- Join CHOICE

Travel insurance

International travel insurance comparison

Buy smarter with choice membership.

Or Learn more

Reviews and ratings you can trust

Based on intensive lab testing across 200+ product and service categories.

Easy side-by-side comparison

Sort, compare and filter to find the right product to match your needs.

Find the best product for you

Our expert advice outlines the best brands and ones to avoid.

Fact-checked

Checked for accuracy by our qualified fact-checkers and verifiers. Find out more about fact-checking at CHOICE .

If you're going overseas, travel insurance is just as essential as your passport. Use our free comparison tool to narrow down international single trip and annual multi-trip policies from 27 insurers, offering cover for COVID-19, existing medical conditions, car rental and more.

Travel insurance is a portable version of health, home, contents, life, public liability, and car rental excess insurance all packaged in one to take on holidays with you. But with all those insurances piled into one product, navigating your way through the terms and conditions to find the loopholes can be very challenging.

Use our travel insurance comparison to narrow down your options and make sure you're getting the best cover for your needs when on holiday.

List of brands we tested in this review.

- Battleface 2

- Cover-More 5

- FastCover 4

- Flight Centre 4

- Go Insurance 4

- InsureandGo 3

- Southern Cross Travel Insurance (SCTI) 3

- Tick Travel Insurance 4

- Travel Insurance Direct 3

- Virgin Australia 5

- WAS Insurance 2

- World Nomads 2

- World2Cover 4

The average cost of the policy compared to other policies of the same type (single trip or annual multi-trip). One $ sign is the cheapest through to five $$$$$ the most expensive. NA means the policy wasn't included in the price rating.

enter value/s in increments of 1 between 0 and 0

Policy type

- One trip 65

- Policy age limit

In years (up to and including the number stated). For policies listed as '100+', there is no age limit.

Does the policy cover international cruises?

- Optional 71

Medical expenses for COVID-19

Whether the policy covers you for medical and emergency evacuation and repatriation expenses for claims arising directly or indirectly from COVID-19. Cover is assessed on individual circumstances.

Cancellation expenses for mental health

Whether the policy covers you for cancellation expenses for claims arising directly from recognised mental health disorders experienced for the first time such as depression, anxiety, schizophrenia, bipolar disorder or PTSD. Cover is assessed on individual circumstances.

- Cancellation for insolvency of a travel services provider

Whether the policy covers you for losses arising out of insolvency of a travel services provider (e.g. airline, accomodation provider, bus line, shipping line, railway company, motor vehicle rental agency). Cover is assessed on individual circumstances.

Cancellation expenses for a natural disaster

Whether the policy covers you for cancellation expenses for claims arising directly or indirectly from a natural disaster. Cover is assessed on individual circumstances.

Cancellation expenses for civil unrest

Whether the policy covers you for cancellation expenses for claims arising directly or indirectly from civil unrest such as political protests, riots and strikes. Cover is assessed on individual circumstances.

- Baggage cover

Are stolen or damaged personal belongings covered

- Limit for baggage expenses

The overall limit for stolen or damaged personal belongings.

- Limit for a smartphone

Limit for a smartphone. Cover is assessed on individual circumstances.

- Limit for a laptop or tablet

Limit for a laptop or tablet. Cover is assessed on individual circumstances.

- Limit for rental car excess

Limit for collision damage excess for a hire car. Cover is assessed on individual circumstances.

- Scuba diving

Does the policy cover scuba diving if you are appropriately certified or diving with a qualified instructor?

Skiing and snowboarding on-piste

Does the policy cover skiing and snowboarding on-piste?

- Optional 82

Skiing and snowboarding off-piste

Does the policy cover skiing and snowboarding off-piste withing the resort boundaries?

- Optional 72

Tobogganing

Does the policy cover tobogganing on snow?

- Optional 50

Does the policy cover riding a moped with an engine capacity 50cc or below, with a helmet and driving license valid in the country the policy holder is in, but without an Australian motorcycle license

- Optional 32

Moped 125cc

Does the policy cover riding a moped with an engine capacity 125cc or below, with a helmet and driving license valid in the country the policy holder is in, but without an Australian motorcycle license

- Optional 28

Does the policy cover riding a motorcycle with an engine capacity above 125cc with an Australian motorcycle license and a helmet?

- Optional 34

Included in this comparison

- Price rating

- Dependant age limit

- Cancellation

- Pregnancy stage covered

- Childbirth costs

- Pre-existing conditions covered without application

- Pre-existing conditions covered on application

- Time period for existing conditions

- Medical expenses

- Expenses for a person to accompany a sick policyholder

- Daily hospital cash allowance

- Hours of hospitalisation before receiving allowance

- Dental expenses for accident or injury

- Dental expenses for acute pain

- Overseas funeral costs

- Additional travel expenses for injury or sickness

- Additional expenses for interrupted travel

- Travel insurance extension for a delayed trip

- Additional expenses for a lost passport

- Additional expenses for a sick relative

- Additional expenses for resumption of journey interrupted for a relative

- Cancellation covered

- Cancellation expenses

- Cancellation for frequent flyer points

- Cancellation expenses for travel agent fees

- Cancellation for insolvency of a travel agent

- Cancellation expenses for redundancy

- Cancellation expenses for defence and emergency workers

- Cancellation expenses for cancellation of work leave

- Cover for transport incidents

- Cover for strikes

- Cover for mental health

- Cover for COVID-19

- Cover for pandemics

- Cover for natural disasters

- Cover for civil unrest

- Cover for terrorism

- Cover for war

- Additional expenses for a special event

- Additional expenses for pre-paid travel arrangements

- Limit for travel delay expenses

- Hours before travel delay covered

- Limit per 24 hours for travel delay

- Limit for a single unspecified item

- Limit for a video or photo camera

- Limit for prescribed medications

- Overall limit for specified items

- Cover for baggage in a car during the day

- Cover for baggage in a car overnight

- Cover for valuables in a car

- Cover for lost or stolen cash

- Limit for baggage lost temporarily

- Hours before cover applies for baggage lost temporarily

- Rental car excess

- Snow sports

- Mopeds and motorcycles

- Bungee jumping

- Horse riding

- High altitude hiking

- White water rafting

- Paragliding

- Hot air ballooning

- Hang gliding

Displaying all 91 products

- Brand (A-Z)

Limit for additional meal and accommodation expenses if scheduled transport is delayed.

Your filters

This overall score is based on our expert assessment of what the policy covers, price and how easy it is to understand and buy. A higher score is better.

1Cover Comprehensive

1Cover Frequent Traveller

1Cover Medical Only

AANT Annual Multi-Trip

AANT Basics

AANT Essentials

AANT Premium

AHM Comprehensive

AHM Comprehensive Multi-Trip

AHM Medical Only

Battleface Covid Essentials

Battleface Discovery

Cover-More Basic

Cover-More Comprehensive

Cover-More Comprehensive Multi-Trip

Cover-More Comprehensive Plus

Cover-More Comprehensive Plus Multi-Trip

FastCover Basics

FastCover Comprehensive

FastCover Frequent Traveller Saver

FastCover Standard Saver

Flight Centre Multi-Trip YourCover Essentials

Flight Centre Multi-Trip YourCover Plus

Flight Centre YourCover Essentials

Flight Centre YourCover Plus

Go Insurance Go Basic

Go Insurance Go Basic Annual Multi-Trip

Go Insurance Go Plus

Go Insurance Go Plus Annual Multi-Trip

InsureandGo Bare Essentials

InsureandGo Gold

InsureandGo Silver

Jetstar Comprehensive

Medibank Comprehensive

Medibank Medical Only

Medibank Multi-Trip Comprehensive

NIB Annual Multi-Trip

NIB Comprehensive

NIB Essentials

NRMA Comprehensive

NRMA Comprehensive Multi-Trip

NRMA Essentials

Qantas Annual Multi-Trip

Qantas International Comprehensive

RAA Essentials

RAA Multi-Trip

RAA Premium

RAC Annual Multi-Trip

RAC Comprehensive

RAC Essentials

RAC Medical Only

RACQ Annual Multi-Trip

RACQ Premium

RACQ Standard

RACT Annual Multi-Trip

RACT Comprehensive

RACT Essentials

RACV Annual Multi-Trip

RACV Basics

RACV Comprehensive

RACV Essentials

Southern Cross Travel Insurance (SCTI) Annual Multi-Trip

Southern Cross Travel Insurance (SCTI) Comprehensive

Southern Cross Travel Insurance (SCTI) Medical Only

Tick Travel Insurance Basic

Tick Travel Insurance Budget

Tick Travel Insurance Standard

Tick Travel Insurance Top

Travel Insurance Direct Annual Multi-Trip

Travel Insurance Direct Basics

Travel Insurance Direct The Works

Virgin Australia International Plan (bought with flight purchase)

Virgin Australia Travel Safe International

Virgin Australia Travel Safe International Multi-Trip

Virgin Australia Travel Safe Plus International

Virgin Australia Travel Safe Plus International Multi-Trip

WAS Insurance Covid Essentials

WAS Insurance Discovery

Webjet Travel Safe International

Webjet Travel Safe International Multi-Trip

Webjet Travel Safe Plus International

Webjet Travel Safe Plus International Multi-Trip

World Nomads Explorer

World Nomads Standard

World2Cover Annual Multi-Trip

World2Cover Basics

World2Cover Essentials

World2Cover Top

- Insurance provider

Product selected for a detailed comparison

Enter your ZIP Code!

