Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Dream, discover, book with Chase Travel

Go further when you book with Chase Travel

Competitive rates.

Take advantage of competitive rates at thousands of hotels and resorts, with no booking fees.

Seamless booking

Smoothly plan and book your whole trip, from coveted hotels and convenient flights to cars and must-do local experiences.

Premium benefits

Make the most of your card rewards. Access exclusive benefits and earn and redeem like never before.

Find inspiration

Don’t just dream it. Discover your next adventure with help from fresh trip recommendations and curated picks for unforgettable stays.

Get rewarded

Earn and redeem Ultimate Rewards points with your eligible Chase card, including Chase Sapphire, Freedom, Ink Business credit cards and more.

Earn up to 8,000 bonus points or more

Eligible cardmembers can purchase a trip through Chase Travel with their eligible Chase credit card and get rewarded with 5,000 bonus Ultimate Rewards points when purchasing 2 qualifying travel components, or 8,000 when purchasing 3. Choose from hotels, flights, cars and cruises.

Haven’t traveled with us in a while? You may be eligible for an extra 2,000 bonus points.

Activate and book March 1 to May 31, 2024 for stays through the end of the year.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

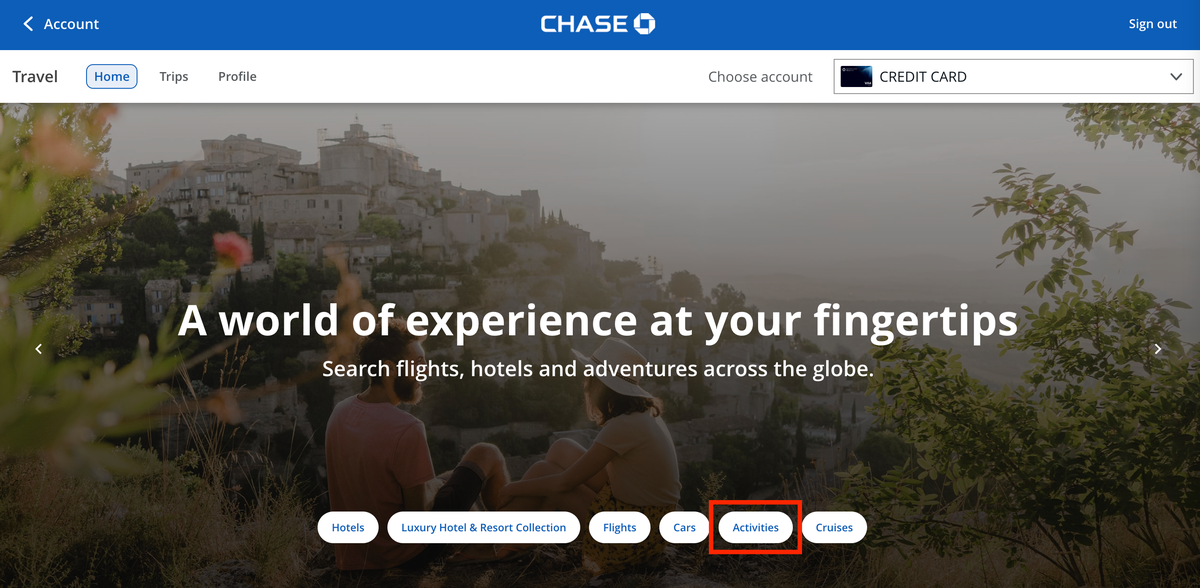

How to use the chase travel portal, you can use chase points to book flights, hotels, car rentals and more through its travel portal..

With the right amount of planning, it's possible to book your entire vacation, including flights , hotels , cruises , car rentals , tours and other activities, entirely on points through the Chase Travel SM portal.

But are you getting the best deal by doing this instead of transferring Chase Ultimate Rewards® points to travel partners and booking directly? It turns out there's a lot more to consider — everything from travel date flexibility and brand variety to the credit card you're using — if you want to get more value for your points by booking through Chase Travel SM .

Below, CNBC Select breaks down the best ways to book flights, hotels, cruises, tours and vacation activities through the Chase Travel SM portal with Ultimate Rewards® points.

How to use the Chase Travel SM Portal

- How to earn and redeem Chase Ultimate Rewards points

- How to get started with the Chase Travel portal

- How to book flights through the Chase Travel portal

How to book rental cars, cruises, and other travel activities

What to know about chase's airport lounges, bottom line, how to earn and redeem chase ultimate rewards® points.

To access Chase Travel SM , you'll need to have a credit card that earns Chase Ultimate Rewards® points, like the Chase Sapphire Preferred® Card , Chase Sapphire Reserve® , Ink Business Preferred® Credit Card , Ink Business Unlimited® Credit Card , Ink Business Cash® Credit Card , Chase Freedom Unlimited® or Chase Freedom Flex® .

The easiest way to earn Chase Ultimate Rewards points quickly is by taking advantage of the lucrative welcome bonuses offered by certain rewards cards:

- You'll earn 75,000 points by signing up for the Chase Sapphire Preferred and spending $4,000 within the first three months of opening your account. That's worth over $900 when redeemed through Chase Travel SM

- With the Ink Business Preferred Credit Card 's welcome bonus, you'll earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel SM.

- The Chase Sapphire Reserve 's welcome bonus gives you 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. That's worth $1,125 when redeemed through Chase Travel SM .

The card you're using to redeem Chase Ultimate Rewards points will also affect your point redemption value . For instance, if you're using the Chase Sapphire Preferred to book through the Chase Travel SM portal, points are worth 25% more (1.25 cents per point). But if you're booking through Chase Travel SM with the Chase Sapphire Reserve , points are worth 50% more (1.5 cents per point) — the other $0 annual fee Chase cards each carry a redemption rate of 1 cent per point.

That means the bonus points you'd earn from either the Chase Sapphire Preferred's welcome bonus is worth over $900 towards travel and the Chase Sapphire Reserve's is worth $1,125 towards travel.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

Ink Business Preferred® Credit Card

Earn 3X points per $1 on the first $150,000 spent in combined purchases in select categories each account anniversary year (travel; shipping purchases; internet, cable and phone services; and advertising purchases with social media sites and search engines), 1X point per $1 on all other purchases

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

21.24% - 26.24% variable

Good/Excellent

Read our Ink Business Preferred® Credit Card review.

Chase Sapphire Reserve®

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

22.49% - 29.49% variable

5%, minimum $5

Read our Chase Sapphire Reserve® review.

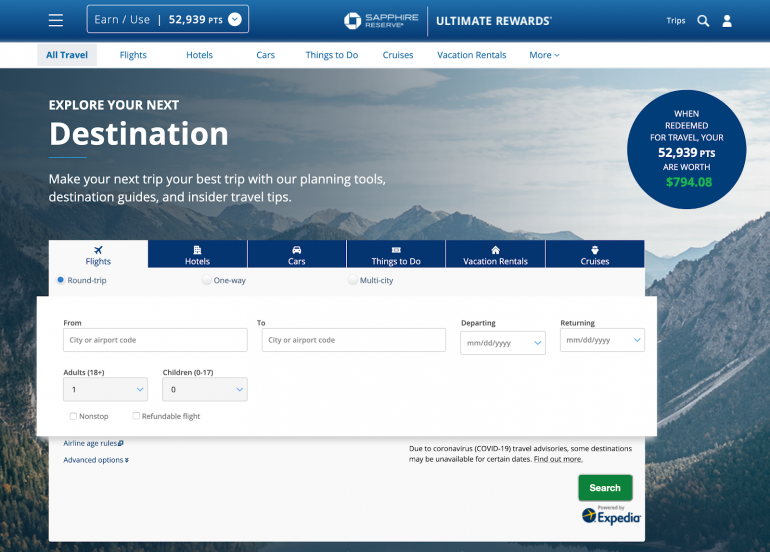

How to get started with the Chase TravelSM portal

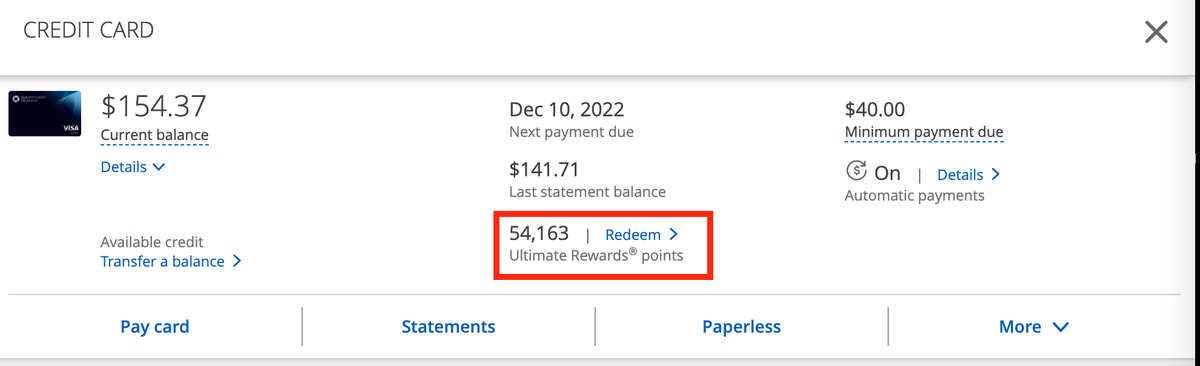

To reach the Chase Travel SM portal, log into your Chase account, then click the area near the right side of the screen where it says the amount of your Chase Ultimate Rewards points. Depending on how many Chase credit cards you have, you may be asked to choose which one you want to proceed with.

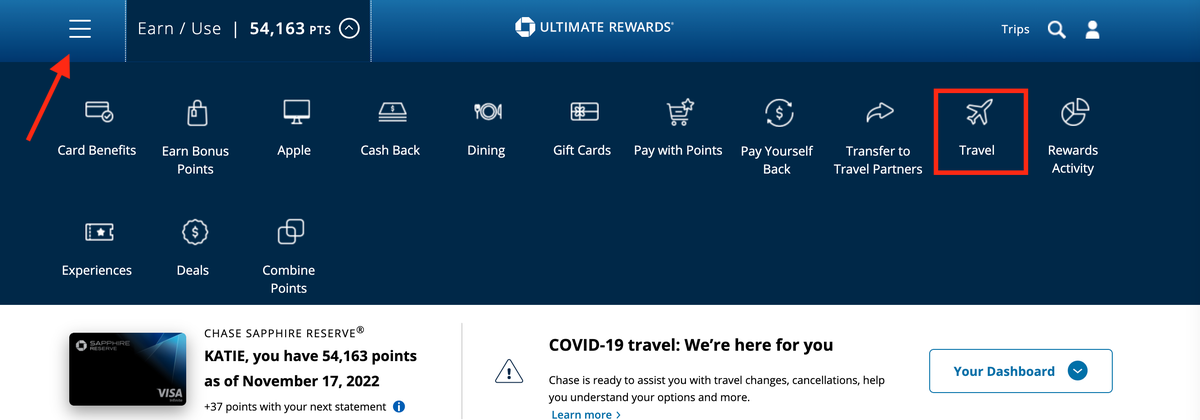

The next screen is your credit card's main dashboard, showing how many Ultimate Rewards points you currently have, as well as any deals or bonus opportunities. On the top of the page, you'll see several menus with redemption options.

