Advice and answers from the TravelBank Team

Get started

Get help with account management, app features, and settings

Travel and rewards

Learn how to manage your travel with TravelBank

Expense management

Learn how to manage your expenses with TravelBank

Advanced configurations

Learn about advanced administrative functions, including integrations and complex banking requirements

Commercial Rewards

Learn about TravelBank's all-in-one commercial card solution

Core and Premium Insights

Learn how to report on any metric

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

6 Things to Know About United TravelBank

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Whether you're saving up for a special occasion — like a honeymoon — or just an upcoming getaway, many travelers opt to save future travel funds in a dedicated bank account. For United Airlines loyalists, this process can be even simpler.

United MileagePlus account members can access a budgeting tool called United TravelBank. Let's dive into the things you'll want to know about the service, how to use it and if it's worth "saving" money in this account at all.

What is United TravelBank? How does it work?

United's TravelBank is pretty much what it sounds like — an online account designed for accumulating travel funds for future United flights. It aims to simplify United MileagePlus members’ budgeting for future personal and/or business flights.

Once the account is set up and has money in it, it syncs with both united.com or the United mobile app as a payment option.

» Learn more: How to use the United MileagePlus X app to earn miles

What to know about United TravelBank

1. you can purchase united travelbank credits for your account.

United gives MileagePlus members the opportunity to buy deposits for their own TravelBank account. However, you can only purchase TravelBank credits in one of six amounts:

If you want to deposit a different amount, you can do so across multiple transactions. Say you want to deposit $150. Just purchase $50 in funds and then make another purchase of $100.

The only limitation is that you can't exceed $5,000 per day per MileagePlus account, meaning that you can do at least five purchases per day.

2. United TravelBank credits are valid for five years

Does United TravelBank expire? Yes. Purchased funds are valid for five years from the date the funds are deposited into your TravelBank account. That gives you plenty of time to use the funds.

That's a much longer validity than other types of airline travel credits. For instance, when purchasing airfare on United, you generally only have 12 months from the date of purchase to use those funds for a flight. So, if you really aren't sure that you'll be able to travel in the next year, you can use the United TravelBank to stash money away for future airfare purchases.

Even with the generous expiration policy, we recommend using up your full TravelBank balance whenever possible to avoid leaving money on the table.

3. You can get United TravelBank credits by holding an IHG card

One of the unexpected ways to get United TravelBank credits is through select IHG credit cards. IHG One Rewards Premier Credit Card and IHG One Rewards Premier Business Credit Card customers can enroll to get up to $50 in TravelBank Cash each calendar year. Cardholders get one deposit of $25 in early January of each year and another $25 deposit in early July.

However, these funds work differently from purchased TravelBank funds. Instead of having five years of validity, you only have a little over six months to use these funds before they expire. The $25 deposited in early January expires on July 15 of the same calendar year, and the $25 funded in July will expire on Jan. 15 of the next year.

During the two-week crossover period, you could have up to $50 in active TravelBank funds from this IHG credit card benefit. That's probably not going to be enough to cover an entire flight, but at least it can save you some out-of-pocket cost on your next United flight.

Eligible cardholders can go to ihg.com/united to register to start receiving this new card benefit. You'll need to log into your IHG One Rewards account and then provide your United MileagePlus number and last name to complete registration. The terms and conditions note that it may take up to two weeks after registration before you receive your first $25 TravelBank deposit.

on Chase's website

4. It’s possible to use credit card travel credits to fund your United TravelBank

United TravelBank purchases often code as travel expenses on your credit card bill. That means you can earn bonus points when using credit cards with a travel bonus category. And you might even be able to use credit card travel credits — such as the Chase Sapphire Reserve® $300 annual travel credit , the Citi Prestige® Card $250 air travel credit or certain other credit card incidental fee credits.

» Learn more: The best airline credit cards right now

5. You can't use United TravelBank funds for other travel purchases

A major downside of the United TravelBank is that funds can only be used to book United-operated or United Express-operated flights, plus certain subscription products.

Travelers living near an airport with a strong United presence may not mind being limited to flying United. However, if Delta Air Lines, Alaska Airlines or American Airlines offers a much cheaper airfare, you won't be able to use your United TravelBank funds to purchase those flights.

Likewise, United TravelBank funds can't be used for hotels or car rental purchases.

» Learn more: United vs. Delta — Which is best?

6. The United TravelBank doesn't earn interest

Another downside of saving funds through the United TravelBank is that you won't earn interest on the saved funds. Over the past few years, interest rates have been so low that you wouldn't have missed out on much interest income by placing funds in the United TravelBank instead.

However, now that interest rates are increasing , you might be able to grow your travel funds faster by saving funds in an actual savings account rather than the United TravelBank.

» Learn more: Compare savings account rates in your ZIP code

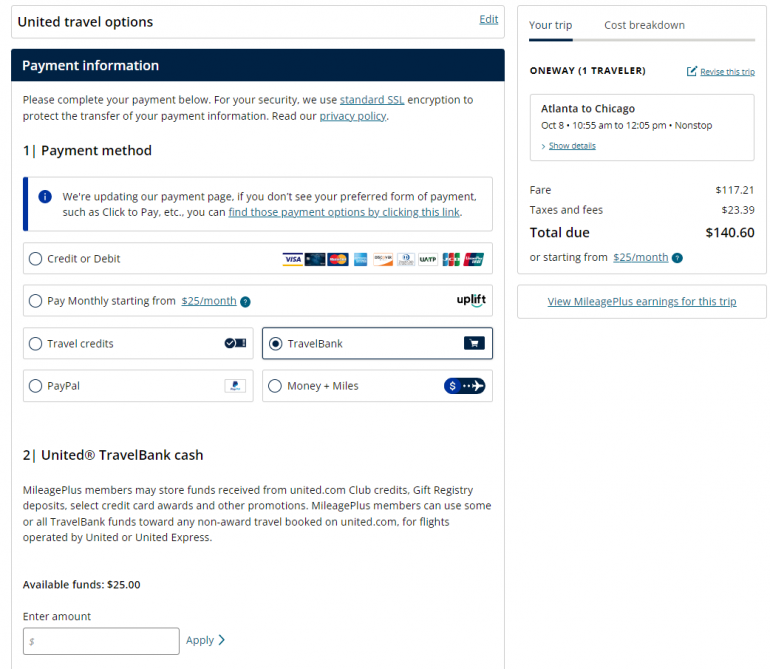

How to use United TravelBank

Once you’ve added money to the TravelBank account, you can select TravelBank cash as a payment option when logged into united.com or the United app.

When you're ready to use your travel funds, just log into your United MileagePlus account and search for a paid flight. On the checkout page, select the TravelBank payment option. Then, you can then enter precisely how much of your funds you want to apply to this booking.

Note that you can only use TravelBank funds for flights priced in U.S. dollars. And unfortunately, you can't use TravelBank funds to pay taxes and fees on a MileagePlus award ticket. For cash bookings, TravelBank monies can be used to cover the ticket price, taxes and surcharges.

Even if you have enough funds to cover the entire purchase, you may want to charge part of your flight booking to a credit card that provides travel insurance .

TravelBank cash can be used alone or in combination with other accepted forms of payment, such as Apple Pay, Visa Checkout or PayPal.

Is United TravelBank worth it?

The United TravelBank provides travelers with another way of stashing away funds for future travel. MileagePlus members can fund as little as $50 at a time, up to $5,000 per day. Your funds are valid for five years from the date of deposit, giving you plenty of time to use them.

However, funding the United TravelBank locks you into booking paid flights through United, decreasing the flexibility of your money. You can't even use TravelBank to pay for taxes and fees on award travel. So, you may only want to deposit funds in the TravelBank if you're sure that you will be paying for a United flight in the near future.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-2x Earn 2 miles per $1 spent on dining, hotel stays and United® purchases. 1 mile per $1 spent on all other purchases

50,000 Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

1x-2x Earn 2 miles per $1 spent on United® purchases, dining, at gas stations, office supply stores and on local transit and commuting. Earn 1 mile per $1 spent on all other purchases.

75000 Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

1x-3x Earn 3x miles on United® purchases, 2x miles on dining, select streaming services & all other travel, 1x on all other purchases

60,000 Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

The browser you are using is not supported. Please see our supported browsers .

The WestJet Group and AMFA reach tentative agreement, averting work stoppage.

Please visit our Guest Updates page for more information.

By using the WestJet website, you agree to the website terms of use , the privacy statement , and the use of cookies .

Travel Bank credits and refunds

Outside of 24 hours from booking, if you’ve cancelled your flight under an eligible fare or changed to a fare lower in price, your refund will be returned as a credit with WestJet and held in your Travel Bank — which is linked to WestJet Rewards account.

- 1 credit = 1 CAD, USD or GBP (depending on your address)

- Apply toward the cost of a flight, with no blackout dates

- 12 month expiry for credits from change/cancel

Popular FAQs

- Fraudulent transactions

What is Travel Bank?

Travel Bank is an easy-to-use account where you accumulate and save credit from non-refundable ticket changes, cancellations or service credits. These credits are kept in your Travel Bank until you use them to pay for new flights with WestJet, excluding WestJet Vacation packages and service fees.

Travel Bank is not an actual physical bank. It’s more like a store credit.

Why do I need an account for Travel Bank?

To receive a credit, you need a WestJet Rewards account.

A Travel Bank requires a WestJet Rewards account and ID in order to be linked to you, the Travel Bank owner. With an account you can sign in online to view your Travel Bank balance.

When will I see the credit in my Travel Bank?

This depends on how your cancellation was processed. If you cancelled with an agent in our contact centre or online in Manage Trips, you will see the balance in your account immediately. Sign in to view your balance.

You can use your Travel Bank credit to book new flights as soon as you see it in your account . If your flight was cancelled due to a schedule change and you do not see the correct balance, please contact us .

