- Travel insurance Compare Our Plans Popular Benefits COVID-19 Benefits International Plans Domestic Plans Comprehensive Insurance Annual Multi-Trip Inbound Plan Cruise Ski & Snowboard Motorcycle & Moped Adventure Activities Seniors Medical Conditions

- Emergency assistance

- Travel alerts Cover-More App

- Manage policy

- Not sure? See full destination list.

Is our travel insurance right for you? Read the Cover-More PDS

We want to cover you, not ourselves. Take a tour of the Cover-More travel insurance Product Disclosure Statement (PDS) to find out if we have the cover you want for the trip you’ve got planned.

Everyone loves curling up with a good Combined Financial Services Guide and Product Disclosure Statement (Combined FSG/PDS), right?

OK, maybe not, but the information this document contains is super important – especially when it comes to knowing whether our travel insurance is the best choice for your amazing holiday.

We know we’ve got great cover, but is it right for you?

Before you hit that big ol’ ‘buy’ button, you’ve got to read the relevant PDS from top to toe. (We’re being serious.) It’s got everything you need to know to help you make a good decision when it comes to buying a policy from us.

If we’ve got the goods you’re looking for, you can either get a quote and buy a policy on this very website or call us on 1300 72 88 22 during business hours to get one over the phone. Easy.

Already got yourself a Cover-More travel insurance policy? You can (re)read the relevant PDS whenever you fancy it.

Our current plans (AKA the ones we’re selling right now)

You can download the PDS for the plan you want to buy here.

Comprehensive+ (issued on or after 7 August 2024)

→ View the Cover-More PDS

This is our ‘more is more’ plan. (Yes, it’s a bit like ordering the ice cream sundae with all the trimmings.) That’s because it’s our most comprehensive travel insurance plan with our best benefits and highest benefit limits, plus a bunch of cover options to help you match your policy to your trip.

This plan is available for:

- Single trip policies

- Annual multi-trip policies

- International trips

- Domestic trips

Good to know: This plan includes some COVID-19 benefits , because this virus is still lurking.

Comprehensive (issued on or after 7 August 2024)

This is our most popular plan, and for good reason: it offers more cover and higher benefit limits than our Basic plan, which means you can worry less. It provides all the essential cover you need, plus much more (including some great cover options).

Basic (issued on or after 7 August 2024)

This plan does what it says on the tin – it offers budget-friendly cover for the essentials. It’s our base-level travel insurance plan for value-conscious travellers, and has cover for the all-important basics. (Think: unexpected overseas medical costs and unforeseen additional expenses.)

Inbound (issued on or after 7 August 2024)

Do you live outside of Australia and want to travel Down Under with our cover in tow? This is our comprehensive international plan designed for non-Australian residents who are travelling to and around Australia from an overseas destination.

Business* (issued on or after 26 July 2023)

→ View the Business PDS

Travel a lot for work? Lucky you! This is our travel insurance plan for business travellers (and their families who like to tag along and turn it into a ‘bleisure’ trip).

For more information or to buy this policy, please speak to our travel agent partners or call our team on 1300 72 88 22 . (You can’t buy it online.)

Corporate* (issued on or after 23 August 2023)

→ View the Corporate PDS

This travel insurance plan is designed for organisations – big and small – that want to cover their employees’ business travel.

For more information or to buy this policy, please speak to our travel agent partners or call our team on 1300 72 88 22 . (You can’t buy it online.)

Got a policy that was issued before the ones above?

Keep scrolling… we’ve got a bunch of older PDSs below for you to flick through.

For policies issued between 26 July 2023 and (up to and including) 6 August 2024, use this:

- Comprehensive+

- Comprehensive

- Basic

For policies issued between 15 June 2022 and (up to and including) 22 August 2023, use this:

- Corporate *

For policies issued between 3 May 2023 and up to and including 25 July 2023, use this:

- Comprehensive+

For policies issued between 15 June 2022 and (up to and including) 25 July 2023, use this:

For policies issued between 20 april 2022 and (up to and including) 2 may 2023, use this:.

- Comprehensive+

- Comprehensive

For policies issued between 2 February 2022 and (up to and including) 24 August 2022, use this:

- Winter Sports

For policies issued between 2 February 2022 and (up to and including) 14 June 2022, use this:

Want to learn more about our cover pick a topic, then click.

- Overseas Medical and Dental

- Additional Expenses

- Amendments or Cancellation Costs

- Luggage and Travel Documents

- Delayed luggage allowance

- Rental Vehicle Insurance Excess

- Travel Delay

- Resumption of Journey

- Special Events

- Hospital Incidentals

- Loss of Income

- Accidental Death

- Personal Liability

- Medical and Dental Expenses in Australia (Inbound plan only)

- Cruise Cover

Did you buy one of our travel insurance policies before 20 April 2022 and want to get your hands on a copy of the Combined FSG/PDS? Our customer service team can help – call us on 1300 72 88 22.

Ready to plan, pack, and go?!

Choose the right travel insurance for you, today.

*Our Business and Corporate products are currently available only through our agents or by calling our customer service centre on 1300 72 88 22.

Any advice is general advice only. Please consider your financial situation, needs, and objectives, and read the Combined FSG/PDS before deciding to buy this insurance. For information on the Target Market and Target Market Determinations, visit our Cover-More TMD page.

HCF Travel Insurance

Our verdict: hcf has a wide range of customisable options so travellers can tailor their cover to suit their specific needs. however, cover covid-19 isn’t the strongest..

In this guide

Summary of HCF International Comprehensive policy

How does hcf travel insurance cover covid-19, what policies does hcf offer, here's a breakdown of hcf travel insurance features, standard features, optional add-ons, how to make an hcf travel insurance claim, here's the bottom line about hcf travel insurance, frequently asked questions, request travel insurance quotes and compare policies.

Destinations

- HCF's Comprehensive, Domestic and Non-Medical Plans are available to travellers of all ages, whereas some brands wont cover anyone over 79.

- You can set your own limit for cancellation costs, which means budget holidays will see cheaper premiums but more luxe trips can be fully covered.

- HCF doesn't cover any pre-existing medical conditions as standard, whereas many insurers cover a limited number for not extra cost.

- Cover for claims related to COVID-19 are limited. In most cases, you or your travelling companion would need to be diagnosed with COVID-19 to claim anything.

Compare other options

Table updated September 2023

HCF offers some cover if you're diagnosed with COVID-19 before you head on holiday or while you're away. Here's what you can expect:

- Overseas emergency assistance, medical care and hospital expenses if you're diagnosed with COVID-19.

- Cancellation or amendment costs if you or your travelling companion are diagnosed with COVID-19.

