- Travel Retail Market

"Assisting You in Establishing Data Driven Brands"

Travel Retail Market Size, Share & Industry Analysis By Product Type (Cosmetic & Fragrances, Wines & Spirit, Confectionery & Fine Foods, Tobacco Products, Fashion & Accessories, and Others), By Sector (Duty Free and Duty Paid), By Sales Channel (Airport & Airline Shops, Seaport & Cruise line Shops, Border Downtown Hotel Shops, Railway Station, and Others), and Regional Forecast, 2024-2032

Last Updated: June 03, 2024 | Format: PDF | Report ID: FBI104620

- Segmentation

- Methodology

- Infographics

- Request Sample PDF

KEY MARKET INSIGHTS

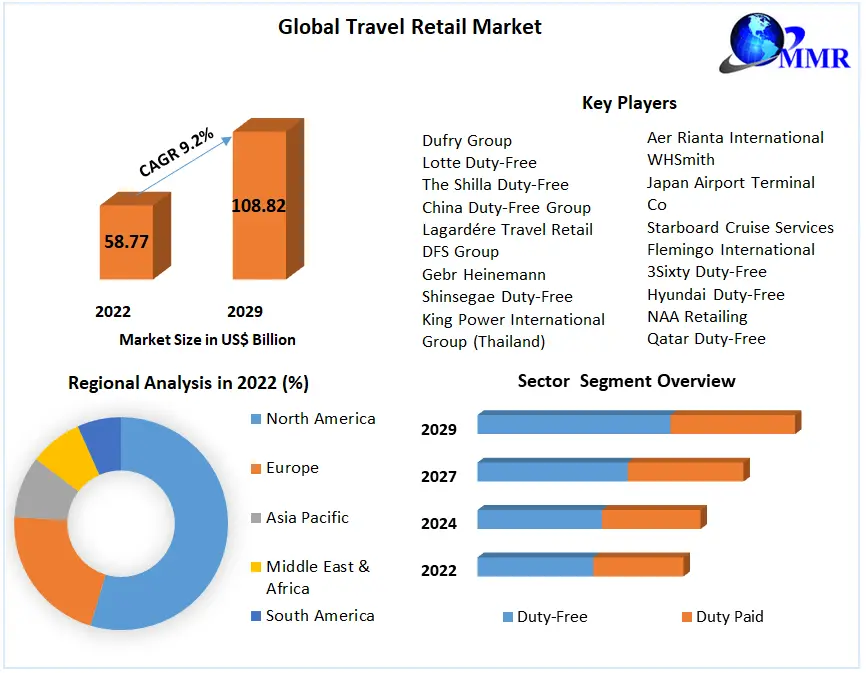

The travel retail market size was valued at USD 60.72 billion in 2023 and is projected to grow from USD 66.30 billion in 2024 to USD 145.46 billion by 2032, exhibiting a CAGR of 10.32% during the forecast period.

Travel retail businesses offer products in travel environments, such as cruises, airports, and airlines. They provide significant revenue generation opportunities to seaports & airports, and also assist companies in enhancing their brand awareness among international travelers at minimum marketing costs. Furthermore, the rising number of stores in countries across the world signifies the market’s expansion. For instance, in June 2023, Pangaia, a U.K.-based lifestyle product brand, unveiled its retail store in partnership with Lagardère Travel Retail, a French retailer, at Terminal 3 of the Dubai International Airport. At a macro level, the rising popularity of luxury goods in airports, cruise liners, and railway stations will favor the market’s expansion over the forecast timeframe.

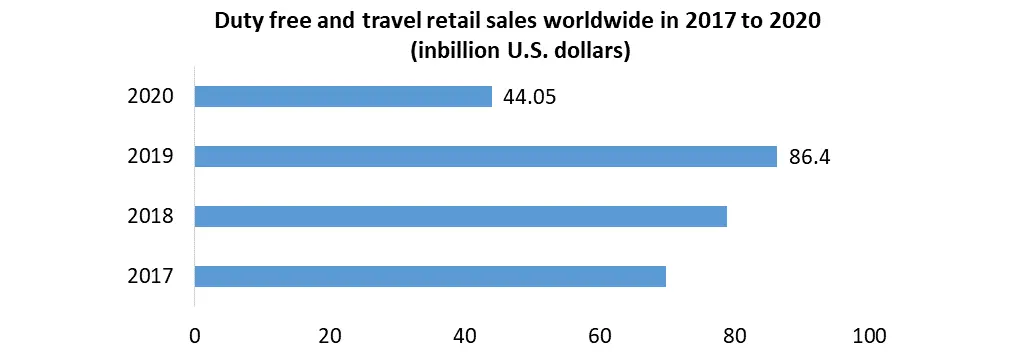

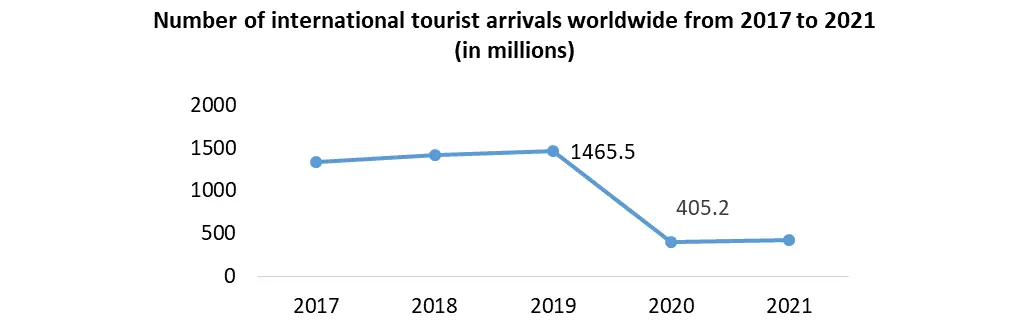

The COVID-19 pandemic significantly impacted the market forecast. To minimize the spread of the coronavirus infection, governments across the globe imposed lockdowns and other travel restrictions. This factor lowered the number of air and marine travelers, thereby threatening the market growth rate. For instance, according to Cruise Lines International Association, a U.S.-based trade association, the number of cruise passengers declined by 81% from 29.7 million in 2019 to 5.8 million in 2020.

Travel Retail Market Trends

Rising Preference for Sustainable Duty-Free Products and Online Store Launches to Boost Market Growth

A sizable number of travelers worldwide prefer sustainable duty-free products to minimize their environmental impact. This factor has encouraged prominent industry participants to launch sustainable and eco-friendly stores to attract eco-conscious consumers. For instance, in March 2022, Lagardère Travel Retail, a French company, introduced its Aelia Duty-Free shop at the Geneva International Airport, Switzerland. The new store is eco-conscious and sustainable in aspects including furnishing, materials, and products.

In addition to this, the rising trend of selling products online to accelerate sales revenues will likely increase the travel retail market share in the future. For instance, in July 2023, Lotte Duty-Free, a South Korea-based retailer, introduced an online liquor store offering products, such as brandy, wine, and Cognac, including limited edition items from more than 100 brands.

Request a Free sample to learn more about this report.

Travel Retail Market Growth Factors

Rising Number of International Travelers to Drive Market Expansion

The increasing number of domestic and international travelers will drive the market growth over the forecast period. For instance, according to VisitBritain, a British Tourist Authority and non-departmental public body, the number of visits to the U.K. is expected to be 39.5 million in 2024, a 5% increase from the visits in 2023 (37.8 million).

Additionally, the rapidly evolving tourism industry of various countries across the globe will support the market’s expansion. For instance, according to the World Travel & Tourism Council, a U.K.-based forum, in 2022, the travel & tourism industry in the U.S. increased by 16% to USD 2 trillion compared to 2021.

Launch of Promotional Campaigns by Major Players to Trigger Product Sales

Recent years have witnessed prominent industry participants launching promotional campaigns and providing discounts and offers to encourage consumers to purchase duty-free products. In addition, they focus on offering high-quality, privately labelled products to attract higher-income travelers and generate revenue streams. These factors are expected to boost the product sales through stores in the future. For instance, in December 2023, Dubai Duty-Free, a company managing Dubai International Airport’s duty-free operations, announced various discounts, offers, and gift cards on its range of products under a promotional activity marking its 40th anniversary.