Get a quote today., expedia travel insurance: plans, costs, reputation, & services.

Expedia markets itself as “the world’s travel platform.”

In business since 1996, the company has grown to be one of the biggest travel insurance providers in the world.

It has several plans with different coverage levels suitable for a variety of travelers, helping keep its spot as a leading travel insurance company in the industry.

Expedia’s plans can be customized with a variety of add-ons and extra benefits that let travelers make sure they get the best travel insurance for their needs and budget.

Travelers can find out more about the costs of an Expedia travel insurance plan by visiting its website and inputting their personal information, with the details of their planned trip.

The company routinely provides flights and hotels, bundling travel insurance as part of this main offering.

Expedia’s travel insurance is only available for purchase when you book your trip and accommodation with the company.

Aon Affinity Travel Practice, who administers Expedia’s travel insurance policies, has a rating of A+ from the Better Business Bureau (BBB).

This is an indicator of the efficient way this company deals with complaints that are filed against it.

While it had 49 logged complaints within the last 12 months, according to the BBB, the company’s prompt response time is reflected in its A+ rating.

Expedia provides a mobile app which gives its customers the ability to file a claim from anywhere in the world.

It also offers 24/7 telephone support.

While this is a pretty standard offering in the travel insurance industry, it’s a great relief knowing that if you need to talk to your travel insurance provider from a different time zone, you’ll be able to.

An insurance company’s financial stability is regularly overlooked by potential customers, but can often be just as important as analyzing travel insurance reviews.

Expedia’s underwriting company, Stonebridge Casualty, has received a rating of “A” by A. M. Best through its parent organization Transamerica Casualty.

Financial stability should always be something to consider when you’re looking at travel insurance providers .

Expedia Travel Insurance Coverage & Plans

Expedia travel insurance offers a wide variety of coverage plans to ensure protection across a variety of situations.

Each offering has several available levels of coverage, so there’s a big chance you can find something that’s right for you to protect you when you’re away from home.

Expedia travel insurance provides the following types of coverage:

- Comprehensive

- Trip Cancellation/ Interruption

- Accidental Death

Expedia Package Protection

This plan provides trip cancellation and interruption coverage.

It also includes reimbursement for any expenses incurred if your travel is delayed due to mechanical failure, strike, or adverse weather conditions.

This plan also protects you in the event of medical emergencies and can help with the costs of medical expenses and medical transportation.

Baggage and personal property is covered, so any lost, stolen, or damaged items during travel can be replaced.

If a hurricane warning has been issued and you need to change the specifics of your trip, the company may waive cancellation fees and liaise with its partnering companies to waive its associated fees as well.

You can also receive assistance with re-booking the entirety of your trip, including your flight and any activities you may have booked.

Though Expedia only offers one travel insurance plan, the company has a wide range of add-ons.

These include coverage for lost passport and document assistance, emergency cash, translation services, medical case management, and concierge services such as restaurant or event referrals and reservations.

While these add-ons may understandably increase the cost of your travel insurance, they also provide you with a greater degree of protection and offer added value.

Expedia Travel Insurance Costs

Travel insurance generally costs between 4 and 8 percent of the total trip.

While this is the industry standard, the actual costs of your travel insurance usually depend on the level of coverage you select and how comprehensive your plan is.

Travel insurance companies base their actuarial math on several factors.

The length of the trip is a significant determiner, as the longer you’re traveling, the more likely adverse calamities could occur. Destination dramatically impacts the price as well.

If you’re visiting an area with a high crime rates, political unrest, or poor infrastructure, to name just a few, insurance providers may view you as a higher risk. The age of the policyholder can also influence the price of the premium.

Generally, consumers aged 70 or over can expect to pay considerably more for their travel insurance.

The price of travel insurance is calculated based on risk, and the older you are, the more your risk increases in the eyes of the insurance providers.

Travelers can get a quote from Expedia by visiting its website and providing precise details of the trip that they plan on making.

Expedia doesn’t have annual options available, so it may not be possible to get a standard rate year in year out.

There’s no minimum age limit for insuring children via this company, though dependents are covered under their parents’ policy.

Expedia only refunds policies purchased ten days before the trip, provided no claims have been made.

Customer Reviews & Reputation

Before purchasing any travel insurance policy, it’s important to look at the insurer’s reviews, to gain insight into the company should you need its services on your trip.

Expedia (through Aon Affinity) has been awarded the Better Business Bureau’s highest rating of A+.

Though this rating is not uncommon, it is noteworthy that Aon Affinity has closed 49 complaints in the past 12 months.

This high volume of complaints can be attributed to the fact that this company is quite a large insurance provider.

Customer Assistance Services

When you take out a travel insurance plan with Expedia, you benefit from 24/7 support and access to its mobile app, with paperless claim filing available.

Choosing a travel insurance company that has modern interfaces is always a good choice, as instant access can significantly reduce your stress should something go wrong on your trip.

Another critical aspect to consider, and one which may not initially cross your mind, is whether the insurance company you choose has 24/7 support available.

This is particularly important for travel to far removed time zones from your own.

Expedia also provides additional concierge services such as ground transportation, up to the minute travel advice, and event or restaurant referrals and bookings.

Expedia Travel Insurance Financial Stability

Financial stability is an essential factor to consider when choosing an insurance company.

Dedicated credit rating agencies such as A.M Best, Standard and Poor’s, and Moody’s analyze insurance companies and report their findings, publishing results regularly.

Good ratings with any of these are generally indicative of a company’s ability to meet its obligations.

Expedia is underwritten by Stonebridge Casualty, a subsidiary of Transamerica Casualty, which has received a rating of A from A. M. Best.

This high rating shows that the backing company can meet its ongoing insurance obligations.

If there were any concerns with the quality of the coverage offered by this company, or of its ability to make good on claims, A. M. Best would have a lower rating.

Expedia Travel Insurance Phone Number & Contact Information

- Homepage URL : https://www.expedia.com/

- Provider Phone : (877) 227-7481

- Headquarters Address : 333 108th Ave NE Ste 300, Bellevue, WA 98004-5736

- Year Founded : 1996

Best Alternatives to Expedia Travel Insurance

Not satisfied with what Expedia has to offer? These companies provide great travel insurance alternatives:

Additional Providers

There are several other travel insurance providers that deserve consideration as well which you can see in our Best Travel Insurance Companies article.

These companies didn’t make our list of top providers but we have created some more detailed reviews that you can view below:

- Allianz Travel Insurance Review

- Aon Travel Insurance Review

- Carnival Travel Insurance Review

- Chubb Travel Insurance Review

- CSA Travel Insurance Review

- Expedia Travel Insurance Review

- Hotwire Travel Insurance Review

- IMG Travel Insurance Review

- InsureMyTrip Travel Insurance Review

- JetBlue Travel Insurance Review

- John Hancock Travel Insurance Review

- Medjet Medical Transport Insurance Review

- Orbitz Travel Insurance Review

- Patriot Travel Insurance Review

- Priceline Travel Insurance Review

- Progressive Travel Insurance Review

- Red Sky Travel Insurance Review

- Ripcord Travel Insurance Review

- Travel Insured International

- Travelex Travel Insurance Review

- USAA Travel Insurance Review

- USI Affinity Travel Insurance Review

- World Nomads Travel Insurance Review

Free Insurance Comparison

Enter your ZIP code below to view companies that have cheap insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

Expedia Travel Insurance - 2024 Review

Expedia travel insurance.

- Available at Check-Out

- Very Expensive

- Poor Coverage - Significant Gaps in Cover

Sharing is caring!

Expedia has grown to become one of the most dominant platforms in travel distribution. Its comparison engine has helped save customers millions of dollars on flights and hotels. At the end of each session, every customer is pushed to buy Expedia Travel Insurance.

Expedia Domestic Travel Insurance

Expedia's Domestic Insurance provides no Travel Delay cover. As in, zero. Expedia does not offer any Baggage cover in its domestic travel insurance. Lost bags are your problem.

Expedia International Travel Insurance

When traveling internationally, Expedia Flight Insurance offers only pitiful medical cover - $5k. We recommend no less than $100k of medical cover when overseas - Expedia's Flight Insurance level of protection is totally inadequate.

Check the cost and cover from Expedia Travel Insurance. Then run a quote with a Travel Insurance Marketplace like TravelDefenders . You will get a range of travel insurance quotes from the leading travel insurers in the USA.