- Additional expenses if you or a travelling companion are diagnosed with COVID-19.

- Costs to return home if you are given medical advice that you should do so.

- Costs to return home if a relative or business partner is hospitalised or dies due to COVID-19.

There are some scenarios that are not covered by HCF including costs incurred as a result of mandatory quarantine or isolation, border closures or government travel bans.

What do Australians think of HCF travel insurance?

- 4.08/5 overall for Customer Satisfaction — lower than the average of 4.26

- 4.66/5 for Trust — higher than the average of 4.57

- 3.94/5 for Customer Service — lower than the average of 4.2

Based on HCF travel insurance scores in Finder's 2024 Customer Satisfaction Awards .

HCF offers five insurance policies to travellers. Comprehensive, Essentials, Domestic, Multi-Trip, and Non-Medical.

Comprehensive

Non-Medical

The insurer of this product is Allianz Australia Insurance Limited. It comes with a cooling-off period of 14 days and choice of $200 standard excess for international plans.

These are some of the main insured events that HCF will cover. Some of these benefits may only apply on the Comprehensive international plan.

- Overseas medical treatment

- Overseas emergency assistance

- Lost, damaged or stolen property

- Trip cancellation or amendment

- Additional accommodation and transport

- Theft of money and travel documents

- Luggage and travel delay

- Emergency dental costs

- Kidnap and hijack

- Personal liability

- Permanent disability

- Accidental death

HCF also offers four add-ons that provide cover for a wider range of risks.

- Adventure Pack. Cover for a wider range of activities that are considered high-risk, including deep sea fishing, outdoor rock climbing, or riding a motorbike with an appropriate licence.

- Cruise Pack. Extends your insurance policy to cover cruises and a range of cruise-specific risks including ship to shore evacuation, marine rescue, and cabin confinement.

- Snow Pack. Extends your insurance policy to cover accidents on the slopes, plus specific risks such as piste closure, avalanches, and equipment hire. .

- Increased Item Limits Cover. Increase or specify the limit of particular items if your base policy doesn't offer enough protection.

You can also vary your excess, paying an additional premium to drop the excess or enjoying cheaper premiums if you increase the excess.

Unfortunately, travel insurance doesn't cover everything. Generally, HCF will not pay your claim if it relates to:

- Unlawful, wreckless or unreasonably unsafe behaviour by you

- Behaviour while you were drunk or under the influence of drugs

- Expenses related to a pre-existing medical condition if it is not listed on your policy

- An act of war, invasion or revolution

- Insolvency of a travel agent , tour operator or accommodation provider

- Mandatory quarantines or isolations

- If you travel against medical advice

- Childbirth or pregnancy complications after the 24th week of gestation or if you have had previous pregnancy complications

- A multiple pregnancy or one where the conception was medically assisted

- An elective medical or dental treatment , cosmetic procedure or body modification (including tattoos or piercing)

- Self-inflicted injury or illness, suicide or attempted suicide

Make sure you review the HCF PDS for a detailed breakdown of what won't be covered, found under its list of general exclusions .

You can submit your claim online, through the Allianz travel insurance claim portal.

Before lodging a claim, you should have your policy number, personal details, any supporting documentation or evidence, and bank account details for the payment of your claim.

HCF Travel Insurance offers a broad range of optional add-ons, making it easy for travellers to customise their policies to suit their specific needs.

However, cover for expenses related to COVID-19 are limited and, in most cases, you or your travelling partner would need to be diagnosed with COVID-19 to make any claims.

If you're still not sure about HCF, you can compare other travel insurance companies here .

How do I get in touch with HCF?

You can email HCFat [email protected] or call the helpline on 1800 689 410 (Weekdays 8am-7pm AEST, Saturday 8am-5pm AEST).

Is there an age limit for HCF travel insurance?

HCF's Comprehensive, Domestic and Non-Medical plans have no age limit. The Cruise Pack also has no age limit.

However, HCF's Essentials and Multi-Trip plans are only available to travellers under the age of 75. The Snow Pack and Adventure Pack are also only available to travellers aged under 75.

Do I have to have health insurance from HCF to get HCF travel insurance?

No, you do not have to be an existing HCF customer to take out a travel insurance policy.

Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Compare other products from HCF

- HCF health insurance

- HCF pet insurance

- HCF life insurance

Nicola Middlemiss

Nicola Middlemiss is a contributing writer at Finder, with a special interest in personal finance and insurance. Formerly a business and finance journalist, Nicola has written thousands of articles helping Australians better understand insurance and grow their personal wealth. She has contributed to a wide range of publications, including Domain, the Educator, Financy, Fundraising and Philanthropy, Insurance Business, MoneyMag, Mortgage Professional, Yahoo Finance, Your Investment Property, and Wealth Professional. Nicola has a Tier 1 General Insurance (General Advice) certification and a Bachelor's degree from the University of Leeds. See full bio

- Personal finance

- Personal insurance, including car, health, home, life, pet and travel insurance

- Commercial business insurance

More guides on Finder

ANZ shares a story about one customer who fell for a bank impersonation scam and almost lost $37,500.

The average Aussie household spends $191 per week on groceries, our data shows – but you could spend much less with these tips and tricks from Finder crew.

Use rewards points to pay for your holiday.

Discover the top-rated consumer brands in Australia.

We asked 1,000+ Australians to rate their home insurer for customer service, value for money and more – these are the winners.

We asked 700+ Australians to rate their travel insurer for customer service, value for money and more — these are the winners.

We asked 500+ Australians to rate their life insurer for customer service, value for money and more — these are the winners.

We asked 400+ Australians to rate their health insurer for customer service, value for money and more — these are the winners.

We asked Australians how they feel about their car insurance provider. They scored them based on value for money, ease of application, customer service, trustworthiness and reliability.

Ask a question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

4 Responses

Where do I find cheap basic insurance for over 80s overseas (Thailand) from Sydney?

Thanks for reaching out.

I’m afraid HCF travel insurance only provides coverage for those below 75 years old. You can check our comparison page on travel insurance for over 80s . There’s a table on the page where you can compare the conditions for travellers over 80 years of age so you’ll have an overview of who might be the right insurer for you. You can fill out the online form from the page and put in your personal details and some information relevant to the travel to receive some quotes that will be suitable for you.

Hope this helped.

Kind Regards, Mai

How do I actually get an HCF quote?

Thanks for your question. finder.com.au is a does not currently have access to HCF Travel Insurance policies. You will need to visit the HCF website for a quote.