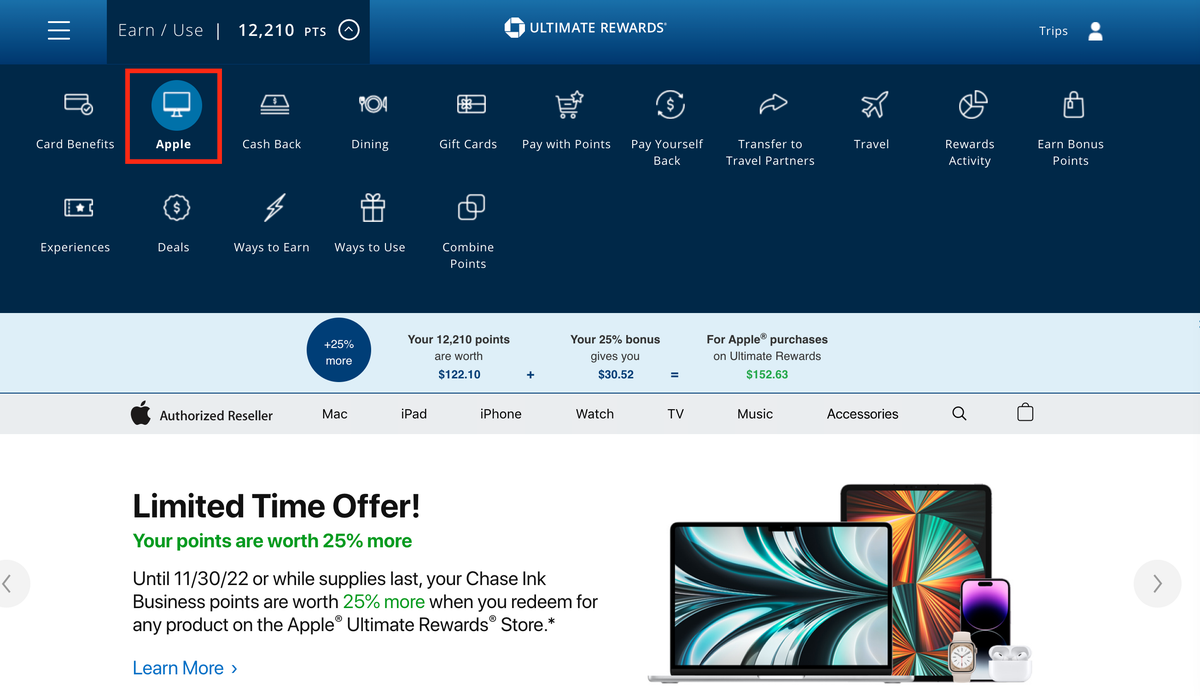

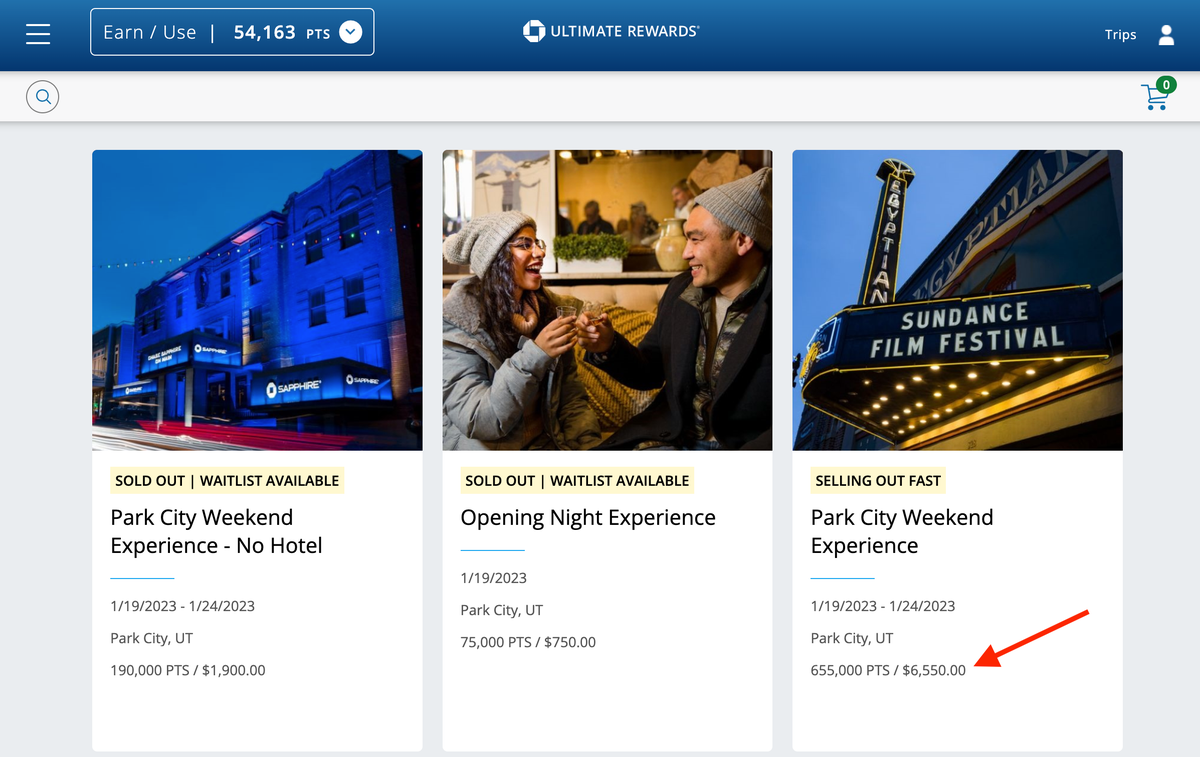

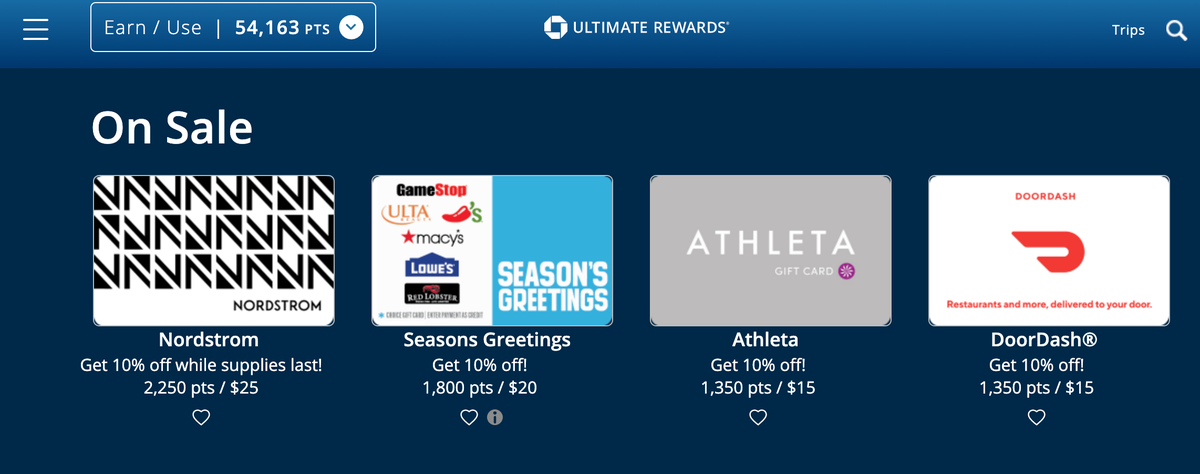

While not the best redemption in terms of overall value, you could choose to use your Chase points for Apple and Amazon purchases, cash them in for gift cards and experiences. You can transfer points directly to one of Chase's 14 travel partners if you have a specific flight or hotel in mind. Otherwise, click "book travel" to enter the Chase Travel SM portal.

From here, you'll be able to search for flights, hotels, rental cars, activities and cruises. Simply choose your category, plug in your desired dates and details, and book with points, cash or some combination of the two.

Chase's travel partner programs

Currently, you can transfer your points to the following airline and hotel programs:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United Airlines MileagePlus

- Virgin Atlantic Flying Club

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

How to book flights through the Chase TravelSM portal

There are a few pros and cons to consider when booking flights through the Chase Travel SM portal. You won't have to worry about blackout dates or limited award availability, which makes it great if you're not flexible with dates and flight times. Just make sure you compare the number of points needed through the Chase Travel SM portal with how many points the airline would require if you were using its own miles, especially if you're hunting for a good deal on economy seats.

The catch with using the Chase Travel SM portal is you won't be able to shop for tickets on low-cost carriers like Spirit Airlines, Frontier Airlines, or Allegiant Air — you can search for flights on Alaska, Southwest, Delta, JetBlue, American, and United. You'll also be able to book flights on most international carriers.

Remember that you can still earn miles and elite credits on flights, as tickets booked through the Chase Travel SM portal are categorized as "paid" rather than as an award flight since you're "paying" for them with points instead of cash. Consider the taxes and fees you might have to pay if you were to transfer the points straight to one of Chase's travel partners versus booking directly through the portal, and to calculate and compare how many points and miles you'd earn by booking with either method.

You'll be able to search, filter, and sort by price, airline, booking class, departure time, arrival time, and departure airport. For this example, below, consider a round-trip flight from Seattle to Austin booked through the travel portal with a Chase Sapphire Preferred Card (redemptions are worth 1.25 cents per point):

Results included 107 results with an economy mix-and-match United and Delta fare for $370 or about 29,600 points being the most affordable option. For comparison's sake, the points price is about the same as what United and Delta are currently charging if you were to book the awards directly through the airlines, but Delta isn't a transfer partner of Chase. You also won't earn miles if you were to book these awards through the airlines, whereas you will earn miles when booking through Chase.

To finish booking your flight through the travel portal, select your route(s), review the details, choose how many points you'd like to use and complete your purchase.

Remember that if you're booking with money rather than points, you can earn extra rewards on your booking. In our example, if you paid $370 for a flight, you'd earn 1,850 Ultimate Rewards points with your Chase Sapphire Preferred or Reserve card. Either card earns 5X points on flight purchases through Chase Travel SM .

Booking travel with Southwest

In 2023, Chase also added the ability to use Ultimate Rewards points to book Southwest flights directly through the issuer's travel portal. To do so, simply search for the flight using the process described above. Your search results will only show Wanna Get Away and Wanna Get Away Plus fares. However, when you proceed with the booking, you'll also have the option to select an Anytime or Business Select fare.

