eLevy Support Contacts

1. 0202714900/1

2. 0717363411

3. 0728337499

1. 0412249829

2. 0703287808

1. 0703288464

2. 0753058836

1. 07553058744

2. 0703289367

1. 0717359988

2. 0780400117

1. 0705395118

2. 0780400118

- SIMCards / eSIMS

Hotels, Resorts, Villas & Holiday Rentals

Bali's no. 1 Travel Guide

Don't Forget:

Things to Do in Bali

With our BaliCard, Bali's Digital Discount Card & Tourist Pass, you save 10% and more

What's on Bali

Events at W Bali Seminyak

Events at Desa Potato Head

Events at AYANA Bali

Events at MRS SIPPY

Bali Tourist Tax

For international travelers – all you need to know.

Don't miss our Digital Discount Card. Get discounts at +200 awesome partners! BaliCard

Beware of Scammer Websites, selling the Tourist Tax Registration. They are not representing the Balinese Government. ONLY use the official LoveBali Portal that we linked in our FAQ below

Bali tourist tax / bali tourist levy.

The Tourist Tax for international visitors to Bali is a tax charged by Bali’s provincial government. This is all you need to know to get ready to come to Bali. Make sure you are only using the links mentioned tha guide you to the official website of the Bali government.

Planning your trip to Bali?

In the FAQ Section below we will answer your questions about the tourist tax.

Equally important for your travel planning:

Don’t miss to check the updated Visa Regulations and general Travel Regulations to ensure a smooth arrival in Bali.

Want to rent a scooter?

International Driving License is Mandatory (online purchase)

More Essentials

Get your SIM and internet connection Book your Hotel / Villa Discounts and Things to do

Bali Tourist Tax Regulations and How to Pay the Bali Tourist Tax

Faq - must know about the tourist tax (levy), the tourist tax will have to be paid by international travelers coming to bali, the tax applies to foreigners coming to bali..

For arrivals to Bali from outside Indonesia and also if you arrive coming from another province to Bali.

The Bali Tourist Tax costs IDR 150,000 per person (ca. USD 10 and AUD 15). Regardless of the age of the traveler.

It seems, that for the online payment there is also a surcharge of Rp 4,500

Most probably you will not be checked (yet). The reason is, that the immigration officers and airport personnel is not responsible to check if you paid. And the Balinese government has not yet installed check points to control the payment (which might happen at some point).

Still you have to pay the tax and checks can happen at popular tourist destinations or then also at the airport and harbours upon entry.

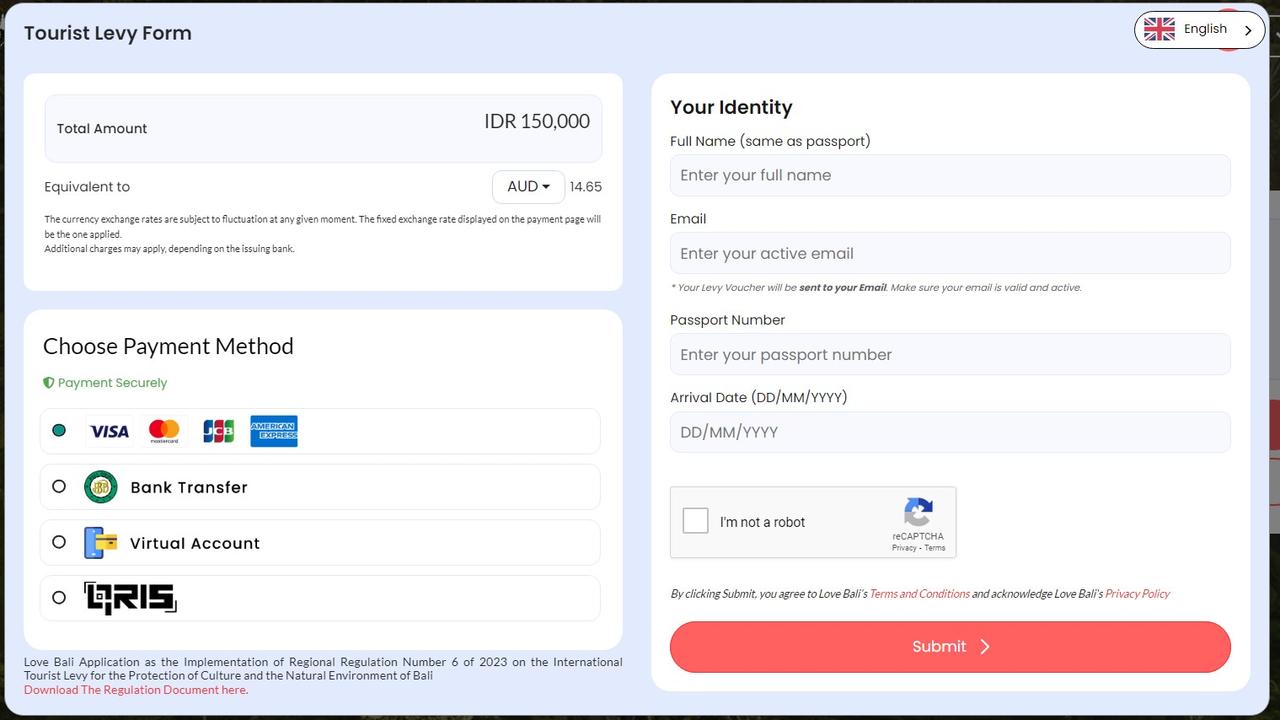

You can pay the tax online on the official Bali Tourism Website ( ONLY use that website, don't pay the tax anywhere else, there might be websites run by scammers).

Official website to pay the bali tourist tax lovebali.baliprov.go.id/.

You will also be able to pay the tax upon arrival (airports and harbours). We strongly suggest however you pay already online before you arrive.

At times the Official Bali Tax Website might be offline.

Lovebali.baliprov.go.id/.

Don't pay the tax anywhere else! Keep trying and come back to the website. Worse case, you can arrive in Bali without paying for the tourist tax online in advance, and then pay at the lovebali-counters. The Balinese government is in the process of installing payment counters at the checkpoints at the airports and harbours.

Travelers with following Visas are exemption from paying the Bali Tourist Tax, without having to apply for the exemption online (automatic exemption)

- Holders of Diplomatic Visas and Official Visas

- Crew Members of Conveyances are exempted

- KITAS & KITAP Holders (Holders of Temporary and permanent stay permits)

- Family unification visa holders

- Student Visa Holders

Foreigners can apply for an exemption on the official website . Apply at least 5 days before your arrival

- Golden Visa Holders

- Any other Visa issued by the immigration office, that do not have the travel purpose tourism ,. In other words, travelers with any visas that is issued with the travel purpose "tourism" will have to pay the tax.

On the official website the government states:

We are not the government, so unfortunately we cannot help you with this issue.

First we would check the Spam / Junk Folder, to be sure you did not receive it.

You can also write a message to the support on

It seems that the official site from the Bali government still has problems from time to time. Since we are not representing the government and are not charging any taxes or fees, we cannot assist you in this matter. We suggest you keep trying opening the website. Worse case, you can pay the tourist tax upon arrival.

