- Accounts Payable Software

- Accounts Receivable Software

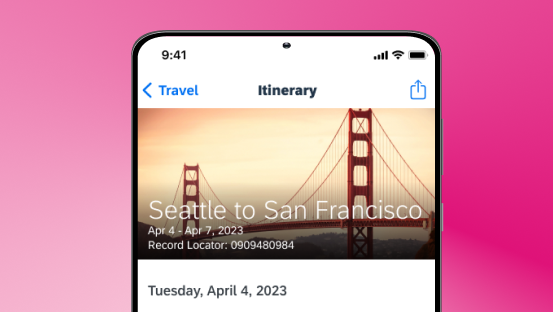

- Travel & Expense Management

- Payment Automation

- Cash Flow Management

- Account Payable

- Account Receivable

- Travel & Expense

- Finance News

- Press Release

- Get Started

The Complete Guide to Travel and Expense Management (T&E)

Managing travel and expenses for your company can be a complex task, requiring careful attention to detail and adherence to company policies. As your business grows, so does the need for effective travel and expense management. From ensuring compliance with policy guidelines to optimizing costs, there are many factors to consider to make the process smoother for everyone involved.

In this blog post, we will explore the fundamentals of travel and expense management, offering insights into best practices that can help streamline the process. Whether you’re a small business with a handful of travelers or a large corporation with a global workforce, understanding the basics of travel and expense management is essential for maintaining control over your travel costs and ensuring compliance with your company’s policies.

What is Travel and Expense Management?

Travel and Expense Management (T&E) is the process of overseeing and controlling an organization’s spending on business-related travel and expenses. It involves documenting, processing, and monitoring the expenses to ensure they are in line with company policies and tax regulations.

T&E management includes various tasks such as booking travel arrangements, managing expenses, and ensuring compliance with corporate policies and legal requirements. The goal of travel and expense management is to optimize spending, improve efficiency, and maintain transparency in business expenses.

Key components of travel and expense management include:

- Approving travel requests

- Booking travel arrangements (such as flights and hotels)

- Managing corporate credit cards

- Submitting and approving expense claims

- Handling reimbursement

- Auditing expenses for compliance

- Guiding travel policies to employees

T&E management helps organizations save money, time, and resources by providing visibility into spending patterns and ensuring that employees only spend money on necessary expenses during business trips. It plays a crucial role in maintaining accurate financial records and ensuring compliance with tax regulations .

What is the Travel & Expense Policy?

A travel and expense policy is a set of guidelines and rules established by a company to regulate how employees spend company funds on business trips and related expenses.

These policies typically cover various aspects of travel and expenses, including:

- How and where to book travel

- Criteria for approving or rejecting travel itineraries

- Expense reimbursement process

- Guidelines for flights, trains, and class accommodations

- Approved hotels and allowable incidental expenses

- Ground transportation guidelines

- Meal allowances

T&E policies are designed to ensure that employees understand the company’s expectations regarding travel and expenses and to provide clarity and consistency in how these expenses are managed and reimbursed. They help companies control costs, ensure compliance with regulations, and provide employees with clear guidelines for managing expenses while traveling for business.

Why is Travel and Expense Management Important?

Travel and expense management is essential for controlling costs, ensuring compliance, optimizing processes, and enhancing employee satisfaction. Implementing an effective travel and expense management process can lead to significant cost savings and operational efficiencies for businesses of all sizes. Let’s take a look at the importance of T&E management:

- Cost Control: Effective management of travel and expenses helps control costs by ensuring that expenditures are in line with budgets and company policies. It allows businesses to identify areas of overspending and implement measures to reduce unnecessary expenses.

- Compliance: Compliance with company policies and regulatory requirements is crucial. A proper travel and expense management process helps ensure that expenses are incurred for legitimate business purposes and comply with tax regulations , reducing the risk of audits and penalties.

- Visibility and Reporting: A centralized process provides visibility into travel and expense data, allowing businesses to track spending, analyze trends, and generate reports. This visibility helps in making informed decisions and optimizing travel budgets.

- Streamlined Processes: Managing travel and expenses manually can be time-consuming and prone to errors. An automated system streamlines processes, reducing administrative burden, and improving efficiency.

- Policy Enforcement: A robust travel and expense management system helps enforce company policies related to travel and expenses. It ensures that employees adhere to guidelines regarding travel bookings, expense submissions, and reimbursement , promoting accountability and compliance.