RESTRAINING FACTORS

High Product Pricing and Currency Fluctuations to Impede Travel Retail Market Growth

Businesses prioritize providing high-quality products from internationally acclaimed and well-renowned brands across the globe, including Gucci, Chanel, Burberry, Dior, Louis Vuitton, and Versace. The high cost of these products limits their sales among lower-income groups and can impede the market’s expansion. Furthermore, currency exchange fluctuations due to various political, economic, and market factors such as inflation, interest rates, and recession can negatively influence the travel retail market growth.

Travel Retail Market Segmentation Analysis

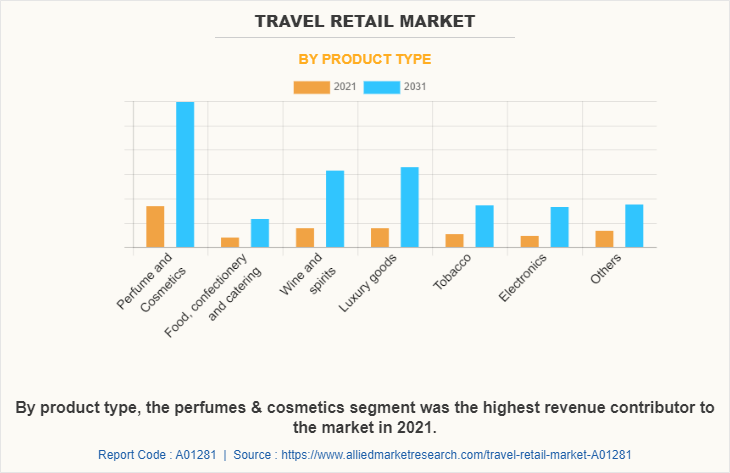

By product type analysis.

Increasing Demand for Cosmetics and Fragrances Among Females and Millennials Led Their Sales

Based on product type, the market is segmented into cosmetics & fragrances, wines & spirits, confectionery & fine foods, tobacco products, fashion & accessories, and others.

The cosmetic & fragrances segment dominated the market share in 2023 due to the growing interest, particularly among females and millennials in internationally acclaimed beauty and perfume brands that are difficult to find in their native locations. In addition, the tax-free pricing of perfumes increases their demand as a gifting item among travelers. Moreover, the retailers showcase multiple brands and product types under one roof, providing travelers with more options and making the purchase easy.

The wines & spirit segment emerged as the second leading segment in 2023. International liquor brands, such as 'Macallan (The Macallan Global Boutiques) and Dalmore (Dalmore Store) emphasize selling products through airport shops and cruise lines to increase their sales, thereby contributing to the wines & spirits segment’s growth.

Furthermore, the fashion & accessories segment is likely to achieve substantial growth during the forecast timeline as fashion products are quite popular among celebrities and sportspersons.

The growing popularity of innovative e-cigarettes will increase their sales through airports and cruise shops, driving the tobacco products segment’s revenue. However, the smoking-related prohibitory rules imposed by airlines and cruises can limit the demand for tobacco products among travelers.

The increasing launch of travel-exclusive collections by confectionery and fine food brands will provide growth opportunities for the confectionery & fine foods segment. For instance, in November 2023, Mondelez World Travel Retail, a U.S.-based confectionery company, introduced its travel collection, including its brands, such as Toblerone, Cadbury, Oreo, and Milka in various flavors. The collection was launched across airports in New Zealand, Australia, Greece, the U.S., Germany, Istanbul, and India.

Furthermore, the others segment includes fine arts and electronic items. The availability of a wide range of these products from various brands at these stores is expected to increase their sales in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By Sector Analysis

Cost Efficiency of Duty-Free Products to Drive Their Sales

Based on sector, the market is categorized into duty-free and duty-paid.

The duty-free segment will likely dominate the market throughout the forecast timeframe. Globally acclaimed cosmetic brands, including L'Oréal and Estee Lauder Inc., emphasize selling their products through duty-free shops to boost sales. In addition, the rising number of international travelers and their demand for duty free products will accelerate the segment’s revenue.

The duty paid segment is expected to grow at a strong CAGR over the forecast period. Furthermore, key players are prioritizing expanding their business by launching new duty-paid stores at key locations, thereby favoring the segment’s growth. For instance, in July 2022, Dufry, a Switzerland-based retailer, announced plans to strengthen its South American business by opening new stores, including three duty-paid shops at the Belo Horizonte International Airport.

By Sales Channel Analysis

Airports & Airline Shops Became Major Sales Channels Due to Availability of Wide Variety of Products

Based on sales channel/distribution channel, the market is segmented into airport & airline shops, seaport & cruise line shops, border downtown hotel shops, railway stations, and others.

The airport & airline shops segment dominated the market in 2023, backed by the provision of a wide variety of products, including liquor and cosmetics from several international and niche brands by airport retailers. Moreover, the rising in-flight Wi-Fi trend offers online shopping opportunities to air passengers, thereby increasing the segment’s growth.

Railway station & others segment emerged as the second leading segment in 2023. Government initiatives to increase passenger traffic at railways will likely create growth opportunities for the railway station segment. For instance, in June 2023, Ashwini Vaishnaw, minister of the Indian railways, announced plans to increase passenger traffic to 11 billion a year by eliminating waiting tickets.

The seaport & cruise line shops segment will likely grow rapidly in the coming years. The surging number of travelers through sea routes will benefit the seaport & cruise line shops segment. For instance, according to Cruise Lines International (CLIA), 28 million individuals traveled on ships and cruises in 2018; this figure was expected to cross the 30 million mark in 2019. In addition, the rising trend of purchasing fragrances and chocolates as gift items from border downtown hotel shops will increase the product’s sales from these channels in the future. The border downtown & hotel shops segment is forecast to witness strong growth in the forthcoming years.

REGIONAL ANALYSIS

The market is studied across North America, Asia Pacific, Europe, South America, and the Middle East & Africa.

Asia Pacific Travel Retail Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Request a Free sample

Asia Pacific dominated the global market in 2023 and has benefitted from the increasing spending of domestic and international travelers on duty-free products, notably in countries, such as China and South Korea. The China duty free and duty paid market has recovered considerably from the negative influence of the COVID-19 pandemic, with increasing footfall across airports. Furthermore, travel companies, including MakeMyTrip and Yatra providing holiday packages, including hotel reservations and airline & rail tickets, will favor the regional market’s expansion.

Recent years have witnessed retailers collaborating with airports in Asia Pacific countries to expand their operations in the region. For instance, in December 2023, Kansai Airports Retail & Services, operating Kansai Airports Group and managing three airports across Kansai, Japan, collaborated with Lagardère Travel Retail, a French retailer, to supply products to the new duty-free shop at Terminal 1, Kansai International Airport.

As the second leading regional market, Europe is witnessing robust growth backed by the growing development of tourism-related infrastructural settings, such as hotels, restaurants, and amusement parks across countries including the U.K, France, and Spain. This move will likely increase travel to these countries in the coming years. For instance, in July 2023, Wyndham Hotels & Resorts, a U.S.-based hotel company, announced plans to launch its Super 8 by Wyndham in the U.K. The new 41-room hotel will provide accommodation to travelers around the North Wales and Greater Manchester areas of the country.

Increasing number of travelers to the U.S. will support the North America travel retail market growth. For instance, as per the International Trade Administration, a U.S.-based government agency, in July 2022, the number of foreign visitors to the country increased by 160.8% compared to July 2021.

The growing consumer interest in travel and duty-free shopping will provide growth opportunities to the South American market in the coming years. Moreover, market players, such as Lagardere Travel Retail and Dubai Duty Free, operating in the Middle East and African countries, provide a wide range of duty-free and duty-paid products, and will contribute to the regional market’s expansion.

List of Key Companies in Travel Retail Market

Key Market Players to Focus On Opening Stores With Advance Features to Gain Competitive Advantage

Key industry participants are adopting various strategies, such as store launches, product launches, and introduction of promotional discounts & offers to accelerate their product’s sales. They are also opening stores featuring advanced technologies to increase the customer base for travel retail, enhance consumer engagement, and gain a competitive advantage. For instance, in April 2023, Lagardère Travel Retail, a French retailer, launched its new store near gate 24, Hong Kong International Airport. The new autonomous shop features computer vision technology and an AI system assisting travelers in buying products without waiting for checkout.

List of Key Companies:

- Lagardere Travel Retail (France)

- Dufry AG (Switzerland)

- King Power International Group (Thailand)

- Aer Rianta International (Ireland)

- Delhi Duty Free Services Pvt. Ltd. (DDFS) (India)

- Lotte Duty Free (South Korea)

- Gebr. Heinemann SE & Co. KG (Germany)

- China Duty Free Group Co., Ltd. (China)

- Abu Dhabi Duty Free (UAE)

- DFS Group Ltd. (France)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Lagardère Travel Retail, a French company, announced plans to open three new stores after winning the electronics tender at the Frankfurt Airport. The new Tech2go shops in Terminal 1, covering a 200 sq. m. area, will offer electronic products.

