Cards, Loans & Savings

Car & home insurance, pet insurance, travel insurance, travel money card, life insurance.

Travel insurance with medical cover

Retrieve saved details

Underwritten by Great Lakes Insurance UK Limited

What is medical cover?

Let’s be honest, when you’re relaxing on holiday, the last thing on your mind is falling ill or getting injured. Sadly, accidents can happen and it’s important you have the right travel insurance. That’s why we include medical cover as standard with all our travel insurance policies. It can help pay medical bills if something goes wrong while you’re abroad.

With Sainsbury Bank Travel Insurance, you’ll also get:

- A discount of up to 20% if you’re a Nectar member *

- Access to a 24-hour helpline for medical emergencies while you’re away

- Unlimited medical expenses with single trip and annual multi-trip policies when you choose Platinum cover

Travel insurance to suit your needs

Medical costs vary from country to country and can be surprisingly expensive. Having a policy with medical insurance as standard, whether you’re travelling to Europe or beyond can help manage that expense.

We offer three levels of cover – Silver, Gold and Platinum:

The cover limits shown in the tables below apply to single trip and annual multi trip policies. Excesses may apply; please see the policy booklet for full details.

Covid-19 Cover

Covid-19 cover is included as standard on all of our policies. Don’t forget to check the latest Foreign, Commonwealth and Development Office (FCDO) and local government travel advice before you go. You won’t be covered if you travel against it.

For full details of the Covid-19 cover provided on new and existing policies take a look at our policy booklet .

How does holiday medical insurance work?

Our travel insurance policies cover a wide range of medical expenses, including emergency dental treatment and hospital visits**. This allows you to enjoy your holiday knowing everything is taken care of.

Make sure you buy travel insurance before you leave for your trip. Once you’ve got your policy, you’ll be covered for eligible illnesses and injuries that happen after the policy start date.

If a medical incident happens, and you’re eligible to claim, hold on to all original receipts, invoices, medical reports or other evidence to help your claim. Contact our Medical Assistance Helpline as soon as something goes wrong to authorise any expenses.

Do you have a pre-existing medical condition?

If you have any pre-existing medical conditions, it’s important to let us know. Our insurance can be tailored to cover a wide range of conditions, including epilepsy, diabetes, heart conditions, high blood pressure and asthma.

A pre-existing medical condition could be an injury, illness, disease or other medical condition that exists before your policy starts.

How to tell us

It’s easy to let us know about a pre-existing medical condition. Before you get a quote, you’ll be asked to complete a quick medical screening, either online or by phone. It’ll make sure you have the right cover in place.

If you’ve declared the condition prior to getting a quote and fall ill or get injured while away, we’ll help cover costs of emergency treatment for your condition or any related issues. If a pre-existing medical condition is not officially declared, claims may be rejected, or payment could be reduced.

For more information on what medical conditions you need to declare, have a look at our full list of pre-existing medical conditions or download our policy booklet .

Letting us know about medical treatment abroad

If you have an emergency or need medical treatment abroad, call our Medical Assistance Helpline as soon as you can:

+44 (0) 1403 288 125

The Medical Assistance team will:

- Confirm that you’re in a safe place

- Find the best local treatment available to you

- Consider your health and best interests

- Make sure the necessary medical fees are guaranteed where cover is provided by your policy

We can’t cover any costs over £500 if you haven’t agreed treatment with the Medical Assistance Helpline.

Which policy could I get?

Not sure which cover’s right for you? If you’re planning a single holiday or have a few trips booked this year, we have a policy to suit you.

Single Trip

Travel disruption

What to do if your flight's delayed, cancelled or overbooked

Losing documents abroad

Take steps to prevent the stress of losing important documents while away

Solo travel guide

Heading on holiday alone? Read our guide to travelling alone

Any questions?

Get in touch with our friendly team to speak about our travel insurance policies.

Call 0345 305 2621 .

Sales and service lines are open 9am-5pm Monday to Friday. Closed weekend and Bank Holidays. Calls may be monitored or recorded. Calls are charged at local rates from landlines and mobiles.

Helpful phone numbers .

Terms and conditions

* Up to 20% discount applies when you tell us your Nectar card number. Discount does not apply to premiums for pre-existing medical conditions or enhanced gadget cover. You won't be eligible if you buy through a price comparison website. We reserve the right to change or cancel this offer without notice.

** Dependent on your medical screening. Claims for incidents affected by a plan holder’s use of drink or recreational drugs may be invalidated.

^ Telephone calls may be recorded for security purposes and monitored under our quality control procedures.

Sainsbury’s Bank Travel Insurance is underwritten by Great Lakes Insurance UK Limited. Great Lakes Insurance UK Limited is a company incorporated in England and Wales with company number 13436330 and whose registered office address is 10 Fenchurch Avenue, London, United Kingdom, EC3M 5BN. Great Lakes Insurance UK Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Firm Reference Number 955859. You can check this on the Financial Services Register by visiting; register.fca.org.uk.

Sainsbury’s Bank Travel Insurance is sold and administered by Hood Travel Limited, registered at Companies House 08318836. Hood Travel is authorised and regulated by the Financial Conduct Authority under registration number 597211. Hood Travel Limited’s registered address is at 2nd Floor, Decora Court, Tylers Avenue, Southend-on-Sea, Essex, SS1 2BB.

- Select cover

- Extra cover

- Your details

Before you buy

It is essential that you check the latest FCDO advice for your destination before you travel. Our travel insurance policies do not provide cover for travel to an area where the FCDO advises against all or all but essential travel unless you purchase our optional Enhanced Covid-19 cover that will protect you if the advice is given solely as a result of Covid 19.

Stay up-to-date with the latest rules:

- The green list

- The amber list

- The red list

Please continue to check our FAQ's regularly which will contain the latest guidance.

For existing customers, you can click here to manage your policy .

It is essential that you check the latest FCDO advice for your destination before you travel. Our travel insurance policies do not provide cover for travel to an area where the FCDO advises against all or all but essential travel.

All fields marked with * must be completed.

Please take care to answer all the questions accurately and completely. If you don't, we may cancel your policy and we may reject any claims, or not pay them in full.

Up to 20%* discount with your Nectar card.

Cruise cover is not covered on our Annual multi trip policies: If you are travelling on a cruise, please purchase a Single trip policy and select the Cruise cover add on.

Important: For Annual multi trip policies you will not be covered for holiday cancellation until your policy start date. Please choose today's date if you want cover as soon as possible.

Medical declarations Your travel insurance policy can cover some pre-existing medical conditions

Please declare any pre-existing medical conditions that you or anyone travelling on this policy have. By answering them, you confirm you have the authority and will provide complete and accurate medical information about everyone to be covered. If you are unsure of any answers please contact the person who you answering on behalf of. If you don't declare pre-existing medical conditions, it may result in part or all of a claim not being paid.

Nectar and promotional codes

Have you got a promotional code?

By clicking the button below you are confirming that you have read, understand and meet our eligibility conditions .

Eligibility conditions

You confirm that:

- You are 18 years of age or over at the date of buying the policy

- You and all persons to be insured have an address in the United Kingdom, Channel Islands or the Isle of Man

- You and all persons to be insured have lived in the United Kingdom, Channel Islands or the Isle of Man for at least 6 of the last 12 months

- You and all persons to be insured are registered with a GP in the United Kingdom, Channel Islands or the Isle of Man

- You and all persons to be insured are in the United Kingdom, Channel Islands or the Isle of Man when the policy is purchased and have not started a trip

- You and all persons to be insured will obtain any recommended vaccines, inoculations, or medications prior to your trip.