- Employee Satisfaction: A well-managed travel and expense process can enhance employee satisfaction by providing a smooth and timely reimbursement process. It also ensures that employees are aware of the company’s travel policies and procedures, reducing confusion and frustration.

What are the Stages of Travel and Expense Management?

Here is a breakdown of the eight different stages of travel and expense management:

1. Developing an Expense Policy

Develop a comprehensive expense policy that covers all aspects of travel and expense management. Specify allowable expenses, limits, and procedures for requesting funds, making authorized transactions, submitting expense reports, and receiving reimbursements. Include clear guidelines for travel-related expenses to ensure consistency and compliance.

2. Streamlining Pre-Travel Processes

Use travel and expense management automation platforms to simplify the pre-travel process. These platforms enable employees to submit travel requests, which are then routed to managers for approval. Managers can quickly review and approve requests, and employees can book their travel directly through the platform, ensuring all bookings are recorded and tracked efficiently.

3. Managing Expense Incurrence

During business trips, employees will incur various expenses, such as meals, transportation, and accommodation. Companies can provide employees with cash advances, and corporate credit cards, or require them to pay out of pocket and submit expense reports for reimbursement. Clear communication and guidelines are essential to ensure employees understand the process and comply with company policies.

4. Efficient Receipt Handling

Managing receipts is a crucial aspect of expense management. Traditionally, employees would need to keep track of paper receipts and submit them along with their expense reports. However, digital solutions offer a more convenient option. Employees can use mobile apps to capture and upload receipts, which are then stored securely in the cloud. Some platforms even offer OCR capabilities, automatically extracting relevant information from receipts and eliminating manual data entry.

5. Standardizing Expense Reporting

Standardize the expense reporting process to ensure consistency and accuracy. Provide employees with easy-to-use tools, such as mobile apps or web-based forms, to submit their expense reports. Include prompts for required information, such as date, amount, and purpose of the expense, to streamline the reporting process and minimize errors.

6. Implementing an Approval Process

Implement a clear and efficient approval process for expense claims. Use expense management software to automate the workflow, allowing managers to review and approve claims quickly. Ensure that all claims are reviewed for compliance with company policies before approval to prevent unauthorized expenses.

7. Ensuring Prompt Reimbursement

Prompt reimbursement of expenses is essential to maintain employee satisfaction. Once expense claims are approved, ensure that reimbursements are processed promptly. Consider using direct deposit or other electronic payment methods to expedite the reimbursement process and reduce administrative burden.

8. Conducting Compliance Audits

Regularly audit expense reports to ensure compliance with company policies and regulations. Look for any anomalies or discrepancies that may indicate fraudulent activity. Conducting regular audits helps maintain the integrity of the expense management process and identifies areas for improvement.

What are the Challenges of Travel and Expense Management?

Managing travel and expenses poses several challenges for organizations, ranging from tracking and controlling costs to ensuring policy compliance. These challenges can impact financial health, employee satisfaction, and operational efficiency. Understanding these challenges is crucial for implementing effective solutions. Here are some common challenges of travel and expense management:

1. Trouble with Policy Compliance

A common challenge in managing travel and expenses is the lack of enforcement of policies. This often occurs due to unclear policies. When policies are ambiguous, employees may spend without regard to guidelines, leading to uncontrolled expenses and budget strain.

As businesses grow, ensuring compliance becomes more challenging. Unauthorized bookings and other policy breaches can occur due to various reasons, such as lack of awareness or attempts at internal fraud.

2. Lack of Data Management

Even with enforced expense reporting within your travel and expense management policy, there’s always a risk of misplacing receipts and losing travel documents. Ensuring comprehensive tracking of every expense can be challenging, especially when employees have to hold onto receipts until they return home to submit them.

3. Limited Visibility into Spends

One of the significant challenges in travel expense management is the lack of visibility into spending. This often occurs due to ineffective tracking of employee expenditures. Without clear visibility, it becomes challenging to control costs effectively.

While some savings might be possible, a comprehensive understanding of spending or potential savings opportunities remains unclear. Delayed submission of expense reports further complicates the situation, as neither managers nor travelers can accurately assess whether expenses align with budgetary constraints.

4. Unclear Expense Policies

Corporate travel and expense management involve many considerations, making it easy to overlook aspects when creating your expense policy. This can create confusion and ambiguity, leading to a lack of clarity for employees.

5. Complicated Expense Workflows

Managing business travel expenses often involves navigating complex workflows. Obtaining approvals from multiple stakeholders can be time-consuming, especially when quick payments are needed. Additionally, the process of filing expense reports after a trip can involve many complex steps.

