- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Revolut travel card review: Rates, fees & limits [2024]

The Revolut travel card is a multi-currency card you can use for convenient spending and withdrawals in the US and when you’re abroad.

This guide walks through everything you need to know about how the Revolut travel card works, its key features and benefits, and the fees associated with using it. We’ll also touch on some alternatives to use abroad, such as the Wise travel card, as a comparison.

Revolut travel card: key features

Revolut offers 3 different account plans

- The Standard plan has no monthly fee to pay, while the Premium and Metal account plans have monthly costs, but also include more features and higher no-fee transaction limits.

- All accounts come with a travel card for spending and withdrawals, but the exact card type you get will depend on the account tier you choose. With the highest tier of account you get an exclusive solid steel Metal card, while all account types can also opt for a personalized card.

- Virtual cards are also available on all account plans, which can be used for mobile and online spending, and added to a walleye like Apple Pay.

We’ll walk through the Revolut travel card in detail throughout this guide, including how it works at home and abroad.

Go to Revolut Here are a few pros and cons of the Revolut travel card to kickstart our full review:

The Revolut travel card offers an easy and flexible way to hold, spend and exchange multiple currencies, with just your card and your phone. You’ll be able to choose the plan that suits your specific needs and transaction requirements, including some with no monthly costs associated. Once you’ve opened a verified account you can order your physical card in the Revolut app, and start spending right away online or using a mobile wallet, with your virtual card.

Who is the Revolut travel card for?

The Revolut travel card can suit frequent travelers as well as anyone living, studying or working abroad. You may want to get a Revolut travel card if:

- You’re a traveler spending in foreign currencies often

- You love to shop online at home and abroad

- You want a virtual card for security

- You’d prefer to manage your money using just your phone

Go to Revolut

What is a Revolut travel card?

The Revolut travel card is a payment card linked to a Revolut digital account. There are several different Revolut cards which are issued with different Revolut account plans – all are debit cards, and all can be used for global spending and cash withdrawals.

If you are looking for more information about Revolut: Revolut review

Is the Revolut Travel card a multi-currency card?

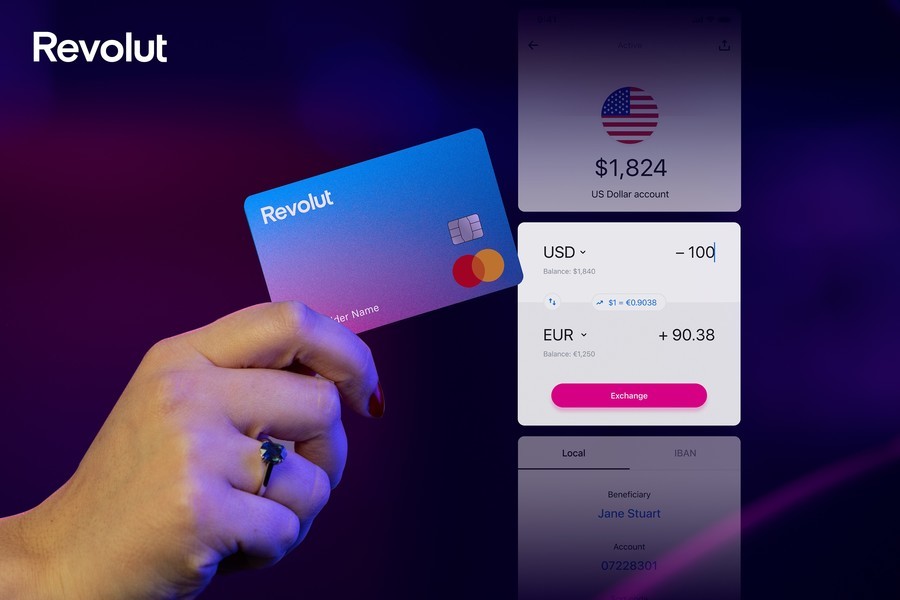

Yes. You can hold around 25 currencies in the Revolut account and spend conveniently in multiple currencies around the world.

Compare the Revolut travel money card to alternative options like the Wise travel money card , to see which suits you best. More on that, next.

Alternatives to Revolut travel card

Non-bank providers like Revolut can be a cost effective way to spend at home and abroad. They’ve often got fairly low fees, and tend to be innovative, offering some helpful and unusual account features to suit different customer needs.

Here’s a quick look at how Revolut lines up on features and fees against a couple of other non-bank services from Wise and Chime .

*Information correct at time of writing, 13th October 2023

Go to Revolut Go to Wise

Wise travel card

Hold 40+ currencies and spend in 150+ countries, with mid-market rate currency conversion, no minimum balance and no monthly fees. You can open your Wise account online and order a card for home delivery. Use your card to spend and make cash withdrawals globally, and get instant in-app notifications to keep on top of your finances.

Go to Wise

Learn more: Wise card review

Chime debit card

Chime accounts have no monthly fees and no minimum balance. In fact there are very few fees to worry about at all. You can only hold USD in your Chime account, but you’ll still be able to use your card around the world to spend in any currency. Your overseas spending will be converted back to USD using the network exchange rate with no foreign transaction fee.

Revolut travel card fees & spending limits

As with any travel card, there are some fees involved in using the Revolut travel card. There are also a few limits applied to keep customers and their accounts safe. Here’s a rundown of the limits for the Revolut travel card:

*Details correct at the time of research – 13th October 2023

Here are the Revolut travel card fees you’ll need to be familiar with:

Exchange rates

All Revolut accounts have some currency exchange every month which uses the mid-market exchange rate. Standard plan holders can convert up to 1,000 USD a month, Premium plan holders can get 10,000 USD a month and Metal plan holders have unlimited conversion with the mid-market rate.

It’s important to note that out of hours conversion fees apply, which means you pay 1% extra when exchanging currencies at the weekend or overnight. If your plan has a limited amount of mid-market rate conversion, you’ll be charged a 0.5% fair usage fee once this is exceeded.

How to get Revolut travel card

To order your Revolut travel card you’ll need to have an active Revolut account. Download the Revolut app, and you can get your new account in just a few taps, by entering your personal information and getting verified.

Once you’ve got your Revolut account set up all you need to do is open the Revolut app and go to the ‘Cards’ tab. Here you’ll see the option to get a physical or virtual card, and to create a card PIN.

What documents you’ll need

To verify your Revolut account you’ll need to upload a selfie and a photo of one of the following documents:

- Driving license

If you don’t have these documents available, you can reach out to Revolut to understand which other documents may be used in your specific situation.

What happens when the card expires?

Revolut will contact you 28 days before your card is due to expire, so you can order a new one in good time. Standard shipping has no fee when getting a new card to replace an expiring Revolut travel card.

How to use a Revolut travel card?

The Revolut travel card is a debit card issued on either the Visa or Mastercard network. That means you can use it to pay or make a withdrawal anywhere you see the logo of your card’s network being displayed, globally. You’ll also be able to add your card or your virtual card to your preferred mobile wallet for on the go payments.

How to withdraw cash with a Revolut travel card?

To make an ATM withdrawal with a Revolut travel card you’ll need to first find an ATM that supports your card network. You can then just insert the card into the ATM and enter your PIN, then the amount you want to withdraw. Easy.

Is the card safe?

Yes. The Revolut card in the US is issued by Community Federal Savings Bank, Member FDIC, pursuant to license by Visa.

How to use the Revolut travel card overseas?

You can spend with your Revolut travel card in about 150 countries , anywhere the card network is accepted. If you hold the currency you need in your account there’s no fee, but an exchange or fair usage fee may apply in some situations – if you’ve exhausted your monthly currency exchange limits, or if you’re exchanging out of hours for example.

If Revolut doesn’t support holding the currency you need, it’s worth checking out Wise which has a broader selection of 40+ currencies for holding and exchange.

Conclusion: is the Revolut travel card worth it?

The Revolut travel card is a flexible option for holding 25+ currencies and spending globally in 150+ countries. Depending on the account tier you select you may pay a monthly fee, and some transaction fees are also likely to apply. Compare the Revolut travel card against some alternatives like the Wise travel card and the Chime debit card to see which suits you best.

The Wise card may suit you if you’re looking for a powerful international account that can hold 40+ currencies, and receive payments in multiple currencies with local bank details. Chime may be a good pick for customers looking for a USD account with pretty much no fees to pay which you can use at home and abroad.

Revolut travel card review FAQ

How does the Revolut travel card work?

The Revolut travel card is linked to a digital account you can hold about 25 currencies in. Add money to your account in USD and then you can start spending and making withdrawals globally.

Is the Revolut travel card an international card?

Yes. The Revolut travel card supports spending in about 150 countries, and you can hold 25+ currencies in your account.

Are there any alternatives to a Revolut travel card?

Other non-bank providers like Wise and Chime also offer spending cards which have their own features and fees. It’s worth comparing these against the Revolut travel card to see which suits you best.

Get a 3 month Revolut Premium trial. Click here

I’ve been traveling for almost 20 years, and until this year I hadn’t found a good spending solution.

I’m sure the stress (before I heard of Revolut) sounds familiar. For 20 years I went back and forth with:

Should I exchange money at the airport, or take money out from an ATM?

Why tf is my bank charging me so much more in exchange rate fees?

Wait, the bank charges a conversion fee AND an international transaction fee?!

I’d come to the conclusion that this was what it meant to be privledged to travel overseas – that you had to suck it up and eat the bank fees.

This past year though, I’ve traveled with Revolut in my wallet (both my phsical wallet, and my Apple wallet). And it’s saved me serious money.

Revolut is financial website and digital app used by 35+ million people, with the tools you need to easily spend, transfer, and protect your money overseas. You can set up accounts in multiple currencies, get a debit card for travel, and you can do it for no monthly fee on the Standard plan.

It’s quick to sign up for a standard account, and there is no monthly fee. If you click here you get a 3 month trial of Revolut premium (higher limits on ATM withdrawrals & currency exchange).

There are already a million Revolut reviews (spoiler – it’s trusted), so why bother writing another? Because the look of that sexy black metal card in my wallet ACTUALLY excites me.

So read on to get excited with me – Revolut is now the only way I spend my money.

Revolut Travel Card Review: Why I Only Spend Money With Revolut

I’m so happy excited using revolut.

All photos in this post are of the metal card, only available on the Metal plan

I didn’t want to write about ‘just another travel card’ until I had very thoroughly tested it and finally found a permanent solution. So since May I have used my Revolut card in the UK, Greece, Spain, Australia, and Morocco.

It’s the best travel card I’ve had, has changed the way I spend money, and I do get a mini adrenalin kick whenever I see the exchange rate they charge me, and realize that I’ve just beaten the banks.

Though I do wonder if it really counts as saving if I buy another mojito with the extra cash?!