Customers with more serious pre-existing medical conditions

Our travel insurance can offer cover for many pre-existing medical conditions. However, if we were unable to provide you with a quote, or if you would like an alternative quote for your medical condition(s), you can access a directory of specialist medical travel insurers who may be able to arrange cover. You can access this by clicking here or by calling 0800 138 7777 .

Important information

Nectar benefits.

*Customers receive a 20% discount when entering your Nectar card number. Excluding pre-existing medical and Enhanced gadget premiums.

Defaqto 5 star travel cover

Our Comprehensive Travel Insurance policies carry a 5 Star rating from Defaqto, which is the highest rating possible on the market.

Our team are here to help:

Monday to Friday 8am-7pm Saturday 9am-5pm Sunday and Bank Holidays Closed

Telephone calls may be recorded for security purposes under our quality control procedures. Calls are charged at local rates from landlines and mobiles.

Find out what you really need to know, plus easily compare prices from hundreds of deals, no matter what insurance you need.

Our Top Picks

- Cheap Car Insurance

- Best, Largest Car Insurance Companies

- Cheap Motorcycle Insurance

- Cheap Home Insurance

- Cheap Moped Insurance

- Best Cheap Cruise Insurance

- Best Pet Insurance

- Best Insurance for Bulldogs

- Best Travel Insurance

- Pet Insurance

- Home Insurance

- Travel Insurance

- Car Insurance

- Motorcycle Insurance

- Caravan & Motorhome Insurance

- Campervan Insurance

- Health Insurance

- Van Insurance

Solar Panels

Get solar panels for your home.

- Best Solar Panels

- Solar Panel Installers

- Solar Panels for Home

- Solar Panel Comparison

- Solar Panel Installation

- Solar Panel Battery

The Financial Aspects

- Solar Panel Costs

- Solar Panel Grants

- Solar Panel Quotes

- Solar Panel Tariffs

Business Insurance

Find the best insurance deals for you and discover what you need to know, whatever your business.

Popular Types of Cover

- Public Liability Insurance

- Employers' Liability Insurance

- Professional Indemnity

- Directors and Officers

- Fleet Insurance

- Best Business Insurance Companies

- Guide to Small Business Insurance

- How Much Does Business Insurance Cost?

- Business Loans

By Type of Business

- Limited Company Insurance

- Self Employed Insurance

By Occupation

- Click for insurance by occupation!

Credit Cards

Read reviews and guides to get clarity over credit cards and see which is best for you.

Credit Card Categories

- Credit Builder Cards for Bad Credit

- Rewards Credit Cards

- Travel Credit Cards

- 0% Interest Credit Cards

- No Foreign Transaction Fee Credit Cards

- Balance Transfer Credit Cards

- Cashback Credit Cards

- Credit Cards with No Annual Fee

- Student Credit Cards

Helping you make the most of your money with our in-depth research on the topics that matter to you.

Stay up to date with the latest news that affects you.

Come say hi!

Connect with NimbleFins

- Follow NimbleFins on LinkedIn

Sainsbury's Bank Travel Insurance Review: The Features You Need?

- Baggage, Scheduled Airline Failure, Delayed Departure and Trip Abandonment on all plans

- Longer trip lengths

- Extended Gadget cover available

- No travel disruption cover

Editor's Rating

The guidance on this site is based on our own analysis and is meant to help you identify options and narrow down your choices. We do not advise or tell you which product to buy; undertake your own due diligence before entering into any agreement. Read our full disclosure here .

Not only can you buy groceries from Sainsbury's, but you can also buy protection for your holidays with travel insurance from Sainsbury's Bank. Their comprehensive cover includes the standard Baggage, Emergency Medical and Cancellation, plus you'll get cover for Scheduled Airline Failure, Delayed Departure and Trip Abandonment on all plans. Read our review to learn about Sainsbury's Bank travel insurance features and prices.

If you're ready to compare prices or make a travel insurance purchase, get quotes from Sainsbury's and nearly 20 other brands by clicking the blue " Get Quotes " button below—their panel includes Sainsbury's Bank, as well as a number of travel insurance providers that will cover coronavirus .

Buy Travel Insurance Today

One form to fill out. Compare quotes from 20 insurers in under 2 minutes.

- Sainsbury's Bank Overall Review

- Sainsbury's Travel Insurance Customer Reviews

- Sainsbury's Bank Price Comparison

- Buying Sainsbury's Bank Direct or from Comparison Site: What are the Differences?

- Sainsbury's Bank Policy Limits and Coverage Options

- Sainsbury's Bank Policy Wording

Choosing the best travel insurance for you will depend on factors like price points and features that you might find valuable. Please use the information in this review to help you understand the nuances of various plans to help you narrow down your options. In our review we also explain the main differences between buying direct from the Sainsbury's Bank website versus buying through a comparison site, to help you decide where to buy—essentially, you'll miss out on a few coverage features buying from a comparison site but that's where you'll get the cheapest prices.

Sainsbury's Bank Travel Insurance Review: What You Need to Know

Sainsbury's Bank offers a range of holiday cover plans to suit a variety of budgets and coverage needs, from those looking to cover a cheap-and-cheerful holiday with a budget option for a cost less than £10, up to those needing insurance for more valuable holidays worth up to £7,500.

There are basically two ways to buy Sainsbury's holiday cover—direct from their website or from a comparison site. What's the main difference? Basically, the plans offered from comparison sites are cheaper and, as a result, provide lower cover limits and have higher excess levels—that said, the most premium plan available from comparison sites ("Premier") offers higher limits across some categories than the cheapest plan available direct ("Silver"), despite a lower price (e.g., Premier offers £5k of Cancellation cover per insured person, but the Silver plan only provides £3k of Cancellation cover).

The Sainsbury's plan with the highest cover (£7.5k Cancellation and £3,000 of Baggage) is the Platinum plan, which is available direct from the Sainsbury's Bank website. Therefore, broadly speaking, those needing this level of cover would be best served buying the Platinum plan direct from the Sainsbury's website. Those who don't need that much cover may very well find a cheaper deal from a comparison site. But see below to understand some of the other differences between plans bought direct or from a comparison site.

Those going on a cruise can get cover for cabin confinement, emergency airlift to hospital, missed port and unused excursions. To learn more about market prices please see our article Average Cost of Cruise Travel Insurance UK .

Are Mobile Phones Covered? Mobile phones are covered (up to £500 or £750) on all plans bought direct through Gadget Cover . If you buy through a comparison site you can add Optional Gadget cover to any policy to get £1k, £2k or £3k of total gadget cover (max £500, £750 or £1,000 per item), depending on the plan. This will cost you on the order of £12 to £64, depending on level of cover and type of plan. Similarly, the regular Gadget cover that's already included on plans bought direct can be increased to these higher levels, but it will cost a bit more than on the comparison site—between £10 and £82.

To see a list of other companies that offer a gadget travel insurance add on please see our article, Travel Insurance Companies with Optional Gadget Cover .

Does Sainsbury's Bank Travel Insurance Cover Trips in the UK? Holidays in the UK are covered under Sainsbury's Bank Annual, Multi-trip policies, so long you have pre-booked accommodation for a minimum of 2 nights.

Who underwrites Sainsbury's travel insurance? Sainsbury's Bank travel insurance (single trip, extended stay and annual, multi-trip policies) are underwritten by ERGO Travel Insurance Services Ltd (ETI) on behalf of Great Lakes Insurance SE (GLISE).

Does Sainsbury's travel insurance cover pre-existing conditions? As part of the online application you'll be asked a series of brief medical questions. If you have a medical condition, Sainsbury's Bank may be able to offer cover for some pre-existing medical conditions , for which you'll probably be required to pay a higher premium. Pre-existing conditions are only covered if they've been fully declared, accepted and paid for.