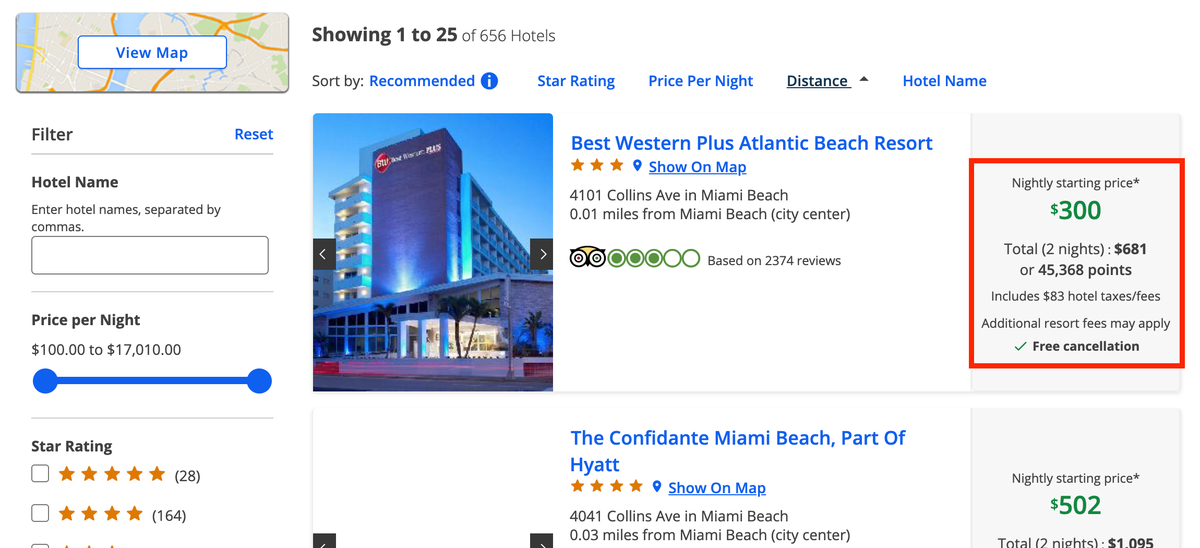

How to book hotels through the Chase TravelSM portal

While the best redemption rates are usually realized when you transfer Chase Ultimate Rewards points at a 1:1 ratio to hotel partner World of Hyatt, if you're not a huge fan of chain hotels or prefer boutiques or brands like Hilton, Choice Hotels, or Wyndham, it can be a good idea to book them through the travel portal.

As with flights, you won't have to worry about blackout dates or limited award night availability. However, keep in mind that hotels treat the Chase Travel SM portal as a third-party booking agency, so you won't be able to earn hotel points on stays as you might by booking your stay directly with the hotel.

Hyatt hotels usually offer better deals when you book directly, and since it's one of Chase's hotel partners, you can transfer UR points instantly at a 1:1 ratio. Marriott and IHG are usually more varied, so you may score a better deal by booking via the Chase Travel SM portal instead of transferring points over. For this reason, it's a good idea to ring up how much your hotel stay would cost in points through the portal as well as the hotel's website.

Start by searching by destination so you can see a list of all the available hotels. For this example, let's try looking for hotels in downtown Austin. Once the results appear, you'll be able to narrow down your search with filters based on price, star ratings, guest ratings, amenities and neighborhood.

Let's go over a couple of options within the Chase Travel SM portal, each booked with a Chase Sapphire Preferred credit card. One option is the Four Seasons Hotel Austin, which is listed for $556 or about 44,500 points per night through Chase. If you book through Four Seasons, directly, you'll pay $561 per night. The hotel chain also doesn't have a rewards program but going through Chase provides a way to pay with points.

Another example is the Hyatt Place Austin Downtown for $288 or about 23,000 points per night through Chase. If you were to book this directly through Hyatt, you'd pay $279 per night as a member of its loyalty program or just 15,000 World of Hyatt points per night if you booked with points. Since you can transfer your Ultimate Rewards points to Hyatt at a 1:1 ratio, in this case, transferring would make more sense.

As you can see, it's worth comparing points required by the travel portal and each hotel's website, as the time of year, location, and other factors may play a part in pricing. To book your stay through the travel portal, select your room type, review the details, choose how many points you'd like to use and complete your purchase.

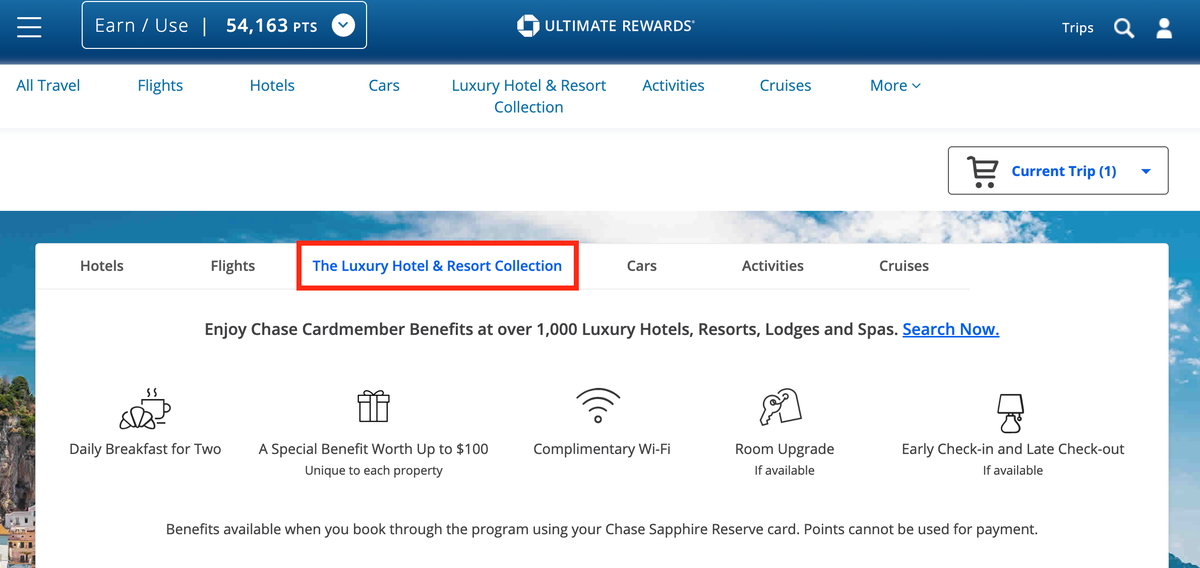

If you have the Chase Sapphire Reserve card, you also get access to The Edit by Chase Travel SM — a premium travel booking platform offering complimentary benefits at featured properties. These perks include a room upgrade (if available), $100 property credit and daily breakfast for two, to name just a few.

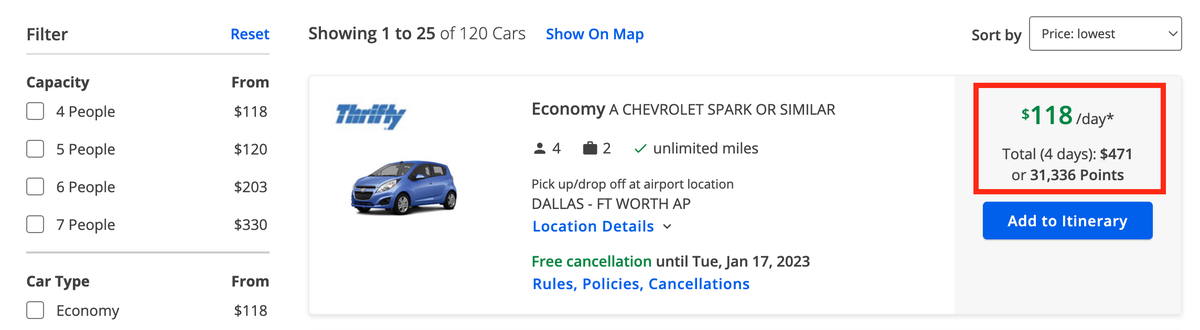

It's a pretty similar process if you want to book rental cars, tours and other travel activities through the Chase Travel SM portal. Cruises can also be booked as well, but you'll need to call.

As far as car rentals, make sure you're booking through the travel portal with points that are connected to Chase Sapphire Preferred or Chase Sapphire Reserve to take advantage of extra perks like primary rental car insurance — you'll also need to decline the rental car company's auto collision damage waiver when you book to activate this. You'll want to charge at least a few dollars to the card and not use points to cover the entire booking which ensures that you're still "paying" for the car rental with your Sapphire card, which means you'll be entitled to the card's rental car insurance.

Beyond that, simply plug in your itinerary and search. Here's an example for a rental in Austin booked with a Chase Sapphire Preferred credit card:

You'll be able to filter your search by capacity, car type, price per day, company, and car options (like air conditioning and automatic transmission). For a seven-day rental, it would cost around 24,800 points or $310 for the cheapest option. As with other travel portal purchases, you'll be able to enter how many Chase Ultimate Rewards points you wish to put toward the final price. It works the same way for booking tours and other travel activities, so you could potentially enjoy a free — or nearly free — vacation solely on Chase points if you were to plan it all out properly.

When it comes to Chase, your travel benefits don't end with booking. If you have the Chase Sapphire Reserve card, you also enroll and get access to two airport lounge networks: Priority Pass and Chase's Sapphire Lounge by The Club.

The Sapphire Lounge network officially consists of four lounges:

- Boston (BOS)

- Hong Kong (HKG)

- New York City (LGA)

- New York City (JFK)

Chase also manages and operates a lounge at Washington Dulles International Airport (IAD) on behalf of Etihad Airways. This lounge isn't branded as a full-fledged Sapphire Lounge, but it features a similar design and follows similar access rules.

Chase is planning to open four more Sapphire lounges in the future: in Las Vegas, Philadelphia, Phoenix and San Diego.

Separately, Chase Sapphire Reserve cardholders also receive access to Sapphire Terrace at the Austin-Bergstrom airport in Austin, Texas.

Priority Pass, on the other hand, is a vast network with over 1,500 airport lounges around the world.

Booking through the Chase Travel SM portal can be a great use of your Ultimate Rewards® points, but make sure to compare the rates against booking directly with an airline or hotel itself. Finally, consider transferring your points to one of Chase's travel partners, especially if you're looking to book a luxury hotel or flight in business class.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card guide is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Information about the Chase Freedom Flex ® has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

- Here are the best travel credit cards for families Jason Stauffer

- Chase Sapphire Preferred Card vs. Citi Strata Premier: Which is better for you? Jason Stauffer

- Best business credit card sign-up bonuses — get over $1,000 in value Jason Stauffer

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Maximize Chase Ultimate Rewards

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

When it comes to flexible rewards points, Chase bank's credit card rewards program, better known as Chase Ultimate Rewards®, is regarded as the gold standard by many points collectors and travelers. With excellent credit card options, powerful points earning opportunities and valuable transfer partners, there are many reasons to love this program.

Plus, Chase Ultimate Rewards® points can be more lucrative and versatile compared with other travel rewards cards.

Here's what you need to know to get the maximum value from your Chase Ultimate Rewards® points.

How to get started using your points

To begin redeeming your points, log in to your account. You can access your Chase Ultimate Rewards® account directly from your Chase online account or through this link .

Once you're logged in, you can view all redemption options through the "Earn / Use" tab in the top menu. Click it to see a drop-down menu with the various redemption options, along with some quick links to your card’s benefits, travel alerts and more.

★ LIMITED TIME OFFER

Heads up! For a limited time, both the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® are offering elevated sign-up bonuses that can be worth more than $900 for the Preferred card and more than $1,100 for the Reserve. Learn more and apply here.

Two ways to maximize Chase Ultimate Rewards® points

While booking through Chase’s online portal is the easiest way to use Chase Ultimate Rewards® for travel, this strategy may not get you the best value overall.

