Explainer: What's next for China Evergrande after restructuring proposal?

- Medium Text

WHAT DOES THE OFFSHORE DEBT RESTRUCTURING PROPOSAL OFFER?

What happens next in the restructuring process, what are some concerns over the proposal, how did evergrande come into the public eye, what role have chinese regulators played.

Sign up here.

Reporting by Clare Jim Editing by Mark Potter

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Embattled Chinese property developer CIFI Holdings said on Monday it has reached agreement with a key group of bondholders on a plan to restructure its offshore debt.

Three people died, including a two-year old boy, after a Huawei AITO M7 SUV burst into flames after crashing into a truck on a highway in Yuncheng, in China's north Shanxi province on Friday, Chinese state media reported.

World Chevron

What polling can (and can't) tell you

On Nov. 5, election officials across America will count more than 150 million ballots to answer a burning political question: Who will be president of the United States? Until then, the best signals we can get will mostly come from public opinion polls, which will be the fuel of endless debate on who has the lead, Democrat Joe Biden or Republican Donald Trump. But what do polls really tell us? Lik

The U.S. military said on Sunday it had engaged five unmanned drones over the Red Sea that "presented an imminent threat to U.S., coalition, and merchant vessels in the region."

China Evergrande will swap defaulted debt in court restructuring

Restructuring plan calls for its offshore creditors to swap their debt for new securities.

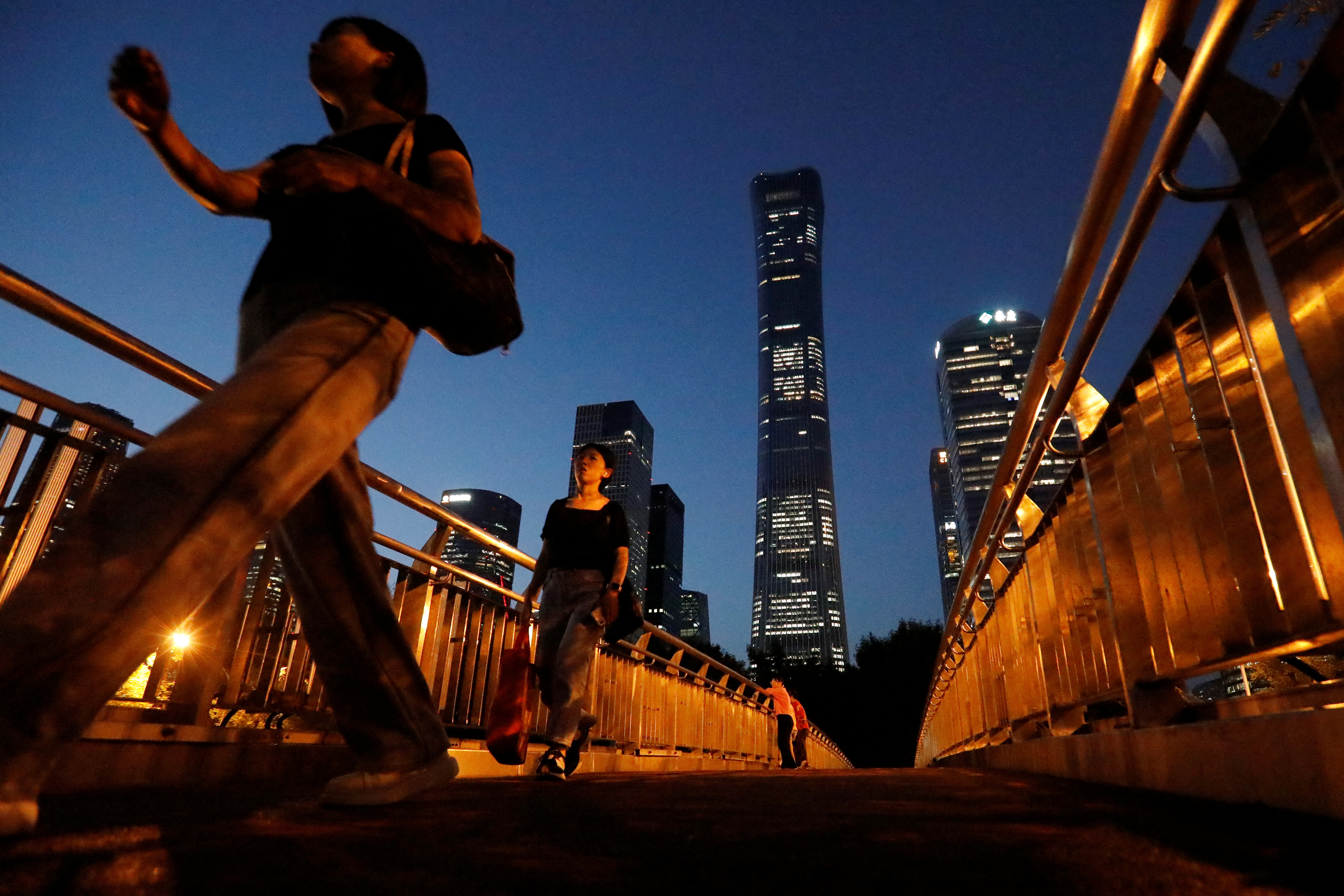

China’s Evergrande's restructuring plan addresses debt tied to Evergrande, its Scenery Journey unit and offshore financing arm Tianji Holding. Photograph: Chan Long Hei/Bloomberg

China Evergrande Group, once among China’s biggest developers and now a poster child for its property crisis, laid out details of a multi-billion dollar restructuring plan that calls for its offshore creditors to swap their debt for new securities.

The proposal, released Wednesday and coming 15 months after Evergrande first defaulted on its public dollar bonds, addresses debt tied to Evergrande, its Scenery Journey unit and offshore financing arm Tianji Holding.

Evergrande credit investors can receive new notes maturing in 10 to 12 years or a combination of new debt and instruments tied to the shares of Evergrande’s property-services unit, its electric-vehicle division or the builder itself, the company said in a Hong Kong Stock Exchange filing. Scenery Journey creditors are slated to get $6.5 billion of new bonds, while Tianji investors will receive $800 million of new notes.

For the first two-and-a-half years, interest on the new bonds can be paid in cash or in kind, meaning with more debt.

Swiftonomics: can Taylor Swift boost her record label’s share price?

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/T36RBVBBZFRTQPX7UFBTQZ3WWI.jpg)

‘This is a land that is all about giving people a go’

:quality(70):focal(1195x1145:1205x1155)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/FDBJZZAUCZE7ZA7QRIM6B5UHL4.jpg)

PTSB most exposed Irish lender to competitive threat from Spanish move into market

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/V2ZND52EDBGPRFPEIRRQ2TIM6M.JPG)

Stella Li of Chinese car maker BYD: ‘We don’t want to engage in a price war’

:quality(70):focal(1950x1026:1960x1036)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/3MSMDOMTWRHPTFF5BFSREISNZA.jpeg)

“The plan is not perfect,” but rather a compromise and “better than nothing,” said Ting Meng, a senior credit strategist at Australia & New Zealand Banking Group. More broadly, the terms “could make investors more cautious when investing in distressed developers”.

Evergrande said the debt restructuring would allow it to focus on returning to normal operations. That will require additional financing of 250 billion to 300 billion yuan (€33.4 billion to €40.15 billion) to “ensure delivery of properties,” the company said. Tianji will require an estimated 1 billion to 2 billion yuan.

“The risk this can’t be covered by unleveraged free cash flow from its projects means there could be prolonged delay in completing some of its 1,316 projects,” wrote Bloomberg Intelligence analysts Kristy Hung and Lisa Zhou. “This would be a fresh blow to buyer confidence in private developers’ projects just as China’s housing sector is starting to recover.”

Meanwhile, Evergrande said that its electric-vehicle business faces “the risk of shutdown” in the absence of new funding. The operation has taken steps to cut costs, including cutting its work force by a quarter in the past nine months.

“It’s very hard to estimate the equity value” of the two Evergrande units given trading of their shares has been suspended for a year, said Eddie Chia, portfolio manager at China Life Franklin Asset Management. “The equity could be worthless.”

The debt restructuring will be implemented through schemes of arrangement or other proceedings that may take place in courts in the Cayman Islands, Hong Kong and the British Virgin Islands, the developer said. Such procedures typically require approval from at least 75 per cent of creditors in value.