6. Labor-Intensive Manual Processes and Paperwork

Many businesses use manual processes, such as spreadsheets, to track their expenses. While this may seem efficient initially, it becomes difficult to manage as the business grows. Manually inputting data into spreadsheets is time-consuming and prone to errors.

Without automation, your team will spend a lot of time on manual data entry and paperwork. It includes collecting and storing receipts, as well as entering each transaction from business trips into spreadsheets. These tasks can decrease productivity and lead to inefficiencies.

7. Expense Fraud

Expense fraud can pose a significant threat to your company’s finances, as employees may misuse company funds by submitting false expenses or using them for personal trips. To prevent such fraud, organizations must implement measures to detect and prevent fraudulent activities.

Expense fraud can take various forms, including internal fraud where employees intentionally make unauthorized transactions, or external fraud where criminals steal company funds. Not enforcing travel and expense policies or carefully controlling spending can lead to multiple fraud attempts, some of which may go unnoticed.

8. Difficulty Managing Multi-Currency Expenses

Business travel can involve transactions in different currencies, which can be complex. Managing expenses in foreign currencies requires decisions on when to convert rates, such as at the time of purchase or reimbursement.

9. Challenges with Filing Expense Reports

Filing expense reports manually can be time-consuming and tedious. Employees often find it challenging to keep track of receipts and complete the paperwork accurately and promptly. This manual process can lead to delays in reimbursement and create a frustrating experience for employees.

10. Dealing with Reimbursements

Managing reimbursements for employee travel expenses can be challenging. Without an efficient system in place, employees may experience delays in receiving their reimbursement checks, leading to frustration and dissatisfaction. Delayed reimbursements can also impact employee morale and may create financial burdens for employees who rely on timely reimbursements.

Best Practices for Travel and Expense Management

Effective travel and expense management is crucial for organizations to control costs, ensure policy compliance, and streamline processes. Here are some best practices to improve your travel and expense management:

1. Enhance Spend Visibility

Utilizing automated travel expense software and mobile tracking apps allows companies to gain real-time insights into their spending. These tools provide detailed reports on expenses, highlighting areas where costs can be optimized. By having a 360-degree view of expenses, businesses can make informed decisions, identify trends, and ensure compliance with policies. Additionally, these tools can help detect any unauthorized or non-compliant spending, allowing for prompt action to be taken. Overall, enhanced spending visibility leads to better financial management and cost control.

2. Prioritize Employee Experience

Improving the travel experience for employees can lead to higher compliance with travel policies. Offering self-booking tools and user-friendly interfaces can make the travel booking process more efficient and enjoyable for employees. This can result in higher employee satisfaction and increased productivity. By prioritizing employee experience, companies can create a positive work environment and improve overall employee morale.

3. Offer Convenient Payment Options

Providing corporate credit cards to employees for business expenses can streamline the payment process and eliminate the need for employees to use personal funds. It can reduce the administrative burden associated with expense reimbursement and ensure that employees are not out of pocket for business expenses. Alternatively, engaging a travel management company can simplify the payment process by consolidating all travel expenses into a single invoice, making it easier to track and manage expenses.

4. Embrace Paperless Processes

Digitizing expense filing and reimbursement procedures can significantly reduce the time and effort required to process expenses. By eliminating paperwork, companies can streamline their expense management processes, reduce the risk of errors, and improve efficiency. Additionally, digital processes can provide greater transparency and visibility into expenses, making it easier for companies to track and monitor spending. Overall, embracing paperless processes can lead to cost savings and improved productivity.

5. Optimize Approval Workflows

Designing workflows that facilitate quick approval for essential expenses can expedite the expense approval process. By setting up auto-approval for certain spending categories, companies can reduce the time and effort required to process expenses. This can lead to faster reimbursement for employees and improved cash flow for the company. Additionally, optimizing approval workflows can help prevent delays and bottlenecks in the approval process, ensuring that expenses are approved on time.

6. Utilize Travel Expense Policy Templates

Using pre-designed policy templates simplifies the creation of travel expense policies. These templates are often customizable, allowing companies to tailor them to their specific needs and requirements. By using templates, companies can save time and effort in developing policies from scratch. Additionally, templates ensure that policies are comprehensive and cover all necessary aspects of travel expenses. This helps to reduce the risk of misunderstandings and ensures that employees are aware of and comply with the company’s policies.