1. Transfer your points to a partner

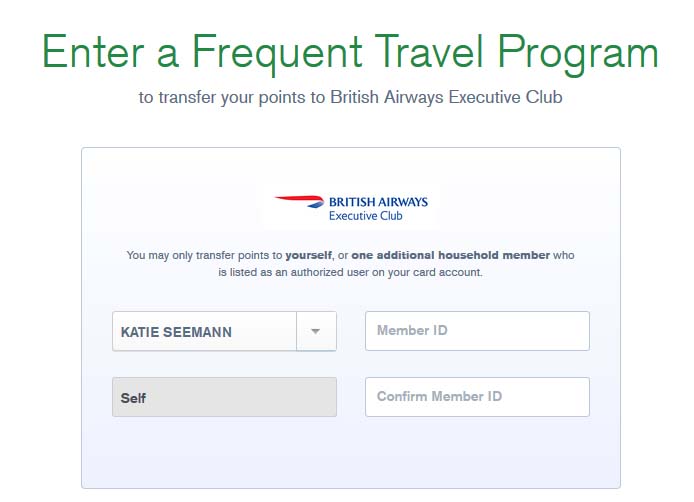

If maximizing the value of your points is the priority, transferring points to one of Chase’s travel partners is likely your best bet. You can transfer points to more than a dozen airline and hotel programs at a 1:1 ratio in increments of 1,000 points.

» Learn more: The best Chase transfer partners — and ones to avoid

Here's a quick rundown of the full list of Chase's transfer partners. Bookmark this list to refer back to in the future when you're ready to redeem.

Chase Ultimate Rewards® airline transfer partners:

Aer Lingus AerClub.

Air Canada Aeroplan .

Air France/KLM Flying Blue.

British Airways Executive Club (Avios).

Emirates Skywards .

Iberia Airlines Iberia Plus.

JetBlue TrueBlue .

Singapore Airlines KrisFlyer.

Southwest Airlines Rapid Rewards .

United Airlines MileagePlus .

Virgin Atlantic Flying Club.

Chase Ultimate Rewards® hotel transfer partners:

IHG Rewards Club .

Marriott Bonvoy .

World of Hyatt .

The value of each of these partners’ points varies. In general, you can often get close to 2 cents per point in value when you transfer them to an airline program, then redeem for award flights.

For example, a one-way business class flight on United Airlines from Los Angeles to New York in May cost $725 on a recent search. But if you transferred points from Chase to United, this same flight would set you back 38,000 points. Divide $725 by 38,000 and you’ll see you’re getting 1.9 cents worth of travel for every point if you transfer your points to United miles.

Expect lower value when transferring to hotel programs, with Hyatt being an exception as those points are among the highest valued hotel points .

You have plenty of other options for redeeming the Chase Ultimate Rewards® points you've earned beyond transferring your points to Chase partner programs — but some offer more value than others.

» Learn more: Helpful tips for earning Chase Ultimate Rewards®

2. Book in Chase's travel portal

Your points are most versatile when you use them to book flights, hotels, rental cars or experiences directly through its portal.

This is where you can redeem points for travel from nearly any provider — almost every major airline, hotel group, car rental company and more. Just search your dates and destination, and you’ll see cash prices from a whole range of providers, with a corresponding price in points for each.

The per-point value you get redeeming them this way depends on which credit card is in your wallet.

Here's how your Chase Ultimate Rewards® points values differ based on the card you hold:

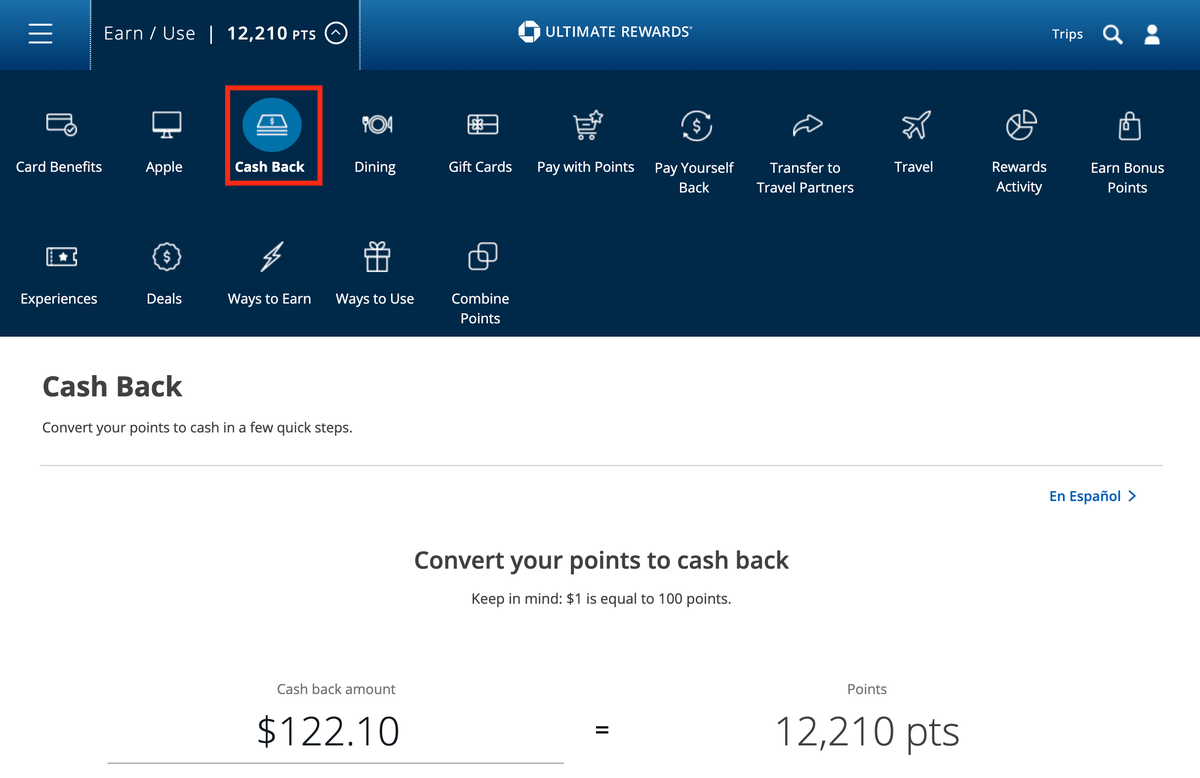

Chase Freedom® , Chase Freedom Unlimited® , Ink Business Unlimited® Credit Card , Ink Business Cash® Credit Card : 1 cent per point.

Chase Sapphire Preferred® Card , Ink Business Preferred® Credit Card : 1.25 cents per point.

Chase Sapphire Reserve® : 1.5 cents per point.

Here's how it works

For example, a hotel room that costs $199 a night in cash can be booked by cardmember with a Freedom-branded or Ink-branded card for 1 cent per point, or 19,900 points. But with Chase Sapphire Preferred® Card , you get 1.25 cents per point in value and would pay 15,920 points for that same room.

A Chase Sapphire Reserve® cardmember, who gets 1.5 cents per point in value, pays 13,267 points for the same hotel stay.

» Learn more: Should Chase cardholders use points or cash to book flights?

Redemptions to avoid

While there are several ways to redeem your points, if your goal is to extract the most value, avoid the temptations of the following redemptions.

Cash back or gift cards

You can redeem your points for cash back as a statement credit or a deposit into your bank account, or redeem points for gift cards at a wide variety of retail stores.

With both of these options, you will receive a flat rate of 1.0 cent per point in value, which may not be the best use of your points.

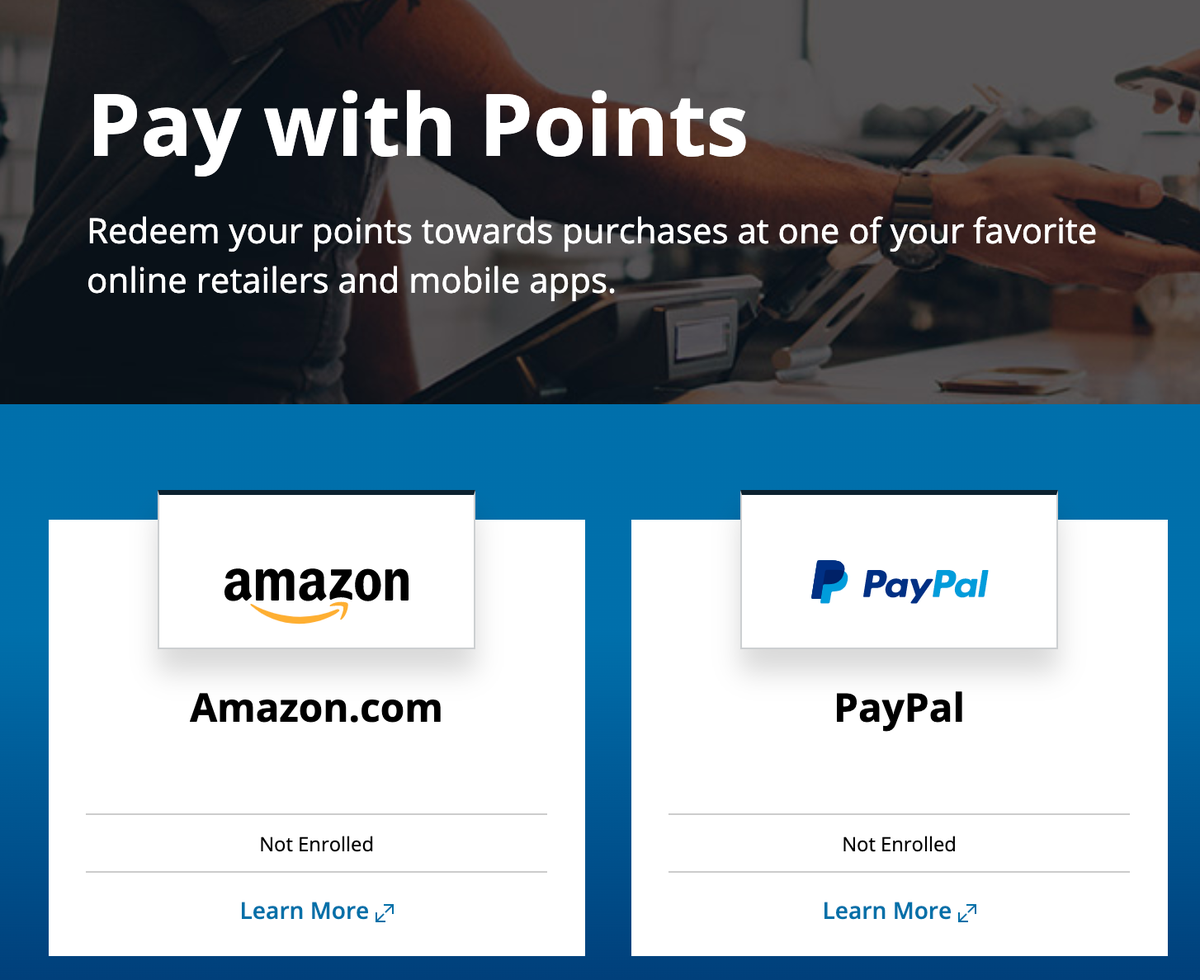

Amazon or Apple purchases

You can use your points to pay for Amazon purchases, but you’ll get only 0.8 cent per point. You're better off making the purchase with your card and redeeming points as a statement credit or cashing in points for a gift card.

You can also use points to shop at Apple, where you’ll get a value of 1 cent per point, but that’s useful only if you need very specific products.

If you want to maximize your Chase Ultimate Rewards® ...

In terms of sheer dollar values, some Chase Ultimate Rewards® redemption options are worth far more than others.

If flexibility and ease of use are important to you, redeeming points directly through Chase's travel portal is straightforward. If you want to use your points to buy merchandise, remember that statement credits and gift cards will usually get you more value than redeeming your points with Amazon or Apple.