Do Travel Bank credits expire? If so, can I get an extension?

Travel Bank credits from changed or cancelled flights can be used to pay for flights up to 12 months from the date your flight was cancelled. Sign in to your WestJet account to check your credit expiry date. Travel can occur after the expiry date. Regular Travel Bank credit can be extended for 12 months one time only for a fee. Please phone our contact centre to request an extension. This does not apply to an already extended credit. Expired credits cannot be extended.

How do I use my Travel Bank credits?

Travel Bank credits can be used to pay for WestJet flights and select fees such as kennels and seat selection, but not WestJet Vacation packages, excess baggage or change fees.

- You can apply credits to one or many flights until the balance is $0

- There are no blackout dates

You can pay for new flights with your Travel Bank credit online, through the call centre or at the airport.

To use your Travel Bank credit when booking online :

- Sign in to your WestJet Rewards account.

- Select your flights and continue to the payment step.

- When you’re signed in your Travel Bank balance will appear with the option to apply the credit to your purchase.

- Choose to apply all, or a portion of your Travel Bank balance toward the cost of your flights. Any remaining cost can be paid with WestJet dollars or a credit card.

Can I transfer my Travel Bank credits?

Yes, Travel Bank credits can be transferred to another WestJet Reward’s account upon request through our contact centre .

Can I use my Travel Bank credits to pay for travel for another guest?

Yes, this is easy to do.

To apply a Travel Bank credit to another guest's flight:

- Sign in to your WestJet Rewards account

- Select the desired flights, fill in the guest details for the person travelling and continue to the payment step

- If there is a balance in your Travel Bank, the option to apply the credit to the travelling guest’s flight will appear as a payment option

Book a flight for another guest

How is my Travel Bank protected?

Your Travel Bank can only be accessed by using your WestJet Rewards ID. Any fraudulent use of your Travel Bank will be investigated, however, WestJet is not liable for any unauthorized use of your WestJet Rewards ID, password, Travel Bank credits or your payment card information. Please take care to keep your WestJet Rewards ID confidential.

WestJet Vacations package bookings

Travel Bank credits cannot be used for WestJet Vacations packages.

Warning about fraudulent transactions involving Travel Bank credits for sale

WestJet Travel Bank credits posted for sale on any online classified website may not be valid or may become invalid at a later date. WestJet is only able to verify if a Travel Bank credit is currently available. Flight bookings and Travel Bank credit purchased with a stolen card or in some other unauthorized fashion will be revoked or cancelled immediately without notice or reimbursement.

WestJet is not involved in any private transaction resulting from an advertisement on an online classified web site. WestJet does not handle the payment, guarantee transactions, offer buyer protection or seller certification for these advertisements. WestJet will not be liable for the loss of funds resulting from a fraudulent transaction.

Helpful links

- Get travel ready

- Travel credits and refunds

- Domestic schedule

- International schedule

- Manage trips

- About WestJet Rewards

Do you want to install app?

Add a shortcut to your home screen: Share button at the bottom of the browser. Scroll left (if needed) to find the Add to Home Screen button.

Request your JetBlue Travel Bank login ID

The official ‘login look-up’ form.

Can’t locate your Travel Bank welcome email or 10-digit login ID? No worries.

If you booked with a TrueBlue account:

from the account menu.

If you didn't book with a TrueBlue account:

Just complete and submit the form below and we’ll send you an email with your login ID within three minutes. Please note: if your travel credit balance is zero, you will not receive an email.