Is Sainsburys travel insurance any good? Mixed customer reviews point to good value for money on the plus side but some customers report not receiving their policy documents quickly, which can lead to stress wondering if you're covered. For these reasons, it's probably a good idea to get a quote for your trip to see what they'll offer, but don't buy the policy at the last second before you travel.

Can I get travel insurance from Sainsburys? Yes, you can buy travel insurance from Sainsbury's, which is underwritten by ERGO Travel Insurance Services Ltd (ETI) on behalf of Great Lakes Insurance SE (GLISE).

Does Sainsbury's travel insurance cover cruises? According to the Policy Booklet from their website, cruise cover can be added as an optional extra to SINGLE TRIP cover only.

How much compensation does Sainsbury's travel insurance give for a delayed flight? If you've been delayed at your point of departure and have travelled there and checked-in, you can receive compensation for each full 12 hour delay depending on the level of cover: £25 per 12 hours (max £250) on Silver, £35 per 12 hours (max £350) on Gold or £50 per 12 hours (max £500) on Platinum; or £25 per 12 hours (max £300) on Essential, £35 per 12 hours (max £500) on Standard or £50 per 12 hours (max £500) on Premier plans from comparison sites. (The max cover for comparison site policies increased up in their September 2023 policy update.)

Is Sainsbury's travel insurance on comparison websites? Yes, Sainsbury's travel insurance is available on many travel insurance comparison engines.

Sainsbury's Bank Customer Reviews

Is Sainsbury's travel insurance really any good? The best way to get a feel is to see what real customers have to say. We've dug through hundreds of online customer reviews to look for common complaints or problems, and to find out what customers really like about the product and service.

Sainsbury's Bank Travel Insurance Trustpilot

Sainsbury's Bank has a trust score of 4.1 out of 5 from over 13742 customers at Truspilot —that's a pretty strong score, but it reflects all of Sainsbury's Bank, not just the travel insurance part of their business. After reading through the reviews to pick out those related to travel insurance, it seems that the most common complaint is not getting the policy documents in a timely manner, leading to policyholders being uncertain if they had cover or not. On the plus side, customers seem happy with the price they paid for the coverage levels.

Here is a sample of the positive reviews of Sainsbury's travel insurance on Trustpilot:

"Chose Sainsburys travel insurance as they had the most competitive price for what they offered me!" "Sainsbury provide great cover for all my uk and foreign travel. The double nectar points whilst my annual policy was running was a great bonus on my weekly shopping and petrol, and they kept me up to date on offers and expiration dates of my cover!" "No problems. Had to change my dates of travel,very good service."

And some negative reviews:

"Was never sent my travel insurance so had to go and buy some from another provider—waste of money." "I didn't receive any policy documents, no contact whatsoever until the day of my return. Very worrying not to know I was covered." "Didn't pay out after a holiday in Paris was cancelled due to strike action."

We should point out that strikes are usually excluded from travel insurance cover, regardless of the brand.

How do Sainsbury's Bank Prices Compare

Generally speaking, holiday cover from Sainsbury's Bank is around the average cost of travel insurance , with policies bought from a comparison site coming in below average and plans bought direct from Sainsbury's Bank coming in above the average cost, regardless of whether your travel plans will take to you Europe , America or elsewhere, as you can see in the following chart.

Nectar cardholders can get a 20% discount on direct policies, making the plans from the Sainsbury's Bank website even more attractive. This discount does not apply to the premium for pre-existing medical conditions and enhanced gadget cover.

Insurance quotes can vary significantly from day to day and according to each individual's details, so please just use this data for general educational purposes only; your quotes may reflect a large degree of variation.

Cost of Sainsbury's Travel Insurance Add-Ons

According to our research, the average cost of optional Gadget travel cover in the market is around £35 for Annual, Multi-trip policies and £13.50 for Single Trip policies, providing around £1,500 of total gadget cover on average.

Buying Direct vs Using a Comparison Site

Generally speaking, the cheapest Sainsbury's Bank holiday cover plans are available through comparison sites, whereas the plan with the highest cover is available direct from the Sainsbury's Bank website. Beyond that, there are pros and cons to both sources in terms of features and price points. We'll try to explain some of the differences to help you decide whether buying direct or through an aggregator comparison site better suits your particular needs. Below, you'll find a table detailing the differences in Standard excess, upper age limits and maximum trip lengths. You'll notice that these details are generally more favourable on plans bought direct rather than from a comparison site—depending on your needs and situation, these details may or may not be worth the added cost to you.

Differences between Direct and Comparison Site Policies

Buying sainsbury's bank direct.

The travel insurance plans bought directly from Sainsbury's Bank offer a few perks not available on comparison sites, such as and some Gadget cover (to help protect your mobile phone, etc.).

There are higher age limits on direct plans—those up to age 80 can buy/renew an Annual, Multi-trip policies; there is no upper age limit on Single trips bought direct. (But expect higher prices for older travellers.)

Buying Sainsbury's Bank via Comparison Site

Generally speaking, the lowest prices on Sainsbury's Bank travel insurance can be found using a travel insurance comparison . In fact, Sainsbury's three comparison site plans (Essential, Standard and Premier) are generally cheaper than the cheapest direct plan (Silver). If price is your priority, then buying from a comparison site will likely secure you the lowest premium on a Sainsbury's travel plan.

Compare Cheap Travel Insurance

Protect your holiday today. Quick quotes from 20 insurers.

Despite the comparison plans coming in at cheaper prices, they still include some level of cover for Baggage Delay, Abandoning your Trip, Scheduled Airline Failure and (except Essential plans) Missed Departure. While Gadget cover isn't included, it can be purchased as an add-on extra for £12 to £62, providing up to £1k, £2k or £3k of total gadget cover (max £500, £750 or £1,000 per item) depending on the plan. However there's no Travel Disruption cover and the excess is a bit higher on comparison site plans.

Bottom Line: If you're looking for a budget plan, compare travel insurance to see three different Sainsbury's Bank holiday cover plans with prices typically ranging from £9 up to £75 (for a healthy, 35-year-old, individual traveller), depending on geography and level of cover (Cancellation from £1,500 to £5,000). Those looking to insure more valuable holidays worth up to £7,500 might find a more suitable policy buying direct from Sainsbury's Bank , but expect prices to be up to 1.6X higher for the added cover of the top-tier direct Platinum plan (versus the top-tier comparison site Premier plan).

Types of Sainsbury's Bank Travel Insurance Policies

Direct from their website, Sainsbury's Bank offers three tiers of travel insurance—Silver, Gold and Platinum. From comparison sites they offer three different plans, which provide lower levels of cover as you can see in the following table—Essential, Standard and Premier. All are available for Single Trips or as Annual, Multi-Trip policies.

They've recently upped a few limits on their comparison site policies—notably increasing the total amount of travel delay benefit they'll pay. See the new limits in the table below.

Sainsbury's Bank Travel Insurance Cover Limits

Other useful information: policy wording.

- Sainsbury's Bank Travel Insurance Silver, Gold and Platinum Policy Wordings

Erin Yurday is the Founder and Editor of NimbleFins. Prior to NimbleFins, she worked as an investment professional and as the finance expert in Stanford University's Graduate School of Business case writing team. Read more on LinkedIn .

