Singlife with Aviva Travel Insurance Review: Covid-19 Cover, SAF MINDEF Promotion

The name “Aviva” rings a bell in the minds of all Singaporean men, since they provide you with life insurance when you’re doing National Service.

Your NS or reservist days might be behind you, but you still need to rely on Aviva if you decide to purchase their Singlife with Aviva travel insurance when you go on overseas holidays.

Despite the fact that Aviva already makes loads of money from MINDEF, Singlife with Aviva Travel Insurance is actually a well thought-out product that offers good value for money.

Let’s have a look at how the plan measures up.

- Singlife with Aviva Travel Insurance: Summary

- Singlife with Aviva Travel Insurance

- Singlife with Aviva Travel Insurance Covid Cover

- Singlife with Aviva Travel Insurance Extreme Sports

- Singlife with Aviva vs AIA Travel Insurance

- Singlife with Aviva Travel Insurance Promotion

- Singlife with Aviva Travel Insurance Claim Review

- Should I buy Singlife with Aviva Travel Insurance?

1. Singlife with Aviva Travel Insurance Summary

Singlife with Aviva travel insurance comes in three iterations:

- Travel Lite – Up to $250,000 of overseas medical expenses

- Travel Plus – Up to $2,000,000 of overseas medical expenses

- Travel Prestige – Unlimited overseas medical expenses

You can also buy single-trip insurance for trips of up to 182 days or annual multi-trip insurance for unlimited trips within a year of up to 90 days per trip.

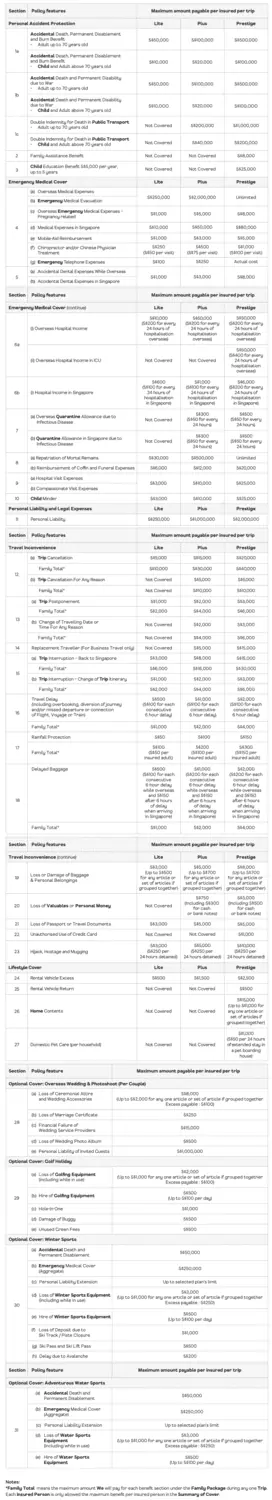

2. Singlife with Aviva Travel Insurance: Coverage

As mentioned previously, Singlife with Aviva travel insurance comes in three tiers—Travel Lite, Travel Plus and Travel Prestige.

Here’s a summary of the plans’ key benefits and coverage.

At a glance, the medical and travel benefits are quite generous compared to what’s being offered by competitors like AXA and DBS , particularly because the higher tier gets you unlimited medical expense claims.

Our main gripe is that you have to purchase an add-on to get coverage for outdoor/adventure activities. But if the riskiest thing you plan to do is to binge on local cuisine, you should be fine.

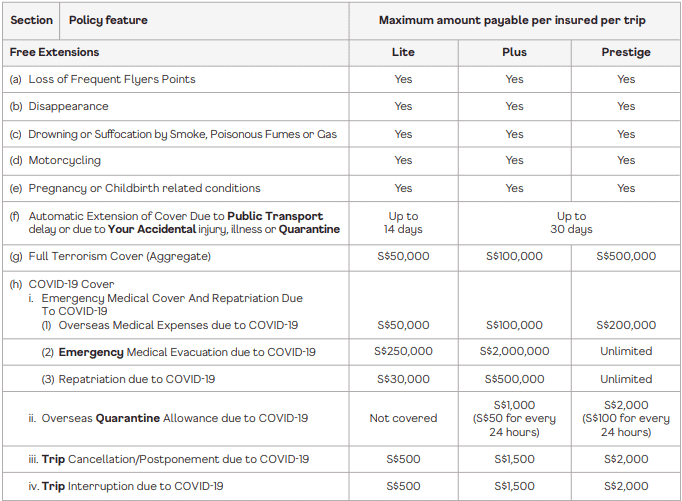

3. Singlife with Aviva Travel Insurance Covid Coverage

The Singlife with Aviva Travel Insurance policy comes with Covid-19 cover, as well it should, because almost all insurers now offer it.

Here are the details:

As far as Covid-19 benefits go, these are pretty decent.

First of all, they’re automatically included and do not need to be added on like with some plans, notably FWD’s travel insurance . Second, the claim amounts are decent, although they are not as generous as those given by some premium plans like MSIG’s .

Total Premium

FWD Business

[ Win a Rolex, Dream Vacation & More! | MoneySmart Exclusive] • Enjoy 25% off your policy premium and 2,400 My Millennium Points (worth S$16) with every policy purchased. T&Cs apply. BONUS: For a limited time only, stand a chance to score over S$10,000 worth of prizes in our Grand Draw . • Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • All Expenses Paid Trip • 2D1N Staycation at any Millennium Hotels and Resorts and 15,000 My Millennium Points (worth up to S$550) Increase your chances of winning when you refer friends today. T&Cs apply.

Key Features

Enjoy cashless medical outpatient treatment in Singapore, access to emergency assistance and your travel policy documents through the FWD SG app!

Add on coverage for COVID-19 available for both Single & Annual Trips for travel period of 90 days or less.

Optional add on coverage available when your trip is cancelled for any reason for Single Trips. (To be purchased within 7 days of your initial trip deposit for your trip).

4. Singlife with Aviva Travel Insurance Extreme Sports

Bad news, adrenaline junkies. The basic plans exclude anything classified as a dangerous sport or leisure activity.

Here’s whether you’ll be covered for various outdoor activities:

Going to Turkey for a hot air balloon ride or to New Zealand for a scenic helicopter ride? You’re in the clear and will be covered.

However, if you want to ski, scuba dive or jet ski, you’ll have to purchase an optional add-on for winter or water sports.

5. Singlife with Aviva vs AIA Travel Insurance

Let’s compare the Singlife with Aviva Travel Insurance plan with AIA Around the World Plus (II), one of their key competitors.

Comparing the main benefits of Singlife with Aviva and AIA’s plans, it looks like Singlife with Aviva’s offers better value for money!

The cheapest plan from Singlife with Aviva is cheaper than AIA’s but offers similar basic benefits.

6. Singlife with Aviva Travel Insurance Promotion

All MINDEF, MHA and POGIS policyholders (as well as their family members) get 43% off Singlife with Aviva travel insurance.

What’s more, until 31 August 2022, you can shave 18% off the price of single trip travel insurance purchases with promo code TRAVEL18.

By the way, the MINDEF discount applies to immediate family members (parents, siblings, wives, kids) too. So, if your dad or brother or husband is a policyholder, you can get them to buy travel insurance for you…

If you want to find out more about Aviva’s voluntary insurance for NSmen , we’ve written about it here. It’s actually a very, very good deal.

7. Singlife with Aviva Travel Insurance Claim Review

The Singlife with Aviva plan was only launched this year, so there isn’t much information from pleased/peeved customers on the claims process.

But there have been some murmurings on the internet that the claims process takes a long while to complete.

Singlife with Aviva Travel Insurance Emergency Hotline: +65 6460 9391 (24 hour)

Singlife with Aviva Travel Insurance Online Claims : Submit here

Singlife with Aviva Travel Insurance Claims: If you need to mail the original supporting documents (write down your policy number) to Singlife with Aviva, this is the mailing address:

Singlife Travel Insurance Claims Singapore Life Ltd. 4 Shenton Way #01-01 SGX Centre 2 Singapore 068807

Singlife with Aviva Travel Insurance Claims Due Date: Claims must be made within 7 days of the event or incident. Notice the rather short time frame – the industry standard is 30 days. This is not one for procrastinators!

