- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

- Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Online Travel Agencies Market

Exploring the Online Travel Agencies Market: A Comprehensive Examination by Transportation, Vacation Packages, Accommodation

Transforming the Travel Landscape- Exploring the Expanding Online Travel Agencies Market and the Influence of Artificial Intelligence on Personalized Travel Experiences. Find more with FMI

- Report Preview

- Request Methodology

Online Travel Agencies Market Outlook (2023 to 2033)

As per newly released data by Future Market Insights (FMI), the online travel agencies market is estimated at US$ 465.1 million in 2023 and is projected to reach US$ 1,694.2 million by 2033, at a CAGR of 13.8% from 2023 to 2033.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Revenue of Online Travel Agencies from 2018 to 2022 Compared to Demand Outlook for 2023 to 2033

As per the FMI analysis, the market for online travel agencies secured a 6.70% CAGR from 2018 to 2022, touching US$ 355.4 million in 2022.

The technological development in the tourism industry has digitalized the entire process of travel bookings. Nowadays traveler makes more use of online services for travel booking as they feel it is a convenient and hassle-free process.

The online process has led to the growth of the tourism and hospitality industry. Therefore, online travel agencies play a significant role in the tourism industry.

Online travel agencies comprise various travel bookings, hotel bookings, transportation service bookings, and many more.

Online travel agencies serve the purpose of selling travel services on online platforms. In the last few years, there is a significant rise in the growth of online travel agencies. The growth has helped to revolutionize the tourism industry.

The above-mentioned factors augur well for the online travel agencies market future trends, where it is predicted that the market likely reaches US$ 1,694.2 million by 2033 at 13.8% CAGR through 2033.

What are the Features and Convenience of Use that Drive the Demand for the Online Travel Agencies?

- Online travel agencies offer a range of services either directly from their own companies or act as intermediaries between travel and booking agencies and end users.

- The main purpose of online travel agencies is to provide booking services online, covering everything from selecting a service to the point of sale on the Internet.

- Online portals offered by these agencies provide various services including price comparison, cost estimation, accommodation options, destination information, transportation modes, and even tour packages.

- The convenience, speed, and ease of booking provided by online travel services attract travelers, offering a convenient and efficient way to plan their trips.

- By utilizing online travel services, travelers can save both time and money, making it an appealing option for those seeking efficient and cost-effective travel arrangements.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

What is Fostering the Expansion of the Market Size: The Rise in Disposable Income and New Development Initiatives?

- Increasing disposable income among individuals has played a significant role in driving the demand for online travel agencies, as people now have more financial resources to explore and travel to various destinations worldwide.

- Online travel agencies have successfully established a global reach, expanding their services and operations across different regions and countries, catering to the diverse travel needs and preferences of customers.

- To meet the evolving demands of the market, online travel agencies continuously adopt new strategies and upgrade their technologies, ensuring enhanced service offerings and improved customer experiences.

- The inclusion of travel insurance and baggage insurance by online travel agencies provides an added layer of security and peace of mind for travelers, contributing to the overall convenience and reliability of their services.

- Transparency throughout the booking process is a key focus for online travel agencies, ensuring customers have access to comprehensive information and pricing details, fostering trust and confidence in their decision-making.

- The initiatives taken by online travel agencies, such as integrating advanced technologies and providing comprehensive travel solutions, have successfully attracted the new generation of tech-savvy travelers, generating a strong demand in the market.

- Despite the challenges faced during the pandemic, the online travel agencies market remains resilient and continues to evolve, adapting to changing customer expectations and emerging market trends.

What Impact Does the Increasing Number of Solo Travelers Have on the Growth of the Online Travel Agencies Industry?

- There has been a significant increase in the number of solo travelers in recent years, driven by specific reasons such as leisure, recreation, and engaging in activities like water sports, hiking, riding, skiing, and more.

- The influence of social media has played a major role in attracting a wide audience to explore different regions, leading to a rise in online travel agencies' booking transactions.

- Online travel agencies offer comprehensive tour plans, including vacation packages, and assist solo travelers in making travel, food, and accommodation arrangements through convenient platforms such as phones or other devices.

- This convenience and affordability make online travel agencies a preferred choice for solo travelers, who may lack extensive knowledge or prefer cost-effective options.

- In recent years, online travel agencies have surpassed offline tour operators and travel agents in terms of popularity and usage among solo travelers.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Country-wise Insights

What is the growth outlook for the europe online travel agencies industry.

The growth outlook for the Europe online travel agencies industry is positive, with a value share of 22.30% in 2022. The industry is expected to continue growing steadily, supported by various factors such as increasing online travel bookings, technological advancements, and evolving customer preferences.

The CAGR of the United Kingdom at 5.00% from 2023 to 2033 indicates a promising growth trajectory for the market. The rising adoption of online platforms for travel planning and booking, along with the convenience and extensive range of services offered by online travel agencies, are driving the industry's growth.

The industry is likely to witness further advancements in mobile applications, personalized travel experiences, and innovative marketing strategies, contributing to the expansion of the Europe online travel agencies market in the coming years.

How Online Travel Agencies Market is Progressing in India?

In India online leading companies like Yatra.com, Kesari Tours, Veena World, Make My Trip, others are dominating the tourism industry in India, contributing to the country’s anticipated CAGR of 6.0% from 2023 to 2033.

India attracts many foreigners to discover and explore its culture and diversity. Foreigners find Indian travel agencies more affordable than booking tours from abroad. Hence, they use Indian online travel agencies’ websites for booking accommodation and transportation.

Meanwhile, India being one of the leading countries in the count of internet users, it can be concluded that the vast majority of the population is tech-savvy. Thus, online travel agencies try various marketing tools to connect with travelers and encourage them to avail of their services.

The attractive advertisements, loyalty programs, and offers from leading online travel agencies have influenced the domestic market. Therefore, the known online agencies have gained the trust of domestic travelers of the country over the years.

What are the Factors Driving the Online Travel Agencies Industry in the United States of America?

As per the FMI analysis, the market for online travel agencies in the United States was predicted to garner a value share of 5.50% in 2022.

United States is one of the major markets of tourism with millions of travelers visiting every year. Domestic travelers in the United States of America use online travel agencies’ websites and applications extensively.

Apart from this, the airline service is availed by United States citizens majorly. Therefore, there is a high demand for travelers using online travel agencies’ websites for airline travel booking.

With the high standard of living and high disposable income due to the high value of currency travelers are ready to spend a high amount of money on traveling and exploring new adventures. Thus, there is a high demand from travelers for luxury tourism, adventure sports, and various type of outdoor activities.

Category-wise Insights

Which service type is more preferred by travelers in online travel agencies market.

According to the analysis, in terms of service type the transportation service is widely preferred by travelers with the sub-segment holding a 22.0% value share in 2022.

Transportation services generate a high demand for their services. Few the transport services such as car rentals or bus travel agencies are in heavy demand as they are the part of daily mode of transport for many travelers.

Apart from this the attractive offers and schemes from the transportation services attract travelers to use these online services more often. Lastly, the transportation services are having a wide coverage of travelers as compared to the tour/vacation packages or accommodations as they generate demand only when there is a need.

How is the Competitive Landscape in the Market for Online Travel Agencies?

Leading players operating globally in the market are focusing on the expansion of their business. Also working on their service and creating advanced technology to attract new customers.

The competitive landscape in the market for online travel agencies is intense and dynamic. Numerous players, ranging from established companies to emerging startups, compete for market share.