Get To Know Us

- Our Company

- Partner Airlines

- Travel Agents

- Sponsorships

- Web Accessibility

- Contract of Carriage

- Canada Accessibility Plan

- Tarmac Delay Plan

- Customer Service Plan

- Human Trafficking

- Optional Services and Fees

- Aviso importante para Bogotá

JetBlue In Action

- JetBlue for Good

- Sustainability

- Diversity, Equity & Inclusion

Stay Connected

- Download the JetBlue mobile app

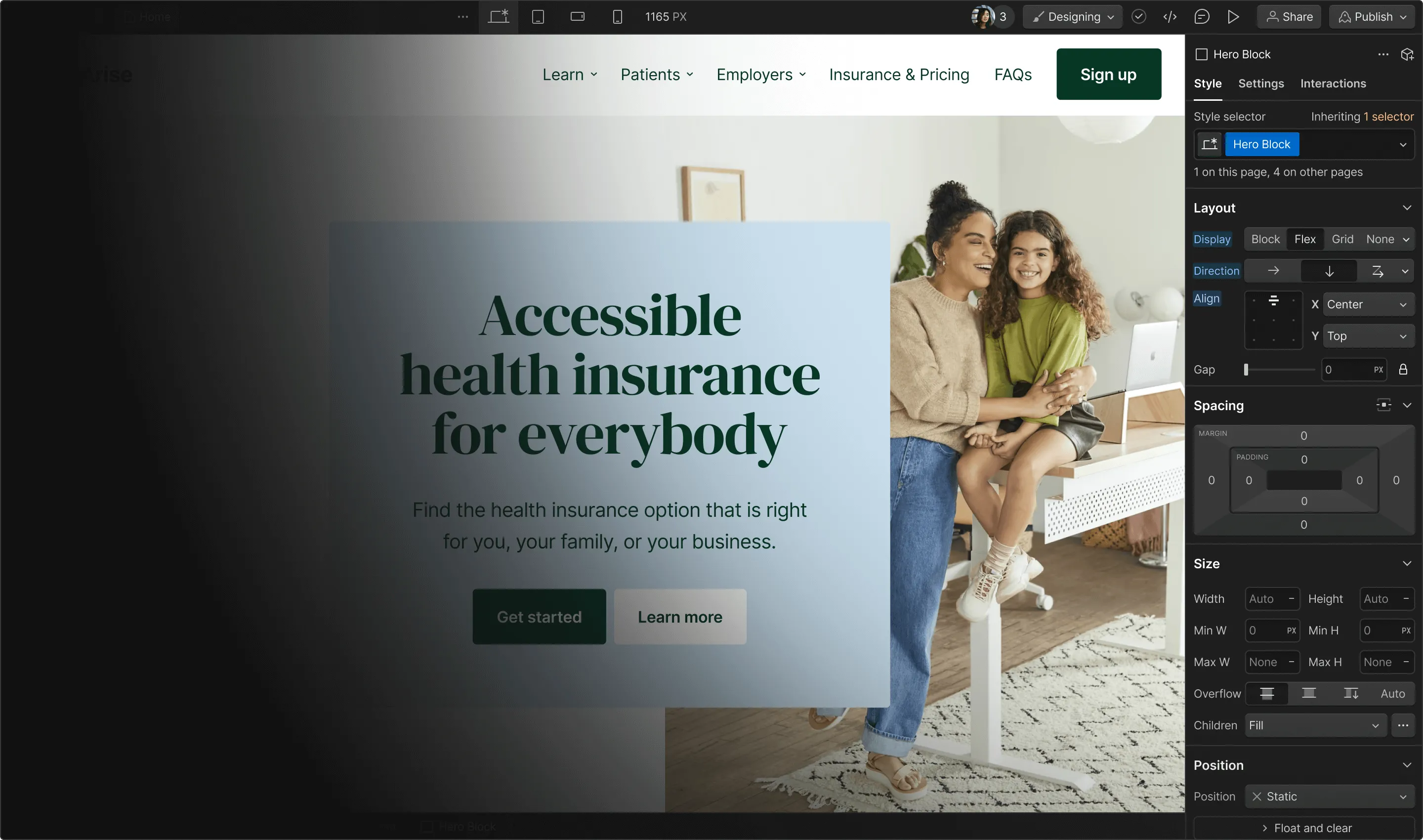

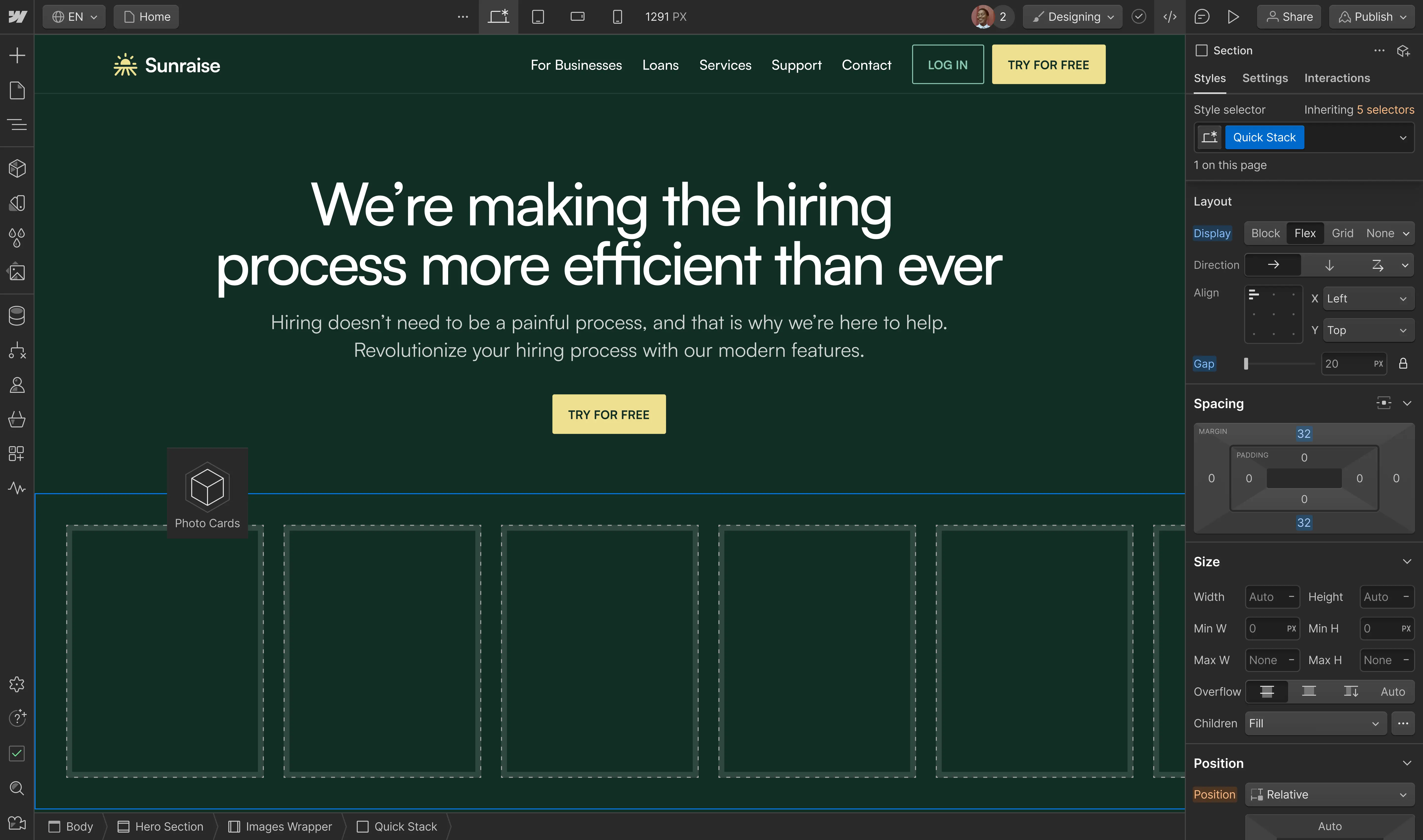

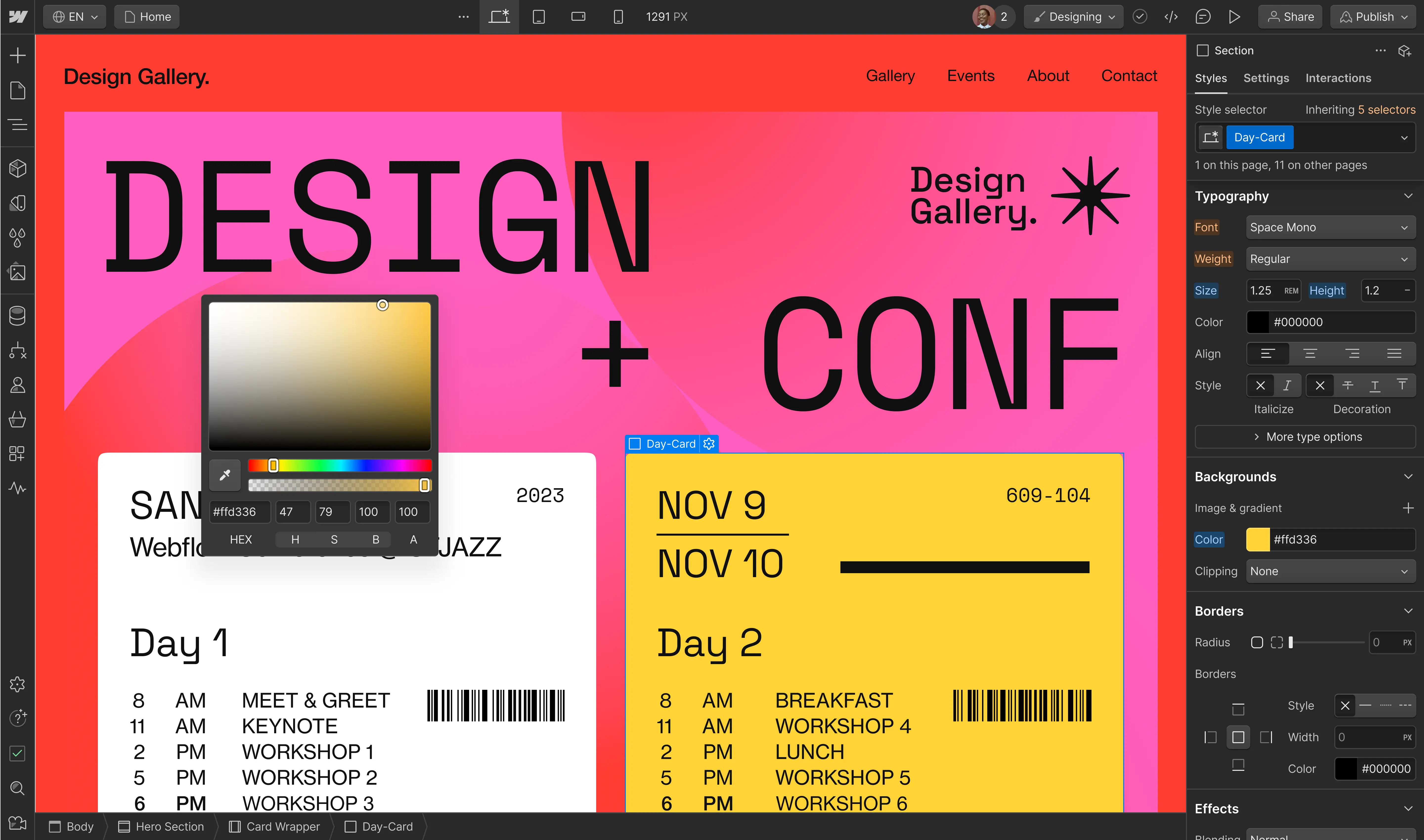

Build with the power of code — without writing any

Take control of HTML, CSS, and JavaScript in a visual canvas. Webflow generates clean, semantic code that’s ready to publish or hand to developers.

Creative power that goes beyond templates

You design, we generate the code — for everything from fully custom layouts to complex animations.

Fully customize page structure

Drag in unstyled HTML elements to build exactly what you want — then turn footers, nav bars, and more into components you can reuse.

Style your site exactly how you want

Take full control of CSS properties and a class system that cascades changes across your site — plus use variables to sync with external design systems.

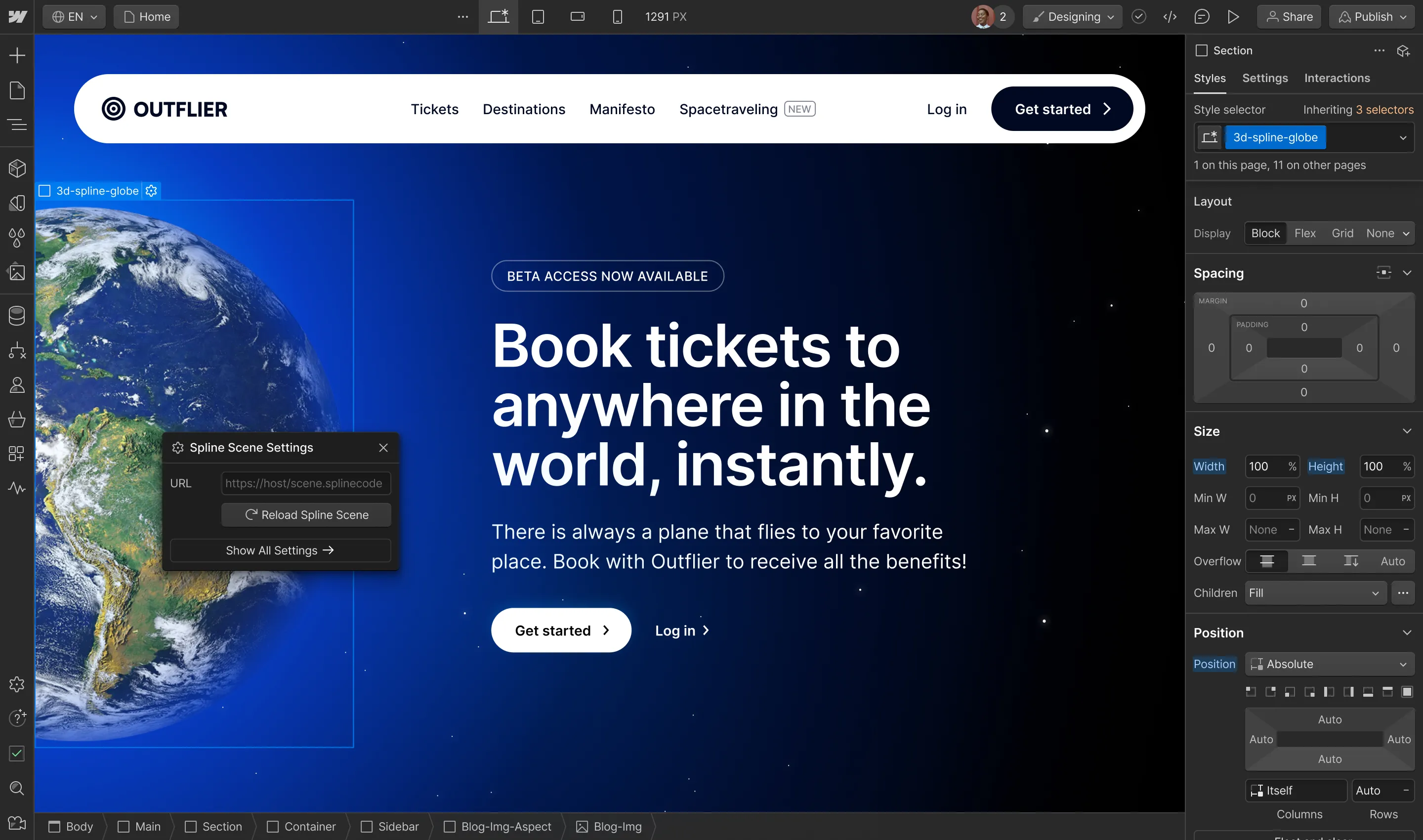

Create complex, rich animations

Design scroll-based and multi-step interactions and easily work with Spline, 3D, Lottie, and dotLottie files — all without even thinking about code.