Singlife with Aviva Travel Insurance Claims Settlement Time: Singlife with Aviva will acknowledge your claim via email or phone call within 2 working days. If they need further clarification they will follow up within 7 working days. You can also call Singlife with Aviva’s customer service hotline at +65 6827 9933 to follow up.

8. Should I buy Singlife with Aviva Travel Insurance?

Overall, the Singlife with Aviva Travel Insurance Policy is a pretty solid one that offers good value for money.

Its main flaw is that it does not offer coverage for most extreme sports or outdoor activities, so you’ll have to purchase an add-on for that ski or dive trip.

So, if you’re a thrill-seeker, look elsewhere!

Still shopping for travel insurance ? Compare all the best travel insurance plans in Singapore here.

Related Articles

Travel Insurance Singapore Guide (2023): Must-Knows for Choosing the Best Travel Insurance

Airline Travel Insurance – What does SIA, Scoot, Jetstar travel insurance cover?

Best Travel Insurance Plans in Singapore [content outdated due to Covid]

Corporate Insurance

Insurance for small & medium enterprise, general insurance, corporate claims, about singlife.

Looking for personal insurance?

Whatever you need, we’re here for you

+65 6827 8030

Email: [email protected]

8.45am to 5.30pm

Closed on weekends and public holidays

+65 6827 9933

Email: [email protected]

+65 6460 9392

In case of emergency, please call this helpline before seeking any emergency medical assistance. This way, you’ll have greater certainty about your claim outcome.

Email: [email protected]

8.45am to 5.30pm Closed on weekends and public holidays

I'm interested!

We’re glad to know you’re interested in a better way to protect your business and your employees’ health and wellbeing with Singlife's Corporate Insurance plans. Leave your details and we’ll get back to you soon.

If you’ll like to speak to someone, you can call us at +65 6827 8030 (Mon-Fri, 8:45am to 5:30pm) or email [email protected] .

By clicking "Submit", you consent to Singapore Life Ltd. (“Singlife”) and Singlife related group of companies contacting you for the processing of the above request. You also consent to Singlife collecting, using, disclosing or transferring your personal data in this form to Singlife related companies, third party providers or intermediaries, whether located in Singapore or elsewhere, for the above purposes and for research, audit, regulatory and compliance purposes.

For details of Singlife's Data Protection Notice, please refer to singlife.com/pdpa .

Yay! Form received

We will get back to you as soon as we can.

Sorry, there seems to be a problem with this page. Please refresh and try again in a few minutes.

Singlife Travel Insurance Review

- Financially Reviewed by Edward Hee

- Published: 24 December, 2023

- Last Updated: 29 December, 2023

At Dollar Bureau, we’re committed to providing you with reliable, unbiased financial guidance. Our content is crafted by everyday Singaporeans who are trained in finance and insurance, ensuring relatable and practical guidance. We uphold strict editorial independence, regularly update our reviews, and value your feedback to keep our information accurate and relevant.

Discover more about our editorial guidelines here .

Table of Contents

Travelling somewhere can be exciting, depending on the reasons for your travelling, whether personal, business or holiday travel.

But sometimes events that are not planned can take place while you are travelling.

Singlife Travel Insurance is comprehensive and provides solutions for many scenarios of what can happen while travelling.

Keep reading for our review of the Singlife Travel Insurance.

Key Features Of Singlife Travel Insurance

Singlife offers some tremendous key features, and when considering your options, it is always important to stay informed and know what you are buying.

Below are some highlights of Singlife Travel Insurance.

Diverse Medical Coverage: Singlife Travel Insurance offers a range of medical coverage, with its Prestige tier providing unlimited overseas medical expenses.

Competitive COVID-19 Provisions: Across its tiers, Singlife offers substantial COVID-19-related benefits, including overseas medical expenses and emergency medical evacuation due to the virus.

Personal Accident Benefits: Singlife provides significant personal accident benefits, ensuring travellers are covered in case of unforeseen incidents.

Baggage and Personal Belongings Protection: Singlife offers competitive coverage for lost or damaged baggage and personal belongings, safeguarding travellers’ possessions.

Value for Money: With its range of benefits and competitive premiums, Singlife Travel Insurance offers a balanced cost-to-benefit ratio, making it a valuable choice for various travellers.

Adventure Sports Inclusion: Specifically covers adventurous water sports, extending various protections like accidental death, permanent disablement, and equipment loss or damage.

Equipment Hire Coverage: Compensates for the hiring cost of replacement water sports equipment in case of accidental loss, damage, or significant delays.

These features represent a blend of standard and unique aspects of Singlife Travel Insurance, emphasising its coverage of typical travel incidents and specific adventurous activities.

Comparison Against Other Single-Trip Travel Insurance Policies

In this section, the insurers that we’re comparing Singlife Travel Insurance against its competitors:

- AIG Travel Guard Direct

- AIA Around the World Plus (II)

- Allianz Travel Bronze

- Klook TravelCare

- MSIG TravelEasy

- NTUC Income Travel Insurance

- Sompo Travel (COVID-19) Insurance

- Etiqa TIQ Travel Insurance (with COVID-19 cover)

- FWD Travel Insurance Plan.

The basis for this comparison will be the coverage for an individual travelling to ASEAN for a week and the lowest-tiered plan across all insurers.

There will also be an add-on for COVID-19 benefits.

In comparing Singlife Travel Insurance with other insurance policies in Singapore, focusing on single-trip policies for ASEAN travel, we observe the following:

- Premium Affordability: Singlife Travel Insurance Lite, priced at $49.36, is competitively priced. It’s more affordable than AIG Travel Guard Direct Basic and AIA Around the World Plus (II) Classic, but slightly higher than Allianz Travel Bronze and Etiqa TIQ Travel Insurance Entry.

- Overseas Medical Expenses Coverage: Singlife offers a high coverage amount of $250,000, which is on par with NTUC Income Travel Insurance Classic and MSIG TravelEasy Standard, and higher than AIG, AIA, Allianz, Sompo, FWD, and Etiqa.

- Accidental Death and TPD: Singlife’s coverage of $50,000 is moderate compared to others. It’s equal to Allianz Travel Bronze but lower than AIA, Sompo, FWD, NTUC Income, MSIG, and Etiqa, which offer higher coverage in this category.

- Overseas Travel Delay Compensation: Singlife’s $500 compensation is competitive, matching Allianz and MSIG, and surpassing AIG and Etiqa. However, it’s less than AIA, Sompo, FWD, and NTUC Income.

- Trip Cancellation Coverage: Singlife provides a $5,000 coverage, which is consistent with most other insurers except AIG, which offers a lower amount.

- Baggage Delay Compensation: Singlife’s $500 is higher than FWD and Etiqa but lower than Sompo and NTUC Income. AIG and Allianz do not offer this benefit.

- Baggage Loss/Damage: Singlife’s coverage of $3,000 is standard among most plans, except for Sompo and Etiqa, which offer lower amounts. Allianz Travel Bronze does not provide this coverage.

- Cost-to-Benefit Ratio: Singlife stands out with a high cost-to-benefit ratio of 6260.13, indicating a favorable balance between cost and coverage, especially in comparison to AIG, AIA, Allianz, and Etiqa.

Comparison Against Other Annual-Trip Travel Insurance Policies

Next up, let’s compare the insurers for annual trips. (We’ve removed Sompo Travel Insurance here because they do not offer travel insurance for annual trips.)

The basis for this comparison will be the coverage for a single individual travelling to ASEAN for an annual trip and the lowest-tiered plan across all insurers.

Here’s a comparison of Singlife Travel Insurance against other annual trip policies:

- Total Premium: Singlife Travel Insurance Lite is priced at $460.00, making it a mid-range option. It’s more affordable than AIG Travel Guard Direct Basic, Allianz Travel Bronze, and NTUC Income Travel Insurance Classic, but slightly more expensive than FWD Travel Insurance Premium and Etiqa TIQ Travel Insurance Entry.

- Overseas Medical Expenses: Singlife offers a high coverage amount of $250,000, matching MSIG TravelEasy Standard and NTUC Income Travel Insurance Classic, and surpassing AIG, AIA, Allianz, FWD, and Etiqa.

- Accidental Death & TPD: Singlife’s coverage of $50,000 is lower compared to most other plans, except Allianz Travel Bronze. AIA, FWD, MSIG, NTUC Income, and Etiqa offer higher coverage in this category.