Only use the official Bali Tax Website:

The tourist tax (levy) is a local tax that the Bali administration is implementing, it is only related to Bali and not to Indonesia

The bali administration has issued following statement:, the levy is paid only 1 (one) time while traveling in bali, before the person leaves the territory of the republic of indonesia., how they will control this is not yet clear to us, but it seems that if you travel to bali, pay the tax, then go to lombok, return to bali, you would not have to pay the tourist tax again., the bali administration has announced that they want to use the income of the tourist tax for the following initiatives (official statement from the bali administration):, preserve heritage, protecting balinese customs, traditions, arts and local wisdom, ensuring the sustainable culture of bali island., nurture nature, contribute to the nobility and preservation of bali's unique culture and natural environment, making it an even more beautiful destination., elevate your experience, improve the quality of service and balinese cultural tourism management, promising you a safe and enjoyable travel adventure in bali., bali and the indonesian tourism officials have discussed over the last few years how they can protect the environment better, handle mass tourism, improve infrastructure and handle the growing trash problem, increase income for the local population who do not yet benefit from the growing tourism sector. they wish to encourage travelers to respect and participate the local culture more and overall have a better experience when they visit the island of gods., for the moment it seems, yes, but we expect the local administration to clarify at some point., 14th february 2024, essentials for your bali vacation.

- Digital Discount Card - The BaliCard

- SIMcards & e-Sims online (NEW)

- International Driving License (mandatory)

- Hotels, Resorts and Villas in Bali

- Trekking Tours & Sightseeing

- Car Rental with Driver (half- & full day)

- Airport Transfer DPS

- Bali Scooter & Motor Bike Rental

- Medical Travel Insurance (incl. Covid coverage)

- Golf Tee Time

People also search for love bali app love bali website bali tourist tax 2024 how to pay bali tourist tax love bali app download we love bali love bali system

- Visa & Regulations

- Things to Do

No products in the cart.

Return to shop

Digital Digital Discount Card

Discounts at 200+ experiences & venues.

Waterbom, LIGA.TENNIS & Padel, Sushimi, Villas, and many more.

–> click here and get our BaliCard 20% cheaper 😉

The discount will be applied directly in the shopping cart.

Username or email address *

Password *

Remember me Log in

Change Location

Find awesome listings near you.

Winter is here! Check out the winter wonderlands at these 5 amazing winter destinations in Montana

- Travel Tips

What Is A Tourism Fee

Published: December 11, 2023

Modified: December 28, 2023

by Aurel Donahue

- Budget Travel

- Hotel Reviews

- Sustainability

Introduction

When planning a trip, it’s important to be aware of any additional fees or charges that may be imposed by your destination. One such fee that has gained attention in recent years is the tourism fee. While it may be unfamiliar to some, understanding what a tourism fee is and how it can impact your travel experience is vital.

A tourism fee, also known as a visitor levy or a tourist tax, is a charge imposed on travelers for staying overnight in certain destinations. This fee is typically collected by the accommodation provider, such as hotels or vacation rentals, and is used to fund various tourism-related initiatives and infrastructure improvement projects.

The purpose of a tourism fee is to offset the costs associated with the increasing number of tourists visiting a specific location. It assists in maintaining and enhancing the local infrastructure, preserving cultural heritage sites, promoting sustainable tourism practices, and providing better visitor experiences.

There are various types of tourism fees, and their implementation can differ from one destination to another. Some fees are charged as a percentage of the accommodation rate, while others have a fixed amount per night. In some cases, specific areas within a destination might have separate tourism fees.

Definition of Tourism Fee

A tourism fee, also known as a visitor levy, tourist tax, or accommodation tax, is a charge imposed on travelers for staying overnight in specific destinations. It is a form of revenue generation for tourism-focused initiatives and infrastructure improvements. The fee is typically collected by the accommodation providers, such as hotels, bed and breakfasts, or vacation rentals, and is either included in the total bill or charged separately.

The purpose of a tourism fee is to generate funds to support various tourism-related activities, such as destination marketing, tourism promotion, conservation of cultural heritage sites, environmental sustainability initiatives, improvement of visitor experiences, and the development of local tourism infrastructure.

Tourism fees are usually implemented in popular tourist destinations that experience a significant influx of visitors. These fees help offset the costs that come with a growing number of tourists, including the strain on local resources, environmental impact, and provision of necessary tourist facilities and services.

The amount of a tourism fee can vary depending on the destination and the type of accommodation. Some fees are calculated as a percentage of the total accommodation cost, while others have a fixed amount per night or per person. In some cases, specific areas within a destination may have separate tourism fees.

It’s important to note that tourism fees are not universal and not all destinations impose them. They are often implemented by local authorities or tourist boards in collaboration with the accommodation providers to ensure sustainable tourism development and support the growth and maintenance of the destination.

Purpose of Tourism Fee

The primary purpose of a tourism fee is to generate funds that can be used for various tourism-related initiatives and infrastructure improvements. These fees play a crucial role in supporting the sustainable development and maintenance of tourist destinations. Here are some key purposes of implementing tourism fees:

Types of Tourism Fees

Tourism fees can take various forms, and their implementation can differ from one destination to another. The type of fee imposed is usually determined by the local authorities and tourism organizations. Here are some common types of tourism fees:

Examples of Tourism Fees

Tourism fees are implemented in various destinations around the world to support tourism-related initiatives and infrastructure improvements. The specific fees and their amounts can vary significantly from one location to another. Here are some examples of tourism fees imposed in different destinations:

Implementation of Tourism Fees

The implementation of tourism fees varies depending on the destination and the local regulations and policies. The process typically involves collaboration between the local authorities, tourism organizations, and accommodation providers. Here are some key aspects of the implementation of tourism fees:

Pros and Cons of Tourism Fees

Tourism fees have both advantages and disadvantages for destinations and travelers. It’s important to consider these pros and cons to understand the impact of these fees on the tourism industry and the overall travel experience. Here are some of the main pros and cons of tourism fees:

Impact of Tourism Fees on Local Economy

Tourism fees can have a significant impact on the local economy of a destination. These fees contribute to the overall revenue generated from tourism activities and can be utilized to support various economic sectors. Here are some key impacts of tourism fees on the local economy:

Usage of Tourism Fees

Tourism fees are collected with the purpose of generating funds to support various aspects of tourism development. The usage of these funds plays a crucial role in ensuring the sustainable growth and enhancement of the destination. Here are some common areas where tourism fees are utilized:

Tourism fees play a pivotal role in supporting the sustainable development and maintenance of tourist destinations worldwide. Understanding what these fees are, their purpose, and their impact is important for both travelers and destination stakeholders.