- 4.8 out of 5 stars**

- Quotes from 20 providers

Our Top Insurance Picks

- Cheap Travel Insurance

Cheap Travel Insurance by Destination

- Travel Insurance to Australia

- Travel Insurance to Ireland

- Travel Insurance to Canada

- Travel Insurance to Turkey

- Travel Insurance to India

Articles on Travel Insurance Costs

- Average Cost of Travel Insurance

- Average Cost of Travel Insurance to USA

- Cost of Travel Insurance with Pre-Existing Medical Conditions

- Average Cost of Travel Insurance to India

- Average Cost of Travel Insurance to Ireland

Recent Articles on Travel Insurance

- Travel Insurance with Optional Gadget Cover

- Top Tips for Travel Insurance with Medical Conditions

- Can Travel Insurance Help if Natural Disaster Strikes?

- Should You Buy Travel Insurance from a Comparison Site?

- Should You Buy Single-Trip or Annual Multi-Trip Travel Insurance?

Travel Insurance Guides

- Do I Need Travel Insurance? 3 Key Questions

- Will Your Travel Insurance Claim be Rejected? Boost Your Odds with These Tips

- 7 Things Your Travel Insurance May Not Cover

- Travel Insurance Guide

Travel Insurance Reviews

- AA Travel Insurance Review

- Admiral Travel Insurance Review

- Aviva Travel Insurance Review

- AXA Travel Insurance Review

- Cedar Tree Travel Insurance Review

- CoverForYou Travel Insurance Review

- Coverwise Travel Insurance Review

- Debenhams Travel Insurance Review

- Direct Line Travel Insurance Review

- Holidaysafe Travel Insurance Review

- Insure & Go Travel Insurance Review

- Sainsbury's Bank Travel Insurance Review

- Tesco Travel Insurance Review

- Travelinsurance.co.uk Travel Insurance Review

- Zurich Travel Insurance Review

Reviews of Travel Insurance for Pre-Existing Conditions

- Fit2Travel Travel Insurance Review

- Free Spirit Travel Insurance Review

- goodtogoinsurance.com Review

- JustTravelcover.com Insurance Review

- OK To Travel Insurance Review

- Saga Travel Insurance Review

- Virgin Money Travel Insurance Review

- Privacy Policy

- Terms & Conditions

- Editorial Guidelines

- How This Site Works

- Cookie Policy

- Copyright © 2024 NimbleFins

Advertiser Disclosure : NimbleFins is authorised and regulated by the Financial Conduct Authority (FCA), FCA FRN 797621. NimbleFins is a research and data-driven personal finance site. Reviews that appear on this site are based on our own analysis and opinion, with a focus on product features and prices, not service. Some offers that appear on this website are from companies from which NimbleFins receives compensation. This compensation may impact how and where offers appear on this site (for example, the order in which they appear). For more information please see our Advertiser Disclosure . The site may not review or include all companies or all available products. While we use our best endeavours to be comprehensive and up to date with product info, prices and terms may change after we publish, so always check details with the provider. Consumers should ensure they undertake their own due diligence before entering into any agreement.

Note regarding savings figures: *For information on the latest saving figures, pay-less-than figures, and pay-from figures used for promotional purposes, please click here .

**4.8 out of 5 stars on Reviews.co.uk is the rating for our insurance comparison partner, QuoteZone.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Visiting the U.S.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Travel insurance basics

Best visitors insurance policies, for the lowest price: trawick international, for customizing options: worldtrips, for pre-existing conditions: worldtrips, for highest medical coverage limit: img, other options to consider, the bottom line.

Since health care can be expensive in the U.S., it’s important that visitors have insurance coverage, aka visitors insurance or travel medical insurance, in case something happens that requires medical attention mid-trip.

Whether you have coverage for travel in the U.S. depends on your health care plan in your home country. But if you don't, you'll need to buy a policy from a third-party insurance provider. Several companies sell this kind of visitor insurance, and each company and policy is a bit different. Let’s look at which is best for you.

First, a few basics about visitor insurance. Two kinds are available: travel medical insurance and trip insurance.

Travel medical insurance covers medical expenses that you may incur while traveling internationally, like a visit to the doctor, a trip to the hospital and medical evacuation and repatriation.

Trip insurance usually covers limited medical expenses like emergency care and can compensate you if your trip is delayed, you need to leave the trip early or you have to cancel the trip. It is designed to help you protect the investment you’re making as you prepare to travel.

Standard trip insurance might not cover a visit to the doctor unless it is an emergency.

It’s important to make sure any pre-existing conditions are covered if the visitor has any. Some policies exclude them.

» Learn more: How to find the best travel insurance

With so many kinds of visitors insurance policies, which is the best?

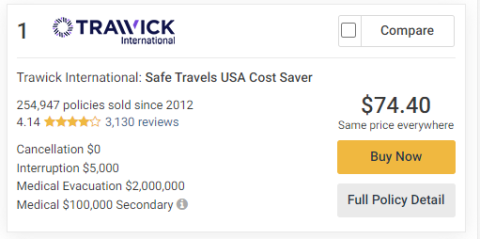

To make comparisons, we got quotes from several companies using Squaremouth , a website to search for different types of travel insurance in one place.

The parameters we set are for a 49-year-old citizen and resident of Spain traveling to the U.S. on May 1-31, 2024.

The quotes don't include cancellation coverage; these examples are for medical coverage only. To get a quote, the hypothetical deposit for the trip was paid on Feb. 15.

Since we’re looking for a policy that will cover medical care for visitors, there are several medical filters to select: emergency medical ($100,000 or more), medical evacuation ($100,000 or more) and coverage for pre-existing medical conditions.

The search came up with nine results ranging in price from $74.40 to $179.18.

The policy with the lowest cost was the Trawick International 's Safe Travels USA Cost Saver at $74.40.

Trawick policies use the FirstHealth PPO network.

The policy as quoted has a $250 deductible and includes $100,000 in emergency medical, $2 million in medical evacuation and $5,000 in interruption coverage. It has limited coverage for pre-existing conditions.

It is possible to change the deductible to as little as $0 or raise it to $5,000.

The same company has another policy, the Trawick International Safe Travels USA Comprehensive policy, that is better at covering pre-existing conditions and costs a little more — $89.59.

The general coverage is the same as the less expensive policy, and the Safe Travels USA Comprehensive option adds coverage for acute onset of a pre-existing condition. it is possible to change the deductible amount to $0 or go up to $5,000.

» Learn more: The best travel credit cards right now

Some policies are sold as is, while others allow some flexibility depending on what is important to you.

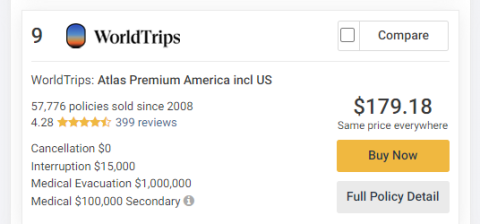

The WorldTrips Atlas Premium America policy for $179.18 allows a lot of customization.

It was also the most expensive of the nine policies Squaremouth suggested.

It’s possible to customize the emergency medical coverage and pre-existing condition coverage and medical deductible. The policy also includes $15,000 in trip interruption coverage, the highest of any of the nine policies available.

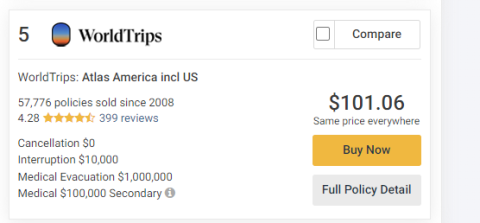

If the traveler has a pre-existing condition, policies from WorldTrips Atlas America are your best bet. The WorldTrips Atlas America policy in our comparison costs $101.06.

The policy as quoted covers $100,000 in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence of a pre-existing condition.

The deductible is also available for customization from $0 to $5,000.