- Overseas Travel Delay Compensation: Singlife provides $500, which is on par with Allianz and MSIG, and higher than FWD and Etiqa. However, it’s less than AIA and NTUC Income.

- Trip Cancellation Coverage: Singlife, along with AIA, Allianz, MSIG, and NTUC Income, offers a $5,000 coverage, which is higher than AIG and lower than FWD.

- Baggage Delay Compensation: Singlife’s $500 is competitive, matching Allianz and MSIG, and surpassing FWD and Etiqa. NTUC Income offers a higher compensation.

- Baggage Loss/Damage: Singlife’s coverage of $3,000 is standard among most plans, except for Etiqa, which offers a lower amount. Allianz Travel Bronze does not provide this coverage.

- Cost-to-Benefit Ratio: Singlife’s ratio of 769.57 indicates a good balance between cost and coverage, especially when compared to AIG and Allianz. However, it’s lower than FWD, MSIG, NTUC Income, and Etiqa.

Who Is Singlife Travel Insurance Prestige Best Suited For:

Frequent international business travellers.

Given the comprehensive features of Singlife Travel Insurance Prestige, it is particularly well-suited for frequent international business travellers.

Here’s why:

Comprehensive Medical Coverage: Business travellers often have tight schedules and cannot afford prolonged medical disruptions.

The unlimited overseas medical expense coverage offered by Singlife ensures they receive the best medical care without worrying about costs, especially in countries with high medical expenses.

COVID-19 Considerations: Business travellers must be especially cautious about COVID-19 in the current global context.

Singlife’s substantial coverage related to the virus, including overseas medical expenses and emergency medical evacuation, provides an added layer of security.

Personal Accident Benefit: Business trips involve various modes of transportation and activities, increasing the risk of accidents.

Singlife’s significant personal accident benefit ensures that travellers are well-covered in case of unforeseen incidents.

Efficiency in Trip Disruptions: Business travellers can’t afford significant delays or cancellations.

While Singlife offers competitive coverage in these areas, its standout medical benefits ensure that health-related disruptions are addressed efficiently.

Adventure Enthusiasts And Solo Backpackers

Singlife Travel Insurance Prestige is an excellent fit for adventure enthusiasts and solo backpackers. Here’s the rationale:

Unparalleled Medical Coverage: Adventure enthusiasts often venture into remote areas or engage in activities that carry inherent risks.

The unlimited overseas medical expenses coverage by Singlife ensures that should they encounter any health issues, they can access the best medical care without being burdened by costs.

Personal Accident Benefit: Solo backpackers and adventure seekers are more exposed to unforeseen incidents, given the nature of their travels.

The substantial personal accident benefit of S$500,000 Singlife provides a safety net, ensuring they’re covered in unexpected accidents.

COVID-19 Coverage: In these times, even the most intrepid travellers need to be cautious about the pandemic.

Singlife’s comprehensive COVID-19 coverage, including medical expenses and emergency medical evacuation, offers peace of mind, allowing travellers to focus on their adventures.

Flexibility in Trip Disruptions: Solo and adventure travel often involves changing plans on the fly.

While Singlife offers competitive coverage for travel delays or cancellations, its standout medical benefits ensure that health-related disruptions are managed promptly and efficiently.

My Review of Singlife Travel Insurance

While Singlife Travel Insurance Prestige offers a compelling package, it’s essential to remember that it’s not the only policy in the market.

Every traveller’s needs are unique, and what works for one might not be the best fit for another.

To ensure you’re making the most informed decision, take a moment to explore and compare various travel insurance options.

Dive into these comprehensive guides to get a clearer picture of what’s available:

- Best Annual Travel Insurance in Singapore

- Best Travel Insurance in Singapore

You can find the perfect travel insurance tailored to your needs and adventures by comparing different policies.

So, after extensive research and comparison with other travel Insurance policies in Singapore, Singlife stands out as one of the best policies for International Business Travellers and Adventure enthusiasts.

With Singlife, your premiums are manageable, so you get value for your money, and paying for the premium does not break your bank account.

It is a competitive product and could be worth it in dire situations.

On the contrary, other insurers like Etiqa and Allianz might be more suitable plans for people with specific needs, such as pre-existing conditions.

Let’s now explore the Singlife Travel Insurance in depth:

Criteria For Singlife Travel Insurance

These requirements are essential for taking out a Singlife Travel Insurance policy.

- Have a valid NRIC or FIN

- Be at least 16 years old at the time of purchase (only required if you’re the applicant)

- Be taking a round-trip journey that begins and ends in Singapore

- Not travelling against the advice of a qualified medical practitioner

- Not travelling to obtain medical treatment

- Have purchased the policy before departing from Singapore.

Benefits Summary Cover & Limits

These detailed table illustrations provide an overview of the coverage limits across the Lite, Plus, and Prestige plans for the different sections and features of the Singlife Travel Insurance policy.

For Singlife Travel Insurance, these are the general summary benefits as a quick guide.

Premiums Rates

Here are the prices for both single trip (7 days) & annual plans for ASEAN and Global coverage for a 25-year-old Singaporean.

Prices are before any discounts.

Benefits Explained for Singlife Travel Insurance

Section 1a: accidental death, permanent disablement & burns benefit, what is covered.

- If you suffer an accidental injury during your trip, Singlife Travel Insurance provides coverage. This includes accidental death, permanent disablement, and burns.

- The assessment of burns is based on the Rules of Nines system.

- The total compensation for an accident won’t exceed 100% of the policy limit under this section.

- For children and individuals above 70 years, the benefit is reduced to 20% of the maximum amount.

- In case of multiple claims (Sections 1a, 1b, or 1c) from the same event, the policy pays under one section only.

- The benefit is paid to you or your legal representative.

What is Not Covered

- Claims for illness, disease, nervous shock, naturally occurring conditions, or degenerative processes are not covered.

- Any exclusions mentioned in the General Exceptions of the policy.

- The policy does not cover any claim related to war if you were directly or indirectly involved in the acts, except for self-protection.

- Coverage ceases 60 days after the initial outbreak of war.

- Claims for accidental injury while on public transport are covered if the accident is the sole cause of death.

Section 1B: Accidental Death & Permanent Disability Due to War

- Singlife Travel Insurance provides coverage if you suffer death or permanent disablement due to war during your trip.

However, there are specific conditions for this coverage:

- You must prove that you were not involved in the war-related acts, directly or indirectly, except for actions taken to protect yourself and your property.

- The country where the incident occurs should not be in a state of war upon your arrival; it should not be your home country or the country you reside in.

- This coverage is only applicable if it’s less than 60 days after the initial outbreak of war.

The policy does not cover accidental death or permanent disability that occurs while you are on board public transport during your trip if the accident is not the sole cause of death or disability.

Section 1C: Double Indemnity for Death in Public Transport

- Singlife Travel Insurance offers double indemnity if you suffer accidental injury leading to death while on board public transport during your trip. This coverage applies if the accident is the sole cause of your death.

Special Conditions

The special conditions and exclusions under Section 1A – Accidental Death, Permanent Disablement, and Burns Benefit also apply to this section.

These include the following:

- The total compensation for an accident does not exceed 100% of the policy limit under Section 1A.

- Reduced benefits for children insured under a family package and individuals above 70.

- The policy pays under only one of Sections 1A, 1B, or 1C for claims resulting from the same event.

The exclusions under Section 1A also apply here.

- Claims related to illness, disease, nervous shock, naturally occurring conditions, or degenerative processes.

- Additionally, any exclusions mentioned in the General Exceptions of the policy are applicable.

Section 2: Family Assistance Benefit

- For those with the Prestige Plan, Singlife Travel Insurance offers a lump sum benefit if you suffer an accidental injury during your trip, which solely causes your death within 6 months of the incident.

- The benefit for this claim will be paid to your legal representative or as per the applicable law.

- The exclusions under Section 1A – Accidental Death, Permanent Disablement, and Burns Benefit also apply to this section.

Exclusions:

Section 3: Child Education Benefit (only applies to Prestige Plan)

Under the Prestige Plan , Singlife Travel Insurance offers a unique benefit in the event of your death:

- A yearly payment of S$5,000 is made on the anniversary of your death for up to 5 years.

- This benefit is applicable as long as the child qualifies under the policy’s definition of a “Child.”

- For children above 18 years old, you must provide annual proof that the child is a full-time student in a recognised higher education institution and is unmarried.