- July 2023: Coty Travel Retail Europe, the European travel retail subsidiary of beauty brand Coty, collaborated with Dufry, a Switzerland-based retailer, to introduce Burberry Goddess Eau De Parfum. The fragrance was launched by Burberry, a U.K.-based luxury brand, at the London Heathrow airport.

- June 2023: Ritter Sport, a German chocolate brand, announced plans to launch Mini Rainbow Crunchies Tower, its limited edition product, exclusively through channels with Dufry, a Switzerland-based retailer.

- January 2023: Lotte Duty-Free, a South Korean company, opened a store for NONFICTION, a Korean beauty brand. To mark the launch, the company offered consumers free goods through both offline and online channels when purchasing NONFICTION products.

- January 2023: Lagardère Travel Retail Belgium and Atos, a French IT service and consulting company, partnered to launch an automated duty-free point of sales at the Brussels Airport. The companies launched the automated POS to offer travelers a new and unique travelling experience.

REPORT COVERAGE

An Infographic Representation of Travel Retail Market

To get information on various segments, share your queries with us

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product types, sectors, and sales channels. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

To gain extensive insights into the market, Request for Customization

REPORT SCOPE & SEGMENATION

Frequently asked questions.

As per the Fortune Business Insights study, the market size was valued at USD 60.72 billion in 2023.

The market is likely to record a CAGR of 10.32% over the forecast timeframe of 2024-2032.

The cosmetics & fragrances segment was leading the market due to the growing demand for these products, notably from females and millennials.

Rising number of international travelers is expected to drive the market’s expansion.

Some of the top players in the market are Lagardere Travel Retail (France), Dufry AG (Switzerland), King Power International Group (Thailand), Aer Rianta International (Ireland), Delhi Duty Free Services Pvt. Ltd. (DDFS) (India), Lotte Duty Free (South Korea), Gebr. Heinemann SE & Co. KG (Germany), China Duty Free Group Co., Ltd. (China), Abu Dhabi Duty Free (UAE), and DFS Group Ltd. (France).

Asia Pacific dominated the market in terms of product sales in 2023.

High product pricing and currency fluctuations can impede the market’s growth.

Seeking Comprehensive Intelligence on Different Markets? Get in Touch with Our Experts

- STUDY PERIOD: 2019-2032

- BASE YEAR: 2023

- HISTORICAL DATA: 2019-2022

- NO OF PAGES: 175

Personalize this Research

- Granular Research on Specified Regions or Segments

- Companies Profiled based on User Requirement

- Broader Insights Pertaining to a Specific Segment or Region

- Breaking Down Competitive Landscape as per Your Requirement

- Other Specific Requirement on Customization

Consumer Goods Clients

Related Reports

- E-Retail Market

- Duty Free Retail Market

- Agritourism Market

Client Testimonials

“We are quite happy with the methodology you outlined. We really appreciate the time your team has spent on this project, and the efforts of your team to answer our questions.”

“Thanks a million. The report looks great!”

“Thanks for the excellent report and the insights regarding the lactose market.”

“I liked the report; would it be possible to send me the PPT version as I want to use a few slides in an internal presentation that I am preparing.”

“This report is really well done and we really appreciate it! Again, I may have questions as we dig in deeper. Thanks again for some really good work.”

“Kudos to your team. Thank you very much for your support and agility to answer our questions.”

“We appreciate you and your team taking out time to share the report and data file with us, and we are grateful for the flexibility provided to modify the document as per request. This does help us in our business decision making. We would be pleased to work with you again, and hope to continue our business relationship long into the future.”

“I want to first congratulate you on the great work done on the Medical Platforms project. Thank you so much for all your efforts.”

“Thank you very much. I really appreciate the work your team has done. I feel very comfortable recommending your services to some of the other startups that I’m working with, and will likely establish a good long partnership with you.”

“We received the below report on the U.S. market from you. We were very satisfied with the report.”

“I just finished my first pass-through of the report. Great work! Thank you!”

“Thanks again for the great work on our last partnership. We are ramping up a new project to understand the imaging and imaging service and distribution market in the U.S.”

“We feel positive about the results. Based on the presented results, we will do strategic review of this new information and might commission a detailed study on some of the modules included in the report after end of the year. Overall we are very satisfied and please pass on the praise to the team. Thank you for the co-operation!”

“Thank you very much for the very good report. I have another requirement on cutting tools, paper crafts and decorative items.”

“We are happy with the professionalism of your in-house research team as well as the quality of your research reports. Looking forward to work together on similar projects”

“We appreciate the teamwork and efficiency for such an exhaustive and comprehensive report. The data offered to us was exactly what we were looking for. Thank you!”

“I recommend Fortune Business Insights for their honesty and flexibility. Not only that they were very responsive and dealt with all my questions very quickly but they also responded honestly and flexibly to the detailed requests from us in preparing the research report. We value them as a research company worthy of building long-term relationships.”

“Well done Fortune Business Insights! The report covered all the points and was very detailed. Looking forward to work together in the future”

“It has been a delightful experience working with you guys. Thank you Fortune Business Insights for your efforts and prompt response”

“I had a great experience working with Fortune Business Insights. The report was very accurate and as per my requirements. Very satisfied with the overall report as it has helped me to build strategies for my business”

“This is regarding the recent report I bought from Fortune Business insights. Remarkable job and great efforts by your research team. I would also like to thank the back end team for offering a continuous support and stitching together a report that is so comprehensive and exhaustive”

“Please pass on our sincere thanks to the whole team at Fortune Business Insights. This is a very good piece of work and will be very helpful to us going forward. We know where we will be getting business intelligence from in the future.”

“Thank you for sending the market report and data. It looks quite comprehensive and the data is exactly what I was looking for. I appreciate the timeliness and responsiveness of you and your team.”

Get in Touch with Us

+1 424 253 0390 (US)

+44 2071 939123 (UK)

+91 744 740 1245 (APAC)

[email protected]

- Request Sample

Sharing this report over the email

The travel retail market size is projected to grow from $66.30 billion in 2024 to $145.46 billion by 2032, at a CAGR of 10.32% during the forecast period

Read More at:-

Moodie Davitt Report

Connect with us

The Moodie Davitt eZine: The world’s leading travel retailers in profile

INTERNATIONAL. Welcome to The Moodie Davitt eZine, Travel Retail’s LookBook. In this edition we present our unique annual guide to the world’s leading travel retailers, measured by their 2021 turnover.

Buoyed by the Hainan Island offshore duty free business, China Duty Free Group built on the number one status it first attained a year ago. Its 2021 sales were more than double the figure of number two player Lotte Duty Free. The Shilla Duty Free, Dufry and DFS Group round out the top five against the backdrop of a second COVID-hit year for the industry.

We present figures for the top 15 with detailed commentary in the special report that leads this edition.

We also feature an interview with Düsseldorf Airport Head of Commercial Operations Pia Klauck on the appointment of Gebr. Heinemann as duty free partner, and much more besides.

We speak to Puig Vice President of Travel Retail Kaatje Noens about Fame, Paco Rabanne’s newest star fragrance, and the beauty house’s recent launch partnership with Heathrow Airport, Dufry and JCDecaux.

Plus you’ll find our latest Customer Experience Column, in association with marketing, brand activation and customer experience specialist CircleSquare.

Follow us :

The Moodie Davitt Report Newsletter

Subscribe to our newsletter for critical marketing information delivered to your inbox

Related Articles

The Moodie Davitt Report Founder & Chairman Martin Moodie flew to Dubai this month to talk to the new man at the helm of Dubai Duty Free about his priorities in the months and years ahead, his philosophy on life and business, his thoughts on his renowned predecessor and much more.

The study aims to shed light on the difference between post-pandemic Chinese travellers and Chinese visitors before COVID-19 as several notable changes have been seen in China since 2019.

The installation includes several LG Electronics 55-inch transparent OLED displays across seven key areas at the airport, including Terminals 1 and 2 and boarding buildings.

Ranked: The world’s Best-Selling Travel Retailers

With a turnover amounting to approximately $8.69 billion, Dufry was the world’s best-selling travel retailer in 2018, according to CEOWORLD magazine report. Despite a challenging year, Lotte Duty-Free ($6.9 billion) retains its number 2 status in the rankings, followed by The Shilla Duty-Free ($6.2 billion), China Duty-Free Group ($6.1 billion), and Lagardère Travel Retail ($4.7 billion).

