with free or reduced-cost healthcare should you require it while abroad. However, these cards may not cover everything, so it’s important to have travel insurance that covers any additional costs that may arise during your trip. In case of any doubts or queries, you can always reach out to your insurance provider for assistance.

7. Coronavirus (COVID-19) Coverage

Travel insurance is an essential part of any trip and offers financial protection against unforeseen incidents. With NatWest’s packaged bank accounts, customers can benefit from European or worldwide travel insurance, depending on their account. The insurance covers a range of areas, including medical care, cancelled flights, lost luggage, and personal liability. Additionally, family cover is included for Platinum and Black account holders, providing protection for the account holder, their partner, and dependent children under 18 or 23 if in full-time education.

Amid the ongoing COVID-19 pandemic, NatWest has updated its travel insurance policy to cover certain cancellations related to the virus. For trips booked from 5th January 2021 to 1st March 2022 and taken before 2nd March 2022, an endorsement was in place which changed the cover available for trip cancellation due to COVID-19. However, this endorsement was removed on 2nd March 2022. The cover has been extended to include the need to quarantine or self-isolate, FCDO advice against ‘all’ or ‘all but essential’ travel due to COVID-19 or another disease declared a pandemic and the inability to use pre-booked and pre-paid accommodation in an area adversely affected by COVID-19 or a pandemic. It is advisable to check the latest government and FCDO advice before booking a new trip or travelling.

In the event that a trip is cancelled for one of the approved reasons, a claim can be submitted. However, it is essential to consider other options for a refund first. If the travel provider has been unable to provide the booked service, customers should seek a refund. If the payment was made by credit card and the value of the booking is over £100, customers may be protected under Section 75 of the Consumer Credit Act 1974. They should contact their card issuer for further information. Similarly, debit or charge cardholders can contact their card issuer for advice as they may be able to make a claim under their chargeback rules. If unable to obtain a refund from any party, customers can consider making a travel insurance claim.

Customers who require an extension to their travel insurance due to being over 70 or with pre-existing medical conditions can complete the online form or call NatWest to find out if they can be covered. However, it is imperative to note that pre-existing medical conditions won’t be covered, and the upgrade insurance premium may be higher than expected. In such cases, help is still available through a directory created by UKI, NatWest’s insurers, in collaboration with the Financial Conduct Authority and MoneyHelper. Customers can search for alternative options by contacting the directory’s phone number. Overall, NatWest’s travel insurance policy provides reliable coverage for travellers with additional options for COVID-19-related cancellations and extensions for those over 70 or with pre-existing conditions.

8. Cancellation Reasons Covered

NatWest offers travel insurance as part of their packaged bank accounts, which are only available to existing customers. Depending on the level of cover chosen, the policy can provide financial protection against unexpected incidents such as medical emergencies, cancelled flights, or lost luggage. Even though travel insurance is not a legal requirement, some tour operators may insist on it before confirming a booking, particularly in countries without a public health service.

Silver, Platinum, and Black account holders have access to different levels of travel insurance cover depending on their account. The Silver account comes with European travel insurance, and the Platinum and Black accounts come with Worldwide travel insurance. Family cover is provided for Platinum and Black account holders, which includes the account holder, their partner, and dependent children. Silver account holders, on the other hand, are only covered along with their joint account holder.

People aged 70 and over must contact NatWest to get their cover and pay an annual premium per person, as pre-existing medical conditions won’t be covered. In case the insurer can’t offer an upgrade to the needed cover level or if an upgrade premium is higher than expected due to existing medical conditions, help is available through a directory created in partnership with the Financial Conduct Authority and MoneyHelper.

The policy provides coverage related to a pandemic such as Coronavirus (Covid-19) for trips taken from 2nd March 2022, subject to the terms and conditions of the policy. For trips scheduled before that, an endorsement was in place until 2nd March 2022, which changed the cover available for trip cancellation as a result of the Covid-19 pandemic. The policy won’t cover travel to countries where the Foreign Commonwealth and Development Office advises against all travel. If a trip must be canceled for one of the covered reasons, a claim can be submitted, but expenses recoverable from elsewhere must first be considered.

NatWest encourages clients to apply for their travel insurance policy after booking a trip as they’ll only need upgrades or extensions to their policy once they travel. If a claim is necessary, they recommend using their online claims service and keeping records of communications with the provider or another party involved. Customers who have booked through their Travel Service or bought tickets for an event and are concerned about cancellations should check the NatWest FAQs or contact them for more information.

9. Making a Claim

NatWest International offers a comprehensive Gold account that includes travel insurance, among other benefits. One of the significant benefits of the Gold account is the travel insurance that provides comprehensive worldwide coverage for the account holder and their family, including winter sports cover. They also offer emergency medical assistance, 24/7, wherever in the world an account holder may be. The partner of the account holder is also covered, whether married or cohabiting, and dependent children under 18 (or 23, if they are in full-time education). The policy is underwritten by AWP P&C SA and administered in the UK by Allianz Global Assistance. However, for more information on how coronavirus (COVID-19) affects your Gold account travel insurance, it is essential to check their website before travelling.