7. Implement a Paperless Policy

Integrating the travel and expense policy into digital tools makes it easily accessible to employees. This eliminates the need for physical documents, reducing paper waste and simplifying document management. A paperless policy also allows for real-time updates and changes to the policy, ensuring that employees always have access to the most up-to-date information. Additionally, a digital policy can be easily distributed to employees, ensuring that everyone is aware of and understands the policy.

8. Regularly Update Your Policy

Keeping the travel and expense policy current reflects changes in business needs and employee behaviors. Regular updates ensure that the policy remains relevant and effective in managing expenses. This helps prevent misunderstandings and ensures that employees are aware of any changes to the policy. Regular updates also demonstrate a commitment to compliance and best practices in travel and expense management.

Closing Thoughts

Implementing best practices for travel and expense management is essential for organizations to achieve greater efficiency, compliance, and cost control. By enhancing spend visibility, prioritizing employee experience, offering convenient payment options, embracing paperless processes, and optimizing approval workflows, businesses can streamline their travel and expense processes and drive better outcomes.

At Peakflo, we understand the importance of effective travel and expense management. Our Travel and Expense solution is designed to simplify and streamline the entire process. With Peakflo’s intuitive software, organizations can automate expense tracking, simplify reimbursement processes, and gain real-time insights into spending patterns. By leveraging our solution, businesses can optimize their travel and expense management, reduce administrative burden, and ensure compliance with policies, ultimately driving greater efficiency and cost savings.

Understanding Expense Claim: The Ultimate Guide

The ultimate guide to business travel process, what is per diem expense & how is per diem rate calculated, latest post, bf borgers named “sham audit mill” by sec, tesco accounting scandal: overstating profits by £326 million, barclays capital lost millions due to an excel error, ditching legacy systems: the key to a sustainable finance landscape, split payment: streamlining transactions for marketplaces.

- Accounts Payable

- Accounts Receivable

- Travel and Expense Management

- B2B Payment Software

- Invoice Management

- Procurement Software

- Product Tour

- Saving Calculator

© 2023 by Peakflo. All rights reserved.

- English (UK)

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

2024 guide to travel and expense management

All about travel expense management, pain points of ineffective t&e processes, a need for comprehensive guidelines, lack of control and autonomy for travelers, unauthorized bookings, paying too much for business travel, endless expense admin, lost receipts, inaccurate t&e spend reports, slow reimbursements, lack of real-time t&e cost tracking, what an effective t&e management tool can provide.

- Full visibility into real-time travel spending: With automated expense reports and consolidated travel booking , your finance team will have real-time expense tracking to help them better understand your travel program.

- Options and autonomy for travelers: By integrating company policies, a travel management solution empowers business travelers to choose their own trip options. No need for travelers to pay upfront: Big business travel purchases like airfares and rental cars shouldn’t require travelers to request a reimbursement. When booking on a business travel platform, the company can pay one monthly invoice and reduce admin for everyone.

- No need for travelers to fill out expense reports: The right expense management solution will automate T&E workflows. A mobile app can scan receipts so travelers don’t have to enter data into the expense management tool manually.

- Fast for office managers to collect invoices: When you consolidate your travel costs into one corporate travel management system , you receive just one invoice at the end of each month.

- Automated purchase reconciliation: Expense data from receipt scans and corporate credit card purchases should be automatically reconciled.

- Automated reimbursement approvals: Automate your company’s T&E policy with rules so that food or taxi purchases under a certain amount can be automatically reimbursed without needing approvers to review manually.

- Quicker reimbursement funds for travelers: Even with consolidated business travel booking, the odd per diem expense will still be generated on the road. But with an automated expense reimbursement process, your employees won't be left waiting.

The best systems for travel and expense management

Travel management platform.

- Great trip inventory

- Customizable travel policies and approvals

- Monthly invoice to consolidate payments

- High-quality customer support

- Insightful travel spend analytics and reporting

- Easy-to-use mobile app for travelers

Consumer-grade functionality to inspire greater policy compliance Travel and expense management that works like a dream

Expense management platform.

- Receipt scanning to reduce manual data entry

- Automated expense approval and reimbursement workflows

- Rules and automatic approvals for low-cost expenses

- Easy-to-use mobile app for employees

- Corporate card integrations and data importing

- Expense reporting and analytics

3 Top travel expense management solutions

Divvy: for the us.

- Access the funding you need with credit lines up to $15m available to companies of all sizes.

- When spending with Divvy, get rewards on restaurants, hotels, travel, and more.