Evergrande bondholders will have about $31.7 billion in outstanding principal as of the restructuring’s effective date, which the company estimates will be in October. The ultimate recoveries would depend on the performance of the securities that bondholders choose.

In the case of Scenery Journey creditors, they will have $5.2 billion in outstanding principal, meaning that the new debt of $6.5 billion could lead to a recovery of more than 120 cents on the dollar if obligations on the new notes are met.

Two Scenery Journey dollar bonds maturing late this year jumped the most in 18 months Thursday morning, rising 3 cents to 9 cents according to data compiled by Bloomberg.

At current levels, “I don’t think Evergrande’s dollar bonds are cheap based on the recovery rate indicated,” especially with the wait because the restructuring needs court approval, said Zerlina Zeng, senior credit analyst at CreditSights.

If the restructuring isn’t successful and Evergrande liquidates, unsecured offshore debtholders would recover around 9.73 billion yuan, according to the company. That means noteholders would stand to recover 2.05 per cent to 9.34 per cent depending on what securities they hold.

Based on that liquidity value, “Evergrande’s plan is much better than expected, which was quite low,” said Xu Liqiang, portfolio manager at Shanghai Silver Leaf Investment Co. Still, “the chance for Evergrande to pay off its debt in 12 years is low. To achieve that, the onshore housing market will have to prosper for more than 10 years consecutively.”

Evergrande, which is still the world’s most-indebted developer, said during a court hearing this week that a restructuring support agreement is expected to be ready by month’s end. An ad-hoc group of offshore bondholders expressed backing for the company’s debt overhaul plans after terms were sweetened, Bloomberg reported Sunday.

The signs of progress allowed for a winding-up petition against the builder to be adjourned to July 31st.

Evergrande missed several self-imposed 2022 deadlines to disclose a debt-restructuring framework. The overhaul will be among the country’s largest ever - potentially impacting banks, trusts and millions of home owners. It could also provide guideposts for other developers’ restructurings.

Questions about Evergrande’s debt-repayment abilities fueled broad worries about Chinese builders in the wake of a government-led leverage crackdown that squeezed developers’ liquidity. Property firms defaulted on a record amount of dollar bonds last year.

“The restructuring doesn’t seem to solve the problem of generating cash through the core property business, which still sees a huge $40 billion investment,” said Andrew Collier, a managing director at Orient Capital Research. “Beijing appears to be unwilling to encourage - or force - banks to lend to Evergrande. So their troubles are not over.” - Bloomberg

IN THIS SECTION

Eu employment rights directive will be part of irish law by november deadline, taoiseach tells unions, return of own-brand formula highlights big companies’ profits - senator, delays in renewing work permits causing problems in cork, say indian nurses, why are so many people leaving the uk’s workforce, british postpone cleverly meeting with mcentee, surrendered passport and €50,000 bail seem no hindrance to flight as top cocaine suspect vanishes, ‘i’m alone pretty much all the time. the older i become, the less hopeful i am this will change’, will inheritance cause a problem with my weekly disability payment, ‘i could rent an apartment, but why’ the teenager who lives on germany’s high-speed trains, latest stories, ‘níl ann ach tús agus tá dualgas orainn go léir’, rory mcilroy and shane lowry take zurich classic title after play-off, britain acted with ‘systematic’ impunity regarding state killings and torture during troubles, say international experts.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/VR3765MFOBH2NMV2QNICYDF67M.png)

- Terms & Conditions

- Privacy Policy

- Cookie Information

- Cookie Settings

- Community Standards

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest news

- Stock market

- Premium news

- Biden economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance transfer cards

- Cash-back cards

- Rewards cards

- Travel cards

- Personal loans

- Student loans

- Car insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Scenery journey limited -- moody's announces completion of a periodic review of ratings of china evergrande group.

Announcement of Periodic Review: Moody's announces completion of a periodic review of ratings of China Evergrande Group

Global Credit Research - 10 Dec 2020

Hong Kong, December 10, 2020 -- Moody's Investors Service ("Moody's") has completed a periodic review of the ratings of China Evergrande Group and other ratings that are associated with the same analytical unit. The review was conducted through a portfolio review in which Moody's reassessed the appropriateness of the ratings in the context of the relevant principal methodology(ies), recent developments, and a comparison of the financial and operating profile to similarly rated peers. The review did not involve a rating committee. Since 1 January 2019, Moody's practice has been to issue a press release following each periodic review to announce its completion.

This publication does not announce a credit rating action and is not an indication of whether or not a credit rating action is likely in the near future. Credit ratings and outlook/review status cannot be changed in a portfolio review and hence are not impacted by this announcement. For any credit ratings referenced in this publication, please see the ratings tab on the issuer/entity page on www.moodys.com for the most updated credit rating action information and rating history.

Key rating considerations are summarized below.

China Evergrande Group's (Evergrande) B1 corporate family rating (CFR) reflects the company's strong market position as one of the top three property developers in China (A1) in terms of contracted sales and land bank size. The rating also reflects the company's nationwide geographic coverage, strong sales execution and low-cost land bank.

However, the rating is constrained by Evergrande's weak liquidity and high debt leverage. The company's significant investments in its non-property businesses also constrain its credit profile.

This document summarizes Moody's view as of the publication date and will not be updated until the next periodic review announcement, which will incorporate material changes in credit circumstances (if any) during the intervening period.

The principal methodology used for this review was Homebuilding And Property Development Industry published in January 2018. Please see the Rating Methodologies page on www.moodys.com for a copy of this methodology.

This announcement applies only to EU rated and EU endorsed ratings. Non EU rated and non EU endorsed ratings may be referenced above to the extent necessary, if they are part of the same analytical unit.

This publication does not announce a credit rating action. For any credit ratings referenced in this publication, please see the ratings tab on the issuer/entity page on www.moodys.com for the most updated credit rating action information and rating history.

© 2020 Moody's Corporation, Moody's Investors Service, Inc., Moody's Analytics, Inc. and/or their licensors and affiliates (collectively, "MOODY'S"). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. AND/OR ITS CREDIT RATINGS AFFILIATES ARE MOODY'S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND MATERIALS, PRODUCTS, SERVICES AND INFORMATION PUBLISHED BY MOODY'S (COLLECTIVELY, "PUBLICATIONS") MAY INCLUDE SUCH CURRENT OPINIONS. MOODY'S INVESTORS SERVICE DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT OR IMPAIRMENT. SEE MOODY'S RATING SYMBOLS AND DEFINITIONS PUBLICATION FOR INFORMATION ON THE TYPES OF CONTRACTUAL FINANCIAL OBLIGATIONS ADDRESSED BY MOODY'S INVESTORS SERVICE CREDIT RATINGS. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS, NON-CREDIT ASSESSMENTS ("ASSESSMENTS"), AND OTHER OPINIONS INCLUDED IN MOODY'S PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY'S PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY'S ANALYTICS, INC. AND/OR ITS AFFILIATES. MOODY'S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND MOODY'S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. MOODY'S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS DO NOT COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODY'S ISSUES ITS CREDIT RATINGS, ASSESSMENTS AND OTHER OPINIONS AND PUBLISHES ITS PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE.

MOODY'S CREDIT RATINGS,ASSESSMENTS, OTHER OPINIONS, AND PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS AND INAPPROPRIATE FOR RETAIL INVESTORS TO USE MOODY'S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS OR PUBLICATIONS WHEN MAKING AN INVESTMENT DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY'S PRIOR WRITTEN CONSENT.

MOODY'S CREDIT RATINGS,ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS ARE NOT INTENDED FOR USE BY ANY PERSON AS A BENCHMARK AS THAT TERM IS DEFINED FOR REGULATORY PURPOSES AND MUST NOT BE USED IN ANY WAY THAT COULD RESULT IN THEM BEING CONSIDERED A BENCHMARK.

All information contained herein is obtained by MOODY'S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided "AS IS" without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODY'S is not an auditor and cannot in every instance independently verify or validate information received in the rating process or in preparing its Publications.

To the extent permitted by law, MOODY'S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any such information, even if MOODY'S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or damages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a particular credit rating assigned by MOODY'S.

To the extent permitted by law, MOODY'S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory losses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the avoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY'S or any of its directors, officers, employees, agents, representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY CREDIT RATING, ASSESSMENT, OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY'S IN ANY FORM OR MANNER WHATSOEVER.

