UponArriving

$75 Southwest Priority Credit Guide [2021]

Travel credits are an easy and efficient way to cut down the annual fee of a credit card. The Southwest Priority Card offers a special $75 travel credit that can help accomplish the task of offsetting your fee to basically nothing.

But there are some rules and limitations that you need to know about with this credit, and in this article I will tell you everything you need to know.

Table of Contents

What is the $75 Southwest Priority credit?

The $75 Southwest Priority credit is a special perk offered by the Southwest Priority Credit Card that you can use to cover the cost of Southwest tickets and fees but there are some exceptions.

Keep reading below to find out more!

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Southwest Priority Credit Card

First, here’s the entire rundown of highlights for the Southwest Priority Credit Card.

- 2X Rapid Rewards on Southwest purchases

- 2X Rapid Rewards on hotel and car rental partner purchases.

- 1X Rapid Rewards on all other purchases

- $75 Southwest annual travel credit

- 7,500 anniversary points each year

- Four Upgraded Boardings per year when available.

- 20% back on in-flight drinks, WiFi, messaging, and movies

- No foreign transaction fees

- Earn tier qualifying points towards A-list Status

- $149 annual fee applied to your first billing statement

The great thing about the $75 credit is that it is such an easy way to come out on top in value with his card.

The $149 annual fee can be offset a few different ways. Based on a Rapid Rewards valuation of 1.46 cents per point , the 7,500 anniversary points are worth ~$110.

When you add on the $75 travel credit, all of a sudden you’ve got $185 worth of value coming your way each year which is over $30 more than the annual fee!

And that is without factoring in other benefits like the upgraded boarding , savings on in-flight drinks, etc.

So for somebody who is truly interested in flying with Southwest Airlines, this card has an amazing long-term value proposition.

How to use the credit

The $75 travel credit will be automatically applied to your account after you use it. There is no need to register or to enroll.

The credit should appear on your statement as soon as you purchase posts according to the terms and conditions:

“Statement credit(s) will post to your account the same day your Southwest Airlines purchase posts to your account and will appear on your monthly credit card billing statement within 1-2 billing cycles.”

Be careful about cutting it close when it comes to using your credit at the end of the anniversary year.

That is because the credit will be issued for the year in which the transaction posts to your account.

So if you make a purchase on the last day of the anniversary year and that purchase does not post until a couple of days later, the purchase would be allocated towards the following year’s $75 credit.

Anniversary year

According to Chase, “Anniversary year means the year beginning with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that each year.”

This means that if you opened up the card on June 1, 2021 and your 12th statement closed on June 20, 2022, your next credit should reset June 20, 2023.

If you have switched to the card then the account open date is going to be the date that the switch is official within the Chase system.

So let’s say you had the Southwest Plus card originally opened on June 1, 2019. But let’s say that you switched from the Southwest Plus card to the Priority Card on July 15, 2021.

That would mean that the renewal date for the credit is going to be July 15, 2022

If you are unclear on what your anniversary date is, my recommendation would be to call Chase.

Uses for the credits?

Below are different ways that you might think about using your credit. Some of these are permitted while others are not.

Upgraded boardings to Business Select are excluded in the terms and conditions. If you’re not familiar, Southwest does not have a true business class cabin. Instead, they have a type of “business” ticket that offers following perks:

- Guaranteed A1-A15 boarding

- Fly By lane access

- Free premium drink

- 12 Rapid Rewards per dollar spent

- Fully refundable fare

While you cannot use your credit for upgraded boarding, the card does come with four upgraded boardings per year.

In-flight purchases

In-flight purchases are purchases like alcoholic beverages and Wi-Fi.

Keep in mind that Southwest will give you free snacks and drinks on many flights so there would be no need to use your credit in some cases.

Related: How to get a free drink coupon on Southwest

When you use Rapid Rewards to book a Southwest flight, you will always be subject to fees. These fees can range from $5.60 all the way up to $100 or more if you are flying to certain international destinations .

There are multiple reports of people using their credit to cover these fees so it seems like a commonly accepted way to cash out on your credit.

Many people have had success using the credit on gift card purchases. Personally, I would recommend going with an e-gift card.

Using travel credits on gift cards is not always a guaranteed successful outcome so always be prepared for the possibility that your credit may not trigger after a gift card purchase.

Southwest EarlyBird

Southwest EarlyBird automatically checks you in 36 hours prior to your departure.

It is a great way to ensure that you will get a good seat, such as a window or aisle seat. However, it will not guarantee you a boarding position in the group a boarding.

According to multiple reports online, the credit can successfully be used for Southwest EarlyBird.

The $75 credit is issued on an anniversary year basis.

According to the terms and conditions, purchases made for upgraded boardings are excluded.

Yes, many people have reported success when using the credit to cover a Southwest EarlyBird purchase.

Yes, many people have had success using the credit for gift cards.

The Southwest Priority $75 travel credit is a great perk because it is easy to use and can be used on a wide variety of expenses that go even beyond airfare. Together with the other perks like the anniversary points and upgraded boarding passes, you can quickly offset the annual fee for this credit card.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo . He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio .

Hi Daniel. Unless Chase screwed up, I believe the $75.00 annual travel credit is per calendar year based on my recent experience. The reason being is my annual membership renewed on Oct 1, 2022, and I received a $75 travel credit on Oct 20 for a flight booked on Oct 12. And today (Feb 16, 2023) I received a second $75 travel credit for a flight booked on Feb 9.

If have a Premier card and want to update to priority, can we keep the same account number?

Can the annual $75 credit be carried forward to the next year? Let’s say by booking a flight worth $100 and cancelling it to get a Southwest voucher?

Comments are closed.

Privacy Overview

- opens in a new window View account activity

- opens in a new window Set up personalized alerts

- opens in a new window Schedule automatic payments

- opens in a new window Add authorized users

- opens in the same window Download the Chase Mobile ℠ App

- opens in a new window Go paperless

- opens in a new window Learn more about contactless

- opens in a new window View your Rewards Dashboard

- opens overlay Check your points balance

- opens overlay Buy points for your next flight

- opens overlay Visit our interactive destination map

- opens overlay Download the Southwest Airlines ® App

- opens overlay Rapid Rewards Shopping ®

- opens overlay Rapid Rewards Dining ®

- opens overlay Southwest Vacations ®

- opens overlay Southwest ® gift cards

- opens in a new window Chase Online ℠ Log in | opens in a new window Not a Cardmember?

- opens in the same window HOME

- opens overlay Download the Southwest Airlines ® App

- opens overlay Rapid Rewards Shopping ® Shop your way to more points at hundreds of online merchants

- opens overlay Rapid Rewards Dining ® Enjoy extra points with every meal

- opens overlay Southwest Vacations ® Earn points when you use your card

- opens overlay Southwest ® gift cards Earn points when you use your card

- opens in the same window PROMOTIONS

- opens in same window EVENTS

- opens in the same window FAQs

Consumer Card Frequently Asked Questions

Yes! Here’s how your Southwest Rapid Rewards ® Priority, Premier, or Plus Credit Card points add up: footnote reference *

- 3 points per $1 spent on Southwest purchases as a Southwest Rapid Rewards Priority or Premier Cardmember

- 2 points per $1 spent on Southwest purchases as a Southwest Rapid Rewards Plus Cardmember

- 2 points per $1 spent on Rapid Rewards hotel and car rental partner purchases

- 2 points per $1 spent on local transit and commuting, including rideshare

- 2 points per $1 spent internet, cable, and phone services, and select streaming

- 1 point per $1 spent on all other purchases made with your card

Not a Southwest Rapid Rewards Priority, Premier, or Plus Credit Cardmember? Call 1-800-792-0001 1-800-792-0001 to confirm the points earned for your card.