- The payment is S$5,000 per year, regardless of the number of children.

- The exclusions under Section 1A – Accidental Death, Permanent Disablement, and Burns Benefit apply here. These include claims related to illness, disease, nervous shock, naturally occurring conditions, or degenerative processes.

- The benefit is not payable if the insured person is a child covered under the policy.

Section 4: Emergency Medical Cover

Overseas Medical Expenses: If you suffer an accidental injury or illness during your trip and require medical treatment outside of Singapore, Singlife Travel Insurance covers:

- Any reasonable medical treatment costs by a doctor, including rescue services to the necessary hospital, are covered.

- As certified by a doctor, there are necessary and reasonable extra charges for standard room accommodation if you extend your stay beyond the intended return date.

- Additional travel expenses (air, sea, or land) to return home if your return ticket cannot be used are covered.

Emergency Medical Evacuation: If you suffer a severe injury or serious illness overseas and it is medically necessary to move you to the nearest registered medical facility or return to Singapore for medical treatment, Singlife will cover:

- Necessary and reasonable transportation costs and en-route medical care and supplies, including the assignment of a doctor and/or nurse to accompany you.

- The cost of returning you home should you need to return to Singapore for recuperation or continued treatment, and your return ticket cannot be used.

Overseas Emergency Medical Expenses – Pregnancy Related: Singlife will cover emergency medical treatment outside Singapore related to pregnancy or childbirth, provided the expected delivery date is more than 12 weeks (or 16 weeks in the case of multiple pregnancies) before your planned return date.

Medical Expenses in Singapore

- Follow-up Treatment: Singlife Travel Insurance covers follow-up medical treatment within 31 days of your return to Singapore if the initial treatment occurred during your trip.

- Treatment for Untreated Injuries/Illnesses : If you didn’t seek treatment during your trip, Singlife covers medical treatment within 5 days of your return to Singapore, up to a maximum of 31 days from the initial treatment in Singapore.

Mobile-Aid Reimbursement

- Singlife reimburses the reasonable costs of medically necessary equipment and aids (like crutches, wheelchairs, and walkers) for your recovery and mobility, recommended by your doctor, following your medical treatment.

Chiropractor and/or Chinese Physician Treatment (Registered)

- Overseas Treatment : If you suffer an accidental injury or illness during your trip and receive outpatient medical treatment from a registered Chiropractor or Chinese Physician, Singlife covers the treatment.

- Follow-up Treatment: This includes follow-up treatment within 31 days of returning to Singapore if the initial treatment occurred during your trip.

- Treatment for Untreated Injuries/Illnesses: Coverage also includes treatment within 5 days of returning to Singapore for injuries/illnesses not treated during the trip, up to 31 days from the initial treatment in Singapore.

- Certification Requirement: The Chiropractor or Chinese Physician must be officially certified and registered in the country of treatment and not related to you or anyone you are travelling with.

Emergency Telephone Charges

- Singlife will cover telephone charges incurred for contacting them or their appointed Medical Emergency Assistance provider for emergency medical assistance. This is applicable when a medical claim is submitted under Section 4a, 4b, 4c, 4d, or 4f. You must provide telephone bills for reimbursement.

Special Conditions for Emergency Medical Cover

- Mandatory Notification: You must immediately call Singlife’s Medical Emergency Assistance helpline at +65 6460 9391 if you require hospitalisation or need to return to Singapore for medical reasons. Failure to do so may affect your claim.

- Medical Necessity for Movement: If Singlife’s appointed Medical Emergency Assistance provider deems it medically necessary to move you to the nearest registered medical facility or return to Singapore for treatment, and you choose not to follow this advice, Singlife’s liability for your medical care ends immediately.

- Specialist & Physiotherapist Costs: Singlife covers the necessary and reasonable costs of treatment by a specialist or physiotherapist, but only if such treatment is deemed necessary and has been referred by a general practice doctor. The specialist or physiotherapist must not be related to you or anyone you are travelling with.

- Determination of Transportation and Location: The means of transportation and the location to which you will be transported will be determined by Singlife’s Medical Emergency Assistance provider, based on the medical necessity and severity of your condition.

Exclusions for Emergency Medical Cover

- Travel Against Medical Advice : Any claim related to a medical condition if you travelled against the advice of a doctor or would have been advised against travelling had you sought such advice.

- Pre-Planned Medical Treatment: Claims arising from medical conditions for which you planned to receive treatment during your trip.

- Coverage by Other Sources: Claims already covered by other insurance, government, or corporate schemes. Singlife will only cover the portion of medical expenses not recoverable from these sources.

- Specific Non-Covered Costs:

- Costs of in-patient hospital treatment or early return home that were not pre-approved by Singlife’s Medical Emergency Assistance provider.

- Costs of non-emergency treatment or surgery, including exploratory tests not directly related to the illness or injury necessitating hospitalisation.

- Any treatment that the treating doctor and Singlife’s Medical Emergency

- Cosmetic surgery and cosmetic products.

- Medication is known to be needed from the start of the trip.

- Unprescribed medicines or supplements.

- Medical equipment or treatment not recommended by a doctor.

- Extra cost for single or private room requests.

- Treatment/services by health spas, convalescent homes, or rehabilitation centres.

- Costs after deciding not to move hospital or return to Singapore when it was safe to do so.

- Claims resulting from tropical diseases without recommended inoculations/medication.

- Sexually transmitted infections, HIV/AIDS, or related illnesses.

- Claims resulting from pregnancy or childbirth (except under specific sections).

- General Exceptions as mentioned in the policy.

Special Conditions:

You must call Our Medical Emergency Assistance helpline at +65 6460 9391 immediately if you need medical attention as a hospital In-Patient or need to return to Singapore.

The special conditions of the Singlife Travel Insurance policy regarding medical emergencies can be summarised as follows:

- Immediate Contact Required: If you require hospitalisation or need to return to Singapore for medical reasons, you must immediately contact the Medical Emergency Assistance helpline. Failure to do so may affect your claim.

- Compliance with Medical Necessity: If the appointed Medical Emergency Assistance provider deems it medically necessary for you to be moved to the nearest registered medical facility or to return to Singapore for treatment, and you choose not to follow this advice, Singlife’s liability for your claim will end immediately.

- Coverage for Specialist or Physiotherapist Costs: Singlife will cover the necessary and reasonable costs of medical treatment by a specialist or physiotherapist. However, this is contingent on the required treatment and having been referred by a general practice doctor. Additionally, the specialist or physiotherapist must not be someone related to you or your travel companions.

- Determination of Transportation & Location: The method of transportation and the destination for medical treatment will be determined by the Medical Emergency Assistance provider. This decision will be based on the medical necessity and the severity of your medical condition.

These conditions highlight the importance of following the guidelines set by Singlife’s Medical Emergency Assistance provider to ensure coverage and support in case of a medical emergency during your travels.

This summary provides an overview of the Emergency Medical Cover section of the Singlife Travel Insurance policy.

The exclusions under Section 1A – Accidental Death, Permanent Disablement, and Burns Benefit apply here. Additionally, any exclusions mentioned in the General Exceptions of the policy are applicable.

For a detailed understanding of the coverage and exclusions, especially those related to general exceptions, it’s recommended to refer to the full policy document and the General Exceptions section.

Section 5: Accidental Dental Expenses

Accidental Dental Expenses While Overseas

- Suppose you accidentally injured your sound and natural teeth during your trip. In that case, Singlife will cover the necessary and reasonable costs for emergency pain relief dental treatment received overseas.

Accidental Dental Expenses in Singapore

- Singlife will also cover necessary and reasonable emergency pain relief dental treatment in Singapore.

- If you had initial dental treatment during your trip, Singlife covers follow-up accidental dental treatment to restore your sound and natural teeth within 31 days of your return to Singapore.

- Suppose you did not seek initial treatment during your trip. In that case, Singlife covers dental treatment to restore your sound and natural teeth within 5 days of your return, up to 31 days from the initial treatment in Singapore.

- Dental treatment resulting from tooth, gum, oral disease or regular teeth wearing.

- Dental expenses related to unnatural teeth, including but not limited to dental dentures, implants, crowns, and bridges.

- Any exclusions mentioned in the General Exceptions section of the policy.

This information is tailored to help you understand the specific coverage and exclusions under the Accidental Dental Expenses section of the Singlife Travel Insurance policy.

