- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

World Nomads travel insurance review 2024

Jennifer Simonson

Mandy Sleight

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Heidi Gollub

Updated 5:28 p.m. UTC Feb. 23, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

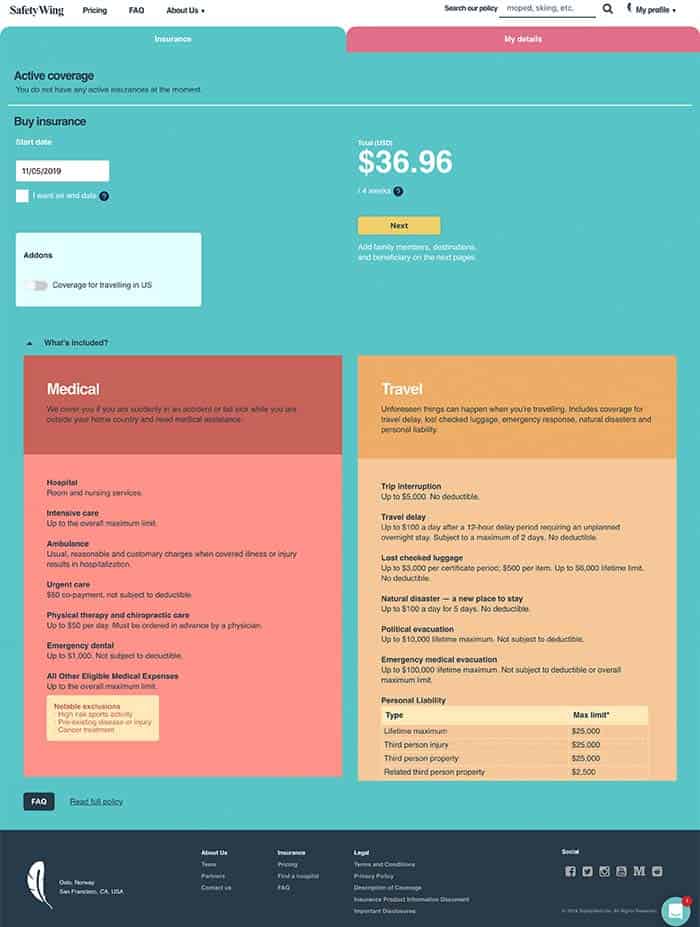

World Nomads

Covers COVID?

Medical & evacuation limits per person, what you should know.

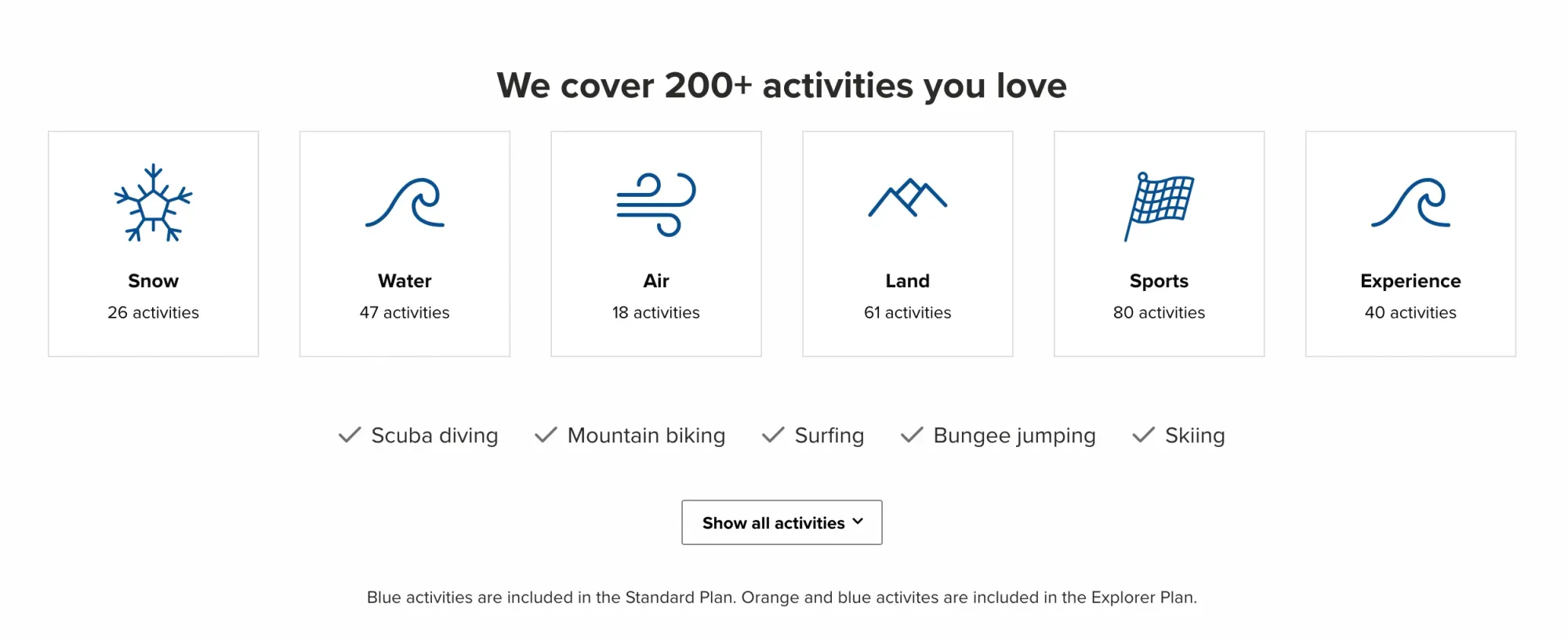

While many travel insurance companies exclude coverage for adventure activities, World Nomads designed its policy with the adventure traveler in mind. Individuals who engage in high-risk, international volunteer work may also benefit from this coverage. World Nomads covers more than 200 adventure activities, from skydiving to running with the bulls. It does not offer “cancel for any reason” coverage .

- Covers hundreds of high-risk athletic and adventure activities.

- Explorer Plan offers $500,000 in emergency evacuation coverage.

- Offers $25,000 non-medical emergency evacuation coverage.

- If you are not an adventure traveler, you can find cheaper rates elsewhere.

- “Cancel for any reason” upgrade not available.

- No waiver for pre-existing conditions available.

World Nomads overview

World Nomads has been selling travel insurance since 2002. Nationwide underwrites all World Nomads travel insurance plans.

Athletes and adventurers may be interested in World Nomads travel insurance because of its generous coverage of potentially risky activities. International volunteers may also consider a World Nomads plan if they volunteer in disaster zones or do high-risk volunteer work like construction.

World Nomads offers two plans, each with different benefits, limits and sub-limits for coverage. Read our World Nomads travel insurance review to determine if one of these plans meets your needs.