Moody's Investors Service, Inc., a wholly-owned credit rating agency subsidiary of Moody's Corporation ("MCO"), hereby discloses that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody's Investors Service, Inc. have, prior to assignment of any credit rating, agreed to pay to Moody's Investors Service, Inc. for credit ratings opinions and services rendered by it fees ranging from $1,000 to approximately $2,700,000. MCO and Moody's investors Service also maintain policies and procedures to address the independence of Moody's Investors Service credit ratings and credit rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold credit ratings from Moody's Investors Service and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the heading "Investor Relations — Corporate Governance — Director and Shareholder Affiliation Policy."

Additional terms for Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY'S affiliate, Moody's Investors Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody's Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be provided only to "wholesale clients" within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODY'S that you are, or are accessing the document as a representative of, a "wholesale client" and that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to "retail clients" within the meaning of section 761G of the Corporations Act 2001. MOODY'S credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail investors.

Additional terms for Japan only: Moody's Japan K.K. ("MJKK") is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly-owned by Moody's Overseas Holdings Inc., a wholly-owned subsidiary of MCO. Moody's SF Japan K.K. ("MSFJ") is a wholly-owned credit rating agency subsidiary of MJKK. MSFJ is not a Nationally Recognized Statistical Rating Organization ("NRSRO"). Therefore, credit ratings assigned by MSFJ are Non-NRSRO Credit Ratings. Non-NRSRO Credit Ratings are assigned by an entity that is not a NRSRO and, consequently, the rated obligation will not qualify for certain types of treatment under U.S. laws. MJKK and MSFJ are credit rating agencies registered with the Japan Financial Services Agency and their registration numbers are FSA Commissioner (Ratings) No. 2 and 3 respectively.

MJKK or MSFJ (as applicable) hereby disclose that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by MJKK or MSFJ (as applicable) have, prior to assignment of any credit rating, agreed to pay to MJKK or MSFJ (as applicable) for credit ratings opinions and services rendered by it fees ranging from JPY125,000 to approximately JPY250,000,000.

MJKK and MSFJ also maintain policies and procedures to address Japanese regulatory requirements.

Evergrande likely in default as debt deadline passes without payment

Chinese developer Evergrande is edging closer to formal default, with reports suggesting that it has missed its final deadlines to pay some bondholders.

Key points:

- Multiple sources have told financial news service Reuters that Evergrande has missed a payment deadline

- This would push Evergrande formally into default unless it can negotiate a deal with all bondholders

- However, Hong Kong's share market rallied on Chinese central bank moves to lower borrowing costs

Evergrande did not make payments on some $US bonds at the end of a month-long grace period, sources familiar with the situation told Reuters, setting the stage for a massive default by the world's most-indebted property developer.

No-one who invested in two bonds — issued by China Evergrande Group's unit Scenery Journey Ltd — had received payment as of 1am AEDT on Wednesday, a source familiar with the situation told Reuters.

Another four sources holding the bonds confirmed to Reuters that they had not received payment.

All declined to be named because they were not authorised to talk to the media.

Evergrande has not issued any communication to bondholders about the missed payment, one of the five sources said.

"From our point of view, it has been a question of when, not if [because of] the scale of the interest payments and then early next year redemption payments has made this [default] seemingly inevitable," said one bondholder, who declined to be named.

Failure by Evergrande to make $US82.5 million ($116 million) in interest payments due last month would trigger cross-default on its roughly $US19 billion of international bonds and put the developer at risk of becoming China's biggest defaulter.

Evergrande was once China's top property developer, with more than 1,300 real estate projects.

However, with $US300 billion of debts and other liabilities, it is now at the heart of a property crisis in China this year that has crushed almost a dozen smaller firms.

Adding to the crisis in China's once-bubbling property market, smaller developer Kaisa Group Holdings was also unlikely to meet its $US400 million offshore debt deadline on Tuesday, a source with direct knowledge of the matter said.

Non-payment by Kaisa would push China's largest issuer of offshore debt among developers after Evergrande into technical default, triggering cross defaults on its offshore bonds totalling nearly $US12 billion.

Evergrande did not respond to Reuters' request for comment. Kaisa, which in 2015 became the first Chinese developer to default on an offshore bond, declined to comment.

Even in the case of a technical default, Kaisa and offshore bondholders could discuss forbearance terms, two sources with knowledge of the matter said.

Kaisa said it was open to discussion on forbearance, without elaborating.

Markets rally on 'lanced boil'

Evergrande shares plunged nearly 20 per cent on Monday, while Kaisa shares lost around 11 per cent across Friday and Monday on the Hong Kong Stock Exchange.

However, both companies bounced back slightly yesterday, rising 1.1 per cent each.

NAB's head of foreign exchange strategy, Ray Attrill, said markets reacted to the news of Evergrande's default with some perverse relief.

"News yesterday that Evergrande had missed the deadline for making a coupon payment on $US debt, and seemingly triggering a wave of cross-defaults, has been seen as more cathartic than troublesome," he noted.

"With this particular boil lanced, the process already looks to be underway for local authorities taking control of Evergrande — and soon, no doubt, other big developers — and doing what's necessary to protect domestic homebuyers and suppliers, in doing so, limiting broader contagion impacts."

That saw a broader rally for Hong Kong's Hang Seng share index, which climbed 2.7 per cent as China's central bank also eased some key policy settings.

The People's Bank of China lowered the required reserve ratio for most banks by 50 basis points, effectively allowing them to lend more at a lower cost, and instituted targeted rate cuts for certain borrowers.

"Neither of these moves, in isolation, constitutes a major loosening of monetary conditions, but we think that they signal a growing desire of policymakers to lower borrowing costs," wrote Oliver Allen from Capital Economics.

However, Mr Allen warned that investors should not expect the Chinese government to simply reinflate the country's property bubble.

"In the past, turning points in China's 'credit cycle' seem to have preceded turnarounds in economic growth there, also often prompting strong gains in certain risky assets," he noted.

"That includes not only China's stock markets, but also industrial metals and those equity indices in many emerging markets in which commodity producers have a large weight.

"This was the case following the Global Financial Crisis, China's growth slowdown in 2014-15, and the large stimulus [that] drove the economy's recovery after the COVID-19 shock early last year.

"However, we doubt that we are on the cusp of a turnaround of a similar scale.

"Unlike in most other economies, the authorities in China steer credit growth not only through influencing the price of credit, but also through various quantitative controls.

"We expect the PBOC to cut its policy rates soon. But we suspect that this will largely be aimed at lowering borrowing costs and reducing financing strains for many heavily indebted borrowers as the economy continues to slow.

"At the same time, we think that ongoing concerns about the extent of leverage within China's economy mean that the authorities there will not want to ease quantitative restrictions on credit growth substantially."

ABC/Reuters

- X (formerly Twitter)

Related Stories

How china's hard landing could expose australia as a one-trick export pony.

China Evergrande avoids default, but where is the money coming from?

China's property giant collapse might not hurt the world's economy, but pain lies ahead for Australia

Evergrande 'may be very close to liquidation'. So what happens then?

- Economic Trends

- Financial Markets

- Housing Construction Industry

- Stockmarket

- Scenery Journey Ltd.DL-Notes 2018(19/22)

Scenery Journey Ltd.DL-Notes 2018(19/22) Bond

About the Scenery Journey Ltd.-Bond (XS1903671854)

The Scenery Journey Ltd.-Bond has a maturity date of 11/6/2022 and offers a coupon of 13.0000%. The payment of the coupon will take place 2.0 times per biannual on the 06.05.. The Scenery Journey Ltd.-Bond was issued on the 11/6/2018 with a volume of 645 M. USD.

Scenery Journey Ltd. 11,5% 20/22

Price information scenery journey ltd. 11,5% 20/22, yield scenery journey ltd. 11,5% 20/22, interest rates scenery journey ltd. 11,5% 20/22, performance scenery journey ltd. 11,5% 20/22, master data scenery journey ltd. 11,5% 20/22, trading parameters frankfurt.

Börse Frankfurt

- Commodities

- Derivatives

- Sustainable

- First Steps

- Announcements

- Visit Börse Frankfurt

- Frankfurt Stock Exchange

- Publications

- Stock Exchange for students

- Registration

- Xetra real-time

Weitere Websites der Gruppe Deutsche Börse

- Deutsche Börse Cash Market

- Deutsche Börse Venture Network

- Deutsche Börse Group

Contact us at:

- ► All contact addresses for your requests

The Other Evergrande Bond Issuers

The troubled real estate developer has been issuing bonds through its listed entity, as well as through subsidiaries. what’s the real evergrande representation in portfolios .