In addition to travel insurance, NatWest International’s Gold account also offers VIP treatment with their concierge service to help account holders with their bookings, flights, holidays, and more. This concierge service is provided by Ten, a leading lifestyle management company, and is available 24/7. Members also enjoy exclusive dining, travel, entertainment, and retail benefits negotiated with world-leading brands by their team of specialists. The concierge service also offers unlimited dining, travel, and ticket requests. Moreover, the account holders can save on flights departing from the UK with Ten’s partnered airlines, including various long-haul destination flights with British Airways .

If the account holder owns and insures their private motor vehicle, the Gold account offers peace of mind with private motor excess insurance, as well as car rental loss damage coverage. The insurance works alongside the existing car insurance and covers the cost of the excess if and when a claim is made and the damage to the vehicle is greater than the excess limit. The limit is £3000 under the policy. There is also coverage under the Car Rental Loss Damage Waiver Insurance for up to £50,000 (or equivalent in local currency) incurred as a result of damage, fire, vandalism, theft, or use of the rental vehicle. Account holders can also claim £20 per day (up to a maximum of £200) if the car rental is cancelled or cut short on the advice of a physician. Lastly, the coverage includes £200 to pay for drop-off charges incurred through the car rental station following an accident or illness and £50 for calling out a locksmith if a named beneficiary unintentionally locks their keys in the rental vehicle.

Choosing travel insurance can be a daunting task, but Which? offers a comprehensive review of the best and worst travel insurance policies. They rate cover for travel and reveal the best policies, with details on medical expenses, cancellation, and airline failures. They have assigned each travel insurance policy a policy score reflecting how comprehensive the coverage is, as well as a dedicated Covid cover rating. To compare travel insurance companies, one can check their tables and reviews of the biggest and best insurers. By clicking on the links in the reviews, one can find more information about them. Comparing policies, especially specialised ones for medical conditions or winter sports, is essential before buying. It is also crucial to read and understand the policy wording, general exclusions, and conditions before purchasing any policy. Lastly, checking the holiday provider’s protection is necessary in case anything goes wrong, and the compensation needs to be claimed from them first before the insurer accepts the claim.

10. NatWest Travel Service FAQs

NatWest offers travel insurance as part of their packaged bank accounts. These accounts are only available to existing NatWest current account customers. The Silver account comes with European travel insurance, while the Platinum and Black accounts come with Worldwide travel insurance. Depending on your level of cover, travel insurance could protect you against unforeseen circumstances while you travel such as medical care, cancelled flights, or lost luggage. It is not legally required to have travel insurance, but some tour operators may require it, especially if you’re travelling to a country like the USA . One of the great things about NatWest’s travel insurance policies is that you have the option of cover for over 70s, and pre-existing medical conditions can be added.

If you’re considering NatWest’s travel insurance policies, it’s important to understand what you’ll be covered for. Their policies cover a range of incidents, including cancelling your trip, delayed or missed departure, cutting your trip short, emergency medical costs, personal accident, personal liability, baggage (lost, stolen, or accidentally damaged), delayed baggage, and lost passports or driving licences. Family cover is included for both Platinum and Black account customers, which provides cover for you, your partner, and dependent children under 18. For Silver account customers, only you and any joint account holder are covered.

If you or your joint account holder are aged 70 or over , you’ll need to get in touch with NatWest each year to get your cover. There will be a £75 annual premium per person, and pre-existing medical conditions won’t be covered. However, you may be able to extend your travel insurance to include cover for someone over 70 or with a new or existing medical condition by completing an online form or calling NatWest. If their insurers are unable to help, they have created a directory in collaboration with the Financial Conduct Authority and MoneyHelper that you can search for help.

In comparison, InsureandGo offers cheap travel insurance policies with free coverage for your children on your policy. They cover over 50 activities and sports as standard under all of their travel insurance policies. InsureandGo is a trading style of Insure & Go Insurance Services Limited, registered in England and Wales, authorised and regulated by the Financial Conduct Authority. InsureandGo prides themselves on providing comprehensive cover and having specialised in travel insurance for over 10 years. Their policies are easy to obtain with a quick and simple application process.

Related Articles

MoneySupermarket Best Travel Insurance As Reccommended in 2024

2 weeks ago

USAA Travel Insurance Deals: Save on Hotels, Flights, and More

September 24, 2023

AMEX American Express Travel Services – Insurance, Lifestyle & More

September 10, 2023

MoneySavingExpert Martin Lewis RecommendsThe Best Travel Insurance for 2023

Are you planning a perfect vacation, but worried about the unexpected expenses you might incur …

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

JavaScript is required to use this site.

Money blog: Major change coming for Barclays customers

The Money blog is a hub for personal finance and consumer news and tips. Today's posts include an end to certain perks for Barclays customers and a controversial new Heinz product. Listen to a Daily podcast episode on the winter fuel allowance as you scroll.

Friday 30 August 2024 08:27, UK

- Major change for Barclays customers next week

- Heinz announces new controversial pasta product

- Listen to the Daily above or tap here to follow wherever you get your podcasts

Essential reads

- Has the Nike trainer bubble burst?

- Top chef shares cheap soup recipe - as he picks best budget eats in Kent

Tips and advice

- The eyewatering rate hike awaiting anyone coming off a five-year fixed

- Treat savings like monthly bill, says savings guru

- Young people doing 'big no-no' with holiday money - here are the golden rules

- Hidden refund option that could save you hundreds of pounds

NatWest says it is working hard to fix an issue which has left customers unable to make payments through its app this morning.