Here are 10 quick reasons to love Revolut before jumping into the full details:

- No monthly fee on Standard plan, paid plans available

- Can top-up and hold accounts in several currencies

- Make payments in 150+ countries

- Phsyical debit card

- Withdrawals at over 55,000 ATMs worldwide (Up to plan’s limits)

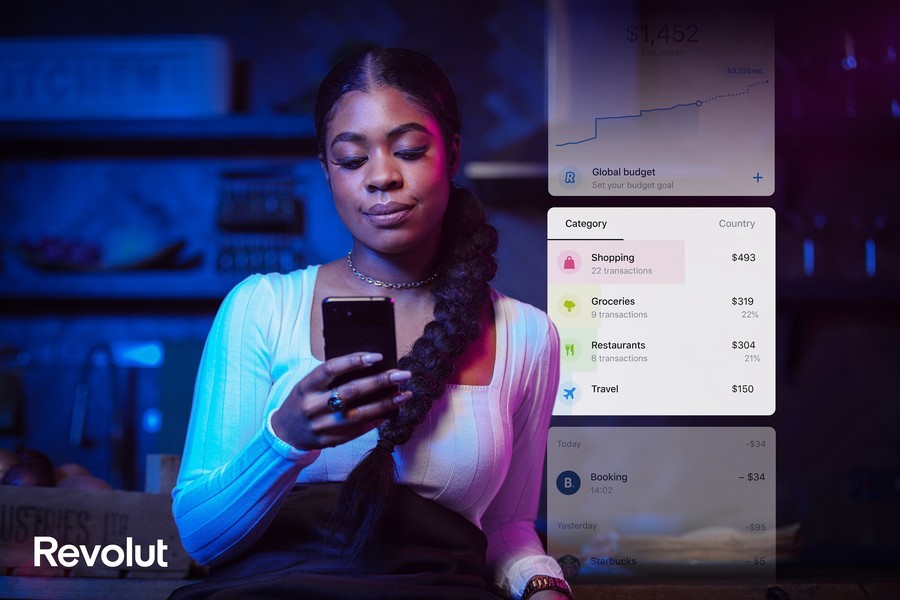

- Track your spending in the Revolut app

- Quick currency conversions for 30+ currencies

- Great value with the Revolut exchange rate

- Compatible with Google Pay and Apple Pay

- Fantastic security features for travelers

Who are Revolut?

Revolut is a British financial technology company who have built an amazing reputation since starting in 2015.

They offer banking and travel cards , with accounts for multiple currencies, and while these work the same as opening an account with a linked debit card with any other traditional bank, Revolut was specifically created to help you make the most of your money.

They have great features like instant accounts, and virtual cards, unlimited foreign exchange (fees may apply outside of plan allowance), and cashback on specific purchases. You can convert currencies in an instant and load up to 30+ currencies on your travel money card, without having to exchange money at the airport again.

I’ve made cash withdrawrals in both Morocco, the UK, and Greece, on amazing exchange rates, basically as if my account was local.

After having put it to the test over the course of 6 months, Revolut has saved me a lot of money.

Withdrawing Money from ATMs

Spoiler: no fee withdrawals / great rates / find atms in the app.

When you open an account with Revolut , you instantly get access to virtual cards, which I linked to my Apple Wallet and was using to pay for things the next day (good reason to go through McDonalds for coffee – I needed to test Revolut!).

And I’ve paid for most things using my virtual Revolut card, including the London Tube, which I was incredibly impressed when I found I could just tap my phone on either end without having to fight with a ticket machine.

But despite most of the world being cash free, I still always stop by an ATM.

I’ve always found I need cash at some point when I’m traveling. There’s always amazing street food, or someone to tip, or your phone battery dies because you’re using it 10 times more than at home, from taking 1,000 selfies, to constantly running Google maps.

And in many countries still, cash is king.

Withdrawing money from overseas ATMs can be expensive using a home bank card, and cost you a lot of money in fees.

But Revolut allows you to withdraw money from ATMs overseas without fees , within limits per month depending on the plan you’re on. I’ve taken money out in both Greece and Morocco, and it was stupidly easy.

Make sure you activate your card, set up your pin number, and turn ATM withdrawrals ON within the mobile app. If you don’t want to make ATM withdrawrals, you can turn this off, which is extra security in case your card is lost.

Pro tip: Within the mobile app is an ATM locator , which allows you to share your locaiton and it will find ATMs nearby.

Fees may apply outside of your plan allowance and ATM operator may charge their own fees.

Best Currency Exchange Rate

Spoiler: it beat the google exchange rate for me.

Revolut offers one of the best exchange rates around which is why they’re one of the most popular options for travel cards.

There’s even a currency converter on their website (and in the app) where you can check the real exchange rate at that moment in time.

If you really want to get the most out of your money, you can set up multiple currency accounts, and convert your money to the local currency you plan to use when the exhange rate is at it’s best. This is called locking in your exchange rate.

Or, if you know it doesn’t really fluctuate too much, you can keep your money in your home currency account (AUD for me), and when you spend on Revolut, it converts your money based on the exchange rate of the day.

I personally leave my money in AUD because I find it simpler. Market exchange rates are changing all the time, almost every day, and I personally don’t find value in spending my time keeping an eye on the rates to decide when I’ll get the most of an exchange.

You can definitely do this, but I found I saved money all the same.

If you’re a digital nomad and you’re recieving payments in multiple currencies, Revolut accounts are also a great way to recieve money in foreign currencies without the crazy foreign currency fees, or PayPal exchange rates.

There is a weekend markup on exchange rates, so keep this in mind.

Track Your Spending in the Revolut App

The Revolut app is seriously good , and it’s very easy to track your spending, and do everything you need to do from your phone.

Keeping in mind that there is no traditional phone or in-branch banking with Revolut, everything is based off the app. Which is fortunately one of the easiest, most well thought-out and use intuitive apps I’ve used.

Through the app, you can see all of your individual transactions, and there are also instant spending notifications – alerts for transactions in and out of your account.

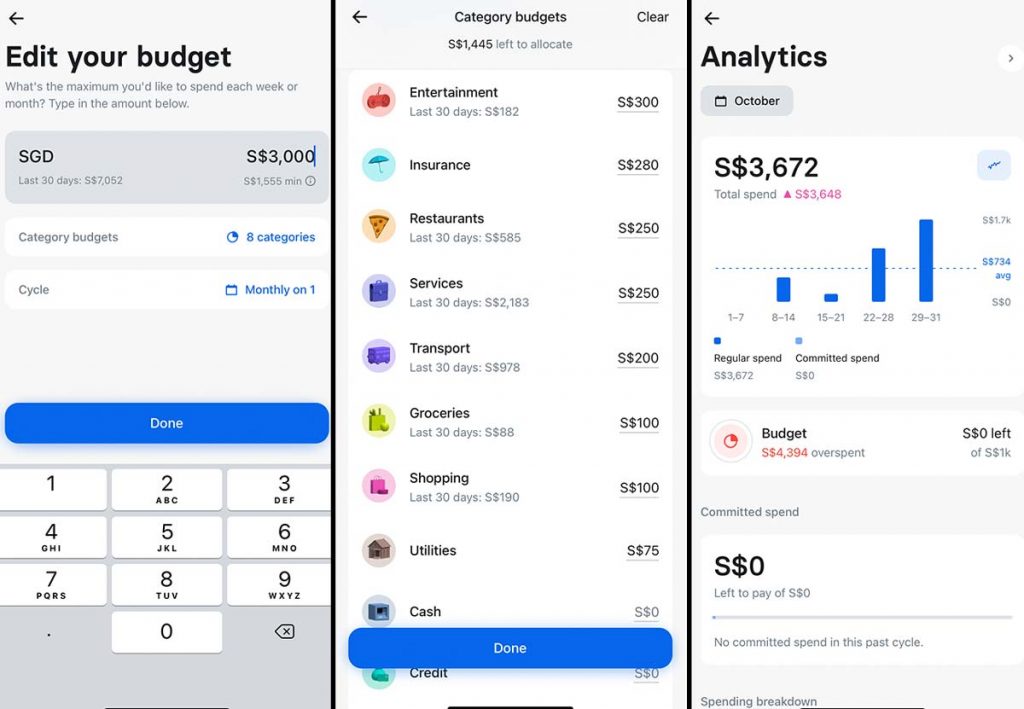

You can add money to your accounts, add new and exchange money between your currency accounts, access your currency converter, pull up your statements, set a monthly budget, set a spending limit on your cards.

If you’re spending one currency, and pulling it from your base currency account (ie me spending Euro in Europe, without having converted my AUD), each transaction shows you both the amount you spent in your currency, and the amount you spent in the foreign.

Choosing the Right Plan for You

Revolut standard – no fee.

The Revolut standard plan is fantastic, and doesn’t have monthly account fees. There are no fees for ATM withdrawals ($350/m limit), it comes with one debit card, and there are no currency exchange fees from Monday to Friday, to a $2,000 per month limit.

- Account fee – $0

- Australian ATM fee – $0 (up to $350/month) and 2% of withdrawal amount after that

- Foreign transaction fee – 0%- 1.5% (depending on amount and when the transfer is made)

- Overseas ATM fee – $0 (up to $350/month) and 2% of withdrawal amount after that

This is an account and card you can use at both home and abroad, with no catches or hidden fees if you use it within the above limits.

It comes with a Revolut Visa card that connects to their app and your digital wallets, and you can spend money in over 150+ countries.

Honestly, this has everything you need if you want a basic no fills spending solution. But there are also paid plans you can consider, with some great extra features if they better suit your lifestyle.

Revolut Premium – Click here for a 3 month trial

- Account fee: $9.99/month

- Australian ATM fee: $0 (up to $700/month) and 2% of withdrawal amount after that

- Foreign transaction fee: 0%- 1.5% (depending on amount and when the transfer is made)

- Overseas ATM fee: $0 (up to $700/month) and 2% of withdrawal amount after that

With the Premium Revolut account, you pay a $9.99 AUD monthly account fee, and have benefits you don’t get with the standard account.

Premium users have transfers in 30+ major currencies up to a $20,000 monthly limit (Monday to Friday, otherwise an additional 1% fee is charged). The no-fee ATM withdrawal limit is also raised to $700 AUD.

