Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

American Express Travel Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

313 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

36 Published Articles 3280 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1179 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

Why purchase travel insurance, travel insurance and the covid-19 virus, american express travel insurance options, additional information — american express travel insurance, how does american express travel insurance compare, the value of travel insurance comparison sites, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

We frequently discuss the travel insurance coverages that are offered complimentary on most credit cards . We do so because these benefits, especially the long list of travel insurance coverages on premium cards, can save you money, offer peace of mind during your travels, and provide help if something goes wrong.

These complimentary coverages are useful and can offer more than adequate coverage for most trips. However, if you’re investing in an expensive trip or 1 that involves multiple travel providers, purchasing a comprehensive travel insurance policy is a prudent move. You’d also want a travel insurance policy if your trip has a complicated itinerary or if you’re anxious about the possibility of having to cancel any portion of the journey.

Additionally, it’s imperative that if you’re worried about having medical coverage while traveling, you’d want to purchase a travel insurance policy that provides medical coverage.

Fortunately, travel insurance is widely available, reasonably affordable, and simple to secure. There are several reputable travel insurance companies , highly-rated by financial rating organizations such as AM Best , that offer nearly endless options from which to choose.

American Express Travel Insurance , underwritten by AMEX Assurance Company, is one of those highly-respected, highly-rated, established companies offering comprehensive travel insurance solutions.

Join us while we check out the types of policies the company offers, any limitations of which to be aware, and additional options for protecting your next trip appropriately.

Travel insurance can help you avoid losing the investment you made when booking your trip, reimburse you for covered expenses should your trip be disrupted due to a covered event, or pay for emergency medical services.

Policies are designed to cover disruption due to the reasons listed in the policy you purchased. These reasons consist of events that are unforeseen and unexpected.

Here are a few situations where travel insurance could cover your loss:

- You or a covered family member become ill and you must cancel your trip. Trip insurance can cover prepaid non-reimbursable expenses.

- You are injured in an accident during your trip and need to be evacuated to a hospital by air ambulance.

- You become ill during your trip and must return home versus continuing on your journey.

- Your flight is delayed or canceled and you must stay at a hotel and incur expenses for lodging and incidentals.

Whether you should purchase travel insurance or not is a personal decision. If losing your trip investment or having to pay for extra expenses if the trip is disrupted makes you uncomfortable or would present a financial burden, then you should purchase a comprehensive travel insurance policy.

If worrying about having to cancel your trip or having it disrupted during your journey is an issue, purchasing a travel insurance policy will definitely deliver some peace of mind, both prior to and during your trip.

For more tips on buying travel insurance in general, you’ll find valuable information in our guide to buying the best travel insurance .

Bottom Line: The longer, more expensive, and more complicated your trip, the greater the need for a comprehensive travel insurance policy.

When you purchase travel insurance and your trip is canceled, you expect to have coverage. However, not all cancellations are covered — only those specifically listed in your policy.

Once COVID-19 was declared a pandemic, it became a known event and therefore is not covered on travel insurance policies. While it’s reasonable to want to cancel your trip due to fear of COVID-19, canceling a trip due to the fear of any illness is not a covered reason on any travel insurance policy.

There is also no coverage for canceling a trip due to a U.S. State Department announcement warning of COVID-19 in a particular area.

In order to have coverage for voluntary trip cancellations, you would need to purchase “Cancel for Any Reason Insurance” (CFAR) . CFAR is not a stand-alone insurance policy — it is an add-on coverage you select when you purchase a travel insurance policy or coverage you may be able to add to a travel insurance policy after purchase, within an initially specified timeframe.

CFAR insurance is expensive, does not cover the entire cost of your trip, and not all companies sell the coverage, including American Express Travel Insurance.

Additionally, there is a small window of time when you are able to purchase the coverage, including during your initial purchase or up to 10 to 21 days after the purchase, depending on the company.

While American Express Travel Insurance does not cover trip cancellation due to fear of contracting COVID-19, there may be coverage in certain circumstances. For example, if you become sick with the virus and have to cancel your trip as a result, you may have coverage under trip cancellation insurance.

Additionally, if you become ill with the virus during your travels, you may have coverage under Travel Medical Protection. Terms and conditions apply.

Bottom Line: Travel insurance does not cover canceled trips due to fear of getting COVID-19 or a government declaration that a specific destination is unsafe. Cancel for Any Reason Insurance must be purchased to cover these voluntary cancellations.

American Express offers you 2 options when it comes to purchasing travel insurance. You can select a package policy that includes several types of coverages in 1 plan or you can build your own travel insurance plan and select just the coverages that are important to you.

Coverage is worldwide except for where it would violate U.S. trade or economic sanctions. All permanent U.S. residents are eligible to purchase travel insurance with American Express.

Package Policy Options

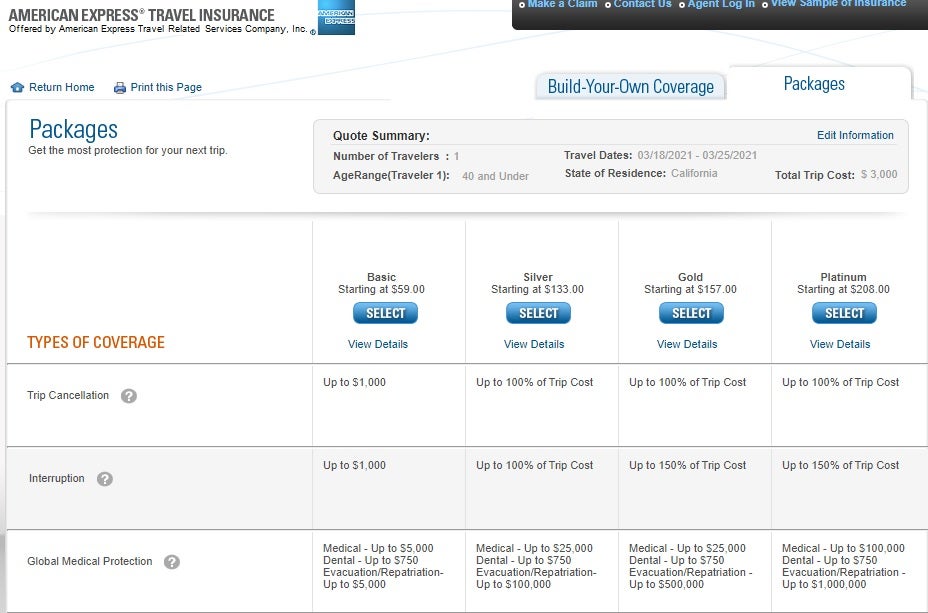

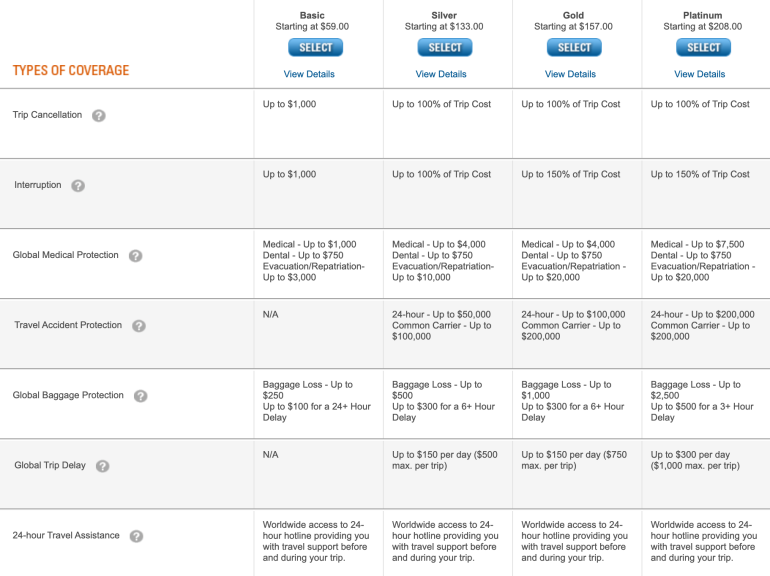

American Express Travel Insurance offers 4 levels of travel insurance package policy plans — a Basic Plan, Silver Plan, Gold Plan, and Platinum Plan. Each has its own levels of coverage and associated premium cost.