World Nomads travel insurance plans

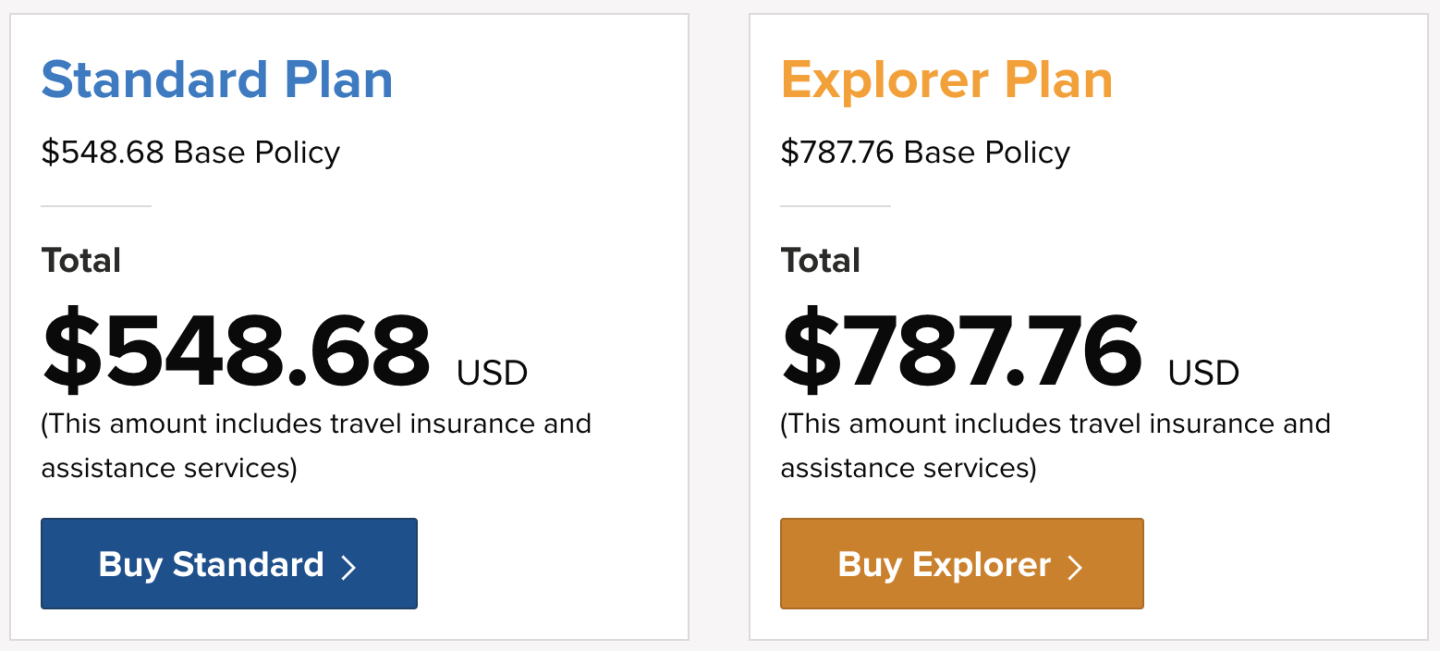

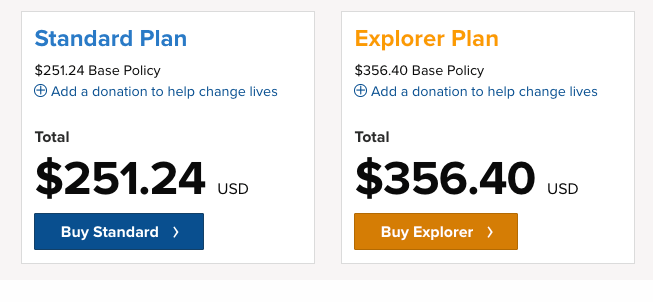

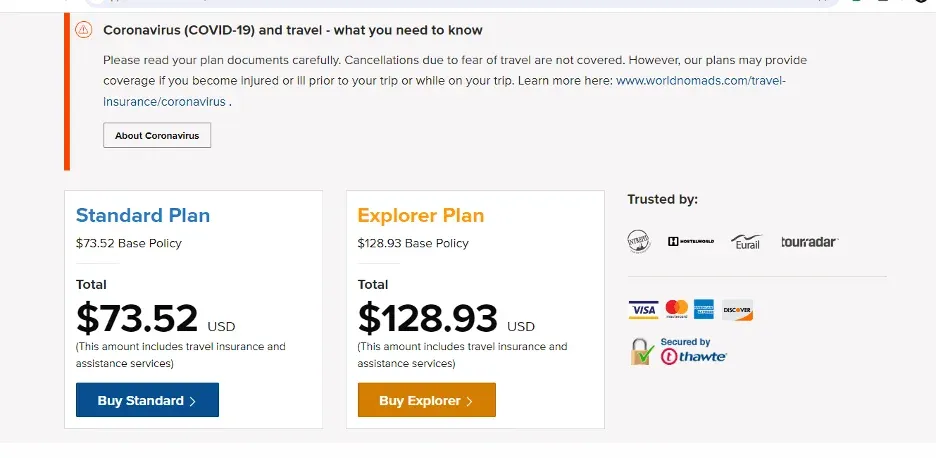

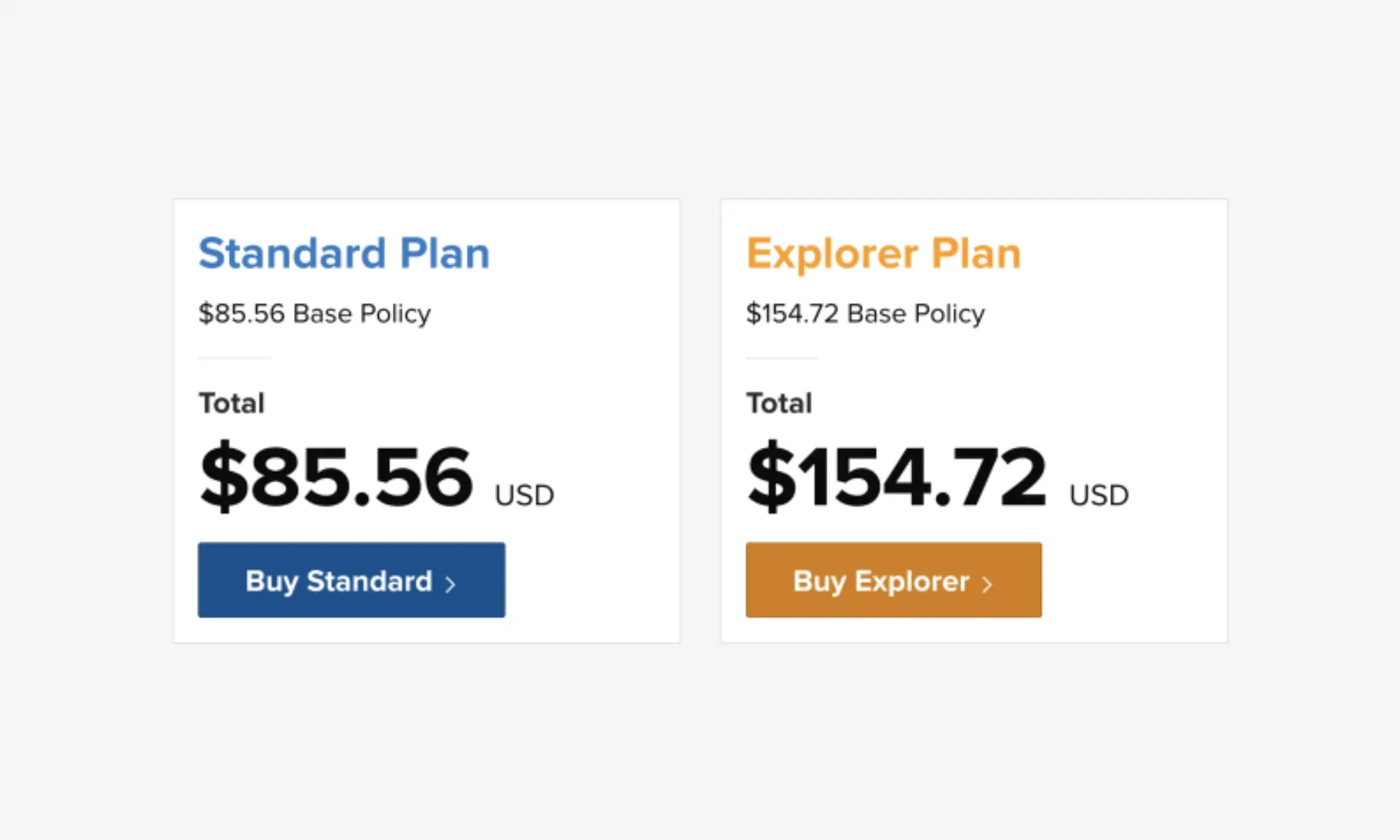

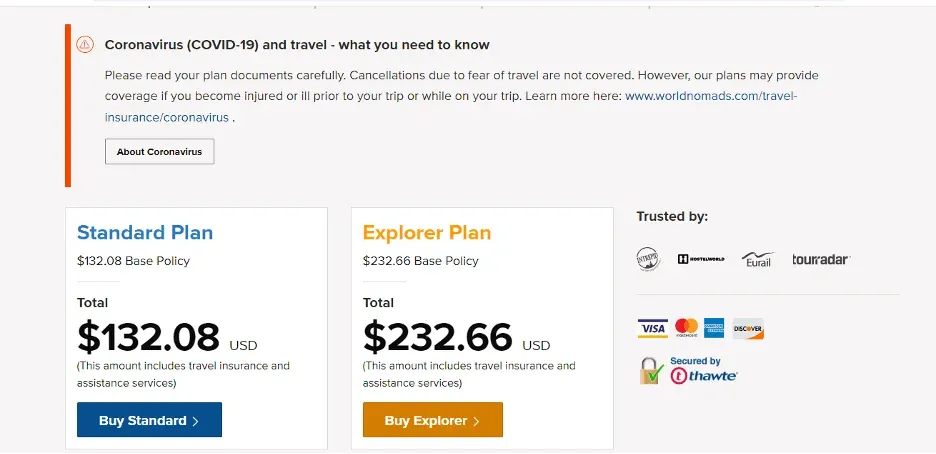

World Nomads offers two travel insurance plans: Standard Plan and Explorer Plan. Get an online quote to compare the plans before buying. You won’t be able to upgrade your plan mid-trip. That said, if you extend your trip while traveling, World Nomads will allow you to buy more coverage.

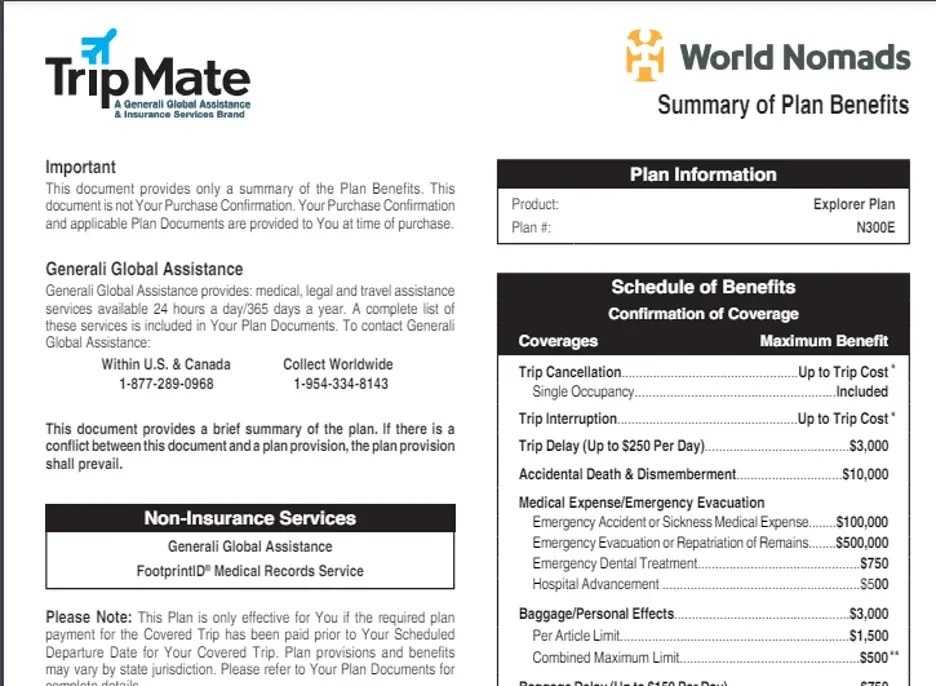

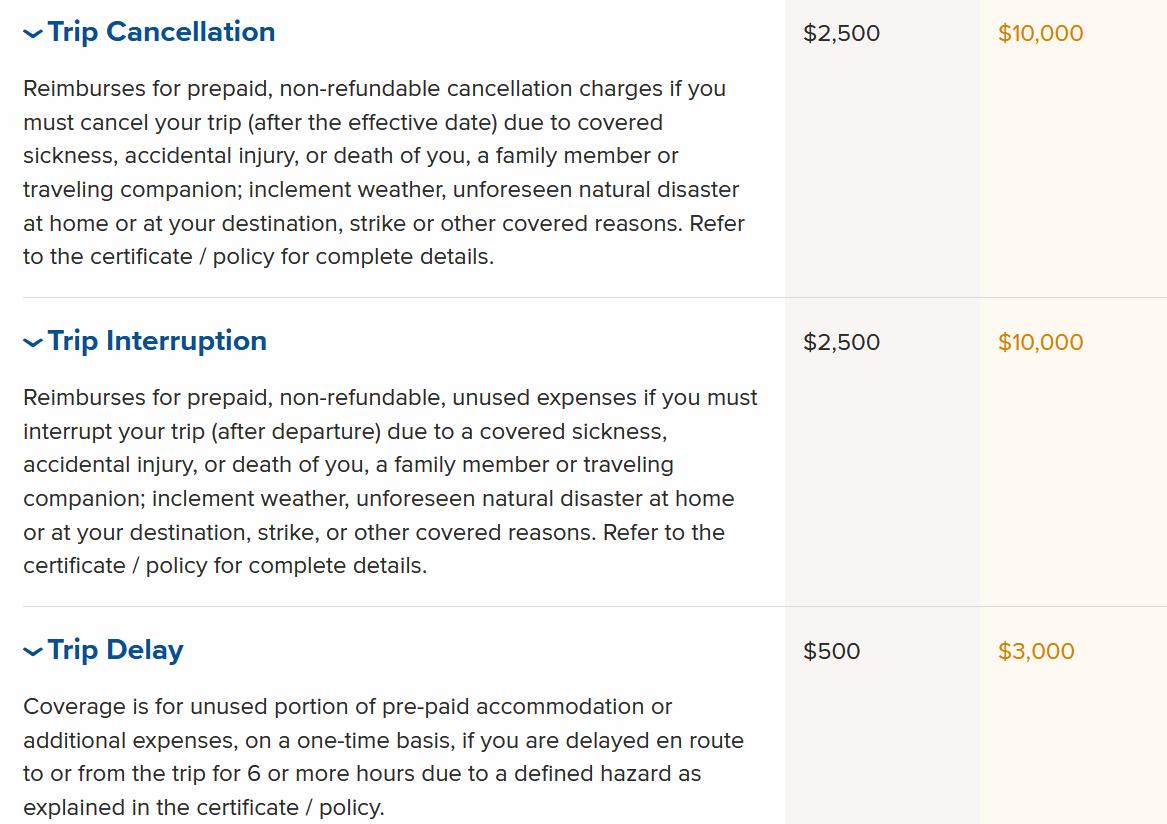

Both Standard and Explorer plans include emergency travel medical insurance coverage of up to $100,000 as well as trip cancellation insurance , trip delay and interruption insurance, baggage coverage and accidental death and dismemberment coverage. The plans also include a 24/7 emergency assistance number where a staff of multilingual assistants can connect you with medical treatment and transportation in the case of an emergency.