Section 6: Hospital Income

Overseas Hospital Income

If you are making a claim for medical expenses, which is claimable in this policy, you are being treated as an In-Patient in a hospital overseas.

We will pay the following amount for every full consecutive 24 hours of hospitalisation in a standard ward overseas.

We will pay the following amount for every full consecutive 24 hours of hospitalisation in an Intensive Care Unit (ICU) overseas.

Hospital Income in Singapore

If you are making a claim for medical expenses which is claimable in this policy and you are being treated as an in-patient in a hospital in Singapore.

We will pay the following amount for every full consecutive 24 hours of hospitalisation in Singapore.

Under the Hospital Income section of the Singlife Travel Insurance policy in Singapore, the following are not covered:

- Exclusions listed under Section 4 – Emergency Medical Cover.

Section 7: Quarantine Allowance Due to Infectious Diseases

This section applies only to the Plus & Prestige Plans.

Quarantine Allowance due to Infectious Diseases

- Overseas Quarantine Allowance:

If you are placed under quarantine by the government or relevant health authority as a result of close contact with confirmed cases of infectious disease or if you are identified as a carrier of the infectious disease, Singlife will pay you a specified amount for every full consecutive 24 hours you are detained.

The specific amounts and further details can be found in the policy document.

- Quarantine Allowance in Singapore:

Under Singlife Travel Insurance’s Plus and Prestige Plans, the policy provides coverage in the following scenario:

- If during your trip, or upon your return to Singapore, you are immediately placed under quarantine by the Ministry of Health due to close contact with confirmed cases of infectious disease, or if the Ministry of Health identifies you as a carrier of the infectious disease, Singlife will pay you a specified amount for every full consecutive 24 hours you are detained.

Exclusions for this section include

The exclusions under Section 4 – Emergency Medical Cover.

Please note that these details are based on the information available in the policy document, and it’s always advisable to consult the full policy or contact the insurer for the most accurate and up-to-date information.

What isn’t covered under Section 4 – Emergency Medical Cover.

- Anything mentioned in the General Exceptions.

Section 8: Repatriation

Calling the Emergency Assistance helpline at +65 6460 9391 for assistance is essential to activate this section. Please do so to ensure the validity of the claims.

- Repatriation of Mortal Remains: In the event of death overseas due to an accidental injury or illness incurred during the trip, the insurer will handle and cover the costs of returning the body or ashes to Singapore or the insured’s home country (if not Singaporean).

- Reimbursement of Coffin & Funeral Expenses: If death occurs within 12 months as a result of an accidental injury or illness while overseas, the insurer will cover the costs of burial or cremation in the country of death, Singapore, or the insured’s home country (if not Singaporean).

- What needs to be covered under Section 4 – Emergency Medical Cover?

- Anything mentioned in the General Exceptions

Section 9: Hospital/Compassionate Visit Expenses

Hospital Visit Expenses

Eligibility

This applies if the insured, due to an accidental injury or illness overseas that is claimable under this policy, is hospitalised for more than 5 consecutive days during the trip.

Covered Expenses

- One travelling companion who remains with or escorts the insured until the end of the insurance period or until the insured can resume the trip or return to Singapore, whichever occurs first.

- One close relative or friend, in cases where no adult travelling companion is a close relative or friend, under similar conditions as above.

What is not covered

Compassionate Visit Expenses

- In the event of the insured’s death overseas due to an accidental injury or illness during the trip.

Covered Expenses

- The insurer will cover the accommodation and travel expenses reasonably and necessarily incurred by one travelling companion, close relative, or friend. This is to assist in the final arrangements after the insured’s death and to bring the body or ashes back to Singapore or the insured’s home country (if not Singaporean).

Section 10: Child Minder

- This coverage is activated if the insured sustains death or becomes hospitalised overseas during the trip, and the situation is claimable under this policy.

- The insurer will cover additional accommodation and travel expenses for a close relative or friend of the insured. This specifically helps accompany a child (also covered under the policy) back home because no other adult is available to accompany the child.

- Any exclusions mentioned in the General Exceptions section of the policy apply to this section. Specific exclusions unique to this section are not provided in the given details. These general exceptions will be detailed later in the document.

The coverage is subject to the policy limits, which should be referenced in the full policy document for exact figures and conditions.

Section 11: Personal Liability

This section covers the insured for legal liabilities incurred due to accidents during the trip.

Specific Liabilities Covered

- Death or Injury to Any Person: If the insured is legally responsible for causing death or injury to any person during the trip, the insurer will cover the damages, claimants’ costs, and expenses.

- Loss of or Damage to Property: If the insured is legally responsible for causing loss or damage to any property during the trip, these costs are also covered.

- General Exceptions: The provided content does not detail specific exclusions unique to this section. However, any exclusions mentioned in the General Exceptions section of the policy apply to this section. These general exceptions will be detailed later in the policy document.

- Policy Limits: The coverage is subject to certain policy limits, which should be referred to in the full policy document for exact figures and conditions.

- Legal Obligations: The coverage is limited to liabilities that the insured is legally obligated to pay.

In addition to the coverage provided in Section 11, it’s important to note the specific exclusions where the insurer will not provide coverage.

These include:

- Fine or Exemplary Damages: Costs related to punishing rather than compensatory fines or damages are not covered.

- Liability from Wilful, Malicious or Unlawful Acts: Any liability resulting from the insured’s intentional, malicious, or illegal actions.

- Liability from Employment or Household Members: Liabilities arising from death or injury to employees or members of the insured’s household.

- Transmission of Illness or Disease: Any liability for transmitting any illness or disease.

- Loss or Damage to Personal Property: Damage or loss of property that belongs to, or is under the control of, the insured, their household members, or employees.

- Contractual, Employer’s Liability, or Job-Related: Contractual Liabilities related to the insured’s employer role or professional duties.

- Ownership or Occupation of Land or Buildings: Liabilities related to owning or occupying land or buildings.

- Ownership or Use of Certain Items and Animals: This includes liabilities from owning or using animals (other than domestic animals), firearms, motorised vehicles, vessels (other than manually-propelled watercraft), or any type of aircraft, including unpowered flight.

- General Exceptions: Additional exclusions are mentioned in the policy’s General Exceptions section.

These exclusions are crucial in defining the coverage boundaries provided under Personal Liability. The insured should consult the policy document to understand these exclusions and other terms and conditions.

This summary emphasises the exclusions of Section 11 of the Singlife Travel Insurance policy. Understanding these limitations is essential for policyholders to comprehend the extent of their coverage.

Section 12a: Trip Cancellation

This section covers the insured for trip cancellation expenses within the stipulated policy limits.

- Covered Costs: Includes travel (air, sea, or land) and accommodation expenses, as well as entertainment costs charged by licensed providers such as transport providers, accommodation providers, tour operators, or travel agents. These are costs that the insured has paid or is legally obligated to pay and cannot recover.

- Insured Event numbers 1 to 8: Arising within 30 days before the insured departing on their trip.

- Insured Event number 9 : Arising any time before the insured departs on their trip.

- General Exceptions: Specific exclusions unique to this section. However, any exclusions mentioned in the General Exceptions section of the policy apply to this section. These general exceptions will be detailed later in the policy document.

- Definition of Insured Events: The specific Events numbered 1 to 9 are defined elsewhere in the policy document and should be reviewed to understand what scenarios are covered under this section.

Recommendation

It is essential to consult the complete policy document to understand the full scope of the coverage, including the details of the Insured Events and the policy limits.

This summary provides an overview based on the provided details, but the policy document will offer comprehensive information.

This summary focuses on the key aspects of Section 12A regarding Trip Cancellation in the Singlife Travel Insurance policy.

- Policy Purchase Timing: The policy must be purchased more than 3 days before the trip’s departure date.

- Notification Obligation: If needing to cancel, postpone, or abandon the travel arrangement, the insured must notify the relevant service providers (like airlines, hotels, and tour operators) as soon as reasonably possible.

- Adjustment for Refunds: Any claim made under the policy will be reduced by the amount of any refund obtained from service providers, regardless of the form of the refund (cash, credit, points, or vouchers).

When filing a claim, the insured must provide proof of compensation or denial from the service providers.

- Disinclination to Travel: Claims made simply because the insured does not feel like travelling is not covered.