In general, you’ll get the highest Chase Ultimate Rewards® points value by transferring them to their airline or hotel partners.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit cards

A traveler’s guide to the Chase Travel portal

Tamara Aydinyan

Julie Sherrier

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Updated 5:23 p.m. UTC Nov. 28, 2023

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

hocus-focus, Getty Images

For qualifying Chase cardholders, the easy-to-use Chase Travel℠ portal offers a flexible and convenient way to book hotels, flights, rental cars, cruises and more using points or a combination of points and cash.

What is the Chase travel portal?

A favorite among frequent travelers for its versatility and redemption options, Chase Ultimate Rewards® (UR) is one of the major transferable credit card rewards points programs and UR points are Chase’s flexible rewards currency.

The Chase travel portal works much like an online travel agency (OTA) similar to Orbitz or Priceline where you can book hotels, flights, cars, activities and cruises. But unlike a traditional OTA, with the Chase travel portal you can book travel with your Chase card’s rewards points, cash or a combination of the two.

Who can use the portal?

A handful of exclusively Chase-issued credit cards grant cardholders access to the Chase travel portal, but how you can utilize the portal and the value you can receive is card-specific.

The following credit cards are the only cards that earn Chase Ultimate Rewards points outright:

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card

- Ink Business Preferred® Credit Card * The information for the Ink Business Preferred® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

But if you or a household member own at least one of the cards above, the rewards on the following cash-back credit cards can be combined with any of the cards listed above and used as Chase Ultimate Rewards points:

- Chase Freedom Flex℠ * The information for the Chase Freedom Flex℠ has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Chase Freedom Unlimited®

- Ink Business Cash® Credit Card

- Ink Business Unlimited® Credit Card

And while the points earned cannot be combined with any of the UR-earning cards, the following pay-in-full card does have access to the Chase travel portal:

- Ink Business Premier℠ Credit Card * The information for the Ink Business Premier℠ Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Is the portal worth using?

It’s often said that having the right travel credit card is important, but knowing how to redeem your miles and points can be as paramount as which card you use to earn them. However, not everybody has the patience or interest to learn the intricacies of different rewards programs to maximize the value of every mile and point.

So while transferring UR points to individual loyalty programs is still one of the best ways to get the most cents per point at a 1:1 basis, for those who value simplicity, the Chase travel portal offers a straightforward way to book travel, earn and redeem points and still receive a great deal. Best of all, you won’t be limited by any loyalty program or award space availability.

When transferring points, the minimum you can transfer is 1,000 points to the following UR travel partners with either the Chase Sapphire Reserve, Chase Sapphire Preferred or the Ink Business Preferred cards:

Regardless of how you’re using the Chase travel portal, it’s worth considering the pros and cons.

- The standard rate for Ultimate Rewards points when redeemed for travel through the Chase travel portal is 1 UR point = 1 cent, but can be worth significantly more with the UR-earning cards. The Chase Sapphire Reserve gets a redemption value of 1.5 cents per point through the Chase Travel℠ portal while the Chase Sapphire Preferred and Chase Ink Business Preferred cards each get 1.25 cents per point.

- Since you’re not limited to any loyalty programs, you can use your UR points to book boutique hotels that you’d otherwise only be able to book with cash.

- Flights booked through the Chase travel portal can earn frequent flyer miles and can be used toward advancing your elite status.

- You can earn a substantial amount of bonus points when booking through the Chase portal depending on the card you’re using.

- You can use a combination of points plus cash to purchase your reservation.

- Hotels booked through the Chase travel portal do not earn hotel points or credits toward elite status. Any elite status perks you’d receive if booking directly with the hotel will likely be forgone.

- If you experience any issues while traveling, you’d have to go through Chase to resolve the issue. For example, if there is a problem with your hotel reservation, you’ll have to contact a Chase representative for help resolving it since you didn’t book directly with the hotel. Dealing with a middleman during travel emergencies is less than ideal and something to be wary of when considering booking through the portal.

- Southwest Airlines flights do not show up in the UR travel portal, but can be reserved by calling the Chase Travel Center at 855-233-9462.

How to book travel through the Chase travel portal

You can access the Chase travel portal by logging into your Chase account and clicking on the Rewards balance on the right or by going to the Chase Ultimate Rewards website .

Once you’re logged in, if you have more than one UR-earning Chase card, you’ll be asked to select one to proceed with — a crucial step as each card has different earning and redemption rates.

After clicking on your selection, you will be taken to the Ultimate Rewards dashboard. If you click on the Earn / Use dropdown button, all of your Ultimate Rewards options will be presented. Click on Travel to proceed to the portal.

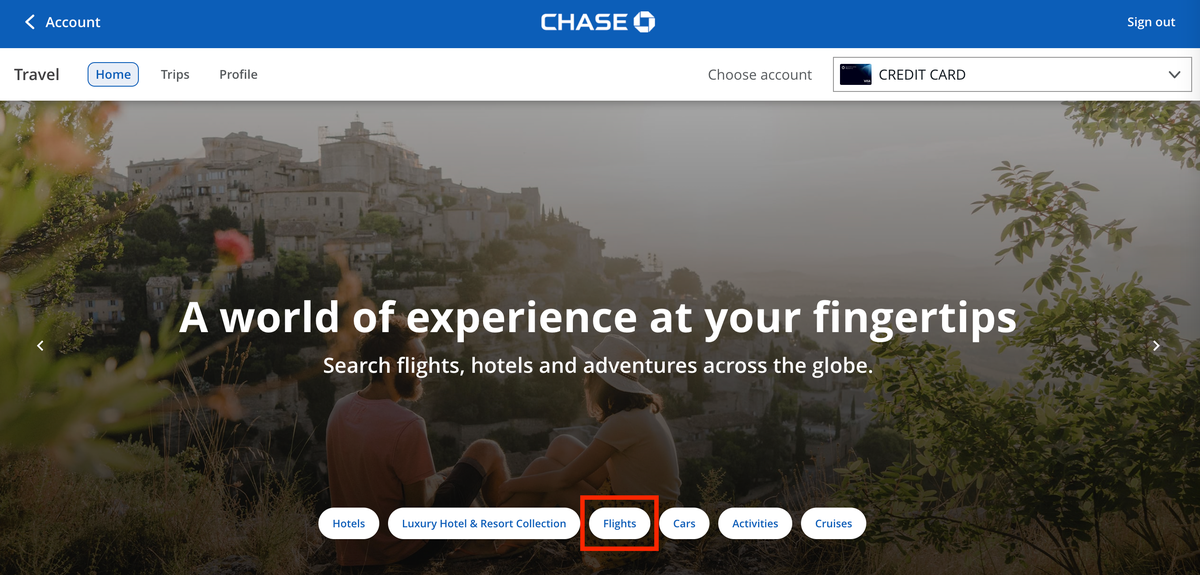

Once in the travel portal, you’ll have the option of selecting the type of booking you’d like to make.

From there, your user experience will be similar to any other OTA where you can search your travel options.

Because the Chase travel portal doesn’t limit you to transfer partners or loyalty programs, you’ll be able to search almost all major airlines. One notable exception is Southwest Airlines, which is still bookable using UR points but will require a phone call to the Chase Travel Center to reserve your flight.

One difference compared to a traditional OTA is the option to buy in cash, points or a combination of both.

If you’re short on points or if you’d like to offset the cash price with some points, you’re given the option to choose how to pay.

After that, you’ll be prompted to enter your traveler information and you’re all booked. However, you will have to log into the specific airline with your reservation code in order to reserve seats.

Booking hotels through the Chase travel portal is a similar process. And with the portal’s easy-to-use search function, you can find boutique hotels that would otherwise be unbookable with loyalty-program-based points.

However, if you have elite status with a hotel chain, you’ll want to book directly rather than going through the Chase portal in order to access status benefits and have that hotel stay count toward achieving a higher status. Or, you can transfer UR points to one of three UR hotel loyalty program transfer partners, including Marriott Bonvoy, World of Hyatt or IHG One Rewards.

Rental cars can also be booked through the portal in a similar fashion. And as in many cases, being aware of which card you’re booking your car rental with can make a big difference in case of an accident as both the Chase Sapphire Reserve and Chase Sapphire Preferred offer primary car insurance , an uncommon, money-saving benefit, which saves you from having to file a claim with your private car insurance carrier first.

A quick guide to the Chase Ultimate Rewards program

As some of the most sought-after flexible points, Chase Ultimate Rewards can be accrued through several avenues. The most lucrative way is by applying for Chase credit cards and earning their respective welcome bonuses — but be wary of Chase’s 5/24 rule , which blocks applicants from opening a Chase credit card if they’ve opened five or more cards from any issuer in the past 24 months.

If you have two Chase cards that earn UR points, you can then transfer the rewards earned to the card that carries the most redemption value. For example, you can open the Chase Sapphire Preferred card and then the Chase Freedom Flex and move any points earned on the Flex card to the Preferred card, which has a boosted value of 25% more when redeemed through the portal.

Looking to add more than one new credit card to your wallet? Here’s why you shouldn’t apply for multiple cards at the same time.

Outside of regular credit card spending, you can also grow your Ultimate Rewards pile by using the Chase shopping portal. By adding just one extra step to your online shopping, you can earn bonus points for your future travels.

While transferring points to partners is one option to maximize the value of your Chase Ultimate Rewards points, there are numerous other ways to use the Chase Ultimate Rewards program to your benefit. Whether it’s redeeming your points as a statement credit for eligible, rotating categories throughout the year through the “Pay Yourself Back” feature, booking special dining experiences with your points or using the portal to book your next vacation, the Chase Ultimate Rewards program’s flexibility makes it a great option regardless of your lifestyle.

Frequently asked questions (FAQs)

Chase Ultimate Rewards (UR) are Chase Bank’s flexible rewards currency that can be earned on several of its credit cards.

The Chase travel portal can be accessed through the Chase app or the Chase website. After logging in, you can select the option to book travel.

You can use your Chase travel credit, like the up to $50 annual hotel statement credit offered by the Chase Sapphire Preferred, by booking your travel through the Chase travel portal. The statement credit will automatically be applied to your account within one to two billing cycles after your purchase posts to your account — up to an annual maximum accumulation of $50.

You can redeem your Chase Ultimate Rewards directly through the travel portal with almost all major airlines with the exception of Southwest Airlines, which can be booked over the phone. With Southwest, select the flight you want at Southwest.com and then call Chase Travel Center at 855-233-9462 with the flight details.

The value you receive from the Chase travel portal will depend on the credit card you’re using. For example, if you have either the Chase Sapphire Reserve or the Chase Sapphire Preferred, your points are worth either 50% or 25% more, respectively, when redeemed for travel.

*The information for the Chase Freedom Flex℠, Ink Business Preferred® Credit Card and Ink Business Premier℠ Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Tamara Aydinyan has been traveling the world with the help of miles and points for over a decade and enjoys teaching others to do the same. When she's not on the move, you can find her in Los Angeles or New York City, or on Instagram @deadlytravel.

Julie Stephen Sherrier is a personal finance writer and editor based in Austin, TX. She is the former senior managing editor for LendingTree, responsible for all credit card and credit health content. Before joining LendingTree, Julie spent more than a decade as the managing editor and then editorial director at Bankrate and CreditCards.com. She also served as an adjunct journalism instructor at the University of Texas at Austin.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Americans’ travel habits and behavior in 2024

Credit cards Dawn Papandrea

American Express Platinum CLEAR® Plus benefit guide 2024

Credit cards Juan Ruiz

Citi Strata Premier vs. Wells Fargo Autograph Journey℠ Visa® Card

Credit cards Jason Steele

Is the Citi Diamond Preferred Card worth it?