World Nomads Standard Plan

This budget-friendly plan covers everything you would expect from a travel insurance plan, but with lower coverage limits than the Explorer Plan. It also covers more than 200 adventurous activities, such as dog sledding, glacier walking, ice fishing, zip lining, bungee jumping, moped biking, tree climbing, sailboarding, triathlons, deep sea fishing and skateboarding. Covered activities may vary depending on your country of residence.

World Nomads Explorer Plan

The World Nomads Explorer plan covers everything in the Standard plan but increases the limits for many coverages and adds coverage for nearly 80 adventure activities. Additional covered activities under the Explorer Plan include backcountry snowboarding, heli-skiing, free diving, shark cage diving, skydiving, running of the bulls and rock climbing.

World Nomads Standard Plan vs. Explorer Plan

The Explorer Plan will cost you more, but it comes with higher coverage limits. Compare the two World Nomads travel insurance plans side by side.

World Nomads travel insurance covers

The main types of travel insurance packaged together in World Nomad policies include:

- Trip cancellation and interruption. Trip cancellation insurance and trip interruption insurance reimburse you for prepaid, non-refundable trip expenses if you need to cancel your trip or cut it short because of a covered reason. Covered reasons typically include severe weather and illness, injury or death of you, your traveling companion or a close family member.

- Emergency medical expenses and evacuation. Travel medical insurance and medical evacuation coverage help pay hospital bills and medevac expenses if you get sick or injured on your trip.

- Travel delay. If your trip is delayed for six hours or more due to a reason listed in the policy, travel delay insurance can help cover the cost of accommodations, meals and local transportation while you are delayed.

- Baggage. Baggage insurance includes lost or stolen baggage, excessive baggage damage and baggage that is delayed more than 12 hours, on your outgoing journey only.

- Travel Assistance Services. Multilingual travel agents with Generali Global Assistance provide 24-hour assistance services for World Nomads. You can call for help locating a physician or to coordinate emergency medical transportation and care.

World Nomads also covers more than 200 adventure activities, many of which may be excluded by other travel insurance plans. A few activities covered by both World Nomads plans are:

- Aerial safari.

- Camel riding.

- Cave tubing.

- Dog sledding.

- Kite surfing.

- Snorkeling.

- Spearfishing.

- White water rafting.

World Nomads travel insurance doesn't cover

Like many travel insurance companies, World Nomads does not cover everything.

Common medical claims that are not covered by World Nomads travel insurance include:

- Injury while intoxicated on drugs or alcohol.

- Injury sustained while behaving in a reckless manner.

- Certain pre-existing medical conditions.

- Non-emergency treatments.

- Routine medical exams.

- Normal labor and childbirth.

- Intentionally harming oneself.

- Suicide or attempted suicide.

There are also a handful of adventure activities that are excluded from coverage, such as base jumping and mountaineering over 22,965 feet.

Read your policy carefully to understand any exclusions before traveling. If you’re not happy with your policy, you have 10 days to request a refund.

Filing a claim with World Nomads

You can file a travel insurance claim using World Nomads’ 24/7 online portal. To start a claim, log into your member account and follow the prompts. You will be asked questions relevant to your claim. Once you are done answering all the questions and uploading any relevant documents, click the declaration to finish the claim. You should then receive an email confirmation with your claim number.

It is a good idea to always have your policy number handy in case you need to file a claim or call the 24-hour Emergency Assistance Team while traveling.

Compare the best travel insurance companies of 2024

Shopping for a travel insurance policy? Consider getting a quote from one of the insurers that made our best travel insurance companies rating.

Via Compare Coverage’s website

World Nomads travel insurance review FAQs

World Nomads does not cover pre-existing conditions and does not provide the option for a pre-existing conditions exclusion waiver, as some of the best travel insurance companies do.

No, World Nomads does not have “cancel for any reason” (CFAR) insurance . This optional upgrade, available with many travel insurance plans, allows you to pay extra for the right to cancel your trip for any reason at all. As long as you cancel at least 48 hours before your scheduled departure, you’re typically entitled to a percentage of your nonrefundable trip expenses, generally 50% or 75%.

Adding CFAR to your plan typically increases the cost of your travel insurance by 50%. Comparing travel insurance plans can help you to find the best CFAR travel insurance .

Yes, World Nomads travel insurance covers personal electronic devices if they are stolen, lost or damaged on your trip. If all other sources of compensation are exhausted — such as filing a claim with your airline or your homeowners insurance — World Nomads may reimburse you for the depreciated value of your loss.

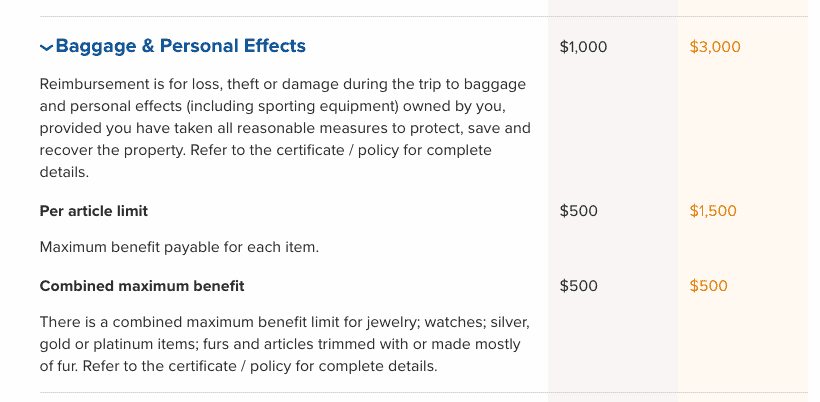

Keep in mind, however, that the per-article limit for World Nomads’ baggage and personal effects coverage is $500 under the Standard Plan and $1,500 with the Explorer Plan.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Jennifer Simonson covers everything from business to the wine industry to international travel. Outdoor adventure, water parks and all things Texas are by far her favorite beats. Her work has appeared in Forbes, Travel + Leisure, Texas Monthly, Smithsonian Magazine, Fodor's, Lonely Planet, Slate and more. You can follow her on Instagram at @storiestoldwell.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel insurance Heidi Gollub

10 worst US airports for flight cancellations last week

How travel insurance works for baggage

Travel insurance Erica Lamberg

What does travel delay insurance cover?

Travel insurance Mandy Sleight

Travel insurance for UK trips

Travel insurance Amy Fontinelle

What is trip interruption insurance?

What are your rights during an airline meltdown?

Hurricanes and travel insurance

Generali Global Assistance travel insurance review 2024

Travel insurance Jennifer Simonson

Travel insurance for vacations to Italy

Travel insurance Timothy Moore

Tricky travel insurance questions answered by experts

Survey: 20% of Americans have had a life-changing experience while traveling

Our travel insurance ratings methodology

AXA Assistance USA travel insurance review 2024

Cheapest travel insurance of September 2024

- World Nomads Travel Insurance Review

World Nomads Plans Available

World nomads travel insurance cost.

- How to File A Claim with World Nomads Travel Insurance

Compare World Nomads Travel Insurance

World nomads travel insurance faqs.

- Why You Should Trust Us

World Nomads Travel Insurance Review 2024: Pros & Cons

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate travel insurance products to write unbiased product reviews.

If you're looking for travel insurance that allows you to confidently participate in a wide range of sports and adventure activities around the world, then World Nomads Travel Insurance might be right for you. The company's policies cover travel to almost anywhere on the globe and are available to residents of nearly every country.

World Nomads Travel Insurance Summary

Among the best international travel insurance companies , World Nomads is particularly good at insuring athletes, covering well over 300 sports, including skydiving, bungee jumping, and golf. World Nomads is also a great last-minute purchase, allowing you to purchase coverage even after your trip has started. However, if you purchase a plan after departure, you will have to wait 72 hours before your plan kicks in.

That said, World Nomads lacks crucial coverage options, such as cancel for any reason coverage and coverage for pre-existing conditions. It also doesn't insure travelers older than 70.

Additionally, the service has received middling reviews from customers, averaging 3.4 stars out of five across 2,510 reviews. Customers often complained about their lengthy claims processes and poor customer service.

Some also took issue with the "Nomads" branding, as some travelers with multiple destinations and long-term trips found their trip wasn't covered by Nomads' specific policies. It's worth noting that World Nomads was very responsive to positive and negative reviews on Trustpilot.

World Nomads has two basic policies: Standard and Explorer. Each covers essentially the same things, but Explorer has higher amounts than World Nomads is willing to pay out for claims. The company's policies cover more than 150 specific activities. These range from bungee jumping and rock climbing to hang gliding and hot-air ballooning. You can see the full list on the company's website.

Additional Coverage Options (Riders)

One of the most common upgraded features of a travel insurance policy is cancel for any reason (CFAR) , where you really can cancel for reason beyond what's in a standard policy. This is not available on every policy, but it is often a feature that travelers are looking for while shopping for travel insurance before their trip. At this time, World Nomads doesn't offer CFAR coverage.

At the time of this review, World Nomads also offers sports equipment coverage. In February of 2022, it expanded coverage to include more than 150 sports and activities including Pickleball and FootGolf. It currently covers over 300 sports. So, as you can imagine, plans with sports coverage will cover virtually any sport you might play.