All the best, Richard

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

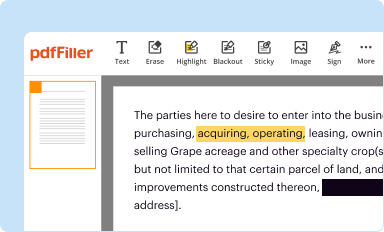

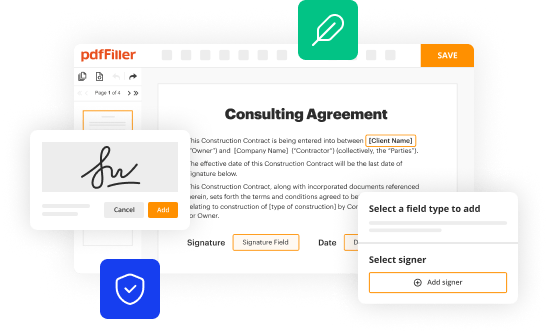

Get the free Product Disclosure Statement and Policy Wording - HCF

Get, create, make and sign product disclosure statement and.

How to edit product disclosure statement and online

How to fill out product disclosure statement and

Who needs product disclosure statement and?

Fill form : try risk free, rate the form, for pdffiller’s faqs.

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your product disclosure statement and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Product Disclosure Statement And is not the form you're looking for? Search for another form here.

Related features, relevant keywords, related forms.

Let’s get in touch

Complete the product disclosure statement and for free.

HCF Travel Insurance

Important information on terms, conditions and sub-limits.

Are you thinking about signing up with HCF travel insurance? Here we have compiled a short page to answer any questions you might have.

Established in 1932, HCF is Australia’s largest not-for-profit health fund with 1.8 million members. It began as a health service provider but has since expanded pet, life, and travel insurance.

Currently, HCF offers both domestic travel insurance and international travel insurance with limited cover relating to COVID-19.

HCF plans currently include:

Comprehensive

Essentials

Domestic

- Single Duo Family

Limits shown apply

Covid medical cover

Covid cancellation cover

Overseas emergency hospital expense

Overseas emergency medical assistance

Maximum excess

Cancellation fees

Pay extra for no excess

Luggage and personal effects

Additional accomodation & travel

Emergency companion

Resumption of journey

Hospital cash allowance

Accidental death

Permanent disability

Loss of income

Credit Card fraud and replacement

Travellers cheques

Travel documents

Rental vehicle excess

Alternative travel expenses

Personal liability

Pre existing conditions

Cardiovascular disease

Mental health illness

High cholesterol

High blood pressure

Blood thinning medication

Activities covered

Bungee jumping

Conservation work

Mountain biking

Mountaineering

Rock climbing

Scuba diving

Snow sports

Ocean Cruise

Comprehensive Plan

$20,000,000

Choose $2,000 to unlimited

Assessment required, may cost extra

Essentials Plan

Multi-trip plan.

Any information provided on this page should be considered a summary and general advice only. All information should be verified before purchase via the relevant Product Disclosure Statement (PDS).

Does HCF travel insurance have COVID-19 coverage?

HCF travel insurance does cover some COVID-19-related claims, although do keep in mind that conditions may vary depending on the policy. Make sure to read the PDS for the full terms and conditions as exclusions and sub-limits may apply. Cancellations before trips due to COVID-19 may be refunded whilst cancellations during the trip will only result in a partial refund.

What other optional extras can I add to my HCF policy?

For optional extras, HCF offers cover for an adventure pack, a snow pack, a cruise pack, and an increased items limit cover.

Are pre-existing medical conditions covered under HCF’s travel insurance policies?

HCF does cover a variety of pre-existing medical conditions, however, this is provided that you have disclosed your condition to Allianz Global Assistance and they have made a written agreement to include cover for the condition under your policy. To make sure your condition is not exempt, make sure to read the PDS.

What do I do if there’s an emergency during my trip?

HCF maintains a 24/7 Australia based emergency assistance team ready alongside registered nurses and doctors.

If you need to contact the HCF emergency assistance team, you can call:

+61 7 3305 7499 (overseas)

1800 010 075 (within Australia)

How do I make a claim with HCF travel insurance?

To lodge a claim with HCF travel insurance, you’ll have to make your claim online at www.claimmanager.com.au or email/post a completed claim form to Allianz Global Assistance.

Also bear in mind that you’ll need to have ready supporting documentation, bank account details, and your policy number with personal details.

Is it possible to cancel my HCF travel insurance policy?

HCF allows for cancellations to be made with full refunds as long as they are within the cooling period (lasting for 14 days after you are issued your Certificate of Insurance). However, if you want to cancel after your cooling off period you may only be entitled to a partial refund on a pro rata basis from the date of contacting HCF to the end date for the period of the cover that was provided by your chosen policy.

For cancellations during and after the cooling off period, HCF requires a few conditions must be met such as:

You have not started your journey

Don’t intend to make a claim under your chosen policy

Don’t want to exercise any other rights covered under your policy

HCF customer reviews

Hcf travel insurance.

Overall 10.0

Value for money

Policy coverage

Customer service

Claims handling

Recent HCF travel insurance customer reviews Recent HCF travel insurance customer reviews

HCF Travel Insurance review

Overall rating 10 / 10

Everything I was looking for at a great price!

I would recommend HCF as they allow your choice of repairer, which was a big factor in my insurance search. They also allow you to pay your insurance in monthly instalments and a great price.

Full review

Value for money 10 / 10

Policy coverage 10 / 10

Customer service 10 / 10

Claims handling 10 / 10

Trust 10 / 10

Nicole, New South Wales, reviewed about 1 year ago

Apply for HCF travel insurance

Compare travel insurance from major brands including:.

Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product.

Who we are and how we get paid

Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. As a marketplace business, we do earn money from advertising.

We do not compare all brands in the market, or all products offered by all brands. At times certain brands or products may not be available or offered to you. If you proceed with a travel insurance policy through Mozo, Mozo may receive a referral fee.

Popular Searches

- Hospital Cover

Welcoming Transport Health

Looking for transport health you're in the right place..

Transport Health is now part of the RT Health brand.

Transport Health (just like us here at RT) served the hardworking men and women of the transport industry for 130+ years. And that’s something to be proud of!

We're now united under the RT Health brand, backed by Australia’s largest not-for-profit health fund HCF, to strengthen our relationships within transport industries and with industry workers. Our ethos of providing ‘small fund care, big fund security’ as part of HCF will support members into the future.

Useful Links

Find a Provider

Get the most out of your cover

Would you to like to chat?

View and update your information

Perform and view eligibility checks

We know change isn’t always easy. That’s why we’ve put together a few answers to questions you may have as you start your journey with RT Health.

And remember, we’re always here if you need us. Give us a call on 1300 886 123 (available Monday to Friday 8.30am to 5pm AEDT/AEDST) or drop us a line via email to [email protected] We’d be happy to help.