Let’s take a look at the package policy offerings and pricing. We chose a week-long trip for a 40-year old that cost $3,000. Prices ranged from $59 to $208 to cover the entire trip.

With package policies, you can expect to find the following coverages. The limits of coverage differ based on the policy plan you select.

- Trip Cancellation/Interruption — Receive reimbursement for prepaid non-refundable expenses due to cancellation for covered reasons and additional costs if your trip is disrupted, also for covered reasons.

- Global Medical Protection — Receive worldwide emergency medical and dental coverage for the first 60 days of your trip and access to emergency evacuation/repatriation services.

- Travel Accident Protection — Receive coverage for accidental death/dismemberment from the time you leave on your trip until the time you arrive home.

- Global Baggage Protection — Coverage varies from $250 to $2,500 for lost luggage depending on the level selected. Baggage delay coverage starts from 3- to over 24-hour delays, depending on the policy plan selected.

- Global Trip Delay — Receive up to $300 per day, $1,000 per trip, depending on the level of coverage selected. Coverage is valid for delayed/canceled flights or involuntary-denied boarding.

- 24-Hour Travel Assistance — Have global access to planning and emergency assistance before and during your trip.

Bottom Line: American Express Travel Insurance offers 4 different levels of package policies, each comprising a collection of coverages most travelers look for. The plan you select and the level of coverage limits chosen determine the amount of the premium cost.

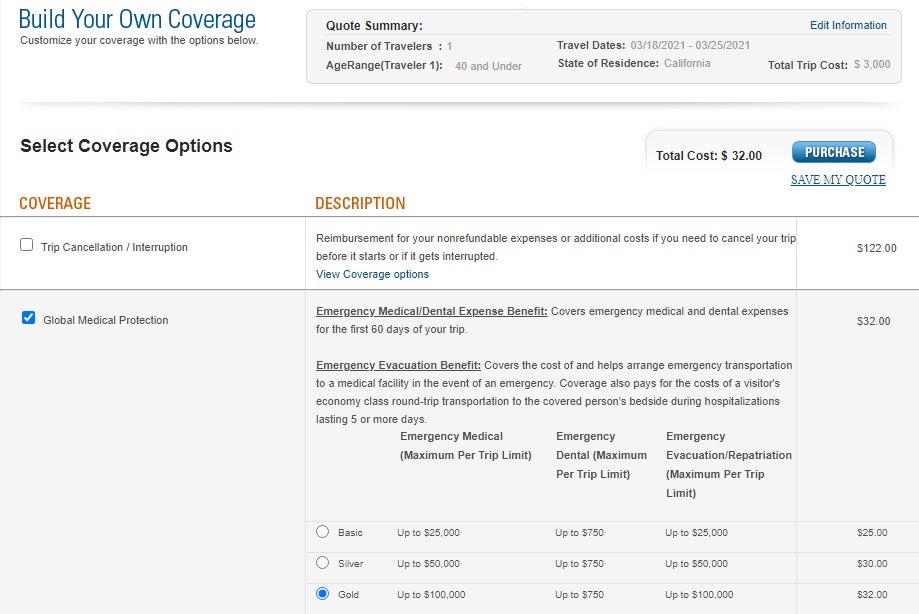

Custom Select Coverage Options

If some of the coverages in the package plan are not important to you, you can select only the coverage(s) you want and pay accordingly. Perhaps, for example, you have a need for just medical coverage while traveling abroad. You have the option to select just that coverage.

This example shows the levels of coverage available and the associated premium costs. The Gold Plan selected offers up to $100,000 in emergency medical, up to $750 in emergency dental, and up to $100,000 in emergency evacuation/repatriation. The price of this plan would be $32 for the entire trip.

Bottom Line: Having the option to select only the coverages you want allows you to save money by not paying for coverages you don’t need. This is a key benefit of purchasing travel insurance through American Express Travel Insurance. Few travel insurance companies offer the option to purchase stand-alone travel medical coverage.

Pricing By Age

Like most travel insurance companies, American Express Travel Insurance prices its products within age brackets. The price for coverage is the same for everyone in that specific age bracket.

Based on dozens of quotes obtained, pricing brackets were determined to be as follows:

- Age 17 to 40

- Age 41 to 65

- Age 66 to 70

- Age 70 to 80

- Age 81 or over

Knowing this upfront can help you determine if you’re at the beginning of the highest price bracket or the end. For example, if you are 40 years old, you’re going to pay less than a 41-year-old in the next pricing bracket but the same as a 17-year-old.

If you’re a senior and want to learn more about purchasing travel insurance in your 60s, 70s, and beyond , the tips in our article will help guide you in the right direction.

Bottom Line: Knowing a travel insurance company’s age pricing brackets can help you determine which company offers you the best value for your money.

Cancellations and Changes

Here is some information you should know about cancellations and changes to an American Express Travel Insurance policy.

- You can change or modify your policy prior to your trip.

- You can request a full refund within 14 days after receiving your policy documents. Some restrictions vary by state.

- If you have purchased American Express Travel Insurance and your trip was canceled due to COVID-19, you may qualify for a policy refund . Contact AMEX Assurance Company for details at [email protected]. Terms apply.

- Once your trip is completed, you cannot request a refund.

Hot Tip: Due to the overall decrease in travel, many travel insurance companies now allow you to cancel your travel insurance and receive a full refund or extend your policy without extra charges.

To Other Travel Insurance Companies

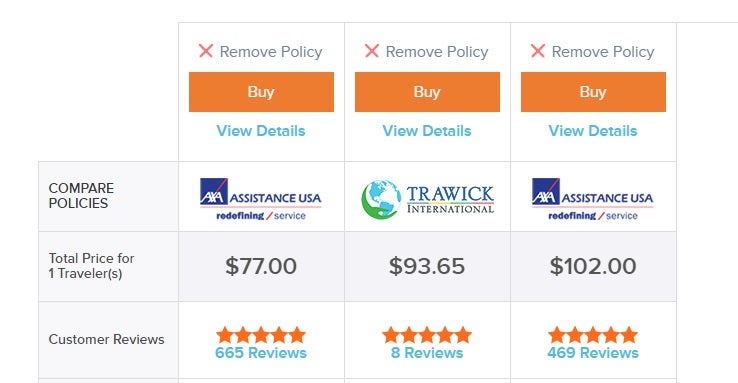

When comparing other package policies to American Express Travel Insurance, the company’s premiums came up higher overall for this specific trip and traveler (1-week trip, 40-year-old, total value $3,000).