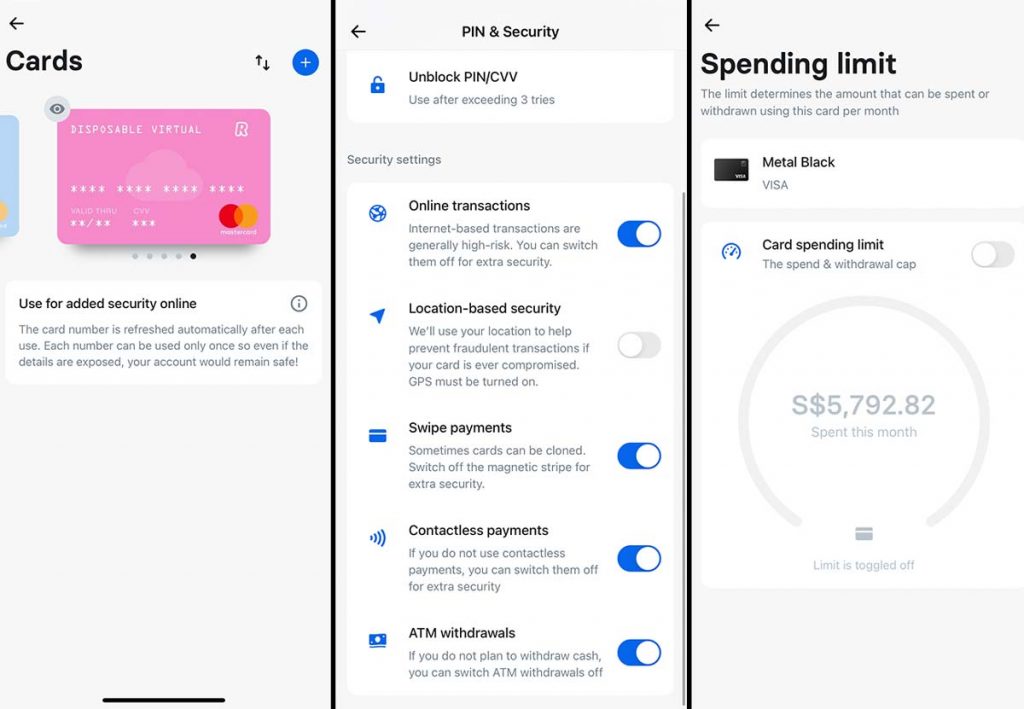

You can choose the color of your Visa card, get priority customer support with the app, and can access disposable virtual cards for greater online security (these cards regenerate after every transaction keeping your card details safe).

You also get discounts to LoungeKey Passes which offer access to over 1,000 airport lounges around the world and can buy these within the app.

Click this link to get a 3 month trial of their premium account.

Revolut Metal – The Plan I’m On Personally

- Account fee: $24.99/month

- Australian ATM fee: $0 (up to $1,400/month) and 2% of withdrawal amount after that

- Foreign transaction fee: 0%-1% (depending on when the transfer is made)

- Overseas ATM fee: $0 (up to $1,400/month) and 2% of withdrawal amount after that

The Revolut Metal account has everything the Premium tier has to offer, but it does also come with a fancy Revolut Metal card. This is the plan I am personally on , and the Metal card is the card you see in my photos.

Metal users are also the only customers able to take advantage of the Revolut’s cashback feature. That includes 1% cashback for card payments made outside of Australia and 0.1% cashback for those made within Australia.

There is a cashback limit for metal plan, up to the cost of the plan.

Comparison of Revolut Account Plans

My travel spending and lifestyle might not be the same as yours, so do make your own decision about the plan which is right for you.

My recommendation: Check out the standard account for yourself (or take advantage of the premium trial while it lasts ) and then check out the paid options if you think an upgrade aligns with what you need.

This table is correct as of December 2023, but before deciding which account is right for you, I recommend you go to the Revolut website to check if anything has changed.

I’ve been seriously impressed with Revolut’s security features , and this is not something I found mentioned in other online reviews, so I think it’s well worth writing about.

The Revolut mobile app is full of security you can tailor to your needs. While I open my online account on my browser with my passcode, I open the phone app using FaceID for extra security.

Their offer of disposable virtual cards for premium account users is fantastic. This is a single use virtual card for online shopping, which is good for one use, and then expires.

If you’re worried about entering your card details into a foreign computer while you’re traveling, or perhaps you’re forced to use public WiFi to buy something, you can use this disposable virtual card and not have to worry about exposing the main.

You can lock or freeze any cards whenever you need. And within each card settings, you have the option to tailor your card security to your needs, turning features on and off like online shopping, swipe payments, ATM withdrawrals, and contactless payments.

These security features do work , as the first time I tried to use my Revolut card, it declined my attempt at a contactless payment. I went into the settings, toggled contactless payments ON, and the payment then worked (check your card settings before you use).

I’ve also never had my account frozen or locked because I was spending in a foreign country, as most banks tend to do. That said, spending money overseas is the whole point of Revolut!

How to Sign Up

Offering an efficient foreign currency exchange service, no-fee ATM withdrawals, and no hidden fees when it comes to transfers, Revolut is baggage free!

Signing up to Revolut is all done via their app.

Click here and then you’ll provide your mobile number, name, address, and payment details (if you’re signing up for a Premium or Metal account).

Opening an account is instant, and you can then add money with your account details as you would by making any other domestic transfer.

Revolut will send the corresponding debit card to your given address, which you can then activate (remember to set up your security features) in the app before you start using it.

It’s that simple and easy!

My Australian credit cards have a terrible exchange rate, and have always charged me 3% per transaction overseas.

So now I exclusively travel with Revolut in my wallet.

Check out Revolut’s website to find out more and see if it’s right for you.

I’m home from my last trip and still have $62.07 sitting in my Revolut account. If I had come home with that in cash, I would have lost it to my jars of leftover foreign currency.

While I could transfer it back to my main bank, I’ll leave it sitting there knowing I’m using Revolut again , the next time I travel.

If You Liked This Post You May Also Like:

Things to Know about International Credit Card Payments

Should You Use a Debit Card or Credit Card When You’re Traveling?

How to be Smart When Spending Money Overseas

Megan is an Australian Journalist and award-winning travel writer who has been blogging since 2007. Her husband Mike is the American naturalist and wildlife photographer behind Waking Up Wild ; an online magazine dedicated to opening your eyes to the wonders of the wild & natural world.

Having visited 100+ countries across all seven continents, Megan’s travels focus on cultural immersion, authentic discovery and incredible journeys. She has a strong passion for ecotourism, and aims to promote responsible travel experiences.

Charlie Schwab for us Amerikanski’s. Been using their debit across the world for 12 years. No fee ATM’s with unlimited rebates when machines charge, great currency conversion rates pretty much equal to the XE App

Post a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search This Site

I am Megan Jerrard, professional travel blogger/journalist with a focus on adventure, discovery, immersion and inspiring you to explore!

Recent Posts

- 7 Smart Eating Strategies for Busy Travelers

- How Solo Female Travelers Can Honor Mothers from Afar

- Exploring the Boundaries of Travel with Cryptocurrency

- Trekking Trends: How to Backpack in Fashion

- How to Enjoy Online Casino Gaming During Travel Downtime

Popular posts

- International Love: Maintaining a Long Distance Relationship

- Illegal Ink – 11 Countries Where Showing Your Tattoos Could Get You Kicked Out!

- 7 Things To Know Before Travelling by Overnight Train in Vietnam

- A Travelers Guide to Tap Water: Countries Where The Drinking Water is Unsafe

- Countries That Don’t Celebrate Christmas

Revolut on the road: a review for travellers

By: Author Jaclynn Seah

Posted on June 13, 2023

Categories Review , Sponsored

I find having to deal with foreign currency on the road a real pain. In Singapore I barely use cash these days, mostly opting to use Paywave (contactless credit card) or Paynow (direct bank transfers usually via QR code) when possible, but cash still remains king in many other countries. On past trips, I’ve tried using Youtrip, Wise and Trust Card, so when Revolut [ affiliate link ] approached me to check out their offerings, I was keen to see how they would match up. Here’s my review of using Revolut for travelling.

This review is sponsored by Revolut. Sign up to Revolut for free and get 3 months of premium free [ Affiliate Link ]

What is Revolut?

To put it simply, Revolut works like a debit card when you’re travelling. For travellers using the card overseas, you can use the Revolut card to:

- spend foreign currency like you would use a debit card

- store money for use

- exchange money to foreign currencies as needed for use/storage

- withdraw foreign currency overseas

- transfer money to foreign accounts

- online shopping in local and foreign currency

You can use it for cryptocurrency and stocks as well, but I don’t really know anything about that so my main concern was how Revolut would work for a traveller like myself.

I used the Revolut card on my latest trip to Taiwan . Taiwan is still pretty cash-dependent overall (unlike South Korea for example where you can use credit cards practically anywhere), so I mostly used Revolut card in convenience stores and when my accommodation or restaurant would accept card payments.

What I like about Revolut

Decent free tier.

I’m using the free tier of Revolut – there are 2 paid tiers : Premium (S$9.99/mth) and Metal (S$19.99/mth) which I honestly don’t think you’ll need unless you are a seriously heavy user and need to withdraw or exchange very high amounts of foreign exchange. The free tier is pretty ok for vacations, but if I was on a longer trip Career Break I think I might need the premium tiers for more cash withdrawal.

Other Premium/Metal travel perks that Revolut has include:

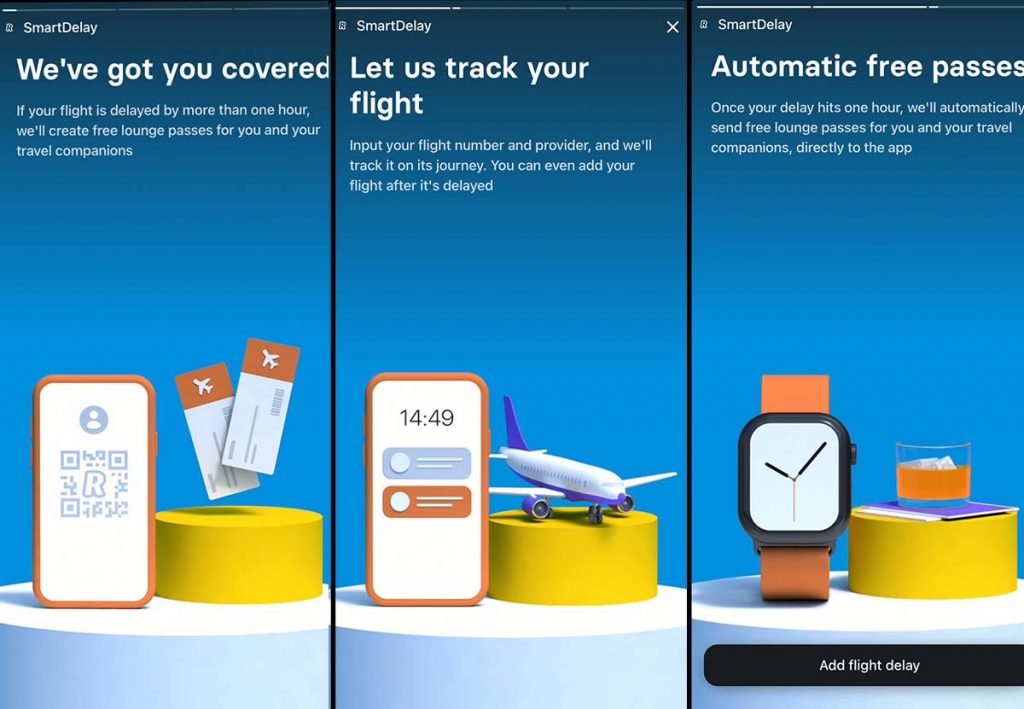

- lounge access with smart delay

- discounted lounge access

- travel insurance

These are not things that matter much to me because I either don’t need or have it already, but it could be useful for some of you out there.