Credit cards Julie Sherrier

Best credit cards for fair credit of May 2024

Credit cards Sarah Sharkey

Why did my credit card issuer just increase my credit limit?

Credit cards Michelle Lambright Black

Cash vs. credit: Which should I use?

Credit cards Sarah Brady

Capital One Venture X vs. Chase Sapphire Preferred

Credit cards Yury Byalik

Capital One Venture X benefits guide: Packed with premium perks for a lower fee than its peers

Credit cards Carissa Rawson

Credit card application rules by issuer

Credit cards Lee Huffman

Why the Chase Ink Business Unlimited is part of my core credit card setup

Credit cards Eric Rosenberg

U.S. Bank Business Platinum review 2024: It’s got one job – an intro APR for purchases and balance transfers

How to do a balance transfer with Capital One

Credit cards Harrison Pierce

Amex Gold vs. Chase Sapphire Reserve

Credit cards Natasha Etzel

How to avoid interest on a credit card

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Complete Guide To Using the Chase Travel Portal — Maximize Your Options

Katie Seemann

Senior Content Contributor and News Editor

349 Published Articles 54 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Senior Editor & Content Contributor

103 Published Articles 698 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

Table of Contents

Why book travel through the chase travel portal, cards that earn chase ultimate rewards points, what are chase ultimate rewards points worth, earning chase points by booking travel, how to access the chase travel portal, how to book a flight through chase travel, how to book a hotel through chase travel, how to book a rental car through the chase travel portal, how to book activities through chase travel, how to book a cruise through the portal, how do the prices compare to other sites, other ways to use the chase travel portal, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Chase Ultimate Rewards is one of the major transferrable points programs and a favorite among many travelers. Points are easy to earn and can be transferred to many different hotel and airline partners. But you can also book travel directly through Chase’s travel portal using Ultimate Rewards points.

Booking travel through the Chase Travel portal is simple and can be a great way to use your points.

We’ll show you everything you need to know about how to redeem your points, including the benefits, how to know what your points are worth, and how to book airlines, hotels, and more through the Chase Travel portal.

Generally, you can get maximum value from your Chase Ultimate Rewards points by transferring them to the Chase airline and hotel partners , so why are we talking about using points through a travel portal? While it’s true that the only way to get the highest value redemptions is by transferring, there is still a lot of value to be had by booking directly through the Chase Travel portal.

Flexibility

Flexibility is not often available with points bookings. Unlike an award booking, booking through Chase Travel is like using any other online travel agency (OTA) . There are no blackout dates or limited inventory award seats. If a flight or hotel is available, you can book it with points through the Chase travel portal.

You Can Earn Frequent Flyer Miles

One of the major bummers of booking flights with frequent flyer miles is that you don’t earn miles on award bookings. You can end up doing a lot of travel without earning miles. However, any booking you make with your Chase Ultimate Rewards points through the Chase Travel portal will earn frequent flyer miles and accrue status points. Unfortunately, hotel and car rental bookings still won’t earn points.

We have talked to so many people over the years that love the idea of collecting points and miles but don’t want to deal with the hassle. While many don’t mind putting a little work into getting an awesome redemption, others are just looking for a simple way to book travel and hopefully save some money in the process.

That’s where the Chase Travel portal comes in. With this method of redeeming points, there is no transferring, comparing points values, blackout dates, limited award availability, or multiple travel accounts. You only have to deal with 1 type of point and 1 travel portal but can still retain many of the benefits of collecting points and miles in the first place.

Bottom Line: You can book flights, hotels, rental cars, activities, and cruises through the Chase Travel portal.

If you like the idea of using the Chase Travel portal, you’ll need a credit card that earns Chase Ultimate Rewards points:

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s over $900 when you redeem through Chase Travel SM .

- Enjoy benefits such as 5x on travel purchased through Chase Travel SM , 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel SM . For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Chase Ultimate Rewards

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $1,125 toward travel when you redeem through Chase Travel SM .

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel SM immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel SM . For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass TM Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- APR: 22.49%-29.49% Variable

- Foreign Transaction Fees: $0

The Ink Business Preferred card is hard to beat, with a huge welcome bonus offer and 3x points per $1 on the first $150,000 in so many business categories.

The Ink Business Preferred ® Credit Card is a powerhouse for earning lots of points from your business purchases , especially for business owners that spend regularly on ads.

Plus the card offers flexible redemption options, including access to Chase airline and hotel transfer partners where you can achieve outsized value.

Business owners will also love the protections the card provides like excellent cell phone insurance , rental car insurance, purchase protection, and more.

- 3x Ultimate Rewards points per $1 on up to $150,000 in combined purchases on internet, cable and phone services, shipping expenses, travel, and ads purchased with search engines or social media sites

- Cell phone protection

- Purchase protection

- No elite travel benefits like airport lounge access

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- APR: 21.24%-26.24% Variable

There are also some great cash-back cards from Chase that can be used to book travel through Chase Travel. The points earned on these cards can be converted into cash-back or alternatively, they can be used in the Chase travel portal.

- Chase Freedom Flex℠

- Chase Freedom Unlimited ®

- Chase Freedom ® card (no longer open to new applicants)

- Ink Business Cash ® Credit Card

- Ink Business Plus ® Credit Card (no longer open to new applicants)

- Ink Business Unlimited ® Credit Card

- Ink Business Premier ® Credit Card

It’s easy to earn lots of Chase Ultimate Rewards points , but do you know how much they are worth ? If you’re transferring your Chase Ultimate Rewards points to a travel partner, their value will go up or down depending on the type of redemption.

However, when you are booking your travel directly through Chase’s travel portal, each Chase Ultimate Rewards point has a set value that won’t change . The credit card you have will determine the value of your Chase Ultimate Rewards points.

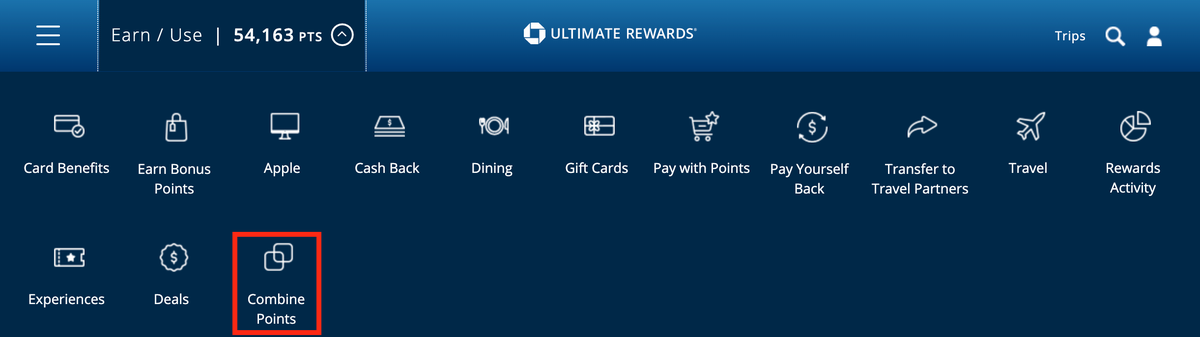

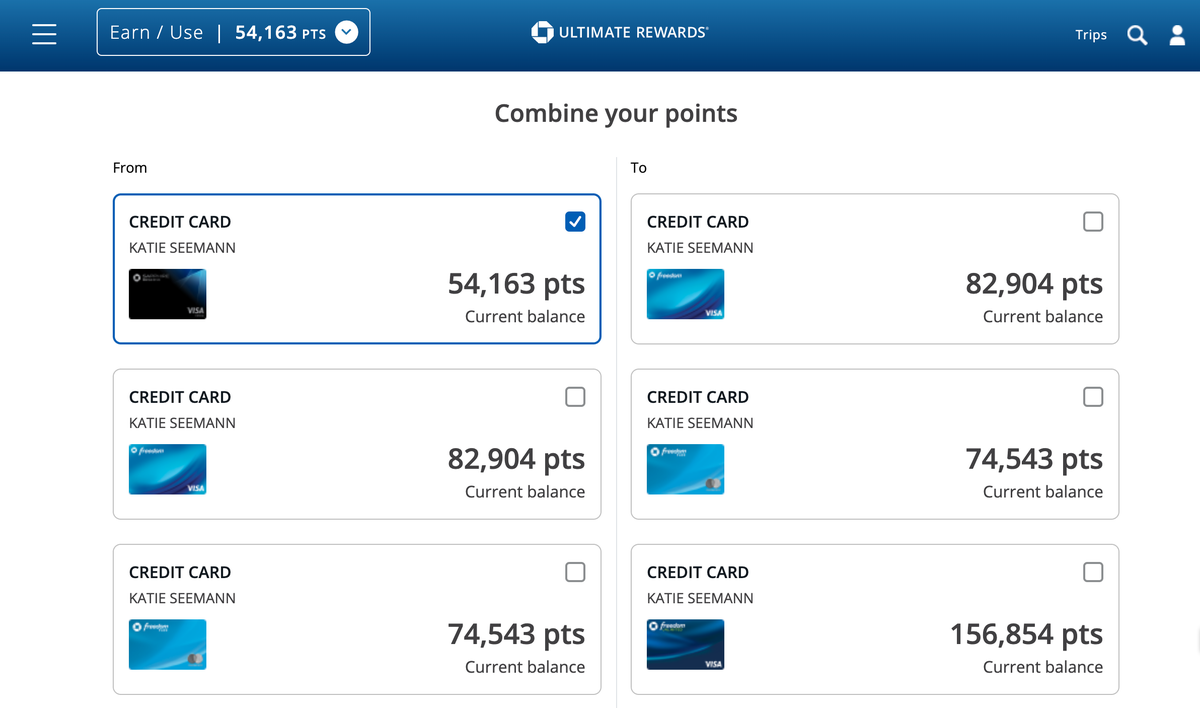

Transfer Your Points Between Credit Cards for Maximum Value

If you have multiple Chase credit cards, it makes sense to transfer your points to the card with the most valuable redemption rate. The only exception to this is the Ink Business Premier card because points earned on this card can’t be transferred to any other card.