Why did Transport Health members move to RT Health?

Transport Health officially merged with HCF, Australia's largest not for profit mutual health fund, in January 2023.

When we informed members of the merger, we also let them know they’d be moving to the RT Health brand to unite members of both organisations as part of our ongoing commitment to industry workers.

Transport Health and RT Health have been side by side for over seven years now (as part of the RT Health Group), both with proud historical ties to the transport industry, working to provide great value health cover to hardworking Aussies.

We're now united under the RT Health brand, backed by HCF, to represent transport industries and a renewed commitment to industry workers. Our ethos of providing ‘small fund care, big fund security’ will support members into the future.

RT Health remains committed to serving the hardworking men and women within the Australian transport industry.

I need to make a claim. How can I do it?

Now you’re with RT Health, you can submit your claims to us. It’s quick and easy. Just download the RT Health app from the Apple or Google Play stores.

- Use your RT Health membership number and password to log in. (These details will be the same as you use for access to the online Member Services portal.)

- If it’s your first-time logging in, registering from the login screen is easy. Just click ‘Login or register’. If you’ve already used the online Member Services portal, just login with your membership number and password. It’s that easy!

- You can also take a look at your claims history and view a snapshot of your cover from the app.

If you aren’t into apps, we’ve still got you covered. Just send your claim documents (including your completed claim form) to [email protected] and we’ll take care of them for you.

I want to look at my membership. Can I access online services?

The RT Health online Member Services portal is your one-stop shop when it comes to managing your membership. Get an overview of your cover, update your personal and account details, view your claims history – all in one place.

To register and log in – your go to ‘Member login’ at the top right of our website – www.rthealth.com.au

You’ll need your membership number (remember to use your new RT Health member number), the date of birth of the main member, and their email address to register.

I pay via BPAY. Do I need to change anything?

If you pay by BPAY, you’ll need to update these details to make sure we receive your payments. RT Health’s biller code is 89623. You’ll find your unique reference number in the bottom left-hand corner of your payment notice.

In the meantime, you can make your payments via the online Member Services portal (see the easy instructions above). Or, give us a call and we’ll give you a hand.

Will I get the same member benefits with RT Health?

Just like Transport Health, RT Health (originally named the Railway & Transport Health Fund Ltd) has 130+ years of experience supporting the hardworking men and women of the transport industry.

The Transport Health team is now part of a bigger team of private health insurance experts. That means you have more people able to help you get the most value from your health cover and to help you out when you need a hand.

Plus, you’ll get even more benefits and services with the move to RT Health. These include:

- A larger team of health insurance experts to help you get more from your cover (including the team members you’ve depended on in your years with Transport Health). And, they’ll be there whenever you need help.

- RT Thank You. You’ll be able to access great savings on everyday household spending items like groceries and fuel, as well as shopping and entertainment.

- Access to programs to help with your health and wellbeing at RT Health’s in-person Branch 2U events. You can book in for free and exclusive health assessments by medical experts including heart health.

- Keeping your kids covered. RT Health’s family extension products can help you keep your kids on your membership until they’re 31.

- Central magazine. Immerse yourself in the RT Health community with our summer and winter magazines. Lots of news from our community, members and some informative items about how to make the most of your cover.

- Be well. Get well. Stay well. A monthly email to keep you up to date with all the offers and news from RT Health.

- An improved range of online services, including social media channels (Facebook, Instagram and TikTok), a better website, claiming app and online Member services portal.

And much more!

I have a claim I forgot to submit to Transport Health. Can you help?

We sure can! If you didn’t get around to sending through claims on your Transport Health membership, we can still help you out. If you have any claims you still need to submit, now’s the time (you have two years from the date of service to make your claim). You can send your claim (with a completed claim form) to [email protected] . Just pop Transport Health claim in the subject line and we’ll take care of them for you.

I have a dependent student on my membership. Will anything change?

Great news! RT Health has awesome arrangements to help you keep your kids on your cover longer. With RT Health, you don’t need to register your dependent students until they turn 22, and they can stay on your cover until they’re 31 (with a family extension product).

If you’re interested in Family Extension cover, give our friendly sales team a call.

I’ve been with Transport Health for decades. Is that loyalty recognised?

Yes! We’ve worked hard to make sure we have details of all our members who transferred from Transport Health. That means you’ll also be recognised (the same way our RT Health members are) for your membership milestones from the date you originally joined Transport Health.

Where do I go for help?

We’re always here if you need us. If you have any questions, please call us on 1300 886 123 (Monday to Friday, 8:30am to 5:00pm AEDT). You can also reach out via email to [email protected]

Popular Searches

- Hospital Cover

Planning your next holiday?

You can choose from a range of plans to suit your needs with hcf travel insurance+. whether you’re travelling near or far, frequently or taking a single trip ensure you have the support and care you need..

RT Health members can save 25%* with our discount code. Just follow these 2 steps below to get the code.

Remember to enter your promotion code when you’re completing your details. You’ll find the code under ‘Member Benefits’ in the online Member Services portal.

To find out more or to get a quote, head to HCF Travel Insurance | HCF .

*25% discount is the total discount on offer for the product, based on standard premium rates. It applies automatically upon successful input of the discount code to premiums for all plans, including policy add-ons. Cannot be used in conjunction with, or in addition to any other discounts. No additional discounts will be provided to Members who already receive a Member discount. Please contact us for more information.

+ The Hospitals Contribution Fund of Australia Ltd ABN 68 000 026 746 AFSL 241414 (HCF) arranges this insurance as agent for the insurer Allianz Australia Insurance Limited ABN 15 000 122 850 AFSL 234708 (Allianz). Travel insurance is issued and managed by AWP Australia Pty Ltd ABN 52 097 227 177 AFSL 245631 trading as Allianz Global Assistance (AGA) for the insurer Allianz. Terms, conditions, exclusions, limits and applicable sub-limits apply. HCF, Allianz and AGA do not provide any advice on this insurance based on any consideration of your objectives, financial situation or needs. Because of that, you should consider whether the advice is appropriate for you. Before making a decision please consider the Product Disclosure Statement , the Financial Services Guide and Target Market Determination (TMD). The TMD is available at allianzpartners.com.au/policies . If you purchase a policy, HCF and AGA receive a commission which is a percentage of your premium - ask us for more details before we provide you with services.

- Privacy Policy

Travelers Plans How to Travelers Plans in The World

Travel insurance hcf.