Tourism fees provide a vital source of revenue that can be used for destination marketing, infrastructure development, cultural preservation, environmental conservation, and enhancing the overall visitor experience. These fees help destinations cope with the increasing number of tourists, preserve their unique cultural heritage, and protect their natural environments.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

Hawaii Is the Latest Place to Consider a Tourist Tax—Here's Where Else Travelers Need to Pay to Enter

By Olivia Morelli

Hawaii is the latest destination to consider taxing visitors to help address the effects of climate change and overtourism, two issues that are particularly front of mind in the Aloha State following the devastating Lahaina fire .

The so-called climate tax is part of a bill first introduced in January that could pass as early as this spring. If approved, visitors to Hawaii would be charged a $25 flat fee during check-in at hotels and short-term rentals. The money would go onto support sustainability initiatives in the state including wildfire and flood prevention, coral reef restoration, emergency water supplies, green infrastructure, and coastal restoration.

The concept of tourist tax isn’t a new one. They have long been the norm for many countries in Europe such as Greece, Spain, and Germany, and hotel tax is standard across many destinations, including US states. The impact of the pandemic on the travel industry was severe—hotels, restaurants and hospitality venues closed, people that relied on tourism for their livelihoods suddenly faced huge losses, and money that the government relied on for development and maintenance was depleted. As a result, many countries have decided to implement a tourist tax to help support local needs. Below, we take a look at what exactly tourist tax is, and which places are introducing the measure for 2024.

Bhutan's tourist tax (one of the most expensive fees on the list) recently decreased from $200 to $100 per night.

What is tourist tax?

Originally, tourist tax was introduced by certain governments with the aim of tempering overtourism and generating income from large numbers of travelers entering the destination. Bhutan , for example, has asked tourists to pay a significant sum of money to enter since it opened to international visitors in 1974. The country uses the tax (called the Daily Sustainable Development Fee) in an attempt to preserve the country’s natural, undisturbed beauty and to protect traditional Buddhist culture . Barcelona , meanwhile, uses the city’s tourist tax to fund local construction and development projects. Most tourist taxes are added onto the cost of your accommodation in the form of a percent or flat fee.

Which destinations will begin imposing tourist taxes in 2024?

- This January, Iceland reintroduced its tourist tax following a pandemic hiatus.

- The Indonesian government began taxing travelers visiting Bali from February 14, 2024.

- In 2024, the UK is imposing a new system called an Electronic Travel Authorization (ETA), whereby visitors from the US, Europe, Australia, and Canada will be required to apply for permission and pay to enter the country.

- Pro tip: Next year, the EU will begin implementing a new tourist visa , whereby non-EU citizens traveling from outside the Schengen zone will need to fill out a €7 (around $7.57) application to enter the country.

Bali started charging tourists a $10 entrance fee on February 14, 2024.

Which destinations currently impose tourist tax?

The below destinations currently impose tourist taxes on travelers entering the country, but the amount of tax charged changes frequently. While we have included some guidance on projected costs, make sure you check with your accommodation or the tourism board for each destination before traveling.

- Austria : The cost of tourist tax is typically added onto your accommodation bill, and is around 3.2% in Vienna.

- Belgium : In Brussels, the tourist tax is typically below $5 and is added onto your accommodation bill, but it varies from city to city.

- Bhutan : Visitors to Bhutan are required to pay a daily Sustainable Development Fee of $100 per person.

- Bulgaria : Tourist tax in Bulgaria varies on destination and hotel standard, but it is usually below $2.

- Caribbean islands: Most of the Caribbean islands charge tourist tax, and the price ranges depending on the island–in St Lucia, for example, it is around 8%, whereas in the Dominican Republic it is 18%.

- Croatia : The cost of tourist tax in Croatia depends on the season you are traveling in and where you are staying.

- Czech Republic: In Prague , tourist tax typically costs around CZK 50 per night (around $2).

- France : Tourist tax here is based on a municipal rate, but the standard cost is typically under $6 a night. As of this January, the nightly visitor fee in Paris has increased to between $3 and $17, dependent on hotel type.

- Germany : It varies from city to city–in Berlin , the standard tourist tax is 5% of the accommodation price.

- Greece : The price you pay in Greece depends on the standard and size of your accommodation. It shouldn’t be more than $5 per night.

- Hungary : Travelers should expect to pay around 4% of the cost of accommodation per night.

- Iceland: The newly reintroduced fee applies to travelers staying at campsites (about $2), hotels (about $4), and cruises (about $7).

- Italy: Venice will begin charging tourists a €5 nightly fee (about $5.50) in 2024.

- Indonesia: Starting on February 14, travelers will have to pay 150,000 rupiah (around $10) upon entering Bali .

- Italy : Depending on the city, tourist tax can be somewhere between $1 and $8 per night.

- Japan : If you’re traveling to Japan, expect to pay 1,000 yen (about $6.65) in tourist tax.

- Malaysia : In 2023, the cost of tourist tax across Malaysia was approximately $2 per night.

- New Zealand: Travelers visiting New Zealand have to pay an International Visitor Conservation and Tourism Levy (IVL) which costs $35 NZD (about $22).

- Portugal : The country charges tourist tax in 13 cities, including Lisbon and Porto . The cost is about $2 per night.

- Thailand : The tourist tax for travelers visiting Thailand is 300 baht (about $8) for visitors arriving by air and 150 baht (about $4) for those arriving by land or water.

- The Netherlands : Amsterdam is one of Europe’s most expensive places for tourist tax–currently the rate states at 7% of accommodation price plus a flat rate of €3 (about $3.24) per person per night.

- Switzerland : The price varies depending on the destination, and it ranges from about CHF 2 (about $2.30) to CHF 7 (about $8) per person per night.

- Slovenia : Again, the rate changes from destination to destination (it is higher in cities than in more rural areas), but generally the cost is around €3 (about $3.24).

- Spain : Several cities in Spain have recently decided to raise the price of tourist tax, and other cities are in discussions about following suit. In Barcelona, the fee is €4 (about $4.30), whereas in the Balearic Islands the fee is between €1 (about $1.10).

- USA: When traveling to the US, visitors need to apply for an ESTA (Electronic System for Travel Authorization), which is a type of visa allowing travellers to stay in the country for up to 90 stays. It is valid for two years. The cost of an ESTA is $21. A version of this article was originally published on Condé Nast Traveller UK .

By signing up you agree to our User Agreement (including the class action waiver and arbitration provisions ), our Privacy Policy & Cookie Statement and to receive marketing and account-related emails from Traveller. You can unsubscribe at any time. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- Destinations

How to pay Bali’s new tourist tax

The entry requirements for Bali are changing from February 14. Here is what you need to do before you arrive.

Bali looks to drastically hike entry fee

Silly mistake that cost me $500 in Bali

Major call for infamous Bali monkeys

Australians heading to Bali from Wednesday will need to pay a new tourist levy to enter the popular holiday island.

Travellers must pay 150,000IDR per person (about $15).

Here is what you need to know.

How to pay the tourist levy

You can pay the $15 fee via the lovebali.baliprov.go.id website or Love Bali app.

You will need to enter your details, including your passport number and arrival date.

Then you can choose your payment method and once successful, you will have a ‘Levy Voucher’ sent to your email.

It is important to make sure the voucher is valid and active as your will need to present it at scanning checkpoints when entering Bali.