- Pre-Planned Medical Treatment: Claims arising from a medical condition that the insured planned to get treatment for during the trip are excluded.

- Timeshare-Related Costs: Claims for management, maintenance, or exchange fees associated with timeshares and similar arrangements are not covered.

- Refunds for Unnamed Persons: Claims for refunds of costs for persons not named in the policy are not covered.

- Failure to Notify: Claims resulting from the insured’s or an adult insured person’s failure to notify the airline, transport provider, licensed tour operator, or licensed travel agent immediately when it becomes necessary to cancel, postpone, or abandon the travel arrangements.

- Overlapping Claims: If a claim under Sections 12a (Trip Cancellation), 12b (Trip Cancellation For Any Reason), 13a (Trip Postponement), 13b (Change of Travelling Date or Time For Any Reason), and 14 (Replacement Traveller) arises from the same event, the policy will only pay under one of these sections.

This includes claims related to COVID-19 under the Free Extension (h) – COVID-19 Cover.

General Exceptions: Any exclusions mentioned in the General Exceptions section of the policy also apply.

These exclusions define the coverage boundaries provided under the respective sections of the Singlife Travel Insurance policy, emphasising the circumstances under which claims will not be considered.

Section 12b: Trip Cancellation For Any Reason

In addition to the coverage provided in Section 12A (Trip Cancellation), it’s important to note specific exclusions where the insurer will not provide coverage.

These exclusions apply to related sections as well, including Trip Cancellation for Any Reason (12b), Trip Postponement (13a), Change of Travelling Date or Time for Any Reason (13b), and Replacement Traveller (14).

- Disinclination to Travel: No coverage is provided for claims made because the insured feels they need to do something other than travel.

- Pre-Planned Medical Treatment: Claims resulting from a medical condition for which the insured was planning to receive medical treatment during the trip are excluded.

- Timeshare-Related Costs: Claims for management, maintenance, or exchange fees associated with timeshares and similar arrangements are not covered.

- Refund for Uninsured Persons: No coverage for a refund of costs for persons not named in the policy.

- Failure to Notify: Claims arising from the insured’s or an adult insured person’s failure to promptly notify the airline, transport provider, licensed tour operator, or travel agent of the need to cancel, postpone, or abandon travel arrangements.

- Overlapping Claims: Where a claim made under Sections 12a, 12b, 13a, 13b, or 14 arises from the same event, the policy will only pay under one of these sections.

This includes Trip Cancellation/Postponement Due to COVID-19 under the Free Extension (h) – COVID-19 Cover.

General Exceptions

Additional exclusions are mentioned in the policy’s General Exceptions section.

These exclusions define the limitations of the coverage provided under the respective sections of the Singlife Travel Insurance policy.

The insured should thoroughly consult the complete policy document to understand these exclusions and other terms and conditions.

Policyholders must understand these limitations to comprehend the extent of their coverage under the Trip Cancellation and related sections of their travel insurance policy.

The Singlife Travel Insurance plan in Singapore has certain exclusions under its trip cancellation benefit. These include:

- Cancellations due to a change of mind or no longer wanting to travel.

- Non-serious illnesses or injuries (e.g. headache).

- Trip cancellations arising from work obligations.

- Failure to notify your airline, transportation provider, tour operator, or licensed travel agent of the cancellation.

Common general exclusions include

- Pre-existing medical conditions.

- Mental disorders.

- Loss or injury due to alcohol/drugs.

- Pregnancy-related events, unless the mother is at risk.

- Travelling when medically unfit.

- Participation in professional or compensated sports.

- Items taken by customs officials.

- Travelling against the advice of regulatory authorities.

- Travelling to a country at war.

- Claims paid for by other insurers.

Please note that this information provides a general overview and may not cover all specific policy details.

Section 13a: Trip Postponement

- Scope : This section covers the insured’s costs for postponing their trip within the stipulated policy limits.

- Covered Costs: Includes reasonable administrative fees, additional travel expenses (air, sea, or land), accommodation, and entertainment costs charged by licensed providers (transport providers, accommodation providers, tour operators, or travel agents) that the insured must pay.

- Eligibility for Claims: Coverage is applicable if the insured unavoidably needs to postpone the trip due to the following:

General Exceptions:

The provided content does not detail specific exclusions unique to this section.

However, any exclusions mentioned in the General Exceptions section of the policy apply to this section.

These general exceptions will be detailed later in the policy document.

- Definition of Insured Events: The specific Events numbered 1 to 9 are presumably defined elsewhere in the policy document and should be reviewed by yourself to thoroughly understand what scenarios are covered under this section.

Consult the complete policy document for a comprehensive understanding of the coverage, including the details of the Insured Events and the policy limits.

This summary highlights the key aspects of the coverage for Trip Postponement in the Singlife Travel Insurance policy. Always refer to the full policy document for detailed and complete information.

- Specific Exclusions for Sections 12a, 12b, 13a, 13b, and 14

- Exclusions under Trip Cancellation (Section 12a): The exclusions specified in the Trip Cancellation section also apply to Trip Postponement.

- Upgraded Travel or Accommodation: Additional costs resulting from choosing better options or upgrading to a higher class or category of transport or accommodation than initially planned are not covered.

- Costs Beyond Original Itinerary: Extra travel, accommodation, and entertainment costs not included in the original itinerary are not covered.

- Overlapping Claims: If a claim under Sections 12a, 12b, 13a, 13b, or 14 arises from the same event, the policy will only pay under one of these sections. This includes claims related to COVID-19 under the Free Extension (h) – COVID-19 Cover.

- General Exceptions: Any exclusions mentioned in the General Exceptions section of the policy apply.

These exclusions are crucial for defining the limitations of the coverage provided under the respective sections of the Singlife Travel Insurance policy.

Policyholders must understand these limitations to comprehend the extent of their coverage under the Trip Postponement and related sections of their travel insurance policy.

Section 13b: Change of Travelling Date or Time For Any Reason

Section 14: replacement traveller (for business travel only).

This section applies only to the Plus and Prestige Plans of the policy.

Here are the key details:

Coverage :

This section covers reasonable administrative fees, additional travel (air, sea, or land), accommodation costs, and Entertainment Costs charged by licensed providers such as transport providers, accommodation providers, tour operators, or travel agents.

These costs are covered when they are incurred to replace one traveller to take over a business trip.

This coverage is applicable if, after purchasing the policy or booking a trip (whichever is later), the insured unavoidably has to cancel their trip due to any of Insured Event numbers 1 to 4 arising within 30 days before departing on the trip.

Exclusions :

The policy does not cover extra costs from selecting better options or upgrading to a better class or category of transport or accommodation than the original itinerary.

It also excludes extra travel, accommodation, and entertainment costs as part of the original itinerary.

Claims for personal trips, more than one replacement traveller per insured person, and claims under Section 12a – Trip Cancellation, Section 12b – Trip Cancellation For Any Reason, Section 13a – Trip Postponement, Section 13b – Change of Travelling Date or Time For Any Reason, and Section 14 – Replacement Traveller arising from the same event will only be paid under one of these sections.

This includes Trip Cancellation/Postponement due to COVID-19 under the summary of cover, Free Extensions (h) – COVID-19 Cover. Additionally, anything mentioned in the General Exceptions is not covered.

Special Conditions:

The policy advises referring to the ‘Special conditions’ under Section 12a – Trip Cancellation for more details.

The insurer will pay for reasonable economy-class transport (air, sea or land travel) and reasonable accommodation expenses of a standard room for your replacement traveller.

Policy Limits: The maximum amount payable per insured per trip under this section is S$5,000 for the Plus plan and S$15,000 for the Prestige plan.

The exclusions under Section 14 – Replacement Traveller (For Business Travel Only) in the Singlife Travel Insurance Policy are as follows:

Upgrading Costs: The policy does not cover any extra costs that result from selecting better options or upgrading to a higher class or category of transport or accommodation than what was included in the original itinerary.

Non-Included Costs : Any extra travel (air, sea, or land) and accommodation costs, as well as Entertainment Costs that are not part of the original itinerary, are not covered.

Personal Trips: Claims related to personal trips are excluded from this coverage.

Limit on Replacement Travellers: The policy does not cover claims for more than one replacement traveller per insured person.