Users have reported receiving an error message and being logged out when trying to approve a transfer, while others say they can't access the app at all.

The most recent data from outage monitor DownDetector shows there were nearly 1,020 complaints about issues with NatWest at 7.40am this morning.

A NatWest spokesperson said: "Some customers have experienced difficulty in making payments via the mobile app this morning. We're working to resolve this as quickly as possible and we're really sorry for any inconvenience caused."

Customers are still reportedly able to make payments via online banking.

Barclays customers will stop receiving certain perks on their Blue Rewards accounts from Wednesday.

The most noticeable being scrapped is the free £5 that pops into their accounts every month just for having at least two direct debits.

All other product cash rewards for holding a Barclays mortgage, loan or life insurance are also going.

The last cash rewards payments will be made on Tuesday.

However, the £5 account fee is remaining.

What new perks are replacing the free cash?

Blue Rewards members can now access an Apple TV+ subscription worth £8.99 a month, and catch every Major League Soccer match with an MLS Season Pass subscription worth £14.99 a month (during the season). Both subscriptions are already available to activate via the app.

Should you cancel?

If you don't fancy either of the above, the account may not be worth the fee.

However, read all the other T&Cs as Blue Rewards comes with other benefits, such as access cashback rewards of up to 15%.

You also have access to savings accounts such as the Rainy Day Saver, with a decent 5.12% AER up to £5,000. This would easily cover the £5 fee but consider whether you can find an as good, or even better rate, for free elsewhere.

What do you need to no now?

Barclays is advising customers: "If you're happy with these changes and still want to be a Blue Rewards member, you don't need to do anything.

"If you feel Blue Rewards is no longer right for you, you can cancel your membership. If you'd like to cancel before the changes happen, you'll need to do it in the Barclays app or Online Banking on or before 3 September.

"If you cancel before 5pm on the last day of a month, we won't charge you the next fee."

You can cancel by logging into the app, clicking on "rewards" and then "cancel Blue Rewards".

Every Friday we take an overview of the mortgage market, hearing from industry voices and getting a round-up of the best rates courtesy of the independent experts at Moneyfactscompare.co.uk .

The daily repricing down of mortgages we've seen in recent months has finally settled, says Moneyfacts finance expert Rachel Springall, with "very few" lenders making changes.

She says that despite a downward shift since summer began on the back of interest rate cut expectations, "borrowers looking to remortgage right now will find the average overall five-year fixed rate is much higher than it was back in August 2019".

Back then it stood at 2.84% - now it's 5.22%, though lower rates are available to many customers.

The five-year rate is lower than that available over two years - the current average there is 5.58%.

As we reported earlier this week, five-year fixed are slightly ahead of two-year deals in popularity, according to the LMSMonthly Remortgage Snapshot . Just 2% of people are going for trackers - which as things stand are not offering value compared with fixed rates, though they may over time of course.

The snapshot also showed a rise in completions and instructions, the latter up a not insignificant 26%.

Honing in on remortgagers, Moneyfacts has looked at the best rates on offer now...

The comparison site also looks at what it calls "best buys" - which considers not just the rate, but other costs and incentives. These are their top picks this week...

Heinz has announced its first pasta product launch in a decade - a canned version of the beloved Italian dish spaghetti carbonara.

People's takes on carbonara can sometimes stir up controversy online - cream or no cream? Pecorino or parmigiano? Only egg yolk or also egg white?

But Heinz says it has "come to the rescue" with its "fail proof" canned carbonara, which takes the "drama" out of trying to perfect the recipe.

It's had a mixed response online, with one user on X going as far as to call it an "abomination" and others saying they're keen to try it.

The food manufacturer is trying to appeal to a younger generation with its latest launch - it said its research shows 32% of the Gen Z cohort want their food to be "fast and convenient".

Alessandra de Dreuille, Kraft Heinz meals director, said: "We understand that people are looking for convenient meals that are effortless to prepare, and our new spaghetti carbonara delivers just that.

"It's the perfect solution for a quick and satisfying meal at home."

Complaints about financial products soared by around 70% in the spring compared with a year earlier, the Financial Ombudsman Service has said.

Some 74,645 cases were raised with the service between 1 April and 30 June - up from 43,953 over the same period in 2023.

Around half the complaints now come from professional representatives, who tend to take commission from any payout, the ombudsman said.

"Whilst professional representatives have an important role to play, they must ensure that their cases are well evidenced and have merit," Abby Thomas, chief executive and chief ombudsman, said.

The opening of Jeremy Clarkson's pub in Oxfordshire has sparked a rise in searches for homes near by, according to Rightmove.

The TV presenter's pub in Asthall, near Burford, reopened to the public on 23 August.

The number of searches for properties in Burford the following day was the highest in more than a year, and 63% higher than a year ago across the bank holiday weekend, Rightmove said.

The average asking price in the area is £537,827.

Unilever says it is trialling the use of plants and flowers that "don't make the grade" to create fragrances for its products.

The consumer goods giant is collaborating with scientists at the University of Nottingham to get the pilot under way, with oils already being extracted from flowers such as petunias, roses and marigolds.

Unilever head of biotechnology Neil Parry said unwanted plants "still have valuable materials with functional benefits".

The move is aimed at being cost and energy effective, as well as a way to reduce waste.

Two big UK supermarkets have announced they're cutting prices on hundreds more products - with one aiming a "big bazooka" at its rivals.

Online grocer Ocado said 450 more of its products were being reduced in price by an average of 17% from yesterday.

Meanwhile, Morrisons announced it was lowering the price on more than 2,000 products in store and online for people signed up to its More Card loyalty scheme.

It comes amid an explosion in popularity for loyalty schemes such as Clubcard and Nectar, which sees members pay less for some products than non-members.

Morrisons also said hundreds of products would be price-matched to Lidl and Aldi.

"Today's move represents our single biggest investment in loyalty and pricing for many years," Alex Rogerson, group marketing director, said.

"Driving strong value for customers remains our number one priority and today we are getting the big bazooka out and slashing the prices on over 2,000 products for More Card customers."

We have been reporting plenty on the tax rises that could be coming in October's budget.

One of the levies that could be in line for changes is council tax, so our politics team has looked at how it works now and how the Labour government might tweak it.

The current system

Council tax is paid on domestic properties and collected by local councils.

Some people don't have to pay it or get discounts, for example those living alone, but most people over 18 who aren't students living with other students are charged.

There are valuation bands which dictate how much tax needs to be paid, based on the value of properties as they were in 1991.

New build properties developed after that date are estimated by the Valuations Office Agency and banded accordingly.

Different local councils charge different rates for each of the bands, with rates in central London often some of the cheapest, and those in more rural areas usually higher.

Current laws stipulate that any local authority wanting to raise council tax by 5% or more has to hold a referendum first.

Is it fit for purpose?

The current system was introduced in 1993.

Property values have changed significantly in the last three decades, with some London house prices having risen by more than 800%, whereas in places like Hartlepool, in County Durham, they have barely tripled.

The Institute for Fiscal Studies has labelled use of the current system as "absurd" while the Institute for Government has called it "incredibly poorly designed".

What has Labour said before?

Chancellor Rachel Reeves is among those to have previously called for a council tax revaluation.

A leaked recording from March revealed chief secretary to the Treasury, Darren Jones, saying he was frustrated by the "out of date" system and hinted those with homes worth over £1m may have to pay more.

In Wales, the Labour Party has promised to introduce new council tax bands and tax band rates, but that has been pushed back to 2028.

Sir Keir Starmer previously described the Welsh Labour government as a "blueprint for what Labour can do across the UK," but later told Sky News council tax was "too high for too many people".

What could the government change?

There have been reports the government could replace the banding system in favour of a 0.5% tax on the value of a property per year.

This would mean that someone in a property worth £350,000, for example, would pay £1,750 a year.

However, the move could particularly impact those living in London, where the average one-bedroom flat peaked at £327,000 in 2020.

Sir Keir Starmer today refused to deny reports his government is considering banning smoking in some outdoor spaces like pub gardens - sparking concern from the struggling hospitality industry.

UKHospitality CEO Kate Nicholls said: "A ban on smoking in outdoor spaces comes with the prospect of serious economic harm to hospitality venues.

"You only have to look back to the significant pub closures we saw after the indoor smoking ban to see the potential impact it could have.

"This ban would not only affect pubs and nightclubs, but hotels, cafes and restaurants that have all invested significantly in good faith in outdoor spaces and continue to face financial challenges."

UKHospitality wants the government to conduct a thorough consultation on the potential impacts - and suggests a ban might not even reduce smoking, but "simply relocate smoking elsewhere, such as in the home".

The demise of the British pub was the focus of a Money blog long read earlier this month - it's well worth five minutes of your commute home...

Ticket prices for Oasis's major reunion tour have been revealed - and the cheapest ticket comes in at less than £100.

Prices listed on the See Tickets and Gigs and Tours websites show seated tickets start at £73 for the Cardiff shows, £74 in Edinburgh and £74.25 for Wembley.

Standing tickets are more expensive, starting at £151.25 in Wembley, £148.50 at Heaton Park, £150 in Cardiff and £151 in Edinburgh.

Earlier today, Oasis announced three extra concert dates in the UK due to "unprecedented demand" for tickets.

The additional gigs mean the band will now play five Wembley concerts, five in their home city, and three in Scotland - on top of two in Ireland and two in Wales.

Yesterday it was revealed that ticket prices for shows at Croke Park in Dublin would start at €86.50 (£73).

By comparison, tickets for Taylor Swift's monster Eras Tour started at around £59 for the cheapest seated tickets at Wembley, rising to as much as £195. Standing tickets came in at around £110.

However, the huge demand for tickets to see Swift saw some people having to pay hundreds or even thousands of pounds for tickets sold at surge prices or through resale sites.

Fans of Bruce Springsteen equally paid around £65 for seated tickets and £120 for standing at his recent tour.

We recently did a deep dive into why ticket prices seem to have entered a new stratosphere in recent years.

You can read the full story here:

Here's the full Oasis reunion tour line-up:

- 4 July 2025 - Principality Stadium, Cardiff

- 5 July 2025 - Principality Stadium, Cardiff

- 11 July 2025 - Heaton Park, Manchester

- 12 July 2025 - Heaton Park, Manchester

- 16 July 2025 - Heaton Park, Manchester - added date

- 19 July 2025 - Heaton Park, Manchester

- 20 July 2025 - Heaton Park, Manchester

- 25 July 2025 - Wembley Stadium, London

- 26 July 2025 - Wembley Stadium, London

- 30 July 2025 - Wembley Stadium, London - added date

- 2 August 2025 - Wembley Stadium, London

- 3 August 2025 - Wembley Stadium, London

- 8 August 2025 - Murrayfield Stadium, Edinburgh

- 9 August 2025 - Murrayfield Stadium, Edinburgh

- 12 August 2025 - Murrayfield Stadium, Edinburgh - added date

- 16 August 2025 - Croke Park, Dublin

- 17 August 2025 - Croke Park, Dublin

Older people are having to fill out a 243-question form to access pension credit and winter fuel payments - a task that will be "daunting" for some, charities have said.

The government has launched a campaign urging eligible people to apply for pension credit after Rachel Reeves announced last month that the winter payments would be means tested.

But some have claimed the 22-page 243-question form could put pensioners off signing up, meaning they'll miss out on a vital payment as temperatures fall.

While the length of the form is typical for a means-tested benefit, the amount of information required could be difficult for some older people, charities say.

Caroline Abrahams, charity director at Age UK, told the Money blog: "The pension credit form has 243 boxes to navigate. It is not particularly long or complex as claim forms go, but completing it would still pose a challenge for many of us, including many older people with no one to help them."

Independent Age's chief executive Joanna Elson agreed, saying the scale of questions "can sometimes be complex, and gathering this amount of personal information can be daunting".

She also said older people struggling financially "may be experiencing stress and anxiety which can make a long form difficult to tackle".

Meanwhile, anti-poverty charity Turn2us said forms for means-tested benefits are typically this long.

It noted that most people who receive winter fuel payments won't need to make a claim, and for those who do, the questionnaire won't be as long as that needed for pension credit.

But Turn2us benefits expert David Samson said the "needless complexity" of the social security system was a "major barrier" for people trying to access support.

"Currently, around 850,000 eligible pensioners are not claiming pension credit, and without timely support to apply, they are at risk of missing out on the winter fuel payment," he said.

Charities have raised concern that the government's pension credit awareness drive is not allowing enough time to increase low take-up of the benefit.

Ms Abrahams said: "We are conscious that time is now very short with the last date for claiming pension credit in time to secure your winter fuel payment this winter being 21 December, only just over four months away.

"Expecting the current 63% take up figure for pension credit to rise substantially in these circumstances would be very much a triumph of hope over experience."

Ms Elson said the government must do "all it can" to remove barriers to receiving pension credit.

A spokesperson for the Department for Work and Pensions told Money that more staff were covering a rise in calls about the benefit.

"There is no increase in pension credit processing time. We have surged additional staff to cover increasing pension credit calls and urge anyone who thinks they may be entitled to pension credit to check now," they said.

Be the first to get Breaking News

Install the Sky News app for free

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Capitol Gains

- Living Not So Fabulously

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

The top ftse 100 winners and losers of 2024 so far, rolls-royce, natwest, vistry and other stocks that have moved markets this year.

UK stocks have been unloved for some time, compared with the tech-heavy US markets . But could things be turning around for these out-of-favour investments?

The FTSE 100 ( ^FTSE ) is up 8% year-to-date, bolstered partly by a more stable political backdrop, as the Labour party won July's general election with a landslide victory.

And yet it still lags behind the US S&P 500 ( ^GSPC ), which has risen 17% year-to-date. Over five years that difference in performance becomes even starker, with the tech-focused Nasdaq Composite ( ^IXIC ) up 126%, while S&P 500 has gained 95% in that time and the Dow Jones Industrial Average ( ^DJI ) has risen 59%.

This far outstrips a near 18% gain on the FTSE 100 over the last five years, with the Brexi t vote having already dampened sentiment towards UK stocks, in addition to the economic and market fallout from the Covid-19 pandemic .

The US indices also hold some of the world's most valuable companies, with Microsoft ( MSFT ) at a market capitalisation of $3.07tn (£2.32tn), which is larger than the market value of the entire FTSE 100 at £2.06tn, according to the London Stock Exchange website.

Tech companies dominate US markets , with the "Magnificent Seven" stocks , which include Apple ( AAPL ) and Nvidia ( NVDA ), representing a third of the S&P 500's market value. In fact, these seven stocks accounted for 88% of the S&P 500's gains in 2023, according to Forbes .

However, tech stocks led recent sell-offs in US markets, as fears around an economic slowdown and concerns that the US Federal Reserve may have been behind the curve on cutting interest rates led to sharp falls in indices. Markets plunged globally, with Japan's benchmark Nikkei 225 ( ^N225 ) experiencing its worst-ever daily selloff , eclipsing the point fall seen the day after "Black Monday" in 1987.

Read more: Five alternatives to Mag 7 stocks if you missed out on Nvidia

Unlike US indices, the FTSE 100 has low exposure to tech stocks and has lately emerged as too cheap to ignore and had a much steadier, even if dull, path and stock brokers and wealth managers are starting to note.

Jason Hollands, managing director at Bestinvest by Evelyn Partners, told Yahoo Finance UK that valuations of UK shares remain cheaper and dividend payouts are also attractive.

"High levels of share buybacks by UK listed companies and buoyant mergers and acquisitions (M&A) are two other reasons why the UK market has a bit of spring in its step," he said.

Hollands added that while UK markets had less exposure to tech companies it "does have strength in areas like financials, energy, commodities, and industrials."

So who have been the FTSE 100's winners and losers so far this year?

Rolls-Royce ( RR.L )

A top performer in the UK's blue-chip index year-to-date is Rolls-Royce, with shares up 66% since the beginning of 2024, it was also the biggest gainer in 2023 .

The engineering company delivered strong first-half results earlier in August, reporting an underlying operating profit of £1.1bn ($1.46bn). As a result, it raised its full-year guidance for underlying operating profit to between £2.1bn and £2.3bn.

Susannah Streeter, head of money and markets at Hargreaves Lansdown ( HL.L ), said: "Tufan Erginbilgic was pulling no punches when he took over as CEO early last year, describing the company as being ‘a burning platform’ but under his leadership, it’s risen from the flames."

Read more: How to choose between saving and investing your money

Restructuring in the company has helped improve productivity, while disposing of certain businesses and assets has "lightened the load of recent financial scars and lowered its debt", she said.

Pent up demand for travel has been another tailwind for Rolls-Royce, given a large proportion of its revenue comes from servicing engines for larger long-haul planes.

"Its position in the aerospace and defence industry is enviable, particularly given the high barriers to entry, which mean s there are very few smaller competitors edging in on its space," Streeter said.

Looking forward, she said that Rolls-Royce's multi-billion-pound order book gives it a "good deal of visibility over future revenue."

NatWest ( NWG.L )

NatWest's shares are up 53% year-to-date , while the bank also produced a solid set of first-half results with an operating profit of £3bn.

Richard Hunter, head of markets at Interactive Investor, said: "The strength and stability of the balance sheet enabled an increase to the dividend, which gives a projected yield of 5.1%, with every likelihood of more hikes to come."

NatWest announced it completed a £1.2bn share buyback programme in May. "Subject to a continuation of the most recent trends, a fresh announcement could quite conceivably follow over the coming months," according to Hunter. By repurchasing its shares, a company can reduce the supply of them on the market which can boost share prices.

Read more: Where to invest your money when interest rates are falling

NatWest also reported a capital cushion, which acts a financial buffer for banks, of 13.6% — slightly higher than the first quarter.

In addition, NatWest reported its impairment charge had decreased to £48m, which refers to the process of writing down assets that are no longer as valuable. The bank said levels of customer defaults remained low and stable.

Vistry ( VTY.L )

The election of the Labour party broadly boosted housebuilding stocks, with Vistry coming out as a winner, as its shares have climbed 47% year-to-date.

Streeter said: "Its pivot to a partnership model, where it works with developers to build homes often in the public sector for long-term investors, looks set to benefit from the policies of the new government , which has vowed to reduce planning red tape and speed up homebuilding programmes."

The housebuilder's sales rate in the first half of 2024 rose to 1.21 units per site per week, up from 0.86 units for the same period last year. Vistry also said it expects its adjusted operating profit to be around 10% higher for the first half of 2024 at approximately £227m versus the previous year.

Read more: Investors flock to tech funds amid AI race

However, Streeter cautioned that partnerships "tend to be lower-margin than ordinary housebuilding projects, so margins may remain under pressure this year — but increasing its scale in the partnerships space looks set to continue boosting future volumes, which should go a long way to offsetting the margin decline's effect on overall profits.

"And the increased size of the business has given it the bargaining power to renegotiate more favourable prices with key suppliers."

Darktrace ( DARK.L )

A takeover bid by US private equity firm Thoma Bravo prompted a rally in the shares of British cybersecurity firm Darktrace, seeing it re-enter the FTSE 100, with the stock up 58% year-to-date.

The sale of the company looks set to move forward despite the tragic death of its founding investor Mike Lynch after his yacht sank off the coast of Sicily earlier in August, Fortune reported . His business partner Stephen Chamberlain also died after being hit by a car while running out in Cambridgeshire on the Saturday before the sinking of the Bayesian yacht.

As Thoma Bravo’s is expected to be completed by the end of the year, Hunter said the cybersecurity firm is “likely to have a short stint” in the FTSE 100.

DS Smith ( SMDS.L )

A buyout deal for DS Smith has helped drive the packaging firm's shares higher, with the stock up 55% year-to-date.

International Paper ( IP ), which is listed on the New York stock exchange, agreed to buy DS Smith for a £5.8bn share capital value. The US rival said it will also seek a secondary listing of its shares on the London stock exchange upon completion of the merger.

Streeter said that the deal offers “a lot of scope to drive efficiency gains, from integrating plants and sharing technology to using the new combined scale to push for better terms with raw material suppliers.”

However, the deal is still subject to certain regulatory clearances and conditions but the companies expect it to become effective in the fourth quarter.

Beazley ( BEZ.L )

Insurance firm Beazley's shares are up 43% year-to-date.

Beazley has been an “early mover into cyber risk” as part of its focus on underwriting business in specialist lines, according to Holland.

Shares rallied in February after the insurer announced that in addition to an ordinary dividend for 2023, shareholders would receive a further $300m in returned capital.

The stock continued to climb after Beazley’s 2023 fiscal year results, released in March, showed the insurer had delivered a record profit before tax of $1.25bn (£945m). Shares then jumped to an all-time high when Beazley reported its profit before tax for the first half of 2024 had nearly doubled to $728.9m.

Burberry ( BRBY.L )

On the opposite end of the scale, luxury fashion house Burberry has so far been the worst performer in the FTSE 100 in 2024, with shares down 53% year-to-date.

Hunter said: “The company has had a horrendous year and is currently a certainty to be relegated from the FTSE100 at the upcoming reshuffle in September.”

The company brought forward its first-quarter trading update, with chair Gerry Murphy saying that weakness it had highlighted coming into its 2025 fiscal year had deepened and that it expected to report an operating loss for the first half, if this trend persisted. The business suspended its dividend payments for 2025.

At this time, Joshua Schulman was appointed as fashion house's CEO and executive director, replacing Jonathan Akeroyd who stepped down and left the company “with immediate effect.”

“The level of the group’s appeal has been thwarted by weakening consumer demand, especially in the likes of China, with sales in the Asia-Pacific region declining by 23% in the first quarter,” said Hunter.

Entain ( ENT.L )

Shares of gambling giant Entain are down 35% year-to-date.

The group’s joint venture with MGM Resorts International in the US, BetMGM, reported a loss of $123m before interest, tax, depreciation and amortisation for the first half of the year and expected to report a similar loss for the second half.

Streeter said: “This had dented sentiment, as it’s taking longer than expected to reach profitability in what is a crucial growth area for the group.”

“It was having to spend heavily on marketing to gain a foothold and hold of the competition in this relatively immature but potentially huge market for online betting and gaming.”

Read more: How to invest in AI as the rally continues

Streeter said that the group was also facing regulatory headwinds, with affordability checks in the UK, as well as new regulations in the German market, which “are expected to continue to weigh on performance.”

However, Entain’s first-half results and slightly improved guidance for the full-year figures, “provided investors with some relief,” according to Streeter.

At the beginning of August, Entain reported earnings before interest, tax, depreciation and amortisation (EBITDA) of £524m for the first half of the year, up 5% on the same period last year and said it expected the group’s full-year figure to range between £1.04bn and £1.09bn.

Spirax Group ( SPX.L )

Shares in Spirax Group, a provider of solutions for industrial processes including steam systems, have fallen 30% year-to-date.

The company’s group chief executive Nimesh Patel said its first-half results came in “slightly below expectations”, with revenues impacted by a weak macroeconomic environment in some of its key markets.

However, Patel said the company expected stronger growth in the second half of the year.

Streeter said: “It’s had to deal with a raft of operational challenges in a weaker global industrial production market, with the slowdowns in both China and the US weighing on performance.”

Prudential ( PRU.L )

Prudential shares have been languishing at around 12-year lows, with the stock down 26% year-to-date.

In results released on Wednesday, the insurer posted a 1% dip in new business profits to $1.4bn for the first six months of the year on an annual equivalent rate basis.

A fall in annualised premium equivalent (APE) sales, as a measure of new business written in insurance, drove a 3% decline in new business profits in Hong Kong. Meanwhile, an 18% fall in APE sales in China resulted in a 33% decrease in new business profits in China.

Read more: How to invest in the Indian stock market

However, Prudential reported a pick up in sales momentum in June, which it saw continuing into the second half of the year.

The company still expected new business profits for 2024 to grow at an annual rate consistent with the level needed to meet its 2022 to 2027 growth target.

Hunter said that the reason for the dip in new business profits was “mainly due to extremely strong comparatives, given that this time last year China released its pandemic restrictions and opened its economy once more."

Whitbread ( WTB.L )

Hospitality business Whitbread, which owns the UK’s largest hotel chain Premier Inn, has seen shares slump 22% year-to-date.

Whitbread said like-for-like accommodation sales were down 2% in the first quarter of this year, with weekend demand “slightly softer” for shorter notice bookings, particularly in London. The company also posted a 1% dip in food and beverage like-for-like sales in the first quarter, “with strong breakfast sales driven by high occupancy in our hotels offset by softer trading in a number of our branded restaurants”.

In April, Whitbread said it planned to cut around 1,500 jobs from its UK workforce of 37,000. The announcement came as part of the company’s “accelerated growth plan”, which included intentions to convert 112 lower-returning branded restaurants into hotel rooms and exit 126 lower-returning restaurants. Whitbread said it also planned to add more than 3,500 hotel rooms, with the aim of reaching at least 97,000 open rooms in the UK by the end of its 2029 fiscal year.

Streeter said: “While the timing of bank holidays impacted on the first half, things are expected to pick up as the year goes on.”

Funds and Investment Trusts

For those investors who still want exposure to UK stocks but prefer to do so in a more diversified way, here are some funds and trusts that have performed well so far this year.

Artemis UK Select

Bestinvest’s Hollands said that the Artemis UK Select fund, managed by Ed Legget and Ambrose Faulks, “hunts for growth companies that can be bought at attractive valuations.”

The fund is up nearly 19% so far this year as of Monday, according to data provided by Bestinvest using the Lipper fund research database. That compares to an 11% rise in the MSCI United Kingdom All Cap index.

“It has a flexible remit, able to roam across the UK market though it typically invests in large and mid-cap names,” said Hollands.

He pointed out that financials are currently a big theme in the fund, representing 37% of its exposure, with banks Barclays ( BARC.L ), NatWest and Standard Chartered ( STAN.L ) in its top 10 holdings, along with private equity firm 3i Group ( III.L ). Vistry and DS Smith are also among its top 10 positions.

Artemis Income

Joseph Hill, senior investment analyst at Hargreaves Lansdown, highlighted the Artemis Income fund which has risen by 12.4% in value so far this year, versus an 11% increase in the FTSE All Share ( ^FTAS ), according to data provided by Hargreaves Lansdown running to 16 August.

Read more: How FTSE All-Share index listings are changing

Artemis Income mainly holds large UK businesses but will also invest in medium-sized companies where opportunities arise, said Hill.

“The fund invests in companies that they think can pay a sustainable income through the market cycle, whatever the economic backdrop,” he said, explaining that these tend to be businesses with a lot of recurring revenues.

“This increases the chance they can retain and grow their customer base, profits, and therefore dividends over time, although nothing is guaranteed,” he added.

Hill said that Hargreaves Lansdown’s analysis indicates that retailers Tesco ( TSCO.L ) and Next ( NXT.L ) have been key contributors to performance this year.

Fidelity Special Situations

Fidelity Special Situations' focus on "unloved companies differentiates the fund from some peers", said Hill. It is invested in large, medium-sized and higher-risk smaller companies that can often be overlooked by other investors.

"Maybe they've missed a profit target, or the management team made some unpopular decisions. Either way, [manager Alex Wright] must believe the company is on the road to recovery. As the company improves, its share price should rise as other investors begin to recognise the change," Hill said.

Read more: The worst performing investment funds so far this year

The fund, which is co-managed by Jonathan Winton, has generated a return of 16% so far this year.

Fidelity Special Values ( FSV.L )

Looking across to investment trusts, Hollands highlighted Fidelity Special Values Plc, also managed by Wright and Winton, which is up 17% year-to-date.

Top 10 holdings in both the fund and trust include tobacco company Imperial Brands ( IMB.L ) and financial services firm Aviva ( AV.L ).

Hollands also noted that the trust's own shares are "trading at a -6% discount to the net asset value of the portfolio".

Temple Bar Investment Trust ( TMPL.L )

Exposure to banks, which have been considered "unfashionable", has served the managers of Temple Bar Investment Trust well over the last year as shares in the sector have rallied, according to Hollands. The trust counts Barclays and NatWest among its top holdings.

The trust's shares have risen 14% year-to-date.

"Over three-quarters of the portfolio is invested in UK listed companies, but the managers also have the flexibility to allocate a portion of the portfolio to overseas companies that meet their criteria," said Hollands.

Edinburgh Investment Trust ( EDIN.L )

Edinburgh Investment Trust, up 12%, has outperformed the FTSE All Share so far this year.

Hill said that manager Imran Sattar's "remains on owning businesses where growth is aided by structural growth tailwinds, or where there’s a change in industry structure or company strategy which will enable future profit growth".

Top holdings in the trust include oil major Shell ( SHEL.L ) and consumer goods company Unilever ( ULVR.L ).

Download the Yahoo Finance app, available for Apple and Android .

- Jump to Accessibility

- Jump to Content

How do I make a claim on my travel insurance?

To make a travel insurance claim, please login to our Membership Services(opens in a new window) . Alternatively, you can contact us on the numbers below.

0345 609 0453 (Relay UK 18001 0345 609 0453). Lines are open 24/7. If you need emergency assistance whilst abroad call us on: 0345 609 0453 or +44 1252 763 658. Lines are open 24/7, 365 days a year. Charges may apply. Calls may be recorded.

01252 308 792 (Relay UK 18001 01252 308 792). Lines are open 24/7. If you need emergency assistance whilst abroad call us on: 0345 601 5219 or +44 125 230 8792. Lines are open 24/7, 365 days a year. Charges may apply. Calls may be recorded.

0345 601 7188 (Relay UK 18001 0345 601 7188). Lines are open 8am-6pm Mon-Fri, and closed Saturday, Sunday and bank holidays. If you need emergency assistance whilst abroad call us on: 0345 601 7188 or +44 2392 660 340. Lines are open 24/7, 365 days a year. Charges may apply. Calls may be recorded.

Didn't find what you were looking for?

Similar questions customers ask.

How do I order a cheque book or paying-in book using Online Banking?

How can I do a balance transfer to my credit card?

Can I transfer cash from my credit card to my bank account?

How can I increase or decrease my overdraft limit?

Is there an early repayment charge if I switch to a new mortgage deal?

Cora can help with a wide range of queries and show you how to do your banking.

Explore support centre topics

Banking from home.

Card reader

How to use the Mobile app

How to use Online Banking

Make payments

View or change your details

Add a party to an account

Find account details

Notifications

Update details

View statements

Help with your product

Credit card

Current accounts

Rooster Money

Help with your card

Card delivery

Card functionality

Going abroad

Transactions

Banking near me

ATM/Cash & Deposit Machine (CDM)

Book an appointment

Mobile branches

Opening times

Order change

Safe custody

Withdrawals

Dealing with difficult times

Bereavement