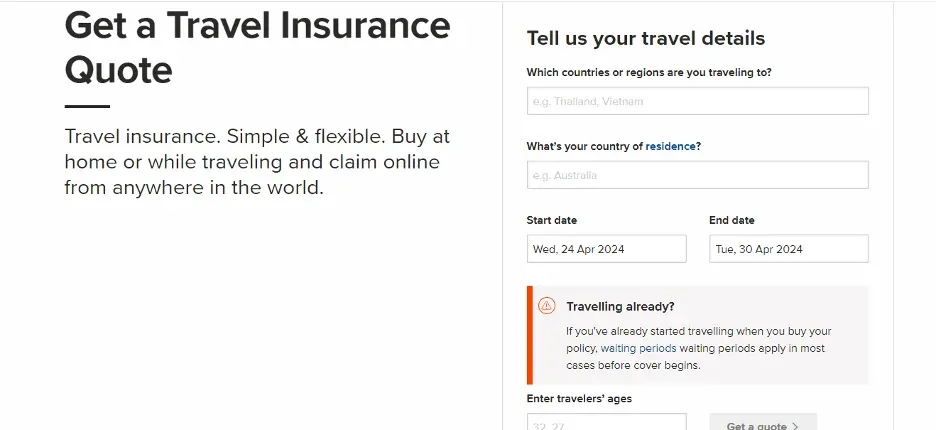

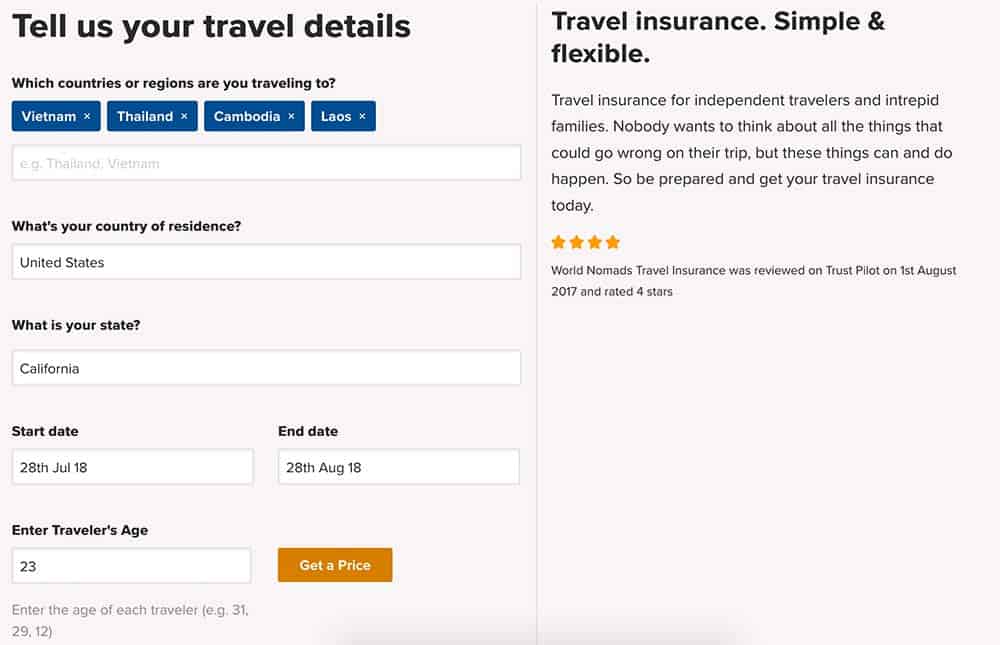

You can obtain a quote from World Nomads on its website by providing details about you and your trip. Be prepared to provide the following information:

- Your destination(s)

- Duration of trip

- Your country of residence

- State of residence (if you're from the US)

- Number of travelers

- Traveler(s) age

Notably, World Nomads does not ask you for the price of the trip, which many travel insurance companies factor into the trip of your policy. As such, World Nomads may be a good option if you're going on a particularly expensive trip.

We ran a few simulations to offer examples of how much a World Nomads policy might cost. You'll see that costs usually fall between 5% and 7% of the total trip cost, depending on the policy tier you choose.

As of April 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following World Nomads travel insurance quotes:

- World Nomads Standard: $76.58

- World Nomads Explorer: $123.34

Premiums for World Nomads's plans are well below the average cost of travel insurance .

World Nomads provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- World Nomads Standard: $85.83

- World Nomads Explorer: $155.06

Once again, premiums for World Nomads plans are between 2.2% and 3.8%, below the average cost for travel insurance.

A couple of 65-years of age looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following World Nomads quotes:

- World Nomads Standard: $152.96

- World Nomads Explorer: $276.34

Premiums for World Nomads plans are between 2.6% and 4.6%, once again below the average cost for travel insurance. This is especially impressive as travel insurance is often more expensive for older travelers.

How to File A Claim with World Nomad Travel Insurance

You can start an insurance claim by filing it on the company's website.

You can call toll-free in the US and Canada if you need to reach the company in an emergency at: (877) 289-0968.

Callers from outside the US and Canada can reach the company at: (954)-334-8143.

The email address is: [email protected]

You'll need to have the following ready to file a claim:

- Your policy number

- A contact number

- The nature of your problem

- Your location

- Prescribed medication (if any)

Keep any documents related to the claim you're filing, including receipts, notices, and invoices.

World Nomads is particularly good at insuring traveling athletes, but let's see how it stacks up against the best travel insurance companies .

World Nomads Travel Insurance vs. Allianz Travel Insurance

Allianz Travel Insurance is a strong competitor against World Nomads, especially for travelers looking for a more business-oriented option. The company has been in business for more than 120 years and offers a wide range of insurance, not just travel-related, around the world. A key difference between World Nomads and Allianz Travel Insurance is that Allianz Travel Insurance offers travel insurance that can cover multiple trips in the same year. You can take an unlimited number of trips within the same calendar year, but you do have to double-check that all of your destinations are covered by the policy you select.

Another difference is that Allianz Travel Insurance offers pre-existing condition waivers for qualifying customers. World Nomads doesn't have the same coverage, requiring that the pre-existing condition is fully stable in order for limited coverage with respect to trip cancellations or having to end a trip early.

Read our Allianz travel insurance review here.

World Nomads Travel Insurance vs. AIG Travel Guard

Travel Guard , a product backed by AIG Travel, is another potential alternative to World Nomads. AIG is a prominent player in the insurance industry, and the Travel Guard product represents true global coverage.

Unlike World Nomads, Travel Guard has coverage for pre-existing medical conditions, but there are conditions. Travelers must purchase their policy within 15 days of the initial trip payment to qualify for a pre-existing condition waiver.

Both travel insurance companies use a tiered approach, but Travel Guard has higher dollar amounts across the board. For example, trip cancellation for Travel Guard covers 100% of the trip cost, while with World Nomads the amount will depends on the tier of the coverage you purchase. Trip Interruption is also a fully covered event with Travel Guard's. Depending on the plan selected, it will either cover 100% or 150% of the trip cost.

If you're concerned about COVID-19 coverage with trip insurance, there's more coverage with World Nomads than Travel Guard. With Travel Guard, coverage for having to stay in a country past your original booking dates is an add-on, not a standard part of the policy.

Read our AIG Travel Insurance review here.

Compare World Nomad vs. Credit Card Travel Insurance

If you already have a major credit card in your wallet, you most likely have some travel insurance benefits that come with it. These benefits do vary from card to card. Be sure to check your card's specific policies.

Not all credit cards will feature travel insurance protection. The ones that do may have specific limitations. For example, many credit cards with travel protection require that your airfare is paid for with the card in question for protections to take effect.

Reimbursement isn't guaranteed. The credit cards do require that you file your claim and wait for a decision. World Nomads makes it easy to file a claim online and submit receipts and documentation. The response is fairly quick based on reviews from travelers who have actually had to file claims.

The more premium the credit card, the more likely expanded travel protections are part of its features. If you don't already have a premium credit card, it's better to get travel insurance. This is also the case if you have multiple trips planned. Some credit cards limit not just the total dollar amount, but the number of claims within a 12-month period.

Read our guide on the best credit cards with travel insurance here.

Yes, you can extend your World Nomads plan while traveling, but you cannot upgrade a standard plan to the Explorer plan.

World Nomads covers COVID-19 like any other illness under its emergency medical coverage.

You can file a claim on World Nomads's website, over the phone, or by mail. Make sure to provide as much documentation as possible to ease the claims process.

World Nomads currently covers 326 sports and adventure activities, from ziplining to zorbing.

Yes, you can purchase World Nomads insurance for a trip that has already started. However, a policy purchased during your trip will have a 72-hour waiting period before insurance starts.

How We Reviewed World Nomads Travel Insurance

To prepare this review on World Nomads, we started by detailing the company's travel insurance offerings. Then we looked at the best travel insurance plans and compared them to World Nomads. We looked at things like typical policy costs, coverage options, available add-ons, what's covered, and claim limits.

You can read more about how Business Insider rates insurance products here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

9 Best Nomad Travel Insurance Options

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Table of Contents

1. World Nomads

2. safetywing, 3. atlas travel insurance, 4. allianz global assistance, 5. insured nomads, 6. img global, 7. heymondo, 8. travelex insurance, 9. aig travel guard, nomad travel insurance recapped.

Travel insurance can safeguard your nonrefundable reservations and reimburse you for any unexpected emergency medical costs that you incur while traveling. However, the travel health insurance needs of those taking several short vacations per year will vary from those of digital nomads, who may spend significant portions of the year living and working from abroad.

Digital nomads may also return home less often, travel with equipment (e.g., laptop, camera, etc.), participate in adventurous activities and want access to health insurance, especially if they don’t have that coverage back home.

Given the prevalence of remote work and increasing options to live and work from abroad, here you'll find some of the most popular nomad travel insurance options .

World Nomads is a travel insurance provider that offers coverage for residents of many countries and also allows you to extend your coverage mid-trip. It is underwritten by Nationwide Insurance. Regardless of which plan you choose, the health insurance limits are fairly good.

Importantly, the provider does not have a pandemic exclusion, so COVID-related claims are covered. However, World Nomads specifically states that fear of travel is not a valid reason for trip cancellation. So if you’d like the option to cancel a trip at your discretion, you’ll want to consider plans that offer Cancel For Any Reason coverage .

There are two trip insurance policies available from World Nomads: Standard and Explorer. The Standard Plan has lower coverage limits and includes more than 200 sports (including some adventure sports), while the Explorer Plan adds on 60 other activities and sports, including more dangerous ones such as shark cage diving, skydiving and paragliding.

The inclusion of athletic activities in both World Nomads plans is unique, since most traditional travel insurance plans exclude them.

Here's a list of what's included with World of Nomads coverage:

Trip cancellation, interruption and delay.

Emergency healthcare coverage, evacuation, repatriation and 24-hour assistance services.

Accidental death and dismemberment.

Nonmedical emergency transportation.

Baggage delay and loss.

Rental car damage (Explorer Plan only).

Adventure sports and activities.

And here are a few items of note that are excluded (not a comprehensive list):

Pre-existing conditions.

Self-harm or accidents occurring while intoxicated.

Finally, coverage can’t exceed 180 days, so if you’re traveling abroad longer than that, you’d have to renew your plan once the current coverage period ends.

To see how World Nomads compares to other travel health insurance providers, we considered a sample 180-day trip to multiple countries by a 30-year-old resident of Colorado.

Due to the lower limits and less coverage for adventure activities, the World Nomads Standard Plan is priced at $549, which is meaningfully cheaper than the $788 Explorer Plan.

It's important to note that if your nonrefundable prepaid trip costs are more than $2,500, the Standard Plan will cover you only up to $2,500 on trip cancellation. In this case, you’d want to consider the pricier Explorer Plan, which provides coverage up to $10,000 on trip cancellation. Notably, emergency accident & medical coverage is $100,000 on both plans, which offers a lot of assurance, especially if you’re abroad for a long time.