There will also be a counter to pay the fee by debit or credit card at I Gusti Ngurah Rai International Airport or Benoa Harbour, but this is not the method encouraged.

What is the tourist levy for?

The tourist levy is promoted as a way to protect Bali’s culture and natural environment.

“This money will be used in our efforts to establish sustainable tourism,” Indonesia’s Deputy Tourism Minister Ni Made Ayu Marthini told news.com.au when she visited Melbourne last October.

“Primarily, these funds will be used to improve waste management, preserve cultural sites and the local environment.”

The government’s Love Bali website added that it will help improve the quality of services, the safety, and comfort of tourists, by developing integrated land, sea and air infrastructure.

The tourist levy is just one of a series of measures introduced in Bali in the last year to crackdown on mass tourism.

An official tourist dos and don’ts list was released, a hotline was established for anyone to dob in misbehaving travellers, and a special task force was set up to monitor foreigners’ activities.

Indonesia has pleaded with Australian tourists to not only respect local customs but explore more of the country beyond Bali.

The Australian government has also urged travellers to listen to Indonesia’s pleas to behave.

Do I need to pay the tourist levy again if I leave Bali and come back?

There has been some confusion about whether travellers will need to pay the fee twice if they visit nearby islands, like Lombok and the Gili Islands, and then return to Bali in the same holiday.

Indonesia’s Tourism Minister Sandiaga Uno confirmed to news.com.au the tourist levy would only need to be paid once by foreign visitors during a trip to Indonesia.

“You could fly to Bali, pay the fee, visit Jakarta [the country’s capital] and then return to Bali and not have to pay again,” he said. “However if you were to go from Bali to Bangkok [Thailand] and then back to Bali, you would need to pay again.”

Who is exempt from the tourist levy?

Foreigners who have the following visas can apply for an exemption via the same website and app.

They must do so at least one month before arriving in Bali or they will have to pay the tourist levy.

• Diplomatic visas and official visas

• Temporary Stay Permit Cards (KITAS) or Permanent Stay Permit Cards (KITAP)

• Family unification visas

• Golden visas

More Coverage

• Student visas

• Holders of other visa types issued by Immigration, excluding those intended for tourist destinations

Crew of conveyances are also exempt and do not need to submit an application for exemption.

Aussies planning a trip to the hotspot may soon have to cough up almost $100 to enter the island with arguments the current fee is “too low”.

This Aussie traveller made a mistake in Bali that saw her fined $500 – but it could have been a lot worse.

The managers of a renowned Bali tourist attraction have made a major call on the site’s mischievous resident long-tailed monkeys.

How to pay the International Visitor Levy

Most people visiting New Zealand for a short period of time must pay the NZD$35 International Visitor Conservation and Tourism Levy (IVL).

What the levy is for

The IVL is used to help pay for conservation and tourism infrastructure in New Zealand.

People who must pay this levy

Most people entering New Zealand on a temporary basis will need to pay this levy. This includes:

- people coming for a holiday (including through the working holiday scheme)

- some student visas

- some short-term work visas.

People who do not need to pay the levy

- New Zealand citizens and residents (including all resident visas)

- People transiting New Zealand on a transit visa or transit NZeTA

- Australian citizens and permanent residents

- American Samoa

- Cook Islands

- Republic of Marshall Islands

- Federated States of Micronesia

- Papua New Guinea

- Pitcairn Islands

- Solomon Islands

- Diplomatic, military, medical, and humanitarian visas

- People travelling to Antarctica under the Antarctic Treaty (including people travelling on the Antarctic Traveller Transit Visa)

- Recognised Seasonal Employment workers

- Business Visitor Visas (including APEC business travel cards)

- Ship and airline crew

- Most visas for dependants (partners and children) of work and student visa holders

- Travellers whose visa or NZeTA requirements have been waived by Immigration New Zealand

When to pay the levy

If you need to pay the IVL , you’ll pay it when you:

- request an NZeTA , or

- apply for your visa to New Zealand.

You pay an IVL at the same time you request an NZeTA or apply for a visa that includes the IVL.

You’ll need to pay the IVL each time you request a new NZeTA or apply for a visa.

For payment options, refer to your NZeTA or visa.

Request an NZeTA — INZ

Apply for a visitor visa — INZ

Who to contact for more help

If you need more help or have questions about the information or services on this page, contact the following agency.

Immigration New Zealand

Utility links and page information

JavaScript is currently turned off in your browser — this means you cannot submit the feedback form. It's easy to turn on JavaScript — Learn how to turn on JavaScript in your web browser. If you're unable to turn on JavaScript — email your feedback to [email protected] .

Do not enter personal information. All fields are optional.

You must enable JavaScript to submit this form

Last updated 12 January 2024

Contact NZ government

- A-Z of government agencies

- Contact details by topic

About this website

- About Govt.nz

- Feedback about Govt.nz

- The scope of Govt.nz

Using this website

- Accessibility

- Terms of use

Date printed 29 June 2024

Welcome To The Mountain Kingdom

+266 8001 0100

Countdown to his majesty's birthday, tourism levy operational.

The Lesotho Tourism Development Corporation (LTDC) Chief Executive Officer (CEO), Dr Retšelisitsoe Nko has expressed gratitude that the Tourism Levy Act, of 2006 became operational on October 1, 2022, after 15 years of its amendment.

The Lesotho Tourism Levy is a tax paid by tourists for specific travel and tourism services offered in Lesotho and its 50 percent will be used for the development and maintenance of tourism.

Mr. Nko noted that as the corporation, they will be pleased to contribute to the country’s economic development through a tourism levy.

He said by maintaining tourism in the country, they will be creating more jobs in the tourism sector.

He, therefore, appealed to Basotho to comply with the Act which he stressed is not intended to harm their business but will help them in the long run.

He stressed that it is the responsibility of every Mosotho to help in the development of tourism in the country.

Also Speaking, LTDC Head of Finance and Administration, Mr. Maurice Thetso Thamae noted that 50 percent of the levy will be used to promote tourism, saying 30 percent will be used for administration while 10 percent will be used by the Ministry of Tourism to formulate laws and regulations for tourism.

He said the levy will be collected by the enterprises thus accommodation owners, tour guides, and event organisers.

By Staff Reporter: ‘Maphoka Likotsi

Recent Posts

LDF WELCOMES LAST CONTINGENT FROM MOZAMBIQUE

PREPARATIONS ON FOR HIS MAJESTY’S BIRTHDAY CELEBRATION

BASOTHO PRAY FOR PEACE

Quick links.

- Tlhopho Bocha

- Lesotho Communications Authority

- Lesotho National Development Corporation

- Central Bank of Lesotho

- Lesotho Revenue Authority

- Southern African Development Community

- Lesotho Highlands Development Authority

- Lesotho Planned Parenthood Association

- National University of Lesotho

- Land Administration Authority

- African Union

- Southern African Customs Union

Tourists Attraction

- Visit Lesotho

- Thaba Bosiu

- Morija Arts & Culture

The BVI Beacon

"The light that comes from wisdom never goes out"

New law aims to free up millions from tourist levy

For more than six years, the government has been collecting a $10 levy from most non-cruise ship visitors as required by the 2017 Environmental Protection and Tourism Improvement Fund Act. …

Continue reading “New law aims to free up millions from tourist levy”

For more than six years, the government has been collecting a $10 levy from most non-cruise ship visitors as required by the 2017 Environmental Protection and Tourism Improvement Fund Act .