It’s common for conglomerates to raise debt funding via multiple subsidiaries or special purpose vehicles. Often, these have different names. The beleaguered China Evergrande Group (03333) is no exception. What are some of the issuers believed to be connected to Evergrande? And who owns the bonds?

One of the issuers is Hengda Real Estate. According to Evergrande’s annual report , Evergrande owns close to 60% of the onshore subsidiary, Hengda Real Estate. The firm is a Shenzhen-based unit that has issued Renminbi-denominated bonds. The coupon payment due on Wednesday came from the five-year bond issued by Hengda with an RMB 4 billion principal value, which is due in September 2025 .

A second such issuer is Scenery Journey, which is owned by Hengda through a holding company called Tianji Holding Limited. According to bondsupermart, there are four outstanding bonds issued by this subsidiary , which are due between October 2022 and November 2023. Unlike bonds issued under Hengda, which are in RMB, Scenery raises money by issuing bonds in U.S. dollars, from offshore investors.

Earlier this month, Fitch Ratings downgraded the Long-Term Foreign-Currency Issuer Default Ratings (IDR) of China Evergrande Group, and its subsidiaries, Hengda Real Estate Group and Tianji Holding, to reflect Fitch’s view that a default of some kind appears probable. “We believe credit risk is high given tight liquidity, declining contracted sales, pressure to address delayed payments to suppliers and contractors, and limited progress on asset disposals,” Fitch noted.

In the broadly tracked JP Morgan Asia Credit Index – Non-Investment Grade Total Return, China Evergrande Group has a weight of 1.5% while Scenery Journey takes up another 0.66% (as of the end of August), according to information provided to Morningstar by fund managers in our coverage universe.

Earlier this week, Morningstar talked about how much the six largest Asian high yield bond funds owned of Evergrande's issuances. This covered only the bonds issued directly by the Hong Kong-listed Evergrande. Today, we take a look at bonds issued by both Evergrande (EVERRE) and Scenery Journey (TIANHL). We also walk through how much of these biggest Asian high yield funds own.

Scenery’s bonds have been issued with a ‘keepwell agreement’. A keepwell agreement is an agreement between a parent company and its subsidiary that financial solvency will be kept through the agreed upon term. These agreements boost confidence in shareholders and bondholders that the subsidiary will meet its obligations. The contact is often seen as a “gentleman's agreement” where Chinese company (the issuer) pledges to keep a bond-issuing offshore subsidiary solvent. This does not guarantee any payment to the bondholders. All of these clauses ultimately depend on the contractual definitions, and the triggers of a default.

As of September 23, the TIANHL bonds that mature on October 24, 2022, and November 6, 2022, are trading at 18.21 cents on the dollar. The EVERRE bonds, due March 23, 2022, and January 22, 2023, are trading 28.50 and 25.21 cents on the dollar, respectively.

Among the funds with the latest data through July, all but HSBC hold both the direct exposure to China Evergrande Bond and the notes issued by Scenery Journey.

Who Owns What?

In the five funds (with data through July 2021) that we featured in the previous article, most had Evergrande exposure in the region of 1%. Allianz Dynamic Asian High Yield Bond had a bigger weighting of 2.56% as of the end of July.

These funds also had additional holdings in Scenery, ranging between 0.32% and 1.16%. HSBC GIF Asia High Yield Bond was the only exception, as it exited all positions of Scenery, retaining its 1.22% Evergrande assets in its portfolio at the end of July.

Among all the featured funds, the BlackRock portfolio absorbed the highest level of both Evergrande and Scenery bonds. The total market value of the combined Evergrande and Scenery holdings is almost double that of the January figure. In recent months, the trend seemed to be steepening, as the managers continue a consistent bond top-up, favouring the Scenery issues.

At the end of August, the BGF Asian High Yield Bond fund had a total of 1.76% invested in bonds related to the Evergrande complex. Scenery represents nearly half of the exposure, or 0.76%.

Note: The freefall in bond value has effectively reduced the overall portfolio’s exposure to the name.

The case at PIMCO differs. The PIMCO managers gradually accumulated Evergrande’s bonds. Its holdings have been brought back to near early 2021 levels.

In Fidelity’s portfolio, the total exposure and the market value of Evergrande bonds are on the decline, like most of its peer funds. Moreover, the fund with US$ 4.7 billion under management is the only portfolio that has trimmed Evergrande exposure by half, and shifted to hold more TIANHL bonds through July, compared to January 2021.

It’s worth noting that all of the below funds hold the bond with coupon payment due September 23 (ISIN: XS1580431143) based on the latest data available.

To view this article, become a Morningstar Member.

Fears are mounting the collapse of one of China's real estate juggernauts could infect global ...

Blackrock, HSBC and UBS have been accumulating Evergrande bonds over the past few months.

Morningstar analysts find limited evidence that there’s a systematic and consistent link...

China pessimism is currently rife, but certain managers believe negative sentiment towards the co...

The explosive growth of Chinese EV companies like BYD has caught competitors off-guard, but it's ...

- ...Search the Article Archive

Morningstar Announces Winners for 2024 Morningstar Awards for Investing Excellence – Hong Kong

After the run up in the Magnificent Seven stocks, it’s a good time to move back to an underweight...

2023 was a vintage year for Japanese equities, and there are a host of reasons why this can conti...

Stocks correlated to interest rates are expected to perform well this year, according to Mornings...

Vanguard's decision not to offer Bitcoin spot ETFs may raise eyebrows, but Morningstar's John Rek...

About Author

.jpg)

Kate Lin is a Data Journalist for Morningstar Asia, and is based in Hong Kong

- Company Website

- Our Signature Methodologies

Connect With Us

- Global Contacts

- Advertising Opportunities

Asia real estate and outbound investment news

China Evergrande Tests the “Too Big to Fail” Hypothesis With $1B Bond Sale at 11%

2018/11/20 by Jan Kot Leave a Comment

Evergrande boss Xu Jiayin seems determined to test out that “too big to fail” hypothesis

Debt-laden developer China Evergrande announced on Monday that it had sold $1 billion in senior notes due in 2020, with the new paper carrying 11 percent interest rates.

The company said that the fresh tranche of bonds, which were issued less than three weeks after the Shenzhen-based home builder had sold $1.8 billion in bonds in an earlier offshore debt issue, were part of a bid to “refinance its existing offshore indebtness,” according to the company’s filing to the Hong Kong Stock Exchange.

Evergrande’s new debt was issued on the same day that another mainland developer, Times China Holdings Ltd also said it is in the process of book building for a two-year bond with initial price guidance at 11 percent, while Shanghai-based builder Greenland Holding Group is taking bids for 1.5 year notes in the low nine percent range, reported Bloomberg .

Developers Reach for Offshore Debt as Beijing Cracks Down

Chinese developers have been caught in a tightening funding squeeze as Beijing pushes forward a deleveraging campaign to reduce the country’s total debt and rein in an overheated property market. To make things worse, the sector is facing a record $62 billion of bonds due in both onshore and offshore markets in 2019, prompting the country’s builders to sell short-term dollar bonds with higher premiums.

Evergrande’s additional notes will be consolidated and form a single class with the $565 million in senior notes that it issued at 11 percent on November 6, which was part of the company’s $1.8 billion bond sale at the end of October, according to the company statement.

Evergrande surprised the bond market on October 31 by selling three tranches of senior notes worth $1.8 billion with interest rates up to 13.75 percent. The company’s billionaire chairman and founder Xu Jiayin subscribed to more than half of the overall issue, a move seen as an attempt to lift investor confidence.

Xu and a wholly owned company bought $500 million of the $645 million in four-year notes, which yield 13 percent, and the same amount of the $590 million in five-year paper, which carried a coupon of 13.75 percent. The company also sold $565 million in two year notes with a coupon of 11 percent, which will be consolidated into the new $1 billion tranche.

Skimpier Covenants and Higher Coupon Rates

Evergrande, which is known for its aggressive approach to leverage and willingness to take on financial risk introduced a new structure for its $1.8 billion bond deal earlier this month,“which is totally different from the old one,” according to a Hong Kong-based lender cited by the Financial Times. This developer is following the same approach for the $1 billion in notes that it sold this week.