The PPO network for Atlas America Insurance is United Healthcare.

The WorldTrips Atlas Premium America policy mentioned above is also good for pre-existing condition coverage.

While eight of the nine policies had $100,000 in secondary medical coverage, one had a limit of $2 million.

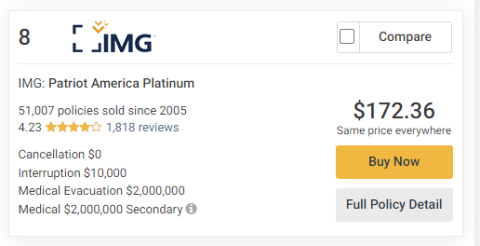

The IMG Patriot America Platinum policy has a premium of $172.36 along with a high medical evacuation limit of $2 million and interruption coverage of $10,000.

If $2 million in medical coverage is not enough, it’s possible to increase that amount to an $8 million policy limit.

It’s not possible to change the level of coverage for preexisting conditions from the high $1 million limit in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence.

It is possible to change the deductible from $0 all the way up to $25,000.

Our comparison also included policies from two additional companies, Seven Corners and Global Underwriters .

Seven Corners had two policies come up in the results, the Seven Corners Travel Medical Basic for $98.27 and the Seven Corners Travel Medical Choice policy for $136.71. Both of the Seven Corners policies include coverage for hurricane and weather, and the less expensive policy covers acts of terrorism.

Having insurance to cover unexpected medical expenses for anyone visiting the U.S. can be a smart money move.

An illness or accident could cause financial problems for visitors because of potentially having to pay for full health care costs. When planning your travel, be sure to check your current health insurance to find out if it will cover you in the U.S.

For a monthlong stay in the U.S., the lowest-priced visitors insurance policy was around $75 (Trawick International Safe Travels USA Cost Saver) and the highest was about $180 (WorldTrips Atlas Premium America). That’s about $2.42 or $5.81 a day, depending on the policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Suggested companies

Admiral insurance, insurefor.com.

Sainsbury's Bank Travel Insurance Reviews

In the Travel Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 1.5.

Most relevant

Please avoid using 'Sainsbury's' travel…

Please avoid using 'Sainsbury's' travel insurance (actually Great Lakes). 8 months since we put in our claim, after having all our luggage stolen on a train in France, we have finally received our payment... but only after a very long, time consuming and upsetting fight! Following months of completely hopeless communication with Great Lakes, and their complaints department, who tried to suggest that we were irresponsible to leave our luggage in the designated luggage compartment (the only place we were allowed to keep large suitcases!) whilst sat in our allocated train seats, we took our case to the Financial Ombudsman. They did a thorough investigation and fully backed and supported us, saying that Great Lakes had been completely unfair and unreasonable in refusing our claim - so I very much recommend going down this route if you find yourself in similar circumstances! Great Lakes will do anything and everything to fob you off, but can be forced into paying up what you are owed if you persevere - it's a total scam and they hope and rely on people giving up!!

Date of experience : 13 August 2023

Sainsburys travel insurance was taken…

Sainsburys travel insurance was taken out for our holiday to Amsterdam last September, we had to cancel this as both went down with Covid. These are underwritten and claims handlers are Great Lakes and CSA We were refused a claim twice, they said the first time we weren’t covered for covid. The second time they told us we didn’t provide a certificate to say we couldn’t travel. Even though we’d passed on details of our gp to the insurance co. as they said they didn’t give out certificates for covid anymore. They said they could write to them. We’d provided photos of our positive covid tests in front of the time and date on our computer. Anyway, wanted to give people a heads up that we took our plight to the Financial Ombudsman and we’ve just found out we’ve won our case. So the insurance company has to pay us plus interest. So don’t give up!

Date of experience : 07 September 2023

It should be zero stars

It should be zero stars, but it won't offer that choice! I only wish i had read some of the reviews here before purchasing Sainsburys annual travel insurance. They say you can only judge an insurance company when you have to make a claim, well that’s where the zero stars come in! To get any regular reliable correspondence from these is at best impossible. I got asked to send three sets of information, once sent then I got asked for another batch of information [different from the first email]. These two emails took about a month to get through to me, since then “nothing”! I have sent numerous emails and have yet to have a reply, I have now given up and will never use or recommend Sainsburys travel insurance to anyone. This is the shortened version as I can’t be bothered to write everything down as it would take up too much time and space.

Date of experience : 26 February 2024

DON'T BUY SAINSBURY'S TRAVEL…

DON'T BUY SAINSBURY'S TRAVEL INSURANCE. In June I booked my holiday. My flight was cancelled without any notice. I contacted insurance. They are still asking millions of questions. 6 moths gone nothing happened. Wasting my time. Now I contacting the Financial Ombudsman.

Date of experience : 12 July 2023

How can they even think of sending an email like this?

I still can't believe that I received this renewal quote (Car Insurance) from Sainsbury Bank but there it was in an email nonchalantly and in a way that they seemed proud of themselves telling me that my renewal cost will be a total price £836.32 and reminded me that last year's total price was £267.70. FYI, I've not made any motor claims for 20+ years. That's an extortionate increase of 312%!!! Disgusting and downright criminal!!

Date of experience : 30 December 2023

Fantastic service

Exchange Bureau Milton Keynes. Good exchange rates and really friendly staff. Unlike many places, greeted with a smile and they are more than happy to give smaller denominations unlike John Lewis, Waitrose etc. Will definitely use again.

Date of experience : 16 December 2023

Complete shambles of a renewal…

Complete shambles of a renewal process... Didn't send out renewal reminder or price. I phoned and automated message said long wait and go to live chat.45 mins later they answered and sent the renewal but WITHOUT pre-existing conditions included. 45 min wait again for live chat only to be told you need to speak on the phone and RE_ENTER the pre existing....but I already gave you that last year. AND WHAT USE IS A RENEWAL QUOTE WITHOUT PRE-EXISTING CONDITIONS Wasted 45 mins x 2 of my life and their staff time....and I still have not got a renewal quote ! LAUGHABLY BAD.

Date of experience : 24 January 2024

Most appalling service and claims process…

Most appalling service and claims handling i have ever experienced. Ryanair are faster at paying out, and that's saying something. Sainsbury's have outsourced all claim handling to a 3rd party .. CSA Ltd claim handling .. they have a 3 week turn around on literally any email exchange, so a simple 1 item clarification resets the clock .. im now at 6 weeks .. and they also tried to weasel out of the delay payment saying it wasn't delayed for 12 hours ! .. Boarding cards submitted , clock started yet again on 3 week SLA ... Sainsbury's brand image ruined for me, and will never buy their insurance for travel, car or shop in their supermarket again - Truly appalling for what should be a premium brand! Sainsbury's CEO you need to get this outsource off your books and reign in the appalling service!

Date of experience : 28 December 2023

Avoid this company at all costs!

Non-existent Insurance & Abysmal Customer Service! I waited nearly two months for a response to my claim. After weeks of relentless follow-ups, I received nothing but false promises. It turns out the travel insurance offered by this company is nothing more than a waste of money and time. My flight was abruptly cancelled by the airline just a few hours before departure at 2am on a bank holiday. This left us stranded in a foreign country. Shockingly, the so-called 'cancelled flight' and 'delayed flight' policies were nothing but smoke and mirrors. Avoid this company at all costs! The combination of non-existent insurance coverage and terrible customer service is utterly unacceptable.

Date of experience : 18 October 2023

Non existing customer services!

Non existing customer services! Only wanted to amend travel details and after an hours wait they still spelt my daughters 3 letter name incorrectly after spelling it out 3 times. Won't use again.