When planning a trip, one of the most important things to consider is travel insurance. It may not be the most exciting part of trip planning, but having it can save you a lot of headaches and expenses in case of unexpected events. If you’re an HCF member, you may be wondering if they offer travel insurance. The good news is, they do! In this article, we’ll discuss why you should consider getting travel insurance with HCF, what it covers, and how to get it.

What is Travel Insurance?

Travel insurance is a type of insurance that covers unexpected events that may occur while you’re travelling. These events can range from minor inconveniences like flight delays and lost luggage, to more serious emergencies like medical emergencies and accidents. Travel insurance can help cover the costs associated with these events, such as medical expenses, cancelled flights, and more.

Why You Should Get Travel Insurance with HCF

Now that you know what travel insurance is, you may be wondering why you should get it with HCF. Here are some reasons:

- HCF travel insurance is backed by Allianz Global Assistance, a leading travel insurance provider.

- It covers a wide range of unexpected events, including medical emergencies, trip cancellations, lost or stolen luggage, and more.

- HCF members receive a discount on travel insurance.

- The process of getting travel insurance with HCF is easy and convenient.

What Does HCF Travel Insurance Cover?

HCF travel insurance covers a wide range of unexpected events that may occur while you’re travelling. Here are some of the things it covers:

Medical Emergencies

If you get sick or injured while travelling, HCF travel insurance can help cover the cost of medical treatment, hospitalization, and emergency medical evacuation. This coverage is especially important if you’re travelling to a country with high medical costs.

Trip Cancellations and Delays

If your trip is cancelled or delayed due to unexpected events like bad weather, natural disasters, or airline strikes, HCF travel insurance can help reimburse you for the costs associated with these events. This may include flight cancellations, hotel cancellations, and more.

Lost or Stolen Luggage

If your luggage is lost, stolen, or damaged while travelling, HCF travel insurance can help reimburse you for the cost of replacing your belongings.

Accidental Death and Disability

If you’re involved in an accident while travelling that results in accidental death or disability, HCF travel insurance can help provide financial support to you or your family.

How to Get HCF Travel Insurance

If you’re an HCF member and you’re interested in getting travel insurance, there are a few ways to do it:

- You can get a quote and purchase travel insurance online through the HCF website.

- You can call HCF on 13 13 34 to purchase travel insurance over the phone.

- You can visit an HCF branch and purchase travel insurance in person.

FAQs about HCF Travel Insurance

Travel insurance may not be the most exciting part of trip planning, but it’s an important consideration that can save you a lot of trouble and expenses in case of unexpected events. If you’re an HCF member, getting travel insurance with them is a great option due to their partnership with Allianz Global Assistance, wide coverage, and member discount. We hope this article has helped you understand why you should get travel insurance with HCF, what it covers, and how to get it.

Travel Insurance

- Traveller type

- Emergency Assistance

Customer Service

- Travel-Advice

- Top Reasons to buy

Product Documents

- Request a plan change

Below you will find Policy documents including Product Disclosure Statement (PDS), Target Market Determination (TMD) and your Duty of Disclosure.

Duty Not To Misrepresent

Duty to take reasonable care not to make a misrepresentation You have a duty to take reasonable care not to make a misrepresentation (“Duty”) to us. This applies whenever you enter into, vary, extend or reinstate your policy. All questions that we ask must be answered truthfully, accurately and to the best of your knowledge; both for yourself and for any other listed traveller. A misrepresentation is a false or partially false response or statement which does not reflect the truth. Your Duty is considered on the basis of the relevant target market, whether you are represented by a broker, and circumstances and characteristics that you have disclosed to us.

If you do not take reasonable care when answering our questions and therefore breach your Duty to us, we may cancel your policy or reduce the amount that we will pay you if you make a claim. If the misrepresentation was deliberately fraudulent, we may refuse to pay your claim or treat your policy as if it never existed.

By continuing, you agree to meet the obligations of your Duty to us.

Product Disclosure Statements (PDS)

Wise and Silent Pty Ltd offer two products issued by battleface Insurance to suit various customer needs. Some products are configurable and have various exclusions or benefit options, please ensure to read the PDS and select a policy configuration that suits your personal circumstances.

Target Market Determination (TMD)

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque launtium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt expica Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit quia consequuntur magni dolores eos qui ratione voluptatem sequi nesciunt. Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci dicta sunt expica Nemo enim ipsam voluptatem quia voluptas sit aspernatur Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque launtium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt expica.

Family Violence Policy

Treating customers fairly, complaints policy.

- Jump to main navigation

- Jump to main content

- Forms & brochures

- Corporate Search Hub

- For providers

- Health Agenda

Information to help you build a quote, claim and make informed decisions about your private healthcare.

- Overseas visitors health cover (OVHC)

- Get a quote

- - Find a cover

- - Show me packages

- - Ambulance only

- - How to choose cover

- Private healthcare explained

- - Selecting a doctor or hospital

- - How to switch your health insurance to HCF

- - Getting loyalty benefits

- - Private vs Medicare

- How to make a claim

- Understanding the costs

- - Charges and the gap

- - How the Govt rebate works

- - Choosing an excess

- - Medicare Levy Surcharge

- - Lifetime Health Cover

- Private vs Medicare

Life & Recover Cover

We’re here for you with Recover Cover – a unique range of recovery and life insurance products to help with the unexpected costs that come with recovery.

- Recover Cover made for you

- - Life Protect Insurance

- - Income Protect Insurance

- - Cash Back Cover

- - Kids' Accident Cover

- - Critical Illness Cover

- - Personal Accident Insurance

- Cover for every stage in life

- - Young adult

- How it works

Whether you’re travelling near or far, choose from a range of cover options with HCF Travel Insurance.

Protect your pet with cover tailored to their life-stage and needs. HCF members save up to 15%.

Home & Contents

Choose from home and contents insurance options to cover your home, inside and out.

Choose comprehensive or third party property damage insurance options for cover to keep you moving.

Health & wellbeing

Programs and resources that help you take control of your physical and emotional health.

- Health & wellbeing programs

- Weight management

- - Get a Healthy Weight for Life with HCF

- - Join the CSIRO Total Wellbeing Diet

- Mental health support

- - Children, parents and carers

- - Improve your sleep with Sleepfit

- HCF’s My Membership app

- Health management programs

- SNUG Health

- Healthy Families for Life

- The COACH Program

No-gap services

Looking after your health is easier with 100% back on six key extras.

- No-Gap Joints

Medical resources

Insights and information to help you feel reassured when it comes to your healthcare.

- Get a Heart Health Check

- Preparing for hospital

- Online GP consultations

- Second opinion service

- Treatment at Home

- - Contracted Providers

Member offers & discounts

HCF members can save on online GP consultations, our travel and pet cover and enjoy other special offers.