The most significant advantage of World Nomads is coverage for adventure activities. In this case, assessing the suitability of the plan has more to do with the type of coverage you’re looking for than price. Because of the multitude of advantages of World Nomads plans over various providers, we've named World Nomads as one of the best travel insurance companies out there. Check out our full rationale here: Best Travel Insurance Right Now .

SafetyWing is another popular digital nomad travel health insurance option that also offers COVID coverage. You can purchase your policy while you’re abroad, which makes it easy for those who are already traveling and decide to get insurance coverage mid-trip.

Unless you are a resident of North Korea, Cuba or Iran, you can purchase a SafetyWing policy. The default length of coverage is 28 days, and the policy will continue to renew unless canceled (maximum policy length is 364 days).

SafetyWing also provides U.S. citizens with incidental coverage in the U.S. for up to 15 days out of every 90 days. Despite the U.S. coverage, SafetyWing is meant to provide medical and travel insurance coverage while you’re abroad; it does not meet the health insurance requirement under the Affordable Care Act.

Trip interruption and delay.

Emergency medical and dental expenses.

Emergency medical evacuation, repatriation of remains and accidental death.

Lost checked luggage and lost visa/travel documents.

Return of minor children and pets.

Political evacuation and border entry protection.

Excluded (not a comprehensive list):

Mental health disorders.

Intentional acts or damages sustained under the influence of drugs or alcohol.

The cost of a SafetyWing policy is based on your age and whether you’d like health insurance coverage while you’re in the U.S. For example, a four-week policy for someone aged 18 to 39 years old who doesn’t need health insurance coverage in the U.S. will cost $45. If you would like coverage while in the U.S., the policy cost jumps to $83.

A 180-day coverage comes out to $290 for a traveler between ages 10 and 39, but increases to $536 if you want to add on U.S. coverage. A deductible of $250 applies every time you start or renew a policy.

Overall, the options to purchase a plan mid-trip and receive health insurance coverage while in the U.S. are some of the main benefits of a SafetyWing policy.

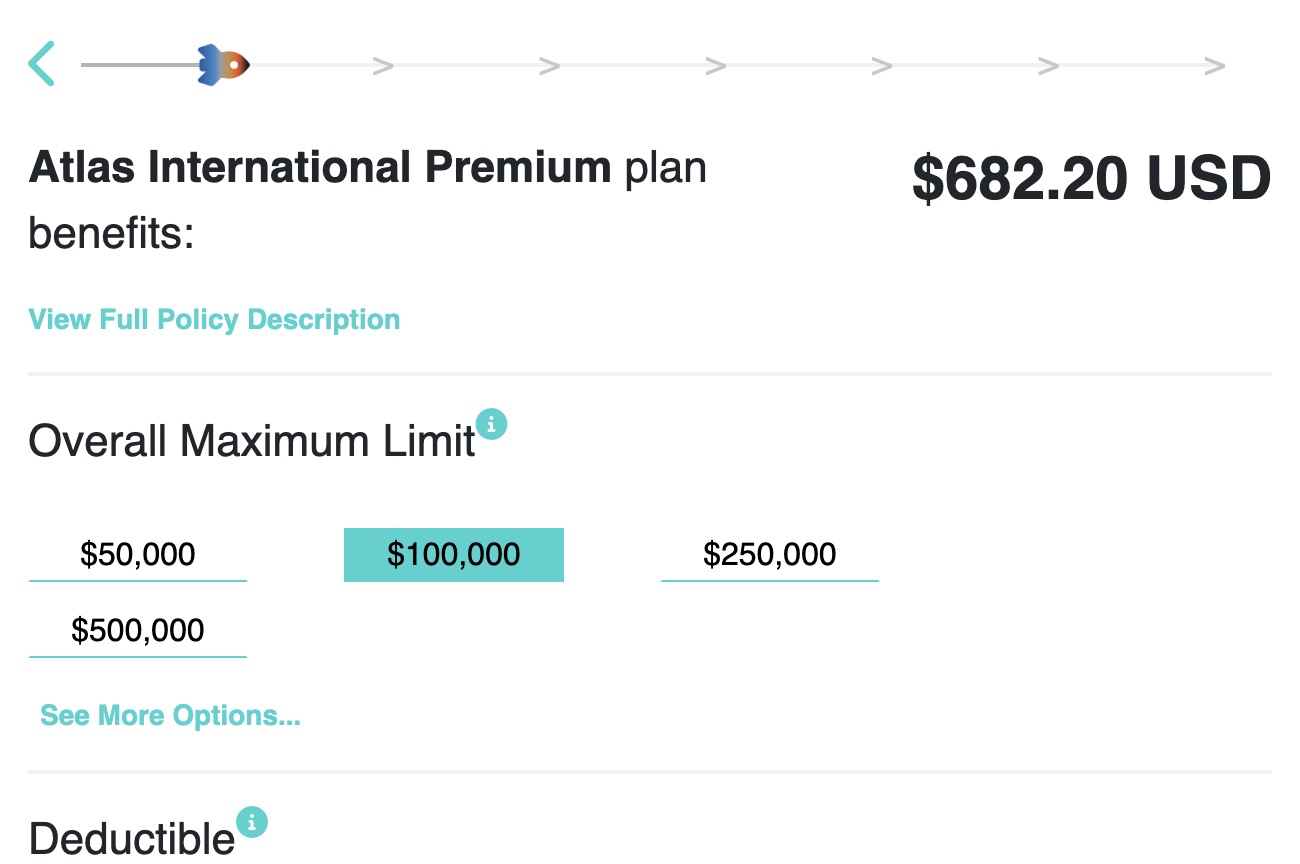

Atlas Travel Insurance offers health insurance plans for digital nomads and long-term travelers looking for medical coverage (including for COVID-19) and some supplemental trip benefits (e.g., trip interruption). When selecting a policy, you’ll need to specify if you’d like to include the U.S. within your coverage area. Coverage limits decrease with age, and the plans offer varying levels of deductibles.

Medical expenses and emergency dental.

Emergency medical and political evacuation.

Trip interruption; travel delay.

Lost checked luggage and stolen visa/passport.

Natural disaster and border entry protections.

Repatriation of remains; accidental death and dismemberment.

Many adventure sports.

Various diseases including cancer.

Self-inflicted injuries and those arising when under the influence of drugs or alcohol.

To compare these plans, we used the same parameters as the preceding example: a 180-day trip by a 30-year-old. Atlas offers two options to digital nomads: Atlas International and Atlas International Premium, which cost $274 and $682, respectively.

The main difference between these two Atlas plans is that the Premium option offers higher coverage limits.

It's also possible to customize the overall maximum limit and the deductible on both policies, so if you don’t want to go with the more Atlas International Premium plan, you can up the limits or change the deductible on the Atlas International plan.

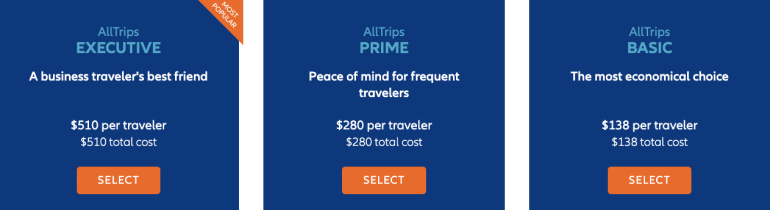

Allianz Global Assistance offers affordable coverage for annual or multi-trip travel. It’s more cost-effective than purchasing coverage for separate trips individually. Allianz’s multi-trip policy covers trips up to 45 days in length.

Allianz is best for travelers who take multiple trips per year from their home base and not those who travel overseas for an extended period of time.

Covered illness.

Missed or delayed departures.

Baggage loss or delays.

A tropical storm (before it’s named).

Loss of passport.

Unforeseen pregnancy complications.

Losses that arise from foreseeable events.

War or civil unrest.

Participating in extreme or high-risk sports.

Flying an aircraft as pilot or crew.

Terrorist events.

Allianz plans limit or exclude coverage related to COVID-19 or resulting from Russia’s invasion of Ukraine.

Allianz Global Assistance offers a few annual plan options to digital nomads. The plans last a full year, so keep that in mind when comparing costs with other nomad insurance providers. The plans are Basic, Prime and Executive, quoting $138, $280 and $510 per year, respectively.

The Basic insurance plan from Allianz is designed for medical emergencies and provides some travel coverage, but it doesn’t provide any trip cancellation or trip interruption coverage.

The Prime plan provides affordable trip protection and medical coverage abroad.

The Executive plan is designed for business travelers by providing higher coverage limits and rental car damage and equipment rentals. The Executive plan covers personal vacations in addition to business trips .

It's also possible to sign up for a Premier plan, which lasts up to 365 days but covers up to 90 days of consecutive travel.

Insured Nomads provides medical coverage, travel insurance and trip cancellation to digital nomads, remote workers and expats.