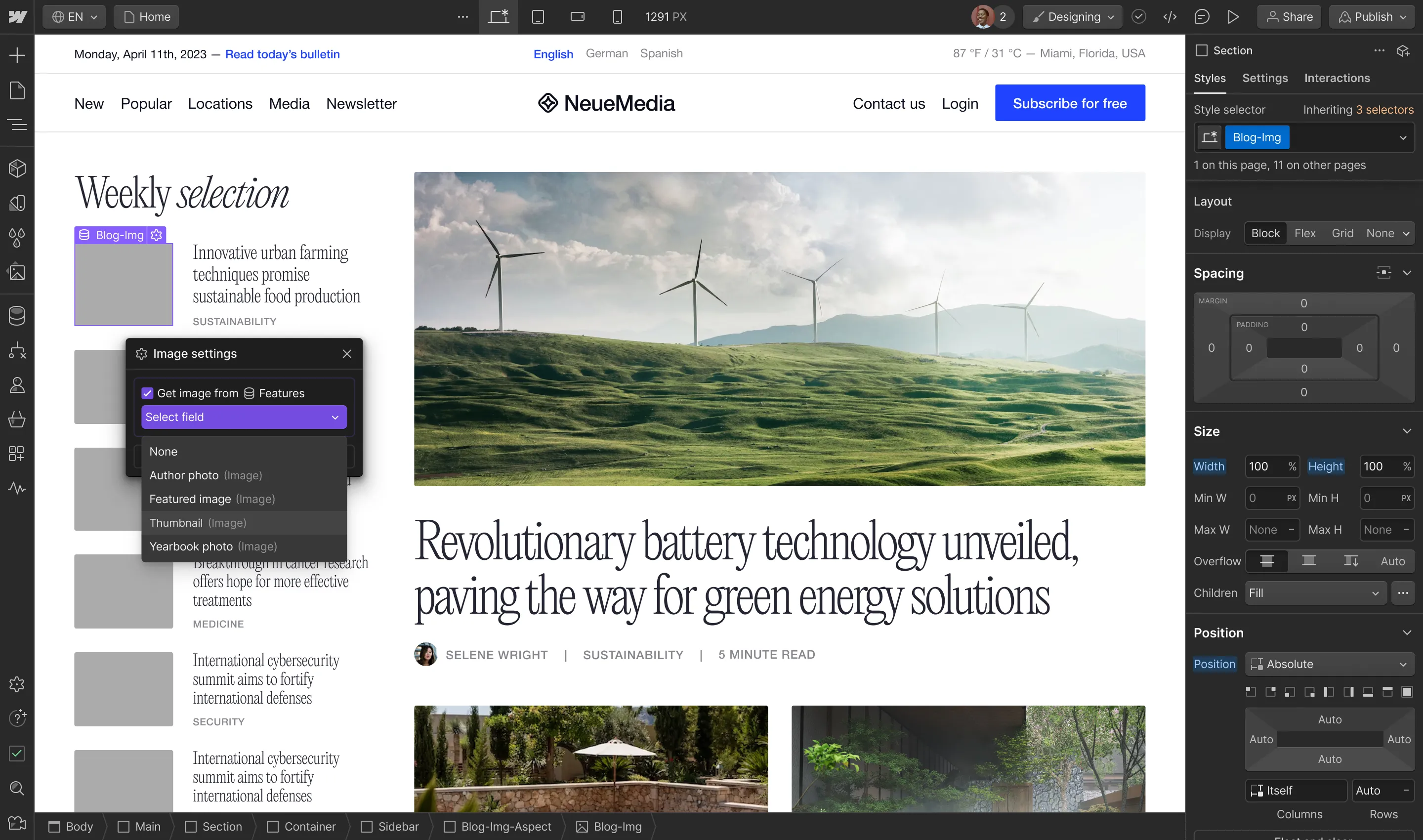

Create content-rich pages

Automatically pull live content from Webflow's powerful CMS into any page — then easily add or edit content over time.

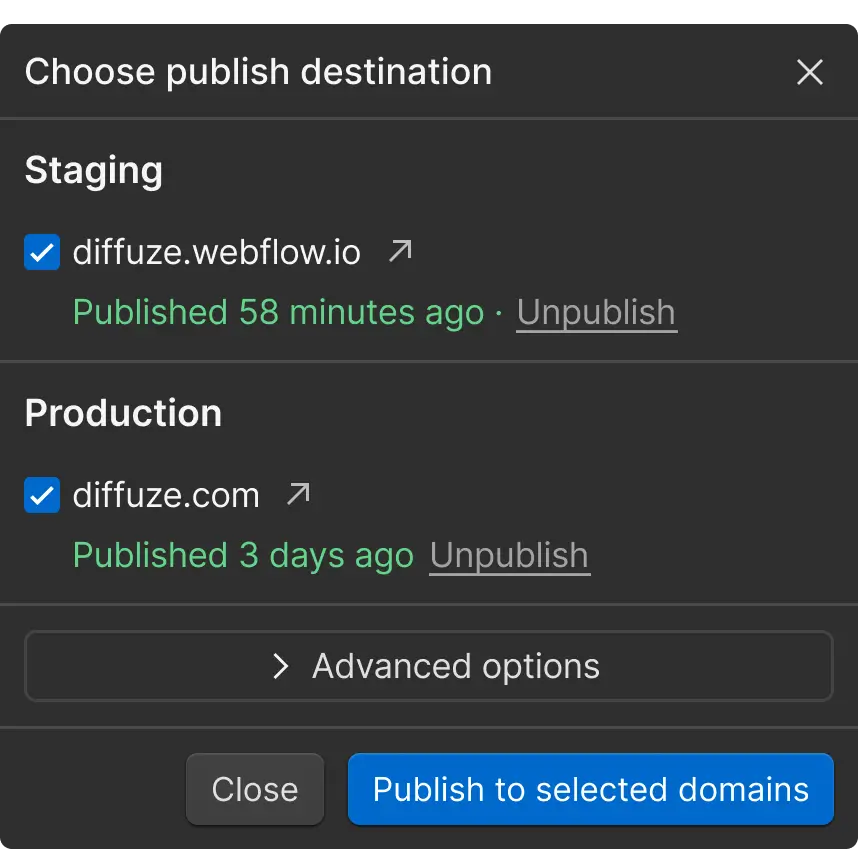

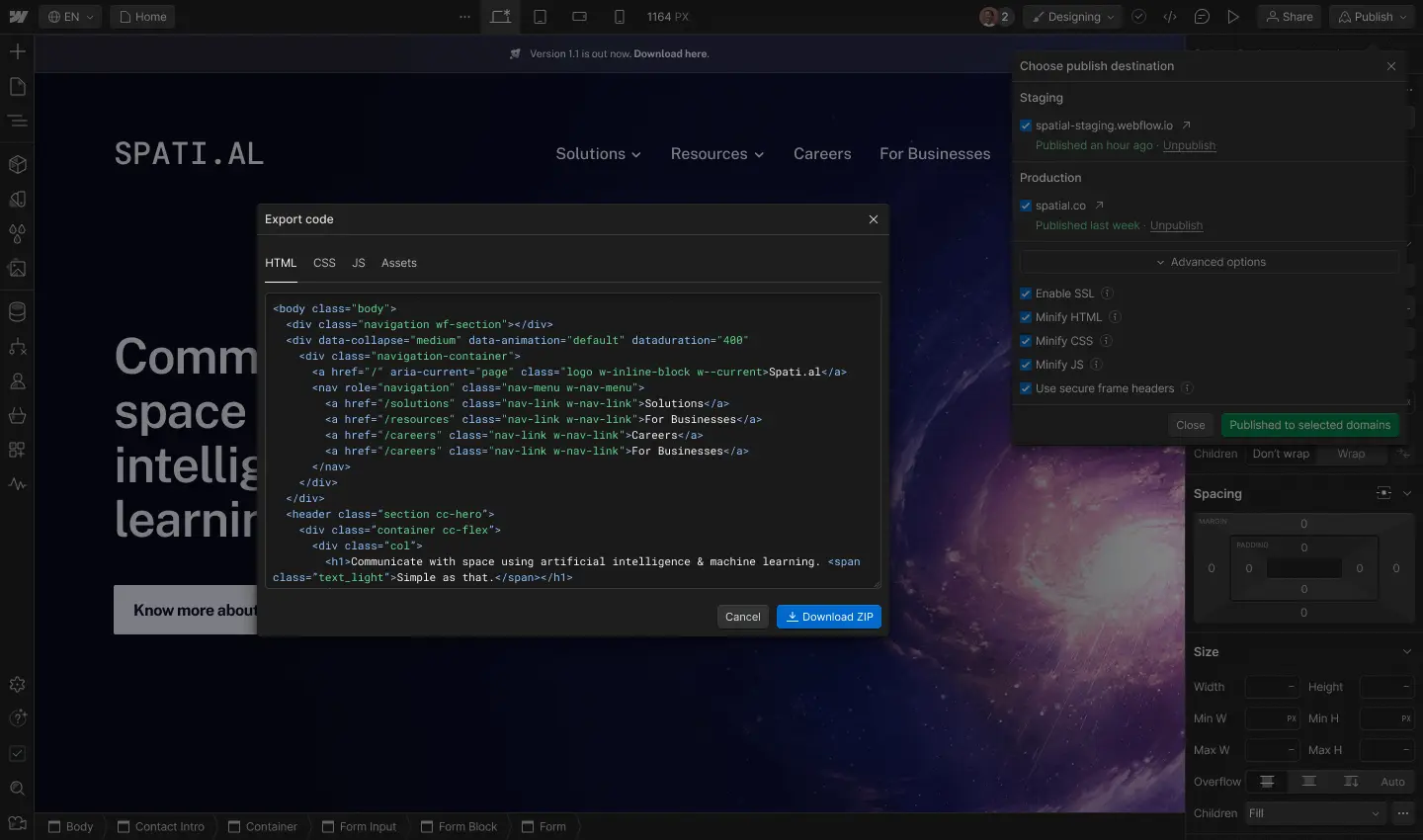

Go live quickly

Publish straight to the web or export clean, semantic code for production.