With Gebr Heinemann ($4.6 billion), DFS Group ($3.6 billion), King Power International Group Thailand ($2.75 billion), Sinsegae Duty-Free ($2.69 billion), and Dubai Duty-Free ($1.99 billion) rounding out the top ten.

To identify the world’s top 25 best-selling travel retailer in 2018, based on turnover, CEOWORLD magazine reviewed numerous national and international media reports. Additional information about the skyscrapers came from Moodie Davitt. The following list showcases the world’s top 25 best-selling travel retailer in 2018.

- Dufry: $8.69 billion

- Lotte Duty-Free: $6.9 billion

- The Shilla Duty-Free:: $6.2 billion

- China Duty-Free Group: $6.1 billion

- Lagardère Travel Retail: $4.7 billion

- Gebr Heinemann: $4.6 billion

- DFS Group: $3.6 billion

- King Power International Group (Thailand): $2.75 billion

- Sinsegae Duty-Free: $2.69 billion

- Dubai Duty-Free: $1.99 billion

- Ever Rich Duty-Free: $1.95 billion

- Duty-Free Americas: $1.83 billion

- Aer Rianta International: $1.24 billion

- JATCO: $1.21 billion

- Starboard Cruise Services: $860.94 million

- WHSmith: $842.71 million

- Doota Duty-Free: $759 million

- NAA Retailing: $746.56 million

- Flemingo International: $740 million

- 3Sixty Duty-Free: $685.48 million

- Sky Connection: $630 million

- Qatar Duty-Free: $565.58 million

- JR/Duty-Free: $480.74 million

- Tallink Group: $444.54 million

- King Power Group (Hong Kong: $34.36 million

Have you read?

# World’s Top 100 Cities To Reside In For 2019 . # RANKED: The World’s Top 10 Richest Countries (2017-2027) . # Revealed: Top Rated Visitor Attractions In Every Country In The World .

CEOWORLD magazine Print and Digital Edition

Emma London

Indian CEOs Show Strong Confidence in AI for Business Success Amid Economic Challenges

CEOs Prioritize Business Travel for Revenue Growth and Employee Morale

Escalating Debt Crisis for Developing Countries as Public Debt Soars Over a Decade

Americans Demand Narrower CEO-Employee Pay Gap, Poll Reveals

Spain Achieves Record Gender Parity, Ranks Among Top 10 Globally

- Report Store

- AMR in News

- Press Releases

- Request for Consulting

- Our Clients

Travel Retail Market Size, Share, Competitive Landscape and Trend Analysis Report by Product Type, by Distribution Channel : Global Opportunity Analysis and Industry Forecast, 2022-2031

CG : Travel & Luxury Travel

Report Code: A01281

Tables: 100

Get Sample to Email

Thank You For Your Response !

Our Executive will get back to you soon

Travel Retail Market Research, 2031

The global travel retail market size was valued at $52.7 billion in 2021, and is projected to reach $187.1 billion by 2031, growing at a CAGR of 9.6% from 2022 to 2031.

The travel retail industry refers to the sale of goods and services to travelers at locations such as airports, train stations, cruise terminals, and border shops. It is a unique segment of the retail industry that capitalizes on the spending power and leisure time of travelers. Travel retail encompasses a wide range of products including luxury items, fashion and accessories, cosmetics and skincare, electronics, confectionery, and alcohol.

The travel retail industry is projected to be fueled by growth in travel around the globe. As the number of passengers passing through airports and other transportation hubs continues to increase, so does the demand for goods & services at these locations. Moreover, growth in global travel has led to more diverse customer base for travel retail. With people from different cultures & countries passing through the same routes, there is increase in demand for products that cater to a range of tastes & preferences. In addition, ss disposable income continues to rise globally, more people are able to afford premium & luxury products such as apparels, luxury goods, premium fragrances, cosmetics. Travel retail has responded to this trend by stocking high-end products such as designer clothing, cosmetics, and electronics.

Moreover, many countries have relaxed their duty-free shopping regulations, allowing travelers to purchase goods tax-free. This has made travel retail more attractive to consumers looking for discounted prices. Retailers are investing in the design & layout of their stores to create a more engaging & immersive shopping experience for customers. This has helped to differentiate travel retail from traditional retail and attracted a wider range of customers.

In addition, development of infrastructure in emerging economies of Asia-Pacific and LAMEA is projected to supplement the growth of the global travel retail market. However, unorganized local market and stringent government regulations in airport retailing hamper the travel retail market growth.

Moreover, the expansion of duty-free shopping is a significant driver of the travel retail market. Duty-free shopping refers to the sale of goods to international travelers who are leaving a country, and are exempted from paying certain taxes or duties on those goods. By purchasing products without paying taxes or duties, travelers can save a significant amount of money on high-end items such as designer clothing, cosmetics, and electronics. This can make the products more accessible to a wider range of customers, and drive the travel retail market demand.

Moreover. the expansion of duty-free shopping has further helped to attract a broader customer base to travel retail. As more travelers become aware of the tax-free shopping opportunities available to them, they may be more likely to purchase goods in these locations. This can help to drive demand for a wider range of products in the travel retail market.

However, rise of e-commerce & online shopping has led to decrease in demand for traditional retail, including travel retail. As more consumers choose to shop online, they may be less likely to make purchases at travel retail locations. Further, various airlines have implemented restrictions on carry-on baggage, which can limit the number of goods that passengers are able to purchase at travel retail locations. This can reduce the demand for certain types of products in the travel retail market.

SEGMENTAL ANALYSIS

The travel retail market forecast is segmented on the basis of product type, channel, and region. By product type, the market is divided into perfume & cosmetics; electronics; wine & spirits; food, confectionery, & catering; tobacco; luxury goods; and others. As per sales channel, the market is divided into airports; cruise liners; railway stations; and border, downtown, & hotel shops. Depending on region, the market is divided into North America, Europe, Asia-Pacific, and LAMEA.

BY PRODUCT TYPE

By product type, the market is divided into perfumes & cosmetics; wine & spirits; tobacco, electronics; luxury goods; food, confectionery, & catering; and others. Sustainability among the perfume & cosmetic products is attracting a large customer base at present as the customer wants various information regarding the products being purchased, such as if they are environment-friendly. Customers are now emphasizing over products made from natural ingredients. In addition, this segment holds a strong customer base, therefore, leading companies, including L’Oréal and Estee Lauder are opening new outlets at several international airports with a wide range of perfumes & cosmetics, skin care products, and beauty products.

BY DISTRIBUTION CHANNEL

By distribution channel, the market is classified into airports; cruise liners; railway stations; and border, downtown, & hotel shops. The airports segment accounted for a major travel retail market share in the travel retail market in 2021 and is expected to grow at a significant CAGR during the forecast period. General retail shop concept is followed by the airports as it carries a diversity of items and further includes full range of product categories, such as perfumes & cosmetics, tobacco goods, wines & spirits, electronics, and food & confectionery. These retail shops at airports are located in central areas with high passenger flow, which attracts the customers to visit the stores. New outlets have been opened by L’Oreal and Estee Lauder at airports globally considering the high footfalls of the passenger. Hence, these factors increase the sales at airport retail shops, which drives the growth of the segment.

By region, Asia-Pacific is expected to dominate the global market during the analysis period, due to presence of a large number of retail companies in China, India, and Thailand. In addition, the market in Asia-Pacific is expected to grow at the fastest rate due to increase in the number of high-net-worth individuals and growth of the tourism industry.

COMPETITION LANDSCAPE

The report offers a comprehensive analysis of the key players such as DFS Group, Dufry, LS travel retail, Lotte Duty Free, King Power International Group, The Shilla Duty Free, Gebr, Heinemann, China Duty Free Group (CDFG), Aer Rianta International (ARI), and The Naunace Group.

Key strategic moves and developments:-

- In June 2021, LVMH formed a partnership with Canopy, a non-profit environmental organization to help in forest conservation.

- In February 2021, Durfy along with Hainan Development Holdings open first shop opens first at Haikou's Mova Mall In Hainan, China.

- In December 2020, Durfy completed its merger successfully with Hudson Ltd in order to expand its portfolio.

- In June 2020, Lotte Confectionery Co, a unit of South Korean conglomerate Lotte Group, launched snack subscription service dubbed “Monthly Snack,” the first of its kind in South Korea.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the travel retail market analysis from 2021 to 2031 to identify the prevailing travel retail market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the travel retail market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global travel retail market trends, key players, market segments, application areas, and market growth strategies.