Points earned on purchases appear in your Rapid Rewards account up to 30 days after your statement cycle date.

Log in to your Rapid Rewards account at opens overlay Southwest.com ® to see the points you've earned.

opens overlay See a list of partner(s).

Use your card and book directly with our partner(s) or through opens overlay Southwest.com ® to earn 2 points per $1 spent. footnote reference *

The number of points needed for a reward flight depends on the fare. Just like fares, reward flight pricing can vary based on destination, time, day of travel, demand, fare class, point redemption rate, and other factors and is subject to change.

In addition to being awarded with flights, you can use your points for international flights, hotel stays, car rentals, gift cards, and more. View all your redemption options opens overlay here .

As a Southwest Rapid Rewards Cardmember, you can now keep track of all the points you've earned so far this year with your card. You can also see the benefits and perks that come with your card.

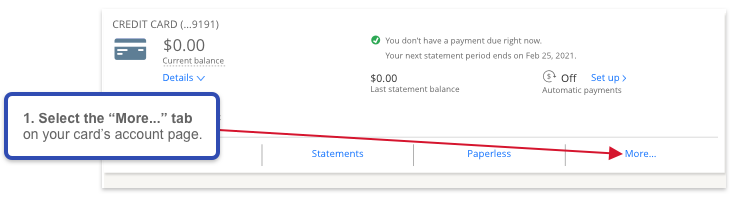

Find your Rewards Dashboard by viewing your Southwest Rapid Rewards Credit Card account on Chase.com:

Illustrative Example Only

Tier qualifying points (TQPs) are earned from revenue flights or through the Southwest Rapid Rewards Priority and Premier Credit Cards from Chase.

Cardmembers can earn 1,500 TQPs toward A-List status for every $5,000 spent in purchases annually—with no limit on the amount of TQPs you can earn. footnote reference *

Points earned via Rapid Rewards partner(s)–with the exception of the Rapid Rewards Priority and Premier Credit Cards from Chase-purchased points, bonus points, or points earned via a promotion are not tier qualifying points and do not count toward tier qualification.

You need 35,000 tier qualifying points or 20 one-way qualifying flights per calendar year to qualify for A-List status. A-List Members enjoy:

- Priority boarding

- Priority check-in and security lane access footnote reference *

- 25% more Rapid Rewards points earned on each flight

- Same-day standby footnote reference *

- Dedicated A-List Members phone line

Companion Pass is the benefit that allows you to choose one person to fly with you, free of airline charges (does not include taxes and fees from $5.60 one-way) every time you purchase or redeem points for a flight. All points earned with your Rapid Rewards Credit Card count toward Companion Pass.

Remember, as an exclusive benefit, Rapid Rewards Credit Cardmembers will receive a boost of 10,000 Companion Pass qualifying points every year.

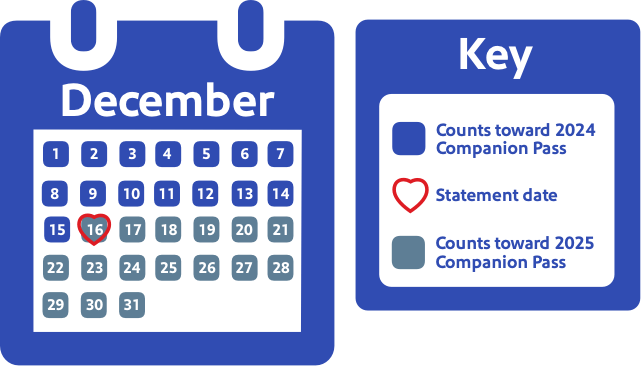

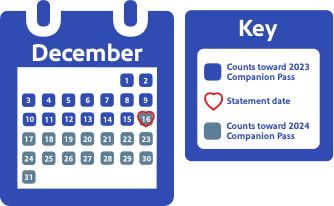

Your December statement closing date is the cutoff for purchases made with your Rapid Rewards Credit Card to count towards a Companion Pass for that calendar year.

For example, if your December statement closes on December 16, points for purchases posted to your statements made after that date will not count toward qualifying points for the year.

Yes, it's easy to pay your bills online and set up one-time or recurring payments footnote reference * . opens in a new window Log in to your account to get started.

No, but letting Chase know when you're on the go—domestically or abroad—can help us identify the transactions as yours. Consumer Cardmembers can opens in a new window set travel notifications online.

You can call the number on the back of your card to learn more about requesting a credit line increase to help you enjoy more purchasing power.

To upgrade to a Rapid Rewards Premier or Priority Credit Card, call 1-800-792-0001 1-800-792-0001 .

The Rapid Rewards Premier Credit Card comes with a $99 annual fee; but it also includes 6,000 anniversary bonus points, 2 EarlyBird Check-In per year, and 25% back on inflight purchases.

The Rapid Rewards Priority Credit Card comes with a $149 annual fee; but it also includes 7,500 anniversary points, $75 Southwest annual travel credit, 4 Upgraded Boardings per year when available, and 25% back on inflight purchases.

You’ll receive a letter explaining the new annual fee and when it will apply, as well as your right to reject the change to your product and the associated annual fee.

It may take up to four business days for your upgrade request to be approved and new benefits to take effect. As long as you continue to meet our credit criteria, your new card will arrive within 7 to 12 business days after the upgrade is approved. You will also receive new cards for any authorized users on this account within 7 to 12 business days.

Yes, for your convenience your credit card account number will not change; but the expiration date and CVV/security code on the back of your card may change. So you should double-check any automatic payments to make sure they are set up correctly.

Of course! Any points you've earned to date will transfer automatically to your newly upgraded account. You will not lose any points as a result of this upgrade.

Business Card Frequently Asked Questions

Yes! Here’s how your Southwest Rapid Rewards ® Performance Business Card points add up: footnote reference *

- 4 points per $1 spent on Southwest purchases

- 3 points per $1 spent on Rapid Rewards hotel and car rental partner purchases

- 2 points for each $1 spent on purchases in the following rewards categories: advertising purchases made with social media sites and search engines; internet, cable, and phone services

If you’re a Southwest Rapid Rewards Premier or Plus Business Cardmember, here’s how your points add up: footnote reference *

- 3 points per $1 spent on Southwest purchases as a Southwest Rapid Rewards Premier Business Cardmember

- 2 points per $1 spent on Southwest purchases as a Southwest Rapid Rewards Plus Business Cardmember

Not a Southwest Rapid Rewards Performance or Premier Business Credit Card Cardmember? Call 1-800-792-0001 1-800-792-0001 to confirm the points earned for your card.

For more information about Chase rewards categories, see opens in a new window chase.com/RewardsCategoryFAQs

Tier qualifying points (TQPs) are earned from revenue flights or through the Southwest Rapid Rewards Premier Business and Performance Business Credit Cards from Chase.

Points earned via Rapid Rewards partner(s)–with the exception of the Rapid Rewards Premier Business and Performance Business Credit Cards from Chase-purchased points, bonus points, or points earned via a promotion are not tier qualifying points and do not count toward tier qualification.

Yes, it's easy to pay your bills online and set up one-time or recurring payments. footnote reference * opens in a new window Log in to your account to get started.

You, as the Authorizing Officer of the account can add employee cards by opens in a new window logging in online . footnote reference *

You can call the number on the back of your card to learn more about requesting a credit line increase to help you enjoy more purchasing power for your business.