Chinese home builders are likely to face more difficult market conditions in 2019

Issued through a British Virgin Islands entity called Scenery Journey, the bond uses a covenant structure which includes its onshore subsidiary Hengda Real Estate Group providing a so-called “keepwell” deed to maintain the issuer’s solvency, without offering a formal guarantee. These deeds have proliferated in China’s bond market in recent years but they are largely untested, according to the industry source.

The lack of security for Evergrande’s creditors appears to fit with a generally erosion in bond covenants in the region, with Moody’s Investors Service stating this week that covenant quality for Chinese developer bond had fallen to its all-time weakest level, according to a recently completed survey by the credit rating agency.

Evergrande said in its statement that it is issuing this set of additional notes to raise fund and that the net proceeds from the approximately $999.3 million borrowed will be used to refinance existing offshore indebtedness.

Ratings Agencies Say Latest Debt Deal Even Junkier

Evergrande’s bonds were assigned a B credit rating by ratings agency S&P – deep into junk-rated territory – and a B2 rating by Moody’s service, as analysts raise questions about risks to the developer’s business, and to China’s real estate sector in general, as home sales slow and the mainland government continues to clamp down on credit.

The Chinese builders’ rush to issue dollar bonds can increase “systemic risk in the form of larger maturity walls that will need to be refinanced,” Paul Lukaszewski, head of Asian corporate debt & emerging market credit research at Aberdeen Standard Investments, told Bloomberg this week. “If the trend toward shorter dated issuance continues, we would not be surprised to see Chinese regulators intervene again much like we saw earlier this year with regards to 364-day issuance,” he said.

Moody’s concluded in its just-released report that the average covenant quality score for Asian full-packaged high-yield bonds fall to all-time weakest level of 3.36. “The weakness in the Q3 score – mainly due to issuance from Chinese property developers – takes Asia’s overall average to 2.71 (moderate) for January 2011 through September 2018,” said Evan Friedman, head of covenant research.

Evergrande, China’s largest property developer by sales, has been under pressure to raise funds. As of the end of June, the company’s offshore debts totaled $16.4 billion even as mainland corporates are finding it increasingly difficult to move funds offshore and the government has restricted access to new onshore bond funding.

The company was said last month to be seeking to raise about $1.5 billion by offering its China Evergrande Center office tower in Hong Kong’s Wanchai district as collateral.

Share this now

Leave a Reply

Your email address will not be published. Required fields are marked *

Connect with Mingtiandi

Real estate news.

- Capital Markets

- 2023 Event Calendar

- MTD TV Archives

- Data Centres

- Asia Outbound

More Mingtiandi

- About Mingtiandi

- Contact Mingtiandi

- Mingtiandi Membership

- Newsletter Subscription

- Terms of Use

- Join the Mingtiandi Team

- First Name *

- Last Name *

- Name This field is for validation purposes and should be left unchanged.

Rating Action Commentary

Fitch Affirms Evergrande, Hengda at 'B+'/Stable; Assigns 'B+' IDR to Tianji with Stable Outlook

Tue 15 Sep, 2020 - 6:16 AM ET

Related Content: China Evergrande Group

Fitch Ratings - Hong Kong/Shanghai - 15 Sep 2020: Fitch Ratings has affirmed the Long-Term Foreign-Currency Issuer Default Ratings (IDRs) of China Evergrande Group and subsidiary Hengda Real Estate Group Co., Ltd at 'B+' with Stable Outlooks. At the same time, Fitch has affirmed Evergrande's senior unsecured rating at 'B' with a Recovery Rating of 'RR5'. We have also assigned Hengda's wholly owned offshore financing platform, Tianji Holdings Limited, a Long-Term IDR of 'B+' with Stable Outlook and a senior unsecured rating of 'B' with a Recovery Rating of 'RR5'.

The Tianji-guaranteed senior unsecured notes issued by Scenery Journey Limited have been downgraded to 'B' with a Recovery Rating of 'RR5', from 'B+' with a Recovery Rating of 'RR4', to reflect Fitch's revised rating approach, whereby the bond rating is linked to Tianji, the guarantor, rather than Hengda, the keepwell provider. Fitch affirmed Hengda's 'B+' senior unsecured rating with a Recovery Rating of 'RR4' and then withdrew the rating because the senior unsecured rating was no longer relevant to the agency's coverage.

The affirmation of Evergrande's and Hengda's IDRs reflects the group's large business scale and diversification, but higher leverage and weaker liquidity than that of peers. The Stable Outlook reflects the expectation that the Evergrande will be able to deleverage after 2020, with improving contracted sales and collection ratio, as well as its stated intention to reduce land acquisitions. In addition, the Stable Outlook also reflects our expectation that Evergrande will be able to negotiate with Hengda's strategic investors not to redeem the CNY130 billion investment in early 2021.

Hengda's 'B+' senior unsecured rating with a Recovery Rating of 'RR4' was withdrawn for the following reason: it was no longer relevant to Fitch's coverage.

Key Rating Drivers

Scenery Journey Notes Downgraded: The US dollar notes issued by Scenery Journey Limited are guaranteed by Tianji and carry a keepwell deed and a deed of equity interest purchase undertaking from Hengda. The notes have been downgraded to 'B' with a Recovery Rating of 'RR5'. The Recovery Rating assessment on the notes is now based on the balance sheet of Tianji, the guarantor, instead of the balance sheet of Hengda, the keepwell provider, yielding a lower Recovery Rating of 'RR5', leading to the notes being rated a notch lower than the guarantor's 'B+' rating. This shift recognises the possible challenges enforcing creditor claims on a keepwell provider in financial distress, as some recent developments have indicated with regards to such an arrangement.

Improving Contracted Sales, Collection: Evergrande's total contracted sales rose by 24% yoy to CNY348.8 billion in 1H20. Gross floor area (GFA) sold climbed by 47% to 38.6 million sq m. The average selling price (ASP) fell by 16% yoy to CNY9,030/sq m. The company demonstrated a sales collection rate of 90%, against 67% in 1H19. Management said Evergrande will generate more than CNY650 billion of total contracted sales in 2020 and will have CNY380 billion of cash collection in 2H20. We forecast 8%-11% growth in Evergrande's contracted sales a year in 2020-2022, and expect the company's ASP to improve from 2021, due to higher land bank mix in tier 1-2 cities.

Deleveraging Expected after 2020: Evergrande's leverage - measured by net debt/adjusted inventory - rose to 52% by end-1H20, from 43% in 2019, after adjusting for the pre-IPO investment of Hengda as debt; 1H20 leverage only increased slightly to 44% without the reclassification. Management said Evergrande is reducing its land bank by 30 million sq m from 240 million sq m of residential land reserve, and interest-bearing debt by CNY150 billion a year from 2020 to 2022.

Fitch expects Evergrande's land bank life to reduce gradually, from around five years in 2019 to less than three years by 2022. In addition, the company has 104 urban regeneration projects (URPs), of which 55 are in Shenzhen and 12 are in the Greater Bay Area outside Shenzhen, supporting the company's focus on shifting to tier 1-2 cities. Fitch expects Evergrande's leverage to drop to 47%-49% in 2020-2022, from 52% in 1H20, due to slower land replenishment despite capex on the electric vehicle segment.

Hengda Pre-IPO Investment Reclassified as Debt: Evergrande owns 63.46% of Hengda, while the remainder is owned by strategic investors, which invested CNY130 billion a few years ago in anticipation of an A-share listing. These investors include state-owned enterprises such as Shandong High-speed Group Co., Ltd. (A/Stable) and Shenzhen Investment Limited, suppliers to Evergrande such as Suning.com Group Co Ltd and Grandland Holdings Group Co Ltd, and domestic private equity funds. Under the terms of the investment, the investors may require Evergrande to redeem the investment, or transfer additional shares without consideration, if the A-share IPO does not materialise by January 2021.

We expect the A-share IPO to be further delayed and have reclassified this CNY130 billion minority interest in Hengda as debt. Evergrande may dilute its stake in Hengda in lieu of redeeming the minority interest, although we believe Evergrande is unlikely to choose this option. This reclassification of minority interests to debt increased Evergrande's leverage by 8pp. Nonetheless, we believe that the minority investors are unlikely to force Evergrande to redeem their investments in January 2021.