Travel Retail Market Report Highlights

Analyst Review

The global travel retail market has witnessed steady growth in recent years. Asia-Pacific and Europe are some of the largest travel markets around the globe. Travel & tourism includes leisure tourism, business tourism, and medical tourism. The factors that promote the trave retail market growth of the travel & tourism industry include changes in lifestyle, tourism promotion, and increase in accessibility of transport facilities, which in turn are expected to fuel the growth of the travel retail market.

CXO further added, the growth of the travel retail market is closely linked to increase in number of travelers passing through airports, train stations, and other transportation hubs. As more people travel for business and leisure, the potential customer base for travel retail expands. However, the border, downtown, & hotel shops are efficient ways of creating brand awareness among consumers as well as increase general sales, as they allow customers to view & purchase products without any hassle and inconvenience. Therefore, brands such as Prada, Gucci, and H&M are increasingly launching their hotel shops to make it easier for customers to view and purchase products, thereby making it the fastest growing channel in the global travel retail market.

- Travel Destinations

- Luxury Accommodations

- Travel Packages

- Travel Safety

- Luxury Travel Experiences

- Travel Planning

- Travel Retail

The global Travel retail market registered a CAGR of 9.6% from 2022 to 2031.

The Travel retail Market was valued for $54.7 billion in 2021 and is estimated to reach $187.1 billion by 2031, exhibiting a CAGR of 9.6% from 2022 to 2031.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the Travel retail market report is from 2022 to 2031.

Loading Table Of Content...

Loading Research Methodology...

- Related Report

- Global Report

- Regional Report

- Country Report

Enter Valid Email ID

Verification code has been sent to your email ID

By continuing, you agree to Allied Market Research Terms of Use and Privacy Policy

Advantages Of Our Secure Login

Easily Track Orders, Hassel free Access, Downloads

Get Relevent Alerts and Recommendation

Wishlist, Coupons & Manage your Subscription

Have a Referral Code?

Enter Valid Referral Code

An Email Verification Code has been sent to your email address!

Please check your inbox and, if you don't find it there, also look in your junk folder.

Travel Retail Market

Global Opportunity Analysis and Industry Forecast, 2022-2031

Travel Retail Market

Travel retail market size, share & trends analysis report by product type (cosmetic & fragrances, wines & spirits, confectionery & fine foods, tobacco products, fashion & accessories, others), by sector (duty free, duty paid), by sales channel (airport & airline shops, seaport and cruise line shops, border downtown hotel shops, others) and by region(north america, europe, apac, middle east and africa, latam) forecasts, 2023-2031.

Market Dynamics

Regional analysis, report scope, segmental analysis.

- Recent Development

Top Key Players

- Report Overview

- Table of Content

- Segmentation

Download Free Sample

Market overview.

The global travel retail market size was valued at USD 58.8 billion in 2022 . It is projected to reach USD 122.5 billion by 2031 , growing with a CAGR of 8.5% during the forecast period (2023–2031).

Travel retail refers to sales made in travel environments where customers require proof of travel to access the commercial area and are subject to taxes and duties. Increased travel and tourism have increased the demand for garments, cosmetics, food products, and electronic goods in the travel retail business. In addition, an increase in urbanization and a shift in consumer lifestyles are predicted to be major development drivers for the market over the forecast period. In addition, a rise in the disposable income of middle-income groups and an improvement in economic conditions are significant market growth drivers. Duty-free and travel retail generates vital revenues for national aviation, travel, and tourism industries across the globe. The first duty-free and travel retail was launched in Shannon airport, Ireland, in 1947. Travel retail has witnessed significant growth in the last few years due to the number of international travelers. The Asia Pacific region is dominating the market. However, western region such as Europe and North America is growing at a moderate pace. In Europe, travel retail has become a key component of aviation and maritime financing and an integral part of the traveling experience.

What are the factors driving the market growth?

Increase in travel.

Increasing product demand due to a rise in the number of international and domestic passengers is projected to contribute to the expansion of the travel retail sector. The growing income levels and rising travel expenditures of the millennial generation are predicted to be significant industry growth drivers. The World Travel and Tourism Council presented data predicting a 34.9% increase in the French travel and tourism business in 2021. The development of promotional activities by major corporations to entice consumers to purchase duty-free goods is anticipated to increase product demand and promote travel retail.

Tourism is the primary driver of the travel retail business in Asia-Pacific, as several foreign investors visit Hong Kong and Malaysia for tax-free shopping. Diverse market participants are eager to increase their market position by establishing themselves in Asian marketplaces. Mitsui Outlet Park KLIA, a premium outlet mall, was inaugurated near the international airport in Kuala Lumpur. Mitsui Outlet Park KLIA is home to several luxury brand stores, including Bally, Guess, and Boss by Hugo Boss. In addition, Dior Homme, Jimmy Choo, Tiffany & Co, Roger Vivier, MCM, Roos, and Alexander Wang have opened boutiques in Thailand. China is one of the largest importers of cosmetics and clothing. This contributes to the expansion of the Asia-Pacific market. India, China, Japan, and South Korea are the frontrunners in the regional market. South Korea is emerging as the world’s largest travel retail market, accounting for around USD 12 billion in sales, followed by China and Japan. The regional’s market generates a significant amount of revenue through the fashion and accessories, fragrances and cosmetics, and wines and spirits segments.

Europe is projected to demonstrate tremendous growth in the future years. The rising infrastructural development for travel and tourism is likely to enhance the market growth in Europe. Moreover, the high presence of sumptuous cosmetics and other prominent duty-free brands is projected to boost the region’s market expansion. The European region is home to the headquarters of some of the major luxury and fashion brands in travel retail, like LVHM and H&M. The shift in consumer lifestyles is anticipated to drive the expansion of the European travel retail market, which will be fueled by a rise in travel & tourism due to an increase in disposable income and rapid urbanization. Continual growth in the travel and tourist business, as well as the infrastructure of the hospitality sector and advances in online booking, will contribute to the growth of the travel retail industry in Europe. Due to its stronger basis of luxury products and the presence of some major clothes and cosmetics companies, the United Kingdom market held the highest proportion, contributing more than one-fourth of the market. Nevertheless, the market in Germany is anticipated to exhibit the highest CAGR throughout the forecast period.

North America is expected to witness substantial growth over the forecast period. The rise in the travel and tourism industry has raised the demand for garments, cosmetics, food products, and electronic goods, as well as the rise in urbanization, lifestyle changes, and disposable income growth among North Americans. In the coming years in North America, the increase in the number of millennials, the growing emphasis on the digitalization of the retailing process, and the rise in demand for retail chains offering luxury and premium brands of a variety of products are anticipated to support the growth of the market. The travel and tourism sector is one of the fastest-growing industries in North America. Infrastructure growth in the travel-retail business, such as greater retail experiences, including stores, restaurants, bars, and other forms of retail, has been driven by increased passenger traffic. Rich tourists from other nations continue to play a key role in the North American economy. However, the rise of terrorism and criminality, as well as stringent government controls, notably for airport shopping, impede industry growth. On the other hand, greater attempts to expand the region's travel and tourist industry are projected to create lucrative opportunities soon.

Latin America is also a significant market for travel retail. Travel retail spending in Latin America and the Caribbean directly accounts for more than 50,000 jobs. People's living standards are rising due to increasing disposable earnings, an improvement in lifestyle, and an expansion of corporate culture. A rise in the dispersion of business entities in emerging nations has popularised the carrying expensive products mentality among consumers. This habit of owning premium goods has become a status symbol among consumers. The rise in the travel and tourism industry has raised the demand for garments, cosmetics, food products, and electronic goods, the urbanization and lifestyle shifts of Latin Americans, and the increase in their disposable income. The millennial population is rising in Latin American nations such as Brazil, Argentina, and Colombia. Consequently, the increasing focus on the digitalization of the retailing process and the rise in demand for retail chains that offer luxury and premium brands of various products are anticipated to moderate the expansion of the market in Latin America in the future. Due to the increasing demand for duty-free products across countries, the duty-free retail spaces at Dubai International Airport and Abu Dhabi International Airport also contribute significantly to travel retail. The Middle Eastern region's beneficial geography, which connects it to all four corners of the globe, is also assisting the market in increasing its revenue by attracting more shoppers.

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports

The market is segmented by product and channel.