We worry that customers who buy Expedia Travel Insurance will think that they have useful comprehensive cover, yet be dangerously short of travel protection. It only takes one minute to compare travel insurance. We strongly recommend that Expedia customers do this.

But, Is Expedia Travel Insurance Worth Buying?

Expedia customers traveling domestically within the USA who think that they are getting cheap Expedia Travel Insurance will have little or no cover. Expedia’s insurer, AIG Travel Guard, won’t even call it Travel Insurance – it is referred to as a ‘Flight Cancellation’ policy. The policy has so little in the way of travel cover we cannot think why the policy was created. It is nearly useless.

Should you buy Expedia Travel Insurance when traveling internationally you will have woefully weak protection. Again, AIG Travel Guard will not call it Travel Insurance on its policy documents. This time, it is known as a ‘Flight Total Protection Plan’. There are so many weaknesses in this policy. The international travel health protection is totally inadequate, in our opinion.

Please enjoy our comprehensive Expedia Travel Insurance Review. Please do not buy Expedia Travel Insurance until you have read the review.

Expedia Travel Insurance Highlights

- Expedia’s Flight Insurance is provided by AIG, a highly reputable travel insurer.

- Expedia Travel Insurance is incredibly expensive – twice the price of other policies.

- Expedia Travel Insurance has very weak levels of cover that are insufficient for most travelers.

We cannot recommend that you buy Expedia Travel Insurance.

There are a multitude of better trip insurance plans with better cover at a lower price.

Expedia Travel Insurance – Cover Provided by AIG Travel Guard

AIG Travel Guard is the underwriting partner for Expedia Travel Insurance. AIG is one of the most respected travel insurance carriers in the USA. Indeed, we are a partner of AIG’s, and host a number of its comprehensive travel insurance policies. However, the policies that AIG provides to Expedia are not Trip Insurance policies. They are described as ‘Flight Protection’ plans, and look nearly worthless to us.

Expedia’s International Travel Insurance Plan is called ‘Expedia Total Protection Plan’.

Expedia’s Domestic Travel Insurance Plan is called ‘Expedia Flight Cancellation Plan’.

We will first cover the Domestic Expedia Trip Insurance, followed by the International Expedia Trip Insurance.

Why Should I Buy Travel Insurance?

Before we jump into the policies that Expedia offers, it probably makes sense to cover the main reasons that people buy travel insurance in the first place.

Tragic Cancellation Cover We want to be able to cancel our trip if we are presented with terrible circumstances at home. If there is a death or serious illness in the family, for example.

Redundancy Protection If we lose our job, we would like to be able to cancel our trip and be compensated.

Vacation Cancellation Protection If our vacation is cancelled by our employer, we would like to be compensated for the cancelled vacation.

Medical Cover Whether we travel at home or abroad, we want health cover in case we get sick or involved in an accident.

Medical Evacuation Cover If we do get sick or injured, we want our travel insurance to take care of the costs involved in moving us to a medical facility.

Baggage Protection If our bags are lost by the airline, is there cover in place?

Now, there are more options than this in any trip protection policy, but these are the ones that people are most worried about. The ones we consider most critical are the travel health insurance elements, because these have costs that could bankrupt a traveler. Yes, it is annoying to lose a bag, and compensation is nice. But, a $75k medical bill after a serious injury is something that can destroy a person’s financial well-being. Big risks need to be covered, in our opinion.

Domestic Expedia Trip Insurance

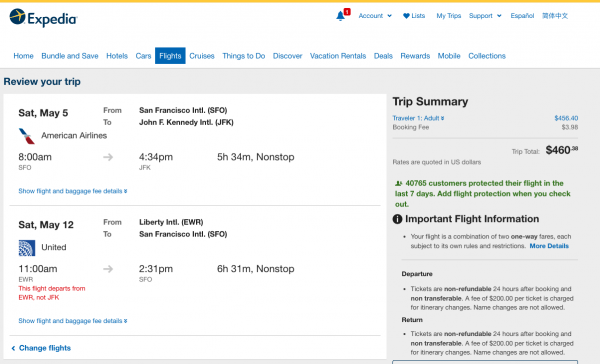

In order to highlight the benefits and protection that Expedia offers on its domestic plans, we ran a full quote. Our traveler is heading from San Francisco to New York, spending a week with friends before heading home.

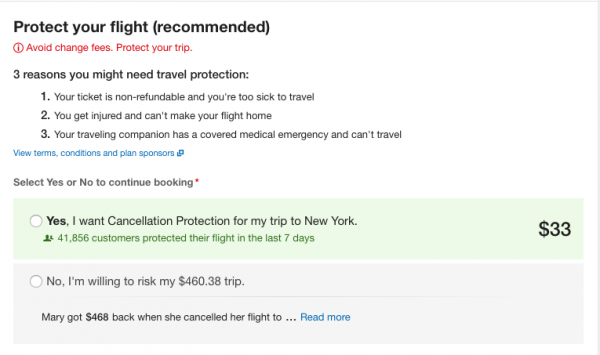

Our flight has a total price of $460. Note that we are encouraged to buy Expedia Travel Insurance - after all, over 40,000 people have bought a policy in the last week.

Expedia recommends that we buy flight protection. They highlight the ‘Buy’ area of the screen. Expedia insists that we make a selection to protect our trip, or risk our funds.

This cheap Expedia Travel Insurance is only $33.

Expedia's Scary Language

Here is how the language is presented to a traveler.

Protect your flight (recommended) Avoid change fees. Protect your trip. Expedia Cancellation Plan

3 reasons you might need travel protection:

- Your ticket is non-refundable and you're too sick to travel

- You get injured and can't make your flight home

- Your traveling companion has a covered medical emergency and can't travel

Yes , I want Cancellation Protection for my trip to New York. 41,856 customers protected their flight in the last 7 days $33

No, I'm willing to risk my $460.38 trip.

Mary got $468 back when she cancelled her flight to ... Read more

Because we are naturally curious, we decided to read more. After all, it sounds as though ‘Mary’ can cancel her trip and get her money back. Well, actually she can only get compensation on this Expedia Travel Protection Plan for a tiny number of reasons.

When we expand the statement from ‘Mary’, we understand that she was only able to receive compensation for an unusually tragic reason:

Mary got $468 back when she cancelled her flight to care for her sick husband.

“I didn't know I would get a refund, thought I would get a credit with the same airline. It will make booking the trip easier, when my husband gets better.”

-Mary C., Gloucester, VA

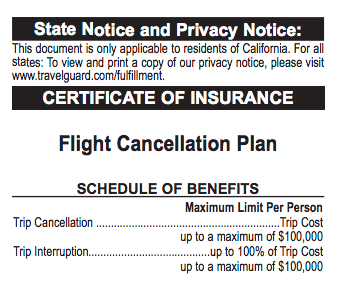

Domestic Expedia Travel Insurance Benefit

Here is the exhaustive list of benefits that a traveler will get from this cheap Expedia Travel Insurance…

AIG Travel Guard Flight Cancellation Plan

SCHEDULE OF BENEFITS Maximum Limit Per Person

- Trip Cancellation - Trip Cost (up to a maximum of $100,000)

- Trip Interruption - up to 100% of Trip Cost (up to a maximum of $100,000)

As in, this nearly worthless policy has protection for cancellation and interruption only. That’s it. And, of course, the reasons that count as being covered are extreme.

It covers disabling injuries or illnesses that make travel impossible, as certified by a doctor. If you are hi-jacked or quarantined or called to jury duty. If you are made redundant.

Now, we recognize that these are risks worth protecting, but surely most of us would expect far higher levels of trip insurance cover? We have never seen a trip protection policy with so little useful cover for a traveler.

What is Missing from Domestic Expedia Travel Insurance?

Travel health insurance.

Most people associate travel insurance with health cover. This is as true for domestic travel as it is for international. Although many of us will have some type of health insurance, there are often restrictions if we travel away from our home state. We should be aware of any additional costs by using out-of-state medical facilities, or out-of-network costs.

Every single travel insurance policy that we offer through TravelDefenders has travel health insurance embedded in. It is standard – every travel insurer seems to offer this on their travel insurance policies. Travelers assume that health cover will be in any policy they buy. We can only assume that most travelers would not even think to check the Expedia Trip Protection policy document. If they did, we assume that they would be shocked by the lack of travel protection.

We cannot recommend Expedia Travel Insurance if it does not include this most basic of travel health insurance provisions.

Travel Evacuation Insurance

In the event that you get seriously injured or very ill, you will need to be moved to the nearest medical facility. The costs of this type of medical transfer can be very high. That’s why we expect to see it in any travel insurance plan. Again, we cannot understand why Expedia does not include it.

Vacation Cancellation Insurance

In the event that our employer cancels our work vacation, it would be great if travel insurance could support us. This type of protection is not available on all policies, but we see it on the more comprehensive plans that we offer.