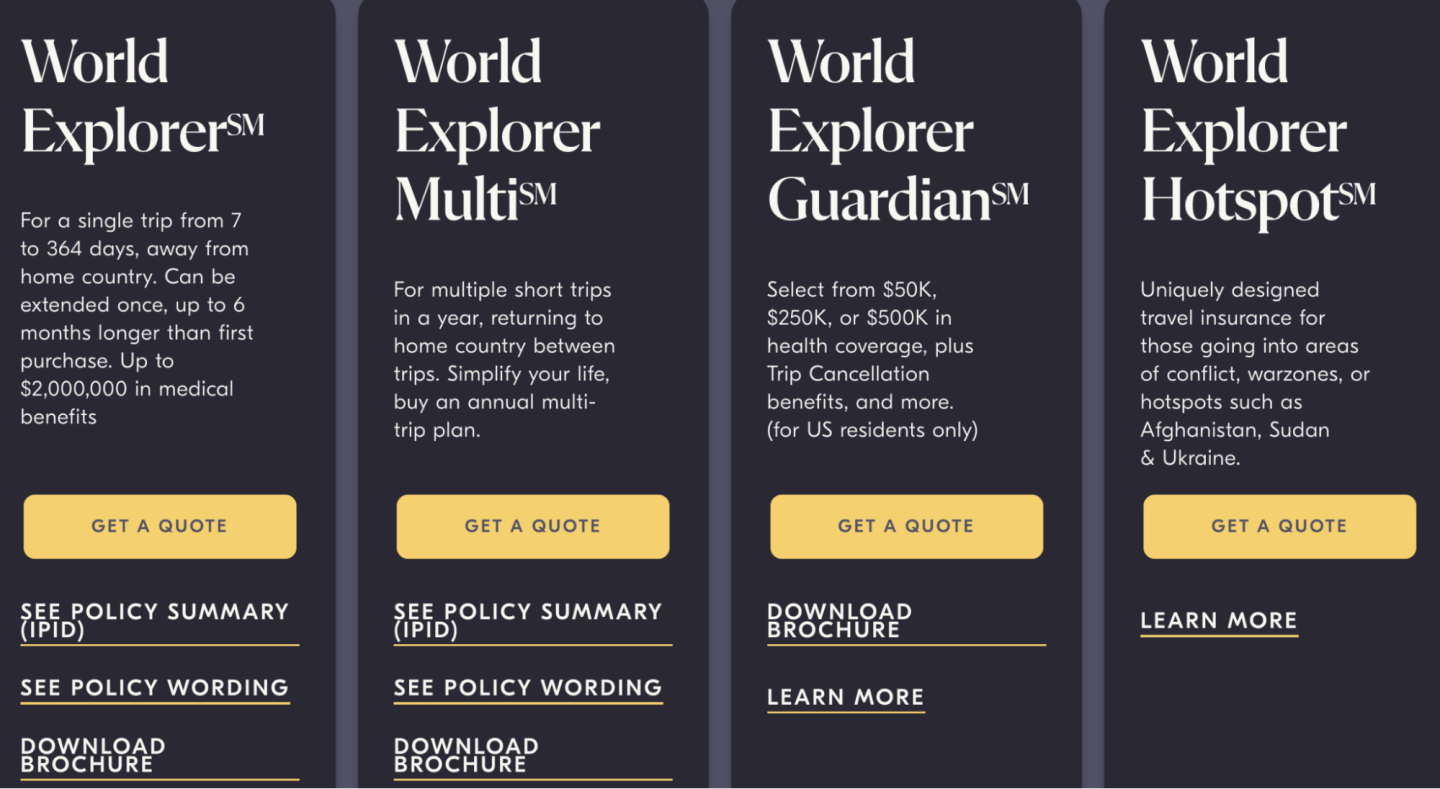

Insured Nomads offers four plans, and they all have their own function. For example, the World Explorer plan provides coverage for a single trip lasting between seven and 364 days away from home, and the World Explorer Multi offers coverage for multiple trips within a single year. Plans are available to citizens of any country, not just the U.S.

Depending on the plan, you’ll have the option to add adventure sports, pet insurance, accidental death and dismemberment and car rental insurance for an extra fee.

Medical benefits, including 24-hour emergency medical care.

COVID-19 coverage.

Acute onset of pre-existing condition.

Emergency dental treatment.

Local ambulance transport.

Natural disaster accommodations.

Evacuation and repatriation.

Airport lounge access for delayed flights.

Lost luggage.

War and terrorism.

Public health emergencies or natural disasters in countries deemed Level 4 by the U.S. Department of State.

Illegal acts.

Injuries sustained while under the influence of drugs or alcohol.

Extreme sports (unless an add-on was purchased).

The quote for a traveler between the ages of 30 and 39 looking to travel to Mexico for six months with the World Explorer plan costs $679. This plan has a medical benefit limit of $250,000 and a deductible of $100. Increasing the medical benefit maximum to $1,000,000 increases the premium to $830, and that’s without any of the additional benefits, such as adventure sports or marine activities.

» Learn more: How to find the best travel insurance

IMG Global offers an insurance plan just for expats and citizens of the world called Global Medical Insurance. It’s a medical-only plan that doesn’t offer trip protection, but offers medical coverage worldwide.

Several tiers of Global medical insurance from IMG Global are available: Bronze, Silver, Gold and Platinum. The more expensive the plan, the lower the deductible and the higher the policy maximum.

The following expat insurance rates are for a 30-year-old traveler whose primary travel destination is Spain.

The deductible amounts can be adjusted in every plan above to reduce the monthly payment. Additionally, the total coverage cost for the year can be reduced with an annual payment. An optional dental and vision rider is available for the policy you pick.

Undoubtedly, the cost is on the high end, but it does come with some noticeable extras, such as COVID-19 coverage , telemedicine and mental health professional counseling, that most travel insurance providers don’t cover.

It’s possible to purchase a World Explorer policy after you’ve left on your trip, and you can extend coverage by up to six months beyond the initial policy purchase.

In addition to the Global Medical Insurance, IMG Global offers the following plans to long-term travelers:

The Global Employer Option: Medical coverage for internationally assigned employees.

International Marine Medical Insurance: Health insurance for long-term (longer than one year) marine crew.

MP+ International: Group travel insurance for mission groups.

Heymondo offers comprehensive travel insurance plans to short-term and long-term travelers. Digital nomads and expats can purchase a Long Stay plan for trips longer than 90 days. The initial coverage is capped at 90 days, but you can renew if necessary. You can also add electronics and adventure sports riders to the Long Stay policy at an extra cost.

Coverage is available to travelers between 90 days old and 49 years old.

What’s included :

Emergency medical and dental coverage (with a $250 deductible).

Medical transport and repatriation home.

Baggage delay , theft and loss.

Travel delay or a missed connection.

Natural disaster.

Personal liability.

Accidental death or disability.

What’s not included (not a comprehensive list):

General medical check-ups.

Trips aimed at receiving medical treatment.

Burial, ceremony and coffin costs in the repatriation of remains.

Petty theft.

Damage caused by strikes, earthquakes or radioactivity.

Motor vehicles.

A 90-day global coverage that excludes travel to Canada and U.S. costs $257 upfront. You can renew coverage once it expires or prepay for additional coverage at the following prices:

30 days: $76.

120 days: $304.

180 days: $456.

275 days: $731.

Notably, medical coverage includes COVID-19, including medically prescribed PCR tests and extra lodging expenses when you’re prescribed a medical quarantine .

» Learn more: Best long-term travel insurance options

Travelex Insurance offers long-term nomad insurance with its Travel Select plan, which is one of the provider’s comprehensive travel insurance plans . This plan covers trips up to 364 days. You must select travel dates and provide the cost of your trip to get a quote.

A 30-year-old Colorado resident traveling to Italy for six months will pay $734 for a Travel Select plan from Travelex Insurance to cover a trip that costs $5,000. It comes with:

100% trip cancellation.

150% trip interruption.

$2,000 trip delay (with a $250 daily limit).

$1,000 baggage loss.

$200 baggage delay.

$50,000 emergency medical expense.

$500,000 emergency medical evacuation and repatriation.

$25,000 accidental death and dismemberment.

Pre-existing conditions waiver : available if purchase conditions are met (more on this below).

Add-ons to the Travel Select plan include double the medical expense, adventure sports rider, car rental collision protection , extra accidental death and dismemberment coverage and even Cancel for Any Reason coverage covering 75% of the insured trip's cost (though the covered trip cost maxes out at $10,000).

The good thing about this plan is it provides coverage for pre-existing conditions as long as you pay for insurance within 15 days of the initial trip deposit. Most annual policies notably exclude a pre-existing conditions waiver.

The bad thing is its high cost because of all the bells and whistles of a comprehensive plan.

AIG Travel Guard offers an annual plan that provides essential coverage to business and leisure travelers who are U.S. residents (not available for Washington state residents).

The Travel Guard Annual Plan is an option for travelers who take multiple trips within a single year (364 days), with a limit of 90 days per trip.

100% trip interruption.

Trip delay.

Missed connection.

Baggage loss or delay.

Medical expenses, including dental.

Emergency evacuation and repatriation of remains.

Non-flight accidental death or dismemberment.

Security evacuation.

War or acts of war.

Participation in a riot, civil disorder or insurrection.

Commission or an attempt to commit a felony.

Being under the influence of drugs or intoxicated above the legal limit.

Trips taken against a physician’s advice.

Release, escape or dispersal of nuclear or radioactive contamination, and pathogenic or poisonous biological or chemical materials.

A Travel Guard Annual Plan comes out to $242 for a Colorado resident, which is a pretty good deal considering all the inclusions — but remember that your trips cannot exceed 90 days each, so its usage is limited to remote workers taking shorter trips.

» Learn more: How much does travel insurance cost?

Expats and digital nomads have different travel health insurance needs than the average traveler, so choosing a policy that aligns with your travel style is advisable.

If you’re looking for adventure sports coverage, World Nomads, Insured Nomads, Heymondo and Travelex Insurance all have the option to add a rider to their policies.

However, if those benefits aren’t relevant to you and you’d instead prefer to have the option of medical coverage when you’re abroad (and to a certain degree while you’re in the U.S.), consider SafetyWing or Atlas, which offer this feature. For medical-only coverage, IMG Global provides some options, albeit pretty expensive ones.

Additionally, take into consideration your travel style. Are you taking one long trip or multiple shorter trips within one year? Because Allianz and AIG Travel Guard won’t work well if you plan to be abroad longer than the limit specified in the policy.

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

Suggested companies

True traveller.

World Nomads Reviews

In the Travel Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 4.1.

3,077 total

Most relevant

Worth the piece of mind - fast, easy, and reasonably priced

I travel extensively and have used World Nomads for years. They consistently provide excellent service at a competitive rate. The quote and purchase process is fast and easy. Definitely worth the piece of mind to have them covering me.

Date of experience : September 08, 2024

Reply from World Nomads

Hi Eric! Thank you so much for your fantastic review! 🖐-⭐️ review We're delighted to hear that you've been a loyal World Nomads customer and appreciate our service.😊 It’s wonderful to know that our fast and easy process, along with competitive rates, gives you peace of mind while traveling. We’re here for all your future adventures— Enjoy every moment as you explore the vibrant cultures, stunning landscapes, and delicious cuisines of Taiwan and Vietnam. Safe travels Lucy ✈️World Nomads.

Highly recommend - best on the market.

Highly recommend. Easy to purchase, good rates, easy to make claims. Also cover outdoor and adventure activities and gear that most insurance companies don’t, and you can purchase and renew while you’re overseas, which many other companies also don’t allow. I have been using them for >12 years and will continue to use them!

Date of experience : September 06, 2024

Many thanks for the 5 ⭐️'s, Taylar! Have the best time on your trip - We hope your travels are as wonderful as the review you've given us 🤩 Safe Travels - Ayden ✈️ World Nomads

Travel agency recommendation was spot on

Based on the travel agencies recommendation, I decided to try world nomads. The website was easy to follow an easy to read. It took me less than 30 minutes to review and understand the information being provided. It was an easy form to complete as long as you had the necessary information in hand, the coverage is fair and reasonable. That said I didn’t shop around, but what they were offering was what we needed for our trip. I did not have to reach out to customer service. The confirmation email Verified what we purchased and was very friendly and thorough. I will definitely use them again for future.

Date of experience : September 03, 2024

Hello Aurora! We are incredibly grateful you took the time to leave us a 5-star review and share your experience. Please let us know what we can do for you in the future. Happy Travels to Japan 🗾🎎! 😊 Babita ✈️World Nomads

Quick and easy!

The insurance plan was well explained and immediately quoted a price. The price was reasonable and it took very little time to make the purchase. It also came highly recommended to us by other travellers.

Hi Shelly! Thank you so much for your wonderful ⭐️⭐️⭐️⭐️⭐️ review! We're thrilled to hear that you found the insurance plan easy to understand and reasonably priced. It's great to know that our service came highly recommended to you. Have an amazing time in Portugal! I recently visited and absolutely fell in💗 with it—such a beautiful place! Safe travels Lucy ✈️World Nomads.