The market is segmented by product into perfumes & cosmetics, wine & spirits, cigarettes, electronics, luxury goods, food & confectionary, and catering & others.

Due to the early adoption of a premium lifestyle, the luxury goods market category is expected to rise steadily in developed nations, where it is expected to see strong growth potential. Rise in disposable income, exposure to social media, urbanization, and preference toward investments in personal luxury goods are some of the reasons that further fuel the market expansion.

The market is segmented by distribution channel into airports, cruise ships, train stations, and border, downtown, and hotel shops.

The airport segment accounts for more than one-third of the market shares. This is because nowadays, most people use to travel by airway rather than ships and roadways. The aviation industry is booming, which in turn increases the sales of the market. As air travel becomes more accessible and affordable, more people are expected to make use of it, which is anticipated to contribute to the sector's expansion. Several airports' endeavors to increase the profitability of non-aeronautical resources have also contributed to the expansion of this market category. In the Americas, among major channels such as Aviation, maritime, and land, the major revenue generated was through the aviation channel.

The cruise line segment is also an important segment of the market. The trade of goods in bulk is majorly made by ships and waterways. In addition, the growing trend of cruising in Asians is expected to impact the market positively. Cruising is a relatively new travel experience for Asians, but it is growing in popularity. In comparison to more established cruise markets , Asians prefer cruises of shorter duration (e.g., 4 to 5 days) and to travel in larger party sizes that include extended family and multiple generations.

Market Size By Product Type

- Cosmetic & Fragrances

- Wines & Spirits

- Confectionery & Fine Foods

- Tobacco Products

- Fashion & Accessories

Recent Developments

- July 2022 - Dufry, the largest airport retailer in the world, is preparing to merge with global travel food and beverage (F&B) business Autogrill to establish a strong new entity in the travel retail channel with combined revenues of $6.7 billion in 2021.

- November 2022 - Beginning in 2023, the ownership of Marché International, with headquarters in Pfaffikon, Switzerland, will change hands. Lagardère Travel Retail International, based in Paris, will buy all of Marché International AG, the parent company for the Marché business.

Travel Retail Market Share of Key Players

Frequently Asked Questions (FAQs)

Sample details.

- You will receive a link to download the sample pages on your email immediately after filling out a form

- A sample report will help you understand the structure of our full report

- The sample shared will be for our off-the-shelf market report

- The off-the-shelf report is curated considering a broader audience for this market, we have insights extending well beyond the scope of this report. Please reach out to discuss

- Should the sample pages not contain the specific information you seek, we extend the option to request additional details, which our dedicated team will incorporate.

- The sample is free of cost, while the full report is available for a fee.

Custom Scope

Connect with our analyst, we are featured on :.

- Terms & Conditions

- Privacy Policy

- Return Policy

Enter the valid email address

TRCF 2024: Reinventing premium and luxury in GTR

ASUTIL Conference in Colombia's Bogotá attracts 300+ delegates

A total of 307 DF&TR executives attended the Asociación Sudamericana de Tiendas Libres (ASUTIL) Conference in Bogotá, Colombia...

King Power partners With AOTGA to launch inclusion campaign

King Power Group, in collaboration with AOTGA (AOT Ground Aviation Services Company Limited) has announced the launch of the “Power of...

Royal Caribbean returns to China with revamped retail onboard Spectrum

Starboard and Royal Caribbean International are celebrating the cruise line’s return to China with Spectrum of the Seas, complete...

Shinsegae DF installs transparent OLED displays at Incheon for first time

Shinsegae Duty Free has installed wireless transparent displays using Organic Light Emitting Diode (OLED) technology across seven key...

Vantage rebrands as airports manager and investor looks to the future

Vantage Airport Group (Vantage) has announced a corporate rebrand to Vantage Group. The organisation, which boasts nearly 30...

Gategroup NA names Chris Kinsella as Regional Chief Commercial Officer

Christopher Kinsella has been promoted to lead gategroup’s North America commercial strategy, the travel catering and onboard retail...

Heinemann's Euro Summer campaign pops at SYD with shopper lucky draw

Heinemann Oceania’s popular Euro Summer campaign has returned to Sydney Airport with a vibrant Italian riviera inspired activation...

TR Consumer Forum 2024: Unlocking the new Chinese travel retail shopper

Following a keynote interview with Dr. Munif Mohammed, CEO of Lagardère Travel Retail KSA and Middle East, the first panel session of...

FRA bulks up retail offer as T3 bid evaluations and negotiations progress

An expanded luxury footprint, new F&B openings and ongoing project developments for the much-anticipated Terminal 3 underpins...

Spend a workday with… Blueprint's Thomas Kaneko Henningsen

Thomas Kaneko Henningsen joined the travel retail industry in 2000 and today is Partner at business development consultancy Blueprint....

A total of 307 DF&TR executives attended the Asociación Sudamericana de Tiendas Libres (ASUTIL) Conference in Bogotá, Colombia this week...

Starboard and Royal Caribbean International are celebrating the cruise line’s return to China with Spectrum of the Seas, complete with a...

Shinsegae Duty Free has installed wireless transparent displays using Organic Light Emitting Diode (OLED) technology across seven key areas at...

Latest Product News

Dr.Ci:Labo spotlights skincare heroes & shares strategy to drive conversion

Japanese dermacosmetics brand Dr.Ci:Labo demonstrated its skincare prowess at the TFWA Asia Pacific Exhibition & Conference in Singapore by spotlighting...

Lancôme partners with CDFG to recruit VVIPs for Absolue L’Extrait relaunch

To mark the relaunch of Absolue L’Extrait, Lancôme has teamed up with China Duty Free Group (CDFG) to recruit high-net-worth individuals with the Black...

Bruichladdich GTR exclusives spotlight at high-profile Changi T4 activation

A duo of global travel retail exclusive single malt whiskies from Islay distillery Bruichladdich are being showcased at a high visibility tasting bar at...

Vantage Airport Group (Vantage) has announced a corporate rebrand to Vantage Group. The organisation, which boasts nearly 30 years’...

Christopher Kinsella has been promoted to lead gategroup’s North America commercial strategy, the travel catering and onboard retail firm has...

Heinemann Oceania’s popular Euro Summer campaign has returned to Sydney Airport with a vibrant Italian riviera inspired activation featuring a...

Following a keynote interview with Dr. Munif Mohammed, CEO of Lagardère Travel Retail KSA and Middle East, the first panel session of day three...

An expanded luxury footprint, new F&B openings and ongoing project developments for the much-anticipated Terminal 3 underpins Frankfurt...

- Product News

Japanese dermacosmetics brand Dr.Ci:Labo demonstrated its skincare prowess at the TFWA Asia Pacific Exhibition & Conference in Singapore by...

To mark the relaunch of Absolue L’Extrait, Lancôme has teamed up with China Duty Free Group (CDFG) to recruit high-net-worth individuals with...

A duo of global travel retail exclusive single malt whiskies from Islay distillery Bruichladdich are being showcased at a high visibility tasting...

Bacardi GTR capitalises on fast-growing whisky category with TREX innovations

Bacardi Global Travel Retail held a press event on its stand at the TFWA Asia Pacific Exhibition & Conference in Singapore in May to...

Suntory kicks off GTR exclusive whisky release with Dubai Duty Free

The House of Suntory has partnered with Dubai Duty Free to promote the launch of its global travel retail exclusive Yamazaki and Hakushu Kogei...

EssilorLuxottica unveils two new GTR exclusive Versace sunglasses

EssilorLuxottica is expanding its luxury eyewear offering with the unveiling of Versace limited edition travel retail...

Aber Falls and Avolta launch ‘proudly Welsh’ whisky in UK airports

Halewood Artisanal Spirits has partnered with Avolta to launch Aber Falls Single Malt Welsh Whisky in UK travel retail. The ‘proudly...

Dubai Duty Free houses 306 bottles of exclusive Loch Lomond single cask

Loch Lomond Group has teamed up with Dubai Duty Free (DDF) to release an exclusive single cask bottling. Available from June, a mere 306...

Ferrero debuts Belgian biscuit brand Delacre in GTR at Brussels Airport

Ferrero Travel Market is boosting its presence in the biscuit category by launching premium Belgian biscuit brand Delacre into global travel...

Coty unveils Gucci The Alchemist's Garden The Heart of Leo Eau de Parfum

Coty has announced the launch of The Heart of Leo Eau de Parfum – the latest scent to join Gucci's sought-after The Alchemist’s Garden...