Overlap with Other Sections: If a claim is made under Section 12a – Trip Cancellation, Section 12b – Trip Cancellation For Any Reason, Section 13a – Trip Postponement, Section 13b – Change of Travelling Date or Time For Any Reason, and Section 14 – Replacement Traveller, and these claims arise from the same event, the policy will only pay for the claim under one of these sections.

This includes Trip Cancellation/Postponement due to COVID-19 under the summary of cover, Free Extensions (h) – COVID-19 Cover.

- General Exceptions: Any exclusions mentioned in the General Exceptions of the policy also apply to this section.

These exclusions are essential when understanding the scope and limitations of the Replacement Traveller coverage under the Singlife Travel Insurance Policy.

Section 15: Trip Interruption

This section applies to Plus and Prestige Plans.

- Unused travel (air, sea, or land), accommodation costs, and Entertainment Costs charged by the licensed provider (such as transport provider, accommodation provider, tour operator, or travel agent) that the insured has paid or is legally obligated to pay for the trip and cannot get back.

- Any additional administrative expenses incurred when it is possible to amend the original travel expenses (air, land, or sea) and accommodation.

- Any additional travel economy-class transport expenses (air, land, or sea) that the insured must pay if it is impossible to amend the original travel expenses.

- This coverage is applicable if, after the commencement of the trip, the insured unavoidably has to:

- Cut short the trip and return to Singapore, or

- Change any part of the trip’s original itinerary due to any of the Insured Events.

- Extra costs result from selecting better options or upgrading to a better class or category of transport or accommodation than the original itinerary.

- Extra travel and accommodation costs and Entertainment Costs are not included in the original itinerary.

Where a claim under Section 15 – Trip Interruption and Section 16 – Travel Delay arises from the same event, Singlife will only pay for the claim under one of these sections. This includes Trip interruption due to COVID-19 under the summary of cover, Free Extensions (h) – COVID-19 Cover.

Anything mentioned in the General Exceptions (which will be covered later on). Special Conditions: The policy advises referring to the ‘Special conditions’ under Section 12a – Trip Cancellation for more details.

- Medical Condition Against Doctor’s Advice: Any claim for a medical condition if any insured person has travelled against the advice of a Doctor or would be travelling against the advice of a Doctor if they had sought such advice.

- Lack of Authorisation by Emergency Assistance Provider: Any claim not authorised by Singlife’s Emergency Assistance provider before the insured returns home.

- Tropical Diseases Without Recommended Precautions: Any claim resulting from a tropical disease where the insured has not had the recommended inoculations and/or taken the recommended medication.

- No Return Ticket to Singapore: Any claim for additional travelling expenses if the insured failed to book a return ticket to Singapore before departing.

- Abandonment of Trip Due to Cancellation by Service Providers: Any claim for trip abandonment due to cancellation by the airline, accommodation, or tour operator, except in cases of the airline’s insolvency, licensed tour operator, or travel agent.

- Costs Outside of Travel Assistant or Emergency Medical Assistance: Any claim for costs not part of Travel Assistant or Emergency Medical Assistance instructions.

- Upgrading Costs: The policy does not cover extra costs that result from selecting better options or upgrading to a higher class or category of transport or accommodation than what was included in the original itinerary.

- Non-Included Costs: Any extra travel (air, sea, or land) and accommodation costs, as well as Entertainment Costs that are not part of the original itinerary, are not covered.

- Overlap with Travel Delay: If a claim under Section 15 – Trip Interruption and Section 16 – Travel Delay arises from the same event, Singlife will only pay for the claim under one of these sections. This includes Trip interruption due to COVID-19 under the summary of cover, Free Extensions (h) – COVID-19 Cover.

These exclusions are crucial for understanding the limitations of the Trip Interruption coverage under the Singlife Travel Insurance Policy.

Section 16: Travel Delay

Coverage : Singlife will pay S$100 for every full consecutive 6-hour period the insured is delayed from the scheduled time of arrival if

- The scheduled Public Transport the insured is booked to travel on is delayed from the scheduled time of departure or

- The insured is denied boarding of the Public Transport for which a confirmed reservation has been received from the travel agent or operators of the scheduled Public Transport due to overbooking or

- The scheduled Public Transport the insured is booked to travel on is diverted, preventing the continuation of the scheduled trip and causing a delay in arriving at the planned destination.

There must be no other travel arrangement made available to the insured by the travel agent or operators of the scheduled Public Transport within 6 hours of the scheduled departure, and the insured must not cause the delay.

The insured must do everything possible to reach the departure point for the time specified on their ticket/itinerary.

The length of the delay is calculated from the date and time the scheduled Public Transport should have arrived until the actual arrival time.

Written confirmation from the carrier or their handling agents of the exact date and time of arrival and the reason for the delay is required.

- Any claim caused by an event (including Catastrophe, strike, riot, or civil commotion) that existed, was planned or occurred before the insured bought the policy or booked the trip, whichever is later.

- According to the original itinerary, the insured should have checked in for the Public Transport.

- Any claim for management, maintenance, or exchange fees associated with timeshares and similar arrangements.

- Any claim if the insured fails to follow the carrier’s revised departure schedule.

- Where a claim under Section 15 – Trip Interruption and Section 16 – Travel Delay arises from the same event, Singlife will pay the claim under only one of the sections.

This includes Trip interruption due to COVID-19 under the summary of cover, Free Extensions (h) – COVID-19 Cover. Where a claim under Section 16 – Travel Delay and Section 23 – Hijack, Hostage, and Mugging arises from the same event, Singlife will pay the claim under only one of the sections.

Anything not mentioned in the General Exceptions.

Section 17: Rainfall Protection

- Singlife will pay a certain amount per insured person if the accumulated rainfall level in the city of the trip destination is more than 6.4 mm for each full 24-hour period and more than 50% of the trip duration is affected due to this rainfall level.

- Under the Family Package policy, Singlife will only pay up to 2 insured adults.

The specific amounts are:

- The Period of Insurance of the Single Trip policy must be at least 3 or more days.

- To claim under this section, full details of the trip, including the country and city, must be submitted. Only one city per day can be declared in the claim submission.

- No claims are applicable if the trip falls under an Annual Multi-trip policy.

- No claims for a child under the Family Package policy.

Exclusions:

Anything mentioned in the General Exceptions (which will be covered later on).

- Any claim if your trip falls under an Annual Multi-trip policy.

- Any claim for a Child under the Family Package policy.

Section 18: Delayed Baggage

Delayed Baggage in the Singlife Travel Insurance Policy, the following exclusions apply:

- To claim under this section, the insured must obtain written confirmation from the carrier on the number of hours they were without their baggage and the reason for the baggage delay.

- Compensation will only be provided for the delay of one piece of checked-in baggage tagged under the insured’s name per incident.

- The policy will only pay for either (a) up to S$200 for every full consecutive 6-hour period the baggage is delayed overseas or (b) S$150 after 6 hours of delay upon the insured’s return to Singapore, but not for both for the same event.

- Any payment made under this section will be deducted from the amount payable under Section 19 – Loss or Damage of Baggage & Personal Belongings if the baggage is later proved to be permanently lost.

- Baggage claims delayed or detained by customs or other officials are not covered.

- These exclusions ensure that the policy covers only specific scenarios of delayed baggage and sets clear boundaries on the claims process and compensation.

Delayed Baggage of the Singlife Travel Insurance Policy, the following are not covered:

- Baggage Delayed or Detained by Customs or Other Officials: Any baggage claim delayed or detained by customs or other officials is not covered.

- General Exceptions: Any exclusions mentioned in the policy’s General Exceptions also apply to this section.

Additionally, there are some special conditions related to claims under this section:

- To claim, you must obtain written confirmation from the carrier on the number of hours you were without your baggage and the reason for the baggage delay.

- The policy will only pay for the delay of at most one piece of your checked-in baggage tagged under your name per incident.

- The policy will only pay for the baggage delay overseas or upon your return to Singapore, but not for both for the same event.

Section 19: Loss or Damage of Baggage & Personal Belongings

This section covers the insured for loss, theft, or accidental damage of valuables and personal money during the trip, subject to the policy limits.

The coverage is available under the Plus and Prestige Plans of the policy.

- Suppose personal belongings or baggage are lost or damaged by an authority, transport company, airline, or hotel. In that case, the insured must report the loss or damage to them in writing, obtain written confirmation, and get a loss or damage report.