The law requires this pool of money — which should now exceed $10 million — to be used to combat climate change, protect the environment, and bolster the tourism industry.

But leaders have said they have been unable to tap these funds because of legal complications.

On Tuesday, the House of Assembly took action to address this problem after years of delays.

“The act should have been brought into force and it was not,” Premier Dr. Natalio “Sowande” Wheatley explained while introducing the Environmental Protection and Tourism Improvement Fund (Validation) Act 2023.

“In essence, it is essentially for us to now validate the [actions] which took place under this act and to protect the government from legal challenge.” He added that such legislative errors are not isolated to the eco-levy law.

“Madam Speaker, as we speak about doing things correctly and building institutions, there have been some measures which have not been properly done in passing legislation and, therefore, this bill has come to the House to correct some of those things,” he said.

After Dr. Wheatley’s brief introduction on Tuesday, legislators discussed the new bill in a closed-door committee session. Then they returned and passed it with amendments without further public debate.

The original law — which legislators passed in April 2017— requires 40 percent of the levy funds to be earmarked for activities related to climate change and environmental protection, with another 40 percent going toward tourist sites and tourism-related activities and 20 percent devoted to tourism marketing.

Among other effects, the ongoing funding freeze has stalled the work of the Climate Change Trust Fund, an independent body established under a 2015 law to finance climate change mitigation and adaptation initiatives in the territory.

Though the CCTF’s board initially was appointed in 2017, the body has never received significant funding.

Instead, its members were left to spend their own money on basic initial steps like creating an operations manual and logo.

Then, shortly after the 2019 general election, the board’s membership was revoked by then-Premier Andrew Fahie’s Virgin Islands Party government — a move the Commission of Inquiry later found to be unlawful.

Dr. Wheatley reappointed the board last June, apologising to members for their previous treatment and assuring them that the government would provide the trust fund with the “necessary seed funding” to get up and running last year.

Privacy Overview

- Levy Portal

- Mon – Fri: 8:00am – 5:00pm

- +254 020 2714901 Telephone

- [email protected] Email

- Governance and Executive

- Levy Resources

- Compliance Certificate Request

- Levy Compliance Checker

- Upskilling Programs

- Media Centre

About Tourism Fund

The Fund is the legal successor to Catering and Tourism Development Levy Trustees. Catering and Tourism Development Levy Trustees has been in existence since 1972 and operated under the umbrella of the Hotel and Restaurant Act, Cap 494, Laws of Kenya. The Act was repealed when the Tourism Act came into effect.

Announcements

Elevy portal, upskilling program, 2% tourism levy.

As 2% tourism Levy collection agency on behalf of the Kenyan government, our role is to effectively manage and shape the levy systems that support and fund tourism services for all Kenyans.

The 2% Tourism Levy

How to Pay Tourism Levy

Tourism Fund Functions

Corporate Responsibility

Tourism Training Revolving Fund

Tourism Training Revolving Fund is designed to support training within the tourism industry to enhance the skills, knowledge, and capabilities of individuals involved in the tourism sector. This includes training programs for tourism professionals, hospitality staff and other related roles.

This will sustain and enhance the quality of tourism services leading to improved visitor experiences, increased competitiveness, and overall growth in the tourism industry. Additionally, it creates a self-sustaining mechanism where the resources are recycled for the benefit of the industry.

News & Updates

Explore the various avenues through which you can engage with the Tourism Fund and leverage our campaign initiatives, research endeavors, market data, and other resources to foster the expansion of your tourism enterprise.

Stakeholder engagement forum and dinner at

Our partners.

Fraud Alert

Beware of certain persons, purpoting to be staff of Tourism Fund, falsely stating that they can coerce, influence, decide or affect outcomes of Procurement processes, Jobs, Penalty waivers ETC. These scams, which may seek to obtain money and / or in many cases personal details from the recipients of such correspondence, are fraudulent.

[email protected]

Tourism levy to squeeze Turkish tourism firms still emerging from slump

- Medium Text

Writing by Ezgi Erkoyun; Editing by Dominic Evans and David Holmes

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron

Trafigura, Gunvor demand sparks jump in Brent oil benchmark

Trading houses Trafigura and Gunvor bought nine cargoes of crude that underpin the international Brent benchmark in the last week and bid for more, helping to drive the steepest gains since a change in the way it was assessed in 2023.

Tourism Players Urged to Collect, Remit Levies

S takeholders in the tourism industry have been challenged to remit tourism levies to Government and help to market Zimbabwe as a destination of choice, Tourism and Hospitality Industry Minister, Barbara Rwodzi, has said.

Addressing tourism sector players during a stakeholder consultative workshop on the Tourism Amendment Bill in Victoria Falls recently, Minister Rwodzi said the industry is not fully executing the role entrusted to it by the Government to collect and remit the Tourism Levy.

She said the levy should contribute to infrastructure development and service delivery.

"It is a charge that you put on tourists and remit it to us. You are not paying the money which the tourist is giving you. The law says a tourist has to pay a Tourism Levy on the service you are giving them," said Minister Rwodzi.

"Government has entrusted you, but some are not charging that. Our strategy follows the national strategy of President Mnangagwa in his vision for an upper-middle-income society by 2030, so business should contribute to that."

Minister Rwodzi said the strategic goal for her ministry is to promote and develop tourism and make Zimbabwe the best destination with international standards.

"I am very certain that if we continue working together we can meet our targets."

Tourism is the country's third highest contributor to the Gross Domestic Product with receipts going up to US$1 160 billion last year from US$911 million in 2022.

She said Victoria Falls as the premier tourism destination had contributed immensely to tourism investments in hotels and lodges construction.

"This approach we are taking to consult those who are in tourism is to ensure that we rise together. The idea is to develop tourism and hospitality industry laws that are in absolute and perfect alignment with national goals and aspirations as the paramount and critical strategy to achieve the national vision."

Minister Rwodzi said the ministry's goal is to modernise and industrialise Zimbabwe in line with Vision 2030, including making the tourism and hospitality industry the top contributor to the national GDP.

"The new blueprint will speak to our aspirations as a nation as it outlines the path towards an economically vibrant, culturally rich, and environmentally responsible industry," she said.

In a speech read on his behalf by Hwange District Development Coordinator, Mr Simon Muleya, Matabeleland North Provincial Affairs and Devolution Minister, Richard Moyo, commended the Tourism ministry for consulting stakeholders, saying such a move was key in unlocking the country's full tourism potential.

"I must say this is a solid step in the right direction. This Bill will not only boost our tourism industry, but also contribute to the country's economic growth and development," he said.