Date of experience : 05 January 2024

Stay well clear

Stay well clear. My wife's phone got stolen while abroad. We couldn't register an account on the portal and had to argue with a CS person to get them to help me. Once logged in, the portal had incorrect contact information for filing a gadget claim. I then discovered gadget insurance is outsourced to Taurus who are an absolute circus when we finally managed to contact them. A phone is pretty much an essential part of life these days. If it gets lost/stolen abroad and you are insured by Sainsbury's/Taurus, you will be waiting 2+ weeks for a replacement - Minimum! Urge you to look elsewhere.

Date of experience : 12 November 2023

Had no issues claiming back

Whilst abroad I had painful toothache, after getting a quick dentist appointment I was told I needed a crown fitted. I made sure to call Sainsbury's Travel Insurance to make sure a) I was covered and b) what they needed to support a claim. After having the surgery, the dentist wrote the note detailing the issue and what I had done and I supplied this to Sainsbury's. It took around 1 month to get the money back but they paid with zero hassle. Really can't complain.

Date of experience : 18 November 2022

Absolute BS! Don't insure with Sainsbury's

Absolute BS! Put in a claim, and I had to do submit a form via email to another insurance company which site doesn't work. I tried calling Sainsbury's bank and keep getting referred to the online portal which doesn't help at all. I now emailed them hoping to get a response. If I don't hear back about my claim in the next week I'm going to the ombudsman and small claims court

Date of experience : 24 August 2023

Sainsburys insurance are a disgrace.

Sainsburys insurance are a disgrace. We paid for holiday cover, which included Covid and I have this in the key facts document. So when we had to cancel because my wife couldn't get out of bed I was reasurre that I had the insurance. NO! Because we cancelled the day before and the trip hadn't "started" they won't pay out, despite me calling to check before we cancelled and they said we were fine. It's just underhanded. They passed the claim to an administrator who initially asked for my bank details to make payment then inexplicably changed their minds and are now refusing to pay. Why would a massive brand like Sainsburys act like this, it does nothing for their reputation, a reputation that initially made me take out the policy in the first place. Awful, awful people. Avoid at all costs.

Date of experience : 14 November 2023

AVOID AT ALL COST

My daughter was stuck in Frankfurt after her flight was cancelled to Bogota with a 23hr delay - Called Sainsburys about 15 times - a nightmare to get hold of and no-one could tell us what was covered if she had to book different flight and what her options are. none of the departments could 'offer advice' on what her rights were. And apparently they only cover flights in and out of the country not the whole trip if you are getting connecting flights. How stupid is that what is the point of insurance? over 40mins to get through to the claims - gave up in the end and just changed the flights hoping for the best.

Date of experience : 02 October 2023

Very poor - AVOID Sainsbury's Bank Travel Insurance

Very poor - their Settlement Claims Agency is a scam. Bad decision on Sainsbury's Bank to ruin a trusted brand with an ineffective claims company. Email response time 6 weeks. Keep asking for the same information every time. Do me a favour, Sainsbury's Bank, and get CSA to pay up for a trip cut short because an airline cancelled flights on me at the airport. I've been waiting for 7 months. Disgusting.

Date of experience : 20 November 2022

Easy refund procedure…

Took out Sainsbury’s Travel insurance and then realised I did not need it so soon. They allow you to cancel within 14 days for full refund unless insurance has been used. Process could not have been easier entered details requested and received an E mail confirmation that the refund had been accepted that same day.

Date of experience : 06 September 2023

Bought travel money euros and dollars…

Bought travel money euros and dollars missing over £600 in euros. Failure to refund. Asking my bank to refund. Avoid this company took over 2 months for them to decide that won't refund me. Said royal mail 4 weeks to investigate took 9 weeks.

Date of experience : 12 October 2023

CSAL are terrible

Sainsbury’s Bank pass claims handling to CSAL (Claims Settlement Agencies Limited) who take an age to handle claims. It is clear they do not have the capacity to process the volume of claims they have. These guys really drag down the Sainsbury’s brand.

Date of experience : 20 November 2023

Please STAY well clear of taking…

Please STAY well clear of taking Sainsbury’s travel insurance started. Claim on January 5th this year and still no acknowledge of my case number after contacting them Now 5 times . I do understand it’s not Sainsbury’s as they use a 3rd party gb uk claims it’s called which is a huge insurance company this is outrages . I had to pay out thousands for my hospital cover whilst on holiday and now out of pocket still 3 months down the line . I would not give any star rating

Date of experience : 19 March 2023

- ALL MOSCOW TOURS

- Getting Russian Visa

- Top 10 Reasons To Go

- Things To Do In Moscow

- Sheremetyevo Airport

- Domodedovo Airport

- Vnukovo Airport

- Airports Transfer

- Layover in Moscow

- Best Moscow Hotels

- Best Moscow Hostels

- Art in Moscow

- Moscow Theatres

- Moscow Parks

- Free Attractions

- Walking Routes

- Sports in Moscow

- Shopping in Moscow

- The Moscow Metro

- Moscow Public Transport

- Taxi in Moscow

- Driving in Moscow

- Moscow Maps & Traffic

- Facts about Moscow – City Factsheet

- Expat Communities

- Groceries in Moscow

- Healthcare in Moscow

- Blogs about Moscow

- Flat Rentals

Healthcare in Moscow – Personal and Family Medicine

Emergency : 112 or 103

Obstetric & gynecologic : +7 495 620-41-70

About medical services in Moscow

Moscow polyclinic

Emergency medical care is provided free to all foreign nationals in case of life-threatening conditions that require immediate medical treatment. You will be given first aid and emergency surgery when necessary in all public health care facilities. Any further treatment will be free only to people with a Compulsory Medical Insurance, or you will need to pay for medical services. Public health care is provided in federal and local care facilities. These include 1. Urban polyclinics with specialists in different areas that offer general medical care. 2. Ambulatory and hospitals that provide a full range of services, including emergency care. 3. Emergency stations opened 24 hours a day, can be visited in a case of a non-life-threatening injury. It is often hard to find English-speaking staff in state facilities, except the largest city hospitals, so you will need a Russian-speaking interpreter to accompany your visit to a free doctor or hospital. If medical assistance is required, the insurance company should be contacted before visiting a medical facility for treatment, except emergency cases. Make sure that you have enough money to pay any necessary fees that may be charged.

Insurance in Russia

Travelers need to arrange private travel insurance before the journey. You would need the insurance when applying for the Russian visa. If you arrange the insurance outside Russia, it is important to make sure the insurer is licensed in Russia. Only licensed companies may be accepted under Russian law. Holders of a temporary residence permit or permanent residence permit (valid for three and five years respectively) should apply for «Compulsory Medical Policy». It covers state healthcare only. An employer usually deals with this. The issued health card is shown whenever medical attention is required. Compulsory Medical Policyholders can get basic health care, such as emergencies, consultations with doctors, necessary scans and tests free. For more complex healthcare every person (both Russian and foreign nationals) must pay extra, or take out additional medical insurance. Clearly, you will have to be prepared to wait in a queue to see a specialist in a public health care facility (Compulsory Medical Policyholders can set an appointment using EMIAS site or ATM). In case you are a UK citizen, free, limited medical treatment in state hospitals will be provided as a part of a reciprocal agreement between Russia and UK.

Some of the major Russian insurance companies are:

Ingosstrakh , Allianz , Reso , Sogaz , AlfaStrakhovanie . We recommend to avoid Rosgosstrakh company due to high volume of denials.