Now, we think that these are pretty important basic trip insurance benefits. We like to see some, if not all of them, on plans that we promote. By far and away, the travel medical insurance and evacuation benefits are most important. These are the ones that offer the most financial protection.

The best Expedia Travel Insurance that you could find would have these policy elements included. Expedia does not include them. Its policy is incredibly weak. Look for better options, please.

Alternatives to Domestic Expedia Travel Insurance

TravelDefenders is a travel insurance marketplace. We make comparisons of travel insurance policies. We only work with the USA’s leading travel insurance providers.

Our insurers are licensed and regulated in all 50 US states and D.C. Every one of our insurance carriers has many different policy options for our travelers to choose from. Our carriers are happy to have their policies compared against those of their competitors. Every one of our Travel Insurance partners has an A.M. Best rating of at least an ‘A’.

Why is this important to an Expedia customer?

Expedia will only offer you one option for travel insurance. What they offer you is awful. So, instead of that, we offer you a dozen or so. We do not share your contact information with the insurance carriers. So, our insurance carriers give you binding insurance quotes, but do not then bombard you with marketing. Your quote is anonymous. You receive the best possible insurance rates available.

Best possible rates?

The price of each insurance we share with you is identical to the price if you went to each and every travel insurer directly.

So, rather than wasting an hour searching and comparing for our insurers directly, you can do it through us in a minute.

Here is what we found when we went to find travel insurance to compete against the awful Expedia Travel Insurance policy.

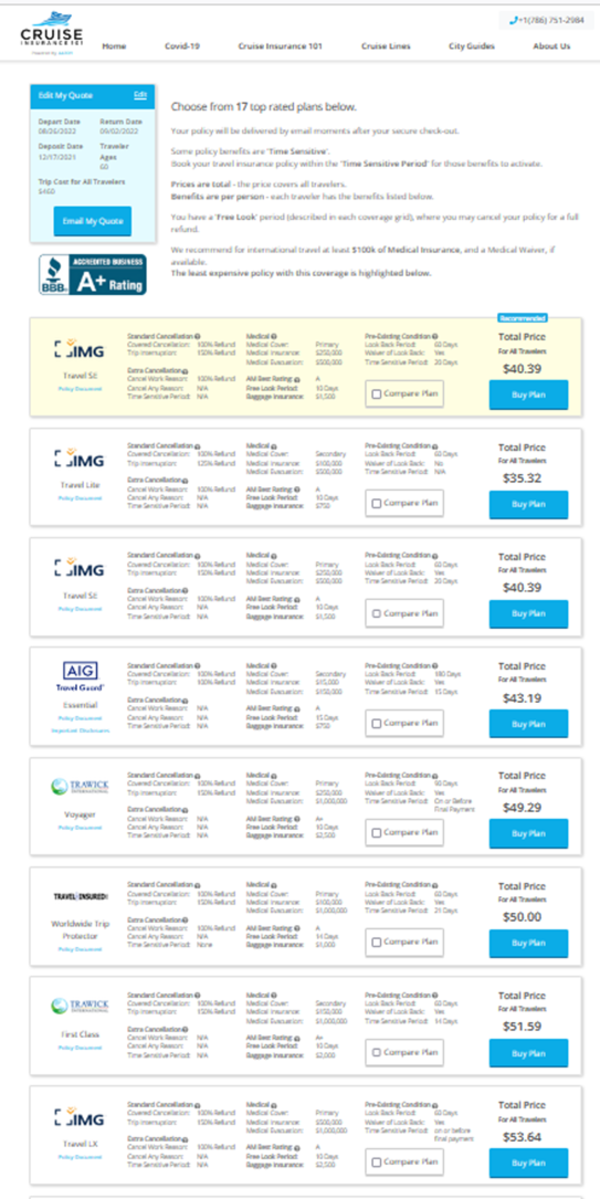

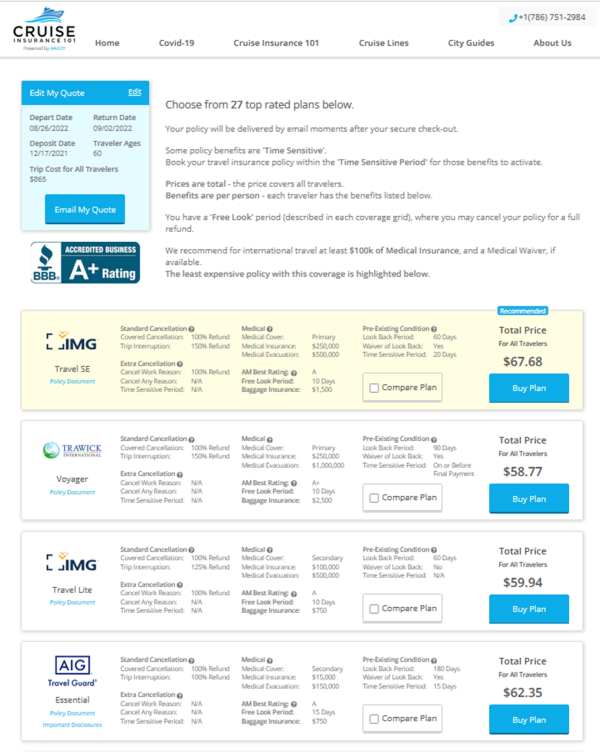

Here is the same trip that we ran through our system. It took less than one minute to generate the quote options. All details were passed to our Travel Insurance Carriers anonymously.

Here is what happens when travel insurance carriers get to compete with one another – the customer wins. Our customer was able to compare 17 different plans, with varying levels of cover and cost. As always, plans are shown with the least expensive first. There is no desire to oversell to a customer cover that they do not need. Travel insurance for seniors is available from all of our carriers. We have travelers in their late 90's still exploring the world, and doing so having compared travel insurance rates with us.

One plan immediately stands out – the IMG Travel Lite plan. It is one of our most popular trip insurance plans for international travel.

Note that at $35, this is $2 more than the expedia plan, yet, look at the powerful benefits available to a customer.

IMG Travel Lite

Standard Cancellation Benefit

- Covered Cancellation: 100% refund

Medical Benefits

- Medical Cover: Secondary

- Medical Sickness: $100,000

- Medical Evacuation: $500,000

- Free Look Period: 10 days

Extra Cancellation Benefit

- Cancel for Work Reason: 100% Refund

- Cancel for Any Reason: N/A

- Time-Sensitive Period: N/A

Pre-Existing Condition Benefit

- Look-Back Period: 60 days

- Waiver of Look-Back: No

A.M. Best Rating: A

Here is a cheap travel insurance policy for an Expedia customer, that has 20 times the level of Travel Medical Insurance cover, yet is just $2 more expensive than that which Expedia suggests to its customers.

If seeking a cheap plan which also contains a strong Pre-Existing Medical Condition Exclusion Waiver , the plan that stands out is the TravelDefenders recommended plan - the IMG Travel SE which has a massive $250,000 of medical cover, cancel for work reasons, and a pre-existing condition waiver added in for free if the plan is bought within 20 days of your initial trip payment. All this for just $40.

Remember that this Travel Insurance policy needs to be booked within 20 days of your initial trip deposit to qualify for the free Medical Waiver .

Cancel for Any Reason Travel Insurance

There are times when we would like the flexibility to cancel our trip without any reason at all and still receive compensation. This type of cover is known as Cancel for Any Reason Travel Insurance , and is embedded in only the most comprehensive of plans.

It is a really useful option for those people who are unsure if their plans will remain consistent, and want the option to cancel, and be compensated. We have long been advocates of the use of this cover to run what we call the Airline Ticket Hack .

Essentially, we book a non-refundable airline ticket. Then we add Cancel for Any Reason Travel Insurance. If we need to cancel the flight, we call in the insurance, and get a 75% refund. It’s the smartest way to get low cost, near-refundable tickets that we know of. We love it. Airlines hate it.

International Expedia Trip Insurance

As terrible as Expedia’s Travel Insurance is, its International Protection is actually worse. When traveling domestically, we may have medical cover from home that works for us on the road. If we do not buy domestic travel insurance we will have co-pays and out-of-pocket expenses, but hopefully this will only be thousands of dollars.

Now think about traveling internationally. A serious accident or illness can take us into hospital. International state-sponsored public health programs are not going to be available to us. We will need to pay the full cost of any medical treatment we receive. Our recommendation is to have at least $100k of medical cover when traveling internationally. With day rates at international private hospitals hitting $3k to $4k per day, any less seems to create too much financial risk.

When overseas, medical evacuation can be critically important as well. Here, we like to see $100k of cover if on a trip close to the USA, and $250k of cover if much further away.