Bengaluru DF and Paul John Whisky partner on exclusive whisky edition

Paul John Whisky, an Indian single malt whisky brand under John Distilleries, has announced an exclusive partnership - and accompanying whisky...

De Rigo Vision and Chopard release targets 'contemporary gentlemen'

De Rigo Vision and Chopard have unveiled a new limited edition release to mark the occasion of the 1000 Miglia 2024 edition. To mark the occasion...

Most popular

- Regional News

- Channel News

- Data & Analysis

- Video Channel

- Sustainability

In the Magazine

TRBusiness Magazine is free to access. Read the latest issue now.

In case you missed it...

- women in travel

- Consumer Goods and Services /

- Travel and Tourism

Travel Retail Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028

- Region: Global

- IMARC Group

- ID: 5820644

- Description

Table of Contents

Companies mentioned, methodology, related topics, related reports.

- Purchase Options

- Ask a Question

- Recently Viewed Products

Travel Retail Market Trends:

Key market segmentation:, breakup by product type:.

- Perfume and Cosmetics

- Wine and Spirit

- Electronics

- Luxury Goods

- Food, Confectionery and Catering

Breakup by Sector:

Breakup by distribution channel:.

- Cruise Liner

- Railway Station

- Border, Downtown and Hotel Shop

Breakup by Region:

North america.

- United States

Asia-Pacific

- South Korea

- United Kingdom

Latin America

Middle east and africa, competitive landscape:, key questions answered in this report:.

- What was the size of the global travel retail market in 2022?

- What is the expected growth rate of the global travel retail market during 2023-2028?

- What are the key factors driving the global travel retail market?

- What has been the impact of COVID-19 on the global travel retail market?

- What is the breakup of the global travel retail market based on the product type?

- What is the breakup of the global travel retail market based on the sector?

- What is the breakup of the global travel retail market based on distribution channel?

- What are the key regions in the global travel retail market?

- Who are the key players/companies in the global travel retail market?

- Aer Rianta International

- China Duty Free Group Co. Ltd.

- Duty Free Americas Inc

- Gebr. Heinemann SE & Co. KG

- KING POWER International

- Lagardère S.A

- Lotte Hotels & Resorts (Lotte Corporation)

- LVMH Moët Hennessy Louis Vuitton and The Shilla Duty Free (Hotel Shilla Co. Ltd.).

Table Information

- Travel And Tourism

Duty-free and Travel Retail Market Report by Product Type (Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, and Others), Distribution Channel (Airports, Airlines, Ferries, and Others), and Region 2024-2032

- Report

Global Travel Retail Market (by Product Type, Sale Channel, & Region): Insights and Forecast with Potential Impact of COVID-19 (2022-2027)

- October 2023

Travel Retail Global Market Report 2024

- January 2024

Global Travel Retail Market by Product (Confectionary & Fine Food, Electronics, Fashion & Accessories), Purchase Type (Duty Free, Duty Paid), Channel - Forecast 2024-2030

Leisure Travel Market Report by Traveler Type, Age Group, Expenditure Type, Sales Channel, and Region 2024-2032

ASK A QUESTION

We request your telephone number so we can contact you in the event we have difficulty reaching you via email. We aim to respond to all questions on the same business day.

Request a Quote

YOUR ADDRESS

YOUR DETAILS

PRODUCT FORMAT

DOWNLOAD SAMPLE

Please fill in the information below to download the requested sample.

Retailers in travel: the power of shopping tourism

- February 26, 2020

The experience economy has driven changes across all economic sectors in recent years, and retail has experienced some of the most radical, yet interesting ones, opening new paths for business by interacting with other industries such as travel. Shopping tourism is showing its power as a business driver and, at the same time, it is pushing a deep transformation of the industry that will guarantee growth and development in the short and long run.

By Otto Ambagtsheer

As experienced retailers, there is a clear trend we are observing worldwide, aligned with the social changes that technology has brought: the increasing demand for unique and personalized experiences–a movement that has been called “the experience economy”. In the midst of it, e-commerce, with its competitive prices and fast delivery, is rewriting the rules of consumption; industries and sectors interact in a competitive race to be original and relevant in a market full of stimulant proposals, and this requires more collaborative initiatives to ensure traditional business models are able to successfully transition to an ultra-connected economy. A good example of these synergies is amalgamation of shopping and tourism, a segment that is growing exponentially around the world.

According to the World Tourism Organization (UNWTO), shopping is among the top deciding factors when travellers choose a destination, showing its relevance beyond that of a mere ancillary service. As 2019 data from UNWTO shows, more than 1.5 billion people traveled around the world in 2019, four percent more than in 2018 despite the travel industry turmoil following the collapse of Thomas Cook and several other low-cost airlines in Europe, and this entity foresees an increase between three and four percent in international tourist arrivals worldwide. Moreover, tourism spending in 2019 has remained strong against a backdrop of global economic slowdown. It continued to grow most notably amongst the world’s top ten spending markets surpassing the previous year’s staggering 1,500,000,000,000 dollars (one trillion five hundred billion dollars).

Range of special activities

These figures paint an interesting picture for travel retail, as the number of travellers grows every year, as does the total spend. Tax-free shopping helps to quantify the dimension of shopping tourism from markets outside Europe, especially when it comes to outlets, as the price factor is particularly appealing. Shopping is of course not confined to airports or malls and has become a key part of the travel experience.

VIA Outlets is in a good position to capitalize on this dynamic and expanding market segment with its eleven outlet centers, which are strategically located at the gateway of many of Europe’s most exciting destinations. Apart from getting the basics of a great shopping experience right–offering a wide range of high-quality brands, an extensive food and beverage offering, leisure areas for children and adults and aesthetics that inspire as well as encourage exploration of the retail offer–VIA Outlets undertakes a range of activities specifically targeted at tourists. For example, we continuously add facilities that purposely cater to tourists’ needs, such as shuttle bus services from and to city centers, as well as added-value services such as tax refund facitlies for guests from overseas and lounges for VIPs.

Shopping, like travel, is all about creating an experience that is unique and unrepeatable from place to place. Real integration of shopping in the travel experience means making retail accessible, locally relevant and convenient. To this end, our vision is to recreate, in an appealing way, each center’s regional architecture, decor, culture and history to differentiate our shopping destinations from our competitors’, and make it available, vivid and present throughout the travel journey–all with the aim of capturing the experience economy. We call this a “beautifully local” experience.

Beyond the mere act of buying

Broadly speaking, shopping tourism is undoubtedly an economic engine that drives direct and indirect employment, revenue and benefits for destinations. The mere concept is a combination of two global industries able to mobilize billions of euros. As we see it, shopping tourism is a transversal segment that interacts with other sectors, products and services, both in travel and retail as well as a number of other industries.

Fashion, just like travel, resonates with consumers’ aspirations and lifestyles, and this is the quintessence of the experience economy. The travel industry has experienced this transformation, from location to experience, long before retail; in fact, travellers’ choices have a deep, relevant, aspirational element, tied to emotions, that shopping also provides. That is why we see shopping tourism as a powerful combination, able to increase revenue for retailers, as well as boost longer stays, higher spending and loyalty ratios for destinations.

Moreover, shopping tourism goes beyond the mere act of buying: it starts at the very moment a traveller picks a certain destination, continues throughout their trip in different contexts, and even evokes that experience once they return home. Interestingly, according to the latest Duty Free World Council (DFWC) KPI Monitor, 75 percent of shoppers plan their purchases prior to their travels, and while the majority–52 percent–of shoppers who plan their purchases do so with a general idea of what they will buy, the remaining 23 percent plan their purchases with a specific product or brand in mind. So, being in the forefront of the traveller’s mind right from the inspiration and planning process is vital for all parties involved in this segment.

A diversification engine

What these figures demonstrate is that to really harness shopping tourism potential, travel and retail should work together. Shopping tourism is the result of the development, growth and evolution of the travel industry and travellers, who are eager to enjoy destinations from a local perspective. It is a global economic driver for both emerging and well-established destinations, that involves and requires the collaboration of players in both the travel and retail industry, as well as other economic sectors and public entities. Working together, we can create a compelling concept that truly reflects what makes a destination unique and appealing to travellers around the world.

Besides becoming one of the key motivators for travellers when choosing a place to visit, shopping tourism is also a strong, sustainable development force for destinations, which is able to contribute to local employment, businesses and the wider economy. It is a diversification engine for both retail or travel. For retail players, travellers revitalize demand and their visits to malls, urban shopping areas and outlets force innovation in products and services to really make a difference in our value proposition, helping to align our shopping experience with the idiosyncrasies of each location and providing a wide range of guest services, adapted to both locals’ and travellers’ needs and expectations.