"These consultative workshops for the Tourism Amendment Bill therefore come at the right time as we are focused on the development of master plans for coordinated development within our province and the nation at large."

Minister Moyo said he is optimistic that the deliberations from the consultative workshop will feed into the Government's national vision.

He said Mice (meetings, incentives, conferences and exhibitions) tourism contributed significantly to tourism in Victoria Falls where a massive cricket stadium is under construction.

UK Edition Change

- UK Politics

- News Videos

- Paris 2024 Olympics

- Rugby Union

- Sport Videos

- John Rentoul

- Mary Dejevsky

- Andrew Grice

- Sean O’Grady

- Photography

- Theatre & Dance

- Culture Videos

- Fitness & Wellbeing

- Food & Drink

- Health & Families

- Royal Family

- Electric Vehicles

- Car Insurance Deals

- Lifestyle Videos

- UK Hotel Reviews

- News & Advice

- Simon Calder

- Australia & New Zealand

- South America

- C. America & Caribbean

- Middle East

- Politics Explained

- News Analysis

- Today’s Edition

- Home & Garden

- Broadband deals

- Fashion & Beauty

- Travel & Outdoors

- Sports & Fitness

- Sustainable Living

- Climate Videos

- Solar Panels

- Behind The Headlines

- On The Ground

- Decomplicated

- You Ask The Questions

- Binge Watch

- Travel Smart

- Watch on your TV

- Crosswords & Puzzles

- Most Commented

- Newsletters

- Ask Me Anything

- Virtual Events

- Betting Sites

- Online Casinos

- Wine Offers

Thank you for registering

Please refresh the page or navigate to another page on the site to be automatically logged in Please refresh your browser to be logged in

Hoteliers fighting back against UK’s first tourist tax in three iconic seaside towns

The charge for visitors of £2 per night is due to begin 1 july, article bookmarked.

Find your bookmarks in your Independent Premium section, under my profile

Sign up to Simon Calder’s free travel email for expert advice and money-saving discounts

Get simon calder’s travel email, thanks for signing up to the simon calder’s travel email.

A group of hoteliers in Bournemouth , Christchurch and Poole are appealing against a tourist tax due to be introduced in the area next week.

The £2 per night levy for overnight stays in Dorset is set to roll out on 1 July as part of plans by Bournemouth, Christchurch and Poole’s Accommodation Business Improvement District (ABID).

If introduced, it w ould be the first seaside tourist tax to be charged in the UK .

Appealing to the Secretary of State against the new charge are 42 hotels that do not support the levy – 56 per cent of the hotels involved in the vote.

The group claim that the nightly visitor charge “financially penalises” the 75 hotels in the seaside resort area, and says only 16 hoteliers voted in favour of the tourist tax introduction.

With the tax set to start next week, hoteliers face charging guests while the appeal process is ongoing.

Levy payments collected in the meantime would not automatically be refunded – a “morally and legally incorrect” move, according to the group.

Officials estimate that the tax will generate £12m for the county in southern England in the next five years.

Appealing hoteliers met with the BCP Council last week to ask to delay the 1 July start date until after the appeal process has been completed.

The appeal group are asking for the ABID team to “see sense, revisit their plans and delay the introduction of the levy whilst our appeal is heard”.

A spokesperson for the group leading the appeal said: “Following the announcement on 14 May that the Bournemouth, Christchurch and Poole Accommodation BID had successfully passed by a single vote, it quickly became clear that a significant number of hotels had not been able to vote and some of these were not even aware that the ballot was taking place.

“If any one of these hotels had they been able to vote, the levy simply wouldn’t have been voted in.”

Graham Farrant, chief executive for Bournemouth, Christchurch and Poole (BCP) council, said: “We are confident the ballot process has been carried out fairly and in line with legal regulations.

“We advised those who are looking to appeal the result to follow the process as outlined in The Business Improvement Districts (England) Regulations 2004.”

The Independent has contacted ABID for comment.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

New to The Independent?

Or if you would prefer:

Want an ad-free experience?

Hi {{indy.fullName}}

- My Independent Premium

- Account details

- Help centre

Daily Sabah

Tourism professionals preparing for Turkey Festival in Moscow

By daily sabah.

The mutual declaration of the tourism year in Turkey and Russia has raised hopes for Turkish tourism professionals to expand sectoral cooperation with their Russian counterparts. Turkish tourism professionals are now preparing for the Turkey Festival to be held in Moscow in June. Turkey is the top destination for Russian tourists. Nearly 6 million Russians visited the country last year, mainly to the Turkish resort town of Antalya. In the first two months of this year, Turkey welcomed 179,461 Russian tourists and the figure corresponded to an increase of nearly 34 percent compared to the same period in 2018. The festival is being organized under the auspices of the Tourism and Culture Ministry and in coordination with the Turkish Hotels Federation (TÜROFED), TÜRSAB and the Turkey Tourism Investors Association (TTYD).

Turkish Travel Agencies Association (TÜRSAB) Chairman Firuz Bağlıkaya underscored that the Turkey Festival in Moscow, which will be inaugurated on June 14, is a great opportunity to increase the number of Russian tourists and tourism revenues.

Hotels, tour operators and tourism destinations and significant tourism brands will attend the event, promoting Turkey's tourism values. The festival will be held in an area of 165 decares in Park Krasnaya Presnya.

TÜRSAB Chairman Bağlıkaya said in a statement, "The festival will augment the perception of Turkey. The Russian people will have the opportunity to experience Turkish values and culture in Moscow." TÜROFED Chairman Osman Ayık noted that the Turkey Festival to be held in one of the most important markets of Turkish tourism will make significant contributions to Turkish tourism. Ayık stressed the importance of continuously carrying out promotion activities in the Russian market. TTYD Chair Oya Narin drew attention to the significance of the Turkey Festival in Russia, the country from which Turkey receives the highest number of tourists. She said the festival is a good opportunity for Turkey to reach its 2023 tourism goals and tourism professionals aim to raise the demand of Russian tourists in Turkey.

- shortlink copied

- Travel Planning Guide

Travel Budget for Moscow Visit Moscow on a Budget or Travel in Style

- Moscow Costs

- Is Moscow Expensive?

- How much does a trip to Moscow cost?

- Russia Costs

- Saint Petersburg

- Nizhny Novgorod

- Vladivostok

- How much does it cost to travel to Moscow? (Average Daily Cost)

- Moscow trip costs: one week, two weeks, one month

Is Moscow expensive to visit?

- How much do I need for a trip to Moscow?

- Accommodation, Food, Entertainment, and Transportation Costs

- Travel Guide

How much does it cost to travel to Moscow?

You should plan to spend around $65 (₽5,802) per day on your vacation in Moscow. This is the average daily price based on the expenses of other visitors.

Past travelers have spent, on average for one day:

- $15 (₽1,315) on meals

- $6.37 (₽566) on local transportation

- $83 (₽7,330) on hotels

A one week trip to Moscow for two people costs, on average, $915 (₽81,233) . This includes accommodation, food, local transportation, and sightseeing.