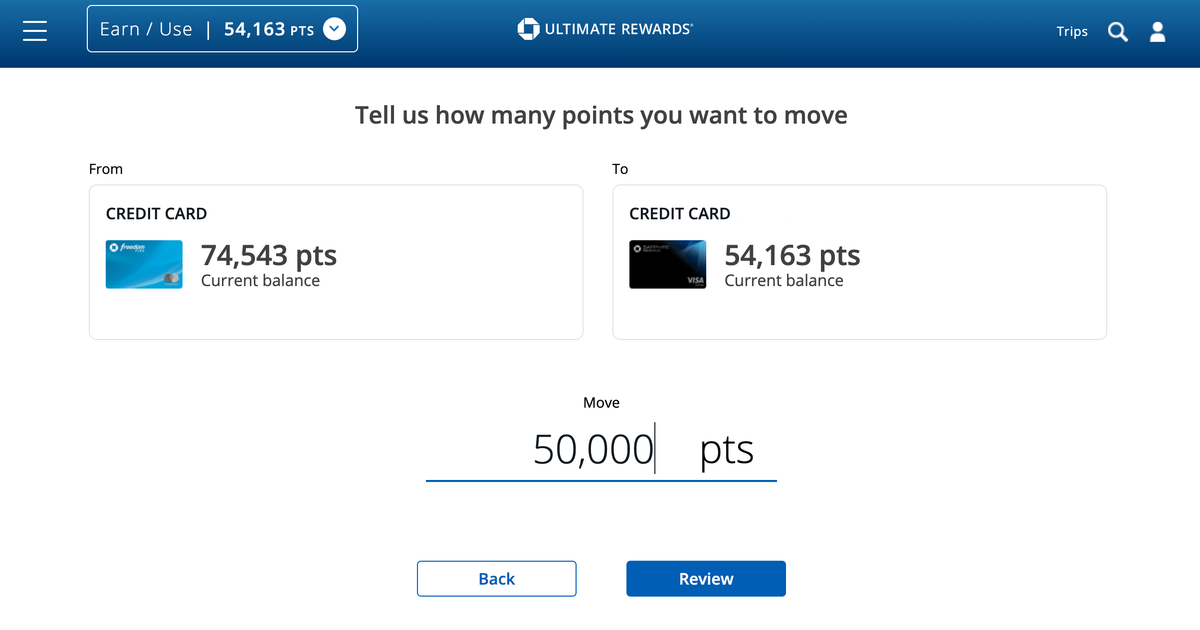

1. To transfer your points between 2 cards, log on to the Chase dashboard and select Combine Points .

2. Then you will be able to select the card you want to transfer points from and the card you want to receive the points. After you choose, click Next.

3. You can transfer all of your points or just what you need. Click Review to continue.

4. Double-check the details and click on the Submit button to complete the transfer.

Bottom Line: Your credit card will determine the value of your Chase Ultimate Rewards points. Your points are worth between 1 to 1.5 cents each depending on which credit card you’re redeeming points through.

What if you’d prefer to pay for your travel with a Chase credit card to earn Ultimate Rewards points? The number of points you’ll earn through the Chase travel portal is dependent on which credit card you have and what type of travel you’re purchasing.

You can log into your account in 2 ways.

First, you can go directly to the Ultimate Rewards website to log in or you can log in through your Chase account .

If you’re in your Chase account, click on one of your Ultimate Rewards credit cards and then click on Redeem next to the card’s Ultimate Rewards balance.

Then choose the card you want to use.

From here you can access Chase Travel by clicking on Travel in the top search box or you can switch to another card’s account by clicking on the 3-line icon in the upper left-hand corner.

1. In the Travel section of your Ultimate Rewards account, click on Flights to start your search for a flight. As with any other OTA, you begin your search by inputting basic information such as departure and arrival city, travel dates, and the number of passengers.

2. Next, you will be able to narrow your search results . At the left-hand side of the page, you can filter your results by things like airline or flight times. Then you can sort your results by price, trip duration, or times using the drop-down box at the top of the search results.

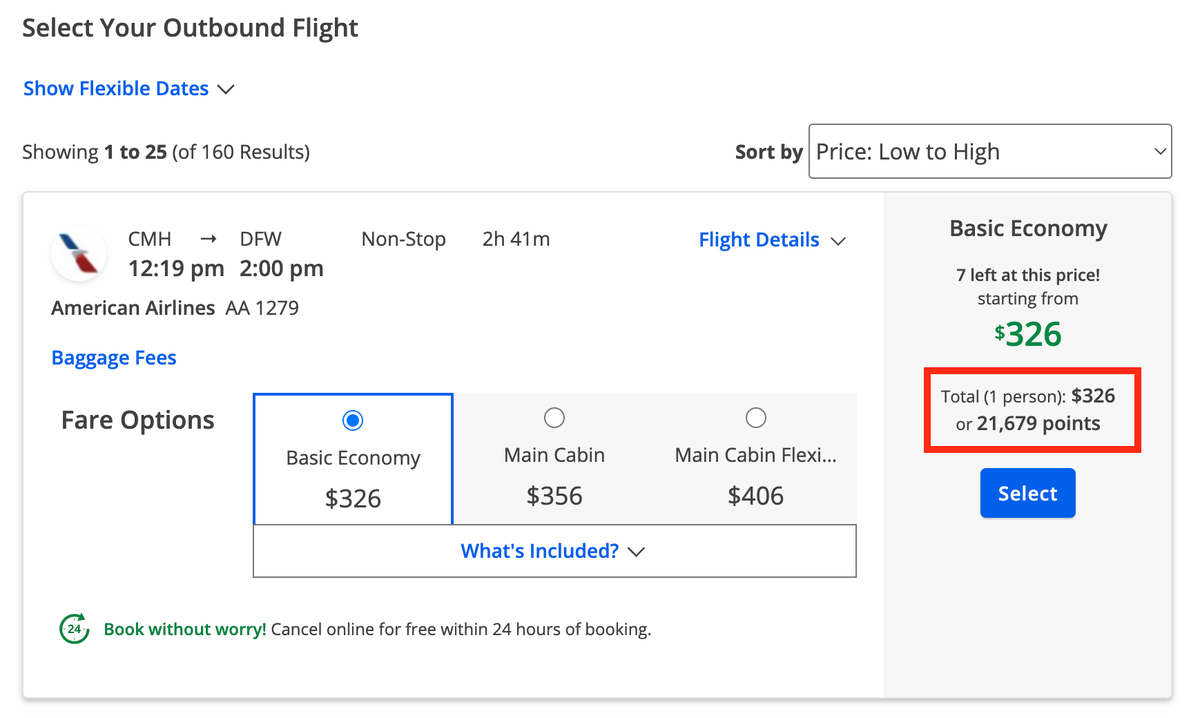

3. For each flight option, you’ll be able to see the price in dollars and in points on the right-hand side of the results box.

4. Once you’ve found the flight you want, click the blue Select button. Next, you can choose your return flight using the same process as you did for selecting the outbound flight. Click the blue Select button once you have made your choice.

5. From here you can confirm your flight details and select a fare upgrade if you wish. Then, you’ll be able to choose how to pay for your flight . You can pay for the entire purchase with points or a Chase credit card, or you can split your payment between points and a Chase credit card.

6. Finally, input your passenger information next. Don’t forget to add a frequent flyer number, a Known Traveler Number, or a Redress number if you have them.

Hot Tip: When purchasing travel through the Chase travel portal, you can split your payment between Chase Ultimate Rewards points and a Chase credit card.

1. To book a hotel through the Chase Travel portal , you’ll need to start by clicking on the Hotels tab in the main search box. Then, input your destination, check-in and check-out dates, and the number of travelers. Next, click on the blue Search button.

2. Your search results will look like other sites that you may be familiar with. You’ll see filtering options to the left and sorting options above your search results.

3. Each search result will show the price in both dollars and Chase Ultimate Rewards points. These prices include taxes and fees with the exception of resort fees.

4. Once you select your hotel, click on Add to Itinerary . You can choose to pay for all or part of your hotel cost using Ultimate Rewards points. Click Begin Checkout to input your reservation details and finalize your booking.

Hot Tip: When booking a hotel through the Chase Travel portal, you won’t be eligible to earn points in the hotel’s loyalty program or take advantage of any elite status you may have.

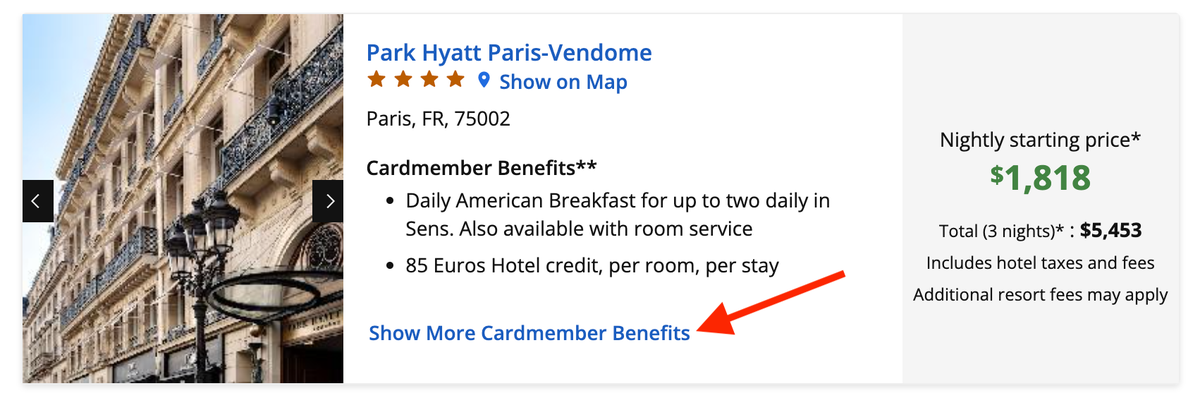

The Luxury Hotel and Resort Collection

The Luxury Hotel and Resort Collection (LHRC) is exclusively for Chase Sapphire Reserve cardholders. From the Ultimate Rewards travel home page, just click on The Luxury Hotel & Resort Collection tab.

Once you are on the LHRC homepage, type in your destination and click Search to view available properties. Each listing will display the property’s unique cardmember benefits. Click on the listing for more information and to continue the booking process.

When booked through the Chase Travel portal, these properties offer the following benefits:

- Daily breakfast for 2

- Special amenity (varies by property)

- Room upgrades (based on availability)

- Early check-in and late checkout (based on availability)

The Luxury Hotel and Resort Collection properties are reservation-only bookings. You’ll make your reservations online and payment doesn’t happen until you check out from the hotel. These bookings will not take Chase Ultimate Rewards points as payment.

Bottom Line: Luxury Hotel and Resort Collection properties are only available to Chase Sapphire Reserve cardmembers. These properties can’t be booked with points.

1. To rent a car through the Chase Travel portal, start by clicking on the Cars tab in the main search box. Then, input your pick-up location, drop-off location, dates, times, and age of the driver. Click on the blue Search box to continue.

2. You can then narrow your search with the filtering options on the left-hand side of the page.

3. For each car option, you will be able to see the car details, rental company, and price in both dollars and Chase Ultimate Rewards points. Once you have selected the car you want to rent, click on Add to Itinerary .

4. You can pay for the entire purchase with points or a Chase credit card or split your payment in any amount. Double-check all of the details before completing your purchase.