Diversified Fund-Raising Channels: Evergrande raised HKD23.5 billion (CNY20.7 billion) from strategic investors in August 2020 for the listing of its property management business, Jinbi Property Management Company Limited. Management expects Jinbi to be listed in the next one to two years, and further raise USD1 billion-2 billion (CNY7 billion-14 billion) by listing in Hong Kong. The Jinbi fund raising and the Hong Kong-listed China Evergrande New Energy Vehicle Group Limited (ENEV, 708 HK), in which Evergrande holds a 74.99% equity stake, provide more flexibility for Evergrande to reduce leverage. ENEV has announced plans to raise approximately HKD4 billion of equity from investors, including Tencent Holdings Limited (A+/Stable) and Yunfeng Financial Group Limited.

Large Capex for Electric Vehicles: Evergrande's non-property business, which consists mainly of the electric vehicle business, has a weak credit profile. It is making operating losses due to the ramp up and R&D expense, although we expect the losses to narrow from 2021. In addition, this business has large capex requirements - Evergrande invested around CNY13 billion in 2019 and has budgeted capex of CNY15 billion-30 billion a year in 2020-2022, which we have factored into our forecasts.

IDRs Equalised: The IDRs of Evergrande, Hengda, and Tianji are equalised under Fitch's Parent and Subsidiary Linkage Rating Criteria. Evergrande and Hengda are both rated based on the group's consolidated profile under the weak parent and strong subsidiary approach to reflect the strong legal and operational ties between the two.

The IDRs of Tianji and Hengda are equalised under the strong parent and weak subsidiary approach. We assess the overall ties to be strong, with moderate legal ties, strong operational ties and strong strategic ties between the two entities. Tianji is the offshore financing company for Hengda and the two companies are fully integrated in terms of operations. Tianji had total assets of CNY353 billion in 2019, accounting for 19% of Hengda's total assets. Tianji is also one of the restricted subsidiaries under Evergrande's guaranteed bonds, which means that a default by Tianji will trigger the default of Evergrande bonds, further binding the whole group to Tianji. Hengda provided CNY44 billion of guarantees to Tianji in 2019 (2018: CNY41 billion), mainly for the financial guarantee of the borrowing of certain onshore project companies of Tianji. This constituted 42% of Tianji's borrowings, excluding the keepwell bonds, as of end-2019.

Derivation Summary

Evergrande's scale and diversification is in line with that of higher-rated homebuilders, such as Country Garden Holdings Co. Ltd. (BBB-/Stable) and China Vanke Co., Ltd. (BBB+/Stable), which also have nationwide operations. Evergrande's ratings are constrained by its weaker leverage and liquidity and volatile historical performance, with a short record of high profit margins. Its working-capital management, which relies on payables rather than customer deposits to fund inventory, and high short-term debt, also leads to the multiple-notch rating difference with peers.

Evergrande is rated one notch lower than Risesun Real Estate Development Co.,Ltd. (BB-/Stable), despite Risesun's significantly lower business scale and concentration in Pan-Bohai and Yangtze River Delta. Risesun has better working capital and liquidity management, higher churn, rising non-property development income, and lower leverage. Evergrande is rated one notch higher than Kaisa Group Holdings Limited (B/Stable) due to Kaisa's higher leverage, lower churn rate and its concentration on URPs in the Greater Bay Area.

Key Assumptions

Fitch's Key Assumptions Within Our Rating Case for the Issuer

- ASP to drop by 12% in 2020 but increase by 4%-5% a year in 2021-2022 (2019: -2%)

- Contracted sales by GFA to drop by 5% in 2019 and stay flat in 2020 (2018: 4%)

- Land bank GFA to increase by 23% in 2020 and increase by 4%-5% a year in 2021-2022 (2019: 11%)

- Land cost to increase by 20% in 2020 and 3% 2019-2021, with an EBITDA margin of 24%-27% in 2019-2021 (2018: 24%)

- We assume Evergrande to successfully renegotiate with Hengda's pre-IPO investors for an extension until 2022.

- Dividend payment at around CNY26 billio-27 billion a year in 2020-2022, including around CNY18.5 billion a year to pre-IPO shareholders of Hengda, remaining CNY6 billion-8 billion a year are expected to pay to Evergrande's shareholders.

Recovery Rating Assumptions

- Evergrande will be liquidated in a bankruptcy because it is an asset-trading company. We assume both Hengda and Evergrande would go into bankruptcy if Evergrande fails.

- 10% administrative claims

- We estimate Evergrande's liquidation value by de-consolidating Hengda. The liquidation estimate reflects Fitch's view of the value of inventory and other assets that can be realised and distributed to creditors

- We applied 25% haircut on net inventory as Evergrande's development property (DP) EBITDA ex cap interest was at 25%-30% range

- We applied a haircut of 30% on its receivables, and 50% on its investment properties and plant, property and equipment

- We assume the company's third-party payables to Evergrande (excluding Hengda) that amounted to CNY77 billion at 2019 are senior to all other debt

- We also assume Evergrande will be able to use 100% of the available and restricted cash to pay debt and payables

- We assume 100% of residual value from Hengda will be distributed to Evergrande's creditors. However, no residual value from Hengda will go upstream to Evergrande as it is used to pay off all the debt on the Hengda level

- Tianji will be liquidated in a bankruptcy because it is an asset-trading company

- The liquidation estimate reflects Fitch's view of the value of inventory and other assets that can be realised and distributed to creditors

- We applied 25% haircut on net inventory as Tianji's DP EBITDA ex cap interest was at 25%-30% range

- We applied a haircut of 30% on its receivables, and 50% on its investment properties and property, plant and equipment

- We assume the company's third-party payables that amounted to CNY35 billion at 2019 are senior to all other debt

- We also assume Tianji will be able to use 100% of the available and restricted cash to pay debt and payables

RATING SENSITIVITIES

Factors that could, individually or collectively, lead to positive rating action/upgrade:

- Net debt/adjusted inventory sustained below 50%, with materially lower trade payables (1H20: 44%, 2019: 43%)

- Evidence of limited contagion risk from non-property businesses to core business

Factors that could, individually or collectively, lead to negative rating action/downgrade:

- Net debt/adjusted inventory above 60% for a sustained period

- EBITDA margin, excluding capitalised interest, of below 20% for a sustained period (1H20: 23%, 2019 25%)

- Evidence of more difficulty in accessing debt financing for the property development business

- Further deterioration of the liquidity position

- Increasing likelihood of Hengda minority interests being redeemed; or a material dilution of Evergrande's stake in Hengda

Downgrade trigger specifically for Evergrande and Tianji:

- Weakening linkages with Hengda

Best/Worst Case Rating Scenario

International scale credit ratings of Non-Financial Corporate issuers have a best-case rating upgrade scenario (defined as the 99th percentile of rating transitions, measured in a positive direction) of three notches over a three-year rating horizon; and a worst-case rating downgrade scenario (defined as the 99th percentile of rating transitions, measured in a negative direction) of four notches over three years. The complete span of best- and worst-case scenario credit ratings for all rating categories ranges from 'AAA' to 'D'. Best- and worst-case scenario credit ratings are based on historical performance. For more information about the methodology used to determine sector-specific best- and worst-case scenario credit ratings, visit https://www.fitchratings.com/site/re/10111579 .

Liquidity and Debt Structure

Tight but Manageable: Evergrande's total cash at end-1H20 amounted to CNY204 billion, which includes restricted cash of CNY64 billion and readily available cash of CNY140 billion, against short-term debt of CNY396 billion. In addition, the company had CNY69 billion of short-term capital market debt during the period, while the remainder of the short-term debt was mostly construction loans, which can be rolled over. The company also had 2.0x of available cash to short-term capital market debt in 1H20, adequate to settle the onshore and offshore bonds in the next 12 months.

Hendga's CNY130 billion pre-IPO investment, which Fitch classifies as debt, is due in January 2021. We expect Evergrande to renegotiate with Hengda's strategic investors for an extension, which should relieve short-term debt pressure.

Summary of Financial Adjustments

We reclassified Hengda's pre-IPO investment of CNY130 billion as debt.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

ESG Considerations

Evergrande and Hengda have an ESG Relevance Score of 4 for Governance Structure due to Evergrande's significant and rising non-core business investments, reflecting corporate governance risk, which has a negative impact on the credit profile, and is relevant to the ratings in conjunction with other factors.

Except for the matters discussed above, the highest level of ESG credit relevance, if present, is a score of 3. This means ESG issues are credit-neutral or have only a minimal credit impact on the entity(ies), either due to their nature or to the way in which they are being managed by the entity(ies).