International Expedia Travel Insurance – Example

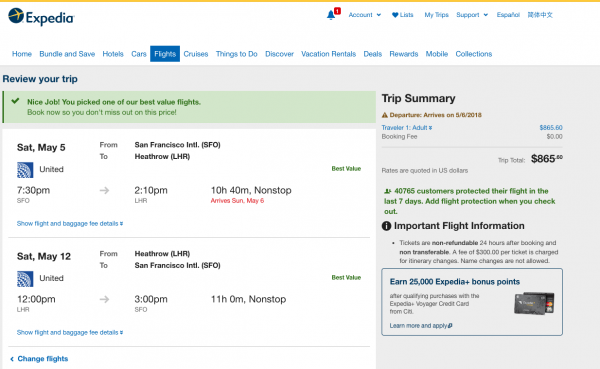

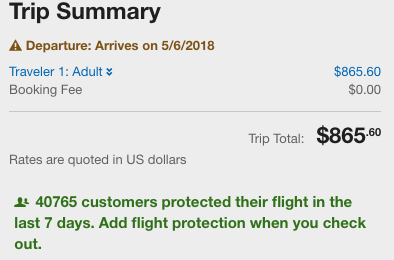

We ran a quote for a flight from San Francisco to London, finding a trip that cost $865.

Again, at check-out Expedia encourages us to buy its flight insurance. We get slightly different language from them this time, because the trip insurance policy has changed.

Instead of an 'Expedia Flight Cancellation' plan, which we saw when traveling domestically, we get the 'Expedia Flight Total Protection Plan.' Now, that sounds comprehensive, doesn’t it? Anything that is called a ‘Total Protection Plan’ ought to be all-encompassing, you would think.

Taking a look, we see the following.

The same message that 2 million people buy Expedia Travel Insurance each year.

An overview of the benefits that ‘total protection’ buys us for $56.

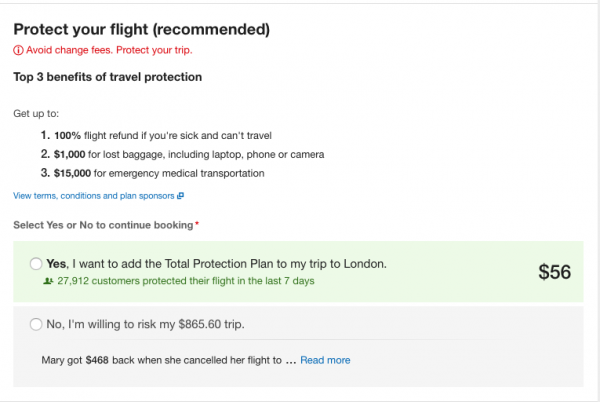

Then we see a similar type of language to scare/nudge our traveler into buying this awful cover.

Yes, I want to add the Total Protection Plan to my trip to London. 27,912 customers protected their flight in the last 7 days $56

No, I'm willing to risk my $865.60 trip.

AIG Travel Guard Flight Total Protection Plan

- Baggage & Personal Effects - $1,000

- Accident Sickness Medical Expense - $5,000

- Emergency Evacuation - $15,000

- Repatriation of Remains - $15,000

- Flight Guard® - $50,000

Protect your flight (recommended)

Avoid change fees. Protect your trip. Expedia Cancellation Plan

Select Yes or No to continue booking

Now, there are a few more benefits on this Expedia ‘total protection’ policy than we saw for the domestic trip. But did you check the cover levels?

$15k for Emergency Evacuation? $5k for Medical Expense?

These cover levels are pathetic as stand-alone insurance levels. They are woefully inadequate unless you have a strong secondary insurance policy that can pick up the vast majority of the costs. These benefit levels are totally insufficient for most international travelers.

TravelDefenders International Travel Insurance Options

Once again we run the trip through our travel insurance marketplace. Again, we quickly get more than a dozen different travel insurance options for a traveler to choose from.

Again, for a plan that includes a waiver of pre-existing conditions, we would opt for the IMG ravel SE plan at $67. This is $11 more than the Expedia plan but again, look at the coverage for our traveler.

Review – International Expedia Travel Insurance $56 Cover versus IMG Travel SE

Img travel se - time-sensitive benefits.

- Cancel for Work Reason: 100% refund

- Pre-Existing Waiver: Yes

- Time-Sensitive Period: 20 days

- Pre-Existing Look-Back: 60 days

IMG Travel SE - Regular Benefits

- Medical Cover: Primary

- Medical Sickness: $250,000

International Expedia Travel Insurance - Time-Sensitive Benefits

- Cancel for Work Reason: 0% refund

- Free Look Period: 15 days

International Expedia Travel Insurance - Regular Benefits

- Medical Sickness: $5,000

- Evacuation: $15,000

There is an embarrassing lack of cover in the Expedia policy. Here are where we think the most obvious cover gaps are.

Work Cancellation

- IMG Travel SE – Yes

- Expedia Insurance – No

Travel Medical Insurance

- IMG Travel SE - $250k Cover

- Expedia Insurance - $5k. Expedia has incredibly weak protection.

- IMG Travel SE - $500k cover

- Expedia Insurance - $15k. Woefully limited cover from Expedia.

Travelers should always consider their options when searching for travel insurance. We consistently see International Expedia Travel Insurance as one of the most expensive in the USA with some of the worst cover. There will almost certainly be a better option with more cover and a lower price.

TravelDefenders – Compare & Save

TravelDefenders is a travel insurance marketplace. We get binding insurance quotes, anonymously, from all of our major travel insurance carriers. We provide simple comparison for travel insurance in less than a minute.

Does TravelDefenders Charge More?

In the USA, insurance is regulated with anti-discrimination protection in place.

Identical travel insurance policies must be sold at the same price. We cannot mark up a policy. We cannot discount a policy. No one can. We offer a fuller explanation here: Travel Insurance Comparison

What does this mean to me as a travel insurance customer? If you went to each of our travel insurance partners and ran quotes with every one of them, you would see the exact same price as we quote. We do not charge a cent more. All that we do is compare insurance plans within the market. You no longer need to jump from insurer to insurer. You will see the best rates for each trip insurance policy.

All we need is one minute of your time. TravelDefenders is the leading travel insurance marketplace in the USA.

Safe travels.

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Yvonne McNamara

Very easy site to follow

Very easy site to follow. Have used this company for previous travel and they never disappoint.

Janet was super helpful

Easy and quick

- Vacation packages

- Vacation rentals

- Things to do

- AARP Member Savings

- Create an Account

- List of Favorites

- Not ? Log in to your account

Create your free account

Sign in to your account, travel protection plans, package protection plan.

Take travel woes into account with the Package Protection Plan. This plan covers you from the moment you book your vacation until you return home.

- Change or cancel your trip for any reason one time prior to departure

- Enjoy coverage from the time you book until you return home

- Provides reimbursement for emergency medical expenses, lost luggage, and more

For a pre-travel plan only, consider the Vacation Waiver

Please see Terms and Conditions for full terms, including limitations and exclusions.

- Plan Coverage

- What's Not Covered

- Claim Instructions

- Terms Of Coverage

- Definitions

Important: This program is valid only if the appropriate plan cost has been received by Expedia, Inc. Please keep this document as your record of coverage.

SECTION I: Expedia Vacation Waiver

IMPORTANT: Benefits under Section I are provided by Expedia, Inc. Details regarding cancellation penalties, terms and conditions are fully outlined here.

Change or cancel for any reason

The Expedia Vacation Waiver helps protect you against life's unexpected occurrences. Your group is allowed to change or cancel your trip for any reason one (1) time prior to the scheduled start time* of your trip without being charged any change or cancellation fees. If canceling, any monies paid will be returned to the customer who booked the travel except the cost of published airfare, which may be made available as a credit for future travel.**

Note: The waiver is valid once you have paid the appropriate waiver cost and your booking is confirmed.

*Scheduled Start Time is defined as the originally scheduled departure time of your flight or, if you haven’t booked a flight as part of your package, the scheduled check-in time of your hotel at the time of booking. Other terms and conditions apply. Please see Terms and Conditions below.

**For a published air ticket , credit may be issued per applicable airline policies less airline change fees and Expedia, Inc. will absorb the change fees. The actual airfare could be higher at the time of rebooking; in that event the price differential would be your responsibility. You are allowed to change or cancel your trip for any reason one (1) time prior to the start of your trip.

Refund Instructions

When your group purchases Expedia Vacation Waiver you will be asked to print your voucher. Please keep your voucher handy as a reference. You do not need to redeem your voucher at any time. You will also be able to access your information from the voucher in your online itinerary once your booking is confirmed. The Expedia Vacation Waiver is valid for redemption only by the person(s) named on the voucher. The waiver is not transferable, has no cash value, and may be redeemed only once. Once the voucher has been utilized it cannot be reused. The Expedia Vacation Waiver must be purchased at the time of booking; waivers cannot be purchased after booking.

You must call contact Expedia at 1-800-675-4318 to cancel or change your vacation package.

Terms & Conditions

The Expedia Vacation Waiver is valid for redemption only by the person(s) named on the voucher. It is not transferable, has no cash value, and may be redeemed only once. The Expedia Vacation Waiver must be purchased at the time of booking; waivers cannot be purchased after booking. The Vacation Waiver excludes the price of the Expedia Vacation Waiver.