Member Care

We’re here to provide the care and support you need, when you need it.

- Vulnerable member support

- Domestic and family violence support

- Involuntary unemployment support

- Find a branch

We have branches located across Australia. Find your nearest branch to join, access advice, claim in person and more.

HCF centres

Find your nearest HCF Dental or Eyecare Centre and read about their services.

- HCF Dental Centres

- - After hours dental care

- HCF Eyecare Centres

- - Book an Eyecare Centre appointment

- HCF Dental Orthodontics

Participating hospitals

We help HCF members avoid out-of-pocket costs by negotiating charge agreements with private hospitals. Find your nearest participating hospital here.

Find a participating provider

Looking for an HCF participating doctor or extras provider? Use our tool to see their biographies and contact details.

How our not-for-profit status benefits our members, how the fund works, and our key partnerships.

- Governance & structure

- - Our leadership

- - Annual report

- - HCF Policies

- - Elected Councillor positions

- Partnerships

- HCF Catalyst

- Customer service

- Information security

- - Fraud protection

- Our History

- Medical Advisory Panel

- Member stories

HCF Research Foundation

Our charitable trust was set up to encourage research and enquiry into the provision, administration and delivery of health services in Australia.

Media centre

Welcome to the HCF Media Centre. Here you can access HCF media contacts, releases and downloads.

- Media releases

- Research & reports

Find out what it's like to work at HCF, and search for current job opportunities.

RT Health joins HCF

Pet insurance, save up to 15% on pet insurance*.

HCF members can save up to 15% on Pet Insurance. You'll need to have the My Membership app or online member services set up to get the discount. Not a member? Sign up to take advantage of all the benefits we offer.

Your pet is family Let us protect them too

Why choose hcf pet insurance.

Choosing the right pet insurance for your beloved pet can feel overwhelming at times. But with HCF Pet Insurance, there are key benefits for you and your pet. With pet cover from HCF, you can:

- claim up to 80% back ^ on eligible vet bills

- claim up to $12,145 per year with our Pet Premium Plus Routine Care cover +

- get a discount of up to 10% on additional pet insurance policies ^^

- access optional benefits with Routine Care (non-insurance benefit) and Dental Illness.

AWARD WINNING PET INSURANCE

Your furry friends deserve exceptional care when it comes to their health and wellbeing. We're proud to have been awarded the Mozo Experts Choice Award for Exceptional Quality Pet Insurance for 2021 and 2022. Helping your pet get the care they need, when they need. That's Uncommon Care.

CLAIM AT THE VET AND PAY THE GAPONLY ®#

When your pet is unwell or injured, get quick and easy access to the treatment your pet needs with HCF’s Pet Insurance, with less out-of-pocket costs for eligible claims.

With GapOnly ® you’ll only pay the gap (the difference between the vet’s invoice and the claim benefit under your policy). You can request pre-approval to confirm your cover or claim on-the-spot at participating vets , so you can worry less about the upfront cost of vet bills and focus on your furry family members' health and wellbeing. #

VET SUPPORT ANYTIME, ANYWHERE

Give your fur baby the care they deserve when they're unwell, not quite themselves, or dealing with an ongoing condition. With HCF Pet Insurance, you can use VetChat to connect with a registered vet by phone or video and access quality vet care when you need it.

As an added benefit of having an HCF Pet insurance policy, you get complimentary access to an annual VetChat membership, valued at $199.95 ** .

How to access and use VetChat: Log in or follow the steps to create an account. Select video or live message. Start your VetChat consultation.

PET CARE FOR MORE THAN 1 PET

When you insure more than one dog or cat, you can get up to a 10% discount on each additional pet insurance policy ^^ .

Pet insurance member portal

Claim, manage your policy, update your details and more through our online portal.

Customer support

If you have questions about Pet Insurance or need to make changes to your Pet Insurance Policy, you can:

- call us on 1800 630 681 (Monday to Friday, 8am to 8pm AEST)

- email us [email protected]

If you wish to make a complaint please visit our FAQs to read more about the complaints process.

For new policies incepting on or after 21 March 2024 and renewals on or after 17 April 2024

HCF Pet Insurance Combined Financial Services Guide and Product Disclosure Statement - Preparation date 21 March 2024

462.9KB PDF

HCF Pet Insurance Target Market Determination (TMD) Pet Essentials

144.7KB PDF

HCF Pet Insurance Pre-existing condition review form

HCF Pet Insurance Target Market Determination (TMD)

153.8KB PDF

HCF Pet Insurance Veterinary Fee Claim Form

116.1KB PDF

HCF Pet Insurance Cruciate Ligament form

Previous Pet Insurance Product Disclosure Statements

Pet Insurance Product Disclosure Statement (PDS)

731.6KB PDF

Manchester Unity Combined Supplementary PDS and Financial Services Guide - 31 July 2012

Manchester Unity Combined Supplementary PDS - 30 June 2019

Manchester Unity Supplementary Financial Services Guide

Manchester Unity Claim Form

751.5KB PDF

HCF Pet Insurance Combined Supplementary PDS (SPDS) and Financial Services Guide - 4 February 2022

Manchester Unity Product Disclosure Statement - 1 March 2009

307.8KB PDF

Manchester Unity Combined Supplementary PDS - 01 July 2014

184.5KB PDF

Manchester Unity Combined Supplementary PDS - 1 July 2021

325.3KB PDF

Manchester Unity Target Market Determination

IMPORTANT INFORMATION

HCF Pet Insurance policies entered into for the first time prior to 21 March 2024 and subsequent renewals of those policies are issued by The Hollard Insurance Company Pty Ltd ABN 78 090 584 473, AFSL 241436, arranged and administered by PetSure (Australia) Pty Ltd ABN 95 075 949 923, AFSL 420183 (PetSure) and promoted and distributed by The Hospitals Contribution Fund of Australia Ltd ABN 68 000 026 746, AFSL 241414 (HCF). HCF Pet Insurance policies entered into for the first time on or after 21 March 2024 and subsequent renewals of those policies are issued by PetSure and promoted and distributed by HCF. Any advice provided is general only and does not take into account your individual objectives, financial situation or needs. Please consider the Product Disclosure Statement (PDS) to ensure this product meets your needs before purchasing, or choosing to continue with the product. PDS and Target Market Determination available at hcf.com.au/petinsurance .

HCF Pet Insurance is not part of HCF's health insurance business. Please do not assume that pet insurance and health insurance are similar.HCF may receive a commission of up to 13% of the premium for promoting HCF Pet Insurance Policies. HCF sales agents are paid a salary or wages but do not receive a commission or other payments attributable to the sale of HCF Pet Insurance. For more information, contact HCF on 1800 630 681 or [email protected] .