The first policy above with Assistance USA for $77, for example, has coverages similar to the Silver Amex plan which has a premium of $133. The coverage on the $102 Assistance USA plan above compares more with the Amex Gold plan at $157.

Prices will vary considerably based on the types of coverages selected, age, and limits of each coverage. We used policy comparison websites and found similar but not identical policies. With so many different coverage options, it’s difficult to compare apples to apples.

This is a very limited comparison — your results will be different based on your specific details. The most important factors to consider are that you’re purchasing from a highly-rated company, the coverages are a match for your needs, and the premium is one with which you’re comfortable paying.

To Credit Card Travel Insurance

The travel insurance coverages that comes complimentary on your credit card can serve to provide coverage for some trips. For example, if you book a domestic round-trip flight, a hotel, and a rental car, you may have sufficient coverages on your credit card to cover that trip.

Credit card travel insurance coverage, however, is not a replacement for a comprehensive travel insurance policy , for these reasons:

- Most credit card travel insurance coverage is secondary and in excess of other coverage you might have. You’ll normally be working with 2 (or more) entities to get your claim resolved.

- Credit card travel insurance is administered by a third party, not by the issuing financial institution, thus making the claims process potentially redundant and complicated.

- You generally won’t find medical coverage on a credit card. The Platinum Card ® from American Express and the Chase Sapphire Reserve ® offer emergency medical evacuation and there is a small medical benefit on the Chase Sapphire Reserve card.

- Coverage limits are set on credit card travel insurance. Travel insurance policies can offer higher limit options.

- Credit card travel insurances have requirements such as purchasing the trip with the associated credit card.

- Additional coverages can be added to travel insurance policies such as CFAR insurance, a preexisting conditions waiver, and other benefits not available with credit cards.

Bottom Line: While the travel insurance coverages that come with credit cards may be sufficient to cover a simple trip where there is no large investment at stake, these coverages are by no means a replacement for a comprehensive travel insurance policy.

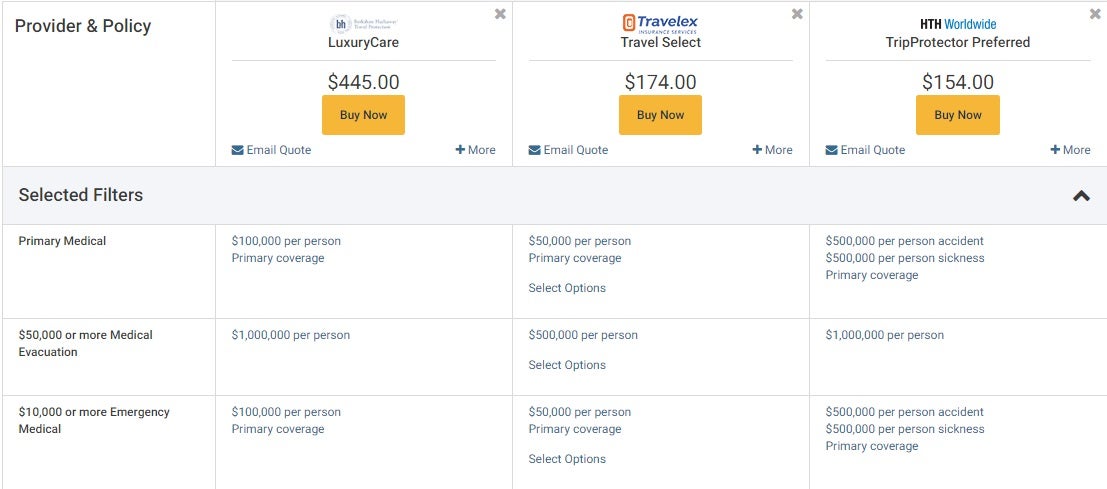

Because travel insurance is widely available and quite competitive, you may find drastic differences in the price you’ll pay between companies and policy offerings. Selecting a company is not difficult as there are dozens of reputable, highly financially-rated, established companies, but comparing policies is essential for getting the best value for your money.

One way to easily compare pricing and coverages is to utilize a travel insurance comparison site to narrow down the appropriate options for your situation.

Here are some of the most popular, easy-to-use comparison sites that only feature highly financially-rated travel insurance companies.

TravelInsurance.com

- Coverage is available instantly

- The comparison tool is easy to use

- The company has a “best price guarantee”

InsureMyTrip

- Calls are handled by licensed agents

- The website contains educational information for understanding travel insurance coverages and policies

- Features nearly 2 dozen companies

SquareMouth

- Compare 90 different policies from over 20 different companies

- Customer service receives high accolades

- Over 86,000 reviews

Bottom Line: Utilizing a travel insurance comparison website can help you quickly narrow your choices to policies that fit your needs and your budget.

There is no doubt that American Express is a financially-stable, established, and well-respected travel insurance company.

One of the company’s strengths is that it offers the consumer the ability to purchase needed coverages separately , such as medical insurance for an international trip. The premiums for such coverage are also very competitively priced. This could be a huge plus if you are not interested in duplicating credit card travel insurance coverages or in having just secondary or excess coverage.

One downside, especially in today’s environment, is that American Express Travel Insurance does not sell CFAR insurance. If this is important to you, you should attempt to find the coverage elsewhere by using comparison sites.

Another downside that may or may not be important is that American Express Travel Insurance does not sell annual or multi-trip policies. You must purchase a new policy for each individual trip.

Also, like several other travel insurance companies, high-risk adventurous activities may not be covered with American Express Travel Insurance. You might look to a company specializing in insuring these activities such as World Nomads .

If you want to make sure you’re purchasing from an established company and have specific coverages you’re more interested in than others, American Express Travel Insurance is a solid decision . For package travel insurance policies, you might be able to realize modest savings by shopping around, but you won’t go wrong with the company selection of choosing American Express Travel Insurance.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is american express travel insurance worth it.

Yes, overall. American Express Travel Insurance is backed by AMEX Assurance Company which is highly-rated, established, and reputable.

The company offers competitive travel insurance package policies but also allows the traveler to build their own policies with only the coverages they deem necessary. This option can save the traveler money.

If you’re looking for medical coverage for an international trip, for example, purchasing with an established company at a reasonable price makes American Express Travel Insurance a worthy choice.

Do I have to have an American Express credit card to purchase American Express travel insurance?

No, you do not need to be an American Express cardholder to purchase a travel insurance policy from American Express Travel Insurance.

Does travel insurance cover COVID-19?

Travel insurance does not cover canceling your trip due to fear of getting sick. It also does not cover canceling your trip due to a government shutdown due to COVID-19, or a surge in cases in a particular area.

You may have coverage if you become ill due to COVID-19 and need to cancel your trip, depending on the terms of your policy.

You may also have coverage if you become ill due to COVID-19 during your travels.

Is credit card travel insurance any good?

The travel insurance coverages that come with your credit card can be sufficient to cover simple trips. If you’re booking a trip that has a complicated itinerary, involves several travel providers, or is more than a week in length, you might consider a comprehensive travel insurance policy.

In addition, if your trip is an expensive one, even if it’s simple and short, it would be prudent to cover your investment with a travel insurance policy.

Finally, credit cards do not come with medical insurance coverage. If you need this coverage while traveling, you’ll want to purchase a separate policy.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to American Express Travel Insurance

Elina Geller is a former Travel Writer at NerdWallet specializing in airline and hotel loyalty programs and travel insurance. Her passion for travel rewards began in 2011 when she flew first class to London and Amsterdam on British Airways and used hotel points to stay in both cities. In 2019, Elina founded TheMissMiles, a travel rewards coaching business. Elina's work has been featured by AwardWallet. She’s a certified public accountant with degrees from the London School of Economics and Fordham University.