- The insured should submit a claim to the responsible authority or service provider first and provide proof of compensation or denial received from them to Singlife.

- All travel tickets and tags must be kept if a claim is made under this policy.

- The insured must be able to prove ownership and the value of the lost, stolen, or damaged items. Please show proof to ensure the claim is valid.

- Singlife will settle claims by payment or replacement based on the value of the items at the time of loss. They will not pay more than the original purchase price of any lost or damaged item.

- If a claim has also been made under Section 18 – Delayed Baggage, and the baggage is

- later proved permanently lost, the amount will be deducted from the claim under this section.

- Loss or theft of personal belongings or baggage left unattended.

- Damage to fragile items like glass, china, musical instruments, contact lenses, medical and dental fittings.

- Wear and tear, inherent defects, loss of value, and damage caused by moths, vermin, or any cleaning, repairing, or restoring process.

- Loss of fruits, perishables, consumables, animals, motorised vehicles and their accessories, remote-controlled devices, drones, sports equipment, and personal mobility devices damaged while used.

- Loss, theft, or accidental damage to items used in connection with the insured’s job, which they do not own.

Please note that this summary is based on the information provided in the Singlife Travel Insurance Policy document and is intended for informational purposes only.

Section 20: Loss of Valuables or Personal Money

Singlife will cover loss, theft, or accidental damage of valuables and personal money during the trip within the stipulated policy limits.

- For the Prestige Plan , the coverage is up to S $3,000 per insured person (but no more than S$500 for cash or bank notes)

- For the Plus Plan , it’s up to S$750 per insured person (but no more than S$300 for cash or bank notes).

- The Lite Plan is not covered under this section.

General Exceptions: Any exclusions mentioned in the policy’s General Exceptions also apply.

These will be covered later on.

Loss of Valuables or Personal Money of the Singlife Travel Insurance Policy, the following exclusions apply specifically to this section:

- Loss or Theft of Unattended Personal Money or Valuables : Singlife does not cover the loss or theft of personal money or valuables you left unattended.

- Cracking, Scratching, or Breaking of Fragile Items: The policy does not cover cracking, scratching, or breaking of glass (except lenses in cameras, binoculars, telescopes, or spectacles), china, or any fragile articles.

- Scratching, Denting, Chipping, or Defacing: Any such damage is not covered.

- Wear and Tear, Inherent Defects: Loss of value and damage caused by moths and vermin, or any process of cleaning, repairing, or restoring are not covered.

- Delayed, Detained, or Confiscated by Customs or Other Officials: Any personal money or valuables that are delayed, detained, or confiscated by customs or other officials are not covered.

- Any items not listed under Personal Money or Valuables such as bonds, securities, credit cards, identity cards, driving licenses, passports or travel documents.

- Any business goods, samples/prototypes, equipment of any kind or any products/ components meant for trade.

- Deliberate or malicious damage to, or loss of, your Personal Money or Valuables caused by you or someone you know.

- Any amount for loss or damage that you can claim against the airline, transport company, hotel or carrier.

- Any amount for loss or damage resulting from your willful act, omission, negligence, recklessness or carelessness.

- Any loss or damage to items not belonging to You.

- Any loss of items resulting from mysterious disappearance.

- Shortages due to a mistake or loss due to a change in exchange rates.

Section 21: Loss of Passport or Travel Documents

Under Section 21 of the Singlife Travel Insurance Policy, which covers the loss of passport or travel documents, the insurer provides coverage within the stipulated policy limits if your passport and other travel documents are lost or stolen while abroad.

This includes covering the administrative fees required to get a replacement passport or other travel documents for your trip, any additional economy-class transport expenses (air, land, or sea), and reasonable accommodation expenses of a standard room incurred solely to replace your passport or other travel documents.

- Loss or theft of passport and other travel documents you left unattended.

- Singlife Travel Insurance does not cover passports and other travel documents that are delayed, detained, or confiscated by customs or other officials.

- Deliberate or malicious damage to, or loss of, your passport and other travel documents caused by you or someone you know.

- This travel insurance does not cover any amount for loss, theft, or damage against the airline, transport company, hotel, or carrier.

- Any transport or other incidental costs incurred while obtaining the replacement passport or travel document in Singapore.

- Any amount for loss, theft, or damage resulting from your willful act, omission, negligence, recklessness, or carelessness.

- Anything mentioned in the General Exceptions of the policy.

These exclusions are important when assessing your coverage under this policy section.

This section applies exclusively to the Prestige Plan.

- The loss must be reported to the credit card issuer within 24 hours of the robbery, burglary, or theft.

- Any claim must be accompanied by a report issued by the credit card issuer evidencing the amount of loss and confirming your liability for the loss.

- Singlife will only pay for such unauthorised charges, for which you are made liable, under the terms and conditions of your credit card(s).

- These exclusions and conditions are crucial for understanding the coverage limitations under this Singlife Travel Insurance Policy section.

Additionally, special conditions are to be met for a claim under this section.

Section 22: Unauthorised Use Of Credit Card

This section is specifically applicable to the Prestige Plan.

Here’s a summary of what is covered and what is not covered under this section:

What is Covered:

Financial Loss Due to Fraudulent Use:

The policy covers financial loss resulting directly from the fraudulent use of your credit cards. This coverage is applicable if the loss of the credit card(s) occurs due to robbery, burglary, or theft during your trip.

Conditions for Coverage:

- The loss must be reported to the credit card issuer within 24 hours of the incident.

- Any claim must be supported by a report from the credit card issuer, showing the amount of loss and confirming your liability.

- The policy covers unauthorised charges for which you are liable under the terms and conditions of your credit cards.

What is Not Covered:

- Loss or Theft of Unattended Credit Card: If the credit card was left unattended at the time of loss or theft, it is not covered.

- Losses Due to Willful Acts or Negligence: Any loss, theft, or damage resulting from your willful act, omission, negligence, recklessness, or carelessness is not covered.

- Non-Registered Credit Cards: Financial loss from credit cards not registered under your name is not covered.

- Cash Advances: Any cash advances made with your stolen credit card(s) are not covered.

- General Exceptions: Any scenarios mentioned in the General Exceptions of the policy are not covered.

This section provides protection against the unauthorized use of credit cards during travel, under specific conditions and exclusions, ensuring a level of financial safety for travelers under the Prestige Plan.

Section 23: Hijack, Hostage, & Mugging

Under Section 23 of the Singlife Travel Insurance Policy, which covers Hijack, Hostage, and Mugging, the insurer provides coverage within the stipulated policy limits.

The policy pays S$250 for each full 24-hour period if:

- You cannot reach your destination or cannot return to Singapore as a result of the transport on which you are travelling being hijacked or you being taken as a hostage.

- You are in the hospital receiving in-patient treatment required following a mugging.

Specific Exclusions:

Additionally, there are special conditions for a claim under this section:

- You must report the mugging to the local police within 24 hours and obtain a written police report.

- In cases where a claim under Section 16 (Travel Delay) and Section 23 (Hijack, Hostage, and Mugging) arises from the same event, Singlife will pay the claim under only one of the sections.

- These exclusions and conditions are crucial for understanding the coverage limitations under this Singlife Travel Insurance Policy section.

Section 24: Rental Vehicle Excess

Under Section 24 of the Singlife Travel Insurance Policy, which covers Rental Vehicle Excess, the insurer provides coverage within the stipulated policy limits for excess or deductible amounts that you become legally liable to pay regarding loss or damage to a rented vehicle during your trip.

This coverage is contingent on the loss or damage the rented vehicle’s insurance policy covers.

- Singlife doesn’t cover any loss or damage arising from operating the rented vehicle beyond the limits of any public roads.

- Any loss or damage while the rented vehicle is not in your custody and control.

- Any loss or damage if you were not licensed to drive the rented vehicle or were participating in or practising for speed or time trials.

- Any loss or damage arising from wear and tear, gradual deterioration, damage from insects or vermin, inherent vice, latent defect, or damage.

- Any claim for loss or damage to the rented vehicle occurring outside the vehicle rental period or the Period of Insurance.

Additionally, there are special conditions to be met for a claim under this section:

- You must be either a named driver or a designated driver of the rented vehicle, and the vehicle must be rented from a licensed vehicle rental business.

- As part of the hiring arrangement, you must take up all comprehensive motor insurance against loss or damage to the rented vehicle during the rental period.