Manchester Unity Pet Insurance is issued by The Hollard Insurance Company Pty Ltd ABN 78 090 584 473; AFSL 241436, is distributed by The Hospitals Contribution Fund of Australia Limited ABN 68 000 026 746, AFSL 241414, and arranged and administered by PetSure (Australia) Pty Ltd ABN 95 075 949 923, AFSL 420183. Manchester Unity Pet Insurance is closed to new customers and is only available for renewal by existing customers. Manchester Unity Pet Insurance is not part of HCF's health insurance business. Please do not assume that pet insurance and health insurance are similar. Any advice provided is general only and does not take into account your individual objectives, financial situation or needs. Please consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) to ensure this product meets your needs before you renew your cover. Manchester Unity Pet Insurance PDS and TMD available at hcf.com.au/petinsurance .

* All HCF members are eligible for a member discount of at least 10% on HCF Pet Insurance. HCF Ruby and Diamond members get a 15% discount. Existing Manchester Unity Pet Insurance policies are not eligible for discounts under HCF Thank You. Visit the HCF Thank You page for further information. Where relevant, increased discount will be applied automatically at first renewal after advancement in HCF Thank You tier. To be eligible for the discount members need to have the HCF My Membership app or online member services set up. This offer may be subject to change.

^ Policy Terms and Conditions, limits, sub-limits, exclusions, excesses and waiting periods apply.

+ Policy conditions, terms, limits, excesses and waiting periods apply. Up to a total of $12,145 annually with Pet Premium Plus Routine Care, on eligible vet bills. $12,000 for Pet Premium.

# The gap means the difference between the vet’s invoice and the eligible claim benefit under your policy. GapOnly® is a trademark owned by PetSure (Australia) Pty Ltd ABN 95 075 949 923, AFSL 420183 (PetSure). GapOnly® is available on eligible claims at participating Vets with a pet insurance policy from a GapOnly® pet insurance partner. Meet our partners at gaponly.com.au

** VetChat is a non-insurance product that is separate from the HCF Pet insurance product and is separately provided by VetChat Services Pty Ltd (VetChat). VetChat is a related company of PetSure (Australia) Pty Ltd. VetChat consult membership and consultations are subject to VetChat’s general Terms and Conditions, including the Privacy Policy which are available online at http://www.vetchat.com.au . VetChat consult membership entitles you to access consults during the current policy period. For the full terms of this offer, visit hcf.vetchat.com.au/terms-and-conditions . Register for VetChat at hcf.vetchat.com.au/signup to access your complimentary VetChat consult membership during the current policy period. HCF may withdraw or extend this offer at any time without notice.

^^ Discount commences on 5 December 2023 at 12:00am AEST. HCF Pet Insurance policyholders get a 10% discount that applies to their second and subsequent HCF Pet Insurance policies only, based on the order that pet details are entered when you obtain a quote, or the order that policies are purchased (if purchased separately) (" Discount "). Discount is applied to your premium at the time of purchasing a second or subsequent policy for an additional pet, when purchased in the same transaction. For existing policyholders that wish to insure an additional pet, please call us on 1800 630 681 for the Discount to apply. To be eligible for the Discount, second and subsequent policies must be purchased from 5 December 2023 at 12:00am AEST. Application and order of the Discount is reallocated across remaining policies upon a policy cancellation, where there are two (2) or more active policies. Should a policy(s) be cancelled resulting in only one (1) remaining active policy, the multi-pet discount will cease to apply on the next renewal. Discount may be used in conjunction with other offers, unless otherwise specified. Existing Manchester Unity Pet Insurance policies are not eligible for this discount. 10% discount is applied to reduced member rates (if applicable). Eligibility criteria applies for HCF Pet Insurance and is subject to the HCF Pet Insurance terms and conditions (refer to the Product Disclosure Statement). HCF Pet Insurance reserves the right to withdraw, vary or amend this Discount at any time, without notice.

Questions about pet insurance?

Visit a branch.

© 2024 HCF All rights reserved

HEALTH INSURANCE Show more

- Customise cover

- Show me packages

CONTACT US Show more

- Complaints/Feedback

ABOUT HCF Show more

- Annual report

- Members Health Fund Alliance

- Privacy policy

- Terms & conditions

- Copyright HCF 2024

The Hospitals Contribution Fund of Australia Limited. ABN 68 000 026 746 AFSL 241 414

Our website uses first and third-party cookies such as Google Analytics to offer you a better browsing experience. To learn more about how we use cookies, please visit our Privacy Policy

Call now for a quote

Our Recover Cover specialists are here to answer any questions and help you find the right cover for your needs.

- Mon-Fr: 8am-8pm (AEST, excludes public holidays)

- Sat: 9am-5pm (AEST, excludes public holidays)

Call 1800 560 855

Arrange a call back

Leave your details here and we'll call you back to discuss Recover Cover

Check the front of your HCF membership card for your membership number.

Thank You For Your Enquiry

We'll be in touch shortly

Your request has not been submitted, try again later or use a different email address.

In progress.

Submitting your query now.

Thank you for your email.

We will be in touch soon.

Sorry, something went wrong.

Please try again later.

In progress

Submitting your booking now

Thanks for submitting your booking

We will be in touch soon

YOUR DUTY TO TAKE REASONABLE CARE

When applying for HCF Life Protect Insurance we’ll ask you some questions about your health, lifestyle and other factors. When answering these questions, please remember you have a duty to take reasonable care not to make a misrepresentation. A misrepresentation includes a statement that is false, partially false, or which doesn’t fairly reflect the truth. It’s not a misrepresentation if you don’t answer a question or if your answer is obviously incomplete or irrelevant to the question asked. So it’s important that you answer any questions in the application process honestly and correctly, and to the best of your knowledge. The duty applies until we issue your cover and extends to making changes to your policy and reinstatements.

This insurance cover is provided under a consumer insurance contract. Your answers to these questions affect the terms and conditions of your cover. If you don’t comply with this duty, we may change the terms of your policy or treat your policy as if it never existed. This may result in your benefit being reduced or denied.

Are you sure you want to exit?

Unfortunately, you're unable to go back to the previous page. You can still retrieve this quote by calling us on 1800 560 855 (Mon-Fri 8am-8pm, Sat 9am-5pm AEST/AEDT) and referencing your quote no.

SOMETHING ISN'T RIGHT

There could be a technical issue. Please refresh this page or call us on 1800 560 855 if you are unable to proceed.