Easy to set up and use

Signing up for the card was a pretty quick and straightforward process. I downloaded the app from the Apple Store and signed up via my Singpass, ordered my free card through the app as well very easily.

The only thing I would like though would be to choose the name to put on my card. Usually I use a shorter version rather than my entire name, but since it automatically pulls from the official data, my full name is on the card.

The app is also pretty easy to use all around. Some banking apps drive me nuts when things are too well hidden, like it took me forever to find the place to swap between accounts for Trust Card for example. So far I’m liking the Revolut interface and app.

Good exchange rates

I tested the card out while I was in Taiwan, paying for one of my hotels with it. My rate was NTD 1 = S$0.0433 (NTD 100 = S$4.33) with no additional conversion or admin fees. Trust Card had similar rates as well when I used it in the past.

I did change some money at the Changi Airport before I flew off and the rate I got was about NTD 100 = $4.60, so definitely much better exchange rates on the Revolut card than in cash!

You can exchange up to 28+ currencies and hold that in your account. Some of the more relevant currencies (i.e. places that Singaporeans love to travel to best) include USD, GBP, EUR, AUD, HKD, JPY, THB. Great if you monitor the rates closely and are looking to exchange a sizeable amount. ($5k limit for free tier, $15k for Premium and unlimited for Metal)

Taiwan dollar isn’t included in this list, but you can still use the Revolut card in Taiwan, just make sure you have enough of your home currency (SGD for me) and the currency exchange happens automatically. I like that they show the rates very clearly as well in the transaction details.

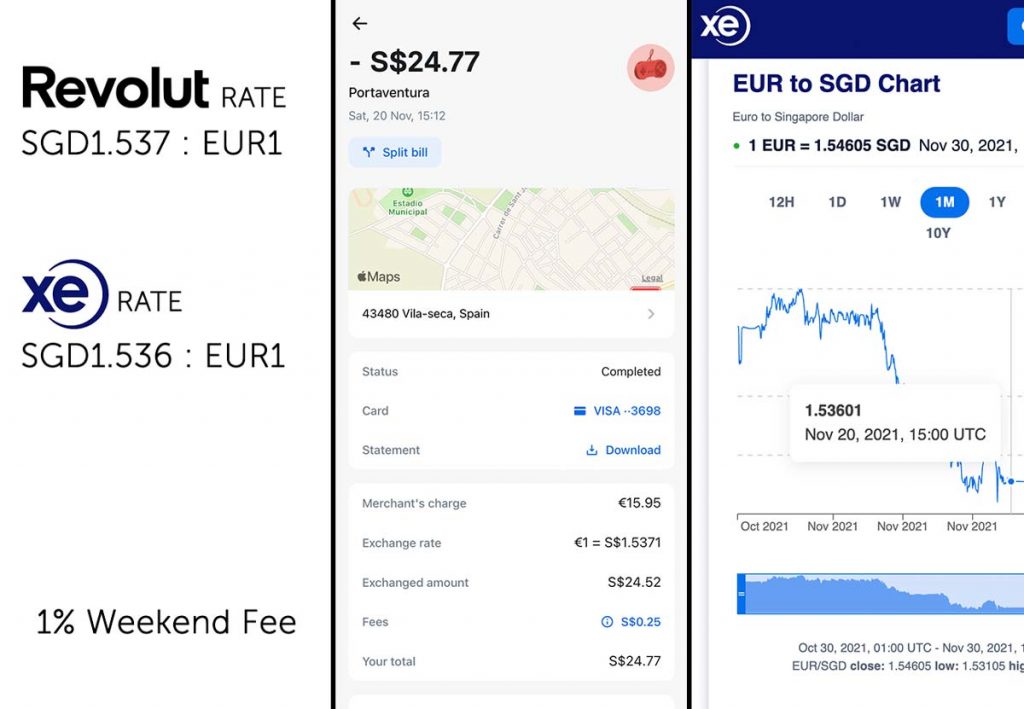

A note that on weekends there is a 1% charge, which is not something I’ve noticed on other cards and honestly a bit odd to me, but something to take note of.

Free 2-way interbank transfer

I linked Revolut to my Singapore bank account and it’s both free and super quick to transfer money between my accounts money. After the initial set up, I don’t even need to key in any more bank details. Good if you need to make quick transactions on the go.

Also, I like that you can actually withdraw money from Revolut back to your bank account – I just need to add myself as a payee and transfer money back to myself almost instantly. Some cards like Youtrip are 1-way only, so if you misjudge and add too little to the Youtrip wallet, your card runs the risk of being rejected. If you add too much, you are then forced to spend from that card or leave the money in there.

For Singaporeans, Revolut uses e-Giro so you can directly link to accounts in major banks including Bank of China, DBS, Maybank, OCBC, Standard Chartered and UOB.

Safer online security

Revolut also makes it easy to set up and use disposable cards. This is especially useful if you are a bit nervous about the security of some of these online shops. I haven’t had the chance to use this yet (juggling around too many cards to make minimum spends for cashback and other rewards) but it’s something I could see myself using.

So if you’re looking for a card to use for spending while travelling, you can check out the Revolut card and see if it works for you, overall my experience with the card was quite good. I have a link below that lets you get 3 months of premium free if you’re considering using the higher tiers as well.

Sign up to Revolut for free and get 3 months of premium free [ Affiliate Link ]

Celetse Hng

Sunday 17th of September 2023

Hi Jaclynn!

Thanks for sharing your experience with Revolut! I’ll be traveling soon and this just answered many of my questions regarding Revolut.

I have a question that I still couldn’t find any answers. Are there any charges when you used Revolut as a debit card in Taiwan? Like some bank charge a 2.65% foreign transaction fee, does Revolut has the same charges? I’ve never used any of these currency cards before, in general, does this kind of currency card (Wise, YouTrip) charge any foreign transaction fees?

Jaclynn Seah

Monday 18th of September 2023

Hi Celeste, no foreign transaction fees on spending, but for Revolut there's a limit to the free withdrawal/currency exchange for the standard plan https://www.revolut.com/en-SG/legal/standard-fees/ (the limits are higher if you use the paid plans)- you'll want to avoid the higher xchange currency on weekends for Revolut!

Revolut Travel Card Review: Is Revolut Good For Traveling?

by Melissa Giroux | Last updated Dec 5, 2023 | Travel Finances , Travel Tips

If you haven’t been living under a rock, you’ve probably already heard about the Revolut card. Revolut is a digital bank that was launched in 2015.

One of the main reasons it has gained so much popularity in such a small window of time is primarily due to the fact it has everything you would need from an online bank in a simple, modern, and easy-to-use app.

Before we do a complete Revolut review and how travelers can use the Revolut travel card abroad, let’s first look at the basics.

KEY TAKEAWAYS

- Revolut is good for traveling, especially if you choose a paid plan.

- You can use Revolut safely abroad, and you can block and unblock your card as much as you want. This can be helpful if you think an ATM or a shop seems a bit dodgy.

- The Revolut Premium and Metal plans offer travel medical insurance options and discounts on airport lounges, which are ideal for travelers.

Revolut Card: The Basics

Revolut has three different card types and four main plans, including Standard, Standard Plus, Premium, and Metal.

The Standard card has no fee and offers some basic benefits.

However, the Premium and Metal cards provide some exciting features, especially if you are a frequent traveler.

Here is a quick breakdown of the main benefits/prices of each of the cards:

**Revolut also has Revolut Business for companies, big and small, that do business beyond borders.

Get Revolut Now

Another major advantage of the Revolut card is that it takes minutes to open an account.

All you need is a working phone number, and with that, you’ll be able to open an account and get a virtual bank card.

To get a physical card, you’ll need to order one, and it takes around 14 days to deliver. You will also need to veri f y your identity .

One of the disadvantages of Revolut is that, at the moment, it isn’t available to residents of all countries.

Currently, only legal residents of the European Economic Area (EEA), Australia, Singapore, Switzerland, Japan, and the United States can download the online bank.

Once you have your card and your identity is verified, you are ready to take full advantage of your Revolut card. This is where the fun begins.

If you are a meticulous traveler who loves planning and budget travel , then the Revolut travel card is the perfect solution for you.

Revolut Travel Card: Spending, Budgeting & Saving

The best part of the Revolut card is that the account section grants you the ability to look at all of your transactions by day, week, and even month.

You can also group transactions into specific categories. So, for example, if you budgeted 200 dollars for restaurants at X location for June, you can track all those costs in the app.

You can also download statements, upload receipts and add notes to each transaction to keep track of your spending.

You can even split the bill if you are traveling with someone or send them money by scanning their QR code.

If you are traveling abroad, the app allows you to create multiple accounts in various currencies.

This means that you can exchange your US dollar for Euro and have two separate accounts in two different currencies.

This also means that whether you are traveling in France or the US, you can pay in the local currency. Be aware that not all currencies are currently available.

Nevertheless, if you are paying for something in a different currency, Revolut converts your account balance into the local currency using the real interbank exchange rate.

This allows you to avoid being charged a fee and a mediocre exchange rate set by the ATM provider or merchant acquirer.

Another great feature is that the app sends you a notification the second you pay with your card, even before the receipt has finished printing (as long as you are connected to the Internet).

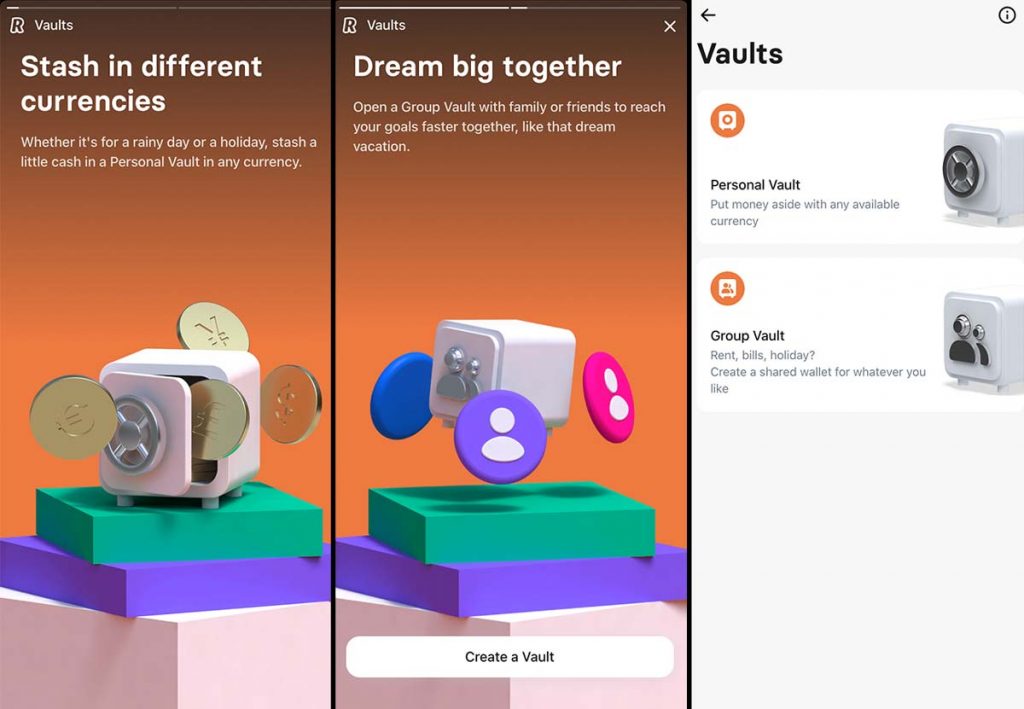

The app also has vaults, where you can save money for travel . You can create multiple vaults, like a “travel to Egypt” vault or a “weekend spa getaway” vault.

You can fund the vaults with a one-time transfer, recurring transfer, or something the Revolut card calls spare change.

Spare change means the app will round up the spare change from your Revolut card spending and place it in this vault.

Using Revolut Abroad

Can Revolut be used abroad? Yes!

Now, you may be wondering “Is Revolut good for traveling?” It is!

I’ve been using Revolut abroad for a few years now, and it’s my go-to card.

So, how does Revolut work abroad?

With the Revolut travel card , you can transfer money abroad in 30+ currencies with the interbank exchange rate , with a small 0.5% fee for anything above €1,000 each month during the weekdays.

However, one disadvantage is that when markets are closed on the weekend, fees are charged at 0.5% and 1% on currency exchange rates no matter the transfer amount.

Revolut also charges an international fee, which will be listed in the payment breakdown when you are sending your money.

The major advantage of Revolut is that it offers the ability to send money around without hidden fees and provides fast and secure money transfers.

The foreign exchange rate can be viewed on the Revolut app before exchanging currency or making a bank transfer involving foreign exchange.

The Revolut travel card also allows you to withdraw cash from an ATM using your Revolut card without fees.

The disadvantage of this is that if you have the standard plan, that means that you’ll only be able to take out 200 dollars per month.

That being said, using a Revolut card abroad is fairly easy and safe.

Security: Preventing Fraud

One of the worst feelings in the world is realizing that your main travel card has been lost or cloned.

What usually ends up happening is a mad dash to call your main bank abroad to freeze the card and ask for a replacement.

Don’t worry, we’ve all been there. The problem is that some banks can take up to 3-4 weeks before they can send you a replacement card, which can ruin your time abroad.

Revolut claims that it is 7x better than a regular bank in stopping card fraud. This is due to their anti-fraud system that helps keep fraudulent transactions under 0.01%.

But that’s not all. Revolut allows users to freeze and unfreeze their cards easily in the app, it takes seconds.

You can also enable location-based security to reduce fraudulent transactions, disable contactless, online, swipe payments or even choose a monthly card spending limit for extra peace of mind.

And, if you do lose your card, you can order a replacement card in the app and ask for express delivery, which usually takes around 2-3 days, depending on your location.

Also, if you lose your phone, Revolut has an automated phone line to block your card instantly.

Extra Perks When Using Revolut Abroad

Although there aren’t many perks with the Standard and Standard Plus plans, if you are a frequent traveler, then you might consider opting for the Premium or Metal Plans.

These plans have perks like pay-per-day travel medical insurance, which means that you can get location-trigger coverage and only pay for the days you use.

You can also upgrade for the delay and lost baggage insurance, emergency dental, and medical coverage, and even insure up to three adults and all your children.

These plans also have lounge access to +1000 airport lounges globally and SmartDelay, which allows you to get an airport lounge pass if your flight is delayed more than an hour.

Get Revolut

Revolut Sign-Up Bonus Promotion

Upgrade to a global lifestyle with Revolut. Transform your finances when you level up to Premium with Revolut’s Premium trial .

You’ll get features to help you save, spend and invest smarter than ever.

Get a 3-month Revolut Premium subscription trial, effective today.

Note that this promotion work everywhere except for Australia and Singapore, where the offer is a cash bonus of $15 AUD in Australia and $15 SGD in Singapore.

All new Revolut customers are eligible.

Final Thoughts On Revolut Travel Card

It seems as if the Revolut card is the travel card of the future.

Not only can it be one of the best cards to use while you are abroad, but it also can be a great day-to-day bank card.

Although the card has a lot of advantages, it is also important to note that there are still some countries where the card might not work.

For example, Revolut users have noted in previous years that the Revolut card didn’t work in many establishments in Rio de Janeiro, Brazil.

Also, be wary that their online support service is not always the best, unlike your local bank.

If you do run into problems, there isn’t a physical location where you can go and talk with a manager. You’ll need to use the chat feature on the app, which can be better than having to call from abroad.

All in all, the Revolut card is a great card to travel with, but it shouldn’t replace your main bank card and instead might be a great backup card that you can use when abroad or if you’re a European expat.

If you’re American, read our Revolut USA review .

Read more about the best banking options for expats .

If you’re not sure if Revolut is the right card for you, you may want to open a multi-currency account with Wise . Learn more about Wise here or compare both Wise and Revolut .

If you want to keep cash flowing even while abroad, you must check out these ways to make money while traveling !

MY TOP RECOMMENDATIONS

BOOK HOTEL ON BOOKING.COM

BOOK HOSTEL ON HOSTELWORLD

GET YOUR TRAVEL INSURANCE

LEARN HOW TO START A TRAVEL BLOG

LEARN HOW TO VOLUNTEER ABROAD

- Destinations

- Travel Tips

- Travel With Us

- Paid Travel Internship

- TTIFridays (Community Events)

- SG Travel Insider (Telegram Grp)

Revolut Review —Travelling For 10 Months with Only One Multi-currency Card For Money

This Revolut Review took many months to test. Download Revolut here — Apple Store or Google Play .

It’s been a while since we travelled, so when we were selected by Airbnb to Live Anywhere around the world for 10 months, we immediately got down to planning for a long trip.

Read also : Guide to Singapore’s Vaccinated Travel Lanes

One of the challenges we faced was figuring our cash situation. Do we bring 10 months’ worth of cash? Or just suck it up and pay hefty surcharges at ATMs overseas — not to mention unfavourable rates 🙁

Setting up local bank accounts in different destinations would also be too much of a hassle.

So when Revolut reached out and asked us to review their product, we thought it was the perfect opportunity to put its different functions to the test.

For our 10 month trip, it was the only financial card we brought along.

We’re not financial experts, but we tried our best to test the card in every situation common to a traveller — both long and short term travel. Hope you find this Revolut review useful!

Note: This Revolut Review is for Singapore Residents only. There are different product features for different markets around the world.

Disclosure : While the writer was provided with a spending allowance to test the card, it’s in The Travel Intern’s interest to protect the editorial integrity of our website. We have taken every reasonable effort to ensure a realistic and honest review for our readers.

But first, what is Revolut?

Revolut is a financial super-app that is best known for its multi-currency wallet and remittance services amongst frequent travellers and expats.

Credit cards typically charge too much for currency exchange so multi-currency wallets/cards like Revolut makes it a lot more affordable and convenient to pay overseas. In fact, their exchange rates are usually very close to that of Google and often better than a physical money changer in Singapore!

Revolut also allows you to hold multiple currencies in your account, letting you lock in favourable exchange rates ahead of time.

Revolut Review: How Revolut works

Revolut works like a supercharged multi-currency pre-paid debit card, with plenty of security and lifestyle features that make it attractive to use overseas.

Picking a Revolut plan to suit your needs

Revolut is free to use, but you can get more features and benefits with their paid subscriptions. There are three Revolut cards with monthly subscription plans . Here’s a quick summary:

We’re on the Metal Plan and the card looks and feels gorgeous. It also gives us a higher limit for ATM withdrawals, lower currency exchange fees, priority customer support, insurance, and LoungeKey Pass access. The Metal Card also offers 1% cashback on overseas spending .

While a free card will be suitable for most of our travels, the metal plan is super useful for long-term travelling or overseas living.

Using Revolut for cashless transactions

Revolut works like a debit card, and can be used anywhere that accepts Visa or Mastercard . The difference with traditional debit/credit cards is that it uses real exchange rate without any markup.

Read also : Multi-currency Cards vs Miles Credit Cards

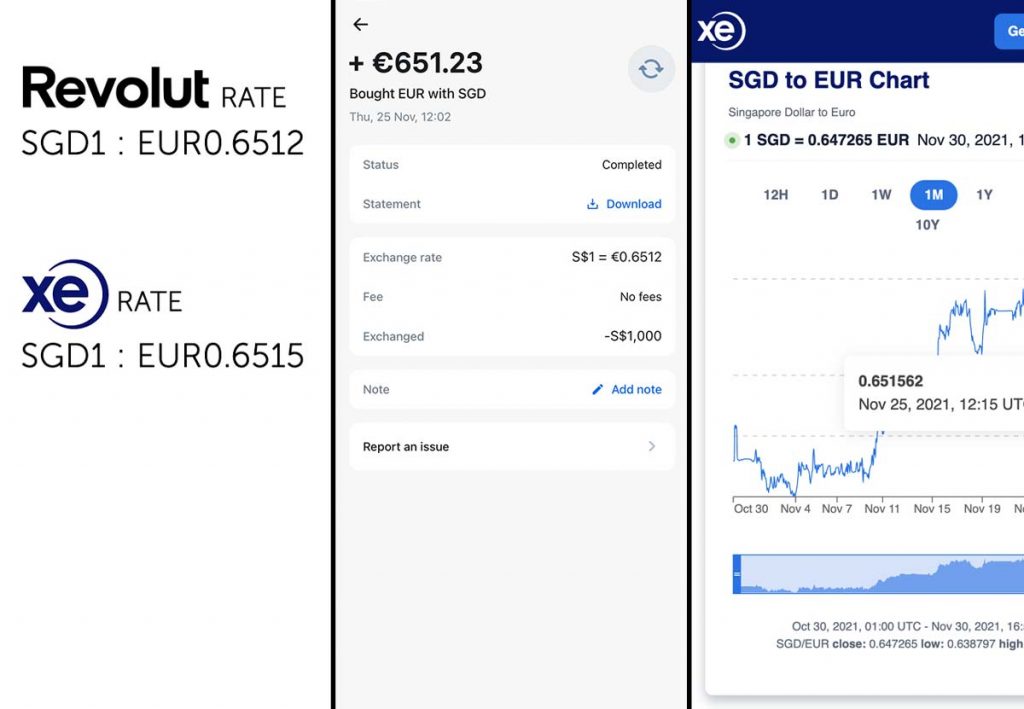

According to Revolut, the ‘real’ exchange rates (or interbank rates ) are “based on the foreign exchange market data feeds that we get from a range of different independent sources.” While it sounds a little iffy, the rates we regularly got were usually the same as the internet rate or sometimes even better.

Other than using the physical card for payment, Revolut can also be linked to your smart devices (smartphones, smartwatches etc) for more convenience.

All you need is to make sure the card has a sufficient balance for your transaction.

Top-up is available via bank transfer, debit cards, credit cards, and even Apple Pay.

Once you’ve topped up the card, you can either exchange it to the local currency, or leave it in your home currency and it will use the real exchange rate at the time of transaction.

It also serves as a multi-currency wallet so you can store up to 28 different currencies at once.

Currency Exchange Fees : 0-2% depending on membership and market hours

Currency exchange fees are charged after a certain amount is spent on the card, but don’t worry, this resets each month. The amount depends on your membership plan:

Weekend fee: 1–2% depending on the currency

Revolut also charges a fee for exchanges over the weekend to protect against market fluctuations when it’s closed.

We were charged an additional 1% for transactions over the weekend when converting from SGD to EUR.

* Pro-tip: Exchange money before the weekend to avoid additional fees

The good thing is that the process is transparent and the foreign exchange rate can be viewed on the Revolut app before any transactions involving foreign exchange.

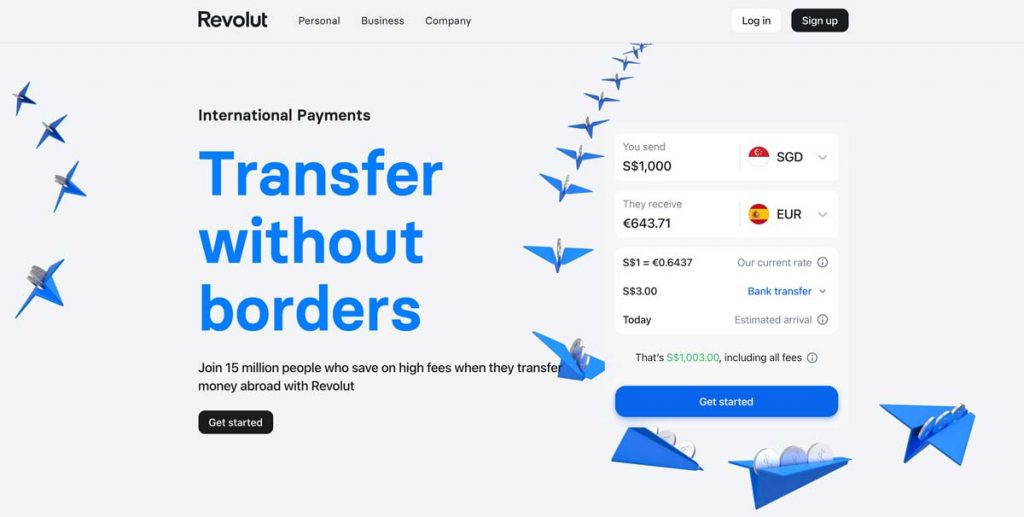

Using Revolut as a remittance service

Revolut supports over 28 currencies (including SGD), which means you can transfer money to foreign bank accounts at a much lower fee. The fees are stated upfront and uses the more favourable interbank transfer exchange rate. Perfect for those studying or working overseas who need to remit cash.

You can use their in-app or website calculator to get an estimate.

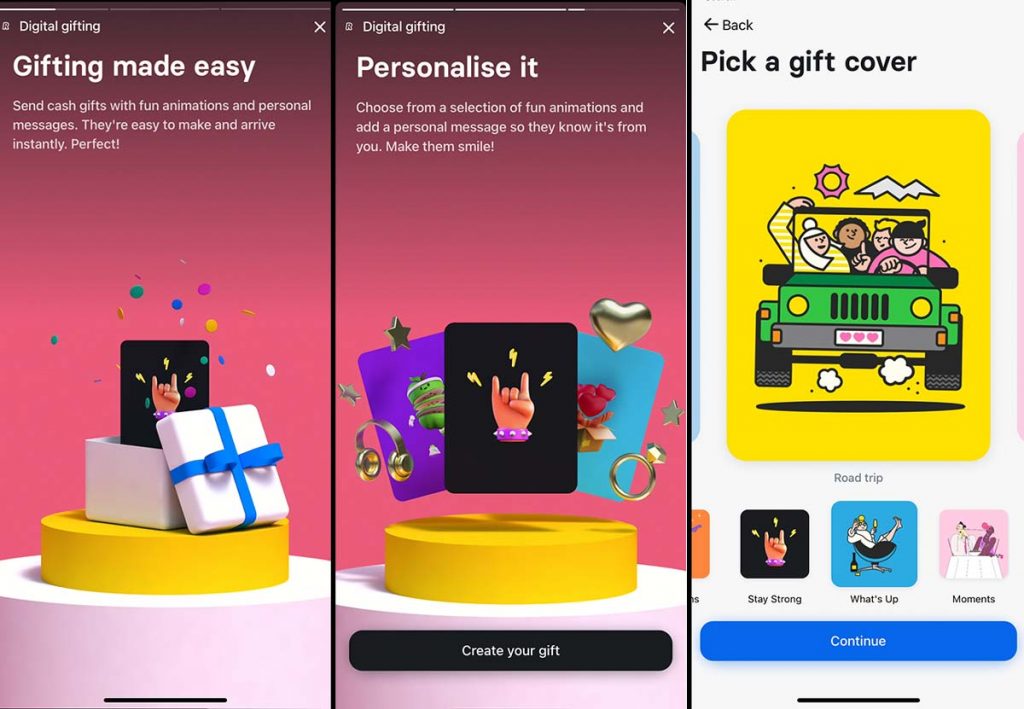

Revolut also allows you to transfer money to other Revolut users for free. As all members of our team have a Revolut account, it was easy to transfer money in the local currency to each other without having to convert to SGD first. There’s also the option of sending money in the form of gifts, which includes adorable animated cards that make it a little more fun.

You can even set up Group Bills, allowing you to split bills easily with every member of the party. Compared to other budgeting apps, you can “settle up” directly into your Revolut account.

Using Revolut to withdraw cash at local ATMs

This is generally fuss-free and ATM withdrawal on Revolut is free up to a monthly cap based on your membership level: Standard: S$350/month Premium: S$700/month Metal Card: S$1050/month

A 2% usage fee is charged only after you’ve exceeded your limit. Some foreign banks may still charge a transaction fee even though Revolut doesn’t.

Here’s a 2019 community-created list of transaction fees for different banks (if any) by country .

We withdrew money at OTP Banka in Croatia for free.

Revolut App Budgeting & Lifestyle Features

Beyond using Revolut to pay for stuff, there are also a few budgeting and analytics tools on the app to help keep your spending in check. Set monthly budgets by categories, receive notifications when you are overspending, and get insights into your spending habits.

You can also set up Personal & Group Vaults to work towards your saving goals. Revolut tries to make this effortless by automatically rounding up your purchases to the nearest dollar and saving it in your account.

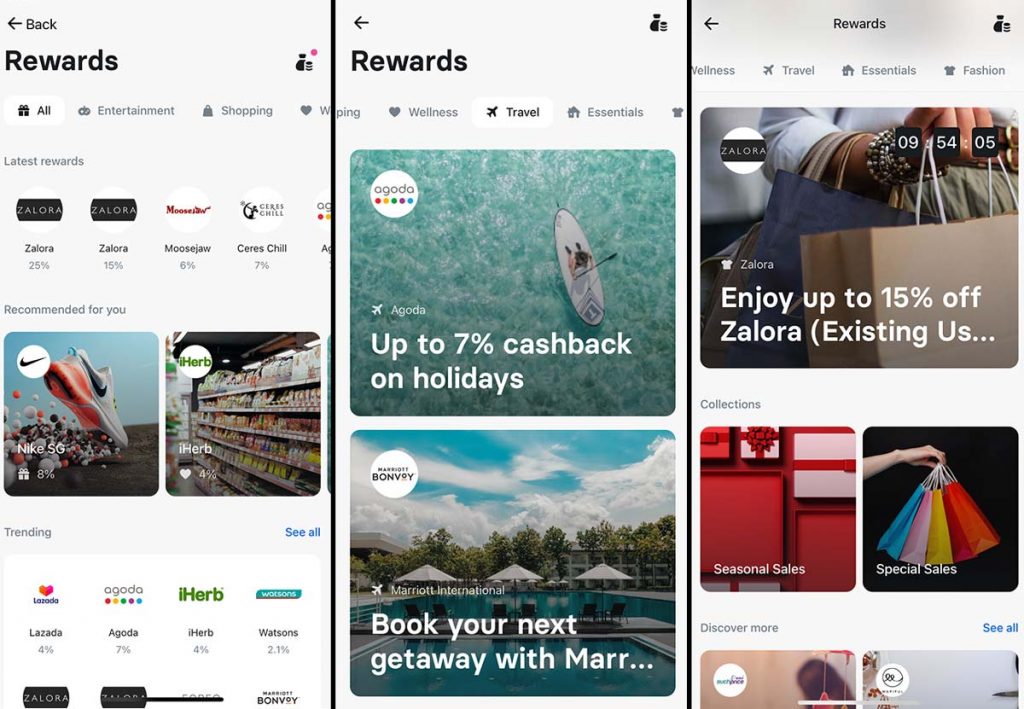

For online shoppers, the Rewards feature allows you to get additional cashback when you pay with Revolut.

If your flights are delayed for more than one hour, Premium and Metal Plan users also get complimentary lounge passes for their companions and themselves under Smart Delay .

Even if there’s no flight delay, Premium and Metal Plan users can purchase Lounge Passes on the App if you simply want to take a break.

Revolut Security Features Review

Convenient access and control of security features For long-term travel, these security features were extra useful. For example, we may want to disable magnetic stripe use in certain countries with a reputation for copying credit cards. In other instances, we may want to increase spending limits if we know we’ll be shopping more.