All of these average travel prices have been collected from other travelers to help you plan your own travel budget.

- Travel Style: All Budget (Cheap) Mid-Range Luxury (High-End)

- Average Daily Cost Per person, per day $ 65 ₽ 5,802

- One Week Per person $ 457 ₽ 40,617

- 2 Weeks Per person $ 915 ₽ 81,233

- One Month Per person $ 1,960 ₽ 174,071

- One Week For a couple $ 915 ₽ 81,233

- 2 Weeks For a couple $ 1,829 ₽ 162,467

- One Month For a couple $ 3,919 ₽ 348,143

How much does a one week, two week, or one month trip to Moscow cost?

A one week trip to Moscow usually costs around $457 (₽40,617) for one person and $915 (₽81,233) for two people. This includes accommodation, food, local transportation, and sightseeing.

A two week trip to Moscow on average costs around $915 (₽81,233) for one person and $1,829 (₽162,467) for two people. This cost includes accommodation, food, local transportation, and sightseeing.

Please note, prices can vary based on your travel style, speed, and other variables. If you're traveling as a family of three or four people, the price per person often goes down because kid's tickets are cheaper and hotel rooms can be shared. If you travel slower over a longer period of time then your daily budget will also go down. Two people traveling together for one month in Moscow will often have a lower daily budget per person than one person traveling alone for one week.

A one month trip to Moscow on average costs around $1,960 (₽174,071) for one person and $3,919 (₽348,143) for two people. The more places you visit, the higher the daily price will become due to increased transportation costs.

Independent Travel

Traveling Independently to Moscow has many benefits including affordabilty, freedom, flexibility, and the opportunity to control your own experiences.

All of the travel costs below are based on the experiences of other independent travelers.

Moscow is a reasonably affordable place to visit. Located in Russia, which is a reasonably affordable country, visitors will appreciate the relatively low cost of this destination. It is in the top 10% of cities in the country for its overall travel expenses. If you're traveling on a budget, then this is a good destination with affordable accommodation, food, and transportation.

Within Europe, which is known to be an expensive region, Moscow is a reasonably affordable destination compared to other places. It is in the top 25% of cities in Europe for its affordability. You can find more affordable cities such as Novi Sad, but there are also more expensive cities, such as Avignon.

For more details, and to find out if it's within your travel budget, see Is Moscow Expensive?

How much money do I need for a trip to Moscow?

The average Moscow trip cost is broken down by category here for independent travelers. All of these Moscow travel prices are calculated from the budgets of real travelers.

Accommodation Budget in Moscow

Average daily costs.

Calculated from travelers like you

The average price paid for one person for accommodation in Moscow is $41 (₽3,665). For two people sharing a typical double-occupancy hotel room, the average price paid for a hotel room in Moscow is $83 (₽7,330). This cost is from the reported spending of actual travelers.

- Accommodation 1 Hotel or hostel for one person $ 41 ₽ 3,665

- Accommodation 1 Typical double-occupancy room $ 83 ₽ 7,330

Hotel Prices in Moscow

Looking for a hotel in Moscow? Prices vary by location, date, season, and the level of luxury. See below for options.

Find the best hotel for your travel style.

Kayak helps you find the best prices for hotels, flights, and rental cars for destinations around the world.

Transportation Budget in Moscow

The cost of a taxi ride in Moscow is significantly more than public transportation. On average, past travelers have spent $6.37 (₽566) per person, per day, on local transportation in Moscow.

- Transportation 1 Taxis, local buses, subway, etc. $ 6.37 ₽ 566

Recommended Services

- Private Transfer from Tengkerang Tengah to Pekanbaru Airport (PKU) Viator $ 40

- Private Transfer from Sidomulyo Barat to Pekanbaru Airport (PKU) Viator $ 40

Flights to Moscow

Rental cars in moscow, what did other people spend on transportation in moscow.

Typical prices for Transportation in Moscow are listed below. These actual costs are from real travelers and can give you an idea of the prices in Moscow, but your costs will vary based on your travel style and the place where the purchase was made.

- Two Metro Passes ₽ 135

Food Budget in Moscow

While meal prices in Moscow can vary, the average cost of food in Moscow is $15 (₽1,315) per day. Based on the spending habits of previous travelers, when dining out an average meal in Moscow should cost around $5.92 (₽526) per person. Breakfast prices are usually a little cheaper than lunch or dinner. The price of food in sit-down restaurants in Moscow is often higher than fast food prices or street food prices.

- Food 2 Meals for one day $ 15 ₽ 1,315

What did other people spend on Food in Moscow?

Typical prices for Food in Moscow are listed below. These actual costs are from real travelers and can give you an idea of the prices in Moscow, but your costs will vary based on your travel style and the place where the purchase was made.

- Lunch for Two ₽ 550

- Lunch in the Center Market ₽ 300

- Breakfast for 2 ₽ 1,000

Entertainment Budget in Moscow

Entertainment and activities in Moscow typically cost an average of $17 (₽1,471) per person, per day based on the spending of previous travelers. This includes fees paid for admission tickets to museums and attractions, day tours, and other sightseeing expenses.

- Entertainment 1 Entrance tickets, shows, etc. $ 17 ₽ 1,471

Recommended Activities

- Custom Private Tour in Palembang with English Speaking Driver Viator $ 85

- 2-Hour Private Guided Walking Tour in Bengkulu Viator $ 143

What did other people spend on Entertainment in Moscow?

Typical prices for Entertainment in Moscow are listed below. These actual costs are from real travelers and can give you an idea of the prices in Moscow, but your costs will vary based on your travel style and the place where the purchase was made.

- Theater Tickets ₽ 1,150

- Kremlin Entry (2) ₽ 1,000

Tips and Handouts Budget in Moscow

The average cost for Tips and Handouts in Moscow is $0.26 (₽23) per day. The usual amount for a tip in Moscow is 5% - 15% .

- Tips and Handouts 1 For guides or service providers $ 0.26 ₽ 23

Scams, Robberies, and Mishaps Budget in Moscow

Unfortunately, bad things can happen on a trip. Well, you've just got to deal with it! The average price for a scam, robbery, or mishap in Moscow is $1.29 (₽115), as reported by travelers.

- Scams, Robberies, and Mishaps 1 $ 1.29 ₽ 115

Alcohol Budget in Moscow

The average person spends about $8.19 (₽727) on alcoholic beverages in Moscow per day. The more you spend on alcohol, the more fun you might be having despite your higher budget.

- Alcohol 2 Drinks for one day $ 8.19 ₽ 727

Water Budget in Moscow

On average, people spend $0.72 (₽64) on bottled water in Moscow per day. The public water in Moscow is considered safe to drink.

- Water 2 Bottled water for one day $ 0.72 ₽ 64

Related Articles

Moscow on a budget.

Neighborhoods

Food and dining, transportation.