If you change or cancel your trip for ANY REASON prior to the scheduled start time* of your trip, all package cancellation fees imposed by the Booking Agent will be waived, except the cost of Published Air.

SECTION II: Coverages offered by Insurer

Stonebridge Casualty Insurance Company Travel Insurance Certificate Policy Number MZ0911076H0002A

DESCRIPTION OF COVERAGE

- Schedule: Expedia, Inc Maximum Benefit Amount

PART A. TRAVEL ARRANGEMENT PROTECTION

- Trip Cancellation Up to Total Vacation Cost

- Trip Interruption Up to Total Vacation Cost

- Trip Delay $500, Up to $100/day

PART B. MEDICAL PROTECTION

- Emergency Evacuation/Repatriation of Remains $15,000

- Accident Medical Expense $5,000

- Sickness Medical Expense $5,000

PART C. BAGGAGE PROTECTION

- Baggage/Personal Effects $1,000

- Baggage Delay $500

PART D. TRAVEL ACCIDENT PROTECTION

- Accidental Death & Dismemberment Air Common Carrier $50,000

PART E. WORLDWIDE EMERGENCY ASSISTANCE (On Call International)

- CareFree™ Travel Assistance 24/7

- Medical Assistance 24/7

- Emergency Services 24/7

The benefits provided in this program are subject to certain restrictions and exclusions. Important: Please read this brochure in its entirety for a complete description of all coverage terms and conditions. Note: Words beginning with capital letters are defined in this text.

SUMMARY OF COVERAGES

Trip Cancellation and Trip Interruption Benefits

Pre-Departure Trip Cancellation

We will pay a Pre-Departure Trip Cancellation Benefit, up to the amount in the Schedule for non-refundable cancellation charges imposed by Expedia, Inc. if you are prevented from taking your Covered Vacation due to your, an Immediate Family Member’s, Traveling Companion’s, or Business Partner’s Sickness, Injury or death or Other Covered Events as defined, that occur(s) before departure on your Covered Vacation.

The Sickness or Injury must: a) commence while your coverage is in effect under the plan; b) require the examination and treatment by a Physician at the time the Covered Vacation is canceled; and c) in the written opinion of the treating Physician, be so disabling as to prevent you from taking your Covered Vacation.

Pre-Departure Trip Cancellation Benefits

We will reimburse you, up to the amount in the Schedule for the amount of prepaid, non-refundable, and unused Payments or Deposits that you paid for your Covered Vacation. We will pay your additional cost as a result of a change in the per person occupancy rate for prepaid travel arrangements if a Traveling Companion’s Covered Vacation is canceled and your Covered Vacation is not canceled.

Note: As respects air cancellation penalties, you will be covered only for air arrangements booked through Expedia, Inc. and flights connecting to such air arrangements booked through Expedia, Inc. We will not pay benefits for cancellation charges imposed on any other air arrangements you may book on your own.

Post-Departure Trip Interruption

We will pay a Post-Departure Trip Interruption Benefit, up to the amount in the Schedule, if: 1) your arrival on your Covered Vacation is delayed; or 2) you are unable to continue on your Covered Vacation after you have departed on your Covered Vacation due to your, an Immediate Family Member’s, Traveling Companion’s, or Business Partner’s, Sickness, Injury or death or Other Covered Events as defined.

For item 1) above, the Sickness or Injury must: a) commence while your coverage is in effect under the plan; b) for item 2) above, commence while you are on your Covered Vacation and your coverage is in effect under the plan; and c) for both items 1) and 2) above, require the examination and treatment by a Physician at the time the Covered Vacation is interrupted or delayed; and d) in the written opinion of the treating Physician, be so disabling as to delay your arrival on your Covered Vacation or to prevent you from continuing your Covered Vacation.

Post-Departure Trip Interruption Benefits

We will reimburse you, less any refund paid or payable, for unused land or water travel arrangements, and/or the following:

- the additional transportation expenses by the most direct route from the point you interrupted your Covered Vacation: a) to the next scheduled destination where you can catch up

- the additional transportation expenses incurred by you by the most direct route to reach your original Covered Vacation destination if you are delayed and leave after the Scheduled Departure Date. However, the benefit payable under (1) and (2) above will not exceed the cost of a one-way economy air fare by the most direct route less any refunds paid or payable for your unused original tickets.

- your additional cost as a result of a change in the per person occupancy rate for prepaid travel arrangements if a Traveling Companion’s Covered Vacation is interrupted and your Covered Vacation is continued.

- reasonable additional accommodation and transportation expenses (up to $100 per day) incurred to remain near a covered traveling Immediate Family Member or Traveling Companion who is hospitalized during your Trip.

In no event shall the amount reimbursed under Trip Cancellation or Trip Interruption exceed the amount you prepaid for your Trip.

Important: You, your Traveling Companion and/or your Immediate Family Member booked to travel with you must be medically capable of travel on the day you purchase this coverage. The covered reason for cancellation or interruption of your Trip must occur after your effective date of Trip Cancellation coverage.

Other Covered Events means only the following unforeseeable events or their consequences which occur while coverage is in effect under this Policy: a change in plans by you, an Immediate Family Member traveling with you, or Traveling Companion resulting from one of the following events which occurs while coverage is in effect under this Policy:

- being directly involved in a documented traffic accident while en route to departure;

- being hijacked, Quarantined, required to serve on a jury, or required by a court order to appear as a witness in a legal action, provided you, an Immediate Family Member traveling with you or a Traveling Companion is not: 1) a party to the legal action, or 2) appearing as a law enforcement officer;

- having your Home made uninhabitable by fire, flood, volcano, earthquake, hurricane or other natural disaster;

- Your involuntary termination of employment or layoff which occurs after your effective date of coverage and was not under your control. You must have been continuously employed with the same employer for 1 year prior to the termination or layoff. This provision is not applicable to temporary employment, independent contractors or self- employed persons.

If your Covered Vacation is delayed for 12 hours or more, we will reimburse you, up to the amount shown in the Schedule for unused land or water travel arrangements, less any refund paid or payable and reasonable additional expenses incurred by you for hotel accommodations, meals, telephone calls and economy transportation to catch up to your Trip, or to return Home. We will not pay benefits for expenses incurred after travel becomes possible.

Trip Delay must be caused by or result from:

- Air Common Carrier delay;

- loss or theft of your passport(s), travel documents or money;

- being Quarantined;

- natural disaster;

- a documented traffic accident while you are en route to departure;

- unannounced strike;

- a civil disorder.

Medical Expense/Emergency Assistance Benefits

We will pay this benefit, up to the amount on the Schedule for the following Covered Expenses incurred by you, subject to the following: 1) Covered Expenses will only be payable at the Usual and Customary level of payment; 2) benefits will be payable only for Covered Expenses resulting from a Sickness that first manifests itself or an Injury that occurs while on a Covered Vacation; 3) benefits payable as a result of incurred Covered Expenses will only be paid after benefits have been paid under any Other Valid and Collectible Group Insurance in effect for you.

We will pay that portion of Covered Expenses which exceed the amount of benefits payable for such expenses under your Other Valid and Collectible Group Insurance.

Covered Expenses:

Accident Medical Expense/Sickness Medical Expense:

- expenses for the following Physician-ordered medical services: services of legally qualified Physicians and graduate nurses, charges for Hospital confinement and services, local ambulance services, prescription drugs and medicines, and therapeutic services, incurred by you within one year from the date of your Sickness or Injury;

- expenses for emergency dental treatment incurred by you;

Emergency Evacuation:

- expenses incurred by you for Physician-ordered emergency medical evacuation, including medically appropriate transportation and necessary medical care en route, to the nearest suitable Hospital, when you are critically ill or injured and no suitable local care is available, subject to the Program Medical Advisors prior approval;

- expenses incurred for non-emergency medical evacuation, including medically appropriate transportation and medical care en route, to a Hospital or to your place of residence, when deemed medically necessary by the attending Physician, subject to the Program Medical Advisors prior approval;

- expenses for transportation not to exceed the cost of one round-trip economy class air fare to the place of hospitalization for one person chosen by you, provided that you are traveling alone and are hospitalized for more than 7 days;

- expenses for transportation not to exceed the cost of one-way economy class air fare to your place of residence, including escort expenses if you are 25 years of age or younger and left unattended due to the death or hospitalization of an accompanying adult(s), subject to the Program Medical Advisors prior approval;

- expenses for one-way economy class air fare to your place of residence, from a medical facility to which you were previously evacuated, less any refunds paid or payable from your unused transportation tickets, if these expenses are not covered elsewhere in the plan.

Repatriation:

- repatriation expenses for preparation and air transportation of your remains to your place of residence, or up to an equivalent amount for a local burial in the country where death occurred, if you die while on your Covered Vacation.

Losses Not Covered:

Please Note: In no event will all benefits paid for Emergency Evacuation and Repatriation expenses exceed the coverage limit of $15,000.

Please note: Benefits under Parts A & B (except Emergency Evacuation and Repatriation) are subject to exclusions listed on Pages 12-13.

Baggage and Personal Effects Benefit

We will reimburse you, less any amount paid or payable from any other valid and collectible insurance or indemnity, up to the amount shown in the Schedule, for direct loss, theft, damage or destruction of your Baggage during your Covered Vacation.

Valuation and Payment of Loss

Payment of loss under the Baggage and Personal Effects Benefit will be calculated based upon an Actual Cash Value basis. For items without receipts, payment of loss will be calculated based upon 80% of the Actual Cash Value at the time of loss. At our option, we may elect to repair or replace your Baggage. We will notify you within 30 days after we receive your proof of loss.

We may take all or part of a damaged Baggage as a condition for payment of loss. In the event of a loss to a pair or set of items, we will: 1) repair or replace any part to restore the pair or set to its value before the loss; or 2) pay the difference between the value of the property before and after the loss.

Items Subject to Special Limitations

We will not pay more than $1,000 (or the Baggage and Personal Effects limit, if less) on all losses to jewelry; watches; precious or semi-precious gems; decorative or personal articles consisting in whole or in part of silver, gold, or platinum; cameras, camera equipment; digital or electronic equipment and media; and articles consisting in whole or in part of fur. There is a $500 per article limit.

Baggage Delay Benefit

We will reimburse you, less any amount paid or payable from any other valid and collectible insurance or indemnity, up to the amount shown in the Schedule for the cost of reasonable additional clothing and personal articles purchased by you, if your Baggage is delayed by an Air Common Carrier for 24 hours or more during your Covered Vacation. You must be a ticketed passenger on an Air Common Carrier.

Accidental Death and Dismemberment

Air Common Carrier Benefits We will pay this benefit, up to the amount on the Schedule, if you sustain a covered loss in an Accident which occurs: 1) while a passenger in or on, boarding or alighting from an Air Common Carrier or 2) being struck or run down by an Air Common Carrier of a regularly scheduled airline or an air charter company that is licensed to carry passengers for hire while you are on a Covered Vacation and covered under the plan, and you suffer one of the losses listed below within 365 days of the Accident. The Principal Sum is the benefit amount shown in the schedule.

- Loss Percentage of Principal Sum Payable

- Both Hands; Both Feet or Sight of Both Eyes 100%

- One Hand and One 100%

- One Hand and Sight of One Eye 100%

- One Foot and Sight of One Eye 100%

- One Hand; One Foot or Sight of One Eye 50%

If you suffer more than one loss from one Accident, we will pay only for the loss with the larger benefit. Loss of a hand or foot means complete severance at or above the wrist or ankle joint. Loss of sight of an eye means complete and irrecoverable loss of sight.

Not a care in the world... when you have our 24/7 global network to assist you

CareFree™ Travel Assistance

- Medical Assistance

Emergency Services

Travel Arrangements

- Arrangements for last-minute flight and hotel changes

- Luggage Locator (reporting/tracking of lost, stolen or delayed baggage)

- Hotel finder and reservations

- Airport transportation

- Rental car reservations and automobile return

- Coordination of travel for visitors to bedside

- Return travel for dependent/minor children

- Assistance locating the nearest embassy or consulate

- Cash transfers

- Assistance with bail bonds

Pre-trip Information

- Destination guides (hotels, restaurants, etc.)

- Weather updates and advisories

- Passport requirements

- Currency exchange

- Health and safety advisories

Documents and Communication

- Assistance with lost travel documents or passports

- Live email and phone messaging to family and friends

- Emergency message relay service

- Multilingual translation and interpretation services

Medical Assistance and Managed Care

- Medical case management, consultation and monitoring

- Medical Transportation

- Dispatch of a doctor or specialist

- Referrals to local medical and dental service providers

- Worldwide medical information, up-to-the-minute travel medical advisories, and immunization requirements

- Prescription drug replacement

- Replacement of eyeglasses, contact lenses and dental appliances

- Emergency evacuation

- Repatriation of mortal remains

- Emergency medical and dental assistance

- Emergency legal assistance

- Emergency medical payment assistance

- Emergency family travel arrangements

CareFree™ Travel Assistance, Medical Assistance and Emergency Services can be accessed by calling On Call International at 1-800-618-0692 or, from outside the U.S. or Canada, call collect:* 1-603-328-1711

* If you have any difficulty making this collect call, contact the local phone operator to connect you to a US-based long-distance service. In this case, please let the Assistance Provider answering the phone know the number you are calling from, so that he/she may call you back. Any charges for the call will be considered reimbursable benefits.

Note that the problems of distance, information, and communications make it impossible for Stonebridge Casualty Insurance Company, Berkely, Expedia, Inc., or On Call International to assume any responsibility for the availability, quality, use, or results of any emergency service. In all cases, you are still responsible for obtaining, using, and paying for your own required services of all types.

Section I: Cancellation Fee Waiver

You may Change or Cancel your trip for ANY REASON one (1) time prior to the start of your trip. All cancellation fees will be covered by Expedia, except the cost of published air. Credit, pursuant to applicable airline policies, may be issued less airline change fees, and Expedia, Inc. will absorb the change fees. The actual airfare could be higher at the time of rebooking; in that event the price differential would be your responsibility.

GENERAL PLAN EXCLUSIONS

In parts a & b:, we will not pay for any loss caused by or incurred resulting from:.

- mental, nervous, or psychological disorders, except if hospitalized;

- being under the influence of drugs or intoxicants, unless prescribed by a Physician;

- normal pregnancy, except if hospitalized; or elective abortion;

- riding or driving in any motor competition;

- declared or undeclared war, or any act of war;

- service in the armed forces of any country;

- operating or learning to operate any aircraft, as pilot or crew;

- any unlawful acts, committed by you or a Traveling Companion (whether insured or not);

- any amount paid or payable under any Worker’s Compensation, Disability Benefit or similar law;

- Elective Treatment and Procedures;

- medical treatment during or arising from a Covered Vacation undertaken for the purpose or intent of securing medical treatment;

- business, contractual or educational obligations of you, an Immediate Family Member or Traveling Companion;

- failure of any tour operator, Common Carrier, or other travel supplier, person or agency to provide the bargained-for travel arrangements;

- a loss that results from an illness, disease, or other condition, event or circumstance which occurs at a time when the plan is not in effect for you.

ITEMS NOT COVERED WE WILL NOT PAY FOR DAMAGE TO OR LOSS OF:

- property used in trade, business or for the production of income, household furniture, musical instruments, brittle or fragile articles, or sporting equipment if the loss results from the use thereof;

- artificial limbs or other prosthetic devices, artificial teeth, dental bridges, dentures, dental braces, retainers or other orthodontic devices, hearing aids, any type of eyeglasses, sunglasses or contact lenses;

- documents or tickets, except for administrative fees required to reissue tickets;

- money, stamps, stocks and bonds, postal or money orders, securities, accounts, bills, deeds, food stamps or credit cards,

- property shipped as freight or shipped prior to the Scheduled Departure Date.

THE FOLLOWING EXCLUSIONS APPLY TO THE ACCIDENTAL DEATH AND DISMEMBERMENT COVERAGE:

- We will not pay for loss caused by or resulting from Sickness of any kind.

- You, your Traveling Companion’s, or Immediate Family Member’s booked to travel with you, suicide, attempted suicide, or intentionally self-inflicted injury, while sane or insane (while sane in CO & MO);

- participation as a professional in athletics;

- participation in organized amateur and interscholastic athletic or sports competition or events;

- nuclear reaction, radiation or radioactive contamination;

- mountain climbing, bungee cord jumping, skin diving, scuba diving, snow skiing, skydiving, parachuting, hang gliding, parasailing or travel on any air supported device, other than on a regularly scheduled airline or air charter company.

LOSSES NOT COVERED WE WILL NOT PAY FOR LOSS ARISING FROM:

- theft or pilferage from an unattended vehicle;

- mysterious disappearance;

- EMERGENCIES ARISING DURING YOUR TRIP: Please refer to Part E. Worldwide Emergency Assistance

- TRIP CANCELLATION CLAIMS: Contact Expedia, Inc. and BerkelyCare IMMEDIATELY to notify them of your cancellation and to avoid any non-covered expenses due to late reporting. BerkelyCare will then forward the appropriate claim form which must be completed by you AND THE ATTENDING PHYSICIAN, if applicable. If you are cancelling due to a death, a death certificate will be required.

- ALL OTHER CLAIMS: Report your claim as soon as possible to BerkelyCare. Provide the policy number, your travel dates, and details describing the nature of your loss. Upon receipt of this information, BerkelyCare will promptly forward you the appropriate claim form to complete. If you are interrupting due to a death, a death certificate will be required.

Online: www.travelclaim.com

Phone: 1-(800) 453-4079 or 1-(516) 342-2720

Mail: BerkelyCare 300 Jericho Quadrangle, P.O. Box 9022, Jericho, NY 11753 Office Hours: 8:00 am - 10:00 pm ET, Monday - Friday; 9:00 am - 5:00 pm ET, Saturday

IMPORTANT: In order to facilitate prompt claims settlement upon your return, be sure to obtain as applicable:

Accident & Sickness Medical Claims – receipts from the treating Physicians, etc. stating the amounts paid and listing the diagnosis and treatment; submit these first to your other medical plans. Forward a copy of their final disposition of your claim to BerkelyCare.

- You must provide us with all bills and reports for medical and/or dental expenses claimed.

- You must provide any requested information, including but not limited to, an explanation of benefits from any other applicable insurance.

- You must sign a patient authorization to release any information required by us, to investigate your claim.

- You must receive initial treatment within 90 days of the accident, which caused the Injury or the onset of the Sickness.

Your duties in the event of a Trip Interruption & Trip Delay Claims: Medical statements from the Physicians in attendance in the country where the Sickness or Injury occurred. These statements should give complete diagnosis, stating that the Sickness or Injury prevented traveling on dates contracted. Or, verification of the Common Carrier’s mechanical or scheduling problems, or verification of other covered reason causing delay. Provide all unused transportation tickets, official receipts, etc.

Your duties in the Event of a Baggage/Personal Effects Loss: In case of loss, theft or damage to Baggage and Personal Effects, you should: 1) immediately report the situation incident to the hotel manager, tour guide or representative, transportation official, local police or other local authorities and obtain their written report of your loss; and 2) take reasonable steps to protect your Baggage from further damage, and make necessary, reasonable and temporary repairs. We will reimburse you for these expenses. We will not pay for further damage if you fail to protect your Baggage. Submit claim first to party responsible, as well as your regular property insurer. Forward copies of the outcome of your claim to BerkelyCare with the appropriate documentation, including copies of receipts for the lost, stolen, or damaged articles, if available.

When Coverage Begins

All coverages (except Pre-Departure Trip Cancellation and Post-Departure Trip Interruption) will take effect on the later of: 1) the date the plan payment has been received by Expedia, Inc.; 2) the date and time you start your Covered Vacation; or 3) 12:01 A.M. Standard Time on the Scheduled Departure Date of your Covered Vacation.

Pre-Departure Trip Cancellation coverage will take effect at 12:01 A.M. Standard Time on the day your plan payment is received by Expedia, Inc. Post-Departure Trip Interruption coverage will take effect on the Scheduled Departure Date if the required plan payment is received.

When Coverage Ends

Your coverage automatically ends on the earlier of:

- the date the Covered Vacation is completed;

- the Scheduled Return Date;

- your arrival at the return destination on a round-trip, or the destination on a one-way trip;

- cancellation of the Covered Vacation covered by the plan.

In the certificate, “you”, “your” and “yours” refer to the Insured. “We”, “us” and “our” refer to the company providing the coverage. In addition certain words and phrases are defined as follows:

Accident means a sudden, unexpected, unintended and external event, which causes Injury.

Actual Cash Value means purchase price less depreciation.

Air Flight Common Carrier means any air conveyance operated under a license for the transportation of passengers for hire.

Baggage means luggage, personal possessions and travel documents taken by you on the Covered Vacation.

Business Partner means an individual who is involved, as a partner, with you in a legal general partnership and shares in the management of the business.

Covered Vacation means a period of travel away from Home to a destination outside your city of residence; the purpose of the Vacation is business or pleasure and is not to obtain health care or treatment of any kind; the Vacation has defined departure and return dates specified when the Insured enrolls; the Vacation does not exceed 6 months.

Common Carrier means any land, water or air conveyance operated under a license for the transportation of passengers for hire.

Domestic Partner means a person who is at least eighteen years of age and you can show: 1) evidence of financial interdependence, such as joint bank accounts or credit cards, jointly owned property, and mutual life insurance or pension beneficiary designations; 2) evidence of cohabitation for at least the previous 6 months; and 3) an affidavit of domestic partnership if recognized by the jurisdiction within which they reside.

Elective Treatment and Procedures means any medical treatment or surgical procedure that is not medically necessary including any service, treatment, or supplies that are deemed by the federal, or a state or local government authority, or by us to be research or experimental or that is not recognized as a generally accepted medical practice.

Home means your primary or secondary residence.

Hospital means an institution, which meets all of the following requirements:

- it must be operated according to law;

- it must give 24 hour medical care, diagnosis and treatment to the sick or injured on an inpatient basis;

- it must provide diagnostic and surgical facilities supervised by Physicians;

- registered nurses must be on 24 hour call or duty; and

- the care must be given either on the hospital’s premises or in facilities available to the hospital on a pre-arranged basis.

A Hospital is not: a rest, convalescent, extended care, rehabilitation or other nursing facility; a facility which primarily treats mental illness, alcoholism, or drug addiction (or any ward, wing or other section of the hospital used for such purposes); or a facility which provides hospice care (or wing, ward or other section of a hospital used for such purposes).

Immediate Family Member includes your or the Traveling Companion’s spouse, child, spouse’s child, son-daughter-in-law, parent(s), sibling(s), brother-sister, grandparent(s), grandchild, step brother-sister, step-parent(s), parent(s)-in-law, brother-sister-in-law, aunt, uncle, niece, nephew, guardian, Domestic Partner, foster-child, or ward.

Injury means bodily harm caused by an accident which: 1) occurs while your coverage is in effect under the plan; and 2) requires examination and treatment by a Physician. The Injury must be the direct cause of loss and must be independent of all other causes and must not be caused by, or result from, Sickness.

Insured means an eligible person who arranges a Covered Vacation and pays any required plan payment.

Insurer means Stonebridge Casualty Insurance Company.

Other Valid and Collectible Group Insurance means any group policy or contract which provides for payment of medical expenses incurred because of Physician, nurse, dental or Hospital care or treatment; or the performance of surgery or administration of anesthesia. The policy or contract providing such benefits includes group or blanket insurance policies; service plan contracts; employee benefit plans; or any plan arranged through an employer, labor union, employee benefit association or trustee; or any group plan created or administered by the federal or a state or local government or its agencies. In the event any other group plan provides for benefits in the form of services in lieu of monetary payment, the usual and customary value of each service rendered will be considered a Covered Expense.

Payments or Deposits means the cash, check, or credit card amounts actually paid to the Expedia, Inc. for your Covered Vacation.

Physician means a person licensed as a medical doctor by the jurisdiction in which he/she is a resident to practice the healing arts. He/she must be practicing within the scope of his/her license for the service or treatment given and may not be you, a Traveling Companion, or an Immediate Family Member of yours.

Policy means the contract issued to the Policyholder providing the benefits specified herein.

Policyholder means the legal entity in whose name this Policy is issued, as shown on the benefit Schedule.

Program Medical Advisors means On Call International.

Quarantined means the enforced isolation of an Insured and/or the restriction of free movement of an Insured suffering or suspected to suffer from a contagious disease to prevent the spread of contagious disease.

Schedule means the benefit schedule shown on the Certificate for each Insured.

Scheduled Departure Date means the date on which you are originally scheduled to leave on your Covered Vacation.

Scheduled Return Date means the date on which you are originally scheduled to return to the point where the Covered Vacation started or to a different final destination.

Scheduled Vacation Departure City means the city where the scheduled trip on which you are to participate originates.

Sickness means an illness or disease of the body which: 1) requires examination and treatment by a Physician, and 2) commences while the plan is in effect.

Traveling Companion means one person whose name appears with you on the same Trip arrangement and who, during the Trip, will accompany you.

Usual and Customary Charge means those charges for necessary treatment and services that are reasonable for the treatment of cases of comparable severity and nature. This will be derived from the mean charge based on the experience in a related area of the service delivered and the MDR (Medical Data Research) schedule of fees valued at the 90th percentile.

Vacation means a scheduled trip for which coverage has been elected and the plan payment paid, and all travel arrangements are arranged by the Expedia, Inc. prior to the Scheduled Departure Date of the trip.

What is the Package Protection Plan?

Part I: Cancel for ANY Reason waiver provided by Expedia.com

- Passengers can cancel or change their vacation one time for ANY REASON not covered under Part II prior to the start of their trip and receive CASH back for all cancellation fees and penalties, except the cost of Published Air.

- The value of Published Air may be used within a year of original ticket issue date, and Expedia will absorb the change fee. The actual airfare could be higher at time of rebooking.

Part II: Travel insurance plan administered by BerkelyCare

- A package of insurance benefits payable for covered reasons, as well as travel assistance services.

- Benefits include coverage for trip cancellations, interruptions and delays; medical coverage including emergency evacuations and repatriations; baggage losses and delays; and 24-hour emergency travel assistance.

Insurance is underwritten by Stonebridge Casualty Insurance Company, Columbus, OH.

Why should I purchase the Package Protection Plan?