For more information on our ESG Relevance Scores, visit www.fitchratings.com/esg

- senior unsecured

View additional rating details

Additional information is available on www.fitchratings.com

PARTICIPATION STATUS

The rated entity (and/or its agents) or, in the case of structured finance, one or more of the transaction parties participated in the rating process except that the following issuer(s), if any, did not participate in the rating process, or provide additional information, beyond the issuer’s available public disclosure.

Applicable Criteria

- Corporates Notching and Recovery Ratings Criteria - Effective from 14 October 2019 to 9 April 2021 (pub. 14 Oct 2019) (including rating assumption sensitivity)

- Corporate Hybrids Treatment and Notching Criteria - Effective from 11 November 2019 to 12 November 2020 (pub. 11 Nov 2019)

- Country-Specific Treatment of Recovery Ratings Rating Criteria - Effective from 27 February 2020 to 5 January 2021 (pub. 27 Feb 2020)

- Corporate Rating Criteria - Effective from 1 May 2020 to 21 December 2020 (pub. 01 May 2020) (including rating assumption sensitivity)

Applicable Models

Numbers in parentheses accompanying applicable model(s) contain hyperlinks to criteria providing description of model(s).

- Corporate Monitoring & Forecasting Model (COMFORT Model), v7.9.0 ( 1 )

Additional Disclosures

- Dodd-Frank Rating Information Disclosure Form

- Solicitation Status

- Endorsement Policy

Type to search

Evergrande Unit Seen Missing Payments on Offshore Bonds

Some holders of us dollar bonds issued by evergrande’s scenery journey have reportedly not received interest due on nov 6. that would have kicked off a 30-day grace period for payment..

Some holders of US dollar bonds issued by China Evergrande Group ‘s unit Scenery Journey Ltd have not received interest payments due on Saturday by Monday morning in Asia, two people familiar with the matter said.

The company was due to make semi-annual coupon payments on Saturday worth a combined $82.49 million on its 13% November 2022 and 13.75% November 2023 bonds.

Non-payment of interest by November 6 would have kicked off a 30-day grace period for payment. The company has narrowly averted defaults by paying previous coupons just before the expiration of their grace periods.

One such period expires on Wednesday, November 10, for more than $148 million in coupon payments that had been due on October 11.

A spokesperson for Evergrande did not immediately respond to a request for comment. The sources could not be named as they were not authorised to speak to the media.

Reuters was unable to determine whether Evergrande has told bondholders what it planned to do regarding the coupon payment due on Saturday.

- Reuters with additional editing by Jim Pollard

Evergrande Says It Finished 184 Projects from July-Oct

China evergrande said to have made $47m coupon payment, china evergrande pledges to finish at least 31 projects.

Jim Pollard

Jim Pollard is an Australian journalist based in Thailand since 1999. He worked for News Ltd papers in Sydney, Perth, London and Melbourne before travelling through SE Asia in the late 90s. He was a senior editor at The Nation for 17+ years.

You Might also Like

Real Estate

explore the most comprehensive database

bonds globally

pricing sources

track your portfolio in the most efficient way

Bond search, excel add-in, — are you looking for the complete & verified bond data, — we have everything you need:.

full data on over 700 000 bonds, stocks & ETFs; powerful bond screener; over 350 pricing sources among stock exchanges & OTC market; ratings & financial reports; user-friendly interface; available anywhere via Website, Excel Add-in and Mobile app.

Moody's Investors Service revised outlook on Scenery Journey to negative and affirmed at "B2" (LT- local currency) credit rating

- Full name Scenery Journey Limited

- Registration country Virgin Islands, British

- Industry Domestic and Commercial Construction

Other Company's News

- Moody's Investors Service withdrew LT- local currency credit rating for Scenery Journey 12/10/2022

- Moody's Investors Service downgrades LT- local currency credit rating of Scenery Journey to "C"; outlook negative 08/09/2021

- Moody's Investors Service downgrades LT- local currency credit rating of Scenery Journey to "Caa2"; outlook negative 03/08/2021

- Moody's Investors Service downgrades LT- local currency credit rating of Scenery Journey to "B3" 01/07/2021

- Moody's Investors Service revised outlook on Scenery Journey to stable and affirmed at "B2" (LT- local currency) credit rating 17/09/2019

- Bond Search & Bond Maps

- Bond & Stock Widget

- API and Data Feed

- API directory

- Loan Search

- Loan League Tables

- Security of payments

- Cbonds Internship

- Partnership program

- League Tables Generator

- Ad placement

- Terms of use

- User Agreement (pdf)

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

The Dark True Story Behind Robert Redford’s Western Jeremiah Johnson, Explained

Legendary mountain man Jeremiah Johnson is an enduringly larger-than-life figure of the American Old West.

- Jeremiah Johnson is a gripping tale of revenge and wilderness survival, based on the larger-than-life legend of a real mountain man.

- Robert Redford delivers a captivating performance amid stunning scenery, showcasing the brutal quest for vengeance that defines Johnson.

- Redford's transition in Jeremiah Johnson marked a bold departure from his Hollywood image, resulting in a successful creative partnership.

The 1972 Western film Jeremiah Johnson stars Robert Redford as the film’s titular character, a world-weary Mexican-American War veteran who, as the film opens, attempts to adjust to the peaceful, secluded life of a mountain-man trapper in the picturesque Rocky Mountains. However, Johnson’s idyllic life is cruelly disrupted after a misunderstanding between Johnson and a native tribe results in the slaughter of Johnson’s wife and adopted son . The ensuing revenge that Johnson takes against the tribal warriors who murdered Johnson’s family forms the basis of Johnson’s legend, in which Johnson allows a lone tribal warrior to survive for the purpose of spreading the tale of Johnson’s quest for revenge.

Jeremiah Johnson is based on the extraordinary life of legendary mountain man John Jeremiah Johnson, who has been variously described by historians as being either a gallant, mild-mannered hero and practical joker or a vicious cannibal . Jeremiah Johnson marked the second collaboration between Redford and director Sydney Pollack, following the 1966 drama film This Property Is Condemned . Prior to this movie, Pollack received a Best Director Academy Award nomination for the 1969 psychological drama film They Shoot Horses, Don’t They? , while Redford achieved major film stardom with the 1969 Western buddy film Butch Cassidy and the Sundance Kid .

Regardless of the accuracy of the legend itself, Jeremiah Johnson is an impressive achievement, in which a thickly bearded Redford delivers a compelling, thoughtful performance amid breathtaking scenery. Filmed in Redford’s adopted home state of Utah, Jeremiah Johnson , like all great nature-based films, reveals the rhythms and unfolding violence of Johnson’s wilderness existence by pulling the viewer into his life.

Jeremiah Johnson Was the Ultimate Revenge Killer

The most common thread between Jeremiah Johnson and the various historical accounts of the life of the real-life Jeremiah Johnson is the brutal, enduring campaign of vengeance that Johnson wages in the film against the Crow tribal warriors who murdered Johnson’s wife, Swan, a native woman who is slaughtered in the film, along with Johnson’s fictional adopted son, as punishment for Johnson’s fateful decision to guide United States Army soldiers through sacred Crow burial ground.

The most spectacular aspects of the legend of Jeremiah Johnson are related to the particularly inventive, merciless means of killing that Johnson practiced amid his quest for revenge, in which Johnson purportedly killed and scalped more than 300 Crow tribal members over a period of approximately 25 years.

After killing and scalping the Crow members, Johnson supposedly ate their livers. Historical accounts state that Johnson devoured the Crow livers to deprive his Crow victims of the chance to enter the afterlife, since the liver, according to Crow tradition, is required in order for deceased Crow members to enter the afterlife. This earned Johnson the nickname Jeremiah “Liver-Eating” Johnson. Moreover, Johnson’s gruesome vendetta against the Crow made Johnson an object of fear and respect within both the Crow nation and the entire American Old West.

Needless to say, Robert Redford’s Johnson doesn’t engage in any acts of cannibalism in Jeremiah Johnson , in which the Crow warriors are presented as being the aggressors in their conflict with Johnson, who, much like Johnson did in real life, eventually finds it in his heart to make peace with the Crow tribe.

Every Movie Directed by Sydney Pollack, Ranked

The legend of jeremiah johnson keeps growing.