- Languages supported: English

- Pricing: Free.

Pleo: for the UK

- Pleo integrates with invoicing software to automate payments and offer enhanced spend visibility.

- Easily track out-of-pocket expense claims to ensure swift expense reimbursement in line with your company's policies.

- Languages supported: Danish, German, English, Finnish, French, Dutch, Norwegian, Portuguese, Spanish, and Swedish.

- Starter: free

- Essential: £39/month

- Advanced: £69/month

Yokoy: for DACH

- Yokoy services and products are available individually or as a pack, so you only buy what you need.

- The AI-based tool analyzes and approves standard expenses and automatically creates real-time expense reports.

- Languages supported: German, English, French, Italian, and Chinese.

- Pricing: Based on requirements.

We caught up with Katharina Wodischeck from adsquare to hear her thoughts on Travel & Expense management.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Topic no. 511, Business travel expenses

More in help.

- Interactive Tax Assistant

- Report Phishing

- Fraud/Scams

- Notices and Letters

- Frequently Asked Questions

- Accessibility

- Contact Your Local IRS Office

- Contact an International IRS Office

- Other Languages

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes.

You're traveling away from home if your duties require you to be away from the general area of your tax home for a period substantially longer than an ordinary day's work, and you need to get sleep or rest to meet the demands of your work while away.

Generally, your tax home is the entire city or general area where your main place of business or work is located, regardless of where you maintain your family home. For example, you live with your family in Chicago but work in Milwaukee where you stay in a hotel and eat in restaurants. You return to Chicago every weekend. You may not deduct any of your travel, meals or lodging in Milwaukee because that's your tax home. Your travel on weekends to your family home in Chicago isn't for your work, so these expenses are also not deductible. If you regularly work in more than one place, your tax home is the general area where your main place of business or work is located.

In determining your main place of business, take into account the length of time you normally need to spend at each location for business purposes, the degree of business activity in each area, and the relative significance of the financial return from each area. However, the most important consideration is the length of time you spend at each location.

You can deduct travel expenses paid or incurred in connection with a temporary work assignment away from home. However, you can't deduct travel expenses paid in connection with an indefinite work assignment. Any work assignment in excess of one year is considered indefinite. Also, you may not deduct travel expenses at a work location if you realistically expect that you'll work there for more than one year, whether or not you actually work there that long. If you realistically expect to work at a temporary location for one year or less, and the expectation changes so that at some point you realistically expect to work there for more than one year, travel expenses become nondeductible when your expectation changes.

Travel expenses for conventions are deductible if you can show that your attendance benefits your trade or business. Special rules apply to conventions held outside the North American area.

Deductible travel expenses while away from home include, but aren't limited to, the costs of:

- Travel by airplane, train, bus or car between your home and your business destination. (If you're provided with a ticket or you're riding free as a result of a frequent traveler or similar program, your cost is zero.)

- The airport or train station and your hotel,

- The hotel and the work location of your customers or clients, your business meeting place, or your temporary work location.

- Shipping of baggage, and sample or display material between your regular and temporary work locations.

- Using your car while at your business destination. You can deduct actual expenses or the standard mileage rate, as well as business-related tolls and parking fees. If you rent a car, you can deduct only the business-use portion for the expenses.

- Lodging and non-entertainment-related meals.

- Dry cleaning and laundry.

- Business calls while on your business trip. (This includes business communications by fax machine or other communication devices.)

- Tips you pay for services related to any of these expenses.

- Other similar ordinary and necessary expenses related to your business travel. (These expenses might include transportation to and from a business meal, public stenographer's fees, computer rental fees, and operating and maintaining a house trailer.)

Instead of keeping records of your meal expenses and deducting the actual cost, you can generally use a standard meal allowance, which varies depending on where you travel. The deduction for business meals is generally limited to 50% of the unreimbursed cost.

If you're self-employed, you can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) , or if you're a farmer, on Schedule F (Form 1040), Profit or Loss From Farming .

If you're a member of the National Guard or military reserve, you may be able to claim a deduction for unreimbursed travel expenses paid in connection with the performance of services as a reservist that reduces your adjusted gross income. This travel must be overnight and more than 100 miles from your home. Expenses must be ordinary and necessary. This deduction is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the standard mileage rate (for car expenses) plus any parking fees, ferry fees, and tolls. Claim these expenses on Form 2106, Employee Business Expenses and report them on Form 1040 , Form 1040-SR , or Form 1040-NR as an adjustment to income.