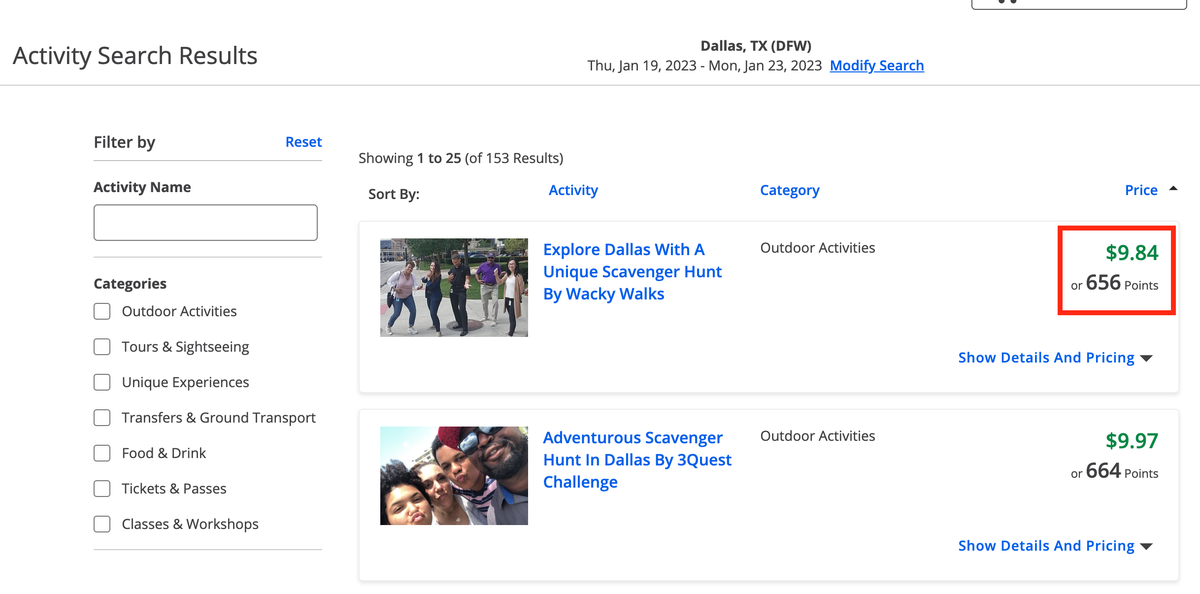

Did you know you can also book activities through Chase Travel?

1. Click the Activities tab on the Ultimate Rewards travel homepage to get started. Then, input your destination and travel dates and click the Search button to continue.

2. You can narrow your search by selecting 1 or more categories at the left-hand side of the page. Categories can include things like:

- Classes & workshops

- Cruises & sailing

- Food & drink

- Outdoor activities

- Seasonal & special occasions

- Tickets & passes

- Tours & sightseeing

- Transfers & ground transport

- Unique experiences

3. Each activity will show the price in both dollars and points to the right side of the screen. Click on Show Details and Pricing for more information and to book the activity.

6. Double-check all of the details on the final page before completing your purchase. Click the box confirming you understand the travel disclosures, then click Complete Checkout to finish your purchase.

Bottom Line: You can book lots of activities through the Chase Travel portal, including airport transfers!

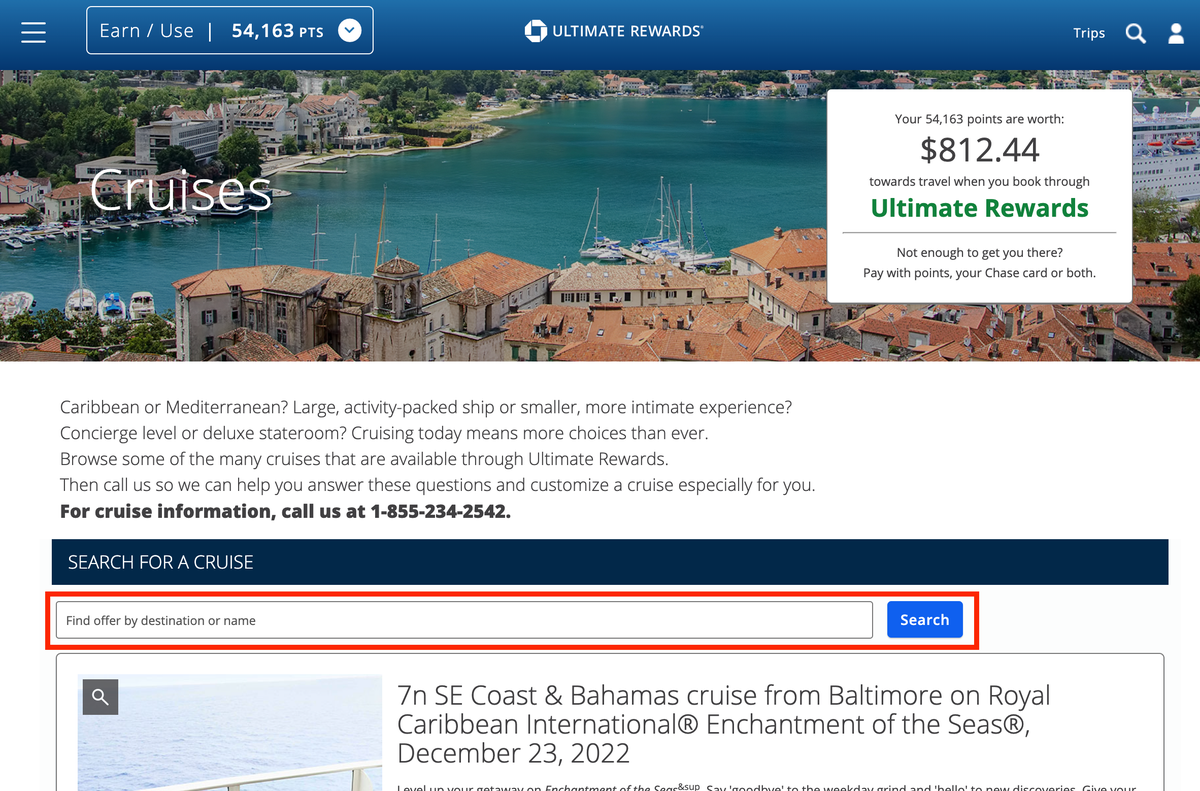

If you’re a fan of cruises, you’ll be pleased to know you can book them through your Chase Travel portal. To get started, click on the Cruises tab on the Ultimate Rewards travel homepage.

This will bring up a list of available cruises, but there’s also a search box at the top of the screen, so you can input a specific destination or cruise line.

Each listing will display the cruise line, ship, ports of call, sailing dates, and baseline pricing for an interior or oceanview cabin. Unfortunately, if you want any more specific information or if you want to book, you will need to call 855-234-2542 .

You’ll notice that only cash prices are listed for cruises, however, they can be booked using your Chase Ultimate Rewards points, too.

Hot Tip: You can book a cruise through Chase Travel but you’ll have to call to make your reservation as they can’t be booked online.

Are you getting a good deal by booking through Chase? Let’s look at how the prices available through the Chase Travel portal stack up to other OTAs and search engines including Hotwire , Kayak , and Expedia .

We did some flight searches and found there’s no clear-cut pattern on prices between the Chase portal to other websites.

Example #1: Round-trip flight between Philadelphia (PHL) and San Francisco (SFO) for 1 person in economy.

We searched this route in the Chase travel portal and the cheapest option was a flight that was split between Alaska Airlines and Delta Air Lines for $526.20. This worked out to be the cheapest price we found, and Priceline had the same low price. Expedia and Hotwire both charge booking fees, making the price a little higher. Each airline’s own website couldn’t split the itinerary between different airlines, so those ended up being much more expensive.

If you are in doubt or would like to check prices yourself, Kayak is a great place to start. Kayak will show you prices for a flight on all of the OTAs as well as the airline’s website. It’s a great one-stop shop to compare flight prices.

Example #2: Round-trip flight between New York City (JFK) and Paris, France (CDG) for 1 person in economy.

We searched this route in the Chase travel portal and the cheapest option was a flight that was split between American Airlines and British Airways for $689.78. This wasn’t the overall best price we found, though. That award goes to Expedia and Priceline.

Hot Tip: You will earn frequent flyer miles when you book your flight through the Chase Travel portal.

Example #1: Here’s how prices looked for a week-long stay at the JW Marriott Cancun Resort & Spa in Mexico for 2 people including all taxes and fees. The $291.55 resort fee can’t be paid with points.

In this example, the best cash rate by far was through Marriott. However, if you wanted to pay with points, booking with Chase Ultimate Rewards points through the travel portal would be your best bet.

Keep in mind that Marriott doesn’t have an award chart, so different time periods can have different point costs. A 7-night stay at this hotel can dip down to 240,000 points for a 7-night stay. If you’re going to pay for your hotel stay in points, it’s always smart to calculate how many points it would cost to book through Chase versus transferring points . This information can help you make the best and least expensive choice.

Hot Tip: You won’t earn hotel loyalty points when booking a hotel through Chase and any elite status you have may not be recognized.

Example #2: Let’s look at an example of a hotel that doesn’t have a loyalty program. We priced out a 2-night stay at Almond Tree Inn Hotel in Key West, FL for 2 people. The highest prices were direct via the hotel with all other websites surveyed being cheaper.

Here’s how the prices stacked up:

Chase’s low price matched the other online travel websites and was actually lower than the hotel’s own website, so it would be a great option in this case. It also affords the opportunity to use points for a hotel that doesn’t have its own loyalty program.

Car Rentals

In many cases, car rental prices found through the Chase Travel portal were similar to prices found on the rental agency’s own website.

The main difference in booking through Chase vs. directly through a car rental agency is that the car rental agency often has the ability to book the car without paying up front. With the Chase portal, you will be paying at the time of booking and there may be change or cancellation fees if you need to modify your reservation.

In both of these examples, Chase Travel didn’t offer the lowest price, however, that won’t always necessarily be the case. Of course, the advantage of booking through Chase is the ability to use your Chase Ultimate Rewards points. It’s always a good idea to price out your car rental on a few different websites before booking to ensure you’re getting the best price.

Chase actually offered the lowest prices on activities for both examples:

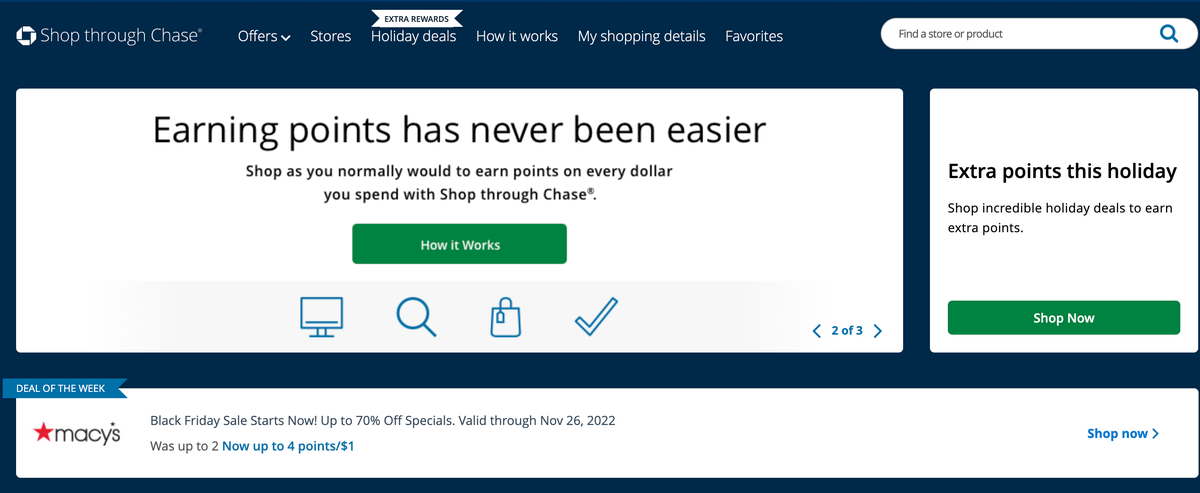

Earn Bonus Ultimate Rewards Points

The Chase Travel portal also helps you earn bonus points. With the Shop through Chase feature, you can earn extra Ultimate Rewards points through your online shopping.

Just click Earn Bonus Points in the top search bar to access the shopping portal. Click on a featured store or search for a specific one. Then simply click through the portal to your website of choice to make your purchase. Your bonus points will be added to your Chase Ultimate Rewards points total within 3 to 5 days in most cases.

Pay With Points