New client review

At this point I am giving a 4 star rating as it was easy to sign up for World Nomads, the pricing is comparable and slightly better than some of the others, response to queries has been prompt and the policy seems to cover most situations. One star is lost in the phone call with a male representative I spoke to when calling World Nomads who was less than friendly.

Date of experience : September 12, 2024

Hi Mary, Thank you kindly for the 4 ⭐️! We strive to give the best customer service to our travellers, so we will definitely pass on your comments to our Customer Service Team! We can't wait to travel with you soon! Ayden ✈️ World Nomads

Simple to understand policies

Simple to understand policies. No need to add up what your cost are, Just pick the plan and coverage you need. I picked policy that has more coverage than I actually need and still saved over $100.00 compared to other insurance companies.

This is what we love to hear, Patrick! It's great to hear that we hit the mark on quality and affordability for our travellers! Safe travels, Leah ✈️ World Nomads

I like World Nomads

I like World Nomads - they are the only UK insurance you can get for a trip over a year long. I've used them for 5 years now and we did need to make a claim last year and they paid us per the policy. They were very easy to deal with, always very helpful, so I would recommend them. Plus their website is great - its so quick & easy to buy the insurance.

Date of experience : September 13, 2024

Hi Kathryn, We strive to give the best customer service to our travellers - We hope that your trip is as wonderful as the review you've given us ✨! Have the best time on your adventure 🌍! Safe Travels - Ayden ✈️ World Nomads

The website is unstable

The website is unstable. I use the Internet for most everything and understand how to navigate websites. I used World Nomads two times in the last 3 years. Both times I had to contact customer service to get the website to work. The website does not work correctly and locks up even when I click on the correct selection in the drop down menus. I also had it lock up when I type information into type in areas. Customer service is excellent which improved my rating.

Date of experience : September 05, 2024

Hi Antoine! Thank you for sharing your feedback. I'm really sorry to hear about the issues you've encountered with our website. It’s clear that the stability problems you’ve faced have been frustrating, especially given your familiarity with online navigation. I’m glad to hear that our customer service was able to help you, but I understand that it’s not ideal to rely on that for website functionality. I’ll make sure your feedback is passed on to our tech team so they can work on improving the website’s performance. Wishing you an amazing trip to Canada! Safe travels and enjoy every moment. – Lucy ✈️ World Nomads

Travel soundly, knowing I'm covered

I have used World Nomads before. As the last time I used World Nomads, easy to apply for Insurance, reasonable rate and I have never had a problem, travelled safely and arrived home without any issues. I aim to have the same service whilst overseas this time, trusting I am covered for anything, if required.

Hi Rochelle! Thanks so much for the amazing review 🤩 Safe travels - Belle ✈ World Nomads

World Nomads Explorer

We purchased the world nomads explorer insurance for our recent international trip. Luckily, we did not use the insurance,but were happy for the peace of mind for having purchased it. We chose this company off of recommendations from friends who have also used your services. The price was fair and the ease of obtaining the plan was excellent.

Date of experience : August 16, 2024

Thanks for taking the time to leave such a wonderful review, Jennifer. I'm glad you had such a great experience. It sounds like you had quite an amazing trip! 🦘🎎 Sarah ✈ World Nomads

Easy but very expensive

The process to arrange travel insurance whilst already away was straightforward but for a period of 10 days it has cost over £130. This doesn’t represent good value for money.

Hi Glyn, thanks for your review! The price of the policy is based on a number of factors. I have passed on your comments to the relevant team so someone can get in touch to discuss with you. Safe travels - Belle ✈ World Nomads

We have used World Nomads for a number…

We have used World Nomads for a number of years. The product and process is consistent and reliable.

Date of experience : September 15, 2024

Thank you for the fantastic 5-star Andrew 😊 . Enjoy your rest of the travels in China 🐼🥡. Safe Travels. Babita ✈️World Nomads.

Duplicate coverage…

I purchased 1 insurance for an upcoming trip, but received 2 confirmations. When I called customer service to rectify this, the rep provided an email address to send a request for a cancellation. 24 hours later, I got a response giving me ANOTHER email address to redirect my request to cancel. I still have not received a response regarding this cancellation.

Date of experience : September 11, 2024

I'm sorry to hear that this hasn't been a smooth start for you, Sandi! I have forwarded this request to the correct team to assist you in your cancellation asap! Safe travels, Leah ✈️ World Nomads Hi again Sandi, I have been notified that your refund has now been processed and you have been sent an email advising you that this has been completed! Safe travels, Leah ✈️ World Nomads

Helpful customer service

Customer service Niamh is very responsive & helpful. Yet to submit any claim and also hope not to use it.

Thanks for your kind words and the 5 ⭐️, Dennis! We'll be sure to pass your comments to Niamh. Safe Travels - Ayden ✈️ World Nomads

Policy # WNUSA24579448

Policy # WNUSA24579448 I cannot view or print my policy online that shows what is included and other details.

Hi David, We're sorry to hear you are not able to print your policy 😢 I have sent you an email with a copy of your policy documents which outlines the cover available under your policy - You should receive this shortly! Ayden ✈️ World Nomads

Easy to setup Travel Insurance Policy

Easy to setup Travel Insurance Policy. This is my second policy, had to actually use the first policy to cover cost of getting Dengue Fever on the first trip in Nepal. The process of claims was easy and quick. Will use for all travel abroad.

Hi Richard, Thank you kindly for the ⭐️⭐️⭐️⭐️⭐️! We're so happy we could help and we can't wait to travel with you soon! Safe Travels - Ayden ✈️ World Nomads

Poor customer service response

This is my 13th trip I've insured with World Nomads. All the others have been good. However, the trip insurance I purchased over a week ago still isn't showing up in my account. I've now called twice and received no help and have written to thecustomer service group two days ago requesting help but haven't received any response. Very disappointing and unlike theirprevious service.

Date of experience : August 29, 2024

We're sorry to hear that your policy did not merge to your account upon purchase, Russ! I have merged it for you manually so you will see it there next time you log in! Safe travels, Leah ✈️ World Nomads

Can't talk to a live person for customer service

Bought a policy three days ago and have been unable to create a login. Called the phone number listed in the policy email and was told that I can only get customer service for my issue through email. So I have to play email tag back and forth.

Date of experience : September 09, 2024

Hi Bethany, we're sorry to hear you're having trouble logging in. I can see a member of our team has been assisting you via email. I have also forwarded your comments to the relevant team so someone can reach out to assist. Safe travels - Belle ✈ World Nomads

Responsive and personal!

World Nomads was very responsive and helpful. When the dates of our trip changed, they were able to accommodate that without fuss. They gave personal attention when we reached out for assistance. Thank you!

Date of experience : September 07, 2024

Thank you so much for the ⭐⭐⭐⭐⭐ review, Joyo! I'm so glad to hear that you had such a great experience. I hope you have a wonderful trip! 🦓 Sarah ✈ World Nomads

Had a unique situation (yes we are all…

Had a unique situation (yes we are all unique) but heading away for 23.5 months . This company was the only one with a travel insurance solution. Easy to deal with by website, email and phone

Thank you for the ⭐️'s, Alain! we hope you make some amazing memories and have the best time on your adventure 🌍! Wishing you all the best during your travels - Ayden ✈️ World Nomads

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

World Nomads Travel Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

327 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

45 Published Articles 3394 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Table of Contents

What is world nomads, plans and coverages offered by world nomads, how to get a quote, how does world nomads compare, filing a claim, why we like world nomads travel insurance, some drawbacks to world nomads travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Spending money on insurance to protect our assets is painful. Whether it’s home, auto, liability, or even business insurance, we rarely receive anything in return besides the peace of mind of knowing we’re covered if something should go wrong.

Travel insurance is different — things frequently go wrong. Whether it’s a flight cancellation, missed connection , weather delay , lost baggage , or other incident, chances are you’ve personally experienced some sort of disruption during your travels.

Perhaps you’ve even had to cancel a trip because you, or an immediate family member, became ill or had a fear of getting ill, during your travels.

It’s not difficult to find a reason to purchase coverage for your travels, but finding the right travel insurance policy for your specific needs can be a challenge.

Today we’re going to look at an organization that is operated by travelers just like us. It’s a company that knows the types of coverage travelers need and partners with highly-rated insurance companies to provide those coverages.

In this regard, World Nomads travel insurance is unique in the travel insurance marketplace. We’re taking the time today to invite you to learn more about the products and services it offers and why you’d want to consider the company when it’s time to purchase coverage for your next trip.

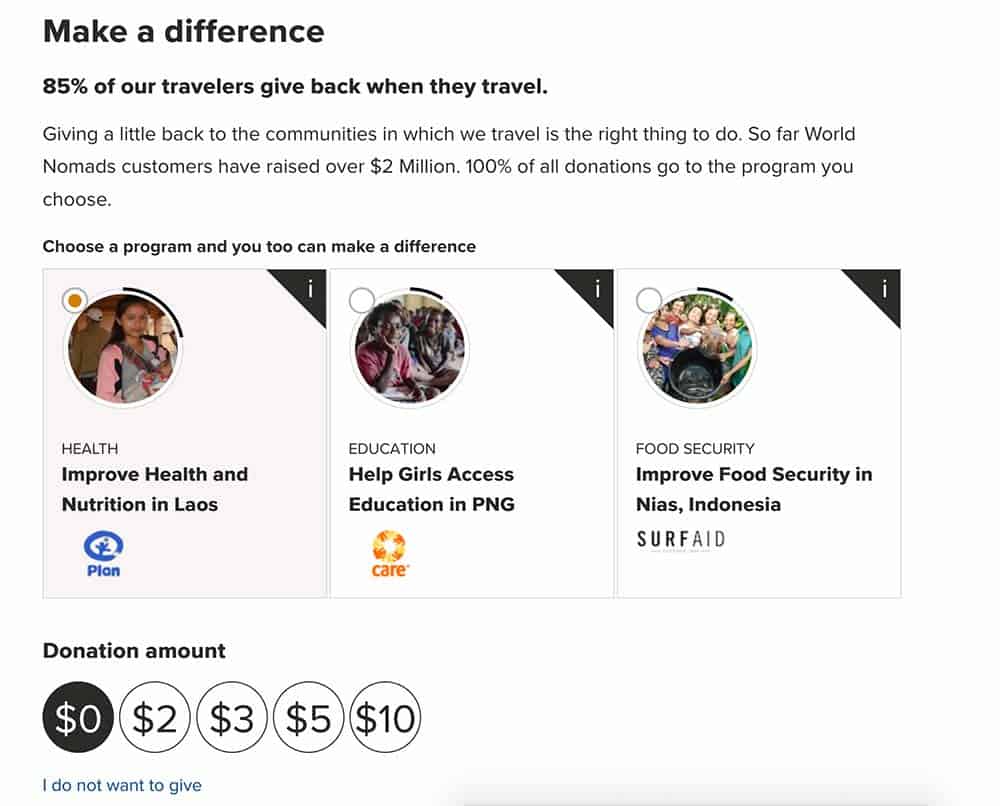

World Nomads is not an insurance company, but you could say that they’re better than an insurance company. World Nomads is an organization based in Australia that offers travel insurance options throughout the world and also gives back to local communities. The organization is made up of travelers, for travelers, so you’ll also find a group of storytellers who additionally provide downloadable guides, recommendations, scholarships , and other travel resources.