Revolut allows you to easily toggle security features like location-based security, use of contactless payments, ATM withdrawals, online payments, magnetic stripe usage, and spending limits via the app. This means even if you lose it without realising, the card cannot be misused since the features only work when you activate them.

You can easily change your PIN number, or unblock your own PIN if it has been accidentally blocked.

My favourite is the ‘Freeze card’ feature, which allows you to temporarily deactivate your card through the Revolut app . I’m sure many of us have been in situations where we think we’ve lost our credit card, only to find them a few days later after going through the trouble of calling the bank and having it deactivated permanently.

All these features make it super convenient as you can easily change them on the app instead of calling the bank.

Disposable Virtual Cards

You can also create Disposable Virtual Cards — perfect for times when you need to make online payments via foreign websites that might have questionable security protocols.

Disposable Virtual Cards are automatically refreshed after every use and can only be used once. So even if your details are exposed, your account will remain safe!

Revolut Review — thoughts after using Revolut for a few months

Over the last couple of months, our Revolut account generally worked really well. We used it for our everyday expenses and simply didn’t leave home without it.

The currency exchange rates were very favourable and the security controls were robust and useful. I personally loved the UI, which is intuitive and easy to navigate.

The biggest drawback would probably be the need for data connection. You need a data connection to top-up, so it’s important to make sure that you always have extra money in the account for unexpected purchases or emergencies. You don’t want to get stuck without money in a small town or rural area!

We also occasionally experienced situations where Revolut flags a suspicious transaction and blocks the card. While it’s easily resolved by logging into the app to unblock the card and mark it as a legit transaction, I can imagine how this might be a problem if you happen to be without data connection.

That said, I hardly carry my wallet around anymore and simply leave home with some emergency cash and the Revolut app on my smartphone. As the world becomes more connected and cashless, I can only imagine how using a multi-currency wallet and super-app like Revolut will become the main form of payment.

If you’d like to give Revolut a try, apply for an account and download the app here: – Apple App Store – Google Play

Revolut is also giving usersa 3% cash back on travel expenses till 23 December. More information here !

Hope you found this Revolut Review useful. Do let us know if you have any questions or suggestions to improve this review.

Disclosure : While the writer was provided with spending allowance to test the card, it’s in The Travel Intern’s interest to protect the editorial integrity of our website. We have taken every reasonable effort to ensure a realistic and honest review for our readers.

This post was brought to you by Revolut .

For more travel inspiration, follow us on Facebook , Instagram , and YouTube .

View this post on Instagram A post shared by thetravelintern.com 🇸🇬 (@thetravelintern)

RELATED ARTICLES MORE FROM AUTHOR

How to Pay in China Without WeChat or Alipay — New Cashless Solution For Singaporeans

JR Pass Budget Alternatives — Is the JR Pass, Single Shinkansen Tickets or Regional Passes More Worth It?

11 Travel Hacks and Pro-tips from Frequent Travellers

Changi is Giving Away 4 Business Class Tickets/Month Until End Oct 2024 — Here’s How to Get Yours

Mobile Payment in China: Step-by-step Guide to Using Alipay and WeChat Pay without a Chinese Bank Account

9 Must-Have Remote Working Travel Essentials That Make Life Easier While on The Road

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Hong Kong’s Outdoor: 9 Lesser-Known Sights for the Adventurous

HK’s Hidden Outdoor Gems: 7 Things to do in Hong Kong...

Sai Kung Guide — 7 Day Trip Itineraries to an Often...

A First-timer’s Guide to Belgium — Why This Should be Your...

Top 11 Hotels Near Tokyo Disney Resort — Quirky Themes, Dino...

- Terms Of Use

- Privacy Policy

Revolut Travel Card Review: Save Money Abroad

Last Updated on August 15, 2023 by Natalia

If you’re looking to avoid unnecessary charges and bad exchange rates when you travel, then this Revolut travel card review is for you. We’ve been using Revolut since 2016, and by now we can safely say it’s saved us hundreds, if not thousands of pounds. Changing money in advance is a thing of the past, as you can now arrive at your destination and use a Revolut prepaid card to get a better rate than currency exchanges ever offer. Although there are a number of different cards available, we personally think that there’s only one winner if you compare Revolut vs Monzo vs N26 travel cards or any of the other competitors. Revolut charges just 2% if you exceed your monthly withdrawal limit compared to the 3% Monzo charge, and N26 charge 1.7% on all transactions on free accounts. On top of that, the standard free Revolut accounts allows you to convert up to £1,000/€1,000 a month with no charge. If you’re looking for better features, then there’s also the option to sign up for a Premium or Metal Revolut account, although these accounts do come at a small cost. We fully recommend signing up now, but if you want to know more then check out our Revolut travel card review below!

Sign up to Revolut today via our referral link and get your first travel card delivered completely free! Click here to sign up!

Table of Contents

Available currencies

One of the most important things with any travel card is the number of currencies supported for card payments and ATM withdrawals. Revolut allows you to make card payments and ATM withdrawals in over 150 different currencies, which means it provides you with great versatility almost anywhere you travel. All major currencies are supported through the card, so unless you’re going really off the beaten path then Revolut will support almost every currency you need. We’ve been using our Revolut travel cards since 2016 and since then have been able to use them everywhere we’ve visited throughout Europe, Asia, Central America and South America.

Some of the currencies that aren’t yet supported are the Zimbabwean Dollar, Tuvaluan Dollar, Armenian Dram, Faroese Króna and Eritrean Nakfa. Even if you’re visiting one or more of the countries where the currency isn’t supported, it’s still worth getting a card for when you travel elsewhere. More and more currencies are becoming supported, so don’t be surprised if soon you’re able to use your Revolut card anywhere in the world!

Exchange Rate

Revolut travel card uses the real exchange rate, so whatever currency you’re changing you will almost always find that Revolut offer a better exchange rate than any of your other options. If you had £10, you wouldn’t actively choose to throw it away, but if you’re getting a bad currency conversion rate then throwing away money is exactly what you’re doing. Considering a Revolut travel card is completely free, you may as well get more currency for your money! Click here to save money when spending abroad by signing up for Revolut!

As the real exchange rate changes in real-time, the rate you will receive depends on when you convert your currency. Rates will fluctuate throughout the day, so you may get slightly different rates if you make a number of payments throughout the day.

Although Revolut uses the real exchange rate, the rates are fixed over the weekend to protect against fluctuations. This means that during weekends there is a fee of 1% on any transaction that involves currency conversion.

To avoid being affected by these markups we recommend making ATM withdrawals during weekdays. It will also affect card payments over the weekend, but there is no way to avoid these and it still almost always works out cheaper than using your normal debit card or a currency exchange.

How to get the best exchange rate with Revolut

There’s a very simple tip to make sure you get the best exchange rate when paying with your Revolut card. When using your card abroad you may be asked whether you would prefer to pay in the local currency or your home currency. Always opt to pay in the local currency.

If you don’t pay in the local currency then the merchant will make the conversion, which normally means you’ll get a very bad exchange rate and will end up paying more. Paying in the local currency allows Revolut to make the conversion (if required) using the real exchange rate, which means you will get a substantially better rate. Sometimes when making card payments abroad the merchant may select for you to pay in your home currency without giving you the choice to pay in the local currency. Always check what currency you’re being charged in and ask to pay in the local currency if you notice you’re being charged in your home currency. Some merchants will insist you will get a better rate by paying in your home currency, but that is never the case.

Make sure to also check what currency you’re paying in when making an ATM withdrawal. Some ATM machines will ask whether you want to use their conversion, but through experience we can say it’s always better to reject this. The phrasing will make it sound like you may be charged more for rejecting their rate, but as Revolut use the real exchange rate you are almost always going to be getting a better rate by rejecting the machine’s conversion and allowing Revolut to convert the currency for you.

Revolut card fees and charges

There are currently three different types of Revolut account: Standard, Premium and Metal. The standard account is completely free to use, whereas the premium and metal accounts require a monthly or yearly fee. There are a number of advantages of upgrading to a metal or premium account, so it’s important to know the difference between the accounts.

Two of the main differences between the accounts are the amount you can withdraw from foreign ATMs each month without incurring a fee, and the amount of currency you can convert each month without a fee. Find out the difference in fees and charges on the different Revolut accounts below:

Standard Revolut Travel Card Account

The standard free Revolut account allows you to make cash withdrawals abroad up to the equivalent of £200/€200 a month without any extra fees or charges. Once you go over this limit there is a 2% fee on any further withdrawals for the remainder of that month.

There is a much higher fee-free limit for transactions that require a currency exchange, such as making a card payment or ATM withdrawal in Euros and paying for it in Pounds. Revolut allows you to convert up to £1,000 a month at the real exchange rate without any charges. If you go over this limit, any payment or ATM withdrawal that requires a currency exchange will incur a charge of 0.5%. Unless you’re planning to spend huge amounts then this limit is unlikely to affect you!

Plus Revolut Travel Card Account

A new option from Revolut is to upgrade the free account to Revolut Plus for £2.99 a month. Here you get some additional perks such as up to £1000 in insurance if something you have purchased with this travel card is faulty or have fraudulent activity on the account.

As well as this there are a few other benefits from upgrading, however if you are looking to upgrade in terms of value for money in our opinion it’s worth doing one of the other options such as premium or metal.

Premium Revolut Travel Card Account

Upgrading to a Revolut premium account costs £6.99/€7.99 per month, and enables you to withdraw up to £400/€400 from foreign ATMs in the local currency without any extra fees or charges. Like with the standard account, once you exceed this limit there is a 2% fee on any further withdrawals within that month.

There is no limit for the amount of currency you can exchange on the premium plan, so if you intend to regularly convert over £1,000 a month it’s worth upgrading.

Metal Revolut Travel Card Account

A Revolut metal account costs £12.99/€13.99 per month, and allows you to withdraw up to £600/€600 from foreign ATMs in the local currency without any extra charges or fees. If you exceed this monthly limit then there is a 2% fee on any further withdrawals.

Like with the premium plan, there is no limit to the amount of currency you can exchange on a Revolut metal account.

Click here to compare the fees and charges of the standard, premium and metal Revolut accounts!

It’s easy to check how much you’ve withdrawn or how much money you’ve converted each month by going to the profile section of your app and selecting ‘Price plan’. That way you can avoid accidentally going over these limits and ensure that you don’t get any charges you aren’t expecting!

In our opinion, Revolut’s fees are more reasonable than their major competitors. For example, Monzo charge a 3% fee on any withdrawals that exceed the £200 monthly limit. Another competitor, N26, charge 1.7% on all withdrawals using their standard free account. Considering Revolut only charge when you exceed £200 a month but charge less than Monzo, then in our mind the best option is Revolut.

Personally we think it’s quite easy to avoid withdrawing over £200 a month, which means you won’t be charged any extra fees. If you prefer withdrawing cash and think you’re likely to exceed this limit regularly then it’s probably worth upgrading to either the premium or metal Revolut account. These accounts not only allow you to withdraw more money without extra fees, but also have a host of other advantages which we cover at the end of this article!

Hold multiple currencies simultaneously

As well as allowing you to spend in over 150 different currencies, Revolut also has the capability to hold money in a number of currencies at once. It’s currently possible to hold money in British Pounds (GBP), American Dollars (USD), Euros (EUR) as well as 27 other currencies including New Zealand Dollars (NZD), Turkish Lira (TRY) and South African Rand (ZAR).

The ability to hold different currencies at the same time is a useful one if you’d rather change some money to another currency all in one go, instead of the conversion being made each time you make a card payment or ATM withdrawal.

It’s important to know that Revolut travel cards are unable to draw from 2 currencies to make one payment. For example if you want to pay $100 USD using the card, it will only be possible if you have a high enough balance in one currency to make the transaction. If you do not hold the equivalent of $100 USD in one currency the transaction cannot go through, even if between currencies you have enough money. This is a relatively unlikely scenario, but should you find it happens to you then just use the app to convert enough money to one currency in order to pay.

There are a number of ways to top up your Revolut travel card, all of which are extremely easy. One of the options, and our personal favourite, is to top up using your debit card. Once you’ve registered your debit card this means you can top up within the app in a matter of seconds from anywhere in the world. Competitors like Monzo and N26 don’t allow you to top up directly from your debit card, which in our opinion gives Revolut a slight edge over the competition.

Another way of topping up your Revolut account is by bank transfer. To find your account details to do this you just need to select the ‘transfer to your Revolut account’ option when you’re on the top up screen of the app. You will then be presented with your Revolut account number and relevant details to top up for both local and international payments. This option takes slightly longer than topping up by debit card as you will need to log in to your online banking to actually make the payment. If you would prefer to do it this way then you have the option, but we personally prefer to top up via our debit card as it’s quicker and can be done instantly from within the Revolut app.

Another great feature of Revolut is the ability to set an automatic top up from your bank card once your balance falls below a certain amount. This is an ideal way to make sure you don’t run out of money when you’re travelling but don’t have any access to the internet access in order to top up.

Although signing up for a Revolut travel card itself is free, you normally have to pay for the delivery of your card. Fortunately for you, if you sign up using our link then standard delivery is completely free too! That means you won’t have to spend a penny to get yourself set up on Revolut – so you can start saving money on your next trip!

Click here to sign up for Revolut today and get free delivery of your first card!

Tracked and express delivery options are available too, but you will have to pay for these. The timeframe for delivery depends on the option you select. Standard delivery and tracked delivery both have a timeframe of 9 working days until you receive your card, although in our experience the cards are often delivered in 4-5 working days anyway. Express delivery has a timeframe of 3-4 working days to receive your card. Check out the list below to see the cost of different delivery options when you sign up for a Revolut card:

Standard Delivery – 9 working days – £4.99 GBP/€5.99 or completely free if you click here and sign up via our link!

Tracked Delivery – 9 working days – £7.99 GBP. Tracked delivery is only available in Great Britain, Guernsey, Jersey and the Isle of Man.

Express Delivery – 3-4 working days – £11.99/€19.99 although the cost may be higher depending on the delivery address.

Please note that prices may vary depending on your currency and location.

Alternatively, if you sign up for either a premium or metal Revolut card account then express delivery is completely free.

Make sure to order your card in plenty of time before your trip, especially if you’re opting for the standard delivery. It’s worth planning ahead to make sure you have your card in time so that you can spend your money hassle-free on your travels. Click here to sign up to Revolut now and get your first card completely free!

Revolut Card Limits

Although we’ve gone over some of the spending limits above, we thought it deserve its own section so that everything you need to know is in one place. The following limits apply to a standard Revolut account:

- No fee ATM withdrawals up to £200 per month. If you exceed this amount you will be charged a 2% fee.

- Convert up to £1,000 fee-free per month. If you exceed this amount you will be charged a fee of 0.5%.

- £3,000 limit for ATM withdrawals within 24 hours.

Customer service

Revolut offer great customer service for all users. There is a help chat function in the app which allows you to speak to a bot named ‘Rita’ who is able to provide generic answers to any queries you may have. If this doesn’t solve your issue then just type ‘Live Agent’ and you will be connected to a Revolut customer service representative who will be able to help. It usually only takes a few minutes to be able to speak to a representative, but if the chat function is busy it may take longer. The customer service chat is available 24/7, with priority support available for customers with a premium or metal account.

There are loads of other great benefits that come with signing up for a Revolut account, some of which don’t fit into any of the categories above. These range from push notifications on your phone when you make a payment to the ability to buy travel insurance to make sure you’re covered for your trip. The list below covers some of our favourite extras that come with signing up for a standard Revolut account:

- Alerts on your phone when you make a payment.

- Ability to disable your card instantly using the app if you lose it.

- Option to enable location based security to help prevent fraud.

- Option to buy travel insurance and device insurance through Revolut.

- Option to disable any of the following: Swipe payments, Contactless payments, ATM withdrawals and Online Transactions.

- Special edition cards are sometimes available. For example, rainbow-coloured cards were released for free to celebrate Pride in 2019.

- Revolut Vault – a money saving tool that rounds up every payment you make and puts the spare change aside in order to help you save up for a target amount of money. Click here to find out more!

- Ability to set monthly spending limits.

What do you need to sign up for Revolut?

Revolut need to verify your identity, which means you will need to provide some ID during the sign up process. You can easily provide your ID through the app, which has easy to follow instructions to guide you through the process of signing up. To further verify your identity you will need to provide personal information including your name, address, phone number, email address and date of birth in order to set up an account.

Premium options

If you like the sound of the above but want higher limits and added perks then upgrading to either a premium or metal Revolut account is probably worth it. Signing up for a Revolut premium account costs £6.99/€7.99 per month, whereas a Revolut metal account costs £12.99/€13.99 per month. Alternatively, both plans are discounted if you pay for a year up front. Find out the additional benefits that come with Revolut premium and metal below:

Revolut Premium Account

- Ability to withdraw up to £400 per month from ATMs without any fee.

- Exchange money in 29 fiat currencies with no monthly limit.

- Free overseas medical insurance.

- Free delayed baggage/flight insurance.

- Free global express delivery.

- Priority customer support.

- Access to 5 cryptocurrencies.

- Exclusive card designs only available to Premium members.

- Disposable virtual cards for safe online shopping.

- Ability to instantly book access to over 1,000 airport lounges around the world.

Revolut Metal Account

- Ability to withdraw up to £600 per month from ATMs without any fee.

- 0.1% cashback on card payments within Europe and 1% cashback on card payments outside of Europe.

- Exclusive Revolut Metal card only available to Metal customers.

- One free airport lounge pass, plus the ability to instantly book access to over 1,000 airport lounges around the world.

- A concierge to help you manage your lifestyle.

So, is Revolut worth it?

Simply put, yes. In our opinion, you’re actively choosing to throw money away if you don’t sign up for a Revolut account. It’s completely free to sign up, and it’s certain to save you money in the long run even if you only spend a few days abroad a year. Considering there’s absolutely no cost to you, we recommend signing up now so you can start saving money on your next trip!

Ready to sign up? Click here to apply for a Revolut travel card today!

Please note that some links in this article are affiliate links, which means if you make a purchase we make a small commission at no extra cost to you. This money is used to support this website and cover the costs of keeping it online and free to access!

Like this guide to the Revolut travel card? Pin it!

Revolut Card Review | How to Use Revolut Abroad

Home | Travel | Revolut Card Review | How to Use Revolut Abroad

The Revolut card is one of the cards we always carry with us while traveling since it allows us to pay and withdraw money abroad without pesky currency exchange fees. Moreover, Revolut lets us carry out transactions in different currencies, such as changing from one currency to another when the exchange rate is more favorable.

I had read many Revolut reviews , but what convinced me to try it was hearing about my cousin’s experience. He went to London for a job opportunity and used his Revolut USD account to pay for his expenses in the UK. Once he started working, he added money to his Revolut card with British pounds, which he used to pay for his expenses when he came back to the USA.

Revolut works in the U.S., and many other countries which is great for us since we travel to different countries most of the year. So, in this guide, I’ll tell you all about Revolut, including what it is exactly, how it works, and why it’s the best financial app for expats and frequent travelers.

What is Revolut?

How does Revolut work?

Types of revolut cards, how to apply for a revolut card, how to use revolut abroad, revolut fees.

- Revolut card reviews

Before we begin, I’ll tell you that we use Revolut in addition to other cards to help save money while traveling , like the Wise card . In this guide, I’ll focus on Revolut and how you can use it to make payments while avoiding currency exchange fees, withdraw money from foreign ATMs, and more .

Revolut is a financial management company that originated in the UK in 2015 and launched in the U.S. in 2020. Over 20 million people use this financial app to make payments abroad, exchange currencies, get paid in other countries, and more.

With your Revolut card , you can withdraw money from just about any ATM, including 55,000 in-network ATMs, without commission fees. Moreover, the card allows you to change your currency when the exchange rate is more favorable, so you can save more money while traveling.

Depending on the country, your Revolut card can be a Mastercard or Visa card. For example, in the UK, it’s a Revolut Mastercard , while in the U.S., it can be a Mastercard or Visa. Of course, it doesn’t matter which card you have with Revolut since the exchange rate is determined by the interbank rate, which is one of the best.

The Standard Revolut prepaid debit card has no card issuance fees (excluding the shipping cost), which makes it one of the best cards for travel out there. Also, since it’s a financial super-app, you can handle all your transactions in the Revolut app , including opening an account and ordering your card.

Revolut frequently updates its products and features, so check out the Revolut Terms and Conditions to see the latest offerings .

The Revolut app lets you take care of basic transactions like ATM withdrawals and currency exchange in one place. Money loaded on your prepaid card is held at Metropolitan Commercial Bank and is FDIC insured up to $250,000 in the event of Metropolitan Commercial Bank’s failure. Securities products are not FDIC Insured, not bank guaranteed, and may lose value.

Revolut’s international bank account number (IBAN) is European, specifically Lithuanian, so deposits to other accounts are made via SWIFT. This means that the funds usually take one to three days to appear in the account.

You can also add money to the Revolut card via the app using a debit or bank transfer. Revolut sends instant spend notifications, and you can see your real-time balance at any time, so you’re always aware of how much money you have. Revolut uses location-based security, so if it sees that your card was used in an unusual location, it’ll alert you and you can freeze and block your card instantly right in the app.