Megan Lee joined the travel rewards team at NerdWallet with over 12 years of SEO, writing and content development experience, primarily in international education and nonprofit work. She has been published in U.S. News & World Report, USA Today and elsewhere, and has spoken at conferences like that of NAFSA: Association of International Educators. Megan has built and directed remote content teams and editorial strategies for websites like GoAbroad and Go Overseas. When not traveling, Megan adventures around her Midwest home base where she likes to attend theme parties, ride her bike and cook Asian food.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

American Express travel insurance vs. coverage provided by AmEx cards

Complimentary travel insurance provided by amex cards, trip cancellation and interruption insurance, trip delay insurance, car rental loss and damage insurance, baggage insurance, premium global assist, global assist hotline, standalone american express travel insurance plans, should you use the complimentary benefits or purchase a policy, amex travel insurance recapped.

You can get AmEx travel insurance via your card or as a standalone policy.

AmEx cards typically include coverage for trip delays, interruptions, cancellations, baggage and car rentals.

Coverage tends to be secondary.

Policies vary by card.

American Express has two different types of travel insurance offerings: standalone travel insurance plans that customers can purchase and travel insurance that is included as a complimentary benefit on certain cards.

So if you’re thinking about getting travel insurance before a trip, get familiar with American Express travel insurance benefits that are included on your credit cards. Knowing what protections you already have will prevent you from spending money on a separate policy with benefits that overlap.

A standalone travel insurance policy from American Express may offer more robust coverage, but depending on your needs, the travel insurance perks provided by your AmEx card may be sufficient.

If you primarily want specific coverage for cancellations, delays or rental cars and baggage, it’s likely your card will be enough.

If, however, you’re mainly concerned with emergency health coverage while traveling , you’re better off with a separate medical insurance policy because the benefits provided by credit cards are limited in those areas. You can purchase this from American Express directly or shop around other travel insurance companies .

» Learn more: How to find the best travel insurance

There are six travel insurance benefits offered on many American Express cards:

Trip cancellation and interruption insurance .

Trip delay insurance .

Car rental loss and damage insurance .

Baggage insurance plans .

Premium Global Assist Hotline .

Global Assist Hotline .

Here's a closer look at each.

Trip cancellation will protect you if you need to cancel your trip for a covered reason (more below), and you will be reimbursed for any nonrefundable amounts paid to a travel supplier with your AmEx card. Bookings made with Membership Reward Points are also eligible for reimbursement. Travel suppliers are generally defined as airlines, tour operators, cruise companies or other common carriers.

Trip interruption coverage applies if you experience a covered loss on your way to the point of departure or after departure. AmEx will reimburse you if you miss your flight or incur additional transportation expenses due to the interruption. American Express considers the following to be covered reasons:

Accidental injuries.

Illness (must have proof from doctor).

Inclement weather.

Change in military orders.

Terrorist acts.

Non-postponable jury duty or subpoena by a court.

An event occurring that makes the traveler’s home uninhabitable.

Quarantine imposed by a doctor for medical reasons.

There are many reasons that are specifically called out as not covered (e.g., preexisting conditions, war, self-harm, fraud and more), so we recommend checking the terms of your coverage carefully.

If you want a higher level of coverage for trip cancellation, consider purchasing Cancel For Any Reason (CFAR) travel insurance . CFAR is an optional upgrade available on some standalone travel insurance plans. This supplementary benefit allows you to cancel a trip for any reason and get a partial refund of your nonrefundable deposit.

Alternately, if you want what essentially amounts to CFAR insurance on your flights specifically, purchase your fares through the AmEx Travel portal and tack on Trip Cancel Guard for an extra fee. Trip Cancel Guard guarantees you an up to 75% refund on nonrefundable airfare costs when you cancel at least two days before departure, regardless of why. This isn't as comprehensive as other CFAR policies, but it can add some peace of mind for people who want the cash back (as opposed to a travel credit) for flights they may not take.

AmEx cards with trip cancellation, interruption coverage

The following American Express credit cards offer trip cancellation and trip interruption coverage:

on American Express' website

Additional AmEx cards that offer trip cancellation and interruption coverage include:

The Business Platinum Card® from American Express .

Centurion® Card from American Express.

Business Centurion® Card from American Express.

The Corporate Centurion® Card from American Express.

The Platinum Card® from American Express for Ameriprise Financial.

The American Express Platinum Card® for Schwab.

The Platinum Card® from American Express for Goldman Sachs.

The Platinum Card® from American Express for Morgan Stanley.

Corporate Platinum Card®.

Delta SkyMiles® Reserve Business American Express Card .

Terms apply.

Covered amount

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Coverage is secondary and applies after your primary policy provides reimbursement. Claims must be filed within 60 days. To start a claim, call 844-933-0648.

This benefit will reimburse you for reasonable, additional expenses incurred if a trip is delayed by a certain number of hours. Examples of eligible expenses include meals, lodging, toiletries, medication and other charges that are deemed appropriate by American Express. It makes sense to use your judgment in terms of what will get approved based on your policy's fine print.

Acceptable delays include those that are caused by weather, terrorist actions, carrier equipment failure, or lost/stolen passports or travel documents. There are also plenty of exclusions, such as intentional acts by the traveler.

AmEx cards with trip delay insurance

The reimbursable amount depends on which card you hold.

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Up to $300 per Covered Trip that is delayed for more than 12 hours; and 2 claims per Eligible Card per 12 consecutive month period.

As expected, the more premium travel credit cards offer higher compensation for shorter delays. Trip delay insurance is offered on the following American Express credit cards:

When you decline the collision damage waiver offered by the car rental agency, you will be covered if the car is damaged or stolen through your AmEx Travel Insurance. Depending on the card you have, the coverage is $50,000 or $75,000.

» Learn more: How AmEx car rental insurance works

In addition, the cards offering car rental damage and theft insurance up to of $75,000 also provide secondary benefits:

Accidental death or dismemberment coverage.

Accidental injury coverage.

Car rental personal property coverage.

To qualify, you must decline the personal accident coverage and personal effects insurance provided by your car rental company.

The entire rental must be charged on the American Express credit card to receive coverage for car rental loss and damage. And keep in mind that you do still need liability insurance when making your rental car reservation (you may have this through your personal auto insurance policy), as these credit card-provided coverage options don't include personal liability.

AmEx cards with car rental coverage

American Express lists over 50 different cards on its site that come with one of the two forms of car rental insurance. Cards that link to the Tier 1 policies are the $50,000-coverage cards, and Tier 2 policies are the $75,000 cards.

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

The amount reimbursed is calculated as whichever is lowest:

The cost to repair the rental car.

The wholesale book value (minus salvage and depreciation).

The invoice purchase price (minus salvage and depreciation).

Here are some key exclusions to be aware of with this coverage:

These policies don't cover theft or damage that was caused by a driver’s illegal operation of the car, operation under the influence of drugs/alcohol or damage caused by any acts of war.

Policies don't cover drivers not named as "authorized drivers" on your rental agreement.

The benefit only covers car rentals up to 30 consecutive days.

Not all cars are included in the policy. Certain trucks, vans, limousines, motorcycles and campers are excluded from coverage.