Trusted by 200,000+ leading organizations

Dropbox sign, a platform designed for growth.

Tools to help you scale your site with your business.

Webflow Apps

Connect your site to the tools your team uses every day — plus find and launch apps in the Webflow Designer.

Collaboration

Work better together, ship faster, and avoid unauthorized changes with advanced roles and permissions, page branching, and more.

Optimize your SEO and improve discoverability with fine-tuned controls, high-performance hosting, and flexible content management tools.

Localization

Create fully localized experiences for site visitors around the world — from design and content to translation and more.

Webflow Enterprise

Webflow Enterprise gives your teams the power to build, ship, and manage sites collaboratively at scale.

A scalable, reliable platform

Scale your traffic, content, and site performance to match your business — without worrying about reliability.

Advanced collaboration

Build and launch sites quickly — and safely — with powerful features designed to help large teams collaborate.

Dedicated, tailored support

From implementation support to in-the-moment troubleshooting, we’re here to offer personalized help.

Security and compliance

Launch with peace of mind thanks to Webflow’s robust security and compliance features and reliable hosting infrastructure.

We’ll help you get started

Browse the Marketplace, educational videos, and customer stories to find what you need to succeed with Webflow.

The 2024 State of the Website

Discover key challenges today’s marketing teams are facing, as well as opportunities for businesses in 2024.

Webflow 101

Learn the fundamentals of web design and development through this comprehensive course.

Marketplace

From templates to Experts, discover everything you need to create an amazing site with Webflow.

Webflow University

Search from our library of lessons covering everything from layout and typography to interactions and 3D transforms.

Reimagining web development teams

Discover how moving web responsibilities closer to marketing and design can accelerate speed to market.

Figma to Webflow

Learn the entire design process from idea to final output as we take you through Figma, Cinema 4D and Octane, and Webflow.

Get started for free

Try Webflow for as long as you like with our free Starter plan. Purchase a paid Site plan to publish, host, and unlock additional features.

- Contact Customer Service

- Call 1-800-769-2553

- Locate a No-Fee 2 U.S. ATM

- RBC Bank (U.S.) Online Banking

- RBC Royal Bank Online Banking

Cross-Border Banking

Cross-border banking bundle, no annual fee cross-border banking for 1 year 20 legal disclaimer (opens in popup) , 29 legal disclaimer (opens in popup).

Head to the U.S. with the essentials:

- No annual fee U.S. banking for 1 year 29 Legal Disclaimer (opens in popup)

- A no annual fee U.S. credit card 20 Legal Disclaimer (opens in popup)

- Cross-border offers & perks

Get the Bundle

Cross-Border Banking for Canadians

Find cross-border solutions to save money and let you focus on enjoying your time in the U.S.

U.S. Bank Accounts

Enjoy your travels with instant cross-border transfers 1 Legal Disclaimer (opens in popup) and 50,000+ no-fee ATMs 2 Legal Disclaimer (opens in popup) – you can even send money to your friends and family – all from your phone.

U.S. Credit Cards

Save on foreign transaction fees, earn rewards and enjoy purchase protection, travel perks and convenience.

U.S. Mortgages

Whether you’re buying your first U.S. home 8 Legal Disclaimer (opens in popup) , using your U.S. equity to upgrade or invest, or renewing your current mortgage, we will guide you through your options and help you find the solution that’re right for you.

The Only U.S.-Based Bank Specifically Designed for Canadians

For 17 years, RBC has been providing secure and easy U.S. banking to over 400,000 Canadians who live, travel, shop and work in the U.S. We make cross-border banking easy and secure.

Unlimited instant CAD <> USD transfers

No worrying about drafts and wires. Enjoy free transfers between your Canadian and U.S. RBC accounts — 24/7 with no delay 1 Legal Disclaimer (opens in popup)

Easy access to cash at 50,000+ no-fee ATMs 2

Get cash at 50,000+ no-fee ATMs 2 Legal Disclaimer (opens in popup) in all 50 states. Plus cash back at large retailers like Target, Costco, CVS and Walgreens

Send and receive money person-to-person in the U.S.

While there is no Interac e-Transfer in the States, there are several ways to send money between U.S. accounts through 3rd party apps like Venmo, PayPal, Apple Cash and Cash App with a U.S. cell number 39 Legal Disclaimer (opens in popup) . You can also transfer funds to other U.S. accounts in Online Banking.

Earn Avion Rewards on your purchases

With your no annual fee 20 Legal Disclaimer (opens in popup) RBC Bank U.S. Visa Signature Black credit card, avoid foreign transaction fees on your U.S. purchases while earning 1 Avion point for every $1 spent. 6 Legal Disclaimer (opens in popup) Redeem points for travel, gift cards or unlimited 1% cash back. 24 Legal Disclaimer (opens in popup)

Playing and Shopping in the U.S.

For the snowbird, U.S. vacationer or cross-border shopper

Moving to the U.S.

For Canadians working in or moving to the U.S.

Golfing in the U.S.

For the avid golfer that wants to golf in the sun year round

Studying in the U.S.

For Canadians going to college or university in the U.S.

Get cash at 50,000+ no-fee ATMs 2 in all 50 states!

Find your closest location, search for a no-fee atm near you:.

Abenity 39 Legal Disclaimer (opens in popup) Perks

Save with 300,000+ discounts on hotels, restaurants, attractions and more

Buy Your U.S. Dream Home 8 Legal Disclaimer (opens in popup)

RBC U.S. HomePlus TM Advantage is built exclusively for Canadians to take the guesswork out of U.S. home buying. You’ll get access to cross-border real estate, tax, legal and financing experts.

Choose the Rate & Term That’s Right For You

Rates starting at:

Choose between 3-, 5-, 7-, and 10-year terms 25 Legal Disclaimer (opens in popup) . All loans are amortized over 30 years to keep your monthly payments low and when your term expires, renew for free.

Mortgage Payment Calculator

Estimate your monthly mortgage payment, including taxes and insurance.

Cash vs. Financing Calculator

See how financing saves you thousands of dollars in one- time, up-front FX costs.

Save thousands on a U.S. mortgage

Don’t pay bank fees on your U.S. mortgage and save up to $4,500 USD in closing costs. 42 Legal Disclaimer (opens in popup)

Discover & Learn

Go-to grandma podcast: kathy buckworth on grandparenting and cross-border living, southward bound: 6 tips for a safe and happy border crossing, can you work remotely in paradise what to consider before you ‘work from home’ in the u.s., with abenity 39 legal disclaimer (opens in popup) , you’ll save with 300,000+ discounts on hotels, restaurants, attractions and more.

As an RBC Bank client, use Abenity's mobile app or website to get access to discounted rates on fun experiences, travel, dining out, necessities and more in the U.S.

14 best travel credit cards of May 2024

The best travel credit cards offer an array of premium perks and benefits . For both occasional travelers and frequent flyers, adding a travel credit card to your wallet is a great way to earn rewards and save money on every trip you take. At The Points Guy, our team has done the legwork and curated a selection of the best travel credit cards for any globe-trotter, whether you prefer to backpack through mountains or settle into a luxury villa for some relaxation. From generous travel credits to premium lounge access, we’ve chosen the cards packed with the best benefits to elevate your next travel experience.

Check out our list below and discover which travel credit card from our partners makes the best addition to your wallet for all of your adventures.

- Capital One Venture Rewards Credit Card : Best for earning miles

- Capital One Venture X Rewards Credit Card : Best for premium travel

- Chase Sapphire Preferred® Card : Best for beginner travelers

- Ink Business Preferred® Credit Card : Best for maximizing business purchases

- The Platinum Card® from American Express : Best for lounge access

- American Express® Gold Card : Best for dining at restaurants

- Capital One VentureOne Rewards Credit Card : Best for no annual fee

- The Business Platinum Card® from American Express : Best for business travel

- Wells Fargo Autograph Journey℠ Card : Best for unlimited point earning

- Chase Sapphire Reserve® : Best for travel credits

- Wells Fargo Autograph℠ Card : Best for variety of bonus categories

- American Express® Business Gold Card : Best for flexible rewards earning

- Bank of America® Travel Rewards credit card : Best for travel rewards beginners

- Alaska Airlines Visa Signature® credit card : Best for Alaska Airlines miles

Browse by card categories

Comparing the best credit cards, more details on the best credit cards, credit pointers with brian kelly, what is a travel credit card, helpful tools, how we rate cards, how to maximize travel credit cards, how to choose the best travel credit card, ask our experts, pros + cons of travel credit cards, frequently asked questions.

- Airport Lounge Access

Capital One Venture Rewards Credit Card

When it comes to simplicity and strong rewards, the Capital One Venture Rewards Credit Card is a solid choice for most travelers. You’ll earn earns 2 miles per dollar on every purchase with no bonus categories to memorize, making it an ideal card for those with busy lives. Read our full review of the Capital One Venture Rewards Credit Card .

- This flexible rewards card delivers a solid sign-up bonus of 75,000 miles, worth $1,388 based on TPG valuations and not provided by the issuer.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories.

- Rewards earned are versatile as they can be redeemed for any hotel or airline purchase for a statement credit or transferred to 15+ travel partners.

- Highest bonus-earning categories only on travel booked via Capital One Travel

- Capital One airline partners do not include any large U.S. airlines.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

Capital One Venture X Rewards Credit Card

If you can maximize the $300 credit toward Capital One Travel, the Venture X’s annual fee effectively comes down to $95, the same annual fee pegged to the Capital One Venture Rewards Credit Card (see rates and fees ). Add in a 10,000-mile bonus every account anniversary (worth $185, according to TPG valuations ) and lounge access, and the card may become the strongest option out there for a lot of travelers. Read our full review of the Capital One Venture X Rewards Credit Card .

- 75,000 bonus miles when you spend $4,000 on purchases in the first three months from account opening.

- 10,000 bonus miles every account anniversary

- $395 annual fee

- $300 credit annually, only applicable for bookings made through Capital One Travel portal

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is one of the most popular travel rewards credit card on the market. Offering an excellent return on travel and dining purchases, the card packs a ton of value that easily offsets its $95 annual fee. Cardholders can redeem points at 1.25 cents each for travel booked through Chase or transfer points to one of Chase’s 14 valuable airline and hotel partners. Read our full review of the Chase Sapphire Preferred Card .

- You’ll earn 5 points per dollar on travel purchased through Chase Travel, 3 points per dollar on dining, select streaming services and online grocery store purchases, 2 points per dollar on all other travel and 1 point per dollar on everything else.

- Annual $50 Chase Travel Hotel Credit

- Premium travel protection benefits including trip cancellation insurance, primary car rental insurance and lost luggage insurance.

- The card comes with a $95 annual fee.

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Ink Business Preferred® Credit Card

The Ink Business Preferred Credit Card’s sign-up bonus is among the highest we’ve seen from Chase. Plus earn points across the four bonus categories (travel, shipping, advertising and telecommunication providers) that are most popular with businesses. The card comes with travel protections, shopping protections and will also have primary coverage when renting a car for business purposes for you and your employees. Read our full review of the Ink Business Preferred Credit Card .

- One of the highest sign-up bonuses we’ve seen — 100,000 bonus points after $8,000 worth of spend in the first three months after card opening.

- Access to the Chase Ultimate Rewards portal for points redemption.

- Reasonable $95 annual fee.

- Bonus categories that are most relevant to business owners; primary car insurance.

- Perks including cellphone and purchase protection; extended warranty; trip cancellation/interruption insurance; trip delay reimbursement.

- Yearly cap on bonus categories.

- No travel perks.

- Subject to Chase's 5/24 rule on card applications.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

The Platinum Card® from American Express

The Amex Platinum is unmatched when it comes to travel perks and benefits. If lounge access, hotel elite status and annual statement credits are important to you, this card is well worth the high annual fee. Read our full review of the Platinum Card from American Express .

- The current welcome offer on this card is quite lucrative. TPG values it at $1,600.

- This card comes with a long list of benefits, including access to Centurion Lounges, complimentary elite status with Hilton and Marriott, and more than $1,400 in assorted annual statement credits and so much more. (enrollment required)

- The Amex Platinum comes with access to a premium concierge service that can help you with everything from booking hard-to-get reservations to finding destination guides to help you plan out your next getaway.

- The $695 annual fee is only worth it if you’re taking full advantage of the card’s benefits. Seldom travelers may not get enough value to warrant the cost.

- Outside of the current welcome bonus, you’re only earning bonus rewards on specific airfare and hotel purchases, so it’s not a great card for other spending categories.

- The annual airline fee credit and other monthly statement credits can be complicated to take advantage of compared to the broader travel credits offered by competing premium cards.

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck® application fee for a 5-year plan only (through a TSA PreCheck® official enrollment provider), when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- See Rates & Fees

American Express® Gold Card

This isn’t just a card that’s nice to look at. It packs a real punch, offering 4 points per dollar on dining at restaurants and U.S. supermarkets (on the first $25,000 in purchases per calendar year; then 1 point per dollar). There’s also an up to $120 annual dining credit at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com , Milk Bar, and select Shake Shack locations, plus it added an up to $120 annually ($10 per month) in Uber Cash, which can be used on Uber Eats orders or Uber rides in the U.S. All this make it a very strong contender for all food purchases, which has become a popular spending category. Enrollment is required for select benefits. Read our full review of the Amex Gold .

- 4 points per dollar on dining at restaurants and U.S. supermarkets (on the first $25,000 in purchases per calendar year; then 1 point per dollar)

- 3 points per dollar on flights booked directly with the airline or with Amex Travel.

- Welcome bonus of 60,000 points after spending $6,000 in the first six months of account opening.

- Weak on travel and everyday spending bonus categories.

- Not as effective for those living outside the U.S.

- Some may have trouble using Uber/food credits.

- Few travel perks and protections.

- Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

Capital One VentureOne Rewards Credit Card

If you’re looking to dip your toes into the world of travel rewards, the Capital One VentureOne Rewards Credit Card is a great way to get started. With no annual fee and a simple 1.25 miles per dollar on all your purchases, you won’t have to keep up with multiple bonus categories — just earn rewards on everything you purchase! Coupled with the 20,000-mile sign-up bonus, you can use your rewards to book travel, transfer to Capital One’s loyalty partners and more. Read our full review of the Capital One VentureOne Rewards Credit Card .

- No annual fee.

- Earn a bonus of 20,000 bonus miles once you spend $500 within the first three months from account opening.

- Use your miles to book or pay for travel at a 1-cent value, or transfer your miles to loyalty programs to gain potentially even greater value for your rewards.

- Earn 1.25 miles per dollar on all purchases.

- No foreign transaction fees.

- Other credit cards can offer you higher rewards for your common purchase categories.

- Capital One airline transfer partners do not include any large U.S. airlines.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

The Business Platinum Card® from American Express

The Business Platinum Card from American Express is a great card for frequent travelers looking to add a touch of luxury to their business trips. While the card does come with a high annual fee, you’re also getting a ton of valuable benefits in return. They include generous annual travel credits, unparalleled lounge access that includes Amex Centurion Lounges and more. Read our full review on The Business Platinum Card from American Express .

- Up to $100 statement credit for Global Entry every 4 years or $85 TSA PreCheck credit every 4.5 years (enrollment is required)

- Up to $400 annual statement credit for U.S. Dell purchases (enrollment required)

- Gold status at Marriott and Hilton hotels; access to the Fine Hotels & Resorts program and Hotel Collection (enrollment required)

- Steep $695 annual fee.

- High spend needed for welcome offer.

- Limited high bonus categories outside of travel.

- Welcome Offer: Earn 150,000 Membership Rewards® points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

- 5X Membership Rewards® points on flights and prepaid hotels on AmexTravel.com, and 1X points for each dollar you spend on eligible purchases.

- Earn 1.5X points (that’s an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- Unlock over $1,000 in statement credits on select purchases, including tech, recruiting and wireless in the first year of membership with the Business Platinum Card®. Enrollment required. See how you can unlock over $1,000 annually in credits on select purchases with the Business Platinum Card®, here.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to the Card.

- $189 CLEAR® Plus Credit: Use your card and get up to $189 in statement credits per calendar year on your CLEAR® Plus Membership (subject to auto-renewal) when you use the Business Platinum Card®.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market as of 03/2023.

- $695 Annual Fee.

Wells Fargo Autograph Journey℠ Card

The Wells Fargo Autograph Journey credit card offers healthy reward earning rates on top of uncapped point-earning meaning the sky's the limit — especially if you strategize and spend in popular categories.

- No foreign transaction fees

- Uncapped earning potential

- $50 annual statement credit

- Solid point earning rates in popular categories

- This card features an annual fee

- Select “Apply Now” to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn 60,000 bonus points when you spend $4,000 in purchases in the first 3 months – that’s $600 toward your next trip.

- Earn unlimited 5X points on hotels, 4X points on airlines, 3X points on other travel and restaurants, and 1X points on other purchases.

- $95 annual fee.

- Book your travel with the Autograph Journey Card and enjoy Travel Accident Insurance, Lost Baggage Reimbursement, Trip Cancellation and Interruption Protection and Auto Rental Collision Damage Waiver.

- Earn a $50 annual statement credit with $50 minimum airline purchase.

- Up to $1,000 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

Chase Sapphire Reserve®

The Chase Sapphire Reserve is one of our top premium travel cards. With a $300 travel credit, bonus points on dining and travel purchases and other benefits, you can get excellent value that far exceeds the annual fee on the card. Read our full review of the Chase Sapphire Reserve card .

- $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Access to Chase Ultimate Rewards hotel and airline travel partners.

- 10 points per dollar on hotels, car rentals and Chase Dining purchases through the Ultimate Rewards portal, 5 points per dollar on flights booked through the Chase Travel portal, 3 points per dollar on all other travel and dining, 1 point per dollar on everything else

- 50% more value when you redeem your points for travel directly through Chase Travel

- Steep initial $550 annual fee.

- May not make sense for people that don't travel frequently.

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

Wells Fargo Autograph℠ Card

The Wells Fargo Autograph card packs a punch for a no-annual-fee product, with an array of bonus categories plus solid perks and straightforward redemption options. Read our full review of the Wells Fargo Autograph here .

- This card offers 3 points per dollar on various everyday purchases with no annual fee. It also comes with a 20,000-point welcome bonus and an introductory APR offer on purchases. Plus, you'll enjoy up to $600 in cellphone protection when you pay your monthly bill with the card. Subject to a $25 deductible.

- Despite the lucrative earning structure, Wells Fargo doesn't offer any ways to maximize your redemptions — you're limited to fixed-value rewards like gift cards and statement credits.

- Select "Apply Now" to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value.

- Earn unlimited 3X points on the things that really add up - like restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Plus, earn 1X points on other purchases.

- $0 annual fee.

- 0% intro APR for 12 months from account opening on purchases. 20.24%, 25.24%, or 29.99% variable APR thereafter.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Redeem your rewards points for travel, gift cards, or statement credits. Or shop at millions of online stores and redeem your rewards when you check out with PayPal.

American Express® Business Gold Card

The Amex Business Gold card is a solid choice for high-spending small businesses with the flexibility to earn 4 points per dollar in the two categories where you spend the most. The card is ideal for businesses who value simplicity above all. Read our full review of the American Express Business Gold Card .

- You'll earn 4 Membership Rewards points per dollar in the top 2 spending categories each month (on the first $150,000 in combined purchases each calendar year).

- Hefty $375 annual fee.

- There may be better options for small businesses who don't spend a lot.

- Welcome Offer: Earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

- Earn 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap.

- Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.

- Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.

- Get up to a $12.95** statement credit back each month after you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. **Up to $12.95 plus applicable taxes on one membership fee.

- Your Card – Your Choice. Choose from Gold or Rose Gold.

- *Terms Apply

Bank of America® Travel Rewards credit card

The Bank of America Travel Rewards credit card is a great starter card thanks to its no annual fee and no foreign transaction fees when you travel internationally. Earning and redeeming is effortless, with no confusing bonus categories to keep track of and the ability to redeem your points for all of your travel needs. Read our full review of the Bank of America Travel Rewards card.

- 1.5 points per dollar on all purchases

- No annual fee

- Bank of America does not offer airline or hotel transfer partners like other banks such as American Express, Chase or Capital One.

- No travel and purchase protections.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 19.24% - 29.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Alaska Airlines Visa Signature® credit card

There’s a lot to love about the Alaska Airlines credit card, in part due to its highly valuable loyalty program: Alaska Airlines MileagePlan. Whether you’re a loyal Alaska flyer or a points maximizer looking to diversify your rewards portfolio, this card has a lot to offer. For starters, you’ll receive Alaska’s Famous Companion Pass each year from $122 ($99 fare plus taxes and fees from $23) each account anniversary after you spend $6,000 or more on purchases within the prior anniversary year, free checked bags for you and up to six guests on your itinerary, 20% back on in-flight purchases and more. Plus, Alaska has joined the oneworld alliance, opening up endless redemption opportunities. Read our full review of the Alaska Airline credit card.

- Free checked bag for you and up to six guests on your reservation.

- Alaska discounts, including 20% back on in-flight purchases.

- Limited Time Online Offer—60,000 Bonus Miles!

- Get 60,000 bonus miles plus Alaska's Famous Companion Fare™ ($99 fare plus taxes and fees from $23) with this offer. To qualify, make $3,000 or more in purchases within the first 90 days of opening your account.

- Get Alaska’s Famous Companion Fare™ ($99 fare plus taxes and fees from $23) each account anniversary after you spend $6,000 or more on purchases within the prior anniversary year. Valid on all Alaska Airlines flights booked on alaskaair.com.

- Earn unlimited 3 miles for every $1 spent on eligible Alaska Airlines purchases. Earn unlimited 2 miles for every $1 spent on eligible gas, EV charging station, cable, streaming services and local transit (including ride share) purchases. And earn unlimited 1 mile per $1 spent on all other purchases. And, your miles don’t expire on active accounts.

- Earn a 10% rewards bonus on all miles earned from card purchases if you have an eligible Bank of America® account.

- Free checked bag and enjoy priority boarding for you and up to 6 guests on the same reservation, when you pay for your flight with your card — Also available for authorized users when they book a reservation too!

- With oneworld® Alliance member airlines and Alaska’s Global Partners, Alaska has expanded their global reach to over 1,000 destinations worldwide bringing more airline partners and more ways to earn and redeem miles.

- Plus, no foreign transaction fees and a low $95 annual fee.

- This online only offer may not be available elsewhere if you leave this page. You can take advantage of this offer when you apply now.

With the Capital One Venture, you’re earning 2 miles per dollar on every purchase, which makes it easy to rack up rewards without having to juggle different bonus categories or spending caps. And with flexible redemption options and a manageable annual fee, this card is an excellent choice if you’re looking to keep just one credit card in your wallet for all spending.

Those looking to earn flexible rewards should use the Capital One Venture card as it allows you to redeem miles for a fixed value or transfer the miles you earn to 15+ airline and hotel transfer partners , including Avianca, Etihad Airways, Turkish Airlines and Singapore Airlines.

“The Capital One Venture is a great card that can add value to pretty much anyone’s wallet. I use it to earn 2 miles per dollar on the purchases that fall outside of my other cards’ bonus categories. The annual fee is low, Capital One miles are easy to redeem and the card does come with a few nice perks — including TSA PreCheck/Global Entry application fee reimbursement.” — Madison Blancaflor , senior content operations editor

Even if you’re a casual traveler, consider jumping to the Capital One Venture X Rewards Credit Card (see rates and fees ). The card’s up to $300 annual credit for purchases made with Capital One Travel immediately covers the higher annual fee — and that’s not even considering the added perks you’ll enjoy.

At $395 per year (see rates and fees ), this premium card is cheaper than all of its competitors without sacrificing the breadth of valuable perks it includes. Cardholders will get unlimited visits to Capital One’s premium network of lounges and 1,300-plus Priority Pass lounges worldwide and able to bring up to two guests for no additional charge.

For frequent travelers, the Capital One Venture X is a must-have and is well worth the $395 annual fee. If you travel frequently with your significant other, family or friends, you can even add some authorized users for no additional cost. This will grant them their own lounge access (and the ability to bring up to two guests for no fee), among many other benefits, making this a huge cost-saver for those who travel in groups.

“With an annual fee that is $300 less than The Platinum Card® from American Express (see Amex Platinum rates and fees ), the Capital One Venture X card is my favorite travel credit card. The card comes with an annual $300 Capital One Travel credit, which I use to book flights. That effectively brings the annual fee down to $95 per year (see rates and fees ). Cardholders enjoy a Priority Pass Select membership. Authorized users — you geta number of them at no cost — also enjoy their own Priority Pass Select membership. I use my Venture X card to earn 2 miles per dollar (a 3.7% return at TPG’s valuations ) in spending categories where most cards would only accrue 1 mile — like auto maintenance, pharmacies and medical bills.” — Kyle Olsen , former points and miles reporter

Those turned off by the Venture X’s annual fee could opt for the Capital One Venture Rewards Credit Card , which has a $95 annual fee (see rates and fees ), identical sign-up bonus and similar earning and redemption options.

You’ll earn a solid return on dining and travel (6% back and 4% back, respectively, based on TPG valuations ) on top of your generous sign-up bonus, and you also have access to some of the best travel protections offered by any travel rewards credit card.

We’ve long suggested the Chase Sapphire Preferred Card as an excellent option for those who are new to earning travel rewards because it lets you earn valuable, transferable points with strong bonus categories and a reasonable annual fee.

“The Chase Sapphire Preferred has remained a top card in my wallet for years. Between the consistently strong sign-up bonus, low annual fee and continual improvements that have been made over the years, it’s hard for any other mid-tier rewards card to compare. I love that I can earn bonus rewards on travel, dining, streaming and online grocery purchases — all with just one card. Plus, Chase Ultimate Rewards points are valuable and easy to use whether you’re new to points and miles or an expert.” — Madison Blancaflor , senior content operations editor

To add more luxury to your travel experience, consider the Chase Sapphire Reserve® . Though it comes with a higher annual fee, you’ll enjoy Priority Pass lounge access plus a $300 annual travel credit.

The Ink Business Preferred earns 3 points per dollar on the first $150,000 in combined travel, shipping, internet, cable, phone services and advertising purchases made on social media sites and search engines each account anniversary year. TPG’s most recent valuations peg the value of Chase Ultimate Rewards points at 2 cents apiece, so you’ll get a fantastic return of 6% on purchases in these categories.

If you spend a lot on business travel or social media advertising, you’ll be able to earn significant points using the Ink Business Preferred card .

“I originally signed up for the Ink Business Preferred primarily for its sign-up bonus. But, over the last year, I’ve found myself making it my go-to card when booking travel. After all, the Ink Business Preferred earns 3 points per dollar spent on travel and provides excellent travel protections, including trip delay protection and rental car insurance.” — Katie Genter , senior writer

If you don’t want to worry about maximizing specific purchases and are looking for a lower spending requirement to earn a sign-up bonus, consider the Ink Business Unlimited® Credit Card , which offers 1.5% cash back on all purchases and carries no annual fee.

The Amex Platinum is a stellar premium travel card that can provide amazing redemptions . Besides the welcome offer, it comes with more than $1,400 in credits each year and various lounge access options. Enrollment is required for select benefits.

Anyone looking for luxury travel benefits will find that the ton of annual statement credits make the annual fee worth it. Plus, you’ll get unparalleled lounge access , automatic Gold status with Hilton and Marriott, and extra perks with Avis Preferred , Hertz Gold Plus Rewards and National Car Rental Emerald Club . Enrollment is required for select benefits.

“While this card has a high annual fee, it more than justifies itself for frequent travelers like me. The lounge access options that come with the Platinum are unrivaled by competitors. I put all of my flights on this card to earn 5 points per dollar spent and trip protection insurance. I make sure to take full advantage of the Uber, Saks Fifth Avenue, Hulu/Disney+ and Clear credits (enrollment is required). And, honestly, pulling a Platinum card out of your wallet to pay for something does feel pretty fancy.” — Matt Moffitt , senior credit cards editor

The Capital One Venture X Rewards Credit Card can be a great alternative to the Amex Platinum, with a notably lower annual fee, similar perks and a more rewarding earning rate on everyday purchases.

The Amex Gold earns 4 points per dollar on dining at restaurants, with no foreign transaction fees (see rates and fees ), meaning you’ll get an 8% return on purchases (based on TPG’s valuations ). While a few other cards temporarily offer higher return rates on dining, this is the best option for long-term spending, making it one of the best dining cards and best rewards cards .

Those looking for a great return on dining and purchases at U.S. supermarkets will get a lot of value from this card.

“Groceries and dining at restaurants are two of my top spending categories, and I love that the Amex Gold rewards those purchases with 4 points per dollar. When you factor in the $10 dining credit and $10 in Uber Cash each month, the $250 annual fee is a net cost of $10.” — Senitra Horbrook , former credit cards editor

For those who dine out a lot and also want additional bonus categories and other valuable perks for a lower annual fee, consider the Chase Sapphire Preferred® Card .

The no-annual-fee Capital One VentureOne Rewards Credit Card (see rates and fees ) has the same redemption options as its sibling card (the Venture Rewards card) but with a lower rewards rate and fewer perks. The miles earned on the card can also be transferred to airline and hotel partners, a benefit not usually seen with a no-annual-fee card.

The VentureOne is a strong card to have in your arsenal and great if you are budgeting. After all, there aren’t many no-annual-fee cards with the ability to transfer points and miles directly to travel partners, so it’s a big bonus that this card offers that (see rates and fees ).

“I wanted a credit card that earns Capital One miles without an annual fee, and this is a winner (see rates and fees ). It doesn’t have the bells and whistles of some other cards, but I’m happy earning 1.25 miles per dollar on all purchases without paying a fee to keep this card year after year. I’ll never cancel this card.” — Ryan Smith , former credit cards writer

For a small annual fee, many travelers could benefit from the Capital One Venture Rewards Credit Card . You’ll earn at least 2 miles per dollar on all purchases and receive a statement credit for TSA PreCheck or Global Entry membership.

There are certain ways to earn bonus points for spending on the Amex Business Platinum Card, but it’s the array of perks on the card that make it a great option. Beyond airport lounge access and automatic hotel elite status, there are a number of statement credits that are specifically targeted to common business expenses.

If you travel for business frequently, this card could help you upgrade your experience in the air and on the ground while saving you money on select business-related services. And the current welcome bonus is just the icing on the cake.

“I find that the annual perks and credits vastly outweigh the large annual fee. And that’s even without using some of them. By using the benefits with Priority Pass and Amex lounges, the airline incidental credits, plus the statement credits for Clear, our cellphone plan and restocking my home printer with ink and paper from Dell (enrollment required), I get more value out of the card than it costs to keep it. Plus, it earns my favorite points — American Express Membership Rewards — earning 5 points per dollar on flights and hotels booked with Amex Travel.” — Ryan Smith , former credit cards writer

For less-frequent travelers, consider the American Express® Business Gold Card , which offers 4 points per dollar spent on your top two spending categories each month on the first $150,000 in combined purchases from these categories each calendar year (then 1 point per dollar thereafter).

The Autograph Journey offers cardholders the chance to earn elevated rates across travel categories including 5 points per dollar spent on hotels, 4 points per dollar on airline purchases and 3 points per dollar on restaurants and 'other travel' which includes timeshares, car rentals, cruise lines, travel agencies, discount travel sites and campgrounds. On top of this, cardholders also get the added benefit of earning a flat rate of 1 point per dollar on other purchases for a $95 annual fee.

If you travel frequently and are looking for a card to help you rack up points you can redeem for future travel, this card is a decent option. Additionally, those looking for a way to fill gaps in their points earning strategy will benefit from the flat 1 point per dollar spent on other purchases outside of the main travel categories.

Another great perk the Autograph Journey features is an annual $50 statement credit triggered by an airline purchase of at least $50. This is on top of elevated earning rates in the certain travel categories and a solid welcome offer for new applicants. There's also no foreign transaction fees on the Autograph Journey card making it a good first travel card as well as a decent supplemental card to add to your travel credit card roster.

If you're looking for a more general use credit card with no annual fee, consider the Wells Fargo Active Cash® Card (see rates and fees ). It earns a flat rate of 2% cash rewards on purchases making an excellent choice to help fill gaps in your reward earning strategy. The best part? Like the Autograph Journey card, the Active Cash Card doesn't put a cap on the amount of cash back you can earn.

The Chase Sapphire Reserve comes with an annual $300 travel credit to offset a variety of expenses — such as airfare, hotels, rental cars, transit and more. You’re also getting an up-to-$100 Global Entry or TSA PreCheck application fee credit once every four years along with Priority Pass Select membership. And Chase’s slate of transfer partners allows plenty of opportunity to get the maximum value from your points.

Those looking for elevated earning rates and extensive travel protections should have this card in their wallet. The 50% redemption bonus when you use your points to pay for travel through the Chase portal is also a nice perk.

“I’ve had the Sapphire Reserve for years, and it’s going to stay in my wallet for the near future. I get $300 off travel every year along with great earning rates on travel and dining (3 points per dollar) and various trip protections that can reimburse me when things go wrong. And by leveraging other cards in the Ultimate Rewards ecosystem, I’m able to maximize the earnings across all of my purchases.” — Nick Ewen , director of content

If you just can’t stomach the Sapphire Reserve’s $550 annual fee, go for the Chase Sapphire Preferred® Card instead. It has similar perks, redemption options and travel protections — for a much lower $95 per year.

The Wells Fargo Autograph is a great no-annual-fee card that offers quality earning categories and travel and shopping protection.

Travel card beginners who are looking to get into points earning should consider the Wells Fargo Autograph, which offers a welcome bonus, 3 points per dollar on a variety of everyday spending categories and cellphone protection.

If you’re just getting into the travel credit card world and are not sure travel cards are for you, consider the Wells Fargo Autograph, which will allow you to earn bonus points on travel spending without the commitment of an annual fee.

If you’re looking to earn transferable reward points but still maintain a similar earning structure, consider the Bilt Mastercard® (see rates and fees ). The card earns 3 points per dollar on dining and 2 points per dollar on travel purchases for no annual fee. Plus, Bilt points can be transferred to any of its multiple travel partners.

The American Express Business Gold card comes packed with perks and benefits, but its most unique feature is the ability to shift your monthly bonus categories. Cardholders will automatically earn 4 points per dollar in their top two spending categories on the first $150,000 in combined purchases from these categories each calendar year (then 1 point per dollar thereafter), so if your business spending varies month to month, you won’t have to commit to a bonus category.

The American Express Business Gold card is an excellent choice for business owners who are looking for a premium business card with premium business perks like monthly office supply statement credits, travel and shopping protection and access to The Hotel Collection.

The American Express Business Gold is an excellent choice for small businesses that have changing bonus categories but still want more premium business perks and benefits.

If you still want to earn Membership Rewards points without paying an annual fee, consider The Blue Business® Plus Credit Card from American Express (see rates and fees ), which earns 2 Membership Rewards points on all business purchases (up to $50,000 per calendar year, then 1 point per dollar).

The Bank of America Travel Rewards card operates similarly to the Capital One Venture Rewards Credit Card . You’re earning flat-rate rewards across all spending, and then you can use those rewards as a statement credit to cover eligible travel purchases.

It’s perfect for low-budget beginner travelers who want a card with no annual fee and a simple way to earn and redeem points.

“I’m happy earning 1.5 points per dollar on all purchases on a card without an annual fee. I can’t pay for everything in life with transferable points, and it’s nice to have a card with fixed-value points for those situations. I use this card for travel purchases where I need to pay in cash, then I can reimburse myself with the points.” — Ryan Smith , former credit cards writer

If you’re interested in a card with transferable miles that still has no annual fee (see rates and fees ), consider the Capital One VentureOne Rewards Credit Card .

The Alaska Airlines Visa earns 3 miles per dollar on eligible Alaska Airlines purchases; 2 miles per dollar on eligible gas, EV charging stations, cable, streaming services and transit (including local ride share purchases); and 1 mile per dollar on everything else. You get a free checked bag on Alaska flights for you and up to six guests on your reservation, an annual Companion Fare on your account anniversary and 20% back on all inflight purchases.

Whether you live on the West Coast or not, the Alaska Airlines Visa is a good cobranded airline card to consider adding to your wallet. The Seattle-based airline is mostly limited to North American routes, but international destinations through Oneworld partners make this card valuable for all travelers.

“With new benefits, this card is even more valuable to me — even with its higher annual fee. It provides a free first checked bag, discounts on inflight purchases and priority boarding. My favorite feature, however, is the annual Companion Fare. I get hundreds of dollars in annual value from this perk.” — Ryan Smith , former credit cards writer

If you’re not looking to collect airline-specific miles, a general travel card like the Chase Sapphire Preferred® Card might be a better option.

Travel rewards credit cards earn points, miles or cash back that are redeemable for travel expenses or are geared toward travel spending. The cards on this list are some of the best credit cards to book flights , hotels and more with their many perks and rewards .

Travel credit cards offer rewards on different purchases that can help you book flights, hotels and more for little to no out-of-pocket expenses. Some cards also provide valuable perks and benefits that upgrade the overall travel experience — from Global Entry application fee credits to lounge access to complimentary elite status . If you have the right card (or cards) in your wallet, the sky is the limit on where your travels can take you — literally.

Additionally, it’s often advantageous to travel with more than one credit card for a variety of reasons. Carrying a backup credit card when you travel can provide peace of mind in the case of bank or issuer problems or if you have a card flagged for fraud while you travel. (In this case, knowing if your card requires you to set up travel alerts for lengthy travel could be worthwhile).

Are you new to travel rewards? Check out our beginner’s guide to all things points and miles . You’ll learn about top loyalty programs, how to maximize your credit card strategy to reach your travel goals and so much more.

Related: The complete history of credit cards, from antiquity to today

We have researched various types of travel credit cards to help you figure out which one is best for you.

Travel vs cash back credit cards