Moscow pharmacies

A.v.e pharmacy in Moscow

Pharmacies can be found in many places around the city, many of them work 24 hours a day. Pharmaceutical kiosks operate in almost every big supermarket. However, only few have English-speaking staff, so it is advised that you know the generic (chemical) name of the medicines you think you are going to need. Many medications can be purchased here over the counter that would only be available by prescription in your home country.

Dental care in Moscow

Dentamix clinic in Moscow

Dental care is usually paid separately by both Russian and expatriate patients, and fees are often quite high. Dentists are well trained and educated. In most places, dental care is available 24 hours a day.

Moscow clinics

«OAO Medicina» clinic

It is standard practice for expats to visit private clinics and hospitals for check-ups, routine health care, and dental care, and only use public services in case of an emergency. Insurance companies can usually provide details of clinics and hospitals in the area speak English (or the language required) and would be the best to use. Investigate whether there are any emergency services or numbers, or any requirements to register with them. Providing copies of medical records is also advised.

Moscow hosts some Western medical clinics that can look after all of your family’s health needs. While most Russian state hospitals are not up to Western standards, Russian doctors are very good.

Some of the main Moscow private medical clinics are:

American Medical Center, European Medical Center , Intermed Center American Clinic , Medsi , Atlas Medical Center , OAO Medicina .

Several Russian hospitals in Moscow have special arrangements with GlavUPDK (foreign diplomatic corps administration in Moscow) and accept foreigners for checkups and treatments at more moderate prices that the Western medical clinics.

Medical emergency in Moscow

Moscow ambulance vehicle

In a case of a medical emergency, dial 112 and ask for the ambulance service (skoraya pomoshch). Staff on these lines most certainly will speak English, still it is always better to ask a Russian speaker to explain the problem and the exact location.

Ambulances come with a doctor and, depending on the case, immediate first aid treatment may be provided. If necessary, the patient is taken to the nearest emergency room or hospital, or to a private hospital if the holder’s insurance policy requires it.

Our Private Tours in Moscow

Moscow metro & stalin skyscrapers private tour, moscow art & design private tour, soviet moscow historical & heritage private tour, gastronomic moscow private tour, «day two» moscow private tour, layover in moscow tailor-made private tour, whole day in moscow private tour, all-in-one moscow essential private tour, tour guide jobs →.

Every year we host more and more private tours in English, Russian and other languages for travelers from all over the world. They need best service, amazing stories and deep history knowledge. If you want to become our guide, please write us.

Contact Info

+7 495 166-72-69

119019 Moscow, Russia, Filippovskiy per. 7, 1

Mon - Sun 10.00 - 18.00

Best International Travel Insurance for May 2024

Find a Qualified Financial Advisor

Finding a financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. Start your search now.

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

If you're planning your next vacation or trip out of the country, be sure to factor in travel insurance. Unexpected medical emergencies when traveling can drain your bank account, especially when you're traveling internationally. The best travel insurance companies for international travel can step in to provide you with peace of mind and financial protection while you're abroad.

Our top picks for the best international travel insurance

- Best overall: Allianz Travel Insurance

- Best for exotic travel: World Nomads Travel Insurance

- Best for trip interruption coverage: C&F Travel Insured

- Best for families: Travelex Travel Insurance

- Best for long-term travel: Seven Corners Travel Insurance

How we rate the best international travel insurance »

Compare the top international travel insurance

As a general rule, the most important coverage to have in a foreign country is travel medical insurance , as most US health insurance policies don't cover you while you're abroad. Without travel medical coverage, a medical emergency in a foreign country can cost you. You'll want trip cancellation and interruption coverage if your trip is particularly expensive. And if you're traveling for an extended period of time, you'll want to ensure that your policy is extendable.

Here are our picks for the best travel insurance companies for international travel.

Best overall: Allianz

Allianz Travel Insurance offers the ultimate customizable coverage for international trips, whether you're a frequent jetsetter or an occasional traveler. You can choose from an a la carte of single or multi-trip plans, as well as add-ons, including rental car damage, cancel for any reason (CFAR) , adventure sport, and business travel coverage. And with affordable pricing compared to competitors, Allianz is a budget-friendly choice for your international travel insurance needs.

The icing on the cake is Allyz TravelSmart, Allainz's highly-rated mobile app, which has an average rating of 4.4 out of five stars on the Google Play store across over 2,600 reviews and 4.8 out of five stars from over 22,000 reviews on the Apple app store. So, you can rest easy knowing that you can access your policy and file claims anywhere in the world without a hassle.

Read our Allianz Travel Insurance review here.

Best for exotic trips: World Nomads

World Nomads Travel Insurance offers coverage for over 150 specific activities, so you can focus on the adventure without worrying about gaps in your coverage.

You can select its budget-friendly standard plan, starting at $79. Or if you're an adrenaline junkie seeking more thrills, you can opt for the World Nomads' Explorer plan for $120, which includes extra sports like skydiving, scuba diving, and heli-skiing. And World Nomads offers 24/7 assistance, so you can confidently travel abroad, knowing that help is just a phone call away.

Read our World Nomads Travel Insurance review here.

Best for trip interruption: C&F Travel Insured

C&F Travel Insured offers 100% coverage for trip cancellation, up to 150% for trip interruption, and reimbursement for up to 75% of your non-refundable travel costs with select plans. This means you don't have to worry about losing your hard-earned money on non-refundable travel costs if your trip ends prematurely.

Travel Insured also stands out for its extensive "reasons for cancellation" coverage. Unlike many insurers, the company covers hurricane warnings from the National Oceanic and Atmospheric Administration (NOAA).

Read our C&F Travel Insured review here.

Best for family coverage: Travelex

Travelex Travel Insurance offers coverage for your whole crew, perfect for when you're planning a family trip. Its family plan insures all your children 17 and under at no additional cost. The travel insurance provider also offers add-ons like adventure sports and car rental collision coverage to protect your family under any circumstance. Got pets? With Travelex's Travel Select plan, you can also get coverage for your furry friend's emergency medical and transportation expenses.

Read our Travelex Travel Insurance review here.

Best for long trips: Seven Corners

Seven Corners Travel Insurance offers specialized coverage that the standard short-term travel insurance policy won't provide, which is helpful if you're embarking on a long-term trip. You can choose from several plans, including the Annual Multi-Trip plan, which provides medical coverage for multiple international trips for up to 364 days. This policy also offers COVID-19 medical and evacuation coverage up to $1 million.

You also get the added benefit of incidental expense coverage. This policy will cover remote health-related services and information, treatment of injury or illness, and live consultations via telecommunication.

Read our Seven Corners Travel Insurance review here.

How to find the right international travel insurance company

Different travelers and trips require different types of insurance coverage. So, consider these tips if you're in the market to insure your trip.

Determine your needs

- Consider the nature of your travel (leisure, business, or adventure) and the associated risks (medical emergencies, trip cancellations, etc.).

- Determine your budget and the amount of coverage you require.

- Consider the duration of your trip and the countries you'll be visiting, as some policies won't cover specific destinations.

Research the reputation of the company

- Look for the company's reviews and ratings from reputable sources like consumer advocacy groups and independent website reviews.

- Check the provider's financial stability and credit ratings to ensure it can pay out claims reliably.

- Investigate the company's claims process to ensure it can provide timely support if you need to file a claim.

Compare prices

- Get quotes from multiple providers to compare rates and coverage options.

- See if the company provides discounts or special offers to lower your cost.

- Look at the deductible or any out-of-pocket expenses you may have to pay if you file a claim to determine if you can afford it.

Understanding international travel insurance coverage options

Travel insurance can be confusing, but we're here to simplify it for you. We'll break down the industry's jargon to help you understand what travel insurance covers to help you decide what your policy needs. Bear in mind that exclusions and limitations for your age and destination may apply.