Boosting the local economy

For destinations, hotels and travel agents, it poses an opportunity to recreate new experiences that are able to drive business and stays, attract alternative and more profitable inbound markets and ensure recurring visitations; but also to reorganize saturated urban destinations and boost the local economy from a long-term perspective. The stronger the shopping destination appeal of a location, region or country, the more visitors will come, and the less the area will be exposed to seasonality.

The most important challenge we face as travel and retail players, is that we have to ensure that travellers and their experiences are at the center of any strategy. Shopping tourism involves a wide range of companies, institutions and public bodies that need to understand each other’s goals, needs and dynamics to really develop shopping tourism to its full potential.

At VIA Outlets, we assumed such a commitment implies working hand-in-hand with the travel industry to develop shopping tourism destinations–as we are currently doing from Mallorca to Gothenburg, from Lisbon to Prague, from Zweibrücken to Landquart–and create industry standards that contribute to achieving this goal. We foster collaborative agreements with hotel companies as well as national and local accommodation associations through our tourism department to leverage natural synergies between travel and retail sectors, right across the travel value chain that have proven successful for all parties. In 2019, we further enhanced our capabilities in this field by hiring dedicated sales representatives in some of our largest non-European customer markets, notably China, the Middle East and Brazil. Our efforts proved successful as we saw a significant increase in tax free sales, amounting to a total increase of 17 percent. The figures were even stronger in especially strong tourist destinations such as Amsterdam and Lisbon, with figures at Batavia Stad Fashion Outlet and Freeport Lisboa Fashion Outlet seeing increases in this metric by 21 and 29 percent respectively.

One thing is certain: shopping is definitively becoming more important in travel spends, a trend that, combined with the outlet sector’s highly commercial force, offers a myriad of opportunities for destinations, investors, retailers, tourists and local guests alike.

The Revo´s 2024, London, UK /// Dec 4, 2024

Can AI Identify Potential Synergies Between Retail And Hospitality? And How Can These Insights Be Practically Implemented?

New date set: Westfield Hamburg-Überseequartier opens on October 17, 2024

Subscribe to across magazine.

Enjoy ACROSS – The European Placemaking Magazine on your desktop, tablet, or smartphone.

Latest Print Issue

News letter

By entering my e-mail address and clicking the “Subscribe” button, I declare my consent to ACROSS Medien – und Verlags GmbH to send me information on a regular basis about expert opinions, current trends, latest news, and industry events by e-mail. Being aware that I can revoke my consent to ACROSS Medien- und Verlags GmbH at any time. Privacy Policy

ACROSS Medien und Verlags GmbH 1010 Vienna, Austria Ebendorferstraße 3|10 Phone:+43 1 533 32 60-0 E-Mail: office@across-magazine.com

For detailed information about ACROSS, the international and independent trade medium for placemaking in Europe please visit: Media Presentation and Rates

If you want to keep up with what’s going on in the international placemaking community, give us a follow!

© ACROSS Medien und Verlags GmbH, All rights reserved

Privacy Overview

- + 1-888-961-4454 (TOLL-FREE)

- +1 (917) 444-1262 (US)

- [email protected]

COVID-19 has impacted all businesses across the globe.

our reports from the

CONSUMER GOODS CATEGORY

The novel coronavirus has affected all businesses across the globe

to access all our reports from the CONSUMER GOODS Category, featuring the impact of the pandemic

featuring the impact of the pandemic

Avail the Christmas season discount on the Travel Retail Market Report 20% OFF

(offer valid only till season lasts)

A Guide on Travel Retail: Definition, Growth Factors, and Future Prospects

Travel retail industry is one of the major subsidiary yet standalone industries of the travel and tourism sector. Since the last few years, barring the pandemic period, this industry has seen a substantial rise in terms of its growth number. Though one of the obvious reasons behind the growth in travel retail industry is the growth in number of travelers, there are certain growth factors which are characteristic to the travel retail industry itself.

In the 1700s, there was a shift from primary economic activities like agriculture, mining, etc. to secondary sector constituting manufacturing, construction, etc. This shift was primarily facilitated by the Industrial Revolution which was kickstarted in the Great Britain. Consequently, on similar lines, the ICT revolution enabled a shift from secondary to tertiary sector which predominantly constituted of service-oriented economic activities. One of the biggest industries that emerged out of the tertiary sector was the travel and tourism industry.

What is Travel Retail and Why is it on the Rise Since the Last Few Years?

In the last few decades, especially after the opening of majority of the global economies post-1991, travel and tourism industry has grown like anything else. Some economists even consider it to be a separate economic sector altogether. On account of this growth, several subsidiary and standalone industries have propped up and thrived under the travel and tourism sector. One such standalone industry is the global travel retail industry. Travel retail pertains to creating, planning, and providing travel services, while at the same time, engaging in sales activities to cater to the shoppers’ demands while they are in transit.

The growth in the travel retail market is mainly attributed to four main factors which are discussed below:

- Boom in the Travel Industry on the Whole

Except the aberration witnessed in the last two years due to the Covid-19 pandemic, there has been a steady growth in the number of people travelling across the globe. Though the reasons for travel might be different for each individual, the travel retail industry has been able to fulfill their varied demands efficiently. Hence, a growth in the travel industry has been mirrored by the travel retail industry. Also, since people have been exploring countries and places that were previously not so often visited, the travel retail industry has found new ways and avenues to offer their services.

- Travelers Tend to Shop More

Studies by various behavioral economists have shown that travelers, especially the ones going out for vacations, tend to shop more. This shift from a thrift behavior, according to these experts, is due to the leisurely atmosphere and stress-free state of mind. Also, since travelers have a lot of free time at their disposal, they can shop for longer periods of time. Another interesting theory as to why people spend more at transit channels, such as airports , is that the infrastructure inside airports is built on the concept of open-plan setups. As a result, luxury shopping and casual shopping spaces are intertwined in each other, thus blurring the lines between the two.

- Accurate Data Insights

The retailers engaging in travel retail and sales activities have an added advantage of accurate information about their customers. Their travel and departure times, the type of aircrafts they are travelling, their destination, etc. helps the retailer in getting a brief idea as to what the traveler might be looking for. This helps these retailers to plan their sale strategy accordingly, which helps in maximizing their profits. Also, providing customer service to the passengers or people in transit becomes much easier due to these vital data points.

- Better Showcasing of Products

Since travelers tend to shop more products and spend more on luxury items during their travel, they tend to appreciate certain products more than in normal circumstances. This provides the companies and travel retailers to showcase their products and test whether the products are sellable. Hence, various international brands of different sectors tend to launch and market their unique products through the travel retail industry.

Future of Travel Retail Industry

Though the Covid-19 pandemic and the subsequent lockdowns put a strain on the travel and the travel retail industries, market analysts are confident that both these industries will register huge growth rates in the post-pandemic world. Also, digitization of financial services has improved the quality of shopping experience at the transit channels and has helped in reducing the complexities associated with foreign currency exchange. Moreover, the introduction of smart technologies has further improved data collection, which has helped travel retailers to improve their business strategies in a much better way. All these factors point toward a great future of the global retail travel industry.

About the Author(s)

Princy A. J

Princy holds a bachelor’s degree in Civil Engineering from the prestigious Tamil Nadu Dr. M.G.R. University at Chennai, India. After a successful academic record, she pursued her passion for writing. A thorough professional and enthusiastic writer, she enjoys writing on various categories and advancements in the global industries. She plays an instrumental role in writing about current updates, news, blogs, and trends.

Related Post

How popularly do capsule hotels takeover the position of conventional hotels in developed countries, a quick look at the top 4 cruise tourism destinations in the world for 2023, how does adventure tourism turn a person’s world around, why camping and caravanning are becoming more popular than ever.

How is Cybersecurity Becoming a Vital Measure to Combat Emerging Threats in the Banking Sector Globally?

Wood Pellet Biomass Boilers: An Eco-Friendly Heating Solution

5 Ways Vanilla Oil Can Transform Your Life

Discovering the Magic of Toasted Flour: Why & How to Use It

Request Sample Form

Subscribe to our newsletter and get our newest updates right on your inbox.

Blog Name Here

Obtain comprehensive insights on the Travel Retail Industry

Preview an Exclusive Sample of the Report of Travel Retail Market

The Company

- Why Research Dive?

- Research Methodology

- Syndicate Reports

- Customize Reports