We've been gathering travel costs from tens of thousands of actual travelers since 2010, and we use the data to calculate average daily travel costs for destinations around the world. We also systematically analyze the prices of hotels, hostels, and tours from travel providers such as Kayak, HostelWorld, TourRadar, Viator, and others. This combination of expenses from actual travelers, combined with pricing data from major travel companies, gives us a uniqe insight into the overall cost of travel for thousands of cities in countries around the world. You can see more here: How it Works .

Subscribe to our Newsletter

By signing up for our email newsletter, you will receive occasional updates from us with sales and discounts from major travel companies , plus tips and advice from experienced budget travelers!

Search for Travel Costs

Some of the links on this website are sponsored or affiliate links which help to financially support this site. By clicking the link and making a purchase, we may receive a small commission, but this does not affect the price of your purchase.

Travel Cost Data

You are welcome to reference or display our travel costs on your website as long as you provide a link back to this page .

A Simple Link

For a basic link, you can copy and paste the HTML link code or this page's address.

Travel Cost Widget

To display all of the data, copy and paste the code below to display our travel cost widget . Make sure that you keep the link back to our website intact.

- Privacy / Terms of Use

- Activities, Day Trips, Things To Do, and Excursions

IMAGES

VIDEO

COMMENTS

Tourism levy payment portal. Nairobi. 1. 0202714900/1. 2. 0717363411. 3. 0728337499. Mombasa. 1. 0412249829. 2. 0703287808

About the eLevy Platform. eLevy' is an innovative web based system, developed by Tourism Fund, which seeks tomake the 2% Tourism Levy remittance easy, convenient and accountable. The name 'eLevy' is coined from two entities which are 'e' to stand for the internet and 'Levy' to stand for the 2% Tourism Levy.

A tourism levy is a fee charged to visitors by a destination or region to fund tourism development and maintenance projects. Learn how it works, what it is used for, and how it affects tourists and the local community.

Bali Tourist Tax / Bali Tourist Levy. The Tourist Tax for international visitors to Bali is a tax charged by Bali's provincial government. This is all you need to know to get ready to come to Bali. Make sure you are only using the links mentioned tha guide you to the official website of the Bali government.

A tourism fee is a charge imposed on travelers for staying overnight in certain destinations to fund tourism-related initiatives and infrastructure improvements. Learn about the different types of tourism fees, how they are collected, and why they are important for sustainable tourism development.

New Zealand: Travelers visiting New Zealand have to pay an International Visitor Conservation and Tourism Levy (IVL) which costs $35 NZD (about $22). Portugal : The country charges tourist tax in ...

What is the tourist levy for? The tourist levy is promoted as a way to protect Bali's culture and natural environment. "This money will be used in our efforts to establish sustainable tourism ...

Tourism levy is paid at the time the accommodation is purchased and is collected by, or on behalf of, the person (operator) who sells, offers for sale, or otherwise provides the accommodation. Tourism levy is calculated on the purchase price of the accommodation before the application of the federal goods and services tax.

Visitor visas and the NZeTA. How to pay the International Visitor Levy. Most people visiting New Zealand for a short period of time must pay the NZD$35 International Visitor Conservation and Tourism Levy (IVL). Note: You pay an IVL at the same time you request an NZeTA or apply for a visa that includes the IVL.

The Tourism Levy is a tax paid by tourists for specific travel and tourism services in Lesotho. It became operational on October 1, 2022, and 50 percent of it will be used for the development and maintenance of tourism.

Effective December 1, 2020, a mandatory Tourism Levy must be collected by registered tourism accommodation service providers as follows: Class 1: Average Daily Rate (ADR) of US$120 and less - US$3.00 per person each night. Class 2: Average Daily Rate (ADR) of US$121 and above - US$6.00 per person each night. Class 3: Nightly Rate (NR) of US ...

Tourism Levy FREQUENTLY ASKED QUESTIONS: TRAVEL TRADE INTERMEDIARIES What is the Tourism Levy?The Government of Saint Lucia will impose a mandatory Tourism Levy. This Levy is a nightly charge to be paid by guests of all registered tourism accommodation service providers in Saint Lucia. What will the Tourism Levy be used for?The Levy will be used to finance destination marketing activities of ...

For TATO, this harmonized approach would alleviate stress for the industry, sparing it from officials who lack insight into tourism operations and fall short in customer care. The members of TATO call for the service levy to be collected net of third party payments, which largely comprised Government money.

What is a tourism tax? Getty Images. The tourism sector was worth about £5bn in 2019 in Wales, according to the Welsh government. A tourism tax, or levy, is a charge which would need to be paid ...

Overview Of The Tourism Levy ‣ Saint Lucia Tourism Levy. Call us today!+1758-458-7101. Reach us via [email protected]. Hours of Operation8AM - 4:30PM, Monday to Friday. Contact Us.

The Tourism Ministry has transferred the function of collecting the two percent tourism levy from the Tourism Fund to the Kenya Revenue Authority (KRA) as part of a restructuring process. The levy is used to finance tourism-related activities and projects in Kenya.

For more than six years, the government has been collecting a $10 levy from most non-cruise ship visitors as required by the 2017 Environmental Protection and Tourism Improvement Fund Act. The law requires this pool of money — which should now exceed $10 million — to be used to combat climate change, protect the environment, and bolster the ...

Tourism Fund is a body corporate that collects and manages the 2% tourism levy on behalf of the Kenyan government. The levy is used to finance the development of a sustainable tourism industry in Kenya and support training, events, and corporate responsibility initiatives.

A new levy on Turkey's tourism industry will hit hotels and travel agencies from October, squeezing businesses which have been forced to offer hefty discounts to overcome a slump in visitor ...

The law says a tourist has to pay a Tourism Levy on the service you are giving them," said Minister Rwodzi. "Government has entrusted you, but some are not charging that. Our strategy follows the ...

A group of hoteliers in Bournemouth, Christchurch and Poole are appealing against a tourist tax due to be introduced in the area next week. The £2 per night levy for overnight stays in Dorset is ...

Corporate Tax Income: Generally - Maximum CIT rate of 20% (federal & regional, until 2024). However, only 3% is attributed to federal budget and 17% is attributed to the relevant regional budget. The 17% attributed to the regional budget may be reduced by the authorities, but may not be less than 13.5%. Applies to Russian resident taxpayers ...

PressReader. Catalog; For You; The Herald (Zimbabwe) Tourism players urged to collect, remit levies 2024-06-26 - Leonard Ncube Victoria Falls Reporter . STAKEHOLDERS in the tourism industry have been challenged to remit tourism levies to Government and help to market Zimbabwe as a destination of choice, Tourism and Hospitality Industry Minister, Barbara Rwodzi, has said.

Sunak's tourist tax 'means Rolex shoppers have given up on Britain' UK's biggest luxury watch retailer says levy has hammered its business

The mutual declaration of the tourism year in Turkey and Russia has raised hopes for Turkish tourism professionals to expand sectoral cooperation with...

Food Budget in Moscow Average Daily Costs. Calculated from travelers like you. While meal prices in Moscow can vary, the average cost of food in Moscow is $15 (₽1,315) per day. Based on the spending habits of previous travelers, when dining out an average meal in Moscow should cost around $5.92 (₽526) per person.