Finding the best price for international travel insurance

Your policy cost will depend on several factors, such as the length of your trip, destination, coverage limits, and age. Typically, a comprehensive policy includes travel cancellation coverage costs between 5% and 10% of your total trip cost.

If you're planning an international trip that costs $4,500, you can expect to pay anywhere from $225 to $450 for your policy. Comparing quotes from multiple providers can help you find a budget-friendly travel insurance policy that meets your needs.

How we reviewed international travel insurance companies

We ranked and assigned superlatives to the best travel insurance companies based on our insurance rating methodology . It focuses on several key factors, including:

- Policy types: We analyzed company offerings such as coverage levels, exclusions, and policy upgrades, taking note of providers that offer a range of travel-related issues beyond the standard coverages.

- Affordability: We recognize that cheap premiums don't necessarily equate to sufficient coverage. So, we seek providers that offer competitive rates with comprehensive policies and quality customer service. We also call out any discounts or special offers available.

- Flexibility: Travel insurance isn't one-size-fits-all. We highlight providers that offer a wide array of coverage options, including single-trip, multi-trip, and long-term policies.

- Claims handling: The claims process should be pain-free for policyholders. We seek providers that offer a streamlined process via online claims filing and a track record of handling claims fairly and efficiently.

- Quality customer service: Good customer service is as important as affordability and flexibility. We highlight companies that offer 24/7 assistance and have a strong record of customer service responsiveness.

We consult user feedback and reviews to determine how each company fares in each category. We also check the provider's financial rating and volume of complaints via third-party rating agencies.

International travel insurance FAQs

Which company has the best international travel insurance.

The best insurance policy depends on your individual situation, including your destination and budget. However, popular options include Allianz Travel Insurance, World Nomads, and Travel Guard.

Are there any limitations or exclusions international travelers should be aware of?

You should pay attention to any limitations regarding covered cancellations, pre-existing conditions, and adventure activities. For example, if you're worried you may have to cancel a trip for work reasons, ensure that you've worked at your company long enough to qualify for cancellation coverage, as that is a condition with some insurers. You should also see if your destination has any travel advisories, as that can affect your policy.

What insurance do you need for international travel?

Typically, your regular health insurance won't cover you out of the country, so you'll want to make sure your travel insurance has adequate medical emergency coverage. Depending on your travel plans, you may want to purchase add-ons, such as adventure sports coverage, if you're planning on doing anything adventurous like bungee jumping.

Should you get travel insurance for international travel?

Travel insurance is worth the price for international travel because they're generally more expensive, so you have more to lose. Additionally, your regular health insurance won't cover you in other countries, so without travel insurance, you'll end up paying out of pocket for any emergency medical care you receive out of the US.

How far in advance should international travelers purchase travel insurance?

You should purchase travel insurance as soon as possible after making payment on your trip. This makes you eligible for add-ons like coverage for pre-existing conditions and CFAR. It also mitigates the chance of any losses in the days leading up to your trip.

If you enjoyed this story, be sure to follow Business Insider on Microsoft Start.

This article may contain affiliate links that Microsoft and/or the publisher may receive a commission from if you buy a product or service through those links.

Healthcare in Moscow

This guide was written prior to Russia's 2022 invasion of Ukraine and is therefore not reflective of the current situation. Travel to Russia is currently not advisable due to the area's volatile political situation.

Healthcare in Moscow is organised by the Moscow Health Department. While public healthcare facilities are available, most expats seek out private healthcare at international medical centres. Expats are advised to take out private medical insurance if it is not provided to them by their company.

Subsidised healthcare is provided to everyone living in the country, paid for by the state and the mandatory health insurance system. That said, professionals in the state system are likely to speak little to no English.

There are several private medical centres in Moscow where English is spoken and where the healthcare is on par with expat standards. These clinics are generally very expensive, so it is highly recommended that expats take out private medical insurance to cover medical costs in Moscow. Most insurance coverage plans will also include evacuation cover for emergencies or life-threatening situations.

Recommended hospitals in Moscow

Alliance medicale.

www.alliancemedicale.ru Address: Kutuzovsky Ave, 1/7

Intermed Center American Clinic

www.en.intac.ru Address: 4 Monetchikovsky Lane, 1/6, Building 3

International Clinic MEDSI

www.medsi.ru Address: 26 Prospekt Mira, Building 6

European Medical Center

www.emcmos.ru Address: 5 Spiridon'yevskiy Pereulok, Building 1

Further reading

►For more on the Russian healthcare system see our Healthcare in Russia page.

Expat Interviews " The standard is high, but health insurance is essential − both international and local cover tend to be adequate and similar for routine things." Read more about Stephen, a British expat, and his experience living in Moscow .

Are you an expat living in Moscow?

Expat Arrivals is looking for locals to contribute to this guide, and answer forum questions from others planning their move to Moscow. Please contact us if you'd like to contribute.

Expat Health Insurance

Cigna Global Health Insurance. Medical insurance specifically designed for expats. With Cigna, you won't have to rely on foreign public health care systems, which may not meet your needs. Cigna allows you to speak to a doctor on demand, for consultations or instant advice, wherever you are in the world. They also offer full cancer care across all levels of cover, and settle the cost of treatments directly with the provider. Get a quote from Cigna Global - 20% off

Aetna Aetna International, offering comprehensive global medical coverage, has a network of 1.3 million medical providers worldwide. You will have the flexibility to choose from six areas of coverage, including worldwide, multiple levels of benefits to choose from, plus various optional benefits to meet your needs. Get your free no-obligation quotes now!

Moving Internationally?

International Movers. Get Quotes. Compare Prices. Sirelo has a network of more than 500 international removal companies that can move your furniture and possessions to your new home. By filling in a form, you’ll get up to 5 quotes from recommended movers. This service is free of charge and will help you select an international moving company that suits your needs and budget. Get your free no-obligation quotes from select removal companies now!

Free Moving Quotes ReloAdvisor is an independent online quote service for international moves. They work with hundreds of qualified international moving and relocation companies to match your individual requirements. Get up to 5 free quotes from moving companies that match your needs. Get your free no-obligation quotes now!

Introduction to AXA Travel Insurance

- Coverage Options Offered by AXA

- AXA Assistance USA Cost

AXA Customer Service Reviews

Compare axa travel insurance.

- Why You Should Trust Us

AXA Assistance USA Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Travel insurance is important because it can help cover the cost of unexpected medical expenses while you're traveling. It can also reimburse you for lost or stolen baggage, canceled flights, and other unforeseeable problems that may occur while you're away from home.

Simply put, there's a lot to consider.

But not all policies are created equal, and you must understand what you're covered for before you purchase a policy. This article will look in-depth at AXA Assistance USA travel insurance. We'll discuss the costs, coverage limits, exclusions, and more to help you make an informed decision about whether or not this particular travel insurance provider is right for you.

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

AXA Assistance USA is among the best travel insurance companies . It covers the fundamentals of travel insurance, with coverage for trip cancellations, medical expenses, and emergency medical/non-medical evacuation. With three plans, AXA also offers coverage for travelers with various budgets.

It's worth noting that many important add-ons aren't available for AXA's cheapest Silver plan, such as pre-existing condition coverage, rental car add-ons, and Schengen travel insurance. Cancel for any reason coverage is also only available for AXA's most expensive Platinum plan.

Coverage Options Offered by AXA

AXA Assistance USA offers three levels of coverage: Silver, Gold, and Platinum. Each plan comes with different protections and varying coverage limits, with the Silver being the most basic option and Platinum offering the most premium coverage.