Much like American frontiersman Hugh Glass, whose harrowing story of survival is immortalized in the 2015 Western film The Revenant , the legend of Jeremiah Johnson has grown over time to mythic and outlandish proportions. It has reached the point where fact and fiction are seemingly indivisible in relation to the events of Johnson’s life. One of the most spectacular tales to be attributed to Johnson involves a supposed adventure in which Johnson traveled over 500 miles in the winter to sell whiskey to Flathead tribal members, only to be ambushed by a group of Blackfoot tribal warriors, who, after capturing Johnson, intended to sell Johnson to the Crow nation, Johnson’s mortal enemies.

However, while being held captive by the Blackfoot within a tent, a bound and naked Johnson, according to legend, broke through his bindings and subdued his Blackfoot guard, whom Johnson subsequently scalped with the guard’s knife, which Johnson then used to sever one of the guard’s legs. After escaping his imprisonment, Johnson set off into the freezing wilderness with the severed leg, which Johnson ate while making an approximately 200-mile journey on foot back to his home territory.

Robert Redford Made a Bold Transition with Jeremiah Johnson

For Robert Redford , the making of Jeremiah Johnson enabled Redford to both indulge his love of nature and shed, if only briefly, his golden boy Hollywood image. Following Jeremiah Johnson , Redford starred in the blockbuster 1973 caper film The Sting , for which Redford received his first and only acting Academy Award nomination.

Robert Redford’s 20 Best Films, Ranked by Rotten Tomatoes

The success of Jeremiah Johnson , which grossed approximately $45 million at the domestic box office against a production cost of about $3 million, heralded an enduring and successful creative partnership between Redford and director Sydney Pollack. Following this, Pollack directed Redford in the hit 1973 romantic drama film The Way We Were , followed by Three Days of the Condor , The Electric Horseman , and then Out of Africa , for which Pollack won Academy Awards for Best Director and Best Picture.

Redford formed a deep personal connection with the man whose life inspired the film. After it was revealed that Johnson, who died in 1900 in Santa Monica, California, at the age of 75, was buried in a Los Angeles cemetery, a campaign was launched in 1974 to have Johnson’s remains relocated to Cody, Wyoming, where Johnson was reburied with the epitaph John Jeremiah Liver-Eating Johnson. At the burial ceremony in Wyoming, Redford was the chief pallbearer.

Finding hope in your family’s autism journey: Cheryl Wahl

- Updated: Apr. 28, 2024, 12:31 p.m. |

- Published: Apr. 28, 2024, 12:30 p.m.

Jack Wahl enjoys a moment with his mother, Cheryl. Photo Courtesy of Cheryl Wahl

- Guest columnist, cleveland.com

Guest columnist Cheryl Wahl lives in Chagrin Falls.

There are moments in our lives that become etched in our memory, moments we never forget. Some are wonderful, joyful experiences; others might result from an emotional trauma or shock.

If you purchase a product or register for an account through a link on our site, we may receive compensation. By using this site, you consent to our User Agreement and agree that your clicks, interactions, and personal information may be collected, recorded, and/or stored by us and social media and other third-party partners in accordance with our Privacy Policy.

IMAGES

VIDEO

COMMENTS

The Scenery Journey Ltd.-Bond has a maturity date of 10/24/2022 and offers a coupon of 11.5000%. The payment of the coupon will take place 2.0 times per biannual on the 24.07.. The Scenery Journey ...

Scenery Journey Ltd was due to make semi-annual coupon payments on Saturday worth a combined $82.49 million on its 13% November 2022 and 13.75% November 2023 U.S. dollar bonds. , ... One yuan bond ...

Bondholders of notes issued by Evergrande's offshore units, Scenery Journey and Tianji Holding, will be able to exchange their existing debt for new notes with tenor of four to eight years, which ...

Two Scenery Journey dollar bonds maturing late this year jumped the most in 18 months Thursday morning, rising 3 cents to 9 cents according to data compiled by Bloomberg.

Moody's Investors Service, Inc., a wholly-owned credit rating agency subsidiary of Moody's Corporation ("MCO"), hereby discloses that most issuers of debt securities (including corporate and ...

No-one who invested in two bonds — issued by China Evergrande Group's unit Scenery Journey Ltd — had received payment as of 1am AEDT on Wednesday, a source familiar with the situation told ...

The developer's Scenery Journey Ltd. unit had two dollar-bond coupons due Nov. 6: $41.9 million on a 13% note and $40.6 million on a 13.75% bond. Coupons that come due on holidays or over ...

Scenery Journey Ltd. 13% 18/22 price in real-time (A2RTWS / XS1903671854) charts and analyses, news, key data, turnovers, company data.

SCENERY JOURNEY LTD.DL-NOTES 2018(19/22) (XS1903671854) - All master data, key figures and real-time diagram.

So the scenery journey bonds are seeing the coupon grace period coming to an end next week. And then even before then a lot of focus on Kaiser. So it has this exchange in the works a 400 million ...

Scenery Journey Ltd. 11,5% 20/22 price in real-time (A28SVS / XS2109191986) charts and analyses, news, key data, turnovers, company data.

The deadline for Evergrande subsidiary Scenery Journey to repay $82.49 million in coupon payments will come due today - Photo: Qirui/Visual China Group, via Getty Images. $82.49 million in coupon payments will come due today for China Evergrande Group's subsidiary Scenery Journey.

This covered only the bonds issued directly by the Hong Kong-listed Evergrande. Today, we take a look at bonds issued by both Evergrande (EVERRE) and Scenery Journey (TIANHL). We also walk through how much of these biggest Asian high yield funds own. Scenery's bonds have been issued with a 'keepwell agreement'.

Issue Information International bonds Tianji Holdings, 11.5% 24oct2022, USD. Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings ... SPV ratings Scenery Journey. Agency. Rating / Forecast. Scale. Date. Moody's Investors Service *** LT- local currency *** Bond classification. Senior Unsecured Registered ...

Issued through a British Virgin Islands entity called Scenery Journey, the bond uses a covenant structure which includes its onshore subsidiary Hengda Real Estate Group providing a so-called "keepwell" deed to maintain the issuer's solvency, without offering a formal guarantee. These deeds have proliferated in China's bond market in ...

The Tianji-guaranteed senior unsecured notes issued by Scenery Journey Limited have been downgraded to 'B' with a Recovery Rating of 'RR5', from 'B+' with a Recovery Rating of 'RR4', to reflect Fitch's revised rating approach, whereby the bond rating is linked to Tianji, the guarantor, rather than Hengda, the keepwell provider.

Some holders of US dollar bonds issued by China Evergrande Group's unit Scenery Journey Ltd have not received interest payments due on Saturday by Monday morning in Asia, two people familiar with the matter said.. The company was due to make semi-annual coupon payments on Saturday worth a combined $82.49 million on its 13% November 2022 and 13.75% November 2023 bonds.

ISIN XS1903671854,Issuer:Scenery Journey Limited Maturity:2022 ,CCY:USD , Sector:Financial Services, Country:Hong Kong, Find the bond info only on BondMetric.com. Toggle navigation BondMetric Beta 1.1. Email: [email protected] +44 203 371 1100 Europe +44 203 371 1100 United States ...

Dial the AT&T Direct Dial Access® code for. your location. Then, at the prompt, dial 866-330-MDYS (866-330-6397).

A bond is a form of loan: the holder of the bond being the lender (creditor) while the issuer of the bond being the borrower (debtor). The borrower guarantees to pay a fixed interest within the specified time and repay the loan on the due date to the lender. ... SCENERY JOURNEY LTD . Guarantor: MULTIPLE GUARANTORS: Maturity Date: 24/10/2022 ...

full data on over 700 000 bonds, stocks & ETFs; powerful bond screener; over 350 pricing sources among stock exchanges & OTC market; ... Moody's Investors Service revised outlook on Scenery Journey to negative and affirmed at "B2" (LT- local currency) credit rating. June 24, 2020 CBonds. Show full article:

Shifting views on economic landings may have thwarted the drop in inflation, while watching the 'dumb money' could be a smart move.

Finally, Pluto retrograde kicks off its months-long journey on May 2 in the sign of Aquarius. From May 2 to October 11, 2024, Pluto retrograde is taking us deep into the Underworld, redirecting ...

James Bond; Jurassic Park; Marvel Movies; Star Wars Movies ... thoughtful performance amid breathtaking scenery. ... which Johnson ate while making an approximately 200-mile journey on foot back ...

When you meet other parents who understand the challenges of raising a child with autism, an immediate bond is formed, writes guest columnist Cheryl Wahl.