Insurance protection doesn't apply in Australia, Italy, New Zealand and any country subject to U.S. sanctions .

You can file a claim online or call toll-free in the U.S. at 800-338-1670. From overseas, call collect 216-617-2500. Your claim must be filed within 30 days of the loss. Additionally, some benefits vary by state, so check the policy for your specific card.

» Learn more: The guide to AmEx Platinum’s rental car insurance

As an American Express cardholder, you are eligible to receive compensation if your luggage is lost or stolen. This benefit is in addition to what you may receive from the carrier. However, the AmEx policy is secondary, which means that it kicks in after the carrier provides any compensation for losses.

AmEx provides this insurance to "covered persons," who are defined as:

The cardmember.

Their spouse or domestic partner.

Their dependent children who are under 23 years old (there are age exceptions for handicap children).

Some business travelers (Tier 2 coverage only).

To qualify, all covered individuals need to be traveling on the same reservation and must be residents of the U.S., Puerto Rico or the U.S. Virgin Islands.

AmEx cards with baggage insurance

Naturally, the higher-end cards offer more protection — but even the basic cards have decent coverage. The compensation limits per person are as follows (note that the maximum payout per covered person for lost luggage is $3,000 on all of these cards).

Below are the limits for cardholders of the The Platinum Card® from American Express , The Business Platinum Card® from American Express , The American Express Platinum Card® for Schwab, The Platinum Card® from American Express for Goldman Sachs, The Platinum Card® from American Express for Morgan Stanley, Hilton Honors American Express Aspire Card , Marriott Bonvoy Brilliant™ American Express® Card, Centurion® Card from American Express and Business Centurion® Card from American Express:

Baggage in-transit to/from common carrier: $3,000.

Carry-on baggage: $3,000.

Checked luggage: $2,000.

Combined maximum: $3,000.

High-end items: $1,000.

And here are the coverage limits for cardholders of the American Express® Gold Card , American Express® Business Gold Card , American Express® Green Card , Business Green Rewards Card from American Express , Hilton Honors American Express Surpass® Card , Marriott Bonvoy™ American Express® Card, Marriott Bonvoy Business® American Express® Card , Delta SkyMiles® Reserve American Express Card , Delta SkyMiles® Reserve Business American Express Card , Delta SkyMiles® Platinum American Express Card , Delta SkyMiles® Platinum Business American Express Card , Delta SkyMiles® Gold American Express Card and Delta SkyMiles® Gold Business American Express Card , The Hilton Honors American Express Business Card :

Baggage in-transit to/from common carrier: $1,250.

Carry-on baggage: $1,250.

Checked luggage: $500.

High-end items: $250.

AmEx also offers limited reimbursement for high-end items (coverage varies by card), such as:

Sports equipment.

Photography or electronic equipment.

Computers and audiovisual equipment.

Wearable technology.

Furs (including items made mostly of fur and those trimmed/lined with fur).

Items made fully or partially of gold, silver or platinum.

Claims must be filed within 30 days of your baggage loss. To file a claim, call 800-645-9700 from the U.S. or collect to 303-273-6498 if overseas. You can also file a claim online.

» Learn more: Compare travel insurance options: airline or credit card?

This benefit helps with events like replacing a lost passport, missing luggage assistance, emergency legal and medical referrals, and in some instances, emergency medical transportation assistance.

The service can also help you figure out important travel-related details like customs information, currency information, travel warnings, tourist office locations, foreign exchange rates, vaccine recommendations for the country you’re visiting, passport/visa requirements and weather forecasts.

AmEx cards with Premium Global Assist

Premium Global Assistance is offered on the following American Express credit cards:

The Platinum Card® from American Express .

Delta SkyMiles® Reserve American Express Card .

Hilton Honors American Express Aspire Card .

Marriott Bonvoy Brilliant™ American Express® Card.

Services provided by Premium Global Assist Hotline

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, the Premium Global Assist Hotline may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility.

The hotline isn’t so much a concierge as a service that provides logistical assistance, which can include the following:

General travel advice

Emergency translation if you need an interpreter to help with legal or medical documents (cost isn't covered).

Lost item search if your belongings are lost while traveling.

Missing luggage assistance if an airline loses your luggage. The hotline will contact your airline on a daily basis on your behalf to help locate your bags.

Passport/credit card assistance if your credit card or passport is lost or stolen.

Urgent message relay if you need to contact a family member and/or friend in the event of an emergency.

Medical assistance

Emergency medical transportation assistance if the cardmember or another covered family member traveling on the same itinerary gets sick or injured and needs medical treatment (there are many conditions for this coverage; review your policy’s fine print).

Physician referral if you need a doctor or dentist (cardmember is responsible for costs).

Repatriation of remains in the event of death.

Financial assistance

Emergency wire service to get help obtaining cash (fees will be reimbursed).

Emergency hotel check in/out if your card has been lost or stolen.

Legal assistance

Bail bond assistance if you need access to an agency that accepts AmEx (cardmember is responsible for paying bail bond fees).

Embassy and consulate referral if you need help finding or accessing local embassies.

English-speaking lawyer referral if you’re traveling and need a list of available attorneys (cardmember is responsible for any legal fees).

To use this benefit, call the Premium Global Assist Hotline toll-free at 800-345-AMEX (2639). You can also call collect at 715-343-7979.

The main difference between the Global Assist Hotline and the Premium version is that some of the services that are fully covered by Premium Global Assist aren't covered in the more basic version (cited examples include emergency medical transportation assistance and repatriation of mortal remains).

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility.

AmEx cards with Global Assist Hotline access

The Global Assist Hotline is available to holders of the following cards:

American Express® Gold Card .

American Express® Business Gold Card .

American Express® Green Card .

Business Green Rewards Card from American Express .

Delta SkyMiles® Platinum American Express Card .

Delta SkyMiles® Platinum Business American Express Card .

Delta SkyMiles® Gold American Express Card .

Delta SkyMiles® Gold Business American Express Card .

Delta SkyMiles® Blue American Express Card .

Hilton Honors American Express Surpass® Card .

Hilton Honors American Express Card .

The Hilton Honors American Express Business Card .

Marriott Bonvoy™ American Express® Card.

Marriott Bonvoy Business® American Express® Card .

The Amex EveryDay® Preferred Credit Card from American Express .

Amex EveryDay® Credit Card .

Blue Cash Preferred® Card from American Express .

The American Express Blue Business Cash™ Card .

The Blue Business® Plus Credit Card from American Express .

You can call the Global Assist Hotline toll-free at 800-333-AMEX (2639), or collect at 715-343-7977.

If you don’t have any of the credit cards above and are thinking about purchasing a policy from American Express or just simply want to price compare to see if you get better perks by purchasing a policy, you can go to the AmEx travel insurance website and input your trip plans to build a quote. You’ll need to provide your departure and return date, state of residence, age of traveler, number of travelers covered by the policy and the trip cost per traveler. Then, you can select the option of choosing a package or building your own.

To see which plans are available, we input a sample $3,000, one-week trip by a 35-year-old from South Dakota. Our search result yielded four different plans ranging from $59 for a Basic plan to $208 for a Platinum plan.

Global medical protection (not included on AmEx cards)

Medical protection includes coverage for emergency healthcare and dental costs as well as medical evacuation and repatriation of remains . The limits increase as the plans become more expensive. Although AmEx cards offer an array of travel insurance benefits, medical coverage isn't included. So if medical protection benefits are important to you, a standalone travel insurance policy is what you’ll want to look for.

Travel accident protection (not included on AmEx cards)

Another benefit not included with AmEx cards is travel accident protection. This benefit provides coverage in case of death or dismemberment while traveling . Although this is a topic no one wants to think about, it's good to be familiar with this coverage. While travel accident protection isn’t offered on the Basic plan, all of the higher plans offer it.

Standalone policy benefits that are also included on AmEx cards

These elements of coverage are offered on the AmEx cards mentioned, although in some, the limits may be higher or lower.

Trip cancellation

The Basic plan only covers a trip up to $1,000, however, all the other plans cover 100% of the trip cost. To compare this with the perks included as a benefit on the cards, all AmEx cards that include trip cancellation coverage provide up to $10,000 per covered trip.

Keep in mind that, all the cards included have annual fees and the card with the lowest fee is the Hilton Honors American Express Aspire Card , with a $550 annual fee.

Trip interruption

Trip interruption coverage ranges from $1,000 on a Basic plan to 150% of trip cost on the Gold and Platinum plans. The trip interruption benefit offered by the AmEx cards is included on all the same cards that offer trip cancellation insurance, with the trip interruption limit capped at $10,000 per covered trip.

Global baggage protection

If your luggage is lost or stolen this benefit will provide monetary compensation to reimburse you for your lost items. AmEx cards offer baggage coverage as a complimentary benefit, with the higher-end cards naturally providing higher limits. Interestingly, the cards with the lower annual fees (i.e. Hilton Honors American Express Surpass® Card , annual fee $150 ) have a high limit as well, offering a total combined limit for lost luggage of $3,000, which is higher than the coverage offered by the standalone Platinum plan.

Global trip delay

If your trip is delayed, you’re eligible for reimbursement of any necessary expenses incurred up to a specific limit. The Basic plan doesn’t offer this benefit, but all the other plans do, with the Platinum plan providing up to $300 per day (maximum of $1,000 per trip). This coverage is also included on the higher-end AmEx cards.

AmEx cards offer key travel insurance benefits: trip cancellation and interruption insurance, trip delay insurance, car rental loss and damage insurance, baggage insurance, Premium Global Assist Hotline (or Global Assist Hotline). However, they don't offer any sort of emergency medical coverage. This is pretty typical of travel credit cards, as the travel insurance perks they offer don't provide coverage for emergency health care costs.

If you’re looking for emergency medical coverage, you’ll need to purchase a separate policy, such as the standalone one offered by American Express. The other limits provided in the American Express travel insurance policy are comparable to what you get on the AmEx cards, so it makes sense to shop around to make sure that the benefits you’re paying for are sufficient for your needs.

» Learn more: What to know about American Express Platinum travel insurance

Yes, if you have one of the cards listed above. If you have a credit card that isn’t listed in this guide or the card is no longer available by American Express, call the number on the back of your card for more information. Generally, AmEx offers a number of travel insurance benefits on its credit cards that shouldn't be overlooked.

Yes, but it depends on which card you have. To qualify for reimbursement, the trip cancellation must be for a covered reason. Refer to the section "Trip Cancellation and Interruption Insurance" for a list of cards and explanations of covered reasons.

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a separate travel insurance policy . If you only need emergency medical coverage , there are policies that provide that as well.

Call the number on the back of your card to ask for guidance. Some benefits may require authorization from American Express before coverage kicks in, so make sure you follow all the correct steps for reimbursement.

Refer to the AmEx credit card policy for the specific benefit because it will include instructions for submitting a claim. If you cannot find the policy, you should call the customer service number on the back of your American Express card for more assistance.

Yes. American Express offers travel insurance as a benefit of some of its cards, but it also sells standalone coverage that you can purchase out-of-pocket. The latter tends to be more comprehensive and customizable to your needs.

No, you do not get automatic travel insurance with American Express. It is available as a benefit on certain cards. Refer to your terms and conditions to learn if you are covered.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as repatriation of remains or medical evacuation coverage .

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a

separate travel insurance policy

. If you only need

emergency medical coverage

, there are policies that provide that as well.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as

repatriation of remains or medical evacuation coverage

American Express travel insurance offers a wide array of benefits, especially on its premium cards. Knowing what benefits are available to you is important in the event of unforeseen circumstances. Determine whether an individual policy is a better fit for your risk tolerance than coverage that is included on an eligible card, then go from there.

Insurance Benefit: Trip Delay Insurance

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Insurance Benefit: Premium Global Assist Hotline

If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

Insurance Benefit: Baggage Insurance Plan

Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g., plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

Underwritten by AMEX Assurance Company.

Baggage Insurance Plan coverage can be in effect for Eligible Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier (e.g. plane, train, ship, or bus) when the entire fare for a Common Carrier Vehicle ticket for the trip (one-way or round-trip) is charged to an eligible Account. Coverage can be provided for up to $1,250 for carry-on Baggage and up to $500 for checked Baggage, in excess of coverage provided by the Common Carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all Covered Persons per Covered Trip.

Insurance Benefit: Global Assist Hotline

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

Credit cards with travel insurance for 2024

Does your credit card come with travel insurance as an added perk find out here..

In this guide

Credit cards with travel insurance comparison table

Priority pass discounts, which credit cards offer free travel accident insurance, american express preferred rewards gold credit card, amex cashback everyday credit card, british airways american express credit card, british airways american express premium plus credit card, american express rewards credit card, benefits of paying for a holiday on a credit card, what is covered.

- What isn't covered?

How to file a claim with a credit card issuer

Frequently asked questions.

We compare the following card issuers

Credit cards have a number of benefits. Perhaps the most obvious is that they can help you break down the cost of an expensive purchase into more manageable payments over several months – ideally interest-free. But some also come with a range of perks, such as travel insurance.

However, rather than being offered comprehensive travel insurance with your credit card, you’re most likely to be offered “travel accident insurance”. This will cover accidental death or accidents resulting in a permanent injury. How much cover you get will depend on the card and whether you need to pay an annual fee.

Lounge access with Priority Pass

Some of the credit cards that offer free travel accident insurance are outlined below. You’ll notice that all of these are American Express cards.

The Amex Preferred Rewards Gold credit card has an annual fee of £140 (£0 in the first year) and offers the following:

- Travel accident insurance of £250,000 for accidental death or accidents resulting in complete loss of or permanent loss of use of limb, sight, speech or hearing while travelling on a public vehicle where the ticket was bought on the card account.

- Cover for flight delays, overbooking or missed connections of up to £200 if no alternative is made available within 4 hours of the published departure time.

- Baggage delay cover of up to £200 per person for reimbursement costs of essential items if your checked-in baggage has not arrived at your destination within 4 hours of your arrival. This limit increases by an additional £200 if your baggage does not arrive within 48 hours of your arrival.

The Amex Platinum Cashback Everyday credit card has no annual fee and offers the following:

- Travel accident insurance of £150,000 for accidental death or accidents resulting in complete loss of or permanent loss of use of limb, sight, speech or hearing while travelling on a public vehicle where the ticket was bought on the card account.

Travel delays are not covered.

The British Airways American Express credit card has no annual fee and offers the following:

- Travel accident insurance of £75,000 for accidental death or accidents resulting in complete loss of or permanent loss of use of limb, sight, speech or hearing while travelling on a public vehicle where the ticket was bought on the card account.

The British Airways American Express Premium Plus credit card has a £250 annual fee and offers the following:

- Cover for flight delays, overbooking or missed connections of up to £200 if no alternative is made available within 4 hours of the published departure time. Up to an additional £400 is payable for overbookings only if alternative arrangements are not provided within 6 hours.

- Baggage delay cover of up to £750 for reimbursement of costs of essential items following baggage delay by an airline for 6 hours. Up to an additional £1,000 is available if baggage has not arrived within 48 hours of your arrival time.

The Amex Rewards credit card has no annual fee and offers the following:

Although you won’t get full travel insurance with your credit card, paying for a holiday on a credit card gives you protection through Section 75 of the Consumer Credit Act. This means that if your holiday costs more than £100 and up to £30,000, and you paid either a deposit or the full price on your credit card, you should be able to claim your money back if something goes wrong. Examples include if your airline or holiday company goes under or if the trip isn’t as described.

The cost of your flights or holiday must be more than £100 to be covered, but you don’t have to have paid more than £100 on the credit card to qualify. Instead, it’s the cash price of the holiday or flights that matters. Provided your holiday cost more than £100, even if you only paid a deposit of £50 on your credit card and paid the rest in cash or on a debit card, you’ll still be covered for the full amount.

Under Section 75, you’ll be covered against the following:

- The travel company, airline or accommodation provider going bust

- The holiday not being as described

- Your travel provider cancelling the holiday

- Additional expenses that you have to pay for through no fault of your own – for example, if you have to pay for more expensive flights to get home after an airline goes bust

What isn’t covered?

Section 75 won’t cover you in the following circumstances:

- You decide not to take your holiday

- You withdrew cash on your credit card to pay for the holiday

- An additional cardholder paid for a holiday that the primary cardholder won’t be going on

- You bought your holiday through intermediaries such as PayPal – although this will depend on the seller. Note that if you bought your holiday through a travel agent, your ability to claim on Section 75 will depend on who took your payment and what it was for. If the travel agent sold you a package holiday that they put together, you will usually be covered as the travel agent is a party to the contract.

Section 75 means that your credit card company is jointly liable with the holiday firm if something goes wrong. If you need to make a claim, it’s generally best to approach the holiday company first to see if they can help. But if they don’t reply, or if you are able to contact them because they have gone into administration, for example, you can go straight to your credit card company.

The process of making a Section 75 claim can vary depending on the provider. In some cases, you can do this through your mobile banking app or by speaking to someone via an online chat service. In other cases, you will need to contact your card provider by phone or by filling in an online form.

When you make your claim, it’s important to include as much detail as possible as well as any receipts of your purchase. If you’ve already approached the holiday firm, include any evidence of this if you can. Explain what you would like your credit card provider to do, which will usually be to issue you with a full refund, and keep a record of all communication.

If you cannot resolve the issue with either the holiday or card company, you can contact the Financial Ombudsman Service, which can independently assess the case. You must do this within 6 months of your claim being rejected.

Is a credit card with travel insurance all you need?

What's covered under trip cancellation insurance.

Rachel Wait

Rachel Wait is a freelance journalist and has been writing about personal finance for more than a decade, covering everything from insurance to mortgages. She has written for a range of personal finance websites and national newspapers, including The Observer, The Mail on Sunday, The Sun and the Evening Standard. Rachel is a keen baker in her spare time. See full profile

More guides on Finder

Pick a card with 0% foreign fees and save big. We’ve rated 20+ cards for spending abroad and listed our top 5.

We look at the average APR on credit cards in the UK and how credit card interest rates have changed over time.

Find out how to spread your purchases over 3, 6 or 12 months with Monzo Flex.

Onmo is making its debut into the credit card market with its new card offering limits starting from £200. Here’s what we know so far.

The Yonder credit card has launched in the UK, using open banking to create a personalised picture of your spending habits to help you get the most out of your credit card.

Enjoy a single rate of interest for all repayments, plus an introductory 0% balance transfer deal with Danske Bank.

Frequent John Lewis and Waitrose shoppers can discover how this loyalty-point-earning Mastercard compares.

Where do UK residents go on holiday and how many overseas visits do we take? We look at the latest outbound tourism statistics.

Get cashback on your purchases with a cashback credit card. Redeem rewards points for cashback or gift cards. Find out more in our guide.

Buy now and pay interest later with a 0% purchase credit card. Compare current offers with 0% p.a. on purchases.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

Bring photo ID to vote Check what photo ID you'll need to vote in person in the General Election on 4 July.

Foreign travel insurance

If you’re travelling abroad, it's important to take out appropriate travel insurance before you go.

If you travel internationally you should buy appropriate travel insurance before you go. If you already have a travel insurance policy, check what cover it provides for coronavirus-related events, including medical treatment and travel disruption, and any planned activities such as adventure sports. If you are choosing a new policy, make sure you check how it covers these issues.

If you do not have appropriate insurance before you travel, you could be liable for emergency expenses, including medical treatment, which may cost thousands of pounds.

For example:

You should buy your travel insurance as soon as possible after booking your trip. Read the small print, and familiarise yourself with any exclusion clauses for the policy.

When you travel, make sure you take your insurance policy details with you, including the policy number and your insurer’s emergency assistance telephone number. Share your policy details with people you’re travelling with and friends or family at home, in case they need to contact your insurance company on your behalf.

The Association of British Insurers (ABI) represents over 200 insurance companies. Read ABI’s advice on travel insurance , including how COVID-19 can affect it, and their guide on choosing the right travel insurance policy .

In addition to making sure you have appropriate insurance, you should check and sign up to travel advice for your destination.

What to consider when you buy travel insurance for you and your family

- emergency treatment and hospital bills can be expensive. Check whether your policy covers treatment in public or private hospitals

- emergency transport, such as an ambulance, is often charged separately to other medical expenses, and emergency travel home on medical grounds can also be expensive

- pre-existing medical conditions: declare existing conditions or pending treatment or tests so that you are covered if anyone gets ill during your trip. Failing to declare something may invalidate your travel insurance

- all activities you may undertake on holiday, such as sports or adventure tourism (you may need specialist insurance for some activities). Also consider all the places you intend to visit, even if you are in transit, in case anyone needs emergency treatment in another country

- cruises generally require an additional level of cover because it is more difficult to get to hospital for treatment. Check the booking conditions of the operator you plan to sail with

- repatriation costs if you or a family member die abroad

- getting home after medical treatment if you cannot use your original ticket

- reasonable costs for a family member or friend to stay with you, or travel out to accompany you home, if required

- 24-hour assistance helplines to offer support and advice about appropriate treatment

- COVID 19 cover for if you or family members cannot return home because you/they test positive for COVID during your travel. Check your insurance covers additional costs such as alternative flights, accommodation and COVID tests. You should also check your insurance provides cover if you cannot reach your final destination during transit due to COVID-19

- within Europe, some insurers may waive any excess on medical treatment if you use a European Health Insurance Card (EHIC) or UK Global Health Insurance Card (GHIC). Check the terms of your policy or contact your insurer to see if this is the case. EHIC and GHIC allow you to access state-provided medically necessary healthcare within the EU and Switzerland on the same terms as residents of these countries. Note that EHIC and GHIC are not alternatives to travel insurance as they do not cover any private medical healthcare costs, repatriation or additional costs such as mountain rescue in ski resorts. Find out more about the EHIC and GHIC, including how to apply for one free of charge

- ATOL is a consumer protection scheme for air holidays and flights, managed by the Civil Aviation Authority (CAA) . Some insurance policies do not provide cover for when airlines or suppliers go out of business. Choose an ATOL-protected holiday or a travel insurance policy that includes airline or supplier failure cover

Policy exclusions

Check how an insurance policy covers:

- alcohol and drugs: most travel insurance policies do not cover events that happen after you have drunk excessive alcohol or taken recreational drugs or other substances

- high risk destinations: many travel insurance policies will not cover travel to a high risk destination where the Foreign, Commonwealth & Development Office (FCDO) advises against all but essential travel or all travel. Check your policy wording and the relevant country travel advice pages before booking your trip and buying insurance

- mental health conditions: some policies may exclude cover for treatment related to a pre-existing mental health condition. For more guidance see foreign travel advice for people with mental health issues

- age restrictions: check whether there are any age-related restrictions if you are buying an annual policy. The Money Advice Service provides guidance on how to choose the right level of cover, get the best deal, and make a travel insurance claim. It also has specific guidance for travellers over the age of 65 or with pre-existing medical conditions

- sports such as bungee jumping, jet skiing, winter sports or skydiving: these are not usually included in standard policies. Use of quad bikes and hire of mopeds is also usually not covered

- driving overseas: check Driving abroad . If you’re hiring a car, check what cover the hire company provides. If you are driving your own vehicle, check your motor insurance policy to see what it covers

- terrorist acts: most policies offer only limited cover for terrorist acts. As a minimum, make sure your policy covers you for emergency medical expenses and travel home if you are caught up in a terrorist attack. Some travel insurers offer policy add-ons to provide additional cover if there is a terrorist attack in your destination. This may include cancellation cover, if your destination is affected by a terrorist attack before your trip and you decide you no longer wish to travel

- other incidents: some policies only offer limited cover for claims related to or caused by a natural disaster (such as an earthquake or tropical cyclone) or civil unrest. You may also not be covered for some claims that arise from an incident (such as strikes or other industrial action) that was known publicly when you booked your trip and/or bought your travel insurance policy

Insurance for extended periods of travel

‘Long-stay’ travel insurance can cover extended periods of continuous travel. Check carefully the maximum duration allowed in any policy you consider buying to ensure that it meets your needs.

Make sure that the entire policy meets your needs, including specific activities and work (paid or unpaid) you may undertake.

Insurance if you live abroad or go for work or study

Travel insurance is not intended for permanent residence abroad. If you live overseas, or you’re planning to move to a different country to live, work or study, you should consider your insurance needs carefully. Local law may require you to have medical insurance, including as part of a visa application.

Read the healthcare guidance in the Living in guide for the country where you live to ensure you have the right healthcare arrangements for your circumstances.

You can buy private medical insurance for UK expatriates. You can also buy insurance from local providers overseas. You should always check policies carefully, including seeing whether you could transfer medical cover if you re-locate to other countries in future.

Support for British nationals abroad

Support for British Nationals Abroad explains how the FCDO can provide support to British nationals if things go wrong abroad.

Reviewed and updated guidance in full.

Updated guidance on using an EHIC or GHIC to access healthcare in Switzerland.

Updated to reflect new rules for travelling to amber list countries.

Updated COVID-19 section on new rules for international travel from 17 May.

Updated to reflect current COVID-19 travel guidance

New link to the declaration form for international travel (for England), from 8 March.

Edited grey box at top of page to provide further information on requirements coming into affect from 15 February

From 15 February you will need to quarantine in a government-approved hotel if you arrive in the UK from countries on the travel ban list.

Updated with new requirements coming into effect from 4am on 18 January 2021.

Updated with information on pre-departure testing for everyone travelling into England and Scotland.

Updated to reflect latest UK COVID-19 restrictions.

Updated the section on travel to Iceland, Liechtenstein, Norway and Switzerland, to reflect changes from 1 January 2021.

Updated ‘Travel to the EU’ section to reflect that UK-issued European Health Insurance Cards (EHIC) will still be accepted in EU countries, with different guidance for people travelling to Norway, Iceland, Liechtenstein and Switzerland from 1 January 2021.

Updated COVID-19 travel guidance

Updated to reflect the latest Tier-based COVID-19 rules for England

Updated to reflect the 5 November national restrictions for England relating to travel

Updated EU travel section with information on EHIC validity

New information on making sure your travel insurance covers you for coronavirus-related events

Update to contents including addition of new segments; travel insurance after starting travel or changing your plans, making a travel insurance claim, other financial protection and if you’re not covered.

Added information on financial protection of package holidays.

Information on the use of European Health Insurance cards (EHIC) in the event of a no deal added to the EU Exit update section

EU Exit update with advice on checking insurance coverage when travelling to Europe after the UK leaves the EU.

Content and format changes

Inclusion of Association of Travel Insurance Intermediaries (ATII) information.

Updated information on travel insurance

First published.

Related content

Is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. Please fill in this survey (opens in a new tab) .

The best cards for trip cancellation and interruption insurance — and what it actually covers

Planning and taking a trip can be exciting, but unexpected events can disrupt even the most meticulously organized vacations. Sudden illness, severe weather and unforeseen circumstances can throw a spanner in the works, forcing you to change your plans and seek compensation.

In this guide, we will explore the best credit cards that offer trip cancellation and interruption insurance . We will explain what these policies cover and provide you with peace of mind for your next adventure.

Best credit cards for trip cancellation and interruption insurance

- Chase Sapphire Reserve® : Best for travelers who want the most travel protections

- Chase Sapphire Preferred® Card : Best for travelers looking for a sub-$100 annual fee

- Capital One Venture X Rewards Credit Card : Best for Capital One loyalists

- United Club℠ Infinite Card : Best for United loyalists

- IHG One Rewards Premier Credit Card : Best for IHG loyalists

- World of Hyatt Credit Card : Best for Hyatt loyalists

- Ink Business Preferred Credit Card® : Best for business travelers

- The Platinum Card® from American Express : Best when traveling with non-family companions

The cards listed above are our top picks for trip cancellation and interruption insurance. But many other cards — including some Bank of America and Barclays cards — also offer trip cancellation and interruption protection.

Related: Credit cards with trip cancellation insurance

What is trip cancellation and trip interruption insurance?

Trip cancellation and interruption insurance may reimburse nonrefundable, prepaid trip expenses when you cancel or alter your trip due to a covered situation. In some cases, you may even be covered for select additional costs. But maximum coverage amounts, the types of covered situations and eligible expenses vary from card to card.

Generally, trip cancellation insurance provides reimbursement when you must cancel a trip before its departure date. Meanwhile, trip interruption insurance may refund you if an ongoing trip is interrupted or canceled.

Although you can buy separate travel insurance that will provide a partial refund if you cancel your trip for any reason , trip cancellation and interruption insurance doesn't typically work the same way. Instead, trip cancellation and interruption insurance typically has specific covered losses and exclusions that define the situations in which you can claim reimbursement (and these vary from card to card).

Many different types of cards — including some credit cards with no annual fee — offer trip cancellation and interruption insurance when you purchase travel with your card. The remainder of this guide details some of our favorite cards that offer trip cancellation and interruption benefits. Of course, benefits frequently change. So, it's best to look at your card's guide to benefits before booking to understand your card's protections.

Related: Why you might actually need road trip travel insurance

What is the difference between trip cancellation and trip interruption coverage?