The travel insurance offered by World Nomads is underwritten in the U.S. by Nationwide Mutual Insurance Company and the company’s affiliates. Nationwide is highly rated by insurance financial rating company A.M.Best and has been in business for 95 years, so you know you’ll be dealing with an established, financially sound company. Different insurance companies underwrite World Nomad policies depending on the country.

World Nomads specializes in providing essential travel insurance coverages but also includes coverage for 200 activities, many of which you might not find coverage for with other companies.

Bottom Line: World Nomads is an organization of travelers that provides travel insurance that is underwritten by different insurance companies throughout the world. The company offers a core group of essential coverages plus coverage for up to 200 specific activities that are automatically included in each of its plans.

Travel insurance can cover a wide range of perils you might face during your travels. Here are the types of core coverages you can expect with the 2 plans World Nomads offers, the Standard plan (in the first column) and the Explorer plan (in the second column).

Medical and Emergency Dental Coverage

Both plan options offered by World Nomads provide up to $100,000 for emergency medical expenses, $750 for emergency dental, and $500 if you should need to make a deposit for any hospital admission. If your major concern is having medical insurance while traveling, either plan would work for meeting that requirement.

Plus, whether you’re planning on taking a polar plunge, bungee jumping, or finally making that indoor skydive, you’ll be able to find coverage with World Nomads for up to 200 such activities. The list of covered activities varies by plan.

Additionally, while it appears pre-existing conditions are not covered, World Nomads states that “the pre-existing condition doesn’t apply if the problem is treated or controlled solely by the taking of prescription drugs.” There are other limitations that do apply.

Sports and Activities Coverage

One of the reasons World Nomads stands out in the travel insurance arena is its inclusion of coverage for activities that other companies exclude or for which there may be a surcharge. Here are some examples of the 200 activities that can be included depending on the plan chosen.

Bottom Line: If you participate in adventure sports while traveling, World Nomads may have a plan that will cover you.

Evacuation Coverage

Evacuation can be expensive, but you’ll have peace of mind knowing that if you’re injured and need to be evacuated, you could have that expense covered. While having $500,000 in coverage is nice to have, according to Travelex Insurance , an evacuation can cost $25,000 within the U.S., up to $100,000 from Europe and $250,000 from more remote locations. So, $300,000 coverage could be sufficient.

World Nomad plans also include evacuation due to civil or political unrest, natural disaster, or if you are expelled from a county. Of course, terms and conditions apply.

COVID-19 Coverage

World Nomads does not sell Cancel for Any Reason insurance , which can cover you if you decide, for any reason, to cancel your trip, even for fear of getting ill. The company does, however, offer some coverage for COVID-19 related illnesses.

The company offers this explanation of coverage: “Cancellations due to the fear of travel are not covered. Our medical coverage includes benefits for serious illnesses, such as COVID-19, or being placed under strict quarantine by a physician or government mandate, among other scenarios.”

You’ll find some coverage for COVID-19 illnesses within the medical, trip cancellation, and trip interruption coverages.

Bottom Line: You won’t be covered if you cancel your trip due to the fear of getting COVID-19. If you should get ill with the virus, prior to or during your travels, there may be trip cancellation, interruption, or medical coverage (during travel) available.

Trip Cancellation, Interruption, and Delay Coverage

When it comes to trip cancellation, interruption, and trip delay coverages , the 2 World Nomad policy plans offer very different coverage limits. You’ll want to select the level of coverage that is close to matching any expenses at risk should a covered loss occur prior to, or during, your trip.

Delayed, Lost, or Stolen Baggage and Personal Effects Coverage

If you’ll be carrying a lot of electronics with you, you’ll want to make sure to select the proper level of coverage, paying close attention to the per-item limit.

Rental Car Coverage

The Explorer plan comes with $35,000 for damage or theft to your rental car. However, World Nomads warns that the coverage may not be accepted by all rental car companies and that the coverage is not available to residents of all states.

Assistance Services

Make just 1 call, 24/7, to receive assistance with emergency transportation, referrals for medical facilities, dentists, and translation services.

Accidental Death and Dismemberment

Both policy plans offer a benefit for accidental loss of life or limb — $5,000 for the Standard plan and $10,000 for the Explorer plan.

With every insurance policy, there are exclusions. Here is a quick summary of losses that are not covered with World Nomads.

- Pre-existing medical conditions that are not stabilized (terms apply)

- Participating as an athlete in professional sports

- War, insurrection

- Participation in military exercises

- Being under the influence of drugs or intoxicants, unless prescribed

- Travel to pursue medical treatment

This is just an abbreviated summary of exclusions. Each coverage has its own list of excluded losses and items that are not covered. You’ll want to read your policy documents thoroughly to be aware of which losses/items are excluded.

Bottom Line: World Nomads offers 2 plans of essential coverages you’d potentially need while traveling. Each plan offers different limits for specific coverages; the greatest differences between plans are for emergency evacuation, baggage insurance, personal effects, and trip cancellation/interruption/delay coverages. If your greatest concern is having medical coverage, either plan could work to meet that requirement.

On the World Nomads website , you can easily secure a quote and obtain immediate coverage. You’ll need to input the countries you’ll be visiting, the dates of your trip, your country/state of residence, how many people are you insuring, and the age of the traveler(s). You will then have the option to view coverages and select the plan you wish to purchase.

Here is a quote for a single traveler, residing in California, age 35, traveling to Mexico for 1 week.

Once you’re selected your preferred plan you can proceed to checkout, enter your personal and payment information, and receive coverage for the start date you requested.

After you receive your issued policy, you will have a 10-day period to review it and if you decide not to keep it, you will get a full refund.

While the cost of your policy will vary depending on the level of coverages selected, the length of your trip, the destinations, your age, and your place of residence, we did a quick comparison for similar coverage for a single traveler, age 35, traveling for 1 week in Mexico.

Above you’ll find the results for similar coverages, however, the medical coverage in our examples was just $50,000 compared to $100,000 with World Nomads. Also, John Hancock offers the additional option to purchase Cancel for Any Reason insurance (+$44) and both Berkshire Hathaway and Generali offer a waiver for pre-existing conditions if the policy is purchased within 14 to 15 days of the first trip deposit.

Bottom Line: In our limited sampling, World Nomads appears to deliver a competitive price with competitive core coverage offerings. Your results will vary based on your own criteria.

World Nomads walks you through submitting a claim with its simple 7-step process:

- Gather your documentation including receipts and invoices.

- Log in to your World Nomads account and select Make a Claim.

- Select the policy for which you’ll be making a claim; each event requires a new claim.

- Answer the questions relating to your claim.

- List your expenses supported by your receipts and invoices.

- Review your claim, summit, and expect an email confirmation.

- Follow up, communicate with the claims team via email , call 844-207-1930 (from the U.S./Canada), or 816-905-3963 from everywhere else in the world.

Remember to take pictures, file any police reports when necessary, and gather documents immediately after the event. It can be difficult to try to obtain supporting documentation once you’ve returned from your trip.

Hot Tip: Be sure to have your policy information with you when you travel, including all emergency phone numbers. Provide these numbers and policy information to any travel companions in case you are unable to make the call. You will be required to contact World Nomads to arrange any medical services and ensure coverage.

There are a lot of reasons to consider World Nomads travel insurance.

Here are some of the pros:

- The company was founded and is managed by travelers who understand the needs of travelers.

- Obtaining a quote and getting immediate coverage is simple.

- You can receive good value for the premium paid (prices will vary depending on your age, length of trip, destinations involved, level of coverages selected, and where you reside).

- Up to 200 activities are included automatically without additional surcharges (the list differs by plan).

- Coverage can be secured or renewed while you’re traveling.

The plans offered by World Nomads are perfect for healthy, active travelers that may travel for extended periods of time, but also serve well to cover just a week-long journey.

While there are a lot of compelling reasons to purchase your travel insurance policy from World Nomads, there are a few drawbacks and information to be aware of.

- World Nomads does not sell Cancel for Any Reason (CFAR) insurance . Granted, this coverage is expensive, does not cover the entire cost of your trip, and is not offered by every travel insurance company. However, it may be important to you if you want to be able to cancel your trip for any reason, including the fear of getting ill.

- If you’re in the U.S. and 70 years of age or older, you will not be able to purchase coverage via World Nomads. The maximum age for purchasing coverage can vary depending on your country of residence. You can, however, purchase via its partner company, TripAssure. To learn more about the best travel insurance options for seniors , check out our article on this specific topic.

- Policies are limited to 180 days in duration . However, World Nomads does offer the benefit of renewing online, even while traveling.

- There is a policy limitation for baggage and personal items. If you carry lots of electronics, as many travelers do, you’ll want to be aware of these limitations. It’s worth noting that some insurance plans do not cover personal items at all.

If you’re looking for travel insurance, it’s a good idea to check out World Nomads . Plus, if there’s a remote possibility you’ll be participating in any 1 of the 200 activities covered automatically on its plans, that’s even more of a reason to consider the company. Few companies cover all of these activities and some charge extra to do so.

The company’s plans may be the best fit for healthy, active travelers. While both plans offered include up to $100,000 in medical coverage, there is a pre-existing condition limitation for coverage. Once again, if you’re active and your primary medical concern while traveling is getting sick or having an accident, even a minor one, this coverage could be a good fit.

If your priority is securing Cancel for Any Reason insurance, covering pre-existing conditions that are not stable, or purchasing a multi-trip annual travel insurance policy, you may find a better travel insurance fit via insurance comparison sites such as InsureMyTrip , TravelInsurance.com , or SquareMouth .

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Should You Buy World Nomads Travel Insurance in 2023?

02/28/2023 by Kristin Addis 46 Comments

I have not been paid to write this World Nomads insurance review, though if you do choose to buy insurance through a link in this post, it supports this site at no extra cost to you. I do honestly discuss the numerous drawbacks of World Nomads and provide alternative suggestions as well here, so please read this fully before purchasing a plan to be sure it will work for you.

Ladies and gents, it’s time we look into travel insurance.

Why? Because it really, truly sucks if you have an emergency abroad and don’t have it, and not all insurance is created equal. There have been horror stories of people being held in hospitals, almost like hostages, for not paying outstanding bills, or worse, not getting care at all.

But if you need to be airlifted out, must have a family member flown to you, or you simply get sick on the road and don’t want to have to suffer when you could get care, then travel insurance is a no-brainer. It’s best if you never have to use it, but when you need it, it can literally save your trip (and self).