Key industry players strive to differentiate themselves by offering unique features, enhanced user experiences, and a wide range of travel services.

They invest in advanced technologies, such as artificial intelligence and machine learning, to provide personalized recommendations and streamline booking processes. Additionally, partnerships with airlines, hotels, and other travel service providers are crucial to expand their offerings and provide competitive pricing.

Continuous innovation, customer-centric strategies, and effective marketing campaigns are vital for online travel agencies to gain a competitive edge in this rapidly evolving market.

Key Players

- Expedia Group Inc.

- Booking Holding Inc.

- Trip Advisor Inc.

- MakeMyTrip Pvt. Limited

- Hostelworld Group PLC (HSW)

- Trivago N.V

- Thomas Cook India Ltd.

- Lastminute.com Group

- Orbitz Worldwide

- Walt Disney World

For instance:

- In the year 2018, Booking.com announced a new product version of the booking.com application and website at Vacation Rental Management Association (VRMA). The new product features allow users to select the product of a partner’s brand beyond booking.com own products. Also, they introduced group connect, guest management, and enhance connectivity features in their new application.

- Recently in 2022, Expedia Group announced an Open World Technology platform. The technology is developed for partner agencies. The platform has a complete e-commerce suit, with various blocks like payments, chatbot, services, and fraud detection, and is perfect for the agency planning to enter the newly in online travel business.

Segmentation Analysis

By service type:.

- Transportation

- Vacation Packages

- Accommodation

By Device Platform:

By payment modes:.

- Debit / Credit Card

- Others (Vouchers, Discount Codes)

By Booking Type:

- Online Travel Agents

- Direct Travel Agents

By Customer Segment:

- Corporate Traveller

- Individual Traveller

By Age Group:

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 66-75 Years

- North America

- Latin America

Frequently Asked Questions

How is the historical performance of the market.

During 2018 to 2022, the market grew at a 6.70% CAGR.

Who are the Key Market Players of this market?

Airbnb, Trip Advisor Inc., and Trivago N.V. are key market players.

What factors contribute to the attraction of this market in Europe?

Increasing online travel bookings raises the market.

How Big is this market?

This market is valued at US$ 465.1 million in 2023.

How Big will be this Market by 2033?

This market is estimated to reach US$ 1,694.2 million by 2033.

Table of Content

Recommendations

Travel and Tourism

Travel Agency Services Market

Published : June 2023

Managed Travel Distribution Market

Published : October 2022

Explore Travel and Tourism Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

- Other Reports

Online Travel Market

Online travel market report by service type (transportation, travel accommodation, vacation packages), platform (mobile, desktop), mode of booking (online travel agencies (otas), direct travel suppliers), age group (22-31 years, 32-43 years, 44-56 years, above 56 years), and region 2024-2032.

- Report Description

- Table of Contents

- Methodology

- Request Sample

Global Online Travel Market:

The global online travel market size reached US$ 512.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,267.1 Billion by 2032, exhibiting a growth rate (CAGR) of 10.4% during 2024-2032. The escalating penetration of smart devices, easy access to high-speed internet connectivity, the rising popularity of solo travel, and an increasing number of business travelers are some of the major factors propelling the online travel market growth.

Online Travel Market Analysis

- Major Market Drivers: The widespread adoption of the internet and mobile technology, making it easier for travelers to find the best deals online and make informed decisions, is primarily driving the growth of the market.

- Key Market Trends: The ongoing innovation, the development of user-friendly online travel booking platforms, and the integration of advanced search functionalities and personalized recommendations are creating a positive outlook for the overall market.

- Competitive Landscape: Some of the leading online travel market companies are Expedia Group Inc., Fareportal Inc., Hostelworld Group plc, HRS, Hurb, MakeMyTrip Pvt. Ltd., priceline.com LLC (Booking Holdings Inc.), Thomas Cook India Ltd. (Fairfax Financial Holdings Limited), Tripadvisor Inc., and Yatra.com, among others.

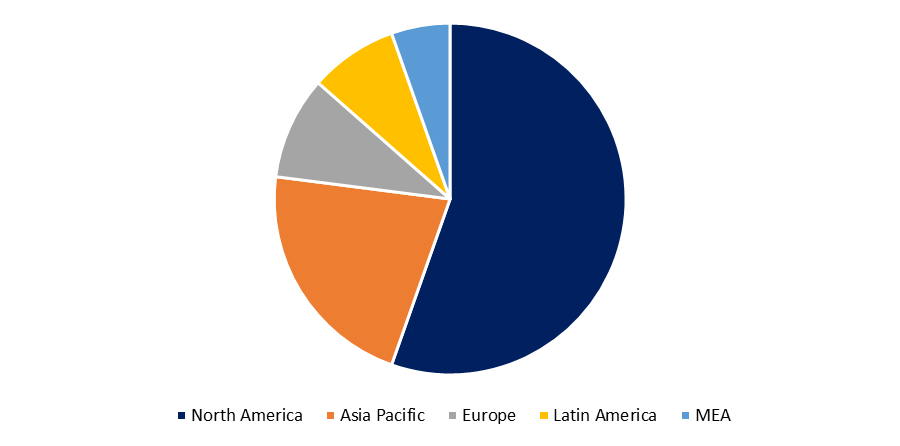

- Geographical Trends: According to the report, North America was the largest market. The region has a highly developed and digitally advanced economy, with a large population of tech-savvy consumers. Moreover, North America has widespread internet access and a high level of smartphone penetration, making it conducive for online travel activities.

- Challenges and Opportunities: Challenges in online travel booking include ensuring data security, maintaining competitive pricing amid fluctuating demand, and addressing customer service issues effectively. However, opportunities arise from technological advancements such as AI-driven personalization, mobile booking convenience, and expanding markets in emerging economies, enhancing user experience and market reach.

.webp)

Online Travel Market Trends:

Increase in Internet and Mobile Penetration

The increasing penetration of the internet and mobile technology has been a significant driver of the market. With more people gaining access to the internet and owning smartphones, the ability to plan and book travel online has become increasingly accessible. Moreover, various travel companies are extensively investing in creating an online presence via social medical platforms in order to expand their reach, which is positively influencing the online travel market outlook. For instance, as of April 2024, there were 5.44 billion internet users worldwide, which amounted to 67.1% of the global population. Of this total, 5.07 billion, or 62.6% of the world's population, were social media users. Moreover, during the third quarter of 2023, global users spent almost 60% of their online time browsing the web from their mobile phones. The increasing availability of the internet is allowing travelers to easily research destinations, compare prices, and make bookings through online platforms, making the process more convenient and efficient.

Increasing Desire for Education in International Universities

The rising preference for overseas education is one of the significant trends propelling online travel market revenue. This can be attributed to the quest for quality education, enhanced employability, and cultural enrichment, which attract students seeking global experiences and language proficiency. For instance, the world's two most populous nations, China and India, have the highest numbers of students studying overseas. According to data published by UNESCO, more than 1 million Chinese students were studying abroad in 2021. India’s total was close to half of this, with around 508,000 students living in other countries. The United States was the largest destination country for students studying abroad, with over 833,000 students there in 2021. It was followed by the United Kingdom with nearly 601,000 students, Australia with around 378,000 students, Germany with over 376,000 students, and Canada with nearly 318,000 students. Online travel agencies capitalize on this trend by offering tailored packages and flexible booking options to cater to the needs of student travelers. Additionally, the global reach of international universities attracts a diverse pool of students, driving the online travel market demand for cross-border travel services and cultural experiences.

Competitive Pricing and Deals

The competitive nature of the market is resulting in aggressive pricing and attractive deals. Travel booking companies are taking initiatives to attract customers by offering exclusive promotions, discounted packages, and last-minute deals. Moreover, the facility to book online allows travelers to compare prices across multiple platforms to find the best available options and secure the most cost-effective deals. Additionally, loyalty programs and reward systems offered by these platforms further incentivize travelers to book through their platforms, enhancing customer loyalty and engagement. For instance, in July 2023, the Expedia Group revamped its loyalty program to allow members to earn and redeem rewards across its three most popular brands: Expedia, Hotels.com, and Vrbo. This simplified loyalty program rewards members with 2% OneKeyCash for every dollar they spend, and elite status based on every travel segment they book. Moreover, various financial institutions are also offering rewards and discounts for online travel bookings in order to increase the utilization of their financial products, like credit cards, which are anticipated to augment the online travel market share. For instance, in March 2024, Wells Fargo launched a transferable travel rewards program, in which a card user will be able to transfer Wells Fargo Rewards points to six travel loyalty programs. Moreover, in April 2023, Expedia launched a New Feature Powered by ChatGPT to help plan travel. This innovative integration aims to enhance the travel planning experience for Expedia users by providing them with a personalized and conversational approach to trip planning. With this new feature, users can engage in natural language conversations with the ChatGPT system, similar to chatting with a virtual assistant.

Note: Information in the above chart consists of dummy data and is only shown here for representation purpose. Kindly contact us for the actual market size and trends.

To get more information about this market, Request Sample

Global Online Travel Industry Segmentation

IMARC Group provides an analysis of the key trends in each segment of the global online travel market report, along with forecasts at the global, regional and country levels from 2024-2032. Our report has categorized the market based on service type, platform, mode of booking and age group.

Breakup by Service Type:

- Transportation

- Travel Accommodation

- Vacation Packages

Travel accommodation dominates the market

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation and vacation packages. According to the report, travel accommodation represented the largest segment.

The dominance of travel accommodations as the primary service type in the market is driven by several key factors. The widespread presence of online travel platforms has made it easier for travelers to access a range of accommodation options, which is positively influencing the online travel market’s recent prices. Similarly, online travel accommodations are also making it easier for hotels and resorts to list and market their properties and attract a wider consumer base. For instance, in April 2024, Spree Hospitality, a subsidiary of EaseMyTrip, announced the opening of its newest property, ZiP by Spree Hotels Bella Heights, nestled in the picturesque hill station of McLeod Ganj, Himachal Pradesh, India. Besides this, the travel accommodations segment of online travel platforms offers a comprehensive inventory of hotels, resorts, vacation rentals, and other types of accommodations, providing travelers with extensive choices and convenience. Apart from this, the ability to compare prices, read reviews, and view photos of accommodations that empower travelers to make informed decisions is contributing to the market growth.

Breakup by Platform:

- Desktop

Desktop holds the largest share in the market

A detailed breakup and analysis of the market based on the platform has also been provided in the report. This includes mobile and desktop. According to the online travel market report, desktop accounted for the largest market share.

The desktop platform typically involves accessing travel websites through web browsers installed on desktop computers, which offer larger screens, full-sized keyboards, and a mouse or trackpad for navigation. Desktop platforms provide travelers with a robust and comprehensive online experience for researching, planning, and booking their travel arrangements. Moreover, various online travel agencies install desktops on a large scale for their employees to easily navigate clients’ travel bookings. In addition to this, desktop platforms provide greater processing power and stability, enabling faster loading times and smoother functionality for complex booking processes, thereby accelerating the product adoption rate.

Breakup by Mode of Booking:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

Direct travel suppliers are the most popular mode of booking

A detailed breakup and analysis of the market based on the mode of booking has also been provided in the report. This includes online travel agencies (OTAs) and direct travel suppliers. According to the report, direct travel suppliers accounted for the largest market share.

Direct booking allows travelers to have a direct relationship with the travel supplier, whether it's an airline, hotel, or car rental company. The online travel market overview by IMARC indicates that this direct interaction gives travelers more control and the ability to personalize their travel experience, including selecting specific preferences, customizing packages, and accessing loyalty programs or exclusive offers. For instance, according to a data report by Statista Consumer Insights 2023, 72% of travelers prefer booking directly from online platforms, whereas only 12% favor booking through a travel agency.

Breakup by Age Group:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

32-43 years dominates the market

A detailed breakup and analysis of the market based on the age group has also been provided in the report. This includes 22-31, 32-43, 44-56, and above 56 years. According to the report, 32-43 years accounted for the largest market share.

The dominance of the 32-43 years age group in the market is driven by several key factors. This age group represents individuals in their prime working and earning years, typically with more disposable income to spend on travel. They are often at a stage in their lives where they have fewer family responsibilities and greater flexibility to plan and embark on trips. Moreover, online travel market statistics by IMARC indicate that the 32-43 years age group is tech-savvy and comfortable with using digital platforms for various activities, including travel planning, and booking, thereby accelerating the product adoption rate.

Breakup by Region:

To get more information on the regional analysis of this market, Request Sample

United States

- South Korea

United Kingdom

- Middle East and Africa

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market.

The dominance of North America as the leading region in the market is driven by several key factors. North America has a highly developed and digitally advanced economy, with a large population of tech-savvy consumers. The region has widespread internet access and a high level of smartphone penetration, making it conducive for online travel activities. Moreover, familiarity and adoption of online platforms for various transactions, including travel bookings, are contributing to the dominance of North America in the market. In addition to this, the presence of prominent market players in the region is also contributing to the market growth. Furthermore, these market leaders are increasingly investing in online booking platforms to make them more personalized and user-friendly. For instance, in July 2023, TripAdvisor partnered with OpenAI on a travel itinerary generator. The AI-powered planning tool will create personalized day-by-day trip itineraries using traveler reviews.

Competitive Landscape:

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Expedia Group Inc.

- Fareportal Inc.

- Hostelworld Group plc

- MakeMyTrip Pvt. Ltd.

- priceline.com LLC (Booking Holdings Inc.)

- Thomas Cook India Ltd. (Fairfax Financial Holdings Limited)

- Tripadvisor Inc.

- Yatra.com

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Online Travel Market Recent Developments:

- May 2024: Travel group booking startup, Joyned, announced the launch of an artificial intelligence planner. This AI planner allows users to share information while providing vendors with additional insight into what information consumers are seeking.

- April 2024: Online travel agency, MakeMyTrip, announced a new exclusive charter service between Mumbai and Bhutan. This service is a part of its holiday packages, and the exclusive charter will depart once a week. The service has been launched due to the increasing popularity of Bhutan among Indian travelers.

- February 2024: Flipkart-owned online travel aggregator, Cleartrip, rolled out a new product, Out of Office (OOO), for corporate travelers. Cleartrip said in a statement that OOO is a corporate travel booking tool designed for small, medium, and large enterprises. The platform houses around 300 SMEs and 10 large corporations as active transactors. The new product claims to handle a monthly business volume of INR 20 crore.

Global Online Travel Market Report Scope:

Key benefits for stakeholders:.

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the online travel market from 2018-2032.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global online travel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global online travel market was valued at US$ 512.5 Billion in 2023.

We expect the global online travel market to exhibit a CAGR of 10.4% during 2024-2032.

The expanding travel and tourism industry and the rising utilization of online travel agencies across numerous hotels to ensure more visibility and increase their overall sales and profitability are some of the online travel market recent opportunities, bolstering the growth of the market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary restrictions on national and international travel activities, thereby limiting the overall demand for online travel.

Based on the service type, the global online travel market has been segmented into transportation, travel accommodation, and vacation packages. Among these, travel accommodation holds the majority of the total market share.

Based on the platform, the global online travel market can be divided into mobile and desktop, where desktop currently exhibits a clear dominance in the market.

Based on the mode of booking, the global online travel market has been categorized into Online Travel Agencies (OTAs) and direct travel suppliers. According to the online travel market forecast by IMARC, direct travel suppliers account for the majority of the global market share.

Based on the age group, the global online travel market can be segregated into 22-31 years, 32-43 years, 44-56 years, and above 56 years. Among these, 32-43 years age group currently holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global online travel market include Expedia Group Inc., Fareportal Inc., Hostelworld Group plc, HRS, Hurb, MakeMyTrip Pvt. Ltd., priceline.com LLC (Booking Holdings Inc.), Thomas Cook India Ltd. (Fairfax Financial Holdings Limited), Tripadvisor Inc., and Yatra.com.

India Dairy Market Report Snapshots Source:

Statistics for the 2022 India Dairy market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports.

- India Dairy Market Size Source

- --> India Dairy Market Share Source

- India Dairy Market Trends Source

- India Dairy Companies Source

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Purchase options

Benefits of Customization

Personalize this research

Triangulate with your data

Get data as per your format and definition

Gain a deeper dive into a specific application, geography, customer, or competitor

Any level of personalization

Get in Touch With Us

UNITED STATES

Phone: +1-631-791-1145

Phone: +91-120-433-0800

UNITED KINGDOM

Phone: +44-753-713-2163

Email: [email protected]

Client Testimonials

IMARC made the whole process easy. Everyone I spoke with via email was polite, easy to deal with, kept their promises regarding delivery timelines and were solutions focused. From my first contact, I was grateful for the professionalism shown by the whole IMARC team. I recommend IMARC to all that need timely, affordable information and advice. My experience with IMARC was excellent and I can not fault it.

The IMARC team was very reactive and flexible with regard to our requests. A very good overall experience. We are happy with the work that IMARC has provided, very complete and detailed. It has contributed to our business needs and provided the market visibility that we required

We were very happy with the collaboration between IMARC and Colruyt. Not only were your prices competitive, IMARC was also pretty fast in understanding the scope and our needs for this project. Even though it was not an easy task, performing a market research during the COVID-19 pandemic, you were able to get us the necessary information we needed. The IMARC team was very easy to work with and they showed us that it would go the extra mile if we needed anything extra

Last project executed by your team was as per our expectations. We also would like to associate for more assignments this year. Kudos to your team.

.webp)

We would be happy to reach out to IMARC again, if we need Market Research/Consulting/Consumer Research or any associated service. Overall experience was good, and the data points were quite helpful.

The figures of market study were very close to our assumed figures. The presentation of the study was neat and easy to analyse. The requested details of the study were fulfilled. My overall experience with the IMARC Team was satisfactory.

The overall cost of the services were within our expectations. I was happy to have good communications in a timely manner. It was a great and quick way to have the information I needed.

My questions and concerns were answered in a satisfied way. The costs of the services were within our expectations. My overall experience with the IMARC Team was very good.

I agree the report was timely delivered, meeting the key objectives of the engagement. We had some discussion on the contents, adjustments were made fast and accurate. The response time was minimum in each case. Very good. You have a satisfied customer.

.webp)

We would be happy to reach out to IMARC for more market reports in the future. The response from the account sales manager was very good. I appreciate the timely follow ups and post purchase support from the team. My overall experience with IMARC was good.

IMARC was a good solution for the data points that we really needed and couldn't find elsewhere. The team was easy to work, quick to respond, and flexible to our customization requests.

- Competitive Intelligence and Benchmarking

- Consumer Surveys and Feedback Reports

- Market Entry and Opportunity Assessment

- Pricing and Cost Research

- Procurement Research

- Report Store

- Aerospace and Defense

- Agriculture

- Chemicals and Materials

- Construction and Manufacturing

- Electronics and Semiconductors

- Energy and Mining

- Food and Beverages

- Technology and Media

- Transportation and Logistics

Quick Links

- Press Releases

- Case Studies

- Our Customers

- Become a Publisher

134 N 4th St. Brooklyn, NY 11249, USA

+1-631-791-1145

Level II & III, B-70, Sector 2, Noida, Uttar Pradesh 201301, India

+91-120-433-0800

30 Churchill Place London E14 5EU, UK

+44-753-713-2163

Level II & III, B-70 , Sector 2, Noida, Uttar Pradesh 201301, India

We use cookies, including third-party, for better services. See our Privacy Policy for more. I ACCEPT X

Global Online Travel Market by Service type (Transportation, Travel Accommodation, and Vacation Packages), by Platform (Mobile and Desktop), Mode of Booking (Online Travel Agencies (OTAs) and Direct Travel Suppliers); By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

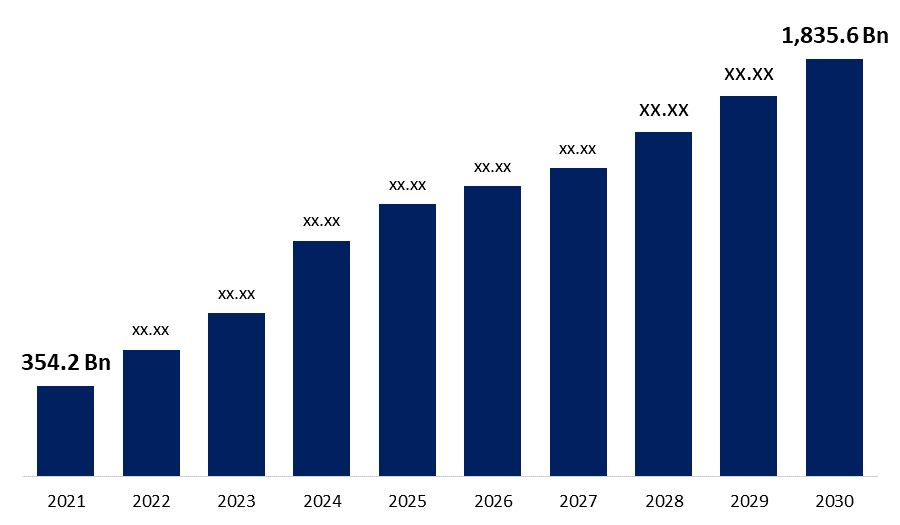

The Global Online Travel Market size was valued at USD 354.2 Bn in 2021. The market is projected to grow USD 1,835.6 Bn in 2030, at a CAGR of 14.8 %. Review sites and travel e-commerce sites make up the majority of the internet travel sector. It provides the convenience of reserving from the comfort of one's own home and frequently entices customers with package deals and cost-cutting choices. As a result, many tourists are opting to book their trips online rather than through traditional brick-and-mortar travel firms. Furthermore, the primary global online travel market is being driven by greater consumer spending power, a government initiative to promote tourism, growing internet and credit card usage, and the creation of new online segments. The increasing penetration of international flight and hotel bookings supplied by online portals such as Booking.com, TripAdvisor.com, .

Get more details on this report -

The emergence of the travel and tourism business, as well as shifting patterns in standard of life, has resulted in a steady increase in the online travel market. The demand for online travels varies depending on the property type and is impacted by factors including location, size, and on-site amenities. The market is likely to be driven by rising disposable income, popularizing weekend culture, the introduction of low-cost airline services, and the developing service industry. The rise in spending power and the style of living are two of the most important factors driving people to luxury resorts. The demand for online travels is also fueled by a city's or country's hosting of sporting events. The development of the market has been hastened by the emergence of online lodging booking services. Marriott International, for example, published a new edition of its mobile app, Marriott Bonvoy, on February 10, 2021, with new features like better booking possibilities, greater personalized experiences, and customizations in earning and redeeming points. As a result, the industry is expected to consolidate due to growing demand for premium services with better booking options.

COVID-19 Analysis

The epidemic of COVID-19 has had a significant influence on the tourism and travel industries. The global implementation of social distancing, stay-at-home, and travel restrictions has stifled the expansion of the online travel industry. According to the American Hotel and Lodging Association 2021 study, hotel occupancy in the United States fell from 66 percent to around 40 percent in 2020, compared to the previous year. As a result of the pandemic, the hotel industry is likely to suffer a severe slowdown; nevertheless, the market is expected to return to its prior growth trajectory in the coming years.

Service Type Outlook

The travel accommodation segment accounted largest market share for the global online travel market in 2020. Market competitors are gradually providing travellers with a varied selection of hotel options at reasonable prices. Customers evaluate lodging options across multiple websites in order to get the most cost-effective option. Because they offer a diverse range of housing options, travelers prefer specialized online accommodation providers such as Airbnb, Inc. and OYO Rooms. As a result, the aforementioned reasons are responsible for the market's rise in the travel accommodation segment. These hotels usually have high-end designer interiors created with cutting-edge technology propels the demand for the growth of the global online travel market.

Global Online Travel Market Report Coverage

Platform Outlook

The mobile segment accounted largest market share for the global online travel market in 2020 owing to the expansion of the market through the mobile sector is mostly due to an increase in mobile usage and the development of novel mobile travel apps. The way people communicate and travel throughout the world has changed as a result of technological advancements. With the advancement of technology and the increased usage of mobile phones, simple and effective techniques are being developed to make travelling simple and comfortable, hence boosting the travel industry's growth. Travelers prefer to make their travel reservations using mobile travel apps, which are gradually gaining traction in the market. As a result, the expansion of the internet travel business is projected to be fueled by an increase in smart phone usage and a rise in digital literacy.

Mode of Booking Outlook

The online travel agencies (OTAs) segment accounted largest market share for the global online travel market in 2020. Online travel firms are becoming the most popular method of making reservations around the world. The rise of online travel agencies has been one of the most striking examples of industry and society's digital revolution in the last 25 years. OTAs have evolved into digital marketplaces that provide direct access to a wide range of online travel options for both B2B and B2C consumers. OTAs can be thought of as a cross between an e-commerce platform and a travel agency. Expedia, Booking.com, and Trip.com, among others, have dominated the global online travel business (hotels, airlines, packaged tours, rail and cruises).

Regional Outlook

Asia Pacific dominated largest market share for the global online travel market in 2020 owing to has the most potential for growth in the internet travel business, with India and China being the most profitable areas. The increase in discretionary income, rise in the middle-class section, and increasing penetration of internet facilities are all factors contributing to the expansion. In China, Ctrip is the most popular online travel agency (OTA), whereas in India, MakeMyTrip, Yatra, and Cleartrip are the most popular OTAs.

Europe is anticipated to emerge as the fastest-growing region over the forecast period. This is due to the presence of some of the world's most popular tourist spots. According to the UNWTO's Foreign Tourism Highlights 2019 Edition, Europe accounted for half of all international visitor arrivals in 2018. The survey also reveals that five major European countries are among the top ten destinations based on foreign tourist arrivals in 2018.

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities.

In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market.

Market Segmentation of Global Online travel Market

By Service Type

- Transportation

- Travel Accommodation

- Vacation Packages

By Platform

By Mode of booking

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

Key Players:

- Alibaba Group

- Elong, Inc.

- Tuniu Corporation

- AirGorilla, LLC

- Hays Travel limited

- Airbnb, Inc.

- Yatra Online Private Limited, India

- Trip Advisor Inc.

- MakeMyTrip Limited

- Hostelworld Group PLC (HSW)

- Trivago N.V

- Despegar.com, Corp

- Lastminute.com Group

- Single User: $3550 Access to only 1 person; cannot be shared; cannot be printed

- Multi User: $5550 Access for 2 to 5 users only within same department of one company

- Enterprise User: $7550 Access to a company wide audience; includes subsidiary companies or other companies within a group of companies

Premium Report Details

15% free customization.

Share your Requirements

We Covered in Market

- 24/7 Analyst Support

- Worldwide Clients

- Tailored Insights

- Technology Evolution

- Competitive Intelligence

- Custom Research

- Syndicated Market Research

- Market Snapshot

- Market Segmentation

- Growth Dynamics

- Market Opportunities

- Regulatory Overview

- Innovation & Sustainability

Connect with us

- smartphone USA- +1 303 800 4326

- smartphone APAC- +91 9561448932

- email [email protected]

- email [email protected]

Need help to buy this report?

Report Description

Table of content, competitive landscape, methodology.

- Consumer Goods

- Travel & Luxury Travel

- Online Travel Agency (OTA) Market Report | Global Forecast From 2024 To 2032

Online Travel Agency (OTA) Market

Segments - by Type (Online and Offline), Application (Making Reservations, Translation Services, Direction Guidance, Audio Guidance, Currency Conversion, Trip Planning, Review Services, Loyalty Programs, Special Offers & Discounts, and Emergency Assistance), Platform (Desktop and Mobile), Service Type (Transportation, Accommodation, Vacation Packages, and Travel Insurance), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Global Industry Analysis, Growth, Share, Size, Trends, and Forecast 2024 – 2032

Debadatta Patel

Fact-checked by:

Partha Paul

Online Travel Agency (OTA) Market Outlook 2032

Impact of artificial intelligence (ai) in the online travel agency (ota) market, online travel agency (ota) market dynamics, major drivers, existing restraints, emerging opportunities, scope of the online travel agency (ota) market report, market segment insights, type segment analysis, application segment analysis, platform segment analysis, service type segment analysis, regional analysis.

- For instance, according to a published report, China's internet penetration rate reached approximately 76% in 2023 , up from 73% in 2021 .

Application

- Making Reservations

- Translation Services

- Direction Guidance

- Audio Guidance

- Currency Conversion

- Trip Planning

- Review Services

- Loyalty Programs

- Special Offers & Discounts

- Emergency Assistance

Service Type

- Transportation

- Accommodation

- Vacation Packages

- Travel Insurance

- Asia Pacific

- North America

- Latin America

- Middle East & Africa

Key Players

- Booking Holdings

- Sabre Corporation

- TripAdvisor LLC

- Travelgenio

Key players competing in the global online travel agency (OTA) market are Booking Holdings; Ctrip; Expedia; HomeAway; Kayak; MakeMyTrip; Opodo; Orbitz; QUNR; Sabre Corporation; TripAdvisor; Travelgenio; Trip.com; Voyages; and Webjet. These companies adopted development strategies including mergers, acquisitions, partnerships, collaboration, product launches, and production expansion to expand their consumer base worldwide. For instance,

In December 2023 , Alipay, the leading digital payment and lifestyle service platform, partnered with top online travel agencies, including Trip.com, a global one-stop travel service provider, and Tuniu, an integrated leisure travel service provider in China, to launch selected tour packages and travel guide on the Alipay app for international tourists traveling to China.

In July 2023 , Tripadvisor, the world's largest travel guidance platform, announces a significant upgrade to Trips - its core trip planning product - with the introduction of a new AI-powered travel itinerary generator. It leverages human insights from over a billion reviews and opinions of the more than eight million businesses listed on Tripadvisor, delivering reliable, trustworthy guidance from its community of real travelers.

Research Design

Research site, data collection, data analysis, research limitations.

Purchase Premium Report

- Single User $4200

- Multi User $5500

- Corporate User $6600

- Online License $2999

- Excel Data Pack $2599

Customize This Report

- Ask for Research To Be Focused On Specific Regions or Segments

- Receive Data As Per Your Format and Definition

- Companies Profiled based on Your Requirements

- Breaking Down Competitive Landscape as per Your Requirements

- Any Level of Customization

Our Clients

We needed a highly accurate and precise report, which delivered promptly. The company compiled information from a wide array of reliable agencies and sourcess.It is extremely satisfactory to be working with you. Strategy Head of Major Tech Company

We were very pleased to contact as they tailored reports precisely as per our requirements. As we are dealing with the aerospace and defense industry, we need reports of high accuracy and substantial quality. Major Player in Defense Industry

Extremely delighted to have a well-crafted report on “Global Packaging Solutions Market Research Report” from your team. Thank you for providing me with all our requirements and for incorporating our suggestions. CMO of Leading Packaging Company from USA

I had a good experience working with as they were very open to all constructive changes in the report. I found that the report had its charm embedded with ample of data. Founder and Managing Partner of Major Korean Company

Our company has been working with for some years now and we are very happy with the quality of the reports provided by the company.I, on behalf of my organization, would like to thank you for offering professional reports. Global Consulting Firm

Quick Contact

+1 909 414 1393

Certified By

Related Reports

Some other reports from this category!

Camping Sleeping Bags Market Report | Global Forecast From 2023 To 2032

Cruise Liners Market Report | Global Forecast From 2023 To 2032

Duty-Free and Travel Retail Market Report | Global Forecast From 2023 To 2032

Duty Free & Travel Retail Market Report | Global Forecast From 2023 To 2032

Business Travel Market Report | Global Forecast From 2023 To 2032

Travel Luggage & Bags Market Report | Global Forecast From 2023 To 2032

Adventure Tourism Market Report | Global Forecast From 2023 To 2032

Cooler Bags Market Report | Global Forecast From 2023 To 2032

Luggage & Bags Market Report | Global Forecast From 2023 To 2032

Leather Luggage Market Research Report 2032

- Free Sample

- Travel, Tourism & Hospitality

Travel agency industry - statistics & facts

The biggest players of the ota market, the travel agency and tour operator retail market, key insights.

Detailed statistics

Online travel market size worldwide 2017-2028

U.S. travel agency industry market size 2012-2022

U.S. tour operator industry market size 2012-2022

Editor’s Picks Current statistics on this topic

Tour Operators & Travel Agencies

Market size of the travel agency services industry worldwide 2011-2024

Online Travel Market

Revenue of leading OTAs worldwide 2019-2022

Further recommended statistics

Industry overview.

- Premium Statistic Market size of the tourism sector worldwide 2011-2024

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Key information on the global travel agency industry January 2024

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Leading travel companies worldwide 2022, by sales

- Premium Statistic Number of employees at leading travel companies worldwide 2022

Market size of the tourism sector worldwide 2011-2024

Market size of the tourism sector worldwide from 2011 to 2023, with a forecast for 2024 (in trillion U.S. dollars)

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Key information on the global travel agency industry January 2024

Key data on the travel agency industry worldwide as of January 2024

Market cap of leading online travel companies worldwide 2023

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Leading travel companies worldwide 2022, by sales

Leading travel companies worldwide in 2022, by gross sales (in billion U.S. dollars)

Number of employees at leading travel companies worldwide 2022

Number of employees at selected leading travel companies worldwide in 2022

Online travel agencies (OTAs)

- Premium Statistic Revenue of leading OTAs worldwide 2019-2022

- Premium Statistic Marketing expenses of leading OTAs worldwide 2019-2022

- Premium Statistic Marketing/revenue ratio of leading OTAs worldwide 2019-2022

- Basic Statistic Revenue of Booking Holdings worldwide 2007-2023

- Premium Statistic Revenue of Expedia Group, Inc. worldwide 2007-2023

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Total revenue of Trip.com Group 2013-2023

- Premium Statistic Revenue of Tripadvisor worldwide 2008-2023

- Premium Statistic Despegar: revenue 2015-2022

Leading online travel agencies (OTAs) worldwide from 2019 to 2022, by revenue (in million U.S. dollars)

Marketing expenses of leading OTAs worldwide 2019-2022

Marketing expenses of leading online travel agencies (OTAs) worldwide from 2019 to 2022 (in million U.S. dollars)

Marketing/revenue ratio of leading OTAs worldwide 2019-2022

Marketing to revenue ratio of leading online travel agencies (OTAs) worldwide from 2019 to 2022

Revenue of Booking Holdings worldwide 2007-2023

Revenue of Booking Holdings worldwide from 2007 to 2023 (in billion U.S. dollars)

Revenue of Expedia Group, Inc. worldwide 2007-2023

Revenue of Expedia Group, Inc. worldwide from 2007 to 2023 (in billion U.S. dollars)

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Total revenue of Trip.com Group 2013-2023

Total revenue of Trip.com Group Ltd. in China from 2013 to 2023 (in billion yuan)

Revenue of Tripadvisor worldwide 2008-2023

Revenue of Tripadvisor, Inc. worldwide from 2008 to 2023 (in million U.S. dollars)

Despegar: revenue 2015-2022

Revenue of Despegar.com, Corp. from 2015 to 2022 (in million U.S. dollars)

Travel websites and apps

- Premium Statistic Most popular travel and tourism websites worldwide 2024

- Premium Statistic Total visits to travel and tourism website booking.com worldwide 2021-2024

- Premium Statistic Total visits to travel and tourism website tripadvisor.com worldwide 2020-2024

- Premium Statistic ACSI - U.S. customer satisfaction with online travel websites as of 2024

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps in the U.S. 2023

- Premium Statistic Leading travel apps in the U.S. 2022, by market share

- Premium Statistic Leading travel apps in Europe 2022, by market share

Most popular travel and tourism websites worldwide 2024

Most visited travel and tourism websites worldwide as of April 2024 (in million visits)

Total visits to travel and tourism website booking.com worldwide 2021-2024

Estimated total number of visits to the travel and tourism website booking.com worldwide from December 2021 to March 2024 (in millions)

Total visits to travel and tourism website tripadvisor.com worldwide 2020-2024

Estimated total number of visits to the travel and tourism website tripadvisor.com worldwide from August 2020 to March 2024 (in millions)

ACSI - U.S. customer satisfaction with online travel websites as of 2024

U.S. customer satisfaction with online travel websites from 2000 to 2024 (index score)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Number of aggregated downloads of leading online travel agency apps in the U.S. 2023

Number of aggregated downloads of selected leading online travel agency apps in the United States in 2023 (in millions)

Leading travel apps in the U.S. 2022, by market share

Market share of leading travel apps in the United States in 2022

Leading travel apps in Europe 2022, by market share

Market share of leading travel apps in Europe in 2022

Travel agencies and tour operators

- Premium Statistic U.S. travel agency industry market size 2012-2022

- Premium Statistic U.S. tour operator industry market size 2012-2022

- Premium Statistic Revenue of TUI AG worldwide 2004-2023

- Premium Statistic Leading travel agents ranked by number of outlets in the UK 2024

- Premium Statistic Leading ATOL-licensed tour operators in the UK 2024, by passengers licensed

- Premium Statistic Turnover of Hays Travel Limited in the UK 2008-2023

Market size of the travel agency sector in the United States from 2012 to 2022 (in billion U.S. dollars)

Market size of the tour operator sector in the United States from 2012 to 2022 (in billion U.S. dollars)

Revenue of TUI AG worldwide 2004-2023

Revenue of TUI AG worldwide from 2004 to 2023 (in billion euros)

Leading travel agents ranked by number of outlets in the UK 2024

Leading travel agencies in the United Kingdom (UK) as of February 2024, by number of travel shops

Leading ATOL-licensed tour operators in the UK 2024, by passengers licensed

Leading ATOL-licensed tour operators in the United Kingdom as of February 2024, ranked by number of passengers licensed

Turnover of Hays Travel Limited in the UK 2008-2023

Turnover of Hays Travel Limited in the United Kingdom from 2008 to 2023 (in million GBP)

Cruise companies

- Premium Statistic Worldwide cruise company market share 2022

- Premium Statistic Revenue of Carnival Corporation & plc worldwide 2008-2023

- Premium Statistic Revenue of Royal Caribbean Cruises worldwide 1988-2023

- Premium Statistic Revenue of Norwegian Cruise Line worldwide 2011-2023

- Premium Statistic TUI cruise brand revenue worldwide 2015-2023, by brand

- Premium Statistic Percentage change in revenue of leading cruise companies worldwide 2020-2023

Worldwide cruise company market share 2022

Worldwide market share of leading cruise companies in 2022

Revenue of Carnival Corporation & plc worldwide 2008-2023

Revenue of Carnival Corporation & plc worldwide from 2008 to 2023 (in billion U.S. dollars)

Revenue of Royal Caribbean Cruises worldwide 1988-2023

Revenue of Royal Caribbean Cruises Ltd. worldwide from 1988 to 2023 (in billion U.S. dollars)

Revenue of Norwegian Cruise Line worldwide 2011-2023

Revenue of Norwegian Cruise Line Holdings Ltd. worldwide from 2011 to 2023 (in billion U.S. dollars)

TUI cruise brand revenue worldwide 2015-2023, by brand

Revenue of TUI cruise brands worldwide from 2015 to 2023, by brand (in million euros)

Percentage change in revenue of leading cruise companies worldwide 2020-2023

Percentage change in revenue of leading cruise companies worldwide from 2020 to 2023 (compared to 2019)

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

What 2023 Will Hold for Travel: New Skift Research

Seth Borko, Skift Research

December 21st, 2022 at 10:30 AM EST

The new year will give no rest to a weary travel industry. After years of work to dig out of the hole the pandemic put us in, travel in 2023 may find that the hardest part still lies ahead. The groundwork for growth is in place but achieving success will be no simple task.

In its annual outlook for the travel industry, Skift Research has created 2023 global revenue forecasts for airlines, hotels, short-term rentals, cruise lines, and online travel agencies. Skift also built an estimate for international cross-border travel from 2023–2025. This outlook is meant as a companion piece to our recent State of Travel report that offers in-depth coverage of all travel segments.

Heading into 2023 the state of travel remains a mixed bag. Pent-up demand has catapulted the Americas back to 2019 levels even as Asia is just beginning its recovery run. Short-term rentals are larger than they were pre-pandemic while passenger airlines remain smaller.

We still see potential for significant catch-up growth in travel to continue in every region of the world even as that optimism is tempered by gathering economic storm clouds.

What You’ll Learn In This Report:

- Forecasts of cross-border trips 2023–2025, globally and for North America, Europe, and Asia-Pacific regions

- Estimates of 2023 industry revenue for airlines, hotels, short term rentals, cruises, and online travel agencies (OTAs)

- Skift Travel Health Index Scores by country and sector

- How the evolving economic outlook may impact travel

Skift Research Global Travel Outlook 2023

Purchase this report, or subscribe to Skift Research to read our latest analysis on the performance of the travel industry.

Jet Stream Newsletter

Airline news moves fast. Don’t miss a beat with our weekly airline newsletter. Landing in your inbox every Saturday.

Have a confidential tip for Skift? Get in touch

Tags: skift research

Search Markets

- Report Store

- Airport Systems Research

- Aviation Research

- CNS Systems Research

- Components Research

- Defence Platforms & Systems Research

- Defense Platforms & Systems Research

- Electronic Warfare Research

- Homeland Security Research

- Maintenance, Repair, and Overhaul (MRO) Research

- Marine/Others Research

- Security Research

- Simulation & Training Research

- Space Research

- Unmanned Systems Research

- Agricultural Biologicals Research

- Agrochemicals & Fertilizers Research

- Animal Feed & Feed Additives Research

- Farm Equipment & Irrigations Research

- Feed & Animal Nutrition Research

- Life Sciences Research

- Precision Agriculture Research

- Seeds & Others Research

- Testing & Services Research

- Automotive Components Research

- Automotive Logistics Research

- Automotive Technology & Services Research

- Autonomous Vehicles Research

- Bikes And Motorcycles Research

- ICE, Electric, Hybrid, Autonomous Vehicles Research

- Off Road Vehicles, LCV, HCV Research

- Power Generation, Transmission & Distribution Research

- Railway Research

- Sensor And Control Research

- Telematics & Infotainment Research

- Testing, Inspection & Certification Research

- Tires & Wheels Research

- Banking Research

- FinTech Research

- Insurance Research

- Payments Research

- Accounting Services Research

- Architectural and Engineering Services Research

- Commercial Cleaning Services Research

- Corporate Training & Development Research

- Environmental Services Research

- Health and Safety Services Research

- Human Resources Services Research

- Information Technology Services Research

- Management Consulting Research

- Overhead, Consumables and Accessories Research

- Professional Services Research

- Real Estate Services Research

- Security Services Research

- Supply Chain Management Services Research

- Adhesives & Sealants Research

- Advanced Materials Research

- Basic Chemicals Research

- Disinfectants & Preservatives Research

- Inorganic Chemicals Research

- Metals & Alloys Research

- Nano Technology Research

- Organic Chemicals Research

- Packaging Research

- Petrochemicals Research

- Pharmaceutical Research

- Plastics, Polymers & Resins Research

- Polymers & Plastics Research

- Renewable Chemicals Research

- Specialty Chemicals Research

- Water Treatment Chemicals Research

- `Building Construction Research

- Construction Equipment & Machinery Research

- Construction Materials Research

- Engineering Services Research

- Green Construction Research

- Infrastructure Construction Research

- Machinery & Equipment Research

- Safety & Security Equipment Research

- Smart Infrastructure Research

- Specialty Construction Research

- Beauty & Personal Care Research

- Clothing, Footwear & Accessories Research

- Consumer Electronic Devices Research

- Consumer F&B Research

- Electronic & Electrical Research

- Electronics & Appliances Research

- Food & Beverage Research

- Food Packaging Research

- Homecare & Decor Research

- Luxury & Designer Research

- Sports & Leisure Research

- Sustainable Consumer Goods Research

- E-Learning & Online Education Research

- Higher Education Research

- K-12 Education Research

- Augmented/Virtual Reality Research

- Battery & Wireless Charging Research

- Camera, Display & Lighting Research

- Chipset And Processors Research

- Communication & Connectivity Technology Research

- Data Center & Networking Research

- Display Technology Research

- Drones & Robotics Research

- Electronics System & Components Research

- Energy Storage Research

- Industrial Automation Research

- Information System & Analytics Research

- Internet of Things & M2M Research

- Materials & Components Research

- Nanotechnology Research

- Next Generation Technologies Research

- Power & Energy Research

- Security, Access Control And Robotics Research

- Semiconductor Materials & Components Research

- Silicon, Wafer & Fabrication Research

- Wearable Technology Research

- Batteries Research

- Drilling, Intervention & Completion Research

- Industrial Motors, Pumps & Control Devices Research

- Offshore Oil & Gas Research

- Renewable Energy Research

- Smart Grid Research

- Alternative Food Sources Research

- Cold Chain Logistics Research

- Flavors, Colors & Fragrances Research

- Food Additives & Ingredients Research

- Food & Beverage Additives Research

- Food & Beverage Ingredients Research

- Food & Beverage Logistics Research

- Food & Beverage Logistics, Cold Chain & Packaging Research

- Food & Beverage Processing and Technology Research

- Food Processing Equipment & Technology Research

- Food Safety & Processing Research

- Food Safety & Standards Research

- Nutraceuticals & Dietary Supplements Research

- Nutraceuticals & Functional Foods Research

- Plant Based Alternatives/Ingredients Research

- Processed & Frozen Foods Research

- Proteins, Vitamins and Minerals Research

- Software & Services Research

- Analytics Research

- Application Software Research

- Artificial Intelligence (AI) Research

- Cloud Computing Research

- Communication Services Research

- Cyber Security Research

- Digital Media Research

- Digitalization & IoT Research

- E-commerce Research

- Endpoint Security Research

- Healthcare IT Research

- Healthcare Services Research

- Maintenance and Repair Services Research

- Materials Research

- Medical Devices Research

- Mobility & Telecom Research

- Network Security Research

- Public Safety Research

- Building Construction Research

- Chemicals & Pharmaceuticals Research

- Consumer Goods Research

- Electronics & Semiconductor Research

- Environmental Management Research

- Environmental & Safety Research

- Heavy Industry Research

- Recycling Research

- Recycling & Waste Management Research

- Safety Equipment Research

- Textiles & Apparel Research

- Valves & Actuators Research

- Metallic Minerals Research

- Metals Research Analysis

- Mining Equipment & Technology Research

- Mining Services Research

- Non-Metallic Minerals Research

- Biotechnology Research

- Cell Biology Research

- Medical Device Research

- Apparel & Footwear Research

- Brick And Mortar Research

- E-Commerce Research

- Home & Furniture Research

- Specialty Retail Research

Global Online Travel Market Size By Service Type, By Platform Type, By Booking Mode, By Geographic Scope And Forecast

- Description

- Table of Contents

- Methodology

Online Travel Market Size And Forecast

Online Travel Market size was valued at USD 519.79 Billion in 2023 and is projected to reach USD 1.01 Trillion by 2030 , growing at a CAGR of 8.9% during the forecast period 2024-2030.

The Emergency Online Travel Market refers to the segment of the travel industry focused on providing immediate travel solutions and services to individuals or groups facing unforeseen circumstances or emergencies. This market encompasses various online platforms, applications, and services that facilitate last-minute travel arrangements, including transportation, accommodation, and other essential travel needs.

Global Online Travel Market Drivers

The market drivers for the Online Travel Market can be influenced by various factors. These may include:

- Convenience and Accessibility: A variety of travel alternatives, such as flights, lodging, vehicle rentals, and activities, are easily accessible through online travel platforms. Travellers on the go who want a hassle-free booking process may find this convenience appealing.

- Mobile Technology: Travellers can now plan and organise their vacations more easily than ever thanks to the widespread use of smartphones and mobile apps. The expansion of the online travel industry can be attributed in large part to mobile technologies.

- reasonable Pricing : Travellers on a tight budget may be drawn to online travel platforms since they frequently offer reasonable pricing and promotions. Features that compare prices make it simple for customers to locate the greatest offers.

- Increased Internet usage : Online travel platforms are now more widely accessible due to the increasing worldwide internet usage. With more people having access to online booking choices, these platforms are serving a bigger consumer base.

- Growth of Remote Work and Digital Nomads : These two travel trends have given rise to a new traveller demographic that prefers online booking and flexible travel schedules.

- Personalisation : To provide individualised travel recommendations, online travel companies leverage AI and data analytics. This allows for a more customised booking experience that caters to individual interests.

- Growing Middle-Class Population : As the middle class grows in emerging nations, disposable money rises and travel demand rises as well, propelling the internet travel industry’s expansion.

- Environmental Concerns : As people become more conscious of climate change, there are more environmentally friendly travel options available. Travellers who care about the environment are likely to be drawn to online destinations that provide sustainable travel options.

Global Online Travel Market Restraints

Several factors can act as restraints or challenges for the Online Travel Market. These may include:

- Security Issues: For online travel platforms, fraud and security lapses are major issues. Customers’ reluctance to divulge financial and personal information online may affect adoption and trust rates.

- Regulatory Obstacles: Depending on the location, the internet travel sector may be subject to a number of different rules and regulations. Adherence to these regulations augments operational intricacy and expenses.

- Infrastructure Restrictions: The expansion of online travel services may be hampered in some areas by a lacklustre internet infrastructure. Online travel platforms may have limited reach and usefulness if high-speed internet connection is restricted.

- Payment Difficulties: Different countries have different preferences and ways of payment. It can be difficult to manage the variety of payment methods that online travel platforms need to offer in order to meet the needs of their diversified clientele.

- Competitive Landscape: There are many companies fighting for market share in the very competitive online travel industry. Reduced profit margins and pricing pressure are two outcomes of intense competition.

- Seasonal Demand: Demand in the travel sector varies with the seasons and holidays. For online travel platforms, off-peak inventory and pricing management can be difficult.

- Expectations for Customer Service: In the travel sector, customers have high standards for customer service. Reaching these standards might be difficult, particularly during periods of high travel demand.

- Data Privacy Concerns: Online travel platforms need to make sure that consumer data is handled securely in light of the growing emphasis on data privacy. Failing to do so may result in legal repercussions and harm to one’s reputation.

- Political and Economic variables: Consumer confidence and travel habits can be impacted by political unrest, economic downturns, and other external variables, which can have an impact on the online travel industry.

- Environmental Concerns: As people become more conscious of environmental issues, their tastes and habits are shifting. Travel websites may have to modify their services to accommodate environmentally conscientious tourists.

Global Online Travel Market Segmentation Analysis

The Global Online Travel Market is Segmented on the basis of Service Type, Platform Type, Booking Mode and Geography.

Online Travel Market, By Service Type

- Online Travel Agencies (OTAs) : These are platforms that allow users to book various travel services such as flights, hotels, car rentals, and vacation packages through their websites or mobile apps. OTAs often aggregate offerings from multiple suppliers and provide users with comparison tools and booking convenience.

- Direct Travel Suppliers : These are travel service providers like airlines, hotels, and car rental companies that offer their services directly to consumers through their own websites or mobile apps, bypassing intermediaries like OTAs.

- Meta Search Websites : Meta search engines allow users to search multiple travel websites simultaneously to find the best deals on flights, hotels, and other travel services. They typically display prices and availability from various OTAs and direct suppliers, enabling users to compare options easily.

Online Travel Market, By Platform Type

- Desktop : Refers to online travel bookings made through desktop or laptop computers.