To upgrade your Rapid Rewards Business Credit Card, call 1-800-346-5538 1-800-346-5538 .

The Rapid Rewards business credit cards come with varying fees. If you are upgrading to the Rapid Rewards Premier Business Credit Card, your fee will increase to $99 ; but it also includes 6,000 anniversary points, 2 EarlyBird Check-In per year, $500 fee credit for points transfers per year, and 25% back on inflight purchases.

If you are upgrading to the Rapid Rewards Performance Business Credit Card, your fee will increase to $199 ; but it also includes 9,000 anniversary points, 4 Upgraded Boardings per year when available, Global Entry or TSA PreCheck ® fee credit, Inflight WiFi Credits, and $500 fee credit for points transfers per year.

* TERMS AND CONDITIONS

Earning Points: See your Card Rewards Program Agreement for more details.

Tier Qualifying Points For Consumer Cards: Tier qualifying points (TQPs) are earned from revenue flights booked through Southwest Airlines ® or when you, or an authorized user, use the eligible Southwest Rapid Rewards ® Credit Card from Chase to make purchases of products and services, minus returns or refunds. (You’ll earn 1,500 for each $5,000 in purchases annually. “Annually” means the year beginning with your account open date through the first December statement date of that same year, and each 12 billing cycles starting after your December statement date through the following December statement date.) TQPs earned during a billing cycle on a eligible Southwest Rapid Rewards ® Credit Card from Chase are not available for qualification for benefits such as A-List and A-List Preferred status until they are posted to your Rapid Rewards ® account. The following will not count toward qualification for A-List or A-List Preferred status: Rapid Rewards program enrollment points; Rapid Rewards reward flights; Rapid Rewards Companion Pass ® travel; Rapid Rewards partner points except for TQPs earned on the eligible Southwest Rapid Rewards ® Credit Card from Chase; Rapid Rewards bonus points, unless specifically designated as such; non-revenue travel, unless specifically designated as eligible; stops at intermediate cities on connecting or through flights; and charter flights. TQPs are not redeemable for travel on Southwest ® or through the “More Rewards” site. Eligible credit cards: Southwest Rapid Rewards ® Premier Credit Card or Southwest Rapid Rewards ® Priority Credit Card.

Tier Qualifying Points For Business Cards: Tier qualifying points (TQPs) are earned from revenue flights booked through Southwest Airlines ® or when you, or an employee, use the eligible Southwest Rapid Rewards ® Credit Card from Chase to make purchases of products and services, minus returns or refunds. (You’ll earn 1,500 for each $5,000 in purchases annually. “Annually” means the year beginning with your account open date through the first December statement date of that same year, and each 12 billing cycles starting after your December statement date through the following December statement date.) TQPs earned during a billing cycle on a eligible Southwest Rapid Rewards ® Credit Card from Chase are not available for qualification for benefits such as A-List and A-List Preferred status until they are posted to your Rapid Rewards ® account. The following will not count toward qualification for A-List or A-List Preferred status: Rapid Rewards program enrollment points; Rapid Rewards reward flights; Rapid Rewards Companion Pass ® travel; Rapid Rewards partner points except for TQPs earned on the eligible Southwest Rapid Rewards ® Credit Card from Chase; Rapid Rewards bonus points, unless specifically designated as such; non-revenue travel, unless specifically designated as eligible; stops at intermediate cities on connecting or through flights; and charter flights. TQPs are not redeemable for travel on Southwest ® or through the “More Rewards” site. Eligible credit cards: Southwest Rapid Rewards ® Premier Business Credit Card or Southwest Rapid Rewards ® Performance Business Credit Card.

Priority Check In And Security Lane Access: For a complete list of available Fly By ® locations, visit opens overlay Southwest.com/flyby .

Same-Day Standby: If there’s an open seat on a different flight that departs on the same calendar day as your original flight and it’s between the same cities, A-List and A-List Preferred Members can get a seat on the new flight free of airline charges. If there isn’t an open seat on this different flight, you can ask a Southwest Gate Agent to add you to the same-day standby list for a flight between the same city pairs that departs on the same calendar day prior to your originally scheduled flight, and you will receive a message if you are cleared on the flight. For both the same-day change and same-day standby benefits, you must change your flight or request to be added to the same-day standby list at least 10 minutes prior to the scheduled departure of your original flight or the no-show policy will apply. Based on the flight status contact preference selected during booking, the message regarding your standby status will be an email or text message with a link to access the boarding pass via the Southwest app, mobile web, or you can visit a Southwest Gate Agent to print off the boarding pass. If there are any government taxes and fees associated with these itinerary changes, you will be required to pay those. Your original boarding position is not guaranteed. Important: These benefits are available only by seeing a Southwest Gate Agent or calling 1-800-I-FLY-SWA ® . If you change your flight through any other channel or to a flight that does not meet the requirements outlined above, you will be responsible for the difference in price. If an A-List or A-List Preferred Member is traveling on a multiple-Passenger reservation, same-day standby and same-day change will not be provided for non-A-List or non-A-List Preferred Members in the same reservation. For A-List and A-List Preferred Members who have also qualified for a Companion Pass ® , A-List, and A-List Preferred benefits are not available to the Companion unless the Companion is also an A-List or A-List Preferred Member.

Companion Pass Qualifying Points: Companion Pass ® qualifying points are earned from revenue flights booked through Southwest ® , points earned on Rapid Rewards ® Credit Cards, and base points earned from Rapid Rewards partners. The following do not count as Companion Pass qualifying points: purchased points; points transferred between Members; points converted from hotel and car loyalty programs, e-Rewards ® , Valued Opinions, and Diners Club ® ; points earned from Rapid Rewards program enrollment, tier bonus points; flight bonus points; and partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase). No points nor tier or Companion Pass qualifying points will be awarded for flights taken by the Companion when flying on a Companion Pass reservation. Points earned during a billing cycle on a Southwest Airlines Rapid Rewards Credit Card from Chase are not available for redemption or qualification for Companion Pass status until they are posted on your billing statement and posted to your Rapid Rewards account. Only points posted on your billing statements and posted to your Rapid Rewards account during the same calendar year are available for qualification for Companion Pass status. For example, if you make a purchase after your December billing statement cycle date, the points on those purchases will not count toward Companion Pass status in the year the purchase was made; they will appear on your January billing statement and post to your Rapid Rewards account in January. Companion Pass Qualifying Points Boost: As a Southwest Rapid Rewards Cardmember, you will earn one boost of 10,000 Companion Pass qualifying points each calendar year. The boost will be deposited into your eligible Rapid Rewards account by January 31st each calendar year or up to 30 days after account opening. To receive Companion Pass qualifying points boost your credit card account must be open and not in default at the time of fulfillment. Only one credit card account per Southwest Rapid Rewards Member (Rapid Rewards Member must be the primary Cardmember on that account), is eligible for one boost of 10,000 Companion Pass qualifying points per calendar year. JPMorgan Chase Bank, N.A. is not responsible for the provision of, or failure to provide, the stated benefits and services.

Paying Bills Online And Automatic Payments: Please contact your service merchant for details on any fees that may be associated with paying your bill using a credit card.

Adding An Employee Card: If any employees are allowed to use the account, they will be authorized users and will have equal charging privileges unless individual spending limits are established for them. You, as the Authorizing Officer, together with the business are responsible for any use of the account by you, an authorized user or anyone else permitted to use the account. You, together with the business, are responsible for repaying all balances on the account. All correspondence, including statements and notifications, will be sent to you as the Authorizing Officer. By requesting to add an employee cardholder to the account, you represent all information provided is accurate and is for persons with which the business has a relationship. You also represent that the business has permission to provide the employee information to Chase and to add the employee as a cardholder. If Chase determines any information provided is fraudulent, Chase has the right to close the account.

SOUTHWEST RAPID REWARDS ® PROGRAM INFORMATION The Southwest Rapid Rewards Credit Card is brought to you by Southwest Airlines ® and Chase. Southwest Airlines is responsible for the redemption of Rapid Rewards points toward benefits and services. The number of points needed for a particular Southwest flight is set by Southwest ® and will vary depending on destination, time, day of travel, demand, fare type, point redemption rate, and other factors, and are subject to change at any time until the booking is confirmed. Rapid Rewards points can only be transferred to the primary Cardmember’s Rapid Rewards account. All Rapid Rewards rules and regulations apply and can be found at opens overlay Southwest.com/rrterms . Southwest reserves the right to amend, suspend, or change the program and/or program rules at any time without notice. Rapid Rewards Members do not acquire property rights in accrued points.

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

Southwest Rapid Rewards® Priority Credit Card

BEST FOR SOUTHWEST LOYALISTS

The Rapid Rewards Priority Card earns 3 points per dollar spent on Southwest purchases, 2 points per dollar spent on transit and commuting (including rideshares) and 2 points per dollar spent on internet, phone services, cable and select streaming services. It is Southwest’s most premium personal credit card and makes earning points on Southwest flights hassle-free. (Partner Offer)

At a glance

- 3X Earn 3X points on Southwest® purchases.

- 2X Earn 2X points on local transit and commuting, including rideshare.

- 2X Earn 2X points on internet, cable, and phone services; select streaming.

- 2X Earn 2X points on Rapid Rewards® hotel and car rental partners.

- 1X Earn 1X points on all other purchases.

- Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- 7,500 anniversary points each year.

- Earn 3X points on Southwest® purchases.

- Earn 2X points on local transit and commuting, including rideshare.

- Earn 2X points on internet, cable, and phone services; select streaming.

- $75 Southwest® travel credit each year.

- No foreign transaction fees.

- Member FDIC

TPG Editor's Rating

The Southwest Rapid Rewards Priority Card is Southwest’s most premium option and offers up to 3 points per dollar spent on Southwest purchases plus an anniversary bonus of 7,500 points. With an array of perks like a $75 annual Southwest travel credit, four upgraded boardings per year, 25% inflight savings and the ability to earn Tier Qualifying Points with spending, loyal Southwest flyers should have the Priority card in their wallet.

- $75 annual Southwest travel credit

- Four upgraded boardings every year

- 7,500 points on each cardmember anniversary

- 25% inflight discount on food, drinks and WiFi

- Ability to earn A-List status faster by spending on this card

- Travel and purchase protections through Chase

- $149 annual fee

Who is this card good for?

The Southwest Rapid Rewards Priority Card is best for regular Southwest flyers who will benefit from the travel credit, upgraded boarding and elite status boosts. It’s especially good for anyone aiming for A-List status and can provide great value for anyone living near a Southwest hub.

Earning Rewards

You’ll earn your rewards in the form of Rapid Rewards points. Earn 3 points per dollar spent on Southwest purchases, 2 points per dollar spent on transit and commuting (including rideshares) and 2 points per dollar spent on internet, phone services, cable and select streaming services, 2 points per dollar on Rapid Rewards hotel and car rental partners, as well as 1 point per dollar spent on all other purchases.

Advertiser Disclosure

Many of the credit card offers that appear on the website are from credit card companies from which ThePointsGuy.com receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). This site does not include all credit card companies or all available credit card offers. Please view our advertising policy page for more information.

Editorial Note: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

3 Perks I’d Love To See With the Potential Southwest Card Changes

Katie Seemann

Senior Content Contributor and News Editor

373 Published Articles 66 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Stella Shon

Senior Features Editor

120 Published Articles 802 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Jestan Mendame

Compliance Associate

106 Edited Articles

Countries Visited: 12 U.S. States Visited: 3

Table of Contents

Overview of southwest credit cards, what could change about southwest credit cards, what’s on my southwest credit card wishlist, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If there’s one thing that divides travelers, it’s whether or not they like the Southwest Airlines boarding process. I’ve been on both sides of the spectrum. Open seating was great when my daughter was young, but now that I have American Airlines elite status and have gotten used to priority boarding and sitting in the front, I’m not a fan.

Ultimately, though, this debate no longer matters. Southwest recently announced that it will switch to assigned seats and add premium extended legroom seats, blurring the lines between them and legacy carriers like American and United.

So, what does this have to do with Southwest credit cards? A lot, actually. As it stands, some of the most useful perks on these cards include upgraded boarding and EarlyBird check-in credits. Since these will be eliminated, it’s reasonable to expect that Southwest will also take this opportunity to overhaul other aspects of the cards.

Let’s review what we know so far and speculate about what changes might be coming.

Southwest Airlines offers a mix of 5 credit cards — 3 consumer and 2 business cards. Here’s a quick look at those offerings, along with each card’s most valuable benefits:

- Southwest Rapid Rewards ® Plus Credit Card : 3,000 anniversary points, 2 EarlyBird check-ins

- Southwest Rapid Rewards ® Premier Credit Card : 6,000 anniversary points, 2 EarlyBird check-ins

- Southwest Rapid Rewards ® Priority Credit Card : 7,500 anniversary points, $75 annual Southwest travel credit, 4 upgraded boardings

- Southwest ® Rapid Rewards ® Premier Business Credit Card : 6,000 anniversary points, 2 EarlyBird check-ins

- Southwest ® Rapid Rewards ® Performance Business Credit Card : 9,000 anniversary points, 4 upgraded boardings, 365 Wi-Fi credits per year, earn 4x points on Southwest flights

All Southwest credit cards have a 10,000-point Companion Pass qualifying points boost. This means that if you have any Southwest card, you only need to earn 125,000 points to get a Companion Pass instead of 135,000 points. This 10,000-point boost is applied once yearly regardless of how many Southwest cards you have, and these aren’t redeemable Rapid Rewards points .

Currently, frequent and even occasional Southwest flyers can find value by having 1 or more Southwest credit cards in their wallet.

However, some of these perks, including complimentary EarlyBird check-In and upgraded boarding will be obsolete once the airline introduces its new boarding process and assigned seating . That means changes are definitely coming to Southwest credit cards to ensure that the perks are worthwhile.

It has also been reported that Southwest has even sent out surveys to select cardholders with some possible changes. Here are some of the ideas included in that survey:

- Increase the annual fees

- Eliminate anniversary points

- Add a discount on point redemptions

- Add an early boarding or seat upgrade benefit

Obviously, I don’t want to see higher annual fees. However, it wouldn’t necessarily be a surprising move as many issuers have increased their annual fees over recent years.

That said, the possibility of eliminating anniversary points is bad news for consumers. These points, which are awarded each year after the card’s anniversary, offer automatic value and makes it easier to justify annual fees year after year. Plus, they do count toward earning the Southwest Companion Pass , which is a nice little bonus.

Eliminating the anniversary points would make it easier for many customers (including me) to cancel the card when the annual fee is due.

Discount on Award Flights: Good or Bad?

Offering point redemption discounts to credit card customers isn’t a new idea. Most Delta credit cards offer a 15% savings on award redemptions , and United cardholders often have access to more award inventory.

It could be possible that a discount on point redemptions would replace the anniversary points. Depending on the discount, this perk could easily be worth more than the anniversary points, but it would require you to actually redeem your points to get value. That won’t be a problem for many frequent Southwest flyers, but I prefer the ease of getting anniversary points.

So far, in 2024, I’ve redeemed about 63,000 Southwest points. A 15% rebate would be worth 9,450 points. However, with the current anniversary points perk, I earn 16,500 points per year (9,000 from the Southwest Performance Business card and 7,500 from the Southwest Priority card), so a 15% points discount would work out to be less valuable for me.

Of course, depending on how the Southwest cards are changed, I might not keep 2 credit cards long-term, so a possible award redemption discount could be a decent value going forward.

1. Premium Seat Coupons

Since the EarlyBird check-in and upgraded boarding perks will soon become futile, I’d love to see them replaced with premium seat credits. I’d happily take 4 premium legroom seat credits per year rather than upgraded boarding credits per year.

Whether or not this is realistic is anyone’s guess. Other airline credit cards don’t offer seat upgrade coupons, so this would be a unique perk that could really add value to Southwest credit cards. However it’s probably more realistic that access to these seats will be added as a perk of holding Southwest elite status .

2. Upgraded Boarding Group

Other airline credit cards offer some type of priority boarding for cardholders, and I hope Southwest adds this perk. I like being able to get on the plane early so I don’t have to worry about overhead bin space. I’m sure priority boarding will be added as a perk of Southwest elite status, but I’d also love to see this introduced as a credit card benefit.

3. Better Earning Categories

The current bonus categories on Southwest credit cards are underwhelming, so I’d love to see them revamped. The consumer cards earn 2 points per dollar spent on categories like Rapid Rewards hotel and car rental purchases, local transit and commuting, internet, cable, phone services, and select streaming. Yawn.

Most people probably don’t spend big money in these categories, so points don’t add up quickly . Now, change that 2x category (or better yet, 3x) to groceries and restaurants, and you have my attention. I don’t think this is unreasonable, either.

Earlier this year, I was targeted for a promotion to earn 3x points per dollar spent on gas stations, grocery stores, and dining for the rest of the year on the Southwest Priority card.

That made spending on Southwest cards much more appealing — earning 3x points while finishing my Companion Pass qualification earlier this year was great.

The official Southwest credit card changes haven’t been announced yet. However, we can expect to see card updates once Southwest’s new assigned seating system is implemented.

Southwest Airlines recently announced changes to its longstanding open seating policy, switching to assigned seats and adding extra legroom seats. This will undoubtedly lead to changes for Southwest credit cards since they currently offer upgraded boarding and EarlyBird check-in perks.

While we don’t know yet what these changes will be, it’s fun to imagine what might be coming. While I’d love to see 8x points per dollar on all purchases, automatic elite status, and a 50% award redemption discount, that’s likely not going to happen. More realistically, we’ll probably see annual fee adjustments, some type of priority boarding group, and maybe even preferred seat coupons.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Credit Cards

Financial planning.

- Cheapest Car Insurance

- Cheapest Full Coverage Car Insurance

- Car Insurance Cost Calculator

- Best Car Insurance

- Compare Car Insurance Costs

- Average Cost of Car Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Best Life Insurance Companies

- Best Universal Life Insurance

- Best Life Insurance for Seniors

- Compare Quotes

- Best Auto and Home Insurance Bundle

- Homeowners Insurance

- Renters Insurance

- Health Insurance

- Pet Insurance

- Small Business Insurance

Insurance Guidance

- Conventional Mortgages

- Jumbo Loans

- Best HELOC Loans and Rates

- Get a HELOC With Bad Credit

- Pay Off Your Mortgage With a HELOC

- Pros and Cons of HELOCs

- The HELOC Approval Process

- Mortgage Payment Calculator

- Reverse Mortgage Calculator

- FHA vs. Conventional Loan Calculator

- Private Mortgage Insurance Calculator

- Debt-to-Income Ratio Calculator

Mortgage Guidance

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Travel Rewards Credit Cards

- Best Airline Credit Cards

- Best Credit Cards for Excellent Credit

- Best Business Credit Cards

- Best American Express Cards

- Best Capital One Credit Cards

- Best Chase Credit Cards

- Best Citi Credit Cards

- Best Bank of America Credit Cards

- Cash Back Calculator

- Pros and Cons of Balance Transfers

- Practical Guide for Improving Credit Fast

- Average Credit Score by Age

- Credit Cards For Bad Debt

- Credit Card Glossary

Recent Credit Card Reviews & Comparisons

- Best Personal Loans of 2024

- Best Personal Loans for Excellent Credit

- Best Personal Loans for Good Credit

- Best Personal Loans for Bad Credit

- Best Same-Day Approval Loans

- Best Personal Loans for Debt Consolidation

- Best Private Student Loans

- Best Student Loans for Bad Credit

- Best Student Loans for International Students

- Best Low-Interest Student Loans

- Best Student Loans Without a Co-Signer

- Personal Loan Calculator

- Auto Loan Calculator

- Student Loan Calculator

- How to Calculate Loan Payments

- Can You Get a Personal Loan With Bad Credit?

Loans Guidance

- Compound Interest Calculator

- Cost of Living Calculator

- Financial Literacy Handbook

- Guide to Retirement Planning

- Ultimate Guide to Budgeting

- Understanding Types of Debt

- How to Pay Down Student Loan Debt

- How to Start Saving & Investing

- Should You Rent or Buy a House

- How to Pay for College

- Guide to Buying a Car

- Guide to Negotiating Salary

- Safest Cities in America

- Top Cities for Job Seekers

- Most & Least Tax-Friendly States

- Most Dangerous Days for DUIs

Southwest Rapid Rewards® Premier Credit Card Review: High Rewards and All the Southwest Perks

It lets you earn high rewards on Southwest flights, a generous sign up bonus and anniversary points. It’s a solid card, but if you’re already a Southwest loyalist, consider upgrading to its pricier version.

Doug Milnes, CFA

Head of Credit Cards at MoneyGeek

Doug Milnes is a CFA charter holder with over 10 years of experience in corporate finance and the Head of Credit Cards at MoneyGeek. Formerly, he performed valuations for Duff and Phelps and financial planning and analysis for various companies. His analysis has been cited by U.S. News and World Report, The Hill, the Los Angeles Times, The New York Times and many other outlets. Milnes holds a master’s degree in data science from Northwestern University. He geeks out on helping people feel on top of their credit card use, from managing debt to optimizing rewards.

Updated: September 3, 2024

Advertising & Editorial Disclosure

- Detailed Review

- Points Earning and Redemption

- How the Card Compares

- Pairing with Other Cards

- Should You Get It?

MoneyGeek partners with leading industry experts and advertisers to help you get to your financial happy place. Our content is accurate when posted but offers may change over time. We may receive compensation for partner advertisements, but our editorial team independently reviews and ranks products. Learn more about our editorial policies .

The Southwest Rapid Rewards® Premier Credit Card is great for frequent Southwest travelers looking to maximize rewards from their flights. It offers high rewards on Southwest and other travel-related purchases, a generous welcome bonus and anniversary points. It also lets you earn points towards Southwest’s elite status, including the highly-coveted Companion Pass (that allows your companion to fly for free, excluding taxes).

It’s mid-tier among the carrier’s co-branded cards, and it used to stand out for having an outsized sign-up bonus. However, due to recent changes that leveled the welcome bonus of all Southwest cards to 50,000 points, the Rapid Rewards Premier lost its primary appeal. Although the Southwest Rapid Rewards® Priority Credit Card is the best option for frequent travelers, this card can still be a good choice for Southwest loyalists.

If you frequently fly Southwest, the Rapid Rewards Premier offers several benefits. It comes with a generous welcome bonus, high rewards on Southwest purchases and the ability to earn Companion Pass and elite status points. However, it comes with an annual fee, and its pricier version may provide better value.

- High rewards on Southwest purchases

- Generous welcome bonus

- No foreign transaction fees

- Anniversary bonus points

- Earns points towards elite status

- With annual fee

- Limited bonus categories

- Non-transferrable points

- Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- 6,000 anniversary points each year.

- Earn 3X points on Southwest® purchases.

- Earn 2X points on local transit and commuting, including rideshare.

- Earn 2X points on internet, cable, and phone services; select streaming.

- 2 EarlyBird Check-In® each year.

- Earn 10,000 Companion Pass® qualifying points every year.

- Earn 1,500 Total Qualifying Points for every $5,000 spent in purchases, which goes towards your A-list status.

- No foreign transaction fees.

- Member FDIC

Rapid Rewards Premier Detailed Review

The Rapid Rewards Premier card is a solid choice if you’re a frequent Southwest flier looking to get the most rewards from your purchases. With a generous 50,000-point welcome bonus after spending $1,000 in the first 3 months and 3X points on Southwest purchases (plus other travel categories), it offers great value for regular travelers.

This card also helps you earn qualifying points for Southwest’s elite status, including the Companion Pass. Plus, it includes perks like anniversary points, EarlyBird Check-Ins and no foreign transaction fees. However, it comes with a $99 annual fee.

Since the sign-up bonus dropped from 85,000 points to 50,000 points, the Rapid Rewards Premier is somewhat overshadowed by the more expensive Rapid Rewards Priority card. The Priority card offers a yearly travel credit and more anniversary points, which can offset its higher annual fee. Nonetheless, the Rapid Rewards Premier is a great option if you want to maximize Southwest benefits but aren’t sure you’ll fully use the Rapid Rewards Priority’s yearly travel credit.

Rapid Rewards Points Earning and Redemption

The Rapid Rewards Premier’s rewards program is tailored for frequent Southwest flyers. You can earn points on Southwest flights and various travel-related categories, making it a versatile option for travelers.

Here’s the rewards rate you get for various spending categories:

- Southwest purchases : 3X points

- Rapid Rewards hotel and car rental partners : 2X points

- Local transit and commuting (including rideshare) : 2X points

- Internet, cable, and phone services; select streaming : 2X points

- All other purchases : 1X points

Your Southwest points are most valuable when you redeem them for Southwest flights, giving you 1.4 cents per point . While you can also use them for gift cards, merchandise, car rentals and hotel stays, these options don’t offer as much value as flights do. Southwest points aren’t transferable to other airline and hotel loyalty programs.

When you fly Southwest, you automatically earn Rapid Rewards points on your ticket. The points you earn range from 6x to 24x of the fare price, depending on the type of ticket you book and status level you may have. The points you earn with a Southwest credit card are added on top of those points.

Does It Earn Companion Pass and A-List Status Points?

The Rapid Rewards Premier lets you earn qualifying points for Southwest’s elite programs.

Companion Pass

Earning points for Companion Pass is simple, since all the points you earn with the Rapid Rewards Premier count toward this total. This includes the card’s 50,000 bonus points (after spending $1,000 in three months) and the 6,000 Companion Pass points boost you earn yearly.

The Companion Pass is Southwest's most-coveted perk, allowing you to bring a designated person along for free (excluding taxes and fees) whenever you book a Southwest flight with cash or points. To qualify, you need to earn 135,000 points or take 100 one-way flights in a calendar year. Once earned, the Companion Pass is valid for the rest of the year and the entire following year.

A-List and A-List Preferred

You earn 1,500 tier qualifying points (TQPs) for every $5,000 you spend with the Rapid Rewards Premier. These TQPs go towards your eligibility for either an A-List Status or an A-List Preferred. Here are the benefits you can expect from these programs:

- A-List Status : A-List status gives you perks like priority boarding, priority check-in, access to expedited security lanes, dedicated customer service contacts and a 25% bonus on points earned from each flight. To qualify, you need to fly 25 one-way flights or earn 35,000 TQPs in a year.

- A-List Preferred : A-List Preferred offers everything in A-List plus extras like free in-flight WiFi and a 100% bonus on points earned from flights. To reach this status, you need to fly 50 one-way flights or earn 70,000 TQPs in a year. This status is perfect for those who travel regularly with Southwest and want to get the most out of their flights.

Benefits and Perks

The Rapid Rewards Premier offers several valuable perks for frequent Southwest flyers.

Generous Welcome Bonus . The card offers a substantial welcome bonus of 50,000 points after spending $1,000 in the first three months. This is worth $700 if redeemed for Southwest flights and a huge boost towards your Companion Pass requirements.

High Rewards . Booking Southwest flights using the card lets you earn 3X points. Meanwhile, you get 2X points on local transit, internet, phone services, select streaming and Rapid Rewards hotel and car rental partners. These are the same bonus categories as the pricier Rapid Rewards Priority.

Anniversary Bonus Points . Each year, you earn 6,000 points during your card’s anniversary. These points are worth $84 if used for Southwest flights, which can nearly offset the card’s $99 annual fee. You also earn 10,000 bonus Companion Pass points annually, which can help make attaining that high-value perk.

No Foreign Transaction Fees . You can use the card internationally without worrying about additional fees.

Earns Points Towards Elite Status . The card allows you to earn 1,500 Tier Qualifying Points (TQPs) for every $5,000 you spend. These TQPs count toward your eligibility for A-List and A-List Preferred, Southwest’s elite status programs. If you're a frequent Southwest traveler, these benefits can make your journeys smoother and more rewarding.

Travel Perks . The card comes with two EarlyBird Check-Ins each year, which ensures priority boarding and a better chance at securing your preferred seat. It also gives you 25% back on inflight purchases. Notably, it comes with a free lost luggage reimbursement and baggage delay insurance, providing financial protection and peace of mind in case of travel mishaps.

Drawbacks and Considerations

Before applying for the Rapid Rewards Premier, keep these drawbacks in mind:

Annual Fee . The card has a $99 annual fee. While your rewards can help offset this cost, it’s still an upfront expense to consider. If you want to earn Southwest points with a lower fee, the Southwest Rapid Rewards® Plus Credit Card might be a better fit.

Limited Bonus Categories . Purchases outside the card’s bonus categories only earn 1X points. While it offers strong rewards on Southwest flights and other travel-related expenses, it falls short in everyday categories like dining and groceries. If you prefer a travel card that also rewards common spending, the Chase Sapphire Preferred Card is worth considering.

Non-Transferable Points . The Rapid Rewards points earned with this card can’t be transferred to other airline or hotel loyalty programs. This limits your options if you want to use your points to book flights with other carriers, especially for international travel to destinations like Tokyo or Paris.

How Rapid Rewards Premier Compares To Other Cards

We break down the differences between the Rapid Rewards Premier and other Southwest cards to help you pick which works best for your needs.

To help you decide if the Rapid Rewards Premier is a good fit, we compare it with another airline card.

Southwest Rapid Rewards® Premier Credit Card vs Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card offers more versatile rewards, with 5x points on travel booked through Chase Travel, 3x points on dining and online groceries and 2x points on other travel purchases. It earns Chase Ultimate Rewards points, which you can transfer to many popular airline and hotel loyalty programs, including Southwest. With a slightly lower annual fee of $94 and greater flexibility for travelers, the Chase Sapphire Preferred is a strong alternative to the Rapid Rewards Premier.

Cards You Can Pair with Rapid Rewards Premier

Pairing with the blue cash everyday® card.

Pairing the Rapid Rewards Premier with a no-annual-fee cash back card can be a smart way to maximize your rewards. The Blue Cash Everyday® Card from American Express is a great option, offering 3% cash back at U.S. supermarkets, online retail purchases and gas stations. By using the Blue Cash Everyday for your everyday spending and the Rapid Rewards Premier for travel-related expenses, you can optimize both your cash back and travel rewards. This strategy allows you to make the most of your purchases without having to juggle multiple annual fees, giving you the best of both worlds in rewards and savings.

Is Rapid Rewards Premier Worth Getting?

The Rapid Rewards Premier is a great option for Southwest loyalists who want to earn strong rewards on their flights. It offers valuable access and boosts toward the Companion Pass and the airline’s elite status programs, along with a 3x rewards rate on Southwest purchases.

However, if you’re confident you can use the yearly $75 Southwest travel credit, the Southwest Rapid Rewards® Priority Credit Card might be a better fit. It offers enhanced benefits and perks, and the travel credit can help offset the $50 increase in the annual fee, making it a more attractive option for frequent travelers. Choosing between these cards depends on how much value you can extract from those extra perks.

Rapid Rewards Premier Card Details

How we evaluated rapid rewards premier.

We evaluated the Southwest Rapid Rewards® Premier Credit Card by reviewing 20 cards and focusing on key features. The evaluation criteria and their weights are as follows:

- Expected Value to Traveler (40%): Measures the expected monetary value of rewards and perks minus the annual fees for a frequent traveler.

- Airline Scope (20%): Rates the number of destinations the airline flies to, which is crucial for frequent travelers.

- Offer ROI (15%): Evaluates the return on investment from the introductory bonus offers.

- Foreign Transaction Fees (5%): Rates the absence of foreign transaction fees, beneficial for international travelers.

- Issuer Satisfaction (5%): Based on JD Power issuer satisfaction study, reflecting customer satisfaction with the card issuer.

- Recommended Credit (5%): Indicates the credit score range required for approval, with higher scores being more inclusive.

About Doug Milnes, CFA

Doug Milnes is a CFA charter holder with over 10 years of experience in corporate finance and the Head of Credit Cards at MoneyGeek. Formerly, he performed valuations for Duff and Phelps and financial planning and analysis for various companies. His analysis has been cited by U.S. News and World Report, The Hill, the Los Angeles Times, The New York Times and many other outlets.

Milnes holds a master’s degree in data science from Northwestern University. He geeks out on helping people feel on top of their credit card use, from managing debt to optimizing rewards.

- American Express . " Blue Cash Everyday® Card ." Accessed August 15, 2024 .

- Chase . " Chase Sapphire Preferred Credit Card ." Accessed August 15, 2024 .

- Chase . " Southwest Rapid Rewards Plus Credit Card ." Accessed August 15, 2024 .

- Chase . " Southwest Rapid Rewards Premier Credit Card ." Accessed August 15, 2024 .

- Chase . " Southwest Rapid Rewards Priority Credit Card ." Accessed August 15, 2024 .

- Car Insurance

- Home Insurance

- Rental Insurance

- Life Insurance

- Refinancing

- Conventional Loan

- Business Credit Cards

- Student Credit Cards

- Balance Transfer Cards

- Credit Cards with Rewards

- Travel Credit Cards

- Cash Back Credit Cards

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Dog Insurance

- Senior Dog Insurance

- Exotic Pet Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- Cat vaccinations cost

- Dog vaccinations cost

- Dog dental cleaning cost

- Dog cataract surgery cost

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- Chase Ultimate Rewards Guide

- Capital One Rewards Guide

- Amex Membership Rewards Guide

- All Credit Card Guides

- Raisin (SaveBetter) Interest Rates

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- UFB Direct Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- How much will $1,000 earn in a HYSA?

- How much will $10,000 make in a HYSA?

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Is Savings Account Interest Taxable?

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- Best Money Market Accounts

- U.S. Bank Money Market Account

- Money Market vs. Savings Account

- How much will $10,000 make in a MMA?

- Best CD Rates

- Best 1-Year CD Rates

- Best 6-Month CD Rates

- Best 3-Month CD Rates

- 6% CD Rates

- How much will a $10,000 CD earn?

- How much will a $50,000 CD earn?

- Synchrony Bank CD Rates

- Capital One CD Rates

- Barclays CD Rates

- How To Get A Loan

- Loan Interest Calculator

- How To Prequalify for a Personal Loan

- What is a Payday Loan?

- How To Get a Loan With No Credit History

- Financial Hardship Loans

- Low-Income Personal Loans

- No Credit Check Loans

- Why Can't I Get a Loan?

- Cash Advance Apps

- Credit Cards

- Chase Credit Cards

- Southwest Priority Card

On This Page

- Key takeaways

- Southwest Rapid Rewards ® Priority Credit Card Review

- Southwest Rapid Rewards ® Priority Credit Card Rewards

- Southwest Rapid Rewards ® Priority Credit Card Benefits

- Southwest Rapid Rewards ® Priority Credit Card The fine print

- Southwest Rapid Rewards ® Priority Credit Card Drawbacks

How Southwest Rapid Rewards ® Priority Credit Card compares

Should you get the southwest rapid rewards ® priority credit card, southwest rapid rewards ® priority credit card: faqs.

Southwest Rapid Rewards ® Priority Credit Card: Strong Perks for Southwest Loyalists

- What we think: The Southwest Rapid Rewards ® Priority Credit Card is a strong pick for Southwest Airlines loyalists who were already going to book regardless of card-related incentives. While an annual fee and lackluster transfer partners detract slightly from its shine, the card offers straightforward point accumulation and redemption.

- Cardholders can enjoy a $75 annual Southwest ® travel credit, a benefit that offsets over half of the annual fee.

- Save money in the air with 25% back on inflight purchases.

- There are no foreign transaction fees with the Rapid Rewards Priority card.

- For every $5,000 you spend per year, you can earn 1,500 TQPs (tier qualifying points), boosting you toward achieving A-List status.

The Southwest Rapid Rewards ® Priority Credit Card is Southwest’s most elite personal card. Ideal for frequent Southwest flyers, it offers cap-free rewards and a generous sign-on bonus. Points are fairly easy to earn and manage with this card. However, a higher fee than many of its peer cards makes it less attractive than a general travel credit card if you’re not a Southwest loyalist already.

Keep reading for an in-depth review of the Southwest Priority Card to discover how you’ll earn reward miles, what cashing in your points looks like and all of the benefits to see if this is the best credit card for you.

Southwest Rapid Rewards ® Priority Credit Card: Review

Is the southwest priority card worth it.

If you’re already locked in with Southwest and fly frequently, the Southwest Rapid Rewards Priority card can definitely be worth it. However, if you currently fly with other airlines regularly, you’ll need to become a Southwest convert to make this card worth it.

Ultimately, whether this airline credit card is a good choice comes down to how often you fly with Southwest, how frequently you travel and if you can utilize the benefits. The Rapid Rewards Priority card also has an annual fee of $149. That means you’ll need to earn more than $150 in points to actually see the value.

Southwest Rapid Rewards ® Priority Credit Card: Highlights

Here’s a rundown of Rapid Rewards Priority’s key points:

- Annual fee: $149 per year.

- Reward rate: 3X per dollar spent on Southwest purchases, 2X per dollar on Rapid Rewards hotel and car rental partner purchases, 2X per dollar on transit and commuting (includes ride-share), 2X per dollar on tech (internet, phone, cable and select streaming services) and 1X back on all other purchases.

- Welcome offer: Earn 50,000 bonus points after spending $1,000 on qualifying purchases in the first three months.

- Key perks: Other perks include $75 annual Southwest credit, 25% back on in-flight Southwest purchases, the ability to earn a free Companion Pass, a 7,500-point anniversary bonus and availability-based credit for up to four upgraded boardings per year.

- Drawbacks: The annual fee of $149 and perks that only matter if you fly with Southwest frequently.

Who is the Southwest Rapid Rewards ® Priority Credit Card best for?

The Southwest Priority card is for Southwest loyalists with frequent-to-heavy travel habits, as they can benefit the most from the 3X points on Southwest purchases, baggage delay insurance, lost luggage reimbursement and generous cash back on in-flight purchases.

Frequent spenders can also get on the fast track to A-List status in the Rapid Rewards loyalty program by earning 1,500 tier-qualifying points (TQPs) for every $5,000 spent per year.

Southwest Rapid Rewards ® Priority Credit Card: Rewards

Earning rewards.

Earning rewards with this Chase credit card is pretty straightforward:

- 3X points on Southwest purchases: Get 3 points per dollar on Southwest purchases, including flights, inflight purchases, gift cards and vacation packages.

- 2X points on Rapid Reward hotel and car rentals: Perfect for trips away, you’ll earn 2 points per dollar spent on hotels and car rentals.

- 2X points on local transit and commuting: This includes rideshare, trains, buses, taxis, tolls and parking - ideal for local commuters.

- 2X points on internet, cable and phone services: You’ll get double points on your digital services and select streaming services.

- 1X points on all other purchases: You’ll earn points at a 1:1 ratio for everything else not listed above.

Redeeming rewards

With this rewards credit card , there are several ways to redeem your points:

- Southwest flights: Use your points to redeem Southwest flights at a typical value of 1.3 cents per point. There are also no blackout dates, which means you can use your points whenever you want.

- Non-Southwest international flights: Although you can redeem your points with non-Southwest flights, the value of points drops significantly compared to redeeming for Southwest flights.

- Statement credits: Points can turn into statement credits by selecting qualifying transactions posted to your account within the last 90 days.

- Hotel stays and car rentals: Use your Rapid Rewards points and the Southwest travel portal to book your hotels and car rentals.

- Other purchases: You can also redeem your points for gift cards, merchandise and Rapid Rewards Access Events. However, the value of your points using these redemption options isn’t worth the most here.

Welcome offer

The Southwest Rapid Rewards Priority Credit Card sign-on bonus offers 50,000 bonus points after spending $1,000 on purchases in the first three months.

Among welcome offers, this is a very “doable” one. While not a jaw-dropping bonus amount, you’ll probably find the relief of not having to stretch spending to meet a goal satisfying.

Southwest Rapid Rewards ® Priority Credit Card: Benefits

Travel benefits.

- Annual travel credit: Get a $75 annual Southwest travel credit to be applied however you like (excludes boarding upgrades and in-flight purchases).

- Discount on in-flight purchases: Cardholders get 25% off drinks, food, internet and other in-flight purchases on Southwest flights.

- Upgraded boarding passes: Cardholders get annual credits for up to four upgraded boardings.

- Travel accident insurance: Depending on if you’re approved for the Visa Signature or Visa Platinum, you could receive accidental death or dismemberment coverage of up to $500,000.

- Lost luggage reimbursement: Have peace of mind if your luggage or the luggage of an immediate family member is damaged or lost by the carrier, as you’re covered up to $3,000.

- Baggage delay insurance: If your baggage is delayed by over six hours, you’ll be reimbursed for any essential purchases made up to $100 a day for three days.

- Travel and emergency assistance: A benefit only included if you’re approved for the Visa Signature - if you have an issue away from home, you can call the Benefit Administrator for legal and medical assistance. You will need to pay the cost of any goods or services obtained, however.

- Auto rental collision damage waiver: Decline the rental company’s collision insurance and charge the cost to your card to be covered.

- Roadside dispatch: 24/7 roadside assistance to help with anything from flat tyres to vehicle lockouts. You will have to pay a fee for this service.

Shopping benefits

- Extended warranty protection: Get an extra year of warranty on eligible warranties of three years or less.

- Purchase protection: Use your card to buy an eligible item and get coverage for 120 days against damage or theft of the item up to $500 per claim and $50,000 per account.

- Anniversary bonus: Cardholders get 7,500 points every account anniversary.

Other perks

- Southwest A-List status 2X faster: Earn 1,500 tier-qualifying points toward A-List status for every $5,000 spent in purchases each year with no annual limits.

- Companion status boost: Get 10,000 Companion Pass qualifying points every year that can be applied toward free travel for a guest.

Southwest Rapid Rewards ® Priority Credit Card: The fine print

- Annual fee: $149 per year

- Foreign transaction fee: None

- Late payment fee: Up to $40

- Cash advance fee: $10 or 5% of the amount of each transaction, whichever is greater

Interest rates

- Regular APR: 21.49% - 28.49% variable APR

- Cash advance APR: 29.99% variable APR

- Intro APR offer: None

Credit limit

The Rapid Rewards Priority card has a starting credit limit of $2,000. However, that can increase based on a cardholder’s creditworthiness. Having a lower ceiling on this card can make it difficult to accrue the points necessary for the big selling point, which is Companion Pass eligibility. You’ll need 135,000 qualifying points in a calendar year to qualify for the Companion Pass.

Southwest Rapid Rewards ® Priority Credit Card: Drawbacks

Higher annual fee.

The Rapid Rewards Priority card has a higher annual fee than peers offering similar points. While $149 doesn’t put this card in the same space as premium credit cards with $300+ annual fees, you must earn $149 in perks before this card becomes worthwhile.

Lacks direct dining perks

While some travel cards have special categories for dining or groceries, the Southwest Rapid Rewards Priority doesn’t. However, cardholders can link this card with a Rapid Rewards Dining membership for free to earn 3 points per dollar if they opt-in for email communication.

No lounge access

The Southwest Rapid Rewards Priority is not a card with airport lounge access . This is disappointing for a card molded specifically for Southwest “super travelers.” As the most premium Southwest card, Priority would have been the only hope for lounge access. While there are some rumors that Priority Pass perks are coming in the future, nothing has been confirmed.

No special travel perks

For a card that caters to frequent Southwest passengers, Rapid Rewards Priority holds back on convenience-adding perks for travelers. There are no statement credits or discounts for TSA PreCheck or Global Entry .

The lack of airline transfer partners is also disappointing. While you can transfer points to hotel loyalty programs, the list is limited to Choice Hotels, Best Western, World of Hyatt, Marriott Bonvoy and MGM Rewards.

Southwest Rapid Rewards ® Priority Credit Card vs. Southwest Rapid Rewards ® Plus Credit Card

Southwest Rapid Rewards ® Plus Credit Card is the lowest-tier card in the Rapid Rewards roster. For a $69 annual fee, you’re keeping all of the rewards earned with the Southwest Priority apart from the 3X rewards on Southwest purchases, which are downgraded to 2X.

Early boarding passes, 25% off in-flight purchases and 10,000 Companion Pass qualifying points annually are also included with the Rapid Rewards Plus. However, the Rapid Rewards bonus anniversary points drop from 7,500 to 3,000 with this card.

Another major downfall is that the Southwest Rapid Rewards ® Plus also tacks on a 3% foreign transaction fee, compared to the Rapid Rewards Priority, which has no foreign transaction fees.

Southwest Rapid Rewards ® Priority Credit Card vs. Capital One Venture Rewards Credit Card