Good records are essential. Refer to Topic no. 305 for information on recordkeeping. For more information on these and other travel expenses, refer to Publication 463, Travel, Entertainment, Gift, and Car Expenses .

Middle East and Africa

Asia Pacific

- Try for free

- Concur Expense

- Company Bill Statements

- Bank Card Feeds

- Concur Detect

- Concur Benefits Assurance

- Concur Event Management

- Concur Request

- Concur Tax Assurance

- Intelligent Audit

- All products

Concur Travel

- Concur TripLink

Concur Invoice

- Payment providers

- Payment solutions

- Purchase Request

- Three-Way Match

- Consultative Intelligence

- Data Delivery Service

- Intelligence

- Concur Advanced Care

- Concur Essential Care

- Concur Select Care

- Concur User Assistant

- Managed Rate Administration

- User Support Desk

Learn about integrations

- Invoice integrations

- Concur Compleat

- TMC solutions

- Traveler self-service

- TravPay Hotel

- Trip Approval

- Sustainable travel

- Business expansion

- Compliance and risk

- Control company costs

- Duty of care

- Employee experience

- Intelligent Spend Management

- Travel and expense

- Travel in China

- Energy & utilities

- Financial services

- Government contracting

- Legal/professional services

- Life sciences

- Manufacturing

- Non profits

- Oil, mine, and gas

- State & local governments

- Technology companies

- Enterprise finance leader

- Small business finance leader

- Travel manager

- Getting started

- Premium Assistant

- Service Assistant

- All solutions

- Intelligent spend management

- Travel and Expense

- REQUEST PRICING

- About SAP Concur

- CONTACT SALES

- Resource center

- Case studies

- Customer experience

- Mobile apps

- SAP Concur Community

- Expense demo

- Invoice demo

Concur Drupal Menu - Mobile

Concur Expense will forever change the way you manage employee spending

Yes, your spend management process could be better.

SAP Concur solutions have been at the top of the expense management business a long time. One thing we know for certain is this: when it comes to employee-initiated spend, “good enough” solutions are never good enough.

When you automate your spend management system, back-office processes are faster, you avoid errors, and you can track every expense. Best of all? Employees are reimbursed faster, and they don’t waste time sorting through paper receipts to fill out expense reports.

This is how we do it Build your expense policy

Companies of all sizes benefit from Concur Expense

Create a total spend management solution for your business.

Whether you’re a small business or an enterprise organization, an investment in Concur Expense, Concur Travel, and Concur Invoice lets you track and manage every employee-initiated expense, travel cost, and invoice payment on one connected system. Check out the video to learn the SAP Concur basics.

See what these other SAP Concur solutions can do

So much more than software

When you become an SAP Concur customer, you’re not just getting our technology platform. You also get immediate access to our huge ecosystem of partner apps and integrations that can help you extend and strengthen your spending solution.

Experience Concur Expense

- SERVICE STATUS

- REQUEST A QUOTE

- VISIT SAP.COM

- Terms of Use

IMAGES

VIDEO

COMMENTS

IRS Tax Tip 2023-15, February 7, 2023. Whether someone travels for work once a year or once a month, figuring out travel expense tax write-offs might seem confusing. The IRS has information to help all business travelers properly claim these valuable deductions. Here are some tax details all business travelers should know.

What is the Travel & Expense Policy? 1. Trouble with Policy Compliance. 2. Lack of Data Management. 3. Limited Visibility into Spends. 4. Unclear Expense Policies. 5. Complicated Expense Workflows. 6. Labor-Intensive Manual Processes and Paperwork. 7. Expense Fraud. 8. Difficulty Managing Multi-Currency Expenses. 9.

Concur Travel & Expense. Integrate T&E processes and get a unified view into travel bookings and spending data, all in one place. Contact us Assess your T&E. Unlock business potential with intelligent travel and expense solutions.

For tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. An ordinary expense is one that is common and accepted in your trade or business.

Travel and expense management (T&E) is the process of collecting all travel-related expenses in order to not pay taxes on that amount. In most countries, business-related travel and entertainment costs, including flights, hotels, and ground transportation count as tax deductible expenditures.

SAP Concur simplifies travel, expense and invoice management for total visibility and greater control. Contact us today.

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes.

Whether you’re a small business or an enterprise organization, an investment in Concur Expense, Concur Travel, and Concur Invoice lets you track and manage every employee-initiated expense, travel cost, and invoice payment on one connected system. Check out the video to learn the SAP Concur basics. See what these other SAP Concur solutions can do.