IMAGES

VIDEO

COMMENTS

Please refer to the Product Disclosure Statement for full details. *** Read more information on the HCF Travel Insurance Campaign. +++ The Hospitals Contribution Fund of Australia Ltd ABN 68 000 026 746 AFSL 241414 (HCF) arranges this insurance as agent for the insurer Allianz Australia Insurance Limited ABN 15 000 122 850 AFSL 234708 (Allianz ...

FINANCIAL SERVICES GUIDE. rance issued and managed by AWP Australia PtyLtd (ABN 52 097 227 177) (AFSL 245631) trading as Allianz Global Assistance for the insurer and underwriter, Allianz Australia Insurance Limited. (ABN 15 000 122 850) (AFSL 234708) (All. anz).In this FSG, we, our, us refers to HCF.We are responsible for this FSG as it rel.

Whether you're travelling near or far, choose from a range of cover options with HCF Travel Insurance. Learn More. Pet. Pet. Protect your pet with cover tailored to their life-stage and needs. HCF members save up to 15%. ... Please read the Combined Product Disclosure Statement (PDS), Policy Document and Financial Services Guide (FSG) and ...

Corporate* (issued on or after 23 August 2023) → View the Corporate PDS. This travel insurance plan is designed for organisations - big and small - that want to cover their employees' business travel. For more information or to buy this policy, please speak to our travel agent partners or call our team on 1300 72 88 22. (You can't buy ...

Page 4 | Travel Insurance Policy Product Disclosure Statement About this document Please take the time to read all information contained in this booklet. It includes important detail that You should read which will assist in Your decision to decide if this product is right for You. About Tokio Marine & Nichido

%PDF-1.4 %âãÏÓ 5335 0 obj > endobj xref 5335 35 0000000016 00000 n 0000002522 00000 n 0000002717 00000 n 0000002754 00000 n 0000004195 00000 n 0000004310 00000 n 0000005961 00000 n 0000006103 00000 n 0000006254 00000 n 0000006418 00000 n 0000006569 00000 n 0000006811 00000 n 0000010734 00000 n 0000011177 00000 n 0000011282 00000 n 0000011387 00000 n 0000011493 00000 n 0000011597 00000 n ...

Compare HCF Travel Insurance, see features, and more. ... general insurance products. ... information with the product or service provider and read the relevant Product Disclosure Statement (PDS ...

Hi Tanya, I have provided here a link to HCF's Travel Insurance Product Disclosure Statement: external link However, as your enquiry is more specific around cover for sports related injuries, please contact QBE (the insurer) on 1300 555 017 to chat through. Thanks, Laura (HCF)

Get the free Product Disclosure Statement and Policy Wording - HCF . Get Form ... CF Travel Insurance Product Disclosure Statement and Policy Wording 10% discount for CF members CONTENTS Who are you dealing with? 1 About CF 1 About QBE Australia 1 About this booklet 1 Updating. Fill form: Try Risk Free. Form Popularity .

When you purchase a policy, keep a copy of this PDS and the Certificate of Insurance we'll give you in a safe place for future reference How to buy Ask your travel consultant in store Customer Service and Claims Call: 1300 468 987 Email: enquiries@covermore com au The insurer of this product is Zurich Australian Insurance Limited (ZAIL),

This insurance cover is provided under a consumer insurance contract. Your answers to these questions affect the terms and conditions of your cover. If you don't comply with this duty, we may change the terms of your policy or treat your policy as if it never existed.

We also want to help you feel safe when you travel. Our benefit inclusions cover more moments that matter to you, so we can help protect you and your travel experience when you need us most. The purpose of the Product Disclosure Statement (PDS) The PDS provides information to help you understand this travel insurance policy,

About HCF. Established in 1932, HCF is Australia's largest not-for-profit health fund with 1.8 million members. It began as a health service provider but has since expanded pet, life, and travel insurance. Cover information and limits in the table below verified as correct at 22 June 2024. Other information correct at the time of writing.

Because of that, you should consider whether the advice is appropriate for you. Before making a decision please consider the Product Disclosure Statement, the Financial Services Guide and Target Market Determination (TMD). The TMD is available at allianzpartners.com.au/policies. If you purchase a policy, HCF and AGA receive a commission which ...

The insurer of this product is Zurich Australian Insurance Limited (ZAIL), ABN 13 000 296 640, AFSL 232507. Table of contents Product Disclosure Statement (PDS)..... 2-54 1. More than just a travel insurance policy..... 2 The purpose of the Product Disclosure

Because of that, you should consider whether the advice is appropriate for you. Before making a decision please consider the Product Disclosure Statement, the Financial Services Guide and Target Market Determination (TMD). The TMD is available at allianzpartners.com.au/policies. If you purchase a policy, HCF and AGA receive a commission which ...

The maximum age limit for HCF travel insurance is 80 years old. Does HCF travel insurance cover pre-existing medical conditions? It depends on the nature of your pre-existing condition. You should check the product disclosure statement for more information. What should I do if I need to make a claim on my HCF travel insurance?

HCF Pet Insurance is issued by: The Hollard Insurance Company Pty Ltd (Hollard) ABN 78 090 584 473, AFSL 241436 of Level 12, 465 Victoria Avenue, Chatswood, NSW 2067. Product Disclosure Statement and Policy Terms and Conditions issued by The Hollard Insurance Company Pty Ltd. ABN 78 090 584 473 AFSL 241436.

Product Disclosure Statements (PDS) Wise and Silent Pty Ltd offer two products issued by battleface Insurance to suit various customer needs. Some products are configurable and have various exclusions or benefit options, please ensure to read the PDS and select a policy configuration that suits your personal circumstances.

The purpose of the Product Disclosure Statement 3 2. THE COVER 4 Benefits table - International 4 Benefits table - Domestic 5 Cruise cover 6 Policy inclusions and choices 6 Options to vary cover 8 3. TRAVEL AND HEALTH 10 Existing Medical Conditions 10 Pregnancy 14 Health of other people impacting Your travel (non-traveller) 15 4. 24 HOUR ...

Please consider the Product Disclosure Statement (PDS) to ensure this product meets your needs before purchasing, or choosing to continue with the product. PDS and Target Market Determination available at hcf.com.au/ petinsurance. HCF Pet Insurance is not part of HCF's health insurance business.

If you have questions about Pet Insurance or need to make changes to your Pet Insurance Policy, you can: call us on 1800 630 681 (Monday to Friday, 8am to 8pm AEST) email us [email protected]. Complaints. If you wish to make a complaint please visit our FAQs to read more about the complaints process. See FAQs.

The purpose of the Product Disclosure Statement (PDS) The PDS provides information to help You understand this travel insurance policy, compare cover and make an informed decision about whether to buy a policy. Please read the PDS carefully to ensure it provides the cover You need. If You have any questions please contact Us. The PDS details: